|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 2)

ALLIANCE RESOURCE PARTNERS, L.P.

(Name of Issuer)

(Title of Class of Securities)

(CUSIP Number)

1717 South Boulder Avenue, Suite 400

Tulsa, Oklahoma 74119

(918) 295-7600

with a copy to:

R. Eberley Davis

Senior Vice President, General Counsel and Secretary

Alliance Resource Management GP, LLC

1717 South Boulder Avenue, Suite 400

Tulsa, Oklahoma 74119

(918) 295-7600

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and five copies of this schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1

|

Name of Reporting Persons

S.S. or I.R.S. Identification Nos. of Above Persons

Alliance Holdings GP, L.P.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a):

|

o

|

|

|

|

(b):

|

x

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

AF

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power:

0*

|

|

|

|

8

|

Shared Voting Power:

87,188,338*

|

|

|

|

9

|

Sole Dispositive Power:

0*

|

|

|

|

10

|

Shared Dispositive Power:

87,188,338*

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

87,188,338

|

|

|

|

|

12

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

66.6%**

|

|

|

|

|

14

|

Type of Reporting Person:

HC, PN

|

|

|

|

|

|

|

|

*

The common units representing limited partner interests (the “ARLP Common Units”) of Alliance Resource Partners, L.P. (“ARLP”) attributable to Alliance Holdings GP, L.P. (“AHGP”) consist of (i) 31,088,338 ARLP Common Units held by AHGP and (ii) 56,100,000 ARLP Common Units held by MGP II, LLC, a wholly owned subsidiary of AHGP (“MGP II”). Alliance GP, LLC (“AGP”) is the general partner of AHGP and is wholly owned by C-Holdings, LLC (“C-Holdings”), which is wholly owned by Joseph W. Craft III. The ARLP Common Units owned by AHGP may be deemed beneficially owned by, and the voting and dispositive power over those ARLP Common Units may be deemed as shared with, AGP, C-Holdings and Mr. Craft.

**

Based on a total of 130,903,256 ARLP Common Units issued and outstanding as of February 22, 2018.

2

|

|

1

|

Name of Reporting Persons

S.S. or I.R.S. Identification Nos. of Above Persons

MGP II, LLC

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a):

|

o

|

|

|

|

(b):

|

x

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

AF

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e)

o

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

Sole Voting Power:

0*

|

|

|

|

8

|

Shared Voting Power:

56,100,000*

|

|

|

|

9

|

Sole Dispositive Power:

0*

|

|

|

|

10

|

Shared Dispositive Power:

56,100,000*

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

56,100,000

|

|

|

|

|

12

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

o

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

42.9%**

|

|

|

|

|

14

|

Type of Reporting Person:

HC, OO

|

|

|

|

|

|

|

|

*

MGP II is a wholly owned subsidiary of AHGP. The ARLP Common Units held by MGP II may be deemed beneficially owned by, and the voting and dispositive power over those units may be deemed as shared with, AHGP, AGP, C-Holdings and Mr. Craft.

**

Based on a total of 130,903,256 ARLP Common Units issued and outstanding as of February 22, 2018.

3

This Amendment No. 2 to Schedule 13D (this “Amendment”) is being filed by each of Alliance Holdings GP, L.P. (“AHGP”) and MGP II, LLC (“MGP II” and together with AHGP, the “Reporting Persons”), to amend the Schedule 13D filed on May 24, 2006, as amended and supplemented by Amendment No. 1 filed on August 8, 2017 (collectively, the “Prior Schedule 13D”). The Prior Schedule 13D shall not be modified except as specifically provided herein. Unless otherwise indicated, all capitalized terms used herein but not defined herein shall have the same meanings ascribed to them in the Prior Schedule 13D.

Item 2.

Identity and Background.

Schedule I is hereby amended and restated in its entirety as attached hereto.

Item 3.

Source and Amount of Funds of Other Consideration.

Item 3 of the Prior Schedule 13D is hereby amended and supplemented by adding the following:

In connection with the transactions described in Item 4 of this Amendment (which Item 4 is incorporated herein by reference), ARLP will issue to SGP a number of ARLP Common Units calculated pursuant to the Simplification Agreement (as defined below) in exchange for a 1.0001% general partner interest in AROP and a 0.001% managing membership interest in Alliance Coal, LLC, a Delaware limited liability company (“Alliance Coal”).

Item 4.

