Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the Registrant

ý

|

Filed by a Party other than the Registrant

o

|

Check the appropriate box:

|

ý

|

|

Preliminary Proxy Statement

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

o

|

|

Definitive Proxy Statement

|

o

|

|

Definitive Additional Materials

|

o

|

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

|

|

FIRST HAWAIIAN, INC.

|

(Name of Registrant as Specified In Its Charter)

|

N/A

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

March 30, 2018

Dear

Stockholder:

On

behalf of the Board of Directors and management of First Hawaiian, Inc., I am pleased to invite you to the 2018 Annual Meeting of Stockholders. The Annual Meeting will be held

at The Bankers Club, 999 Bishop Street, 30

th

Floor, Honolulu, Hawaii on Wednesday, April 25, 2018 at 8:00 a.m., local time.

The

attached Notice of Annual Meeting and Proxy Statement describe the formal business to be conducted at the Annual Meeting. Our Board of Directors and senior officers, as well as

representatives from our independent registered public accounting firm, will be present to respond to appropriate questions from stockholders.

Your

vote is important. Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card in the envelope provided or vote telephonically or

electronically using the telephone and Internet voting procedures described on the proxy card at your earliest convenience.

|

|

|

|

|

|

|

Sincerely,

|

|

|

Robert S. Harrison

|

|

|

|

Chairman and Chief Executive Officer

|

Table of Contents

FIRST HAWAIIAN, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 25, 2018

NOTICE HEREBY IS GIVEN that the 2018 Annual Meeting of Stockholders of First Hawaiian, Inc. (the "Company") will be held at The Bankers Club, 999 Bishop

Street, 30

th

Floor, Honolulu, Hawaii on Wednesday, April 25, 2018, at 8:00 a.m., local time, for the purpose of considering and voting upon:

-

1.

-

The

election of nine directors named in this Proxy Statement to serve until the 2019 Annual Meeting of Stockholders;

-

2.

-

The

appointment of Deloitte & Touche LLP to serve as the independent registered public accounting firm for the fiscal year ending December 31,

2018;

-

3.

-

An

advisory vote on the frequency of future votes on the compensation of our named executive officers;

-

4.

-

An

amendment of the second amended and restated certificate of incorporation of the Company (the "Certificate of Incorporation") that would eliminate the

supermajority voting requirement for any stockholder alteration, amendment, repeal or adoption of any bylaw of the Company on the date that BNP Paribas ("BNPP") or an affiliate thereof ceases to

beneficially own at least 5% of our outstanding common stock;

-

5.

-

An

amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for the amendment, alteration, repeal or adoption of any

provision of certain articles of the Certificate of Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock;

-

6.

-

A

stockholder proposal requesting that the Board of Directors adopt a policy for improving Board diversity, if properly presented at the meeting;

-

7.

-

A

stockholder proposal requesting that the Board of Directors amend the Bylaws to provide proxy access for stockholders, if properly presented at the meeting; and

-

8.

-

Such

other business as properly may come before the Annual Meeting or any adjournments or postponements thereof. The Board of Directors is not aware of any other

business to be presented to a vote of the stockholders at the Annual Meeting.

The

Board of Directors has fixed the close of business on March 5, 2018 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual

Meeting and any adjournments or postponements thereof.

A

list of stockholders entitled to vote at the 2018 Annual Meeting will be available for inspection upon request of any stockholder for a purpose germane to the meeting at our principal

executive offices at 999 Bishop Street, 29

th

Floor, Honolulu, Hawaii 96813 during the ten days prior to the meeting, during ordinary business hours, and at The Bankers Club, 999

Bishop Street, 30

th

Floor, Honolulu, Hawaii during the meeting.

If

you hold your shares of common stock through a broker or nominee and you plan to attend the 2018 Annual Meeting, you will need to bring either a copy of the voting instruction card

provided by your broker or nominee or a copy of a brokerage statement showing your ownership as of March 5, 2018.

i

Table of Contents

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY WITH YOUR VOTING INSTRUCTIONS. YOU MAY VOTE BY TELEPHONE OR INTERNET (BY

FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD) OR BY MAIL.

|

|

|

|

|

|

|

By order of the Board of Directors,

|

|

|

|

|

|

|

Joel E. Rappoport

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

Honolulu,

Hawaii

March 30, 2018

ii

Table of Contents

TABLE OF CONTENTS

iii

Table of Contents

FIRST HAWAIIAN, INC.

999 Bishop Street, 29

th

Floor

Honolulu, Hawaii 96813

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, APRIL 25, 2018

These proxy materials are furnished in connection with the solicitation by the board of directors (the "Board" or our "Board") of First Hawaiian, Inc.

("First Hawaiian" or the "Company"), a Delaware corporation, of proxies to be voted at the 2018 Annual Meeting of Stockholders of the Company and at any adjournment of such meeting (the "Annual

Meeting"). This Proxy Statement (this "Proxy Statement"), together with the Notice of Annual Meeting and proxy card, is first being mailed to stockholders on or about March 30, 2018.

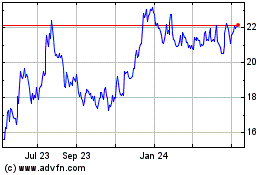

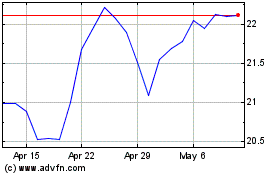

The

Company completed the initial public offering (the "IPO") of shares of its common stock, par value $0.01 per share (our "common stock"), in August 2016 and is a publicly traded bank

holding company with its shares listed on the NASDAQ Global Select Market ("NASDAQ") under the ticker symbol "FHB." Prior to the IPO, the Company was a wholly-owned indirect subsidiary of BNP Paribas

("BNPP"), a financial institution based in France. Following the IPO and a subsequent secondary offering of the Company's common stock in February 2017 (including the full exercise of the

underwriters' option to purchase additional shares of common stock completed on February 17, 2017), BNPP continues to own approximately 62.0% of the Company's common stock. BNPP exercises

considerable control over the Company as a controlling stockholder and pursuant to a Stockholder Agreement between the Company and BNPP entered into in connection with the IPO (the "Stockholder

Agreement"). The Company owns 100% of the outstanding common stock of First Hawaiian Bank ("FHB" or the "Bank").

When

used in this Proxy Statement, the terms "First Hawaiian," "FHI," "we," "our," "us" and the "Company" refer to First Hawaiian, Inc., a Delaware corporation, and its

consolidated subsidiaries, which include only First Hawaiian Bank and its subsidiaries, and the term "fiscal year" refers to our fiscal year, which is based on a 12-month period ending

December 31 of each year (e.g., fiscal year 2017 refers to the 12-month period ended December 31, 2017).

1

Table of Contents

ABOUT THE MEETING

When and where is the Annual Meeting?

