SCHEDULE 14A

(RULE

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☒

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §

240.14a-12

|

Goldman Sachs BDC, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules

14a-6(i)(1)

and

0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transactions applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11

(Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identity the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

GOLDMAN SACHS BDC, INC.

200 West Street

New York, New

York 10282

, 2018

Dear Stockholder:

You are cordially

invited to attend a Special Meeting of Stockholders (the “Meeting”) of Goldman Sachs BDC, Inc. (the “Company”) to be held on , May

, 2018, at a.m. (Eastern time), at the offices of

Goldman Sachs Asset Management, L.P., located at 30 Hudson Street, Jersey City, New Jersey 07302. Please note that if you plan to attend the Meeting in person, photographic identification will be required for admission.

The Meeting is being held to consider and vote upon a proposal to authorize the Company, with the approval of the Company’s board of

directors, to sell or otherwise issue shares of the Company’s common stock (during the 12 months following such stockholder authorization) at a price below the then-current net asset value per share, provided the number of shares issued does

not exceed 25% of its then-outstanding common stock.

A formal Notice of Special Meeting and Proxy Statement setting forth in detail

the matters to come before the Meeting are attached hereto, and a proxy card is enclosed for your use. You should read the Proxy Statement carefully. You will also receive separate proxy materials for the 2018 Annual Meeting of Stockholders, which

will be held on the same date and at the same location as the Meeting. Please be certain to vote each proxy card you receive from us.

WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, YOUR VOTE IS VERY IMPORTANT.

If you do not plan to be present in person at the

Meeting, you can vote by signing, dating and returning the enclosed proxy card promptly or by using the Internet or telephone voting options as described on your proxy card. If you have any questions regarding the proxy materials, please contact the

Company at

(800) 621-2550.

Your prompt response will help reduce proxy costs—which are paid by the Company and indirectly by its stockholders—and will also mean that you can avoid receiving

follow-up

phone calls and mailings.

Sincerely,

/s/ Brendan McGovern

Brendan McGovern

Chief Executive Officer and President

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR USE THE INTERNET OR TELEPHONE VOTING OPTIONS TO CAST YOUR VOTE AS SOON AS

POSSIBLE. YOUR VOTE IS IMPORTANT.

GOLDMAN SACHS BDC, INC.

200 West Street

New York, New

York 10282

NOTICE OF SPECIAL MEETING

To Be Held On May , 2018

, 2018

Notice is hereby given to the owners of shares of common stock (the “Stockholders”) of Goldman Sachs BDC, Inc. (the

“Company”) that:

A Special Meeting of Stockholders (the “Meeting”) will be held on

, May , 2018, at

a.m. (Eastern time), at the offices of Goldman Sachs Asset Management, L.P., located at 30 Hudson Street, Jersey City, New Jersey 07302, for the

following purpose (the “Proposal”):

|

|

1.

|

to authorize the Company, with the approval of the Company’s board of directors, to sell or otherwise issue shares of the Company’s common stock (during the 12 months following such Stockholder

authorization) at a price below the then-current net asset value per share, provided the number of shares issued does not exceed 25% of its then-outstanding common stock.

|

The matter referred to above is discussed in the Proxy Statement attached to this Notice. The Board of Directors of the Company, including

each of the independent directors, unanimously recommends that you vote

“FOR”

the Proposal.

Stockholders of record at

the close of business on , 2018 are entitled to receive notice of, and to vote at, the Meeting and at any postponements or adjournments thereof. Each

Stockholder is invited to attend the Meeting in person. Please note that if you plan to attend the Meeting in person, photographic identification will be required for admission.

Your vote is extremely important to us. If you will not attend the Meeting in person, we urge you to sign, date and promptly return the

enclosed proxy card in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. You may also vote easily and quickly by Internet or by telephone. In the event there are not sufficient votes

for a quorum or to approve the Proposal at the time of the Meeting, the Meeting may be postponed or adjourned in order to permit further solicitation of proxies by the Board of Directors of the Company.

By Order of the Board of Directors

of Goldman Sachs BDC, Inc.

/s/ Caroline Kraus

Caroline Kraus

Secretary

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY SHARES YOU OWN

To secure the largest possible representation at the Meeting, please mark your proxy card, sign it, date it, and return it in the postage-paid

envelope provided (unless you are voting by Internet or by telephone).

If you sign, date and return a proxy card but give no voting instructions, your shares will be voted “FOR” the proposal indicated on the card.

If you prefer, you

may instead vote via the Internet or by telephone. To vote in this manner, you should refer to the directions below.

To vote via the

Internet, please access the website found on your proxy card and follow the

on-screen

instructions on the website.

To vote by telephone, Stockholders within the United States should call the toll-free number found on the proxy card and follow the recorded

instructions. Stockholders outside the United States should vote via the Internet or by submitting a proxy card instead.

You may revoke

your proxy at any time at or before the Meeting (1) by notifying the Secretary of the Company in writing at the Company’s principal executive offices, (2) by submitting a properly executed, later-dated proxy or (3) by attending

the Meeting and voting in person.

SPECIAL MEETING

OF

GOLDMAN SACHS BDC,

INC.

200 West Street

New

York, New York 10282

PROXY STATEMENT

, 2018

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors (the

“Board”) of Goldman Sachs BDC, Inc. (the “Company”) for use at a Special Meeting of Stockholders (the “Meeting”), to be held at the offices of Goldman Sachs Asset Management, L.P., located at 30 Hudson Street,

Jersey City, New Jersey 07302, on , May , 2018, at

a.m. (Eastern time), and any postponement or adjournment thereof. Much of the information in this Proxy Statement is required under rules of the

Securities and Exchange Commission (the “SEC”), and some of it is technical in nature. If there is anything you do not understand, please contact the Company at (800)

621-2550.

