As filed with the Securities and Exchange Commission on March 9,

2018

Registration

No. 333- _______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VistaGen Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

Nevada

|

|

20-5093315

|

|

(State

or Other Jurisdiction of

|

|

(I.R.S.

Employer

|

|

Incorporation

or Organization)

|

|

Identification

No.)

|

343 Allerton Avenue

South San Francisco, California 94080

(Address

of Principal Executive Offices)

1999 Stock Incentive Plan

and

Amended and Restated 2016 Equity Incentive Plan

(Full

title of the plan)

Shawn K. Singh

Chief Executive Officer

VistaGen Therapeutics, Inc.

343 Allerton Avenue

South San Francisco, California 94080

(Name

and address of agent for service)

(650) 577-3600

(Telephone

number, including area code, of agent for service)

Copies to:

Jessica R. Sudweeks, Esq.

Disclosure Law Group, a Professional Corporation

600 W. Broadway, Suite 700

San Diego, California 92101

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large Accelerated filer

[ ]

|

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

|

Smaller reporting company [X]

|

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered

|

Amount to be

Registered

(1)

|

Proposed Maximum

Offering Price per

Share

(2)

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

|

Common Stock,

$0.001 par value per share: To be issued under the Amended and

Restated 2016 Equity Incentive Plan

|

3,286,671

|

$

1.22

|

$

4,009,738.62

|

$

499.21

|

|

Common Stock,

$0.001 par value per share: Outstanding options issued by the

Registrant under the Amended and Restated 2016 Equity Incentive

Plan

|

5,015,829

(3)

|

$

1.22

|

$

6,119,311.38

|

$

761.86

|

|

Total

|

8,302,500

|

|

$

10,129,050.00

|

$

1,261.07

|

|

(1)

|

We

previously registered an aggregate total of 997,229 shares of our

common stock, both issued and issuable under our 1999 Stock

Incentive Plan (the

1999

Plan

) and our Amended and Restated 2016 Equity Incentive

Plan, formerly the 2008 Stock Incentive Plan (the

2016 Plan

, and collectively, the

Plans

) on a registration

statement on Form S-8 (File No. 333-208354). This registration

statement on Form S-8 is being filed to register an additional

8,302,500 shares of our common stock underlying options that may be

issued or are currently outstanding under the 2016 Plan. In

accordance with Rule 416 under the Securities Act of 1933, as

amended, this registration statement shall also be deemed to cover

any additional securities that may from time to time be offered or

issued to prevent dilution resulting from stock splits, stock

dividends or similar transactions.

|

|

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the

registration fee pursuant to Rules 457(c) and (h) under the

Securities Act of 1933, as amended.

|

|

|

|

|

(3)

|

Represents

5,015,829 shares of common stock issuable upon exercise of

outstanding stock options previously issued under the 2016

Plan.

|

EXPLANATORY NOTE

VistaGen

Therapeutics, Inc. (the

Company

) has prepared this

Registration Statement in accordance with the requirements of Form

S-8 under the Securities Act of 1933, as amended (the

Securities

Act

), to register an additional

8,302,500 shares of the Company’s common stock, $0.001 par

value, issuable pursuant to the Company’s Amended and

Restated 2016 Equity Incentive Plan, formerly the 2008 Stock

Incentive Plan (the

2016

Plan

). The 2016 Plan provides for the grant of incentive

stock options, non-qualified stock options, restricted shares of

common stock, stock appreciation rights and dividend equivalent

rights, collectively referred to as “Awards.” Awards,

other than incentive stock options, may be granted to the

Company’s employees, directors and consultants. The Company

previously registered an aggregate of 997,229 shares of its common

stock (Registration No. 333-208354) (the

Prior Registration Statement

) under

the 2008 Stock Incentive Plan (the

2008 Plan

) and the Company’s

1999 Stock Incentive Plan (the

1999 Plan

). The 2008 Plan was amended

and restated on July 26, 2016 and

subsequently

amended

on September 15, 2017, and is now known as the 2016

Plan.

Pursuant to General

Instruction E to Form S-8, the contents of the Prior Registration

Statement relating to the 2008 Plan and the 1999 Plan, and all

periodic reports filed by the Company after the Prior Registration

Statement to maintain current information about the Company are

hereby incorporated by reference. The Prior Registration Statement

included a reoffer prospectus, which is not incorporated by

reference and made a part hereof. Instead, a revised reoffer

prospectus (the

Reoffer

Prospectus

) has been included in Part I of this Registration

Statement.

The

names of certain persons who may, from time to time in the future,

sell shares under the Reoffer Prospectus and the amount of such

shares are set forth below under the caption “

Selling Stockholders

.” However,

non-affiliates who hold less than the lesser of 1,000 shares or 1%

of our common stock issuable under the Plans may resell restricted

securities issued under each respective Plan and are not identified

herein as Selling Stockholders, but may use this Reoffer Prospectus

for future reoffers and resales. In addition, other affiliate

selling stockholders may elect to sell shares under the Reoffer

Prospectus as they receive them from time to time in the future in

which case, as their names and amounts of shares to be reoffered

become known, we will supplement the Reoffer Prospectus with that

information. Any securities covered by the Reoffer Prospectus which

qualify for sale pursuant to Rule 144 may be sold under Rule 144

rather than pursuant to the Reoffer Prospectus.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

document(s) containing the information concerning the 1999 Plan and

the 2016 Plan (collectively, the

Plans

) specified in Part I will be

sent or given to participants of the Plans as specified by Rule

428(b)(1). Such documents are not filed as part of this

Registration Statement in accordance with the Note to Part I of the

Form S-8 Registration Statement.

REOFFER PROSPECTUS

VISTAGEN THERAPEUTICS, INC.

5,301,546 Shares of Common Stock

This Reoffer Prospectus relates to the sale of up 5,301,546 shares

of our common stock, par value $0.001 per share, that may be

offered and resold from time to time in the future by existing

stockholders of the Company (the

Selling Stockholders

) identified in

this Reoffer Prospectus for his or her own account issuable

pursuant to the Company's 1999 Stock Incentive Plan (the

1999 Plan

) and the Amended

and Restated 2016 Equity incentive Plan, formerly known as the 2008

Stock Incentive Plan (the

2016

Plan

and, together with the 1999 Plan, the

Plans

).

The Plans

provide for the grant of incentive stock options, non-qualified

stock options, restricted shares of common stock, stock

appreciation rights and dividend equivalent rights, collectively

referred to as “Awards.” Awards, other than incentive

stock options, may be granted to the Company’s employees,

directors and consultants.

It is anticipated that the

Selling Stockholders will offer common stock for sale at prevailing

prices, as reported by the NASDAQ Capital Market on the date of

sale. We will receive no part of the proceeds from sales made under

this Reoffer Prospectus. The Selling Stockholders will bear all

sales commissions and similar expenses. Any other expenses incurred

in connection with the registration and offering of the shares will

be borne by the Company.