Purpose of Transaction.

Item 4 of the Prior Schedule 13D is hereby amended and supplemented as follows:

On February 22, 2018, ARLP entered into a Simplification Agreement (the “Simplification Agreement”) by and among AHGP, AGP, certain subsidiaries of AHGP and AGP, MGP and SGP, pursuant to which, among other things, through a series of transactions (the “Simplification Transactions”), (i) AHGP would become a wholly owned subsidiary of ARLP and (ii) all of the ARLP Common Units held by AHGP and its subsidiaries (the “Exchange Units”) would be distributed to the unitholders of AHGP in exchange for their common units representing limited partner interests of AHGP (“AHGP Common Units”). The Simplification Transactions are structured such that each AHGP unitholder will hold directly after the transactions the same economic share of ARLP and its subsidiaries that it held indirectly through AHGP before the transactions.

The Simplification Transactions also contemplate that (i) New AHGP GP, LLC, a wholly owned subsidiary of AHGP, would become a wholly owned subsidiary of ARLP and the new general partner of AHGP, (ii) MGP would become a wholly owned subsidiary of AGP and continue to be the general partner of ARLP and (iii) ARLP would issue to SGP a number of ARLP Common Units calculated pursuant to the Simplification Agreement on an economically equivalent basis in exchange for a 1.0001% general partner interest in AROP, and a 0.001% managing membership interest in Alliance Coal.

The Simplification Transactions will be effected in part through a merger, whereby Wildcat GP Merger Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of AGP (“Merger Sub”), will merge with and into AHGP, the separate existence of Merger Sub will cease and AHGP will survive and continue to exist as a Delaware limited partnership (the “Merger”). By virtue of the Merger, each AHGP Common Unit that is issued and outstanding immediately prior to the effective time (the “Effective Time”) will be canceled and converted into the right to receive a portion of the Exchange Units (the “AHGP Unitholder Consideration”). As part of the Merger, all of the limited liability company interests in Merger Sub outstanding immediately prior to the Effective Time will be converted into and become limited partner interests in AHGP and will be momentarily held by SGP. All AHGP deferred phantom units that are outstanding immediately prior to the Effective Time will be paid in full and deemed to have been converted into AHGP Common Units and will have a right to receive a portion of the AHGP Unitholder Consideration on the same economically equivalent basis as other AHGP unitholders as described below.

Immediately following the consummation of the Merger, (i) SGP will contribute all of the limited partner interests in AHGP to ARLP in exchange for a number of ARLP Common Units calculated pursuant to the Simplification Agreement, and ARLP will be admitted as the sole limited partner of AHGP, and (ii) AGP will contribute all of the limited liability company interests of New AHGP GP, which will become the new general partner of AHGP, to ARLP, and ARLP will be admitted as the sole member of New AHGP GP. The number of

4

ARLP Common Units to be issued to SGP upon the closing of the Simplification Transactions will be based on the actual dollar amount distributed to MGP in respect of its 1.0001% general partner interest in AROP and the per unit amount actually distributed by ARLP with respect to the ARLP Common Units, in each case in connection with ARLP’s last quarterly distribution of available cash prior to the closing of the Simplification Transactions. Based on the amount distributed to MGP in respect of its 1.0001% general partner interest in AROP and the ARLP distribution of $0.51 per ARLP Common Unit, in each case, with respect to the fourth quarter 2017, ARLP would issue approximately 1,320,377 ARLP Common Units to SGP upon the closing of the Simplification Transactions.

In connection with the Merger, the AHGP Unitholder Consideration will be distributed so that each AHGP Common Unit issued and outstanding at the Effective Time (other than AHGP Common Units held by SGP) will be converted into the right to receive a number of Exchange Units equal to an “Exchange Ratio” calculated pursuant to the Simplification Agreement. The Exchange Ratio will be based on the actual number of ARLP Common Units to be issued to SGP plus the Exchange Units and the actual number of outstanding AHGP Common Units at the Effective Time. Based on the number of outstanding AHGP Common Units as of the date hereof (including AHGP deferred phantom units), the number of Exchange Units and the assumption that ARLP would issue approximately 1,320,377 ARLP Common Units to SGP upon the closing of the Simplification Transactions, the Exchange Ratio would be approximately 1.478. The remainder of the Exchange Units will be distributed to SGP on an economically equivalent basis.