This Proxy Statement, the accompanying Notice of Special Meeting and proxy card are being mailed to stockholders (the

“Stockholders”) of the Company of record as of , 2018 (the “Record Date”) on or about

, , 2018.

PURPOSE OF THE MEETING

At the Meeting, you will be asked to vote on the following proposal:

|

|

1.

|

To authorize the Company, with the approval of the Board, to sell or otherwise issue shares of the Company’s common stock (during the 12 months following such Stockholder authorization) at a price below the

then-current net asset value per share (“NAV”), provided the number of shares issued does not exceed 25% of its then-outstanding common stock (the “Proposal”).

|

INFORMATION REGARDING THIS SOLICITATION

It is expected that the solicitation of proxies will be primarily by mail. The Company’s officers, and personnel of the Company’s

investment adviser and transfer agent and any authorized proxy solicitation agent, may also solicit proxies by telephone, email, facsimile, Internet or in person. If the Company records votes through the Internet or by telephone, it will use

procedures designed to authenticate Stockholders’ identities to allow Stockholders to authorize the voting of their shares in accordance with their instructions and to confirm that their identities have been properly recorded.

The Company will pay the expenses associated with this Proxy Statement and solicitation, in a manner agreed upon by the Board. The Company has

engaged Computershare Inc. (“Computershare”) to assist in the distribution of the proxy materials and tabulation of proxies. The cost of Computershare’s services with respect to the Company is estimated to be approximately

$ , plus reasonable

out-of-pocket

expenses.

1

To vote by mail, sign, date and promptly return the enclosed proxy card in the accompanying

postage

pre-paid

envelope. To vote by Internet or telephone, please use the control number on your proxy card and follow the instructions as described on your proxy card. If you have any questions regarding

the proxy materials, please contact the Company at (800)

621-2550.

If the enclosed proxy card is properly executed and received prior to the Meeting and has not been revoked, the shares represented thereby

will be voted in accordance with the instructions marked on the returned proxy card or, if no instructions are marked, the proxy card will be voted “FOR” the Proposal described in this Proxy Statement; and in the discretion of the persons

named as proxies in connection with any other matter that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

Any person giving a proxy may revoke it at any time before it is exercised (1) by notifying the Secretary of the Company in writing at

the Company’s principal executive offices, (2) by submitting a properly executed, later-dated proxy or (3) by attending the Meeting and voting in person.

If (i) you are a member of a household in which multiple Stockholders share the same address, (ii) your shares are held in

“street name” and (iii) your broker or bank has received consent to household material, then your broker or bank may send to your household only one copy of this Proxy Statement, unless your broker or bank previously received contrary

instructions from a Stockholder in your household. If you are part of a household that has received only one copy of this Proxy Statement, the Company will deliver promptly a separate copy of this Proxy Statement to you upon written or oral request.

To receive a separate copy of this Proxy Statement, please contact the Company by calling (toll-free) (800)

621-2550

or by mail to the Company’s principal executive offices at Goldman Sachs BDC, Inc., 200

West Street, New York, New York 10282.

If your shares are held with certain banks, trust companies, brokers, dealers, investment advisers and other financial intermediaries (each, an “Authorized Institution”) and you would like

to receive a separate copy of future proxy statements, notices of internet availability of proxy materials, prospectuses or annual reports or you are now receiving multiple copies of these documents and would like to receive a single copy in the

future, please contact your Authorized Institution.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL

MEETING TO BE HELD ON , MAY , 2018

This Proxy Statement is available online at www.proxyvote.com (please have the control number found on your proxy card ready when

you visit this website).

2

INFORMATION REGARDING SECURITY OWNERSHIP

Control Persons and Principal Stockholders

The following table sets forth, as of , 2018,

certain ownership information with respect to shares of the Company’s common stock for each of the Company’s current directors (including the nominee), executive officers and directors and executive officers as a group, and each person

known to the Company to beneficially own 5% or more of the outstanding shares of the Company’s common stock. With respect to persons known to the Company to beneficially own 5% or more of the outstanding shares of the Company’s

common stock, such knowledge is based on beneficial ownership filings made by the holders with the SEC and other information known to the Company. The percentage ownership is based on

shares of common stock outstanding as of , 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address

|

|

Type of Ownership

(5)

|

|

|

Shares Owned

|

|

|

Percentage

|

|

|

Beneficial owners of 5% or more

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Goldman Sachs Group, Inc.

(1)

|

|

|

Beneficial

|

|

|

|

6,483,653

|

|

|

|

[16.2]%

|

|

|

|

|

|

|

|

Interested Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kaysie Uniacke

|

|

|

Beneficial

|

|

|

|

[10,000

|

]

|

|

|

*

|

|

|

|

|

|

|

|

Independent Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jaime Ardila

|

|

|

Beneficial

|

|

|

|

[13,850

|

]

|

|

|

*

|

|

|

Janet F. Clark

(2)

|

|

|

Beneficial

|

|

|

|

[5,000

|

]

|

|

|

*

|

|

|

Ross J. Kari

|

|

|

Beneficial

|

|

|

|

[5,000

|

]

|

|

|

—

|

|

|

Ann B. Lane

|

|

|

Beneficial

|

|

|

|

[6,890

|

]

|

|

|

—

|

|

|

|

|

|

|

|

Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brendan McGovern

|

|

|

Beneficial

|

|

|

|

[35,000

|

]

|

|

|

*

|

|

|

Jon Yoder

|

|

|

Beneficial

|

|

|

|

[5,000

|

]

|

|

|

*

|

|

|

Jonathan Lamm

|

|

|

Beneficial

|

|

|

|

[5,000

|

]

|

|

|

*

|

|

|

Maya Teufel

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Salvatore Lentini

(3)

|

|

|

Beneficial

|

|

|

|

[30,810

|

]

|

|

|

*

|

|

|

David Yu

|

|

|

Beneficial

|

|

|

|

[8,000

|

]

|

|

|

*

|

|

|

Jordan Walter

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Carmine Rossetti

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

All executive officers and directors as a group ([13] persons)