The Annual Meeting will be held on Wednesday, April 25, 2018 at 8:00 a.m., local time, at The Bankers Club, 999 Bishop Street,

30

th

Floor, Honolulu, Hawaii.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters described in the Notice of Annual Meeting that accompanies this Proxy Statement,

including (i) the election of nine nominees for director named in this Proxy Statement, (ii) the ratification of the appointment by the Audit Committee of the Board of Deloitte &

Touche LLP as the Company's independent registered public accounting firm for fiscal year 2018, (iii) an advisory vote on the frequency of future votes on the compensation of our named

executive officers ("NEOs"), (iv) an amendment of the second amended and restated certificate of incorporation of the Company (the "Certificate of Incorporation") that would eliminate the

supermajority voting requirement for any stockholder alteration, amendment, repeal or adoption of any bylaw of the Company on the date that BNPP or an affiliate thereof ceases to beneficially own at

least 5% of our outstanding common stock, (v) an amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for the amendment, alteration, repeal or

adoption of any provision of certain articles of the Certificate of Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock,

(vi) a stockholder proposal requesting that the Board of Directors adopt a policy for improving Board diversity and (vii) a stockholder proposal requesting that the Board of Directors

amend the Bylaws to provide proxy access for stockholders.

Who may vote at the Annual Meeting?

Only record holders of our common stock as of the close of business on March 5, 2018 (the "Record Date"), will be entitled to vote at the

Annual Meeting. On the Record Date, the Company had outstanding 139,601,123 shares of common stock. Each outstanding share of common stock entitles the holder to one vote.

What constitutes a quorum?

The Annual Meeting will be held only if a quorum is present. A quorum will be present if the holders of a majority of the shares of common stock

outstanding on the Record Date and entitled to vote on a matter at the Annual Meeting are represented, in person or by proxy, at the Annual Meeting. Shares represented by properly completed proxy

cards either marked "abstain" or "withhold," or returned without voting instructions are counted as present and entitled to vote for the purpose of determining whether a quorum is present at the

Annual Meeting. If shares are held by brokers who are prohibited from exercising discretionary authority for beneficial owners who have not

given voting instructions ("broker non-votes"), those shares will be counted as represented at the Annual Meeting for the purpose of determining whether a quorum is present at the Annual Meeting.

How are votes counted?

Each stockholder entitled to vote at the Annual Meeting will be entitled to one vote for each share of stock held by such stockholder as of the

Record Date, which has voting power upon the matter in question.

Shares

of capital stock of the Company (i) belonging to the Company or (ii) held by another corporation if the Company owns, directly or indirectly, a sufficient number of

shares entitled to elect a

2

Table of Contents

majority

of the directors of such other corporation, are not counted in determining the total number of outstanding shares and will not be not voted. Notwithstanding the foregoing, shares held by the

Company in a fiduciary capacity are counted in determining the total number of outstanding shares at any given time and may be voted.

A plurality of the votes cast for their election is required for the election of each of the nine nominees for director. This means that the

nine nominees receiving the highest number of votes will be elected regardless of whether the number of votes received by any such nominee constitutes a majority of the number of votes cast.

Abstentions, votes to withhold and broker non-votes will not be counted for purposes of this proposal and will not affect the result of the vote.

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal 2 is required for

the ratification of the appointment of our independent registered public accounting firm. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the outcome of

the voting on this proposal.

Proposal 3: Advisory Vote on the Frequency of Future Votes on the Compensation of Our Named Executive

Officers

The frequency (i.e., Every Year, Every Two Years or Every Three Years) that receives the highest number of votes cast by stockholders

will be considered by us as the stockholders' recommendation as to the frequency of future shareholder advisory votes to approve the compensation of our named executive officers. Abstentions will not

be included in the total votes cast and will not affect the results.

Proposal 4: Elimination of Supermajority Voting Requirement for Any Stockholder Alteration, Amendment,

Repeal or Adoption of Any Bylaw

The affirmative vote of no less than 75% of the votes of all outstanding shares entitled to vote on Proposal 4 is required for the approval of

an amendment of the Certificate of

Incorporation that would eliminate the supermajority voting requirement for any stockholder alteration, amendment, repeal or adoption of any bylaw of the Company on the date that BNPP or an affiliate

thereof ceases to beneficially own at least 5% of our outstanding common stock. Abstentions and broker non-votes will have the same impact on the outcome of the voting on this proposal as votes

"against" this proposal.

Proposal 5: Elimination of Supermajority Voting Requirement for Any Amendment, Alteration, Repeal or

Adoption of Any Provision of Certain Articles of the Certificate of Incorporation

The affirmative vote of a majority of the outstanding stock entitled to vote on Proposal 5 is required for the approval of an amendment of the

Certificate of Incorporation that would eliminate the supermajority voting requirement for the amendment, alteration, repeal or adoption of any provision of certain articles of the Certificate of

Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock. Abstentions and broker non-votes will have the same impact on the

outcome of the voting on this proposal as votes "against" this proposal.

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposals 6 is required for

the approval of stockholder proposal requesting that the

3

Table of Contents

Board

of Directors adopt a policy for improving Board diversity. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the outcome of the voting on this

proposal.

Proposal 7: Stockholder Proposal Requesting a Bylaw Amendment to Provide Proxy Access for Stockholders

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on Proposal 7 is required for

approval of the stockholder proposal requesting that the Board of Directors amend the Bylaws to provide proxy access for stockholders. Abstentions and broker non-votes will not be counted as votes

cast and will have no effect on the outcome of the voting on this proposal.

How do I submit my vote?

If you are a stockholder of record, you can vote by:

-

•

-

attending the Annual Meeting and voting by ballot;

-

•

-

signing, dating and mailing in your proxy card;

-

•

-

using your telephone, according to the instructions on your proxy card; or

-

•

-

visiting http://www.voteproxy.com and then following the instructions on the screen.

What do I do if I hold my shares through a broker, bank or other nominee?

If you hold your shares through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy,

including whether telephone or Internet voting options are available.

How do I attend the Annual Meeting and vote in person, and what do I need to bring?

All stockholders who attend the Annual Meeting in person will be asked to check in at the registration desk prior to admittance to the meeting.

Stockholders who own Company stock through a broker, or other nominee, will need to bring either a copy of the voting instruction card provided by the stockholder's broker or nominee or a copy of his

or her brokerage statement as proof of ownership, along with photo identification. No cameras or recording equipment will be permitted in the Annual Meeting, and all cell phones must be turned off. If

you hold your shares through a broker, bank or other nominee and would like to vote in person at the Annual Meeting, you will need to ask the holder for a legal proxy. You will need to bring the legal

proxy with you to the Annual Meeting and turn it in with a signed ballot that will be provided to you at the Annual Meeting.

Can I change or revoke my vote after I return my proxy card?

Yes. If you are a stockholder of record, you may change your vote by:

-

•

-

voting in person by ballot at the Annual Meeting;

-

•

-

returning a later-dated proxy card;

-

•

-

entering a new vote by telephone or on the Internet; or

-

•

-

delivering written notice of revocation to our Corporate Secretary by mail at 999 Bishop Street, 29

th

Floor, Honolulu,

Hawaii 96813.

4

Table of Contents

Who will count the votes?

A representative of our Transfer Agent, American Stock Transfer & Trust Company, LLC, will act as inspector of election at the

Annual Meeting and will count the votes.

Will my vote be kept confidential?

Yes. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are available

only to the Company and its inspectors, who are required to acknowledge their obligation to keep your votes confidential.

Who pays to prepare, mail and solicit the proxies?

