Additional Proxy Soliciting Materials (definitive) (defa14a)

March 15 2018 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

x

|

Soliciting Material under §240.14a-12

|

|

|

|

CF INDUSTRIES HOLDINGS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

1 2017 Third Quarter Financial Results November 1, 2017 NYSE: CF Shareholder Engagement Winter – Spring 2018 NYSE: CF

Business Overview Essential plant nutrient End Uses for our products Chemical feedstock Emissions control CF Industries is a leading global fertilizer and chemical company with outstanding operational capabilities and a highly cost advantaged production and distribution platform Our 3,000 employees operate world-class chemical manufacturing complexes in Canada, the United Kingdom and the United States We distribute our products through a system of terminals, warehouses, and associated transportation equipment located primarily in the Midwestern United States We also export nitrogen products from our Donaldsonville, Louisiana, and Yazoo City, Mississippi, manufacturing facilities and our United Kingdom manufacturing facilities in Billingham and Ince World’s Largest Ammonia Producer 1) (Million metric tons, 2017) Source: IFDC 1) Excludes Chinese state owned enterprise JAMG and Indonesian consortium PT Pupuk 2,744 3,294 3,500 3,991 5,185 7,760 9,022 9,879 EuroChem Koch TogliattiAzot OCI Group DF (Ukraine) Nutrien Yara CF

Our Strategy Vision Corporate strategy CF core values Distinctive set of core capabilities A leading chemical company with superior shareholder returns over the cycle Leverage core capabilities to optimize and grow the world’s most advantaged nitrogen and chemicals platform to serve customers, creating long-term shareholder value Best-in-class operational capability We do it right We do it well We execute as a team We take a long-term view Disciplined capital and corporate stewardship Mission We feed the crops that feed the world; we produce building blocks for a better life

Strong Performance Supporting Long-Term Value Creation Achieved industry leading recordable injury rate of 0.67 (industry average: 2.2), our lowest rate, while being the largest nitrogen producer in the world New capacity expansion plants started up safely and achieved up to 15-20% higher output than original nameplate capacity SG&A among the lowest in the industry at $10 per product ton or 4.6% of sales Reduced long-term debt by approximately $1.1 billion and lowered our controllable cost of sales per product ton Strong history of integrating and improving acquired assets: increased production, margin, and safety record Achieved these exceptional results in one of the weakest global nitrogen pricing environments of the last two decades Results reflect the enduring strengths of our company – manufacturing and distribution excellence built on safe and reliable operations Maintain a customer focus that serves long-time purchasers and grows new opportunities Focus on prudent capital stewardship to optimize our cost structure Recent Financial and Operational Achievements Market Conditions and Context Due to the cyclical nature of the commodity chemical industry in which we operate, it is important to consider performance over a longer time horizon than just one year The execution of our strategy has delivered strong shareholder value creation over the cycle Strong Shareholder Return Over the Cycle Number of Years Total shareholder return (TSR) 39% - 15% 17% 81% 126% 1 3 5 7 10

Total Shares Outstanding (in millions) 323.3 296.0 256.7 236.1 233.1 233.9 Balanced Approach to Capital Allocation Capital allocation philosophy balances strategic investments with returning cash to shareholders Capital Allocation Priorities Commitment to investment grade metrics over long term Pursue growth within strategic fairway, where returns exceed risk-adjusted cost of capital and investments are cash flow accretive Consistently return excess cash to shareholders with historic bias towards share repurchases Total capital returned to shareholders since 2012 is more than twice net strategic investments Actions Business Growth / (Shrink) Sales / Divestitures ($4.2B) Acquisitions / Expansions $6.7B Net Major Portfolio Investment $2.5B Actions Cash Returned Share Repurchases $4.4B Dividends $1.3B Total Capital Returned $5.7B Dividend Growth: ~25% CAGR Dividend Per Share Dividend Trends Since 2012 CF has increased dividend per share by almost 4x Annual cash outflow for dividends increased less than 3x Buybacks reduced shares outstanding by ~30% 1 Source: Factset, Company filings $0.32 $0.44 $1.00 $1.20 $1.20 $1.20 2012 2013 2014 2015 2016 2017

