Self-Funded Record Production, Reserves,

Asset Value and Financial Results

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent Latin American oil and gas explorer, operator

and consolidator with operations and growth platforms in Colombia,

Peru, Argentina, Brazil, and Chile reports its consolidated

financial results for the three-month period ended December 31,

2017 (“Fourth Quarter” or “4Q2017”), and its audited annual results

for 2017.

A conference call to discuss 4Q2017 Financial Results will be

held on March 8, 2018 at 10:00 a.m. Eastern Standard Time.

All figures are expressed in US Dollars and growth comparisons

refer to the same period of the prior year, except when specified.

Definitions and terms used herein, are provided in the Glossary at

the end of this document. This release does not contain all of the

Company’s financial information. As a result, investors should read

this release in conjunction with GeoPark’s consolidated financial

statements and the notes to those statements for the years ended

December 31, 2017 and 2016 available on the Company’s website.

FOURTH QUARTER AND FULL YEAR 2017 HIGHLIGHTS

Record Oil and Gas Production

- Consolidated production up 30% to

30,654 boepd with current production of 33,000 boepd

- Colombia production up 39% to 24,378

boepd

- Annual average production up 23% to

27,586 boepd

Record Oil and Gas Reserves

- Certified consolidated proven (1P)

reserves of 97 million boe

- Certified consolidated proven and

probable (2P) reserves of 159.2 million boe

Record Oil and Gas Asset Valuation – Total and Per

Share

- Certified 1P NPV10 up 38% to $1.5

billion (equivalent to net debt adjusted NPV10 of $18.3 per

share)

- Certified 2P NPV10 up 21% to $2.3

billion (equivalent to net debt adjusted NPV10 of $29.2 per

share)

- Colombia 2P NPV10 up 38% to $1.4

billion (equivalent to net debt adjusted NPV10 of $15.8 per

share)

Record Capital Investment and Cost Efficiencies

- Finding and development costs:

Consolidated 2P of $4.0/boe / Colombia 2P of $2.8/boe

- Full year 2017 operating costs of $7.3

per boe / Colombia $5.6 per boe / Llanos 34 $4.3 per boe

- Full year 2017 operating

netback/capital expenditure ratio of 2.2x

- Capital investment program of $105.6

million in 2017 generated $404 million in 2P NPV10

Record Cash Flow/Adjusted EBITDA Growth

- Adjusted EBITDA more than doubled - up

105% to $55.2 million / full year up 124% to $175.8 million

- Operating netback up 77% to $69.8

million / full year up 87% to $228.3 million

- Full year cash flow from operating

activities up 72% to $142.2 million

- Net loss reduced to $3.4 million / full

year net loss of $17.8 million

Strengthened Balance Sheet and Credit Rating

- Cash in hand of $134.8 million

- Net debt to Adjusted EBITDA ratio

decreased from 3.6x to 1.7x in 4Q2017

- 2024 new bond issued ($425 million at

6.5%), with longer maturities and lower cost, oversubscribed by

four times by high-quality investors

- S&P upgraded GeoPark’s long-term

corporate credit rating to B+ with a stable outlook

New Acreage/Projects Acquired and New Strategic Acquisition

Partnership Announced

- Colombia: Tiple and Zamuro high-impact

exploration acreage acquired adjacent to Llanos 34 block

- Argentina: low-cost, cash

flow-producing acquisition in the prolific Neuquen basin with

production, development, exploration and unconventional

opportunities

- ONGC Videsh + GeoPark strategic Latin

American acquisition partnership

James F. Park, Chief Executive Officer of GeoPark, said: “Our

team has GeoPark firing on all cylinders. Through good science and

engineering, we found and produced more oil and gas. Through

innovation and efficiencies, we reduced our capital and operating

costs. Through organic cash flows, we self-funded our work and

investment program. Through effective capital allocation, every

dollar of new investment created multiples of net present value.

Through engagement with our neighbors and conscientious operations,

we operated safely, cleanly and without interruption. Through

regional knowledge and scouting, we acquired new high-impact

acreage and projects. Through a rewarding and motivating workplace,

we were able to train and attract talented people to continue to

build our capabilities for the future. Through efforts to more

widely share our performance story, we were the number one

performing E&P stock on the NYSE. Our team now has a proven

15-year track record of continuous growth, but we feel we are just

getting warmed up for the big opportunities coming our way.”