The Company pays all of the costs of preparing, mailing and soliciting proxies in connection with this Proxy Statement. In addition to

soliciting proxies through the mail by means of this Proxy Statement, we may solicit proxies through our directors, officers and employees in person and by telephone, facsimile or email. The Company

asks brokers, banks, voting trustees and other nominees and fiduciaries to forward proxy materials to the beneficial owners and to obtain authority to execute proxies. The Company will reimburse the

brokers, banks, voting trustees and other nominees and fiduciaries upon request. In addition to solicitation by mail, telephone, facsimile, email or personal contact by its directors, officers and

employees, the Company has retained the services of D. F. King & Co., Inc., 40 Wall Street, New York, NY 10005 to solicit proxies for a fee of $7,500 plus expenses.

What are the Board's recommendations as to how I should vote on each proposal?

The Board recommends a vote:

-

•

-

FOR the election of each of the nine director nominees named in this Proxy Statement;

-

•

-

FOR the ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the Company's independent registered public

accounting firm for fiscal year 2018;

-

•

-

a frequency of EVERY YEAR for future advisory votes on the compensation of our named executive officers;

-

•

-

FOR an amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for any stockholder alteration,

amendment, repeal or adoption of any bylaw of the Company on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock;

-

•

-

FOR an amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for the amendment, alteration,

repeal or adoption of any provision of certain articles of the Certificate of Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding

common stock;

-

•

-

AGAINST the stockholder proposal requesting that the Board of Directors adopt a policy for improving Board diversity; and

-

•

-

AGAINST the stockholder proposal requesting that the Board of Directors amend the Bylaws to provide proxy access for stockholders.

5

Table of Contents

How will my shares be voted if I sign, date and return my proxy card?

If you sign, date and return your proxy card and indicate how you would like your shares voted, your shares will be voted as you have

instructed. If you sign, date and return your proxy card but do not indicate how you would like your shares voted, your proxy will be voted:

-

•

-

FOR the election of each of the nine director nominees named in this Proxy Statement;

-

•

-

FOR the ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the Company's independent registered public

accounting firm for fiscal year 2018;

-

•

-

a frequency of EVERY YEAR for future advisory votes on the compensation of our named executive officers;

-

•

-

FOR an amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for any stockholder alteration,

amendment, repeal or adoption of any bylaw of the Company on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock;

-

•

-

FOR an amendment of the Certificate of Incorporation that would eliminate the supermajority voting requirement for the amendment, alteration,

repeal or adoption of any provision of certain articles of the Certificate of Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding

common stock;

-

•

-

AGAINST the stockholder proposal requesting that the Board of Directors adopt a policy for improving Board diversity; and

-

•

-

AGAINST the stockholder proposal requesting that the Board of Directors amend the Bylaws to provide proxy access for stockholders.

With

respect to any other business that may properly come before the Annual Meeting, or any adjournment of the Annual Meeting, that is submitted to a vote of the stockholders, including

whether or not to adjourn the Annual Meeting, your shares will be voted in accordance with the best judgment of the persons voting the proxies.

How will broker non-votes be treated?

A broker non-vote occurs when a broker who holds its customer's shares in street name submits proxies for such shares, but indicates that it

does not have authority to vote on a particular matter. Generally, this occurs when brokers have not received any instructions from their customers. In these cases, the brokers, as the holders of

record, are permitted to vote on "routine" matters only, but not on other matters. Shares for which brokers have not received instructions from their customers will only be permitted to vote on the

following proposal:

-

•

-

The ratification of the Audit Committee's appointment of Deloitte & Touche LLP as the Company's independent registered public

accounting firm for fiscal year 2018.

Shares

for which brokers have not received instructions from their customers will not be permitted to vote on the following proposals:

-

•

-

To elect the nine director nominees named in this Proxy Statement.

-

•

-

To vote on the frequency of future votes on the compensation of our named executive officers.

-

•

-

To amend the Certificate of Incorporation to eliminate the supermajority voting requirement for any stockholder alteration, amendment, repeal

or adoption of any bylaw of the Company on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock.

6

Table of Contents

-

•

-

To amend the Certificate of Incorporation to eliminate the supermajority voting requirement for the amendment, alteration, repeal or adoption

of any provision of certain articles of the Certificate of Incorporation on the date that BNPP or an affiliate thereof ceases to beneficially own at least 5% of our outstanding common stock.

-

•

-

The stockholder proposal requesting that the Board of Directors adopt a policy for improving Board diversity.

-

•

-

The stockholder proposal requesting that the Board of Directors amend the Bylaws to provide proxy access for stockholders.

What if other matters come up during the Annual Meeting?

If any matters other than those referred to in the Notice of Annual Meeting properly come before the Annual Meeting, the individuals named in

the accompanying proxy card will vote the proxies held by them in accordance with their best judgment. First Hawaiian is not aware of any business other than the items referred to in the Notice of

Annual Meeting that will be considered at the Annual Meeting.

Your vote is important.

Because many stockholders cannot personally attend the Annual Meeting, it is necessary that a large number be represented by proxy in order to

satisfy that a quorum be present to conduct business at the Annual Meeting. Whether or not you plan to attend the meeting in person, prompt voting will be appreciated. Stockholders of record can vote

their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services are provided on the proxy card. Of course, you may still vote your shares on

the proxy card. To do so, we ask that you complete, sign, date and return the enclosed proxy card promptly in the postage-paid envelope.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to Be Held on April 26, 2017:

This Proxy Statement and our 2017 Annual Report to Stockholders Are Available Free of Charge at:

http://proxy.fhb.com.

7

Table of Contents

PROPOSAL NO. 1—ELECTION OF DIRECTORS

Board of Directors

Our Board currently has nine members, consisting of our Chief Executive Officer, five directors designated for nomination and election by BNPP

and three other directors who are "independent" under the listing standards of NASDAQ. The terms of office of all directors expire at the Annual Meeting.

Our

Amended and Restated Bylaws provide that the Board will consist of no less than five directors and that there initially will be nine directors. Pursuant to our Certificate of

Incorporation and the Stockholder Agreement, the number of directors constituting our Board will be fixed from time to time by resolution of the Board; provided that, until the date BNPP ceases to

directly or indirectly beneficially own at least 25% of our outstanding common stock, we cannot change the size of our Board without either the approval of a majority of the BNPP designated directors

on the Board at the time of such action or BNPP's waiver of its rights under the Stockholder Agreement.

Until

the date BNPP ceases to beneficially own at least 5% of our common stock, in connection with any meeting of our stockholders at which directors are to be elected, the Stockholder

Agreement provides BNPP the right to designate a number of individuals for nomination and election to our Board determined by a formula described in the agreement. BNPP currently has the right to

designate five individuals for nomination and election to our Board. We are required to recommend and solicit proxies in favor of, and to otherwise use our best efforts to cause the election of, each

person designated by BNPP whose nomination has been approved. For background on our relationship with BNPP and the Stockholder Agreement, see "

Our Relationship with BNPP and

Certain Other Related Party Transactions—Relationship with BNPP

."

Nominees for Election as Directors at the 2018 Annual Meeting

The Corporate Governance and Nominating Committee of the Board seeks candidates for nomination to the Board who are qualified to be directors

consistent with the Company's corporate governance guidelines, as described below under the section entitled "

Board of Directors, Committees and

Governance—Corporate Governance Guidelines and Code of Conduct and Ethics

." In evaluating the suitability of individuals for Board membership, the Corporate

Governance and Nominating Committee takes into account many factors. Those factors include: whether the individual meets various independence requirements; the individual's general understanding of

the varied disciplines relevant to the success of a publicly traded company in today's business environment; understanding of the Company's business and markets; professional expertise and educational

background; and other factors that promote diversity of views and experience. The Corporate Governance and Nominating Committee evaluates each individual in the context of the Board as a whole, with

the objective of recruiting and recommending a slate of directors that can best perpetuate the Company's success and represent stockholder interests through the exercise of sound judgment, using its

diversity of experience. In determining whether to recommend a director for re-nomination, the Corporate Governance and Nominating Committee also considers the director's attendance at, participation

in and contributions to Board and committee activities.