Independent Board with the Right Skills and Expertise Balanced Tenure Average Tenure: 6.9 Years Summary of Core Director Competencies Skill Definition Total1 Public Company Governance Deep understanding of the Board’s duties and responsibilities enhances board effectiveness and ensures independent oversight 7 Senior Executive Leadership Current/former CEOs or senior executives can effectively challenge management and contribute practical insight 9 Operations Benefit from directors with experience serving in senior executive roles at global manufacturing and distribution companies 7 Accounting and Finance Expertise Helps ensure the integrity of our financial reporting and the critical evaluation of our performance 7 Industry Focus Directors who are knowledgeable about the chemical, energy, and agriculture industries help guide the company in assessing trends and external forces in these industries 7 International Business Offer guidance as we develop and grow our international manufacturing operations and global product distribution 5 Strategic Initiatives Experience with transactions, partnerships, capital projects, and integration helps us identify, pursue and consummate the right major initiatives to achieve our strategic objectives and realize synergies and optimal growth 10 Risk Management Provide valuable insight as we make decisions on our strategic plan 10 Environmental & Safety As core values, we put safety first and act as stewards for the environment, taking guidance from directors who have experience at industrial manufacturing companies 6 1 Represents the aggregate number of directors with each skill; a matrix with individual director attribution will be available in the proxy statement Independent chairman and chair of the corporate governance and nominating committee lead process to regularly review overall Board composition Board composition & succession planning is a standing item on the agenda for each regular corporate governance and nominating committee meeting Review process incorporates results of the annual Board and committee self-assessment process in assessing and determining whether any gaps in experience, qualifications, attributes, and skills exist When anticipating change, the Board generally prefers to recruit and add new directors such that there is time for the new directors to learn in detail our strategy, business, and governance in advance of expected departures Focus On Board Composition & Succession Planning Independent chairman of the Board / separate chief executive officer Annual election of directors Majority voting in uncontested elections 9 of our 10 director nominees are independent (all except CEO) Independent directors meet regularly in executive session Annual Board and committee self-evaluations, including peer evaluations Women comprise 20% of director nominees Governance Highlights 5 Dir 0 - 4 Years 1 Dir 5 - 9 Years 4 Dir 10+ Years

Ratification of Shareholder Right to Call Special Meetings We are seeking ratification of our current charter and bylaw provisions that grant holders of at least 25% of our outstanding shares the ability to call special meetings We have maintained this special meeting right since 2014, when we put forward a management proposal that passed with overwhelming support This year, we are asking shareholders to ratify these provisions, including the 25% ownership threshold We received a shareholder proposal to reduce the ownership threshold for our shareholders to call a special meeting from the existing 25% to 10%. We believe that a vote in favor of ratification is tantamount to a vote against a proposal to lower the ownership threshold to 10% Considerations for our Current Special Meeting Provisions The Board considers the existing special meeting right in the context of the company’s overall corporate governance practices and shareholder rights, including proxy access, annual election of directors, and no supermajority voting provisions (see next page for details) Consistent with its current practice, the Board will continue to evaluate appropriate corporate governance measures and changes to the company's governance structure, policies and practices that it believes will serve the best interests of the company and its shareholders The Board has evaluated a number of different factors in adopting and retaining the existing special meeting right, including: Shareholder interest in having a meaningful right to call a special meeting The resources required to convene a special meeting The opportunities shareholders otherwise have to engage with the Board and senior management in between annual meetings Our existing right prevents the unnecessary waste of corporate resources: The charter and bylaw provisions are designed to ensure that a special meeting will be called only if a significant portion of our shareholder base believes in the urgency of holding such a meeting Current threshold is consistent with market practice: of U.S.-based S&P 500 companies with special meeting rights, ~67% have a threshold of 25% or greater

Regular assessment of Board composition and attributes; considers diversity in identifying nominees for directors Annual election of directors Proxy access bylaw (3% ownership threshold with a 3-year holding period / 25% of the Board / 20 aggregation limit) Stock ownership requirements for directors and executive officers Shareholder ability to call special meetings (25% threshold) No supermajority voting provisions in charter or bylaws Policy on adoption of a shareholder rights plan Robust shareholder engagement program Regular review and disclosure of political contributions Board review and disclosure of Corporate Sustainability report using GRI framework Corporate Governance Practices We believe that building positive relationships with our shareholders is critical to our success We regularly engage with our shareholders on a variety of topics, including our strategic priorities, financial performance, corporate governance, and executive compensation program Feedback is shared with our senior management, the Board’s committees, and the full Board, as applicable Commitment to an Open Dialogue with Our Shareholders Strong Corporate Governance Practices We value shareholder feedback and look forward to continued engagement with you