(4)

|

|

|

Beneficial

|

|

|

|

[124,550

|

]

|

|

|

*

|

|

|

(1)

|

Based on a Schedule 13G/A filed with the SEC on February 14, 2018. The address of The Goldman Sachs Group, Inc. (“Group Inc.”), a Delaware corporation, is 200 West Street, New York, New York 10282. The

shares of the Company’s common stock shown in the above table as being owned by Group Inc. include 652,354 shares held directly by Goldman Sachs & Co. LLC (“Goldman Sachs”), a wholly owned subsidiary of Group Inc. Group Inc.

disclaims beneficial ownership of such shares except to the extent of its pecuniary interest therein. Each of Group Inc. and Goldman Sachs has indicated that it intends to vote the Company’s shares over which it has voting discretion in the

same manner and proportion as shares of the Company over which Group Inc. or Goldman Sachs does not have voting discretion.

|

|

(2)

|

On February 21, 2018, Janet Clark notified the Company that she intends to resign as a director of the Company upon the Board’s selection of a replacement for her. Ms. Clark’s decision to resign is not the

result of any disagreement with the Company.

|

|

(3)

|

[2,031] of the shares in the table above are held in trust for the benefit of Mr. Lentini’s children, and Mr. Lentini disclaims beneficial ownership of such shares except to the extent of his pecuniary

interest therein.

|

3

|

(4)

|

The address for each of the Company’s directors and executive officers is c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282.

|

|

(5)

|

Beneficial ownership has been determined in accordance with Rule

13d-3

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

|

Dollar Range of Equity Securities Beneficially Owned by Directors

The following table sets out the dollar range of the Company’s equity securities beneficially owned by each of the Company’s

directors as of , 2018. Beneficial ownership is determined in accordance with Rule

16a-1(a)(2)

under the Exchange

Act. The Company is not part of a “family of investment companies,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

|

|

|

|

|

|

|

Name of Director

|

|

Dollar Range of

Equity Securities

in the Company

(1)

(2)

|

|

|

Interested Director

|

|

|

|

|

|

Kaysie Uniacke

|

|

|

[over $100,000]

|

|

|

|

|

|

Independent Directors

|

|

|

|

|

|

Jaime Ardila

|

|

|

[over $100,000]

|

|

|

Janet F. Clark

|

|

|

[over $100,000]

|

|

|

Ross J. Kari

|

|

|

[over $100,000]

|

|

|

Ann B. Lane

|

|

|

[over $100,000]

|

|

|

(1)

|

Dollar ranges are as follows: none, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000.

|

|

(2)

|

Dollar ranges were determined using the number of shares beneficially owned as of , 2018 multiplied by the closing sales

price of the Company’s common stock as reported on the New York Stock Exchange (the “NYSE”) on , 2018.

|

4

PROPOSAL

AUTHORIZATION TO SELL OR OTHERWISE ISSUE SHARES OF

COMMON STOCK BELOW NET ASSET VALUE

The Company is a

closed-end

investment company that has elected to be regulated as a business

development company (“BDC”) under the 1940 Act. As a BDC, the Company is generally prohibited from issuing its common stock at a price below the then-current NAV unless it meets certain conditions, including obtaining Stockholder approval.

As a result, the Company is seeking the approval of the Stockholders so that it may, in one or more public or private offerings of its

common stock, sell or otherwise issue shares of its common stock, not exceeding 25% of its then outstanding common stock, at a price below NAV, subject to the conditions set forth in this Proposal. The authorization would include offerings in

connection with acquisitions of portfolio companies or other BDCs. If approved, the authorization would be effective for securities issued during a twelve-month period following such Stockholder approval.

The Board, including all of the Independent Directors, recommends the Proposal to the Stockholders for their approval. For these purposes,

directors are not deemed to have a financial interest solely by reason of their ownership of the Company’s common stock. The Board believes that flexibility for the Company to sell common stock at a price below NAV would, among other benefits,

add financial flexibility to comply with regulatory requirements and credit facility covenants, including the asset coverage requirements of the 1940 Act, and provide access to the capital markets to pursue attractive investment and acquisition

opportunities. Upon obtaining the requisite Stockholder approval, the Company will comply with the conditions described in this Proxy Statement in connection with any issuance undertaken pursuant to such authorization. A discussion of the risks of

dilution appears below.

Background and Reasons to Offer Common Stock Below NAV

Status as a BDC and RIC and Maintaining a Favorable Debt to Equity Ratio

As a BDC and a regulated investment company (“RIC”) for tax purposes, the Company is dependent on its ability to raise capital

through the issuance of its common stock. RICs generally must distribute substantially all of their earnings to stockholders as dividends in order to achieve pass-through tax treatment, which prevents the Company from retaining a meaningful amount

of earnings to support operations or growth. Further, as a BDC the Company generally must maintain an asset coverage ratio of at least 2 to 1 in order to incur additional indebtedness. The Company’s revolving credit facility requires an asset

coverage ratio of at least 2 to 1 as well. Therefore, to continue to grow the Company’s investment portfolio, the Company must maintain access to the equity capital markets.

Failure to maintain the required asset coverage ratio could have severe negative consequences for the Company, including the inability to pay

dividends and breach of covenants in the Company’s credit facility. Although the Company does not currently expect to breach the asset coverage ratio, the markets it operates in and the general economy may be volatile and uncertain. Even if the

underlying performance of one or more portfolio companies may not indicate an impairment or inability to repay all principal and interest in full, volatility in the capital markets may negatively impact the valuations of investments and create

unrealized capital depreciation on certain investments. Any such write-downs in value (as well as unrealized capital depreciation based on the underlying performance of the Company’s portfolio companies, if any) will negatively impact the

Company’s total assets and the resulting asset coverage ratio. Issuing additional equity would allow the Company to realign its debt to equity ratio and avoid these negative consequences. In addition to meeting legal requirements applicable to

BDCs, having a more favorable debt to equity ratio would also generally strengthen the Company’s balance sheet and give it more flexibility to fully execute its business strategy.