The Simplification Agreement also contemplates the amendment of the partnership agreement or limited liability company agreement of AROP, Alliance Coal, MGP, AHGP and New AHGP GP (collectively, the “Amendments”) as necessary to effect the Simplification Transactions. The Amendments will become effective in connection with the consummation of the Simplification Transactions.

The completion of the Merger and the other Simplification Transactions is conditioned upon, among other things: (1) the approval of the Simplification Agreement by the affirmative vote or consent of holders of a majority of the outstanding AHGP Common Units; (2) all filings, consents, approvals, permits and authorizations required to be made or obtained prior to the Effective Time in connection with the Simplification Transactions have been made or obtained; (3) the absence of legal injunctions, laws or other impediments prohibiting the Simplification Transactions; (4) the effectiveness of a registration statement on Form S-4 (the “Registration Statement”) with respect to the distribution of the Exchange Units in the Merger; (5) the accuracy of the representations and warranties of the parties as of the date of the Simplification Agreement and/or as of the closing of the Merger (subject to certain exceptions and materiality qualifiers); and (6) the approval of the listing of the ARLP Common Units to be issued to SGP on the NASDAQ, subject to official notice of issuance.

Upon consummation of the Merger, AHGP Common Units would cease to trade on NASDAQ and cease to be registered under the Securities Exchange Act of 1934, as amended.

The foregoing description of the Simplification Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of such agreement, a copy of which is filed as Exhibit 2.1 to ARLP’s Current Report on Form 8-K filed on February 23, 2018 and is incorporated by reference herein.

Except as set forth in this Amendment, no Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) — (j) of Item 4 of Schedule 13D. The Reporting Persons reserve the right to increase or decrease their respective positions in ARLP through, among other things, the purchase or sale of securities of ARLP on the open market or in private transactions or otherwise, including the exercise of warrants or options, on such terms and at such times as the Reporting Persons may deem advisable. The Reporting Persons reserve the right to change their intention with respect to any and all matters referred to in this Item 4.

Item 5.

Interest in Securities of the Issuer.

Item 5 of the Prior Schedule 13D is hereby amended and restated as follows:

(a) — (b)

The aggregate number and percentage of shares of ARLP Common Units beneficially owned by the Reporting Persons (on the basis of 130,903,256 ARLP Common Units issued and outstanding as of February 22, 2018) are as follows:

5

(1)

AHGP

(a)

Amount beneficially owned: 87,188,338 ARLP Common Units

Percentage: 66.6%

(b)

Number of ARLP Common Units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 0

(ii)

Shared power to vote or to direct the vote: 87,188,338

(iii)

Sole power to dispose or to direct the disposition of: 0

(iv)

Shared power to dispose or to direct the disposition of: 87,188,338

(2)

MGP II

(a)

Amount beneficially owned: 56,100,000 ARLP Common Units

Percentage: 42.9%

(b)

Number of ARLP Common Units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 0

(ii)

Shared power to vote or to direct the vote: 56,100,000

(v)

Sole power to dispose or to direct the disposition of: 0

(vi)

Shared power to dispose or to direct the disposition of: 56,100,000

(3)

The Reporting Persons’ ownership has been adjusted to reflect the two-for-one split of the ARLP Common Units that occurred on June 16, 2014, which had no impact on the ownership percentages of the Reporting Persons.

(c)

The Reporting Persons have not acquired any ARLP Common Units during the past 60 days.

(d)

The Reporting Persons have the right to receive distributions from, and the proceeds of sale of, the ARLP Common Units held by each Reporting Person as a record holder.

(e)

Not applicable.

Item 6.

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Prior Schedule 13D is hereby amended and supplemented as follows:

The information included or incorporated by reference in Item 4 is hereby incorporated by reference.

Item 7.

Material to be Filed as Exhibits.

Item 7 of the Prior Schedule 13D is hereby amended and supplemented by adding the following:

Exhibit H:

Simplification Agreement, dated as of February 22, 2018, by and among Alliance Holdings GP, L.P., Alliance GP, LLC, Wildcat GP Merger Sub, LLC, MGP II, LLC, ARM GP Holdings, Inc., New AHGP GP, LLC, Alliance Resource Partners, L.P., Alliance Resource Management GP, LLC and Alliance Resource GP, LLC, filed as Exhibit 2.1 of ARLP’s Form 8-K filed with the Securities and Exchange Commission on February 23, 2018.

