UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MARCH 2018

TIM S.p.A.

A company directed and coordinated by Vivendi S.A.

(Translation of registrant’s name into English)

Via Gaetano

Negri 1

20123 Milan, Italy

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

FORM

20-F ☒ FORM

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.

YES ☐ NO ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82-

Press Release

TIM: Stefano Siragusa new Chief TIM Infrastructures Officer

Rome, 12 March 2018

TIM hereby informs that Stefano

Siragusa enters in TIM Group as Chief TIM Infrastructures Officer.

Stefano Siragusa does not hold company shares.

Curriculum Vitae is attached.

TIM Press Office

+39 06 3688 2610

www.telecomitalia.com/media

Twitter: @TIMnewsroom

Telecom Italia Investor Relations

+39 02 8595 4131

www.telecomitalia.com/investor_relations

CV Stefano Siragusa

Stefano Siragusa international managerial profile has allowed him to hold a series of leadership positions in multinational companies.

In 2000 he joint Siemens AG as Product manager in the Automation and Drives Division. In 2002, he began his career in BCG defining value-creation strategies

in Europe, Asia-Pacific and particularly in North America where, as BCG Global talent, he transferred in 2005. Once back to Italy, in 2011 he was elected Partner & Managing Director of BCG and was appointed as leader of the industrial goods

division. In 2012 he was also requested to coordinate Aerospace & Defence division in Europe and Middle East. In 2013 he was elected member of BCG’s Global Operations Leadership Team and he decided to move to New York to be entrusted

also with the responsibility of defining and coordinating BCG’s global content agenda for Lean, Procurement and Supply Chain.

In 2014, he returned

back to Italy to be nominated CEO and General Manager of Ansaldo STS, a public company listed on the Milan Stock Exchange (STS.IT) which delivers worldwide the most important mass transportation and urban railways projects. Under Siragusa’s

leadership, AnsaldoSTS experienced a superior value creation renaissance: new orders grew by 160%, cash generation by 90%, net results by 80% and productivity by 60%.

Successfully finalized Ansaldo STS turnaround and its transition from Leonardo into Hitachi Group, in 2016 Siragusa decided to join Bain&Company, a global

management-consulting firm with 55 offices in 36 countries, as Senior Partner and Director.

Since 2017 Stefano is Member of the Advisory Board of LUMSA

University.

In 2016 Stefano has supported the successful IPO of Enav, the public listed company that provides Air Traffic Control services, as member of

the Board of Directors, Chairman of the Remuneration and Nomination Committee and member of the Risk and Related party committee.

In 2015 and 2016,

Stefano has been Member of the Board of Directors and Member of the Governance Committee of Saipem, global leader in the Engineering & Construction and Drilling businesses.

In 2015 and 2016 Stefano has been, also, Chairman of the Board of Metro 5—new Metro Systems in Milan.

In 2015 and 2016 Stefano has been Member of the Board of Directors of Marangoni, global leader in the tyre industry.

Stefano Siragusa, born in 1976, graduated summa cum laude in Electrical Engineering from Politecnico di Milano with a major in Energy. He successfully

completed his education by obtaining an MBA cum laude from MIP and an Executive Master from Harvard Business School—HBS

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the United States Private

Securities Litigation Reform Act of 1995.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking

statements. The Group’s interim report as of and for the twelve months ended December 31, 2017 included in this Form

6-K

contains certain forward-looking statements. Forward-looking statements are

statements that are not historical facts and can be identified by the use of forward-looking terminology such as “believes,” “may,” “is expected to,” “will,” “will continue,” “should,”

“seeks” or “anticipates” or similar expressions or the negative thereof or other comparable terminology, or by the forward- looking nature of discussions of strategy, plans or intentions.

Actual results may differ materially from those projected or implied in the forward-looking statements. Such forward-looking information is based on certain

key assumptions which we believe to be reasonable but forward-looking information by its nature involves risks and uncertainties, which are outside our control, that could significantly affect expected results.

The following important factors could cause our actual results to differ materially from those projected or implied in any forward-looking statements:

|

|

1.

|

our ability to successfully implement our strategy over the 2018-2020 period;

|

|

|

2.

|

the continuing effects of the global economic crisis in the principal markets in which we operate, including, in particular, our core Italian market;

|

|

|

3.

|

the impact of regulatory decisions and changes in the regulatory environment in Italy and other countries in which we operate;

|

|

|

4.

|

the impact of political developments in Italy and other countries in which we operate;

|

|

|

5.

|

our ability to successfully meet competition on both price and innovation capabilities of new products and services;

|

|

|

6.

|

our ability to develop and introduce new technologies which are attractive in our principal markets, to manage innovation, to supply value added services and to increase the use of our fixed and mobile networks;

|

|

|

7.

|

our ability to successfully implement our internet and broadband strategy;

|

|

|

8.

|

our ability to successfully achieve our debt reduction and other targets;

|

|

|

9.

|

the impact of fluctuations in currency exchange and interest rates and the performance of the equity markets in general;

|

|

|

10.

|

the outcome of litigation, disputes and investigations in which we are involved or may become involved;

|

|

|

11.

|

our ability to build up our business in adjacent markets and in international markets (particularly in Brazil), due to our specialist and technical resources;

|

|

|

12.

|

our ability to achieve the expected return on the investments and capital expenditures we have made and continue to make in Brazil;

|

|

|

13.

|

the amount and timing of any future impairment charges for our authorizations, goodwill or other assets;

|

|

|

14.

|

our ability to manage and reduce costs;

|

|

|

15.

|

any difficulties which we may encounter in our supply and procurement processes, including as a result of the insolvency or financial weaknesses of our suppliers; and

|

|

|

16.

|

the costs we may incur due to unexpected events, in particular where our insurance is not sufficient to cover such costs.

|

The foregoing factors should not be construed as exhaustive. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on such

forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date

hereof, including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: March 12, 2018

|

|

|

|

|

|

TELECOM ITALIA S.p.A.

|

|

|

|

|

|

|

|

|

|

|

BY:

|

|

/s/ Umberto Pandolfi

|

|

|

|

|

|

|

|

Umberto Pandolfi

|

|

|

|

|

|

|

|

Company Manager

|

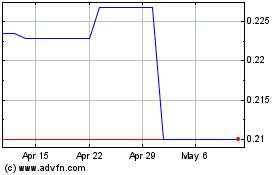

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

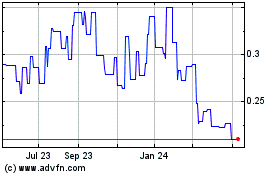

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Apr 2023 to Apr 2024