On

the recommendation of the Corporate Governance and Nominating Committee, the Board has determined that the size of the Board is currently appropriate and has nominated all nine

current members of the Board for re-election as directors at the Annual Meeting, each to serve for a one-year term expiring at the next annual meeting of stockholders in 2019.

8

Table of Contents

The

following table sets forth certain information regarding the director nominees standing for re-election at the Annual Meeting. Additional biographical information on each of the

nominees is included below under the section entitled "

Directors and Executive Officers

."

|

|

|

|

|

|

|

|

|

Director Name

|

|

Age

|

|

Director

Since

|

|

Principal Occupation

|

|

Robert S. Harrison

|

|

57

|

|

2016

|

|

Chairman and Chief Executive Officer of First Hawaiian

|

|

Matthew J. Cox

|

|

56

|

|

2016

|

|

Chairman of the Board and Chief Executive Officer of Matson, Inc.

|

|

W. Allen Doane

|

|

70

|

|

2016

|

|

Retired Chairman and Chief Executive Officer of Alexander & Baldwin, Inc.

|

|

Thibault Fulconis

|

|

52

|

|

2016

|

|

Chief Operating Officer and Vice Chairman of Bank of the West, Vice Chairman of BancWest Corporation

|

|

Gérard Gil

|

|

68

|

|

2016

|

|

Retired senior finance and accounting advisor to BNPP

|

|

Jean-Milan Givadinovitch

|

|

62

|

|

2016

|

|

Head of Operational Risk Framework Design and Strategy for BNPP

|

|

J. Michael Shepherd

|

|

62

|

|

2016

|

|

Chairman of BNP Paribas USA, Inc., BancWest Corporation and Bank of the West

|

|

Allen B. Uyeda

|

|

68

|

|

2016

|

|

Retired Chief Executive Officer of First Insurance Company of Hawaii

|

|

Michel Vial

|

|

60

|

|

2016

|

|

Head of Group Strategy and Development of BNPP

|

In

considering the nominees' individual experience, qualifications, attributes, skills and past Board participation, the Corporate Governance and Nominating Committee and the Board have

concluded that when considered all together, the appropriate experience, qualifications, attributes, skills and participation are represented for the Board as a whole and for each of the Board's

committees. There are no family relationships among any directors and executive officers. Each nominee has indicated a willingness to serve, and the Board has no reason to believe that any of the

nominees will not be available for election. However, if any of the nominees is not available for election, proxies may be voted for the election of other persons selected by the Board. Proxies

cannot, however, be voted for a greater number of persons than the number of nominees named. Stockholders of the Company have no cumulative voting rights with respect to the election of directors.

Required Vote

With regard to the election of the director nominees, votes may be cast in favor or withheld. The nominees receiving the greatest number of

affirmative votes cast at the Annual Meeting will be elected directors; therefore, abstentions, votes withheld and broker non-votes will have no effect on the results of the vote.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR NAMED ABOVE.

9

Table of Contents

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information regarding each of our directors and executive officers.

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

Robert S. Harrison

|

|

|

57

|

|

Chairman of the Board of Directors and Chief Executive Officer

|

|

Matthew J. Cox

|

|

|

56

|

|

Director

|

|

W. Allen Doane

|

|

|

70

|

|

Director

|

|

Thibault Fulconis

|

|

|

52

|

|

Director

|

|

Gérard Gil

|

|

|

68

|

|

Director

|

|

Jean-Milan Givadinovitch

|

|

|

62

|

|

Director

|

|

J. Michael Shepherd

|

|

|

62

|

|

Director

|

|

Allen B. Uyeda

|

|

|

68

|

|

Director

|

|

Michel Vial

|

|

|

60

|

|

Director

|

|

Eric K. Yeaman

|

|

|

50

|

|

President and Chief Operating Officer, Interim Chief Financial Officer

|

|

Alan H. Arizumi

|

|

|

58

|

|

Vice Chairman of Wealth Management Group

|

|

Lance A. Mizumoto

|

|

|

59

|

|

Executive Vice President and Chief Lending Officer, Commercial Banking Group

|

|

Mitchell E. Nishimoto

|

|

|

54

|

|

Executive Vice President, Retail Banking Group

|

|

Ralph M. Mesick

|

|

|

58

|

|

Executive Vice President and Chief Risk Officer

|

A

brief biography of each person who serves as a director or executive officer of our First Hawaiian is set forth below:

Robert S. Harrison

, the Chairman and Chief Executive Officer of First Hawaiian, has been the Chief Executive Officer of First Hawaiian

Bank since January 2012 and the Chairman of the Bank's board of directors since May 2014. Mr. Harrison served as the Chief Operating Officer of First Hawaiian Bank from December 2009 to January

2012 and as its President from December 2009 to June 2015. He was named Vice Chairman of First Hawaiian Bank in 2007 and served as the Bank's Chief Risk Officer from 2006 to 2009. Mr. Harrison

joined First Hawaiian Bank's Retail Banking group in 1996 and has over 29 years of experience in the financial services industry in Hawaii and on the U.S. mainland. Prior to the Reorganization

Transactions (described elsewhere in the proxy statement), Mr. Harrison served as Vice Chairman of BancWest. Following the completion of the Reorganization Transactions, Mr. Harrison

continues to serve as Vice Chairman of BancWest Corporation. Mr. Harrison serves on the board of Alexander & Baldwin, Inc., a Hawaii publicly traded company with interests in,

among other things, commercial real estate and real estate development. He also serves as the Chairman of Hawaii Medical Service Association. He is a member of the boards of Hawaii Community

Foundation, Hawaii Business Roundtable and Blood Bank of Hawaii. Mr. Harrison holds a bachelor's degree in applied mathematics from the University of California, Los Angeles and an M.B.A. from

Cornell University.

Mr. Harrison's

qualifications to serve on the Board include his operating, management and leadership experience as First Hawaiian Bank's Chairman and Chief Executive Officer, as

well as his prior experience as First Hawaiian Bank's President and Chief Operating Officer and as its Chief Risk Officer. Mr. Harrison has extensive knowledge of, and has made significant

contributions to, the growth of First Hawaiian and First Hawaiian Bank. Mr. Harrison also brings to First Hawaiian's Board his expertise in the financial services industry generally and in

Hawaii in particular.