= Base Salary Components of 2017 Compensation Paid in line with individual performance and contribution to company goals Aligned to competitive market data Salary Annual Incentives See slide 10 for more details regarding the design of our annual incentive plan Subject to achievement of a specified EBITDA threshold If the threshold level of EBITDA is achieved, the amount of the actual incentive earned is determined based on our level of achievement of two secondary performance metrics: 75%: level of achievement of adjusted EBITDA 25%: year-over-year percentage change in adjusted EBITDA (2017 vs. 2016) relative to the performance of a comparison group of other chemical companies Long-Term Incentives Based on a specified cash value, which amount is split among three different award types: 60%: stock options 20%: RSUs (3-year vesting) 20%: PRSUs (3-year vesting based on relative TSR) Component Key Characteristics Changes to the LTI for 2018 Increasing the share of performance-based awards to 60% of the LTI mix Increasing the share of restricted stock unit awards to 40% of the LTI mix Eliminating stock options from the LTI mix CEO NEOs* Compensation Mix = Annual Incentives = Long-Term Incentives *Based on average NEO compensation 2017 Supplemental Performance Alignment Awards The Committee approved additional RSU awards for our NEOs in 2017 based, in part, on its assessment of the Company’s strong operating performance in an environment where financial results and stock performance were negatively impacted by weak nitrogen pricing In determining the structure of the grant as RSUs subject to three-year vesting, the Committee considered that a) the strong management team that drove outstanding operating performance in a challenging pricing environment should be retained, particularly at the time the company’s new capacity expansion plants would all be operating at capacity and b) PRSUs granted in 2014 and 2015 resulted in no payout 85% Variable At-Risk Pay 74% Variable At-Risk Pay 15% 19% 66% 26% 21% 53%

Design of Annual Incentive Program The annual incentive awards granted to our named executive officers are contingent on exceeding an EBITDA threshold for the company's fiscal year, with the compensation committee reserving negative discretion If that threshold is attained, actual payments are determined by secondary performance metrics (from 0% of target for below threshold performance to 200% of target at maximum performance) The compensation committee updated the secondary performance metrics for 2017 to eliminate strategic objectives, increase the weighting on adjusted EBITDA to 75%, and add a relative adjusted EBITDA metric with a 25% weighting For 2018, the compensation committee replaced the 2017 relative adjusted EBITDA metric with a new metric tied to behavioral safety goals and production performance 2016 2017 Secondary Performance Metrics 50%: progress toward four strategic objectives (with each assigned a target weighting of 12.5%) 50%: level of achievement of adjusted EBITDA 75%: level of achievement of adjusted EBITDA 25%: year-over-year percentage change in adjusted EBITDA relative to the performance of a comparison group of other chemical companies 75%: level of achievement of adjusted EBITDA 25%: level of achievement of ammonia production goals, subject to achieving behavioral safety initiatives 2018

Historical AIP Payouts Demonstrate Pay-for-Performance Linkage Our management team has executed our strategy and operated our business very well over the past three years We have received numerous safety awards, completed the construction and safe start-up of our capacity expansion plants, and maintained industry leading ammonia production capacity utilization We set company production and sales volume records in 2017 while achieving our lowest 12-month recordable injury rate Despite these significant accomplishments in operating our assets reliably and safely, our financial results were negatively impacted particularly during 2015 and 2016 due to one of the weakest global nitrogen pricing environments of the last two decades Year Attainment of Primary EBITDA Performance Metric Secondary Performance Metrics Weighting Percent of Target Achieved Aggregate Short-Term Incentive Award Earned 2017 Yes Adjusted EBITDA 75% 118% 126% Relative Adjusted EBITDA Growth 25% 150% 2016 No Adjusted EBITDA 50% N/A 0% Strategic Objectives 50% 2015 Yes Return on Net Assets 100% 88% 88% These historical AIP outcomes – our three-year average payout of ~71% of target – illustrate our pay-for-performance philosophy and alignment with stockholders

Compensation Governance Strong pay-for-performance alignment Robust clawback policy CEO stock ownership guideline: 5x base salary Annual bonus is 100% formulaic A majority of compensation for CEO and NEOs is performance-based and paid in equity No employment agreements Named executive officers are prohibited from hedging or pledging our stock No new excise tax gross-ups after 2011 (CEO and CFO have no such gross-up) No repriced stock options What We Do What We Don’t Do

Committed to the U.N. Sustainable Development Goals Our business supports thousands of direct and indirect American jobs, contributing to the local economies and financial well-being of communities By feeding the crops that feed the world, we’re helping ensure food security for people worldwide We’re educating farmers on responsible agricultural techniques that allow them to grow more crops while protecting our air and water Clean, abundant natural gas powers our operations, while recaptured waste heat technologies make our plants more efficient We invest in energy-saving technologies – and track our energy, water and greenhouse gas emissions impacts with an eye toward continuous improvement We bring much-needed jobs to rural communities where our presence is a key driver of local economic development We manufacture and distribute our nitrogen-based fertilizers using state-of-the-art technologies that emphasize safety and energy-efficient production Helping farmers maximize soil health and yield per acre protects forests and supports critical carbon sequestration We help teach farmers the optimal amount of nitrogen to apply to their crops, minimizing runoff and keeping water sources clean CF is committed to helping support the following goals, which align most closely with our business: Since 2015, countries around the world have been working toward a series of ambitious goals for securing a sustainable planet by 2030. Achieving these goals will require the contributions of governments, the private sector and citizens everywhere