CONSOLIDATED OPERATING

PERFORMANCE

Key performance

indicators:

Key Indicators

4Q2017 3Q2017 4Q2016

FY2017 FY2016 Oil productiona (bopd)

25,341 23,237 18,798 22,761 16,955 Gas

production (mcfpd) 31,876 30,528 28,770

28,950 32,634 Average net production (boepd) 30,654

28,325 23,593 27,586 22,394 Brent oil

price ($ per bbl) 61.5 52.1 51.1 54.8 45.2 Combined price ($ per

boe) 39.7 33.0 29.3 34.6 25.2 ⁻ Oil ($ per bbl) 43.0 34.6

32.3

36.6 25.6 ⁻ Gas ($ per mcf) 5.2 5.3 4.6 5.3 4.5 Sale of crude oil

($ million) 92.2 68.4 49.3 279.1 145.2 Sale of gas ($ million) 14.1

13.6 11.0 51.0 47.5 Revenue ($ million) 106.3 81.9 60.3 330.1 192.7

Commodity Risk Management Contracts ($ million) -18.4 -8.3 -2.6

-15.4 -2.6 Production & Operating Costsb ($ million) -30.5

-25.7 -20.8 -99.0 -67.2 G&G, G&Ac and Selling Expenses ($

million) -14.8 -12.0 -13.2 -50.9 -48.7 Adjusted EBITDA ($ million)

55.2 44.6 27.0 175.8 78.3 Adjusted EBITDA ($ per boe) 20.6 18.0

13.1 18.4 10.2 Operating Netback ($ per boe) 26.1 23.2 19.2 23.9

15.9 Profit (loss) ($ million) -3.4 -19.1

-26.0 -17.8 -60.6 Capital Expenditures ($ million)

25.3 30.9 15.1 105.6 39.3 Cash

and cash equivalents ($ million) 134.8 135.2 73.6 134.8 73.6

Short-term financial debt ($ million) 7.7 1.9 39.3 7.7 39.3

Long-term financial debt ($ million) 418.5 418.5 319.4 418.5 319.4

Net debt ($ million) 291.4 285.2 285.1

291.4 285.1 a) Includes government royalties paid

in-kind in Colombia for approximately 881, 774 and 718 bopd in

4Q2017, 3Q2017 and 4Q2016 respectively. No royalties were paid in

kind in Chile and Brazil. b) Production and Operating costs include

operating costs and royalties paid in cash. c) G&A expenses

include $0.7, $0.8, $0.5, $3.1 and $1.8 million for 4Q2017, 3Q2017,

4Q2016, FY2017 and FY2016, respectively, of (non-cash) share-based

payments that are excluded from the adjusted EBITDA calculation.

Production: Significant oil production growth of 39% in

Colombia increased average consolidated oil and gas production to

30,654 boepd in 4Q2017 from 23,593 boepd in 4Q2016. The increase

was mainly attributed to new oil production from the Tigana/Jacana

oil fields in Llanos 34 block in Colombia. On a consolidated basis,

gas production increased by 11% compared to 4Q2016, primarily

attributed to increased industrial demand in Brazil.

For further detail, please refer to 4Q2017 Operational Update

published on January 10, 2018.

Reference and Realized Oil Prices: Brent crude oil price

averaged $61.5 per bbl during 4Q2017, and the consolidated realized

oil sales price averaged $43.0 per bbl in 4Q2017, representing a

24% increase from $34.6 per bbl in 3Q2017 and a 38% increase from

$31.2 per bbl in 4Q2016. Differences between reference and realized

prices are a result of commercial and transportation discounts as

well as the Vasconia price differential in Colombia, which averaged

$4.0 per bbl in 4Q2017 from $2.8 per bbl in 3Q2017 and $5.7 per bbl

in 4Q2016. Commercial and transportation discounts in Colombia were

reduced to $14.9 per bbl in 4Q2017 from $15.2 per bbl in 3Q2017 and

$15.0 per bbl in 4Q2016.

Company efforts are currently underway to continue improving

realized oil prices, including negotiation of existing conditions

with off-takers plus construction of a flowline and related

facilities in Llanos 34 block, expected to continue improving

current commercial and transportation discounts.

The following table provides a breakdown of reference and net

realized oil prices in Colombia and Chile in 4Q2017:

4Q2017 - Realized Oil

Prices

($ per bbl)

Colombia Chile Brent oil price

61.5 61.5 Vasconia differential (4.0) - Commercial and

transportation discounts (14.9) (8.4) Realized oil

price 42.6 53.1 Weight on Oil Sales Mix 96%

4%

Revenue: Higher oil and gas production and pricing drove

total consolidated revenues up by 76% to $106.3 million in 4Q2017,

compared to $60.3 million in 4Q2016.

Sales of crude oil: Consolidated

oil revenues increased by 87% to $92.2 million in 4Q2017, driven by

a 35% increase in oil sales volumes and a 38% increase in realized

oil prices. Oil revenues represented 87% of total revenues compared

to 82% in 4Q2016.