The

shares of common stock will be issued pursuant to stock options

previously granted under the Plans or granted in the future under

the 2016 Plan. This Reoffer Prospectus has been prepared for the

purposes of registering the common stock under the Securities Act

of 1933, as amended, to allow for future sales by the Selling

Stockholders on a continuous or delayed basis to the public without

restriction.

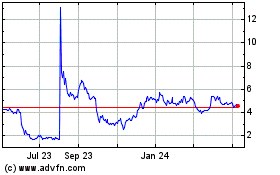

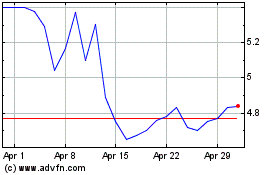

Our common stock is quoted on NASDAQ Capital Market under the

symbol “VTGN.” The closing sales price for our common

stock on March 8, 2018 was $1.37 per share.

Investing

in our common stock involves risks. See “

Risk Factors

” on page 6 of this

Reoffer Prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE

SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED

IF THIS REOFFER PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO

THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this Reoffer Prospectus is March 9, 2018

VISTAGEN THERAPEUTICS, INC.

|

|

|

PAGE NO.

|

|

|

|

1

|

|

|

|

5

|

|

|

|

6

|

|

|

|

7

|

|

|

|

8

|

|

|

|

8

|

|

|

|

8

|

|

|

|

11

|

|

|

|

12

|

|

|

|

12

|

|

|

|

13

|

|

|

|

14

|

You should rely only on the information contained in this Reoffer

Prospectus or any related prospectus supplement. We have not

authorized anyone to provide you with different information. If

anyone provides you with different or inconsistent information, you

should not rely on it. The information contained in this Reoffer

Prospectus or incorporated by reference herein is accurate only on

the date of this Reoffer Prospectus. Our business, financial

condition, results of operations and prospects may have changed

since such date. Other than as required under the federal

securities laws, we undertake no obligation to publicly update or

revise such information, whether as a result of new information,

future events or any other reason.

This Reoffer Prospectus is not an offer to sell, nor is it an offer

to buy, these securities in any jurisdiction where the offer or

sale is not permitted.

This summary highlights certain information that we present more

fully in the rest of this Reoffer Prospectus. This summary does not

contain all of the information you should consider before investing

in the securities offered pursuant to this Reoffer Prospectus. You

should read the entire prospectus carefully, including the section

titled “Risk Factors,” before making an investment

decision.

Except where the context otherwise requires and for purposes of

this Reoffer Prospectus only, “we,” “us,”

“our,” “Company,” “our

Company,” and “VistaGen” refer to VistaGen

Therapeutics, Inc., a Nevada corporation, and its consolidated

subsidiaries.

Overview

We are

a clinical-stage biopharmaceutical company focused on developing

new generation medicines for depression and other central nervous

system (

CNS

) disorders.

Unless the context otherwise requires, the words

“

VistaGen Therapeutics,

Inc.

” “

VistaGen

,” “

we

,” “

the Company

,”

“

us

” and

“

our

” refer to

VistaGen Therapeutics, Inc., a Nevada corporation. All references

to future quarters and years in this Report refer to calendar

quarters and calendar years, unless reference is made

otherwise.

AV-101

is our oral CNS glutamatergic product candidate in Phase 2 clinical

development in the United States, initially as a new generation

adjunctive treatment for Major Depressive Disorder (

MDD

) in patients with an inadequate

response to standard antidepressants approved by the U.S. Food and

Drug Administration (

FDA

). AV-101’s

mechanism of action (

MOA

)

involves both NMDA (N-methyl-D-aspartate) and AMPA

(alpha-amino-3-hydroxy-5-methyl-4-isoxazolepropionic acid)

receptors in the brain responsible for fast excitatory synaptic

activity throughout the CNS. AV-101’s MOA is

fundamentally different from all standard FDA-approved

antidepressants, as well as all atypical antipsychotics, such as

aripiprazole, often used adjunctively with standard

antidepressants. We believe AV-101 also has potential to treat

several additional CNS indications

where modulation of the

NMDA receptors, activation of AMPA pathways and/or key active

metabolites of AV-101 may achieve therapeutic benefit

,

including, among others, as a non-opioid alternative for

neuropathic pain, Parkinson’s disease levodopa-induced

dyskinesia (

PD LID

) and

suicidal ideation.

Clinical studies

conducted at the U.S. National Institute of Mental Health

(

NIMH

), part of the U.S.

National Institutes of Health (

NIH

), by Dr. Carlos Zarate, Jr., Chief

of the NIMH’s Experimental Therapeutics & Pathophysiology

Branch and its Section on Neurobiology and Treatment of Mood and

Anxiety Disorders, have focused on the antidepressant effects of

ketamine hydrochloride injection (

ketamine

), an ion-channel blocking

NMDA receptor antagonist approved by the FDA as an anesthetic, in

MDD patients with inadequate responses to multiple standard

antidepressants. These NIMH studies, as well as clinical research

at Yale University and other academic institutions in the U.S.,

have demonstrated ketamine’s fast-acting antidepressant

effects in treatment-resistant MDD patients, achieving therapeutic

benefits within twenty-four hours of a single sub-anesthetic dose

administered by intravenous (

IV

) injection.

We

believe orally administered AV-101 may have potential to deliver

ketamine-like antidepressant effects, without ketamine’s

psychological side effects and other safety concerns, and without

the need for IV administration. As published in the October 2015

issue of the peer-reviewed,

Journal of Pharmacology and Experimental

Therapeutics,

in an article titled,

The prodrug 4-chlorokynurenine causes

ketamine-like antidepressant effects, but not side effects, by

NMDA/glycineB-site inhibition,

using well-established

preclinical models of depression, AV-101 was shown to induce

fast-acting, dose-dependent, persistent and statistically

significant antidepressant-like responses following a single

treatment. These responses were equivalent to those seen with a

single sub-anesthetic control dose of ketamine. In addition, these

studies confirmed that the fast-acting antidepressant effects of

AV-101 were mediated through both inhibiting the glycine binding

(

GlyB

) site of the NMDA

receptor and activating the AMPA receptor pathway in the

brain.

In

October 2017, we received FDA authorization to launch our Phase 2

double blind, placebo-controlled efficacy and safety study of

AV-101 as a new generation adjunctive treatment for MDD patients

with an inadequate therapeutic response to standard, FDA-approved

antidepressants (the

AV-101

MDD Phase 2 Adjunctive Treatment Study

), and in December

2017 the FDA granted Fast Track Designation to AV-101 for

development as a potential adjunctive treatment for MDD. We

intend to launch the AV-101 MDD Phase 2 Adjunctive Treatment Study

in the first quarter of 2018 with Dr. Maurizio Fava, Professor of

Psychiatry at Harvard Medical School and Director, Division of

Clinical Research, Massachusetts General Hospital (

MGH

) Research Institute, as the

Principal Investigator. Dr. Fava was the co-Principal

Investigator with Dr. A. John Rush of the STAR*D study, the largest

clinical trial conducted in depression to date, whose findings were

published in journals such as the

New England Journal of

Medicine

(

NEJM

) and the

Journal of the American Medical

Association

(

JAMA

). We expect top line results of

the AV-101 MDD Phase 2 Adjunctive Treatment Study to be available

in the first half of 2019. In addition, pursuant to our

Cooperative Research and Development Agreement (

CRADA

) with the NIMH, the NIMH is

currently funding, and Dr. Zarate, as Principal Investigator, and

his team are currently conducting, a small Phase 2 clinical study

of AV-101 as a monotherapy in subjects with treatment-resistant MDD

(the

NIMH AV-101 MDD Phase 2

Monotherapy Study

).