Safe harbor statement All statements in this communication by CF Industries Holdings, Inc. (together with its subsidiaries, the “Company” or “we,” “our” or “us”), other than those relating to historical facts, are forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to our prospects, future developments and business strategies. We have used the words "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "predict," "project," "will" or "would" and similar terms and phrases, including references to assumptions, to identify forward-looking statements in this document. These forward-looking statements are made based on currently available competitive, financial and economic data, our current expectations, estimates, forecasts and projections about the industries and markets in which we operate and management's beliefs and assumptions concerning future events affecting us. These statements are not guarantees of future performance and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control. Therefore, our actual results may differ materially from what is expressed in or implied by any forward-looking statements. We want to caution you not to place undue reliance on any forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, the cyclical nature of our business and the agricultural sector; the global commodity nature of our fertilizer products, the impact of global supply and demand on our selling prices, and the intense global competition from other fertilizer producers; conditions in the U.S. and European agricultural industry; the volatility of natural gas prices in North America and Europe; difficulties in securing the supply and delivery of raw materials, increases in their costs or delays or interruptions in their delivery; reliance on third party providers of transportation services and equipment; the significant risks and hazards involved in producing and handling our products against which we may not be fully insured; our ability to manage our indebtedness; operating and financial restrictions imposed on us by the agreements governing our senior secured indebtedness; risks associated with our incurrence of additional indebtedness; our ability to maintain compliance with covenants under the agreements governing our indebtedness; downgrades of our credit ratings; risks associated with cyber security; weather conditions; risks associated with changes in tax laws and disagreements with taxing authorities; our reliance on a limited number of key facilities; potential liabilities and expenditures related to environmental, health and safety laws and regulations and permitting requirements; future regulatory restrictions and requirements related to greenhouse gas emissions; risks associated with expansions of our business, including unanticipated adverse consequences and the significant resources that could be required; the seasonality of the fertilizer business; the impact of changing market conditions on our forward sales programs; risks involving derivatives and the effectiveness of our risk measurement and hedging activities; risks associated with the operation or management of the strategic venture with CHS, Inc., risks and uncertainties relating to the market prices of the fertilizer products that are the subject of our supply agreement with CHS over the life of the supply agreement, and the risk that any challenges related to the CHS strategic venture will harm our other business relationships; risks associated with our Point Lisas Nitrogen Limited joint venture; acts of terrorism and regulations to combat terrorism; risks associated with international operations; and deterioration of global market and economic conditions. More detailed information about factors that may affect the Company’s performance and could cause actual results to differ materially from those in any forward-looking statements may be found in CF Industries Holdings, Inc.’s filings with the Securities and Exchange Commission, including CF Industries Holdings, Inc.’s most recent annual and quarterly reports on Form 10-K and Form 10-Q, which are available in the Investor Relations section of the Company’s website. Forward-looking statements are given only as of the date of this presentation and the Company disclaims any obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Additional Information and Where to Find It CF Industries Holdings, Inc. (the “Company”) and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the Company’s 2018 annual meeting of stockholders (the “Annual Meeting”). Information regarding the identity of such participants and a description of their direct or indirect interests, by security holdings or otherwise, is contained in the Company’s preliminary proxy statement filed with the Securities and Exchange Commission on March 14, 2018 (the “Preliminary Proxy Statement”). Stockholders should read the Company’s definitive proxy statement for the Annual Meeting carefully when it becomes available because it will contain important information. Stockholders can get the definitive proxy statement, when it becomes available, and other documents filed by the Company with the SEC in connection with the Annual Meeting for free at the SEC’s web site at www.sec.gov. Stockholders may also obtain free copies of the definitive proxy statement for the Annual Meeting, when it becomes available, from the Company by directing such request to Investor Relations, CF Industries Holdings, Inc., 4 Parkway North, Suite 400, Deerfield, Illinois 60015 or by calling (847) 405-2400.

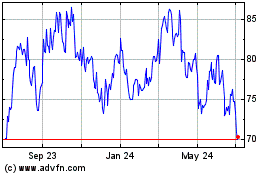

CF Industries (NYSE:CF)

Historical Stock Chart

From Mar 2024 to Apr 2024

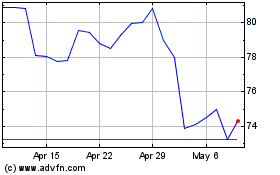

CF Industries (NYSE:CF)

Historical Stock Chart

From Apr 2023 to Apr 2024