- Colombia: In 4Q2017, oil revenues

increased by 98% to $87.5 million mainly due to increased sales

volumes and higher realized prices. Oil sales volumes increased by

40% to 23,283 bopd. Realized oil prices also increased by 40% to

$42.6 per bbl, in line with higher Brent prices and a lower

Vasconia discount. Colombia earn-out payments (deducted from

Colombia oil revenues) increased to $3.7 million in 4Q2017,

compared to $2.3 million in 4Q2016, in line with increased

production and higher oil revenues.

- Chile: In 4Q2017, oil revenues

decreased by 11% to $4.4 million due to lower sales volumes

partially offset by higher realized prices. Oil sales volumes

decreased by 31% to 902 bopd and realized oil prices increased by

28% to $53.1 per barrel, in line with higher Brent prices.

Sales of gas: Consolidated gas

revenues increased by 28% to $14.1 million in 4Q2017 compared to

$11.0 million in 4Q2016 due to 15% higher realized gas prices and

11% higher gas sales volumes.

- Chile: In 4Q2017, gas revenues

increased by 6% to $4.4 million mainly due to higher gas prices,

partially offset by lower sales volumes. Gas prices increased by

24% to $4.5 per mcf ($27.1 per boe) in 4Q2017, due to increased

methanol prices. Gas sales volumes decreased by 15% to 10,630 mcfpd

(1,772 boepd).

- Brazil: In 4Q2017, gas revenues

increased by 42% to $9.4 million, due to both higher realized

prices and sales volumes. Gas prices, net of taxes, increased by 8%

to $5.7 per mcf ($34.0 per boe) due to the annual gas price

inflation adjustment of approximately 7%, effective January 2017.

Gas sales volumes increased by 31% to 18,000 mcfpd (3,000 boepd),

primarily due to higher gas consumption by Brazilian industrial

users.

Commodity risk management contracts: Consolidated

commodity risk management contracts registered a realized loss of

$5.8 million in 4Q2017, totaling realized losses of $2.1 million in

full year 2017 ($3.8 million cash gains were recorded and cashed-in

during the first nine months of 2017). Unrealized cash losses

amounted to $12.6 million in 4Q2017 compared to $3.1 million loss

in 4Q2016 resulting from the significant increase in forward Brent

oil price curve. The company uses risk management contracts to

minimize the impact of oil price fluctuations on the Company´s

self-funded work program.

Production and operating costs[1]:

Consolidated operating costs per barrel decreased by 9% to $7.3 per

boe in 4Q2017 from $8.1 per boe in 4Q2016. Following the 30%

increase in oil and gas sales volumes, total operating costs

increased by $3.0 million to $19.6 million. Consolidated royalties

increased by $6.8 million to $10.7 million in 4Q2017, mainly as the

Jacana oil field in the Llanos 34 block accumulated more than five

million barrels of production that triggered Colombia’s “high

price” royalty scheme beginning in 2Q2017, and to a lesser extent

due to increased volumes and higher realized prices.

Below is a breakdown of production and operating costs by

country:

- Colombia: Operating costs per boe

remained flat at $6.1 per boe in both 4Q2017 and 4Q2016, due to:

- Significant increase in volumes sold,

40% compared to a year earlier, that increased overall operating

costs by 40% to $13.1 million in 4Q2017 from $9.3 million in

4Q2016,

- Incremental costs related to the

reopening of mature oil fields temporarily closed in 4Q2016 which

have higher operating costs per barrel compared to Llanos 34

block.

- Chile: Operating costs decreased by 6%

to $5.2 million in 4Q2017 from $5.6 million in 4Q2016 mainly due to

lower volumes sold (-21%). As a result of the lower volumes,

operating costs per boe increased by 18% to $21.3.

- Brazil: Operating costs decreased by

45% to $1.0 million in 4Q2017 from $1.7 million in 4Q2016, mainly

due to a one-time recovery of maintenance costs in Manati that were

incurred in previous quarters. Operating costs per boe decreased to

$3.4 per boe from $8.0 in 4Q2016.

Selling expenses: Consolidated selling expenses decreased

to $0.3 million in 4Q2017 compared to $0.6 million in 4Q2016.

Administrative, Geological and Geophysical expenses:

Consolidated G&A and G&G expenses increased by 15% to $14.5

million in 4Q2017 compared to $12.6 million in 4Q2016 mainly due to

higher staff costs resulting from an increased scale of operations.

Consolidated G&A and G&G costs per boe decreased by 13% to

$5.5 per boe in 4Q2017 (vs. $6.1 per boe in 4Q2016).

Adjusted EBITDA: Consolidated adjusted EBITDA of $55.2

million was more than two times higher than the $27.0 million in

4Q2016. That is the equivalent of $20.6 per barrel and was driven

by the combination of increased production and higher realized oil

and gas prices.