5

Market Conditions Have Created, and May in the Future Create, Attractive Investment and Acquisition

Opportunities

From time to time, capital markets may experience periods of disruption and instability. For example, from 2008 to

2009, the global capital markets were unstable as evidenced by the lack of liquidity in the debt capital markets, significant write-offs in the financial services sector, the

re-pricing

of credit risk in the

broadly syndicated credit market and the failure of major financial institutions. Despite actions of the U.S. federal government and various foreign governments, worsening general economic conditions materially and adversely impacted the broader

financial and credit markets and reduced the availability of debt and equity capital for the market as a whole and financial services firms in particular. While market conditions generally have improved from the beginning of the disruption, there

have been recent periods of volatility and adverse market conditions may repeat themselves in the future. If similar adverse and volatile market conditions repeat in the future, we and other companies in the financial services sector may have to

access, if available, alternative markets for debt and equity capital in order to grow. Volatile economic conditions may lead to strategic initiatives such as merger activity in the BDC space. We believe that attractive investment opportunities may

present themselves during these periods of volatility, including opportunities to make acquisitions of other companies or investment portfolios at compelling values.

However, these periods of market disruption and instability may adversely affect the Company’s access to sufficient debt and equity

capital in order to take advantage of attractive investment and acquisition opportunities that are created during these periods. Debt capital that will be available, if any, may be at a higher cost and on less favorable terms and conditions, and

market volatility may adversely affect the market price of the Company’s common stock, causing it to trade at a price below NAV. Stockholder approval to sell or otherwise issue shares of the Company’s common stock at a price below NAV,

subject to the conditions set forth in this Proposal, would provide the Company with the flexibility to invest in such attractive investment and acquisition opportunities, which typically need to be made expeditiously.

Board Approval

The Board believes that

having the flexibility to issue common stock at a price below NAV in certain instances is in the best interests of the Company and the Stockholders. This would, among other things, add financial flexibility to comply with regulatory requirements and

credit facility covenants and provide access to capital markets to pursue attractive investment and acquisition opportunities.

While the

Company has no immediate plans to sell or otherwise issue any shares of its common stock at a price below NAV, it is seeking Stockholder approval now in order to provide flexibility if it desires in the future to sell or otherwise issue shares of

its common stock at a price below NAV, which typically must be undertaken quickly. The final terms of any such transaction will be determined by the Board at the time of sale or other issuance and the shares of common stock will not include

preemptive rights. Also, because the Company has no immediate plans to sell or otherwise issue any shares of its common stock at a price below NAV, it is not possible to describe the transaction or transactions in which such shares of common stock

would be sold or otherwise issued. Instead, any transaction in which the Company sells or otherwise issues such shares of common stock, including the nature and amount of consideration that would be received by the Company at the time of sale or

other issuance and the use of any such consideration, will be reviewed and approved by the Board at the time of sale or other issuance. If this Proposal is approved, no further authorization from the Stockholders will be solicited prior to any such

transaction in accordance with the terms of this Proposal. If approved, the authorization would be effective for securities sold or otherwise issued during a twelve-month period following such Stockholder approval.

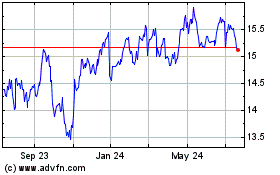

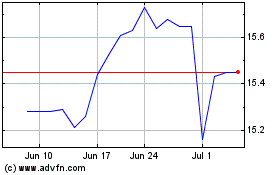

Trading History

The following table sets

forth, since January 1, 2016, the NAV of the Company’s common stock, the range of high and low closing sales prices of the Company’s common stock reported on the NYSE, the closing sales

6

prices as a premium (discount) to NAV and the dividends or distributions declared by us. On , 2018,

the last reported closing sales price of the Company’s common stock on the NYSE was $ per share, which represented a [premium] of approximately

% to the NAV as of December 31, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV

(1)

|

|

|

Closing Sales

Price

|

|

|

Premium/

(Discount) of

High Sales Price

to NAV

(2)

|

|

|

Premium/

(Discount) of

Low Sales Price

to NAV

(2)

|

|

|

Declared

Distributions

(3)

|

|

|

Period

|

|

|

High

|

|

|

Low

|

|

|

|

|

|

Fiscal year ending December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter (through ,

2018)

|

|

|

N/A

|

|

|

$

|

[22.61

|

]

|

|

$

|

[19.24

|

]

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Fiscal year ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter

|

|

$

|

18.09

|

|

|

$

|

23.00

|

|

|

$

|

21.63

|

|

|

|

27.1

|

%

|

|

|

19.6

|

%

|

|

$

|

0.45

|

|

|

Third Quarter

|

|

|

18.23

|

|

|

|

23.01

|

|

|

|

21.33

|

|

|

|

26.2

|

|

|

|

17.0

|

|

|

|

0.45

|

|

|

Second Quarter

|

|

|

18.23

|

|

|

|

25.09

|

|

|

|

22.25

|

|

|

|

37.6

|

|

|

|

22.1

|

|

|

|

0.45

|

|

|

First Quarter

|

|

|

18.26

|

|

|

|

25.43

|

|

|

|

22.51

|

|

|

|

39.3

|

|

|

|

23.3

|

|

|

|

0.45

|

|

|

Fiscal year ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter

|

|

$

|

18.31

|

|

|

$

|

23.65

|

|

|

$

|

20.77

|

|

|

|

29.2

|

%

|

|

|

13.4

|

%

|

|

$

|

0.45

|

|

|

Third Quarter

|

|

|

18.58

|

|

|

|

22.26

|

|

|

|

19.98

|

|

|

|

19.8

|

|

|

|

7.5

|

|

|

|

0.45

|

|

|

Second Quarter

|

|

|

18.41

|

|

|

|

20.02

|

|

|

|

19.34

|

|

|

|

8.7

|

|

|

|

5.1

|

|

|

|

0.45

|

|

|

First Quarter

|

|

|

18.67

|

|

|

|

20.00

|

|

|

|

17.41

|

|

|

|

7.1

|

|

|

|

(6.7

|

)