VistaStem

Therapeutics (

VistaStem

)

is our wholly owned subsidiary focused on applying human

pluripotent stem cell (

hPSC

) technology to discover, rescue,

develop and commercialize (i) proprietary new chemical entities

(

NCEs

) for CNS and other

diseases and, through collaborations, (ii) regenerative medicine

(

RM

) involving

hPSC-derived blood, cartilage, heart and liver cells. Our

internal drug rescue programs are designed to

utilize

CardioSafe

3D

, our customized cardiac bioassay system, to develop small

molecule NCEs for our pipeline. To advance potential RM

applications of our cardiac stem cell technology, in December 2016,

we exclusively licensed to BlueRock Therapeutics LP, a next

generation RM company established by Bayer AG and Versant Ventures

(

BlueRock Therapeutics

),

rights to certain proprietary technologies relating to the

production of cardiac stem cells for the treatment of heart disease

(the

BlueRock

Agreement

). In a manner similar to our agreement with

BlueRock Therapeutics, we may pursue additional RM collaborations

or out-licensing transactions involving blood, cartilage, and/or

liver cells derived from hPSCs for RM and cell-based therapy, cell

repair therapy, and/or tissue engineering.

AV-101 and Major Depressive Disorder

Background

The

World Health Organization (

WHO

) estimates that 300 million people

worldwide are affected by depression. According to the NIH, major

depression is one of the most common mental disorders in the U.S.

The NIMH reports that, in 2016, approximately 16 million adults in

the U.S. had at least one major depressive episode in the past

year. According to the U.S. Centers for Disease Control and

Prevention (

CDC

) in an

August 2017 report, 1 in 8 Americans over the age of 12 reported

taking an FDA-approved antidepressant in the previous

month.

Most

antidepressants target chemical imbalances in the brain related to

neurotransmitter reuptake inhibition – either serotonin

(antidepressants known as

SSRIs

) or serotonin/norepinephrine

(antidepressants known as

SNRIs

). Nearly 2 out of every 3

drug-treated depression patients do not obtain adequate therapeutic

benefit from their initial treatment with a standard

antidepressant. Even when effective, these standard antidepressants

take many weeks to achieve adequate therapeutic effects. After

multiple treatment attempts involving many different standard

antidepressants, nearly one out of every three drug-treated

depression patients still do not achieve adequate therapeutic

benefits from their antidepressant medication. Such

patients with an inadequate response to standard antidepressants

often seek to augment their treatment regimen by adding an atypical

antipsychotic drug (a drug such as aripiprazole), despite only

modest potential therapeutic benefit and the significant risk of

additional side effects from such adjunctive drugs.

All

antidepressants have risks of side effects, including, among

others, anxiety, metabolic syndrome, sleep disturbance and sexual

dysfunction. Adjunctive use of atypical antipsychotics to augment

inadequately performing standard antidepressants may increase the

risk of significant side effects, including, tardive dyskinesia,

substantial weight gain, diabetes and heart disease, while offering

only a modest potential increase in therapeutic

benefit.

AV-101

AV-101

is our oral CNS product candidate in Phase 2 development in the

United States, initially as a new generation glutamatergic

antidepressant for the adjunctive treatment of MDD patients with an

inadequate therapeutic response to standard, FDA-approved

antidepressants. As published in the October 2015 issue of the

peer-reviewed,

Journal of

Pharmacology and Experimental Therapeutics,

in an

article titled, “The prodrug 4-chlorokynurenine causes

ketamine-like antidepressant effects, but not side effects, by

NMDA/glycineB-site inhibition,” using well-established

preclinical models of depression, AV-101 was shown to induce

fast-acting, dose-dependent, persistent and statistically

significant ketamine-like antidepressant effects following a single

treatment, responses equivalent to those seen with a single

sub-anesthetic control dose of ketamine, but without the negative

side effects seen with ketamine. In addition, these studies

confirmed that the antidepressant effects of AV-101 were mediated

through both inhibition of the GlyB site of NMDA receptors and

activation of the AMPA receptor pathway in the brain, a key final

common pathway feature of certain new generation glutamatergic

antidepressants such as ketamine and AV-101, each with a MOA that

is fundamentally different from all standard antidepressants and

atypical antipsychotics used adjunctively to augment

them.

We

have completed two NIH-funded, randomized, double blind,

placebo-controlled AV-101 Phase 1 first-in-human safety studies.

Currently, pursuant to our CRADA with the NIMH and Dr. Carlos

Zarate, Jr., the NIMH is currently funding, and Dr. Zarate, as

Principal Investigator, and his team are currently conducting, the

NIMH AV-101 MDD Phase 2 Monotherapy Study.

In

October 2017, we received authorization from the FDA to proceed,

under our Investigational New Drug (

IND

) application, with the AV-101 MDD

Phase 2 Adjunctive Treatment Study, which will test the safety,

efficacy and tolerability of AV-101 as an adjunctive treatment of

MDD in adult patients with an inadequate therapeutic response to

standard, FDA-approved antidepressants. We intend to launch the

AV-101 MDD Phase 2 Adjunctive Treatment Study in the first quarter

of 2018, and expect top line results to be available in the first

half of 2019. Additionally, in December 2017 the FDA granted Fast

Track Designation to AV-101 for development as a potential

adjunctive treatment for MDD.

The FDA’s Fast Track

Designation is a process designed to facilitate the development and

expedite the review of drugs to treat serious conditions and unmet

medical needs. With Fast Track Designation, there is an increased

possibility for a priority review of AV-101 by the

FDA.

We

believe preclinical studies and Phase 1 safety studies support our

hypothesis that AV-101 also has potential as a non-opioid treatment

alternative for neuropathic pain, as well as several additional CNS

indications

where modulation of the

NMDA receptors, activation of AMPA pathways and/or key active

metabolites of AV-101 may achieve therapeutic benefit

,

including PD LID, epilepsy, Huntington’s disease and suicidal

ideation. We are beginning to plan additional Phase 2 clinical

studies to further evaluate the therapeutic potential of AV-101

beyond MDD, however we do not intend to initiate such studies in

2018.

CardioSafe 3D™; NCE Drug Rescue and Regenerative

Medicine

VistaStem

Therapeutics is our wholly owned subsidiary focused on applying

hPSC technology to discover, rescue, develop and commercialize

proprietary small molecule NCEs for CNS and other diseases, as well

as potential regenerative medicine (RM) and cellular therapies

involving stem cell-derived blood, cartilage, heart and liver

cells.