- Colombia: Adjusted EBITDA of $51.6

million in 4Q2017 (+95% vs. 4Q2016)

- Chile: Adjusted EBITDA of $1.1 million

in 4Q2017 (+75% vs. 4Q2016)

- Brazil: Adjusted EBITDA of $7.2 million

in 4Q2017 (+116% vs. 4Q2016)

- Corporate, Argentina and Peru: Adjusted

EBITDA of negative $4.7 million in 4Q2017

The table below shows production, volumes sold and breakdown of

the most significant components of adjusted EBITDA for 4Q2017 and

4Q2016, on a per country and per barrel basis:

Adjusted EBITDA/boe Colombia

Chile Brazil Total

4Q17 4Q16 4Q17

4Q16 4Q17 4Q16

4Q17c

4Q16 Production (boepd) 24,378 17,535

2,932 3,523 3,328 2,535 30,654

23,593 Stock variation /RIKa (1,004) (878)

(258) (151) (285) (206) (1,593)

(1,235) Sales volume (boepd) 23,374 16,657 2,674 3,372 3,043

2,329 29,091 22,358 % Oil 99.6% 100% 34%

39% 1% 1% 83% 80%

($ per

boe) Realized oil price 42.6 30.4 53.1 41.4 68.0 54.7 43.0 32.3

Realized gas priceb 30.8 - 27.1 21.9 34.0 31.4 31.4 27.3 Earn-out

(1.8) (1.4) - - - -

(1.4) (1.1)

Combined Price 40.8

29.0 35.9 29.4

34.5 31.7 39.7

29.3 Realized Commodity Risk Management Contracts

(2.7) - - - - - (2.2)

- Operating costs (6.1) (6.1) (21.3) (18.0) (3.4) (8.0)

(7.3) (8.1) Royalties in cash (4.4) (1.9) (1.4) (1.2) (3.3) (2.6)

(4.0) (1.9) Selling & other expenses 0.0 0.2

(0.7) (1.0) - - (0.1)

(0.3)

Operating Netback/boe 27.6

21.1 12.4 9.2 27.8

21.0 26.1 19.2 G&A,

G&G

(5.5) (6.1)

Adjusted

EBITDA/boe

20.6

13.1 a)

RIK (Royalties in Kind). Includes

royalties paid in kind in Colombia for approximately 881 and 718

bopd in 4Q2017 and 4Q2016, respectively. No royalties were paid in

kind in Chile and Brazil

b) Conversion rate of mcf/boe=1/6

c)

Total amount includes 16 bopd of oil

production from CN-V block in Argentina

Depreciation: Consolidated depreciation increased by 17%

to $19.8 million in 4Q2017, compared to $16.9 million in 4Q2016,

due to higher volumes sold. On a per barrel basis, however,

depreciation costs were lower given drilling successes and

increased reserves. Depreciation costs per boe decreased by 10% to

$7.4 per boe.

Write-off of unsuccessful exploration efforts:

Consolidated write-off of unsuccessful exploration efforts was $1.1

million in 4Q2017, compared to $17.7 million in 4Q2016. Amounts

recorded in 4Q2017 mainly correspond to unsuccessful exploration

efforts in non-operated Sierra del Nevado and Puelen blocks in

Argentina.

Impairment of Non-Financial Assets: Consolidated non-cash

impairment of non-financial assets was zero in 4Q2017 compared to a

$5.7 million gain in 4Q2016 ($5.7 million non-cash recovery in

Colombia).

Other expenses: Other operating expenses were $2.7

million in 4Q2017, compared to $0.9 million in 4Q2016.

CONSOLIDATED NON-OPERATING RESULTS AND PROFIT FOR THE

PERIOD

Net financial expenses: Net financial costs decreased by

7% to $8.2 million in 4Q2017, compared to $8.9 million in 4Q2016,

mainly resulting from lower bank charges and other financial

results.

Foreign exchange: Net foreign exchange charges were a

$3.6 million loss in 4Q2017 and $1.4 million loss in 4Q2016, mainly

due to the devaluation of the Brazilian Real over the US

Dollar-denominated net debt incurred at the local subsidiary level,

where the Real is the functional currency.

Income tax: Income taxes amounted to a $10.7 million in

4Q2017, as compared to a $9.7 million in 4Q2016, in line with

higher taxable profits in 4Q2017.

Net income: Net losses amounted to $3.4 million in 4Q2017

compared to $26.0 million in 4Q2016. The net loss in 4Q2017

resulted from unrealized hedge charges.

BALANCE SHEET

Cash and cash equivalents: Cash and cash equivalents

totaled $134.8 million as of December 31, 2017 compared to $73.6

million a year earlier. The difference reflects cash generated from

operating activities of $142.2 million and cash from financing

activities of $24.0 million, partially offset by cash used in

investing activities of $105.6 million.