|

|

|

0.45

|

|

|

(1)

|

NAV is determined as of the last day in the relevant quarter and therefore may not reflect the NAV on the date of the high and low closing sales prices. The NAVs shown are based on outstanding shares at the end of the

relevant quarter.

|

|

(2)

|

Calculated as the respective high or low closing sales price less NAV, divided by NAV (in each case, as of the applicable quarter).

|

|

(3)

|

Represents the dividend or distribution declared in the relevant quarter.

|

Examples of Dilutive Effect of

the Issuance of Shares Below NAV

The following three headings and accompanying tables explain and provide hypothetical examples on the

impact of a public offering of the Company’s common stock at a price less than NAV on three different types of investors:

|

|

•

|

|

existing Stockholders who do not purchase any shares in the offering;

|

|

|

•

|

|

existing Stockholders who purchase a relatively small amount of shares in the offering or a relatively large amount of shares in the offering; and

|

|

|

•

|

|

new investors who become Stockholders by purchasing shares in the offering.

|

A sale of common

stock at a price less than NAV to a third party in a private placement would have an impact substantially similar to the impact on existing Stockholders who do not purchase any shares in the public offerings described below.

Impact on Existing Stockholders Who Do Not Participate in the Offering

Existing Stockholders who do not participate in an offering at a price below NAV or who do not buy additional shares in the secondary market

at the same or lower price obtained by the Company in the offering (after any underwriting discounts and commissions) face the greatest potential risks. These Stockholders will experience an immediate dilution in the NAV of the shares of common

stock they hold. These Stockholders will also experience a disproportionately greater decrease in their participation in the Company’s earnings and assets and their voting power than the increase the Company will experience in its assets,

potential earning power and voting interests due to such offering. These Stockholders may also experience a decline in the market price of

7

their shares, which often reflects to some degree announced or potential increases and decreases in NAV. This decrease could be more pronounced as the size of the offering and level of discounts

increases. Further, if Stockholders do not purchase any shares to maintain their percentage interest, regardless of whether such offering is at a price above or below NAV, their voting power will be diluted.

The following chart illustrates the level of NAV dilution that would be experienced by a nonparticipating Stockholder in three different

hypothetical offerings of different sizes and levels of discount from NAV. The examples assume that Company XYZ has 1,000,000 shares of common stock outstanding, $15,000,000 in total assets and $5,000,000 in total liabilities. The current net asset

value of the Company and NAV are thus $10,000,000 and $10.00, respectively. The table below illustrates the dilutive effect on nonparticipating stockholder A of (1) an offering of 50,000 shares (5% of the outstanding shares) at $9.50 per share

after offering expenses and commissions (a 5% discount from NAV); (2) an offering of 100,000 shares (10% of the outstanding shares) at $9.00 per share after offering expenses and commissions (a 10% discount from NAV); (3) an offering of 250,000

shares (25% of the outstanding shares) at $7.50 per share after offering expenses and commissions (a 25% discount from NAV); and (4) an offering of 250,000 shares (25% of the outstanding shares) at $0.00 per share after offering expenses and

commissions (a 100% discount from NAV). The prospectus pursuant to which any discounted offering is made will include a chart for these examples based on the actual number of shares in such offering and the actual discount from the most recently

determined NAV. It is not possible to predict the level of market price decline that may occur. These examples are provided for illustrative purposes only.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to

Sale Below

NAV

|

|

|

Example 1

5% Offering

at 5% Discount

|

|

|

Example 2

10% Offering

at 10% Discount

|

|

|

Example 3

25% Offering

at 25% Discount

|

|

|

Example 4

25% Offering

at 100% Discount

|

|

|

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Offering Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price per share to public

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

9.47

|

|

|

|

—

|

|

|

$

|

7.89

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

Net proceeds per share to issuer

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

$

|

9.00

|

|

|

|

—

|

|

|

$

|

7.50

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

Decrease to NAV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shares outstanding

|

|

|

1,000,000

|

|

|

|

1,050,000

|

|

|

|

5.00

|

%

|

|

|

1,100,000

|

|

|

|

10.00

|

%

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

NAV per share

|

|

$

|

10.00

|

|

|

$

|

9.98

|

|

|

|

(0.20

|

)%

|

|

$

|

9.91

|

|

|

|

(0.90

|

)%

|

|

$

|

9.50

|

|

|

|

(5.00

|

)%

|

|

$

|

8.00

|

|

|

|

(20.00

|

)%

|

|

Dilution to Stockholder

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares held by Stockholder A

|

|

|

10,000

|

|

|

|

10,000

|

|

|

|

—

|

|

|

|

10,000

|

|

|

|

—

|

|

|

|

10,000

|

|

|

|

—

|

|

|

|

10,000

|

|

|

|

—

|

|

|

Percentage held by Stockholder A

|

|

|

1.00

|

%

|

|

|

0.95

|

%

|

|

|

(5.00

|

)%

|

|

|

0.91

|

%

|

|

|

(9.00

|

)%

|

|

|

0.80

|

%

|

|

|

(20.00

|

)%

|

|

|

0.80

|

%

|

|

|

(20.00

|

)%

|

|

Total Asset Values

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net asset value held by Stockholder A

