Wintershall 2017 Net Profit Doubled on Favorable Oil Prices

March 07 2018 - 5:22AM

Dow Jones News

By Nathan Allen

BASF SE's (BAS.XE) oil-and-gas subsidiary Wintershall AG said

Wednesday its 2017 net profit almost doubled, thanks to higher

hydrocarbon prices and increased earnings from its share in a

Russian natural-gas field.

Net profit for the year was 719 million euros ($889.8 million)

compared with EUR362 million a year earlier, while sales rose 17%

to EUR3.24 billion, the company said.

Wintershall said its earnings before interest and taxes, or

EBIT, climbed to EUR1.04 billion from EUR499 million a year

earlier, due partly to the reversal of impairments.

Improved management of exploration and technology projects, and

cost-cutting measures also helped improve profitability,

Wintershall said.

BASF and LetterOne's intended merger of Wintershall with DEA

Deutsche Erdoel AG should provide further momentum in 2018, and the

company will also begin exploration operations in Brazil, it

said.

"We expect a considerable increase in sales and Ebit before

special items, driven by positive price effects and the start of

production at fields in Norway," said Chief Executive Mario

Mehren.

The company started production at the Maria field in the

Norwegian Sea in December, one year ahead of schedule.

"Our plans for 2018 are based on an average crude oil price

(Brent) of $65 per barrel and an average exchange rate of $1.20 per

euro," Mehren said.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

March 07, 2018 05:07 ET (10:07 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

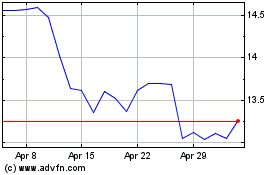

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

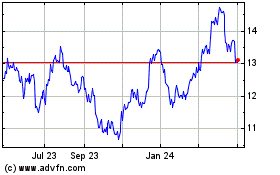

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024