Cash generated from operating activities of $142.2 million is

net of a $15.6 million advance payment paid in December 2017 to

Pluspetrol, as a security deposit related to the recently announced

acquisition of Aguada Baguales, El Porvenir and Puesto Touquet

blocks in Neuquen basin in Argentina, which is expected to close in

March 2018.

Cash from financing activities of $24.0 million includes net

proceeds from the issuance of 2024 Notes of $418.3 million, offset

by: (i) principal paid of $355.0 million related to the payment of

2020 Notes and the prepayment of the Itau loan, (ii) cancellation

costs of $12.3, and (iii) interest payments of $27.7 million.

Cash used in investing activities of $105.6 million (76%

allocated to Colombia) includes capital expenditures related to

development, appraisal and exploration activities carried out in

2017 that allowed GeoPark to increase its reserves with low finding

and development costs of $3.6/boe for 1P and $4.0/boe for 2P

reserves (or $2.4/boe and $2.8/boe for 1P and 2P, respectively in

Colombia).

Financial debt: Total financial debt (net of issuance

costs) amounted to $426.2 million, including the $425 million 2024

Notes issued in September 2017. Short-term debt amounted to $7.7

million as of December 31, 2017.

FINANCIAL RATIOSa

($ million)

At period-end

Financial Debt

Cash and Cash Equivalents Net Debt

Net Debt/ LTM Adj. EBITDA LTM Interest

Coverage

4Q2016 358.7 73.6 285.1 3.6x

2.7x 1Q2017 341.7 70.3 271.4 2.6x 3.4x 2Q2017 346.3 77.0 269.3 2.2x

4.1x 3Q2017 420.4 135.2 285.2 1.9x 5.3x 4Q2017 426.2 134.8 291.4

1.7x 6.3x a)

Based on trailing 12-month financial

results.

Issuance of 2024 Notes: During September 2017, the

Company successfully placed $425 million notes (“2024 Notes”). The

2024 Notes carry a coupon of 6.50% per annum. Funds were used to

repay financial debt, to provide financial flexibility and for

general corporate purposes.

The indenture governing the 2024 Notes includes incurrence test

covenants that require the net debt to adjusted EBITDA ratio be

lower than 3.5 times and the adjusted EBITDA to interest ratio

higher than 2 times until September 2019. Failure to comply with

the incurrence test covenants would not trigger an event of

default. As of the date of this release the Company is in

compliance with all provisions and covenants.

COMMODITY RISK OIL MANAGEMENT CONTRACTS

The Company has the following commodity risk management

contracts (reference ICE Brent), in place as of the date of this

release:

Period

Type Volume (bopd) Contract

terms ($ per bbl) Purchased Put

Sold Put Sold Call

1Q2018

Zero cost collar 9,000 50.0-52.0 - 54.9-60.0 Zero

cost 3-way 2,000

52.0

42.0

59.5-59.6 Zero cost 3-way 2,000

53.0

43.0

64.6 Total: 13,000

2Q2018

Zero cost collar 5,000

52.0

- 58.3-60.0 Zero cost 3-way 3,000

52.0

42.0

59.5-59.6 Zero cost 3-way 2,000

53.0

43.0

64.6 Total: 10,000

3Q2018

Zero cost 3-way 5,000

53.0

43.0

69.0

Total: 5,000

For further details, please refer to Note 8 of GeoPark’s

consolidated financial statements for the year ended December 31,

2017, available on the Company’s website.

SELECTED INFORMATION BY BUSINESS SEGMENT

(UNAUDITED)

Colombia 4Q2017 4Q2016 Sale of

crude oil ($ million) 87.5 44.2 Sale of gas ($ million) 0.2 0.2

Revenue ($ million) 87.7 44.4 Production and Operating Costsa ($

million) -22.6 -12.5 Adjusted EBITDA ($ million) 51.6 26.5 Capital

Expendituresb ($ million) 19.4 11.5

Chile 4Q2017 4Q2016 Sale

of crude oil ($ million) 4.4 5.0 Sale of gas ($ million) 4.4 4.2

Revenue ($ million) 8.8 9.1 Production and Operating Costsa ($

million) -5.6 -6.0 Adjusted EBITDA ($ million) 1.1 0.6 Capital

Expendituresb ($ million) 1.4 1.0

Brazil 4Q2017 4Q2016 Sale

of crude oil ($ million) 0.3 0.2 Sale of gas ($ million) 9.4 6.6

Revenue ($ million) 9.7 6.8 Production and Operating Costsa ($

million) -1.9 -2.3 Adjusted EBITDA ($ million) 7.2 3.3 Capital

Expendituresb ($ million) 0.5 2.0 a) Production and

Operating = Operating Costs + Royalties. b) The difference with the

reported figure in Key Indicators table corresponds mainly to

capital expenditures in Argentina and to a lesser extent in Peru.