CardioSafe

3D™ is our

customized

in

vitro

cardiac bioassay system capable of predicting

potential human heart toxicity of small molecule

NCEs

in vitro

, long

before they are ever tested in animal and human studies. Potential

commercial applications of our stem cell technology platform

involve using

CardioSafe

3D internally for NCE

drug discovery and drug rescue to expand our proprietary drug

candidate pipeline. Drug rescue involves leveraging substantial

prior research and development investments by pharmaceutical

companies and others related to public domain NCE programs

terminated before FDA approval due to heart toxicity risks and RM

and cellular therapies. To advance potential RM applications of our

cardiac stem cell technology, in December 2016, we exclusively

licensed to BlueRock Therapeutics LP, a next generation

regenerative medicine company established by Bayer AG and Versant

Ventures, rights to certain proprietary technologies relating to

the production of cardiac stem cells for the treatment of heart

disease. In a manner similar to the BlueRock Agreement, we may also

pursue additional potential RM applications using blood, cartilage,

and/or liver cells derived from hPSCs for (A) cell-based therapy

(injection of stem cell-derived mature organ-specific cells

obtained through directed differentiation), (B) cell repair therapy

(induction of regeneration by biologically active molecules

administered alone or produced by infused genetically engineered

cells), or (C) tissue engineering (transplantation

of

in

vitro

grown complex tissues) using hPSC-derived blood,

bone, cartilage, and/or liver cells.

Risk Factors

Our

business is subject to substantial risk. Please carefully consider

the section titled “

Risk

Factors

” on page 6 of this Reoffer Prospectus for a

discussion of the factors you should carefully consider before

deciding to purchase the securities offered by this Reoffer

Prospectus. These risks include, among others:

●

we

are a development stage biopharmaceutical company with no current

revenues or approved products, and limited experience developing

new drug, biological and/or regenerative medicine candidates, which

makes it difficult to assess our future viability;

●

we depend heavily on the success of AV-101, and we cannot be

certain that we will be able to obtain regulatory approval for, or

successfully commercialize, AV-101, or any product

candidate;

●

failures or delays in the commencement or completion of, or supply

of AV-101 for, our planned clinical trials could delay, prevent or

limit our ability to complete clinical development of AV-101 in a

timely manner, or at all, or generate revenue and continue our

business;

●

we face significant competition, and if we are unable to compete

effectively, we may not be able to achieve or maintain significant

market penetration or improve our results of

operations;

●

some of our programs have been partially supported by government

grants, which may not be available to us in the

future;

●

if we are unable to adequately protect our proprietary technology,

or obtain and maintain issued patents that are sufficient to

protect our product candidates, others could compete against us

more directly, which would have a material adverse impact on our

business, results of operations, financial condition and prospects;

and

●

we have incurred significant net losses since inception and we will

continue to incur substantial operating losses for the foreseeable

future.

Additional risks and uncertainties not presently known to us or

that we currently deem immaterial may also impair our business

operations. You should be able to bear a complete loss of your

investment.

By

this Reoffer Prospectus, the Selling Stockholders are offering up

to 5,301,546 shares of our common stock, which are issuable

pursuant to our 1999 Plan and 2016 Plan. The Selling Stockholders

are not required to sell their shares, and any future sales of

common stock by the Selling Stockholders are entirely at the

discretion of the Selling Stockholders. We will receive no proceeds

from any future sale of the shares of common stock in this

offering. However, upon any exercise of outstanding stock options

granted under the Plans and any stock options granted in the future

under the 2016 Plan, we will receive proceeds associated with such

exercises.

|

Securities Registered:

|

|

5,301,546

shares of common stock, par value $0.001

|

|

|

|

|

|

Shares of Common Stock Outstanding Prior to Completion of the

Offering:

|

|

22,902,615

|

|

|

|

|

|

NASDAQ Symbol:

|

|

VTGN

|

|

|

|

|

|

Transfer Agent:

|

|

Computershare,

Jersey City, New Jersey.

|

|

|

|

|

|

Risk Factors:

|

|

Our

business operations are subject to numerous risks. See

“

Risk Factors

”

beginning on page 6 of this prospectus for a discussion of factors

you should carefully consider before investing in our

securities.

|

|

|

|

|

|

Use of Proceeds:

|

|

We

will not receive any proceeds from the sale of the shares of common

stock registered pursuant to this Reoffer Prospectus. However, upon

exercise of oustanding stock options granted under the Plans and

any stock options granted in the future under the 2016 Plan, we

will receive proceeds associated with such exercises. To the extent

that we receive any funds from the exercise of options or other

awards issued to the Selling Stockholders under the Plans, such

funds will be used to fund the research and development of our

product candidates, including AV-101, and for working capital and

general corporate purposes.

|

|

|

|

|

|

Sales by Affiliates and Sales of Restricted Securities

|

|

Selling

Stockholders who are considered “affiliates” of the

Company, as defined in Rule 405 under the Securities Act, or who

are selling “restricted securities”, as defined in Rule

144(a)(3) under the Securities Act, may not sell an amount of

shares pursuant to this Reoffer Prospectus which exceeds in any

three month period the amount specified in Rule 144(e) under the

Securities Act.

|

RISK FACTORS

An investment in our

securities involves a high degree of risk. You should consider the

risks, uncertainties and assumptions described under Item 1A,

“

Risk

Factors

,” in our Annual

Report on Form 10-K for the fiscal year ended March 31, 2017, as

well as subsequently filed Quarterly Reports on Form 10-Q, which

risk factors are incorporated herein by reference, and may be

amended, supplemented or superseded from time to time by other

reports we file with the SEC in the future. The risks and

uncertainties we have described in our Annual Report on Form 10-K

for the fiscal year ended March 31, 2017 and subsequent Quarterly

Reports on Form 10-Q are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we

currently deem immaterial may also affect our operations. The

occurrence of any of these known or unknown risks might cause you

to lose all or part of your investment.

CAUTIONARY NOTES

R

EGARDING

FORWARD-LOOKING STATEMENTS

This

Reoffer Prospectus contains forward-looking statements that involve

substantial risks and uncertainties. All statements contained in

this Reoffer Prospectus other than statements of historical facts,

including statements regarding our strategy, future operations,

future financial position, future revenue, projected costs,

prospects, plans, objectives of management and expected market

growth, are forward-looking statements. These statements involve

known and unknown risks, uncertainties and other important factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

The

words “anticipate,” “believe,”

“estimate,” “expect,” “intend,”

“may,” “plan,” “predict,”

“project,” “target,”

“potential,” “will,” “would,”

“could,” “should,” “continue,”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. These forward-looking statements include,

among other things, statements about:

●

the

availability of capital to satisfy our working capital

requirements;

●

the

accuracy of our estimates regarding expenses, future revenues and

capital requirements;

●

our plans to develop and

commercialize our lead product candidate, AV-101, initially as an

adjunctive treatment of MDD patients with an inadequate therapeutic

response to standard, FDA-approved antidepressants,

and

subsequently as a treatment for additional diseases and disorders

involving the CNS;

●

our

ability to initiate and complete our clinical trials and to advance

our product candidates into additional clinical trials, including

pivotal clinical trials, and successfully complete such clinical

trials;