|

|

$

|

100,000

|

|

|

$

|

99,800

|

|

|

|

(0.20

|

)%

|

|

$

|

99,100

|

|

|

|

(0.90

|

)%

|

|

$

|

95,000

|

|

|

|

(5.00

|

)%

|

|

$

|

80,000

|

|

|

|

(20.00

|

)%

|

|

Total investment by Stockholder A (assumed to be $10.00 per Share)

|

|

$

|

100,000

|

|

|

$

|

100,000

|

|

|

|

—

|

|

|

$

|

100,000

|

|

|

|

—

|

|

|

$

|

100,000

|

|

|

|

—

|

|

|

$

|

100,000

|

|

|

|

—

|

|

|

Total dilution to Stockholder A (total NAV less total investment)

|

|

|

—

|

|

|

$

|

(200

|

)

|

|

|

—

|

|

|

$

|

(900

|

)

|

|

|

—

|

|

|

$

|

(5,000

|

)

|

|

|

—

|

|

|

$

|

(20,000

|

)

|

|

|

—

|

|

|

Per Share Amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV held by Stockholder A

|

|

|

—

|

|

|

$

|

9.98

|

|

|

|

—

|

|

|

$

|

9.91

|

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

$

|

8.00

|

|

|

|

—

|

|

|

Investment per share held by Stockholder A (assumed to be $10.00 per share on shares held prior to

sale)

|

|

$

|

10.00

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

Dilution per share held by Stockholder A (NAV less investment per share)

|

|

|

—

|

|

|

$

|

(0.02

|

)

|

|

|

—

|

|

|

$

|

(0.09

|

)

|

|

|

—

|

|

|

$

|

(0.50

|

)

|

|

|

—

|

|

|

$

|

(2.00

|

)

|

|

|

—

|

|

|

Percentage dilution to Stockholder A (dilution per share divided by investment per share)

|

|

|

—

|

|

|

|

—

|

|

|

|

(0.20

|

)%

|

|

|

—

|

|

|

|

(0.90

|

)%

|

|

|

—

|

|

|

|

(5.00

|

)%

|

|

|

—

|

|

|

|

(20.00

|

)%

|

8

Impact on Existing Stockholders Who Participate in the Offering

Existing Stockholders who participate in an offering at a price below NAV or who buy additional shares in the secondary market at the same or

lower price as the Company obtains in the offering (after expenses and commissions) will experience the same types of NAV dilution as the nonparticipating Stockholders, although at a lower level, to the extent they purchase less than the same

percentage of the discounted offering as their interest in shares of the Company’s common stock immediately prior to the offering. The level of NAV dilution will decrease as the number of shares such Stockholders purchase increases. Existing

Stockholders who buy more than such percentage will experience NAV dilution but will, in contrast to existing Stockholders who purchase less than their proportionate share of the offering, experience accretion in NAV over their investment per share

and will also experience a disproportionately greater increase in their participation in the Company’s earnings and assets and their voting power than the Company’s increase in assets, potential earning power and voting interests due to

such offering. The level of accretion will increase as the excess number of shares such Stockholder purchases increases. Even a Stockholder who over-participates will, however, be subject to the risk that the Company may make additional discounted

offerings in which such Stockholder does not participate, in which case such a Stockholder will experience NAV dilution as described above in such subsequent offerings. These Stockholders may also experience a decline in the market price of their

shares, which often reflects to some degree announced or potential increases and decreases in NAV. This decrease could be more pronounced as the size of the offering and level of discounts increases.

The examples assume that Company XYZ has 1,000,000 shares of common stock outstanding, $15,000,000 in total assets and $5,000,000 in total

liabilities. The current net asset value of the Company and NAV are thus $10,000,000 and $10.00, respectively. The table below illustrates the dilutive and accretive effect in the hypothetical 25% discount offering from the prior chart for

stockholder A that acquires shares equal to (1) 50% of their proportionate share of the offering (i.e., 1,250 shares, which is 0.50% of the offering of 250,000 shares rather than their 1.00% proportionate share) and (2) 150% of their

proportionate share of the offering (i.e., 3,750 shares, which is 1.50% of the offering of 250,000 shares rather than their 1.00% proportionate share). The prospectus pursuant to which any discounted offering is made will include a chart for these

examples based on the actual number of shares in such offering and the actual discount from the most recently determined NAV. It is not possible to predict the level of market price decline that may occur. These examples are provided for

illustrative purposes only.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to

Sale Below

NAV

|

|

|

50% Participation

|

|

|

150% Participation

|

|

|

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Offering Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price per share to public

|

|

|

—

|

|

|

$

|

7.89

|

|

|

|

—

|

|

|

$

|

7.89

|

|

|

|

—

|

|

|

Net proceeds per share to issuer

|

|

|

—

|

|

|

$

|

7.50

|

|

|

|

—

|

|

|

$

|

7.50

|

|

|

|

—

|

|

|

Increases in Shares and Decrease to NAV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shares outstanding

|

|

|

1,000,000

|

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

NAV per share

|

|

$

|

10.00

|

|

|

$

|

9.50

|

|

|

|

(5.00

|

)%

|

|

$

|

9.50

|

|

|

|

(5.00

|

)%

|

|

(Dilution)/Accretion to Participating Stockholder A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares held by Stockholder A

|

|

|

10,000

|

|

|

|

11,250

|

|

|

|

12.50

|

%

|

|

|

13,750

|

|

|

|

37.50

|

%

|

|

Percentage held by Stockholder A

|

|

|

1.0

|

%

|

|

|

0.90

|

%

|

|

|

(10.00

|

)%

|

|

|

1.10

|

%

|

|

|

10.00

|

%

|

|

Total Asset Values

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total NAV held by Stockholder A

