Tellurian In Talks for Fields in Louisiana -- WSJ

March 09 2018 - 3:02AM

Dow Jones News

By Christopher M. Matthews and Stephanie Yang

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 9, 2018).

Tellurian Inc. is in talks to buy Chesapeake Energy Corp.'s

Louisiana drilling fields as it seeks to become a producer as well

as exporter of natural gas, according to people familiar with the

matter.

Chesapeake, a pioneer of the shale boom, has been selling off

some of the vast holdings assembled by its late co-founder Aubrey

McClendon as it struggles with low energy prices and a mountain of

debt it took on to lock up drilling rights for swaths of land.

Tellurian is the latest venture by Charif Souki, who developed

the first terminals to liquefy natural gas and export it from the

U.S. Gulf Coast as founder of Cheniere Energy Inc. The company,

which has few assets, has said it is looking to acquire drilling

fields near a coastal site where it plans to build an export

facility, to sell fuel overseas.

Chesapeake's Louisiana fields, located in the Haynesville shale

formation, are valued at about $2 billion, according to Jefferies

analysts.

The talks to purchase Chesapeake's fields could fall apart and

there is no guarantee of an agreement. Tellurian has offered to

Chesapeake to take equity as a part of the asset sale, something

Chesapeake isn't interested in doing, people familiar with the

talks said.

Tellurian has also held talks with other producers with

Haynesville assets to acquire more acreage, people familiar with

the matter say. Tellurian's stock closed up 1.5%, at $8.55 per

share, Thursday and is down about 25% on the year.

The advent of shale drilling has flooded the U.S. with cheap

energy, including vast resources of natural gas that producers have

sought to export to generate electricity and heat homes around the

world.

Mr. Souki founded Tellurian in 2016 after being ousted as chief

executive of Cheniere in 2015. Cheniere sent the first shipment of

liquefied natural gas from the mainland U.S. in 2016, after

Congress lifted a ban on U.S. energy exports in late 2015.

At Tellurian, Mr. Souki is again trying to build out U.S.

capabilities to send natural gas abroad, but additionally offering

investors a stake in the full supply chain by owning producing

assets along with pipeline and liquefaction capacity.

The strategy could potentially make it easier to raise capital

to construct a multibillion-dollar export terminal, but it isn't

without risks. Tellurian will have to prove it can produce gas as

cheaply as other operators who have years of experience.

By some estimates, Tellurian would have to become one the 25

largest natural gas producers in the U.S. to supply all the fuel it

would need for its terminal.

"You have to find a business model that applies to the expensive

financing of a project," Mr. Souki said at the IHS Markit CERAWeek

conference in Houston on Wednesday.

Last year, Tellurian acquired acreage in northern Louisiana for

$85 million that currently produces about four million cubic feet

of natural gas a day. Driftwood LNG is expected to start

construction in 2019, pending regulatory approval.

In a February earnings call, Chesapeake executives pointed to

opportunities to sell gas assets from its portfolio and reiterated

plans to reduce debt by up to $3 billion this year through large

transactions.

"Gas is extremely out of favor in the equity markets, as you all

know, and extremely out of favor in many circles," said Chesapeake

Chief Financial Officer Domenic J. Dell'Osso Jr. on the call, but

added, "there is real financial return to be created in these

assets."

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Stephanie Yang at stephanie.yang@wsj.com

(END) Dow Jones Newswires

March 09, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

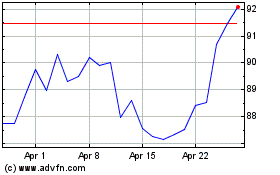

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

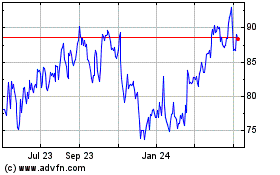

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024