●

regulatory

developments in the U.S. and foreign countries;

●

the

timely and satisfactory performance of the U.S. National Institute

of Mental Health, our third-party contract manufacturer(s),

contract research organization(s) and other third-party

non-clinical and clinical development collaborators and regulatory

service providers;

●

our

ability to obtain and maintain intellectual property protection for

our assets;

●

the

size of the potential markets for our product candidates and our

ability to serve those markets;

●

the

rate and degree of market acceptance of our product candidates for

any indication once approved;

●

the

success of competing products and product candidates in development

by others that are or become available for the indications that we

are pursuing;

●

the

loss of key scientific, clinical and nonclinical development,

and/or management personnel, internally or from one of our

third-party collaborators; and

●

other risks and

uncertainties, including those

described under Item 1A,

“

Risk

Factors

,” in our Annual

Report on Form 10-K for the fiscal year ended March 31, 2017 and

subsequent Quarterly Reports on Form 10-Q, which risk factors are

incorporated herein by reference

.

These

forward-looking statements are only predictions and we may not

actually achieve the plans, intentions or expectations disclosed in

our forward-looking statements, so you should not place undue

reliance on our forward-looking statements. Actual results or

events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements we make.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our business, financial condition and

operating results. We have included important factors in the

cautionary statements included in this Reoffer Prospectus, as well

as certain information incorporated by reference into this Reoffer

Prospectus, that could cause actual future results or events to

differ materially from the forward-looking statements that we make.

Our forward-looking statements do not reflect the potential impact

of any future acquisitions, mergers, dispositions, joint ventures

or investments we may make.

You

should read this Reoffer Prospectus with the understanding that our

actual future results may be materially different from what we

expect. We do not assume any obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by applicable

law.

DETERMINATION OF OF

F

ERING PRICE

The Selling Stockholders may, from time-to-time in the future, sell

the common stock issued to them from time-to-time upon exercise of

stock options granted to them under the Plans at prices and on

terms then prevailing or at prices related to the then current

market price, or in negotiated transactions.

This Reoffer Prospectus relates to shares of our common stock that

may be offered and sold from time to time in the future by the

Selling Stockholders. We will not receive any proceeds from the

sale of the shares of common stock registered pursuant to this

Reoffer Prospectus.

However,

upon any exercise of outstanding stock options granted under the

Plans and any stock options granted in the future under the 2016

Plan, we will receive proceeds associated with such

exercises.

To the extent that we receive any funds from the

exercise of options or other awards issued to the Selling

Stockholders under the Plans, such funds will be used to fund the

development of product candidates, including AV-101, and for

working capital and general corporate purposes.

The Selling Stockholders named in this Reoffer Prospectus are

offering up to 5,301,546 shares of our common stock, issuable upon

exercise of stock options granted to the Selling Stockholders

pursuant to the Plans.

The following table provides, as of March 2, 2018, information

regarding the beneficial ownership of our common stock held by each

of the Selling Stockholders, including:

|

1.

|

the

number of shares of common stock beneficially owned by each Selling

Stockholder prior to this offering;

|

|

2.

|

the

total number of shares of common stock that are to be offered by

each Selling Stockholder;

|

|

3.

|

the

total number of shares of common stock that will be beneficially

owned by each Selling Stockholder upon completion of the offering;

and

|

|

4.

|

the

percentage beneficially owned by each Selling

Stockholder.

|

Non-affiliates

who hold less than the lesser of 1,000 shares or 1% of our common

stock issuable under the Plans may resell restricted securities

issued under each respective Plan and are not identified herein as

Selling Stockholders. These non-affiliates may, however, use this

Reoffer Prospectus for reoffers and resales.

Information with respect to beneficial ownership is largely based

upon Company records, as well as information obtained from the

Selling Stockholders. Information with respect to "Shares

Beneficially Owned Prior to this Offering" includes the shares

issued pursuant to the Plans. Information with respect to "Shares

Beneficially Owned Upon Completion of this Offering" assumes the

sale of all shares of the common stock offered by this Reoffer

Prospectus and no other purchases or sales of our common stock by

the Selling Stockholders. Except as described below and to our

knowledge, each named Selling Stockholder beneficially owns and has

sole voting and investment power over all common stock or rights to

these shares of common stock.

|

|

|

Position

with

|

Shares

Beneficially

Owned Prior

to

this

Offering (1)

|

|

Shares

Beneficially

Owned

Upon

Completion

of

this

Offering

|

|

Name

(3)

|

|

the

Company

|

|

|

|

|

|

|

Shawn

K. Singh

|

|

Chief

Executive Officer, Director

|

941,348

|

3.95

%

|

980,375

|

(2

)

|

504,037

|

2.16

%

|

|

Mark

A. Smith, Ph. D.

|

|

Chief

Medical Officer

|

277,215

|

1.20

%

|

685,000

|

(2

)

|

-

|

*

|

|

H.

Ralph Snodgrass, Ph. D.

|

|

President,

Chief Scientific Officer and Director

|

630,668

|

2.69

%

|

621,250

|

(2

)

|

370,224

|

1.59

%

|

|

Jerrold

D. Dotson

|

|

Vice-President

and Chief Financial Officer

|

377,593

|

1.62

%

|

531,001

|

(2

)

|

165,000

|

*

|

|

Mark

McPartland

|

|

Vice-President

- Corporate Development

|

174,960

|

*

|

465,000

|

(2

)

|

-

|

*

|

|

Jerry

B. Gin, Ph. D.

|

|

Director

|

317,566

|

1.37

%

|

260,000

|

(2

)

|

200,000

|

*

|

|

Jon

S. Saxe

|

|

Chairman

|

189,067

|

*

|

246,375

|

(2

)

|

85,126

|

*

|

|

Brian

Underdown, Ph. D.

|

|

Director

|

184,316

|

*

|

244,250

|

(2

)

|

82,500

|

*

|

|

Kristina

Bonham

|

|

Employee

|

95,282

|

*

|

216,501

|

(2

)

|

-

|

*

|

|

Hai-Qing

Xian

|

|

Employee

|

94,532

|

*

|

215,751

|

(2

)

|

-

|

*

|

|

Danajane

Katz

|

|

Employee

|

52,555

|

*

|

122,250

|

(2

)

|

30

|

*

|

|

Caren

Scannell

|

|

Employee

|

59,837

|

*

|

146,750

|

(2

)

|

-

|

*

|

|

Jason

Adelman

|

|

Consultant

|

27,687

|

*

|

25,000

|

(2

)

|

19,875

|

*

|

|

Reid

Adler

|

|

Consultant

|

106,329

|

*

|

77,500

|

(2

)

|

69,629

|

*

|

|

Steven

Angel

|

|

Consultant

|

39,062

|

*

|

125,000

|

(2

)

|

-

|

*

|

|

James

A. Burness

|

|

Consultant

|

96,221

|

*

|

25,125

|

(2

)

|

88,724

|

*

|

|

Andrew

Golden

|

|

Consultant

|

104,501

|

*

|

10,000

|

(2

)

|

101,376

|

*

|

|

Roberta

Jones

|

|

Consultant

|

16,070

|

*

|

25,551

|

(2

)

|

-

|

*

|

|

Gordon

Keller, Ph. D.