Matthew J. Cox

, a member of the Board and both the Audit and Compensation Committees of First Hawaiian, has served on the First Hawaiian

Bank board of directors since 2014. He is the Chairman of the Board and Chief Executive Officer of Matson, Inc., a public company and leading carrier for ocean transportation services in the

Pacific, where he has been since 2012, having previously

10

Table of Contents

served

as President, Chief Operating Officer and Chief Financial Officer. Mr. Cox brings to the Board of First Hawaiian extensive experience in supervising and performing company financial

functions. Prior to joining Matson, Inc. in 2001, he served as Chief Operating Officer and Chief Financial Officer for Distribution Dynamics, Inc., a provider of outsourced logistics,

inventory management and integrated information services that is now a division of Anixter Industries, a Fortune 500 public company. Mr. Cox also previously held executive and financial

positions with American President Lines, Ltd., a global container transportation company. Mr. Cox served on the board of the Standard Club from 2010 to 2017, the board of Gallo Glass

Company, a subsidiary of Gallo, Inc. and the advisory boards of Catholic Charities of Hawaii and the University of Hawaii Shidler College of Business, and, from 2008 to 2012, he served on the

board of the Pacific Maritime Association. Mr. Cox holds a bachelor's degree in accounting and finance from the University of California, Berkeley.

W. Allen Doane

, a member of the Board and the Risk Committee and the chair of the Audit Committee of First Hawaiian, has served on the

board of First Hawaiian Bank since 1999 and the board of BancWest from 2004 to 2006 and since 2012, and he has been the chairman of the First Hawaiian Bank audit committee since 2012. As the retired

Chairman and Chief Executive Officer of Alexander & Baldwin, Inc., a Hawaii public company with interests in, among other things, commercial real estate and real estate development,

Mr. Doane brings to the First Hawaiian Board broad-based knowledge about Hawaii and its business environment, as well as extensive financial and managerial experience. Mr. Doane served

as Chief Executive Officer of Alexander & Baldwin, Inc. from 1998 until his retirement in 2010. Prior to joining Alexander & Baldwin, Inc. in 1991, Mr. Doane served

as Chief Operating Officer of Shidler Group, a real estate investment organization. He also held executive positions at IU International Corporation, a Philadelphia-based public company, and

C. Brewer & Co., Ltd., one of Hawaii's oldest operating companies, which has since been dissolved. He currently serves on the board and audit committee of Alexander &

Baldwin, Inc. and on the board and audit committee of Pacific Guardian Life Insurance Company, the largest domestic life and disability insurer in Hawaii. Mr. Doane holds a bachelor's

degree from Brigham Young University and an M.B.A. from Harvard Business School.

Thibault Fulconis

, a member of the Board and the Risk Committee of First Hawaiian, has served as Chief Operating Officer and Vice Chairman

of Corporate Functions at Bank of the West since 2015. Before that, he served as Co-Chief Operating Officer of BNP Paribas USA from 2016 to 2017 and as Vice Chairman—Commercial Banking and

Consumer finance from 2012 to 2015. Previously, Mr. Fulconis was Chief Financial Officer and Treasurer of BancWest from 2006 to 2012. He brings to the First Hawaiian Board extensive experience

in the financial services industry, having held numerous other senior management positions, including Head of Finance and Development for BNPP's International Retail and Financial Services Division

from 2003 to 2006, Head of Financial Management

at BNPP from 1995 to 2003, Senior Corporate Banking Officer at Banque Paribas Luxembourg from 1992 to 1995 and Head of Management Accounting at Banque Paribas Luxembourg from 1989 to 1992.

Mr. Fulconis also served as a business analyst in the mergers and acquisitions division of Booz Allen Hamilton in Paris from 1988 to 1989. Mr. Fulconis graduated from the business school

at École des Hautes Etudes Commerciales with a major in finance. Mr. Fulconis was nominated to First Hawaiian's Board by BNPP consistent with its rights under the Stockholder

Agreement.

Gérard Gil

, a member of the Board and the chair of both the Compensation and Corporate Governance and Nominating Committees

of First Hawaiian, has been Senior Advisor to BNPP's executive committee from 2012 through April 2017. Mr. Gil brings to the First Hawaiian Board extensive experience in financial reporting and

accounting, as he was Deputy Chief Financial Officer of BNPP from 2009 to 2011 and Group Chief Accounting Officer of BNPP from 1999 to 2009, supervising BNPP's accounting department from its creation.

Before joining BNPP, he served as Group Chief Accounting Officer with Banque Nationale de Paris from 1985 to 1999, during which time he developed accounting and internal control policies and oversaw

group financial and regulatory reporting. Mr. Gil

11

Table of Contents

previously

held positions with Banque Française du Commerce Extérieur and KPMG. He was Chairman of the accounting committee of the French Banking Association from 1998 to

2016 and of the accounting committee of the European Banking Federation from 2006 to 2011. Mr. Gil serves as chairman of the audit committee of Banco BNP Paribas Brazil and BNP Paribas Brazil

Conglomerado, as a board member of the French High Council for Statutory Auditors and as a member of the audit committee of BNP Paribas USA, Inc., New York, New York. He also chairs the audit

committee of BNP Paribas US Wholesale Holdings, Corp. He also served on the audit committee of BGL BNP Paribas, Luxembourg from 2012 to 2015 and on the audit and finance committees of CLS Group

Holdings AG, Zurich and CLS International, NY from 2013 to 2017. Mr. Gil graduated from the business school of École Supérieure de Commerce de Paris and holds a

graduate degree in accounting. Mr. Gil was nominated to First Hawaiian's Board by BNPP consistent with its rights under the Stockholder Agreement.

Jean-Milan Givadinovitch

, a member of the Board and the Risk Committee of First Hawaiian, has been Head of Operational Risk Framework

Design and Strategy within the BNP Paribas Risk Division since September 2017. Mr. Givadinovitch brings to the First Hawaiian Board extensive experience in overseeing audit functions and risk

management in the banking industry. He previously served as Executive Vice President of Bank of the West and Head of its Business Compliance Project Office since January 2016 and was Director of Audit

and Inspection at Bank of the West from 2002 to 2008. Prior to joining Bank of the West, he held positions at Turk Ekonomi Bankasi ("TEB"), a commercial bank in Turkey that is owned more than 70% by

BNPP. From 2009 to 2015, he served on the board of TEB Investment, a TEB brokerage firm. From 2010 to 2015, Mr. Givadinovitch served on the board of TEB, as chairman of TEB's audit committee

and as vice-chairman of its credit committee. During this time, he also served on the board of TEB N.V. (Netherlands), a bank specialized in commodity financing, the board of TEB Asset

Management and the board of TEB Factoring, an affiliate of TEB that renders factoring services, where he served as chairman of the audit committee as well. From 2008

to 2010, Mr. Givadinovitch served as Chief Risk Officer of TEB and headed the working groups on risks and recovery during TEB's merger with Fortis Turkey. Mr. Givadinovitch holds a

bachelor's degree in public administration from the Paris Institute of Political Studies and an M.B.A. from HEC—Business School. Mr. Givadinovitch was nominated to First Hawaiian's

Board by BNPP consistent with its rights under the Stockholder Agreement.