|

|

$

|

100,000

|

|

|

$

|

106,875

|

|

|

|

6.88

|

%

|

|

$

|

130,625

|

|

|

|

30.63

|

%

|

|

Total investment by Stockholder A (assumed to be $10.00 per share on shares held prior to

sale)

|

|

$

|

100,000

|

|

|

$

|

109,863

|

|

|

|

9.86

|

%

|

|

$

|

129,588

|

|

|

|

29.59

|

%

|

|

Total (dilution)/accretion to Stockholder A (total NAV less total investment)

|

|

|

—

|

|

|

$

|

(2,988

|

)

|

|

|

—

|

|

|

$

|

1,037

|

|

|

|

—

|

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to

Sale Below

NAV

|

|

|

50% Participation

|

|

|

150% Participation

|

|

|

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Per Share Amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV held by Stockholder A

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

Investment per share held by Stockholder A (assumed to be $10.00 per share on shares held prior to

sale)

|

|

$

|

10.00

|

|

|

$

|

9.77

|

|

|

|

(2.30

|

)%

|

|

$

|

9.42

|

|

|

|

(5.80

|

)%

|

|

(Dilution)/accretion per share held by Stockholder A (NAV less investment per share)

|

|

|

—

|

|

|

$

|

(0.27

|

)

|

|

|

—

|

|

|

$

|

0.08

|

|

|

|

—

|

|

|

Percentage (dilution)/accretion to Stockholder A (dilution/accretion per share divided by

investment per share)

|

|

|

—

|

|

|

|

—

|

|

|

|

(2.76

|

)%

|

|

|

—

|

|

|

|

0.85

|

%

|

Impact on New Investors

Investors who are not currently Stockholders and who participate in an offering of the Company’s common stock at a price below NAV, but

whose investment per share is greater than the resulting NAV due to selling compensation and expenses paid by the Company, will experience an immediate decrease, although small, in NAV of their shares and their NAV compared to the price they pay for

their shares. Investors who are not currently Stockholders and who participate in an offering of the Company’s common stock at a price below NAV and whose investment per share is also less than the resulting NAV due to selling compensation and

expenses paid by the Company being significantly less than the discount per share, will experience an immediate increase in the NAV of their shares and their NAV compared to the price they pay for their shares. These investors will experience a

disproportionately greater participation in the Company’s earnings and assets and their voting power than the Company’s increase in assets, potential earning power and voting interests due to such offering. These investors will, however,

be subject to the risk that the Company may make additional discounted offerings in which such new Stockholder does not participate, in which case such new Stockholder will experience dilution as described above in such subsequent offerings. These

investors may also experience a decline in the market price of their shares, which often reflects to some degree announced or potential increases and decreases in NAV. This decrease could be more pronounced as the size of the offering and level of

discounts increases.

The following examples illustrate the level of NAV dilution or accretion that would be experienced by a new

stockholder who purchases the same percentage (1.00%) of the shares in the three different hypothetical offerings of common stock of different sizes and levels of discount from NAV. The examples assume that Company XYZ has 1,000,000 shares of

common stock outstanding, $15,000,000 in total assets and $5,000,000 in total liabilities. The current net asset value of the Company and NAV are thus $10,000,000 and $10.00, respectively. The table below illustrates the dilutive and accretive

effects on stockholder A at (1) an offering of 50,000 shares (5% of the outstanding shares) at $9.50 per share after offering expenses and commissions (a 5% discount from NAV); (2) an offering of 100,000 shares (10% of the outstanding

shares) at $9.00 per share after offering expenses and commissions (a 10% discount from NAV); (3) an offering of 250,000 shares (25% of the outstanding shares) at $7.50 per share after offering expenses and commissions (a 25% discount from

NAV); and (4) an offering of 250,000 shares (25% of the outstanding shares) at $0.00 per share after offering expenses and commissions (a 100% discount from NAV). The prospectus pursuant to which any discounted offering is made will include a

chart for these examples based on the actual number of shares in such offering and the actual

10

discount from the most recently determined NAV. It is not possible to predict the level of market price decline that may occur. These examples are provided for illustrative purposes only.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Example 1

5% Offering at

5% Discount

|

|

|

Example 2

10% Offering

at 10% Discount

|

|

|

Example 3

25% Offering

at 25% Discount

|

|

|

Example 4

25% Offering

at 100% Discount

|

|

|

|

|

Prior to Sale

Below NAV

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Following

Sale

|

|

|

%

Change

|

|

|

Offering Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price per share to public

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

9.47

|

|

|

|

—

|

|

|

$

|

7.89

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

Net offering proceeds per share to issuer

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

$

|

9.00

|

|

|

|

—

|

|

|

$

|

7.50

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

Decrease to NAV

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shares outstanding

|

|

|

—

|

|

|

|

1,050,000

|

|

|

|

5.00

|

%

|

|

|

1,100,000

|

|

|

|

10.00

|

%

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

|

1,250,000

|

|

|

|

25.00

|

%

|

|

NAV per share

|

|

|

—

|

|

|

$

|

9.98

|

|

|

|

(0.20

|

)%

|

|

$

|

9.91

|

|

|

|

(0.90

|

)%

|

|

$

|

9.50

|

|

|

|

(5.00

|

)%

|

|

$

|

8.00

|

|

|

|

(20.00

|

)%

|

|

Dilution to Stockholder A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares held by Stockholder A

|

|

|

—

|

|

|

|

500

|

|

|

|

—

|

|

|

|

1,000

|

|

|

|

—

|

|

|

|

2,500

|

|

|

|

—

|

|

|

|

2,500

|

|

|

|

—

|

|

|

Percentage held by Stockholder A

|

|

|

—

|

|

|

|

0.05

|

%

|

|

|

—

|

|

|

|

0.09

|

%

|

|

|

—

|

|

|

|

0.20

|

%

|

|

|

—

|

|

|

|

0.20

|

%

|

|

|

—

|

|

|

Total Asset Values

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total NAV held by Stockholder A