|

|

Consultant

|

36,007

|

*

|

32,528

|

(2

)

|

5,563

|

*

|

|

Marion

Kennedy

|

|

Consultant

|

1,001

|

*

|

1,001

|

(2

)

|

-

|

*

|

|

Jeffrey

A. Lindeman

|

|

Consultant

|

38,621

|

*

|

25,000

|

(2

)

|

30,809

|

*

|

|

Michael

Phillips

|

|

Consultant

|

184,966

|

*

|

25,438

|

(2

)

|

176,716

|

*

|

|

Valter

Pinto

|

|

Consultant

|

38,850

|

*

|

100,000

|

(2

)

|

7,600

|

*

|

|

Assaf

Raz

|

|

Consultant

|

21,375

|

*

|

10,000

|

(2

)

|

18,250

|

*

|

|

Justin

Romanowski

|

|

Consultant

|

15,140

|

*

|

10,000

|

(2

)

|

5,140

|

*

|

|

James

V. Sanders DVM, Ph. D.

|

|

Consultant

|

3,895

|

*

|

1,001

|

(2

)

|

2,894

|

*

|

|

Jenene

Thomas

|

|

Consultant

|

43,125

|

*

|

20,000

|

(2

)

|

23,125

|

*

|

|

Bernhard

Votteri, M.D.

|

|

Consultant

|

46,869

|

*

|

775

|

(2

)

|

46,094

|

*

|

|

Ronald

Wester, Ph. D.

|

|

Consultant

|

3,816

|

*

|

1,001

|

(2

)

|

2,815

|

*

|

|

Charles

M. Whiteman

|

|

Consultant

|

15,625

|

*

|

50,000

|

(2

)

|

-

|

*

|

|

Holders of less than 1,000 shares (as a group)

|

5,146

|

*

|

2,123

|

(2

)

|

3,373

|

*

|

|

|

|

|

|

5,301,546

|

|

|

|

____________

* less

than 1%

|

(1)

|

The

number and percentage of shares beneficially owned is determined in

accordance with Rule 13d-3 of the Securities Exchange Act of 1934,

as amended, and the information is not necessarily indicative of

beneficial ownership for any other purpose. Under such rule,

beneficial ownership includes any shares as to which the Selling

Stockholder has sole or shared voting power or investment power and

also any shares, which the Selling Stockholder has the right to

acquire within 60 days. "

Shares

Beneficially Owned Upon Completion of this Offering

" assumes

the sale of all of the common stock offered by this Reoffer

Prospectus and no other purchases or sales of our common stock by

the Selling stockholders.

|

|

|

|

|

(2)

|

Includes

shares that are issuable upon exercise of stock options issued

pursuant to the Plans, some of which are not, and will not become

vested within 60 days from March 2, 2018, and are not included in

the calculation of "

Shares

Beneficially Owned Prior to this Offering

".

|

|

|

|

|

(3)

|

Unless

otherwise indicated, the address for each Selling Stockholder is

c/o VistaGen Therapeutics, Inc., 343 Allerton Avenue, South San

Francisco, CA 94080.

|

|

|

|

|

(4)

|

Applicable

percentage ownership is based on 22,902,615 shares of common stock

outstanding as of March 2, 2018, together with securities

exercisable or convertible into shares of common stock within 60

days of March 2, 2018 for each stockholder, including, for purposes

of the shares beneficially owned prior to the Offering, the shares

offered for resale pursuant to this Reoffer

Prospectus.

|

Beneficial

ownership is determined in accordance with the rules of the SEC and

generally includes voting or investment power with respect to

securities. Shares of common stock that are currently exercisable

or exercisable within 60 days of March 2, 2018, are deemed to be

beneficially owned by the person holding such securities for the

purpose of computing the percentage of ownership of such person,

but are not treated as outstanding for the purpose of computing the

percentage ownership of any other person.

Timing of Sales

Subject to the

foregoing, the Selling Stockholders may elect to offer and sell the

shares covered by this Reoffer Prospectus at various times in the

future. The Selling Stockholders will act independently of our

Company in making decisions with respect to the timing, manner and

size of each sale.

No Known Agreements to Resell the Shares

To

our knowledge, no Selling Stockholder has any agreement or

understanding, directly or indirectly, with any person to resell

the common stock covered by this Reoffer Prospectus.

Offering Price

The

sales price offered by the Selling Stockholders to the public may

be:

|

1.

|

the

market price prevailing at the time of sale;

|

|

2.

|

a

price related to such prevailing market price; or

|

|

3.

|

such

other price as the selling stockholders determine from time to

time.

|

Manner of Sale

To the extent permissible, the shares of common stock may be sold

by means of one or more of the following methods:

|

1.

|

a

block trade in which the broker-dealer so engaged will attempt to

sell the common stock as agent, but may position and resell a

portion of the block as principal to facilitate the

transaction;

|

|

2.

|

purchases

by a broker-dealer as principal and resale by that broker-dealer

for its account pursuant to this Reoffer Prospectus;

|

|

3.

|

ordinary

brokerage transactions in which the broker solicits

purchasers;

|

|

4.

|

through

options, swaps or derivatives;

|

|

5.

|

in

transactions to cover short sales;

|

|

6.

|

privately

negotiated transactions; or

|

|

7.

|

in a

combination of any of the above methods.

|

The

Selling Stockholders may, from time-to-time in the future, sell

their common stock directly to purchasers or may use brokers,

dealers, underwriters or agents to sell their common stock. Brokers

or dealers engaged by the selling stockholders may arrange for

other brokers or dealers to participate. Brokers or dealers may

receive commissions, discounts or concessions from the selling

stockholders, or, if any such broker-dealer acts as agent for the

purchaser of common stock, from the purchaser in amounts to be

negotiated immediately prior to the sale. The compensation received

by brokers or dealers may, but is not expected to, exceed that

which is customary for the types of transactions

involved.

Broker-dealers

may agree with a Selling Stockholder to sell a specified number of

common stock at a stipulated price per share, and, to the extent

the broker-dealer is unable to do so acting as agent for a selling

stockholder, to purchase as principal any unsold common stock at

the price required to fulfill the broker-dealer commitment to the

selling stockholder.

Broker-dealers

who acquire common stock as principal may thereafter resell the

common stock from time to time in transactions, which may involve

block transactions and sales to and through other broker-dealers,

including transactions of the nature described above, in the

over-the-counter market or otherwise at prices and on terms then

prevailing at the time of sale, at prices then related to the

then-current market price or in negotiated transactions. In

connection with resales of the common stock, broker-dealers may pay

to or receive from the purchasers of shares commissions as

described above.

If

the Selling Stockholders enter into arrangements with brokers or

dealers, as described above, we are obligated to file a

post-effective amendment to this registration statement disclosing

such arrangements, including the names of any broker-dealers acting

as underwriters.