J. Michael Shepherd

, a member of the Board and the Corporate Governance and Nominating Committee of First Hawaiian, has served on the

board of directors of each of First Hawaiian Bank, Bank of the West and BancWest since 2008, including as a member of the First Hawaiian Bank compensation committee since 2010. Mr. Shepherd

brings to the First Hawaiian Board extensive legal and managerial experience as well as knowledge of the banking industry. He is Chairman of BNP Paribas USA, Inc., BancWest Corporation and Bank

of the West, having served as Chairman and Chief Executive Officer of BancWest and Bank of the West from January 2008 to June 2016. Prior to 2008, Mr. Shepherd served as President, General

Counsel, Chief Risk Officer and Chief Administrative Officer of Bank of the West. Before joining Bank of the West, Mr. Shepherd was General Counsel of The Bank of New York Company, Inc.

from 2001 to 2004 and a partner in the San Francisco law firm Brobeck, Phleger & Harrison LLP from 1995 to 2000. He was previously General Counsel of Shawmut National Corporation

(currently a Bank of America affiliate) from 1993 to 1995 and Special Counsel to Sullivan & Cromwell LLP from 1991 to 1993. Mr. Shepherd also served as Senior Deputy Comptroller

of the Currency, Associate Counsel to the President of the United States and Deputy Assistant Attorney General. He was President of the Federal Advisory Council to the Federal Reserve in 2014 and was

a member of the Council from 2012 to 2014. He has served as a Member of the FDIC Advisory Committee on Economic Inclusion from 2011 to 2017 and as a Director of the Presidio Trust from 2008 to 2012.

He received the HOPE Silver Rights Vision Award in 2015 and was the 2013 Recipient of the Distinguished Achievement Award of B'nai B'rith International. Mr. Shepherd also serves on the boards

of Pacific Mutual Holdings, Inc., which engages in insurance, financial services

12

Table of Contents

and

other investment-related businesses, and Pacific Life Insurance Company, a provider of various life insurance products, mutual funds and investment advisory services. He is a member of the

Advisory Boards of FTV Capital and of Promontory Interfinancial Network, and the Council on Foreign Relations. He holds a bachelor's degree from Stanford University and a J.D. from University of

Michigan Law School. Mr. Shepherd was nominated to First Hawaiian's Board by BNPP consistent with its rights under the Stockholder Agreement.

Allen B. Uyeda

, the lead independent director and a member of both the Audit and Corporate Governance and Nominating Committees and the

chair of the Risk Committee of First Hawaiian, has served on the board of directors and risk committee of First Hawaiian Bank since 2001 and 2012, respectively, and the board and risk committee of

BancWest since 2012, and he has been the chairman of the First Hawaiian Bank risk committee since 2012. Mr. Uyeda brings to the First Hawaiian Board extensive knowledge of Hawaii and experience

in supervising and performing company financial functions. From 1995 to 2014, he was Chief Executive Officer of First Insurance Company of Hawaii, a Honolulu-based property and casualty insurance

company that, during the course of Mr. Uyeda's

leadership, became a subsidiary of Tokio Marine Holdings, Inc., a multinational insurance holding company listed on the Tokyo Stock Exchange. Previously, Mr. Uyeda served as Vice

President and Chief Financial Officer of the Agency and Brokerage Group of Continental Insurance Company, prior to its acquisition by CNA Financial Corporation, a public unified holding company for

insurance entities. Mr. Uyeda also has several years of management, financial analyst and project engineering experience with International Paper, a public company with interests in paper-based

packaging, paper and pulp industries, and Johnson Controls, Inc., a public company that provides batteries and builds efficiency services. He serves on the boards of The Queen's Health Systems

and The Queen's Medical Center and is a Special Advisor to the Oahu Economic Development Board. Mr. Uyeda holds a bachelor's degree in electrical engineering from Princeton University and an

M.B.A. from the Wharton School at the University of Pennsylvania.

Michel Vial

, a member of the Board and the Compensation Committee of First Hawaiian, has been Head of Group Strategy and Development at

BNPP since 2011. Mr. Vial brings to the First Hawaiian Board extensive experience in the financial services industry, having been an employee and officer of BNPP for over three decades. He

served as Head of BNPP Corporate Finance from 1992 to 1996, Head of French Coverage for Large Corporates from 2004 to 2006 and Head of BNPP Development from 2007 to 2011. During his time as Head of

BNPP Development, he was in charge of BNPP's acquisition of Fortis Bank. Prior to joining BNPP, Mr. Vial worked at Arthur Andersen Consulting, now known as Accenture. Mr. Vial serves on

the supervisory boards of STET, a French payments company in which BNPP participates, and 441 Trust Company Ltd. (a United Kingdom company representing former Visa Europe Ltd. members).

He is a graduate of École Polytechnique and École Nationale Supérieure des Télécommunications in Paris and holds a master's

degree from Stanford University. Mr. Vial was nominated to First Hawaiian's Board by BNPP consistent with its rights under the Stockholder Agreement.

Eric K. Yeaman

, the President and Chief Operating Officer of First Hawaiian, has been President and Chief Operating Officer of First

Hawaiian Bank and a member of the Bank's board of directors since June 2015. Since February 2018, he has also served as Interim Chief Financial Officer of First Hawaiian and First Hawaiian Bank. Prior

to joining First Hawaiian Bank, Mr. Yeaman was the President and Chief Executive Officer of Hawaiian Telcom Holdco, Inc. (NASDAQ: HCOM), Hawaii's leading telecommunications provider,

from 2008 until 2015. In December 2008, Hawaiian Telcom filed a petition for bankruptcy under Chapter 11 of the federal bankruptcy laws. Under Mr. Yeaman's leadership, the company

emerged from bankruptcy in October 2010 and operated profitably throughout his remaining tenure with that company. Mr. Yeaman's prior experience also includes consulting and audit work from

1989 to 2000 at Arthur Andersen LLP, where he was a Senior Manager. From 2000 until 2003, Mr. Yeaman served as Chief Operating and Financial Officer at Kamehameha Schools, and

13

Table of Contents

from

2003 until 2008, he served as Financial Vice President and Chief Financial Officer of Hawaiian Electric Industries Inc. (NYSE: HE), a publicly traded electric utility holding company

owning the largest supplier of electricity in Hawaii, taking responsibility for financial strategy and reporting, investor relations and pension plan management. He later served as Senior Executive

Vice President

and Chief Operating Officer of its Hawaiian Electric Company subsidiary. Mr. Yeaman serves on the publicly traded company boards of Alaska Air Group, Inc., Alexander &

Baldwin, Inc. and Hawaiian Telcom as well as the not-for-profit boards of the Harold K.L. Castle Foundation, the Friends of Hawaii Charities and the First Hawaiian Bank Foundation.

Mr. Yeaman holds a bachelor's in business administration degree in accounting from the University of Hawaii at Manoa and is a Certified Public Accountant (not in public practice) in Hawaii.

Alan H. Arizumi

, the Vice Chairman of Wealth Management of both First Hawaiian and First Hawaiian Bank, oversees all areas of the Wealth

Management Group, which includes Personal Trust, Private Banking, Wealth Advisory, Institutional Wealth Management, Investment Services, Wealth Management Service Center, Trust Compliance and Bishop

Street Capital Management Corporation. At the Bank level, he has overseen the Wealth Management Group since 2013. From 2014 to 2017, he also concurrently oversaw the Consumer Banking Group.

Previously, Mr. Arizumi was Executive Vice President of the Bank's Business, Dealer and Card Services Group from 2010 to 2013 and Executive Vice President and Chief Risk Officer of the Bank's

Risk Management Group from 2009 to 2010. From 2013 to 2017, he served as the Chairman and Chief Executive Officer of Bishop Street Capital Management Corporation, and since 2016 has served as Vice

President and Treasurer (2016) and subsequently President (2017) of the Center Club, Inc. Mr. Arizumi serves on the boards of Bishop Street Capital Management Corporation, Bankers

Club, Inc. and Center Club, Inc., which are subsidiaries of the Bank, and he serves on the Board of the First Hawaiian Bank Foundation. He also serves on the local boards of Hawaii

Community Foundation, Hawaii Youth Symphony, Kuakini Medical Center, Kuakini Health System, McKinley High School Foundation and KCAA Preschools of Hawaii, and he is a special advisor to the Oahu

Economic Development Board. Mr. Arizumi holds a bachelor's degree in business administration from the University of Hawaii and is a graduate of the Pacific Coast Banking School.