CONSOLIDATED STATEMENT OF INCOME

(QUARTERLY INFORMATION UNAUDITED) (In millions

of $)

4Q2017 4Q2016 FY2017

FY2016

REVENUE

Sale of crude oil 92.2 49.3 279.1 145.2 Sale of gas 14.1 11.0 51.0

47.5

TOTAL REVENUE 106.3 60.3 330.1

192.7 Commodity risk management contracts -18.4 -2.6 -15.4

-2.6 Production and operating costs -30.5 -20.8 -99.0 -67.2

Geological and geophysical expenses (G&G) -3.9 -2.7 -7.7 -10.3

Administrative expenses (G&A) -10.6 -10.0 -42.1 -34.2 Selling

expenses -0.3 -0.6 -1.1 -4.2 Depreciation -19.8 -16.9 -74.9 -75.8

Write-off of unsuccessful exploration efforts -1.1 -17.7 -5.8 -31.4

Impairment for non-financial assets - 5.7 - 5.7 Other operating

-2.7 -0.9 -5.1 -1.3

OPERATING PROFIT (LOSS) 19.1

-6.1 79.0 -28.6 Financial costs, net

-8.2 -8.9 -51.5 -34.1 Foreign exchange gain (loss) -3.6 -1.4 -2.2

13.9

PROFIT (LOSS) BEFORE INCOME TAX

7.3

-16.3 25.3 -48.8 Income tax -10.7 -9.7

-43.1 -11.8

PROFIT (LOSS) FOR THE PERIOD -3.4

-26.0 -17.8 -60.6 Non-controlling interest 1.1

-5.6 6.4 -11.6

ATTRIBUTABLE TO OWNERS OF GEOPARK -4.5

-20.4 -24.2 -49.1

SUMMARIZED CONSOLIDATED STATEMENT OF

FINANCIAL POSITION

(In millions of $)

Dec '17 Dec

'16 (Audited) (Audited) Non-Current

Assets Property, plant and equipment 517.4 473.6 Other

non-current assets 53.8 45.7

Total Non-Current Assets

571.2 519.3 Current Assets Inventories

5.7 3.5 Trade receivables 19.5 18.4 Other current assets 54.9 25.7

Cash at bank and in hand 134.8 73.6

Total Current Assets

215.0 121.2 Total Assets 786.2

640.5 Equity Equity attributable to owners of

GeoPark 84.9 105.8 Non-controlling interest 41.9 35.8

Total

Equity 126.8 141.6 Non-Current

Liabilities Borrowings 418.5 319.4 Other non-current

liabilities 74.5 80.0

Total Non-Current Liabilities

493.0 399.4 Current Liabilities

Borrowings 7.7 39.3 Other current liabilities 158.6 60.2

Total

Current Liabilities 166.3 99.5

Total Liabilities

659.3 498.9 Total Liabilities and Equity

786.2 640.5

SUMMARIZED CONSOLIDATED STATEMENT OF

CASH FLOWS

(In millions of $)

Dec '17 Dec

'16 Cash flows from operating activities 142.2 82.9 Cash

flows used in investing activities -105.6 -39.3 Cash flows from

(used) in financing activities 24.0 -51.1

RECONCILIATION OF ADJUSTED EBITDA TO

PROFIT (LOSS) BEFORE INCOME TAX

2017 (In millions of $)

Colombia Chile Brazil

Other Total Adjusted EBITDA 168.3 4.1

20.2 -16.8

175.8 Depreciation -40.0 -23.7 -10.8 -0.4 -74.9

Unrealized Commodity Risk Management

Contracts

-13.3 - - - -13.3 Impairment - - - - - Write-offs unsuccessful

exploration efforts -1.6

-0.5

-3.0 -0.7 -5.8 Share Based Payments/Other

2.9

0.4

-2.0

-4.1

-2.8

OPERATING PROFIT (LOSS) 116.3

-19.7

4.4 -22.0

79.0 Financial costs, net

-51.5 Foreign Exchange charges, net

-2.2

PROFIT (LOSS) BEFORE

INCOME TAX 25.3 2016 (In millions of $)

Colombia Chile Brazil

Other Total Adjusted EBITDA 66.9 5.1

17.5 -11.2

78.3 Depreciation -31.1 -31.3 -13.0 -0.3 -75.8

Unrealized Commodity Risk Management

Contracts

-3.1 - - - -3.1 Impairment 5.7 - - - 5.7 Write-offs unsuccessful

exploration efforts -7.4

-19.4

-4.6 - -31.4 Share Based Payments/Other 0.5 0.6

-0.5 -3.0 -2.4

OPERATING PROFIT (LOSS)

31.5 -45.0 -0.6 -14.5

-28.6 Financial costs, net -34.1 Foreign Exchange charges,

net

13.9

PROFIT (LOSS) BEFORE

INCOME TAX -48.8

OTHER NEWS / RECENT EVENTS

2017 YEAR-END RESERVES SUMMARY

GeoPark engaged DeGolyer & MacNaughton (“D&M”) to carry

out an independent appraisal of reserves as of December 31, 2017,

covering 100% of the current assets in Colombia, Chile, Brazil,

Peru and Argentina.