The

Selling Stockholders and any broker-dealers or agents that

participate with the Selling Stockholders in the sale of the common

stock may be deemed to be “underwriters” within the

meaning of the Securities Act. In that event, any commissions

received by broker-dealers or agents and any profit on the resale

of the common stock purchased by them may be deemed to be

underwriting commissions or discounts under the Securities

Act.

Sales by Affiliates and Sales of Restricted Securities

Selling

Stockholders who are considered “affiliates” of the

Company, as defined in Rule 405 under the Securities Act, or who

are selling “restricted securities”, as defined in Rule

144(a)(3) under the Securities Act, may not sell an amount of

shares pursuant to this reoffer prospectus which exceeds in any

three month period the amount specified in Rule 144(e) under the

Securities Act.

Sales Pursuant to Rule 144

Any

shares of common stock covered by this Reoffer Prospectus which

qualify for sale pursuant to Rule 144 under the Securities Act may

be sold under Rule 144 rather than pursuant to this Reoffer

Prospectus.

Accordingly,

during such times as a Selling Stockholder may be deemed to be

engaged in a distribution of the common stock, and therefore be

considered to be an underwriter, the selling stockholder must

comply with applicable law and, among other things:

|

1.

|

may

not engage in any stabilization activities in connection with our

common stock;

|

|

2.

|

may

not cover short sales by purchasing shares while the distribution

is taking place; and

|

|

3.

|

may

not bid for or purchase any of our securities or attempt to induce

any person to purchase any of our securities other than as

permitted under the Exchange Act.

|

In

addition, we will make copies of this Reoffer Prospectus available

to the selling stockholders for the purpose of satisfying the

prospectus delivery requirements of the Securities

Act.

State Securities Laws

Under the

securities laws of some states, the common stock may be sold in

such states only through registered or licensed brokers or dealers.

In addition, in some states the common stock may not be sold unless

the stock have been registered or qualified for sale in the state

or an exemption from registration or qualification is available and

is complied with.

Expenses of Registration

We are bearing all costs relating to the registration of the common

stock which may be sold from time-to-time in the future by the

Selling Stockholders. These expenses are estimated to include, but

are not limiteded to, legal, accounting, printing and mailing fees.

The Selling Stockholders, however, will pay any commissions or

other fees payable to brokers or dealers in connection with any

future sale of their common stock pursuant to this Reoffer

Prospectus.

The validity of the common stock offered by this Reoffer Prospectus

will be passed upon by Disclosure Law Group, a Professional

Corporation, of San Diego, California (

DLG

). Partners of DLG beneficially own

an aggregate of 84,487 registered and/or restricted shares of our

common stock.

EXPERTS

The financial statements as of and for the fiscal year ended March

31, 2017, incorporated by reference in this Reoffer Prospectus,

have been audited by OUM & Co. LLP, our independent registered

public accounting firm, as stated in their report and

are incorporated by reference in reliance upon the report

of such firm given upon their authority as experts in accounting

and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Securities and Exchange Commission (the

SEC

) allows us to "incorporate by

reference" into this Reoffer Prospectus the information that we

file with the SEC. This means that we can disclose important

information to you by referring you to those documents. Information

incorporated by reference is part of this Reoffer Prospectus.

Information that we file at a future date with the SEC will update

and supersede this information. For further information about the

Company and our common stock, please read the documents

incorporated by reference below.

●

Annual Report on

Form 10-K for the fiscal year ended March 31, 2017, filed on June

29, 2017;

●

Quarterly

Report on Form 10-Q for the quarter ended June 30, 2017, filed on

August 14, 2017;

●

Quarterly

Report on Form 10-Q for the quarter ended September 30, 2017, filed

on November 9, 2017;

●

Quarterly

Report on Form 10-Q for the quarter ended December 31, 2017, filed

on February 12, 2018;

●

Current

Report on Form 8-K, filed on April 28, 2017;

●

Current

Report on Form 8-K, filed on May 1, 2017;

●

Current

Report on Form 8-K filed on August 9, 2017;

●

Current

Report on Form 8-K, filed on August 31, 2017;

●

Current

Report on Form 8-K, filed on September 20, 2017;

●

Current

Report on Form 8-K, filed on October 2, 2017;

●

Current

Report on Form 8-K, filed on October 26, 2017;

●

Current

Report on Form 8-K, filed on November 7, 2017;

●

Current

Report on Form 8-K, filed on December 6, 2017;

●

Current

Report on Form 8-K, filed on December 8, 2017;

●

Current

Report on Form 8-K, filed on December 13, 2017;

●

Current

Report on Form 8-K, filed on January 8, 2018;

●

Current Report

on Form 8-K, filed on March 7, 2018; and

●

The

description of our common stock contained in the Registration

Statement on Form 8-A filed pursuant to Section 12(b) of the

Exchange Act on May 3, 2016, including any amendment or report

filed with the SEC for the purpose of updating this

description.

WHERE YOU C

A

N FIND ADDITIONAL

INFORMATION

This

Reoffer Prospectus is part of a registration statement on Form S-8

that we filed with the SEC. Certain information in the registration

statement has been omitted from this Reoffer Prospectus in

accordance with the rules of the SEC. We file annual, quarterly and

special reports, proxy statements and other information with the

SEC. You can inspect and copy the registration statement as well as

reports, proxy statements and other information we have filed with

the SEC at the public reference room maintained by the SEC at 100 F

Street N.E. Washington, D.C. 20549, You can obtain copies from the

public reference room of the SEC at 100 F Street N.E. Washington,

D.C. 20549, upon payment of certain fees. You can call the SEC at

1-800-732-0330 for further information about the public reference

room. We are also required to file electronic versions of these

documents with the SEC, which may be accessed through the SEC's

website at http://www.sec.gov. No dealer, salesperson or other

person is authorized to give any information or to make any

representations other than those contained in this Reoffer

Prospectus, and, if given or made, such information or

representations must not be relied upon as having been authorized

by us. This Reoffer Prospectus does not constitute an offer to buy

any security other than the securities offered by this Reoffer

Prospectus, or an offer to sell or a solicitation of an offer to

buy any securities by any person in any jurisdiction where such

offer or solicitation is not authorized or is unlawful. Neither

delivery of this Reoffer Prospectus nor any sale hereunder shall,

under any circumstances, create any implication that there has been

no change in the affairs of our company since the date

hereof.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Insofar as

indemnification for liabilities arising under the Securities Act

may be permitted to our directors, officers or persons controlling

us pursuant to the foregoing provisions, we have been informed that

in the opinion of the SEC such indemnification is against public

policy as expressed in the Securities Act and is therefore

unenforceable. In addition, indemnification may be limited by state

securities laws.

VISTAGEN THERAPEUTICS, INC.