Lance A. Mizumoto

, the Executive Vice President and Chief Lending Officer, Commercial Banking Group, rejoined the Bank in January 2017 and

was named to his current position in July 2017. He oversees all areas of the Commercial Banking Group, including Corporate Banking Division, Commercial Real Estate Division and Trade Finance

Department. Prior to joining First Hawaiian Bank in 2017, Mr. Mizumoto held a number of management positions at Central Pacific Bank, serving as Vice Chairman, Chief Operating Officer and Chief

Risk Officer from September to November 2016, President and Chief Banking Officer from June 2014 to August 2016, Executive Vice President of the Commercial Markets Group from July 2010 to June 2014

and Executive Vice President and Commercial Banking Division Manager from November 2005 to June 2010. Mr. Mizumoto also worked for First Hawaiian Bank in various management roles from 1996 to

2005. Mr. Mizumoto is the Chief Executive Officer of FHL SPC One, Inc. and First Hawaiian Leasing, Inc., both of which are subsidiaries of the Bank, and is a director of the First

Hawaiian Bank Foundation. He currently serves as the Chairman of the Board of Education of Hawaii and as a Regent on the Chaminade University Board of Regents. Mr. Mizumoto holds a bachelor's

degree in marketing and management from the University of Hawaii at Manoa and an M.B.A. from Chaminade University.

Mitchell E. Nishimoto

, the Executive Vice President and Manager of the Retail Banking Group of First Hawaiian, has served in that position

since 2016. He is responsible for First Hawaiian Bank's entire 62 branch network in Hawaii, Guam and Saipan in addition to the Bank's Residential Real Estate Division. Mr. Nishimoto started his

career with First Hawaiian Bank in 1986 as a Management Trainee. He managed branches throughout the Maui County from 1988 to 2011, advancing to the position of Senior Vice President and Maui Region

Manager from 2006 to 2011. Mr. Nishimoto was

14

Table of Contents

Senior

Vice President and Kapiolani Region Manager from 2011 to 2014 and Executive Vice President and Chief Risk Officer from 2014 to 2016. He is on the boards of directors of Adventist Health Castle,

Japanese Cultural Center of Hawaii, Chamber of Commerce of Hawaii and the First Hawaiian Bank Foundation. Mr. Nishimoto is also a member of the Honolulu Japanese Chamber of Commerce and

Japan-America Society of Hawaii. He holds a bachelor's degree in finance from the University of Southern California and is a graduate of the Pacific Coast Banking School.

Ralph M. Mesick

, the Executive Vice President and Chief Risk Officer of both First Hawaiian and First Hawaiian Bank, is responsible for

the design, implementation and oversight of the Company's risk management strategy and framework. Mr. Mesick previously served as Manager and Senior Vice President of the Bank's Commercial Real

Estate Division. Prior to joining the Bank in 2012, he spent over twenty-five years at Bank of Hawaii, where he was Executive Vice President and managed Bank of Hawaii's business lines and functions,

such as private banking and wealth management, credit risk and commercial real estate. He also served on Bank of Hawaii's operating, credit and trust executive committees. In addition to his over

thirty years of experience in the banking industry, Mr. Mesick is active in the community and also serves as a member of the board of directors for the First Hawaiian Bank Foundation, Board of

Regents at Chaminade University, the Hawaii Community Reinvestment Corporation, Saint Francis Healthcare Systems, Kapiolani Health Foundation and HomeAid Hawaii. He earned an MBA with a concentration

in Banking, Finance and Investments from the University of Wisconsin-Madison, graduating Beta Gamma Sigma, and a Bachelor of Business Administration from the University of Hawaii at Manoa.

15

Table of Contents

BOARD OF DIRECTORS, COMMITTEES AND GOVERNANCE

Overview

Our Board provides oversight with respect to our overall performance, strategic direction and key corporate policies. It approves major

initiatives, advises on key financial and business objectives, and monitors progress with respect to these matters. Members of the Board are kept informed of our business by various reports and

documents provided to them on a regular basis, including operating and financial reports and audit reports made at Board and committee meetings by our Chief Executive Officer, Chief Operating Officer,

Chief Financial Officer, Chief Risk Officer and

other officers. The Board has four standing committees, the principal responsibilities of which are described below under the section entitled "—

Committees of Our

Board of Directors

." Additionally, the directors meet in regularly scheduled executive sessions, without First Hawaiian management (generally other than Mr. Harrison)

present, at each regularly scheduled meeting of the Board. An executive session may not occur for a special meeting of the Board called for a specific purpose.

Meetings

The Board met nine times in 2017. Each member of the Board attended more than 75% of the total number of meetings of the Board and the

committees on which he served. We strongly encourage, but do not require, the members of our Board to attend annual meetings of our stockholders. Six members of the Board attended our 2017 annual

meeting of stockholders.

Status as a "Controlled Company"

Our common stock is listed on NASDAQ and, as a result, we are subject to the corporate governance listing standards of the exchange. However,

under NASDAQ rules, a listed company that satisfies the definition of a "controlled company" (i.e., a company of which more than 50% of the voting power is held by a single entity or group) may

elect not to comply with certain of these requirements.

Pursuant

to the Stockholder Agreement, so long as BNPP directly or indirectly owns more than 50% of our outstanding common stock, and we are therefore a "controlled company," and during

the 12-month transition phase following the date on which we are no longer a "controlled company" as a result of BNPP's ownership of shares of our outstanding common stock, we expect to elect not to

comply with the corporate governance standards of NASDAQ requiring: (i) a majority of independent directors on the board of directors; (ii) a fully independent corporate governance and

nominating committee; and (iii) a fully independent compensation committee. BNPP currently beneficially owns approximately 62.0% of our outstanding common stock. Five of our nine directors,

including at least one member of each of the Corporate Governance and Nominating Committee, the Compensation Committee and the Risk Committee of our Board are directors designated by BNPP who do not

qualify as "independent directors" under the applicable rules of NASDAQ.

A

director is independent if the Board affirmatively determines that he or she satisfies the independence standards set forth in the applicable rules of NASDAQ, has no material

relationship with the Company that would interfere with the exercise of independent judgment in carrying out the

responsibilities of a director, and is independent within the meaning of Rule 10A-3 of the Exchange Act. The Board has reviewed the independence of our current non-employee directors and has

determined that each of Matthew J. Cox, W. Allen Doane and Allen B. Uyeda is an independent director.

16

Table of Contents

Board Leadership Structure and Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and

standards. They should have broad experience at the policy-making level in business, government or banking. They should be committed to enhancing stockholder value and should have sufficient time to

carry out their duties and to provide insight and practical wisdom based on experience. Their service on boards of other companies should be limited to a number that permits them, given their

individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all stockholders. When considering potential director candidates, our Board also

considers the candidate's character, judgment, diversity, skills, including financial literacy, and experience in the context of our needs and those of the Board.