|

|

|

—

|

|

|

$

|

4,990

|

|

|

|

—

|

|

|

$

|

9,910

|

|

|

|

—

|

|

|

$

|

23,750

|

|

|

|

—

|

|

|

$

|

20,000

|

|

|

|

—

|

|

|

Total investment by Stockholder A

|

|

|

—

|

|

|

$

|

5,000

|

|

|

|

—

|

|

|

$

|

9,470

|

|

|

|

—

|

|

|

$

|

19,725

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

Total (dilution)/accretion to Stockholder A (total NAV less total investment)

|

|

|

—

|

|

|

$

|

(10

|

)

|

|

|

—

|

|

|

$

|

440

|

|

|

|

—

|

|

|

$

|

4,025

|

|

|

|

—

|

|

|

$

|

20,000

|

|

|

|

—

|

|

|

Per Share Amounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAV held by Stockholder A

|

|

|

—

|

|

|

$

|

9.98

|

|

|

|

—

|

|

|

$

|

9.91

|

|

|

|

—

|

|

|

$

|

9.50

|

|

|

|

—

|

|

|

$

|

8.00

|

|

|

|

—

|

|

|

Investment per share held by Stockholder A

|

|

|

—

|

|

|

$

|

10.00

|

|

|

|

—

|

|

|

$

|

9.47

|

|

|

|

—

|

|

|

$

|

7.89

|

|

|

|

—

|

|

|

$

|

0.00

|

|

|

|

—

|

|

|

(Dilution)/accretion per share held by Stockholder A (NAV less investment per share)

|

|

|

—

|

|

|

$

|

(0.02

|

)

|

|

|

—

|

|

|

$

|

0.44

|

|

|

|

—

|

|

|

$

|

1.61

|

|

|

|

—

|

|

|

$

|

8.00

|

|

|

|

—

|

|

|

Percentage (dilution)/accretion to Stockholder A ((dilution)/accretion per share divided by

investment per share)

|

|

|

—

|

|

|

|

—

|

|

|

|

(0.20

|

)%

|

|

|

—

|

|

|

|

4.65

|

%

|

|

|

—

|

|

|

|

20.41

|

%

|

|

|

—

|

|

|

|

—

|

|

Conditions to Sales or Other Issuances Below NAV

If Stockholders approve this Proposal, the Company will only issue shares of its common stock at a price below NAV pursuant to such approval if

the following conditions are met:

|

|

•

|

|

a “required majority” of the Company’s directors has determined that any such sale would be in the best interests of the Company and the Stockholders; and

|

|

|

•

|

|

a “required majority” of the Company’s directors, in consultation with the underwriter or underwriters of the offering if it is to be underwritten, has determined in good faith, and as of a time

immediately prior to the first solicitation by or on behalf of the Company of firm commitments to purchase such common stock or immediately prior to the issuance of such common stock, that the price at which such shares of common stock are to be

sold is not less than a price which closely approximates the market value of those, less any distributing commission or discount.

|

For purposes of this Proposal, the 1940 Act defines a “required majority” of directors as both (1) a majority of the

Company’s directors who have no financial interest in the transaction and (2) a majority of the Independent Directors. For these purposes, directors are not deemed to have a financial interest solely by reason of their ownership of the

Company’s common stock.

11

The Board may determine to issue shares of the Company’s common stock at a price below NAV

in a registered public offering or in a private placement either with or without an obligation to seek to register their resale at the request of the holders. The Board may also determine to use an underwriter or placement agent to assist in selling

such shares of common stock if it concludes that doing so would assist in marketing such securities on favorable terms.

Key Stockholder Considerations

Before voting on this Proposal or giving proxies with regard to this matter, Stockholders should consider the potentially dilutive

effect on the NAV of the issuance of shares of the Company’s common stock at a price less than NAV. Any sale of common stock by the Company at a price below NAV would result in an immediate dilution to existing Stockholders on a per share

basis. This dilution would include reduction in the NAV as a result of the issuance of shares at a price below NAV and a proportionately greater decrease in a Stockholder’s per share interest in the earnings and assets of the Company and per

share voting interest in the Company than the increase in the assets of the Company resulting from such issuance.

The 1940 Act

establishes a connection between market price and NAV because, when stock is sold or otherwise issued at a market price below NAV, the resulting increase in the number of outstanding shares is not accompanied by a proportionate increase in the net

assets of the issuer. The Board will consider the potential dilutive effect of the issuance of shares at a price below NAV when considering whether to authorize any such issuance pursuant to the Stockholder approval being sought here.

Stockholders should also consider that they will have no subscription, preferential or preemptive rights to additional shares of common stock

proposed to be authorized for issuance, and thus any future issuance of common stock at a price below NAV would dilute a Stockholder’s holdings of common stock as a percentage of shares outstanding to the extent the Stockholder does not

purchase sufficient shares in the offering or otherwise to maintain the Stockholder’s percentage interest. Further, if the Stockholder does not purchase, or is unable to purchase, any shares to maintain the Stockholder’s percentage

interest, regardless of whether such offering is at a price above or below the then-current NAV, the Stockholder’s voting power will be diluted.

As discussed above, the maximum number of shares issuable at a price below NAV that could result in such dilution is limited to 25% of the

Company’s then outstanding common stock.

THE BOARD, INCLUDING EACH OF THE COMPANY’S DIRECTORS WHO HAS NO FINANCIAL INTEREST

IN THE TRANSACTION AND EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL.

12

OTHER BUSINESS

The management of the Company does not know of any other matters to be brought before the Meeting. If such matters are properly brought before