Following oil and gas production of 10.2 mmboe in 2017, D&M

certified 2P reserves of 159.2 mmboe at 2017 year-end, following a

261% Reserve Replacement, with an NPV valuation of $2.3

billion.

- PDP Reserves: Net proven developed

producing (PDP) reserves increased by 47% to 28.5 mmboe, with a PDP

reserve replacement index (RRI) of 189%. PDP NPV10 increased by 74%

to $491 million.

- 1P Reserves: Net 1P reserves increased

by 24% to 97.0 mmboe, with 1P reserve life index (RLI) of 9.5 years

and a 1P RRI of 284%. 1P NPV10 increased by 39% ($430 million) to

$1.5 billion.

- 2P Reserves: Net 2P reserves increased

by 11% to 159.2 mmboe, with a 2P RLI of 15.6 years and a 2P RRI of

261%. 2P NPV10 increased by 21% ($404 million) to $2.3

billion.

- Finding and Development (F&D) costs

for 2017 were $3.6 per boe for 1P reserves and $4.0 per boe for 2P

reserves.

- Colombia: Net PDP reserves increased

89% to 21.6 mmboe, Net 1P reserves increased 64% to 66.1 mmboe and

net 2P reserves increased 31% to 88.2 mmboe. F&D Costs were

$2.4 per boe for 1P reserves and $2.8 per boe for 2P reserves.

For further detail, please refer to 2017 Reserves Release

published on February 5, 2018.

CONFERENCE CALL INFORMATION

GeoPark will host its Fourth Quarter 2017 Financial Results

conference call and webcast on Thursday, March 8, 2018, at 10:00

a.m. Eastern Standard Time.

Chief Executive Officer, James F. Park and Chief Financial

Officer, Andres Ocampo will discuss GeoPark's financial results for

4Q2017, with a question and answer session immediately

following.

Interested parties may participate in the conference call by

dialing the numbers provided below:

United States Participants: 866-547-1509 International

Participants: +1 920-663-6208 Passcode: 6197567

Please allow extra time prior to the call to visit the website

and download any streaming media software that might be required to

listen to the webcast.

An archive of the webcast replay will be made available in the

Investor Support section of the Company’s website at

www.geo-park.com after the conclusion of the live call.

GeoPark can be visited online at www.geo-park.com

GLOSSARY

Adjusted EBITDA Adjusted EBITDA is defined as profit

for the period before net finance costs, income tax, depreciation,

amortization, certain non-cash items such as impairments and

write-offs of unsuccessful exploration efforts, accrual of

share-based payments, unrealized results on commodity risk

management contracts and other non-recurring events

Adjusted

EBITDA per boe Adjusted EBITDA divided by total boe sales

volumes

bbl Barrel

boe Barrels of oil equivalent

boepd Barrels of oil equivalent per day

bopd Barrels

of oil per day

CEOP Contrato Especial de Operacion Petrolera

(Special Petroleum Operations Contract)

D&M DeGolyer and

MacNaughton

F&D costs Finding and development costs,

calculated as capital expenditures in 2016 divided by the

applicable net reserves additions before changes in Future

Development Capital

“High price” royalty An additional

royalty incurred in Colombia when each oil field exceeds 5 mmbbl of

cumulative production and is determined by a combination of API

gravity and WTI oil prices

mboe Thousand barrels of oil

equivalent

mmbo Million barrels of oil

mmboe Million

barrels of oil equivalent

mcfpd Thousand cubic feet per day

mmcfpd Million cubic feet per day

mm3/day Thousand cubic meters per day

NPV10 Present value of estimated future oil and gas

revenues, net of estimated direct expenses, discounted at an annual

rate of 10%

Operating netback per boe Revenue, less

production and operating costs (net of depreciation charges and

accrual of stock options and stock awards) and selling expenses,

divided by total boe sales volumes. Operating netback is equivalent

to adjusted EBITDA net of cash expenses included in Administrative,

Geological and Geophysical and Other operating costs

PRMS

Petroleum Resources Management System

SPE Society of

Petroleum Engineers

SQ KM Square kilometers

WI

Working interest

NOTICE

Additional information about GeoPark can be found in the

“Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release have been rounded for

ease of presentation. Percentage figures included in this press

release have not in all cases been calculated on the basis of such

rounded figures, but on the basis of such amounts prior to

rounding. For this reason, certain percentage amounts in this press

release may vary from those obtained by performing the same

calculations using the figures in the financial statements. In

addition, certain other amounts that appear in this press release

may not sum due to rounding.