The

corporate governance guidelines of our Board provide that the Board may, in its sole discretion, designate one of the independent directors who is not a BNPP-designated director as

its lead director to preside over meetings of the Board held in the absence of any director who is also an executive officer and to have such additional responsibilities and authority as the Board may

direct from time to time.

Currently,

Robert Harrison serves as our Chief Executive Officer and as the Chairman of our Board, and Allen B. Uyeda has been designated to serve as the lead independent director of our

Board.

Our

Chief Executive Officer is generally in charge of our business affairs, subject to the overall direction and supervision of the Board and its committees, and is the only member of

our management team that serves on the Board. Our Board believes that combining the roles of Chairman of the Board and Chief Executive Officer and appointing a lead independent director is the most

effective board leadership structure for us and that it provides an effective balance of strong leadership and independent oversight. Having one individual serve as both Chief Executive Officer and

Chairman contributes to and enhances the Board's efficiency and effectiveness, as the Chief Executive Officer is generally in the best position to inform our independent directors about our

operations, the competitive market and other challenges facing our business. Our Board believes that the Chief

Executive Officer is in the best position to most effectively serve as the Chairman of the Board for many reasons as he is closest to many facets of our business, and has frequent contact with our

customers, regulators and other stakeholders in our business. The Board believes that combining roles of Chief Executive Officer and Chairman of the Board also promotes timely communication between

management and the Board on critical matters, including strategy, business results and risks because of Mr. Harrison's direct involvement in the strategic and day-to-day management of our

business.

Board Oversight of Risk Management

Our Board believes that effective risk management and control processes are critical to our safety and soundness, our ability to predict and

manage the challenges that we face and, ultimately, our long-term corporate success. Our Board, both directly and through its committees, is responsible for overseeing our risk management processes,

with each of the committees of our Board assuming a different and important role in overseeing the management of the risks we face.

The

Risk Committee of our Board oversees our enterprise-wide risk management framework, which establishes our overall risk appetite and risk management strategy and enables our

management to understand, manage and report on the risks we face. Our Risk Committee also reviews and oversees policies and practices established by management to identify, assess, measure and manage

key risks we face, including the risk appetite metrics developed by management and approved by our Board. The Audit Committee of our Board is responsible for overseeing risks associated with financial

matters (particularly financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting), reviewing and discussing generally the

identification,

17

Table of Contents

assessment,

management and control of our risk exposures on an enterprise-wide basis and engaging as appropriate with our Risk Committee to assess our enterprise-wide risk framework. The Compensation

Committee has primary responsibility for risks and exposures associated with our compensation policies, plans and practices regarding both executive compensation and the compensation structure

generally. In particular, our Compensation Committee, in conjunction with our Chief Executive Officer and Chief Risk Officer and other members of our management as appropriate, reviews our incentive

compensation arrangements to ensure these programs are consistent with applicable laws and regulations, including safety and soundness requirements, and do not encourage imprudent or excessive

risk-taking by our employees. The Corporate Governance and Nominating Committee oversees risks associated with the independence of our Board and potential conflicts of interest.

Our

senior management is responsible for implementing and reporting to our Board regarding our risk management processes, including by assessing and managing the risks we face, including

strategic, operational, regulatory, investment and execution risks, on a day-to-day basis. Our senior management is also responsible for creating and recommending to our Board for approval appropriate

risk appetite metrics reflecting the aggregate levels and types of risk we are willing to accept in connection with the operation of our business and pursuit of our business objectives.

The

role of our Board in our risk oversight is consistent with our leadership structure, with our Chief Executive Officer and the other members of senior management having responsibility

for assessing and managing our risk exposure, and our Board and its committees providing oversight in connection with those efforts. We believe this division of risk management responsibilities

presents a consistent, systemic and effective approach for identifying, managing and mitigating risks throughout our operations.

Committees of Our Board of Directors

The standing committees of our Board were organized in April 2016 in connection with our IPO and consist of an audit committee, a corporate

governance and nominating committee, a compensation committee and a risk committee. The responsibilities of these committees are described below. Our Board may also establish various other committees

to assist it in its responsibilities. However, the Stockholder Agreement provides that, until the date BNPP ceases to directly or indirectly beneficially own at least 5% of our outstanding common

stock, without either the approval of a majority of the BNPP designated directors on our Board at the time of such action or BNPP's waiver of its rights under the Stockholder Agreement, we may not

form, or delegate any authority to, any new committee of our Board or to any subcommittee thereof. The following table summarizes the current membership of the Board and each of its committees:

|

|

|

|

|

|

|

|

|

|

|

Director Name

|

|

Audit

Committee

|

|

Corporate

Governance &

Nominating

Committee

|

|

Compensation

Committee

|

|

Risk

Committee

|

|

Matthew J. Cox*

|

|

Member

|

|

|

|

Member

|

|

|

|

W. Allen Doane*

|

|

Chair

|

|

|

|

|

|

Member

|

|

Thibault Fulconis**

|

|

|

|

|

|

|

|

Member

|

|

Gérard Gil**

|

|

|

|

Chair

|

|

Chair

|

|

|

|

Jean-Milan Givadinovitch**

|

|

|

|

|

|

|

|

Member

|

|

Robert S. Harrison

|

|

|

|

|

|

|

|

|

|

J. Michael Shepherd**

|

|

|

|

Member

|

|

|

|

|

|

Allen B. Uyeda*

|

|

Member

|

|

Member

|

|

|

|

Chair

|

|

Michel Vial**

|

|

|

|

|

|

Member

|

|

|

-

*

-

"Independent"

under NASDAQ listing standards.

-

**

-

BNPP-designated

director.

18

Table of Contents

Audit Committee.

The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of our

financial

statements and regulatory reporting, our compliance with legal and regulatory requirements, our independent auditors' qualifications and independence and the performance of our internal audit function

and independent auditors. Among other things, the Audit Committee:

-

•

-

appoints, oversees and determines the compensation of our independent auditors;

-

•

-

reviews and discusses our financial statements and the scope of our annual audit to be conducted by our independent auditors and approves all

audit fees;

-

•

-

reviews and discusses our financial reporting activities, including our annual report, and the accounting standards and principles followed in

connection with those activities;

-

•

-

pre-approves audit and non-audit services provided by our independent auditors;

-

•

-

meets with management and our independent auditors to review and discuss our financial statements and financial disclosure;

-

•

-

establishes and oversees procedures for the treatment of complaints regarding accounting and auditing matters;

-

•

-

reviews the scope and staffing of our internal audit function and our disclosure and internal controls; and

-

•

-

monitors our legal, ethical and regulatory compliance.

Pursuant

to the Audit Committee's charter and the terms of the Stockholder Agreement, the Audit Committee must consist of at least three members, all of whom are required to be

"independent" under the listing standards of NASDAQ and meet the requirements of Rule 10A-3 of the Exchange Act. The Audit Committee also must include at least one "audit committee financial

expert." Under the Stockholder Agreement, and unless BNPP waives its rights to appoint members to our Audit Committee, until the date BNPP ceases to directly or indirectly beneficially own at least 5%

of our outstanding common stock, if any of the directors designated for nomination and election to our Board by BNPP qualifies as an independent director and satisfies the requirements of

Rule 10A-3 and the NASDAQ listing standards, at least one member of the Audit Committee will be a director designated for nomination and election to our Board by BNPP. Because no director