6

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

|

Dated: March 14, 2018

|

|

|

|

|

|

|

ALLIANCE HOLDINGS GP, L.P.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Kenneth Hemm

|

|

|

Name:

|

Kenneth Hemm

|

|

|

Title:

|

Attorney-in-Fact

|

|

|

|

|

|

|

|

|

MGP II, LLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Kenneth Hemm

|

|

|

Name:

|

Kenneth Hemm

|

|

|

Title:

|

Attorney-in-Fact

|

7

SCHEDULE I

Executive Officers and Directors of Alliance GP, LLC

Joseph W. Craft III

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: President, Chief Executive Officer and Chairman of Alliance GP, LLC; President, Chief Executive Officer and Director of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 87,554,971

|

Percentage: 66.9%

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 357,452

(ii)

Shared power to vote or to direct the vote: 87,197,519

(iii)

Sole power to dispose or to direct the disposition of: 357,452

(iv)

Shared power to dispose or to direct the disposition of: 87,197,519

Brian L. Cantrell

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Senior Vice President and Chief Financial Officer of Alliance GP, LLC; Senior Vice President and Chief Financial Officer of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 108,361

|

Percentage: *

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 108,361

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 108,361

(iv)

Shared power to dispose or to direct the disposition of: 0

R. Eberley Davis

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Senior Vice President, General Counsel and Secretary of Alliance GP, LLC; Senior Vice President, General Counsel and Secretary of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 79,407

|

Percentage: *

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 79,407

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 79,407

(iv)

Shared power to dispose or to direct the disposition of: 0

Robert G. Sachse

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Executive Vice President of Alliance GP, LLC; Executive Vice President of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 118,210

|

Percentage: *

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 118,210

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 118,210

(iv)

Shared power to dispose or to direct the disposition of: 0

8

Charles R. Wesley

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Executive Vice President of Alliance GP, LLC; Executive Vice President and Director of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 0

|

Percentage: 0

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 0

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 0

(iv)

Shared power to dispose or to direct the disposition of: 0

Thomas M. Wynne

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Senior Vice President and Chief Operating Officer of Alliance GP, LLC; Senior Vice President and Chief Operating Officer of Alliance Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 75,160

|

Percentage: *

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 75,160

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 75,160

(iv)

Shared power to dispose or to direct the disposition of: 0

Thomas M. Davidson, Sr.

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Director of Alliance GP, LLC

Citizenship: USA

|

Amount beneficially owned: 0

|

Percentage: 0

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 0

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 0

(iv)

Shared power to dispose or to direct the disposition of: 0

Robert J. Druten

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Director of Alliance GP, LLC; Senior Vice President and Chief Financial Officer of Alliance

Resource Management GP, LLC

Citizenship: USA

|

Amount beneficially owned: 0

|

Percentage: 0

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 0

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 0

(iv)

Shared power to dispose or to direct the disposition of: 0

Wilson M. Torrence

1717 South Boulder Avenue, Suite 400, Tulsa, Oklahoma 74119

Principal Occupation: Director of Alliance GP, LLC

Citizenship: USA

|

Amount beneficially owned: 34,796

|

Percentage: *

|

Number of units to which the Reporting Person has:

(i)

Sole power to vote or to direct the vote: 34,796

9

(ii)

Shared power to vote or to direct the vote: 0

(iii)

Sole power to dispose or to direct the disposition of: 34,796

(iv)

Shared power to dispose or to direct the disposition of: 0

*

Less than 1%.

10

EXHIBIT INDEX

Exhibit H:

Simplification Agreement, dated as of February 22, 2018, by and among Alliance Holdings GP, L.P., Alliance GP, LLC, Wildcat GP Merger Sub, LLC, MGP II, LLC, ARM GP Holdings, Inc., New AHGP GP, LLC, Alliance Resource Partners, L.P., Alliance Resource Management GP, LLC and Alliance Resource GP, LLC, filed as Exhibit 2.1 of ARLP’s Form 8-K filed with the Securities and Exchange Commission on February 23, 2018.

11

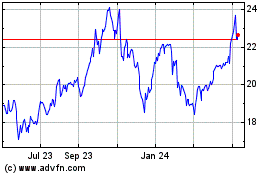

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

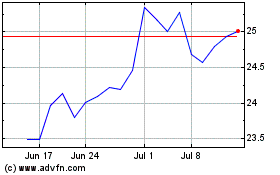

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Apr 2023 to Apr 2024