This press release contains certain oil and gas metrics,

including information per share, operating netback, reserve life

index, and others, which do not have standardized meanings or

standard methods of calculation and therefore such measures may not

be comparable to similar measures used by other companies. Such

metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including expected 2018 production growth and

performance, operating netback per boe and capital expenditures

plan. Forward-looking statements are based on management’s beliefs

and assumptions, and on information currently available to the

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various

factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission.

Oil and gas production figures included in this release are

stated before the effect of royalties paid in kind, consumption and

losses. Annual production per day is obtained by dividing total

production for 365 days.

Information about oil and gas reserves: The SEC permits

oil and gas companies, in their filings with the SEC, to

disclose only proven, probable and possible reserves that meet

the SEC's definitions for such terms. GeoPark uses

certain terms in this press release, such as "PRMS Reserves" that

the SEC's guidelines do not permit GeoPark from including in

filings with the SEC. As a result, the information in the

Company’s SEC filings with respect to reserves will differ

significantly from the information in this press release.

NPV10 for PRMS 1P, 2P and 3P reserves is not a substitute for

the standardized measure of discounted future net cash flows for

SEC proved reserves.

The reserve estimates provided in this release are estimates

only, and there is no guarantee that the estimated reserves will be

recovered. Actual reserves may eventually prove to be greater than,

or less than, the estimates provided herein. Statements relating to

reserves are by their nature forward-looking statements.

Adjusted EBITDA: The Company defines adjusted EBITDA as

profit for the period before net finance costs, income tax,

depreciation, amortization and certain non-cash items such as

impairments and write-offs of unsuccessful exploration and

evaluation assets, accrual of stock options stock awards,

unrealized results on commodity risk management contracts and other

non-recurring events. Adjusted EBITDA is not a measure of profit or

cash flows as determined by IFRS. The Company believes adjusted

EBITDA is useful because it allows us to more effectively evaluate

our operating performance and compare the results of our operations

from period to period without regard to our financing methods or

capital structure. The Company excludes the items listed above from

profit for the period in arriving at adjusted EBITDA because these

amounts can vary substantially from company to company within our

industry depending upon accounting methods and book values of

assets, capital structures and the method by which the assets were

acquired. Adjusted EBITDA should not be considered as an

alternative to, or more meaningful than, profit for the period or

cash flows from operating activities as determined in accordance

with IFRS or as an indicator of our operating performance or

liquidity. Certain items excluded from adjusted EBITDA are

significant components in understanding and assessing a company’s

financial performance, such as a company’s cost of capital and tax

structure and significant and/or recurring write-offs, as well as

the historic costs of depreciable assets, none of which are

components of adjusted EBITDA. The Company’s computation of

adjusted EBITDA may not be comparable to other similarly titled

measures of other companies. For a reconciliation of adjusted

EBITDA to the IFRS financial measure of profit for the year or

corresponding period, see the accompanying financial tables.

Operating netback per boe should not be considered as an

alternative to, or more meaningful than, profit for the period or

cash flows from operating activities as determined in accordance

with IFRS or as an indicator of our operating performance or

liquidity. Certain items excluded from Operating Netback per boe

are significant components in understanding and assessing a

company’s financial performance, such as a company’s cost of

capital and tax structure and significant and/or recurring

write-offs, as well as the historic costs of depreciable assets,

none of which are components of Operating Netback per boe. The

Company’s computation of Operating Netback per boe may not be

comparable to other similarly titled measures of other companies.

For a reconciliation of Operating Netback per boe to the IFRS

financial measure of profit for the year or corresponding period,

see the accompanying financial tables.

[1] Production and Operating Costs = Operating Costs plus

Royalties

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180307006454/en/

GeoPark LimitedINVESTORS:Santiago, ChileStacy

Steimel – Shareholder Value

Directorssteimel@geo-park.comorMEDIA:New York, USAJared Levy

– Sard Verbinnen & CoT: +1 (212)

687-8080jlevy@sardverb.comorKelsey Markovich – Sard Verbinnen &

CoT: +1 (212) 687-8080kmarkovich@sardverb.com

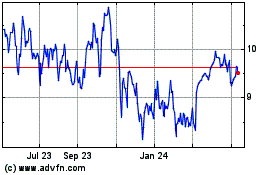

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024