5,301,546

shares of common stock

Reoffer

Prospectus

Dated,

March 9, 2018

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

Item 3.

|

Incorporation of Documents by Reference

|

The following

documents, which have been previously filed by the Registrant with

the Securities and Exchange Commission (the

SEC

),

are hereby incorporated by reference in this Registration

Statement:

●

Annual Report on

Form 10-K for the fiscal year ended March 31, 2017, filed on June

29, 2017;

●

Quarterly Report on

Form 10-Q for the quarter ended June 30, 2017, filed on August 14,

2017;

●

Quarterly Report on

Form 10-Q for the quarter ended September 30, 2017, filed on

November 9, 2017;

●

Quarterly Report on

Form 10-Q for the quarter ended December 31, 2017, filed on

February 12, 2018;

●

Current Report on

Form 8-K, filed on April 28, 2017;

●

Current Report on

Form 8-K, filed on May 1, 2017;

●

Current Report on

Form 8-K filed on August 9, 2017;

●

Current Report on

Form 8-K, filed on August 31, 2017;

●

Current Report on

Form 8-K, filed on September 20, 2017;

●

Current Report on

Form 8-K, filed on October 2, 2017;

●

Current Report on

Form 8-K, filed on October 26, 2017;

●

Current Report on

Form 8-K, filed on November 7, 2017;

●

Current Report on

Form 8-K, filed on December 6, 2017;

●

Current Report on

Form 8-K, filed on December 8, 2017;

●

Current Report on

Form 8-K, filed on December 13, 2017;

●

Current Report on

Form 8-K, filed on January 8, 2018;

●

Current Report

on Form 8-K, filed on March 7, 2018; and

●

The

description of our common stock contained in the Registration

Statement on Form 8-A filed pursuant to Section 12(b) of the

Exchange Act on May 3, 2016, including any amendment or report

filed with the SEC for the purpose of updating this

description.

Until

such time that a post-effective amendment to this Registration

Statement has been filed which indicates that all securities

offered hereby have been sold or which deregisters all securities

remaining unsold at the time of such amendment, all documents

subsequently filed by the Registrant pursuant to Sections 13(a),

13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as

amended, shall be deemed to be incorporated by reference in this

Registration Statement and to be a part hereof from the date of

filing of such documents. Any statement contained herein or in a

document incorporated or deemed to be incorporated by reference

herein shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that a statement

contained herein or in any subsequently filed document which is

also deemed to be incorporated by reference herein modifies or

supersedes such statement. Any such statement so modified or

superseded shall not be deemed, except as so modified or

superseded, to constitute a part of this Registration

Statement.

|

Item 4.

|

Description of Securities

|

Not

applicable.

|

Item 5.

|

Interests of Named Experts and Counsel

|

Not

applicable.

|

Item 6.

|

Indemnification of Directors and Officers

|

Limitations of liability and indemnification

Our

amended and restated bylaws (

bylaws

) provide that we will indemnify

our directors, officers and employees to the fullest extent

permitted by the Nevada Revised Statutes (

NRS

).

If

the NRS are amended to authorize corporate action further

eliminating or limiting the personal liability of a director, then

the liability of our directors will be eliminated or limited to the

fullest extent permitted by the NRS, as so amended. Our Articles of

Incorporation do not eliminate a director’s duty of care and,

in appropriate circumstances, equitable remedies, such as

injunctive or other forms of non-monetary relief, will remain

available under the NRS. This provision also does not affect a

director’s responsibilities under any other laws, such as the

federal securities laws or other state or federal laws. Under our

bylaws, we are empowered to enter into indemnification agreements

with our directors, officers and employees to purchase insurance on

behalf of any person whom we are required or permitted to

indemnify.

In

addition to the indemnification required in our bylaws, we have

entered into indemnification agreements with each of the

individuals serving on our board of directors. These agreements

provide for the indemnification of our directors to the fullest

extent permitted by law. We believe that these bylaw provisions and

indemnification agreements are necessary to attract and retain

qualified persons as directors, officers and employees. We also

maintain directors’ and officers’ liability

insurance.

The

limitation of liability and indemnification provisions in our

bylaws may discourage stockholders from bringing a lawsuit against

our directors and officers for breach of their fiduciary duties.

They may also reduce the likelihood of derivative litigation

against our directors and officers, even though an action, if

successful, might benefit us and our stockholders. Further, a

stockholder’s investment may be adversely affected to the

extent that we pay the costs of settlement and damage awards

against our directors and officers pursuant to these

indemnification provisions.

Insofar as

indemnification for liabilities arising under the Securities Act

may be permitted to our directors, officers and certain employees

pursuant to the foregoing provisions, or otherwise, we have been

advised that, in the opinion of the SEC, such indemnification is

against public policy as expressed in the Securities Act, and is,

therefore, unenforceable.

There is

no pending litigation or proceeding naming us or any of our

directors or officers as to which indemnification is being sought,

nor are we aware of any pending or threatened litigation that may

result in claims for indemnification.

|

Item 7.

|

Exemption from Registration Claimed

|

Not

applicable.

|

Exhibit No.

|

|

Document Description

|

|

Incorporation by Reference

|

|

|

|

|

|

|

|

Opinion

and Consent of Disclosure Law Group

|

|

Filed

herewith.

|

|

|

|

|

|

|

|

Consent

of OUM & Co., LLP, independent registered public accounting

firm

|

|

Filed

herewith.

|

|

|

|

|

|

|

|

|

|

1999

Stock Incentive Plan, as amended

|

|

Incorporated

by reference from Exhibit 10.1 to the Company’s Current

Report on Form 8-K, filed with the SEC on May 16,

2011.

|

|

|

|

|

|

|

|

Amended

and Restated 2016 Equity Incentive Plan

|

|

Incorporated

by reference from the Company’s Definitive Proxy Statement,

filed with the SEC on August 8, 2016.

|

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a

post-effective amendment to this Registration

Statement:

(i) To include any prospectus required by

Section 10(a)(3) of the Securities Act; and

(ii) To

reflect in the prospectus any facts or events arising after the

effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set

forth in the Registration Statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed

in the Registration Statement or any material change to such

information in the Registration Statement; and

(2) That,

for the purpose of determining any liability under the Securities

Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof; and

(3) To

remove from registration by means of a post-effective amendment any

of the securities being registered which remain unsold at the

termination of the offering.

Provided

,

however

,

that paragraphs (1)(i) and (1)(ii) above do not apply if the

information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished

to the Commission by the Company pursuant to Section 13 or Section

15(d) of the Securities Exchange Act that are incorporated by

reference in the Registration Statement.

(b) The

undersigned Registrant hereby undertakes that, for purposes of

determining any liability under the Securities Act, each filing of

the Registrant's annual report pursuant to Section 13(a) or

Section 15(d) of the Exchange Act (and, where applicable, each

filing of an employee benefit plan's annual report pursuant to

Section 15(d) of the Exchange Act) that is incorporated by

reference in this Registration Statement shall be deemed to be a

new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act

may be permitted to directors, officers and controlling persons of

the Registrant pursuant to the foregoing provisions, or otherwise,

the Registrant has been advised that in the opinion of the SEC such

indemnification is against public policy as expressed in the

Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than

the payment by the Registrant of expenses incurred or paid by a

director, officer or controlling person of the Registrant in the

successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with

the securities being registered, the Registrant will, unless in the

opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public