UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

February 28, 2018

Invitation Homes Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001- 38004

|

|

90-0939055

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1717 Main Street, Suite 2000, Dallas, Texas 75201

(Address of Principal Executive Offices) (Zip Code)

(972) 421-3600

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

Emerging growth company

x

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

x

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

As part of its February 28, 2018 meeting and the annual compensation review and award process, the Compensation and Management Development Committee (the “Compensation Committee”) of the Board of Directors of Invitation Homes Inc. (the “Company”) approved several compensation matters applicable to members of management, including the Company’s named executive officers (“NEOs”), as described below.

Base Salary

The Compensation Committee increased the annual base salary of Mr. Dallas B. Tanner, the Company’s Executive Vice President and Chief Investment Officer, from $450,000 to $525,000.

Annual Equity-Based Awards

The Compensation Committee, also approved a new long-term incentive stock program (the “LTIP”) and a form of award agreement (the “LTIP Agreement”) and granted under the Invitation Homes Inc. 2017 Omnibus Incentive Plan (the “Incentive Plan”) equity-based awards in the form of time vesting restricted stock units (“RSUs”) and performance vesting RSUs (collectively, the “LTIP RSUs” and, such awards, the “LTIP RSU Awards”).

The material terms of the LTIP RSUs are described below.

Time Vesting RSUs

The time vesting RSUs are scheduled to vest in equal annual installments on each of the first three anniversaries of March 1, 2018, subject to the executive’s continued employment through the applicable vesting date. If the executive’s employment terminates for any reason other than as described below, all unvested time vesting RSUs will be forfeited.

Upon a termination of the executive’s employment by the Company without “cause” (as defined in the Incentive Plan) or, if the executive resigns from employment following a “constructive termination” (as defined in the award agreement applicable to the LTIP RSUs, and together, with a termination without cause, a “qualifying involuntary termination”), the next installment of time vesting RSUs that would have vested on the next scheduled vesting date will vest as of the date of termination. Time vesting RSUs that are eligible to vest upon a qualifying involuntary termination are subject to the executive’s execution and non-revocation of a release of claims in favor of the Company. Upon an executive’s death or a termination of the executive’s employment by the Company following the executive’s “disability” (as defined in the Incentive Plan), any unvested time vesting RSUs will vest as of the date of termination. Time vesting RSUs will also continue to vest according to the original vesting schedule following the executive’s “retirement” (as defined below) and will be subject to forfeiture if the executive violates specified restrictive covenants agreed to with the Company and described below.

Upon a change in control, if the time vesting RSUs are assumed by the successor or acquiror and a qualifying involuntary termination occurs during the two-year period following a change in control, any then-unvested time vesting RSUs will vest. Upon a change in control, if the time vesting RSUs are not assumed by the successor or acquiror, any then-unvested time vesting RSUs will immediately vest.

“Retirement” is generally defined as a voluntary resignation of employment at such time that the executive is at least 55 years old, the participant has at least 10 years of continuous service and the sum of the executive’s age and years of service equals at least 65, provided that the executive has given at least six months’ prior notice of the executive’s retirement.

On February 28, 2018, the Compensation Committee granted time vesting RSUs to the Company’s named executive officers in the following amounts: Fredrick Tuomi was granted 39,937 time vesting RSUs; Ernest Freedman was granted 17,116; and Dallas Tanner was granted 17,116.

Performance Vesting RSUs

The performance vesting RSUs may be earned based on the achievement of performance conditions over a three-year performance period from January 1, 2018 through December 31, 2020. The number of performance vesting RSUs that may be earned will be determined based on performance achieved during the specified performance period. Within each tranche, the performance vesting RSUs may be earned based on two performance measures: (1) the compounded annual growth rate of the Company’s shareholder return relative to the MSCI US REIT Index for the performance period and (2) the compounded annual growth rate of the Company’s net operating income for an identified population of homes.

Under the terms of the LTIP Agreement, each executive is eligible to earn, in respect of each performance condition, a threshold, target and maximum number of performance vesting RSUs based on whether the performance criteria are achieved at threshold, target or maximum levels. The total number of performance vesting RSUs earned with respect to each performance measure is based on an achievement factor which, in each case, ranges from a 0% payout for below threshold performance, to

50% for threshold performance, to 100% for target performance, up to 200% for performance at maximum levels or above. For actual performance between the specified threshold, target and maximum levels, the resulting achievement percentage will be adjusted on a linear basis.

In general, performance vesting RSUs are earned on the date after the end of the performance period on which the Compensation Committee certifies the extent to which the performance criteria have been achieved (the “Certification Date”). The performance vesting RSUs will vest on the Certification Date, subject to the executive’s continued employment through such Certification Date except in the event of a qualifying involuntary termination as described below. Any unearned performance vesting RSUs will be forfeited without consideration.

Notwithstanding the foregoing, upon a qualifying involuntary termination prior to the last day of any performance period, a prorated portion of the performance vesting RSUs will remain outstanding and eligible to vest based on actual performance through the last day of the applicable performance period, based on the number of days during the applicable performance period that the executive was employed. Any performance vesting RSUs that are earned based on actual performance will vest on, and settle as soon as practicable following, the applicable Certification Date. Upon a qualifying involuntary termination following the last day of any performance period but prior to the Certification Date, any unearned and unvested performance vesting RSUs will vest on the applicable Certification Date based on actual performance as of the end of the performance period. Upon a qualifying involuntary termination following the Certification Date where such performance vesting RSUs are subject to continued service-vesting conditions, such earned but unvested RSUs will vest on the executive’s termination date. Performance vesting RSUs that are eligible to vest upon a qualifying involuntary termination are subject to the executive’s execution and non-revocation of a release of claims in favor of the Company.

Upon a change in control, the number of performance vesting RSUs that become earned will be calculated based on actual performance through the date of the change in control without proration. Any earned performance vesting RSUs will vest as to 50% of such earned performance vesting RSUs on the date of the change in control and, as to the remaining 50% on the first anniversary of the change in control (or, in each case, upon a qualifying involuntary termination that occurs within the two-year period following the change in control). If the awards are not assumed by the successor or acquiror, or are unable to be measured in a consistent manner, any earned performance vesting RSUs (including the LTIP RSUs that become earned in connection with the change in control) will immediately vest as of the change in control.

On February 28, 2018, the Compensation Committee granted performance vesting RSUs to the named executive officers in the following amounts, which amounts assume that target level of performance is achieved (with the actual number of shares to be earned based on the actual achievement of the performance criteria described above): Mr. Tuomi was granted 111,794 performance vesting RSUs; Mr. Freedman was granted 47,912; and Mr. Tanner was granted 47,912.

Dividends

Under the terms of the LTIP Agreement, holders of time vesting RSUs (whether or not settled) and earned performance vesting RSUs (whether unvested or vested and not yet settled) are entitled to receive dividends or dividend equivalent payments, as applicable, to the extent dividends are declared on the Company’s common stock. Such dividends or dividend equivalent payments, as applicable, are payable on the same date and in the same form (cash or additional shares of common stock) as are paid to holders of the Company’s common stock. Unearned performance vesting RSUs accrue dividend equivalents, but such dividends will only be paid to the extent the underlying performance vesting RSUs are earned and, once earned, are payable on the same date and in the same form as that paid to the Company’s holders of common stock.

Covenants and Clawback

Each of the foregoing executive grantees of LTIP RSUs is subject to restrictive covenants related to post-employment non-solicitation and non-competition for twelve months following any termination of employment and indefinite covenants covering trade secrets, confidentiality and non-disparagement. Under the LTIP Agreement, if there is a restrictive covenant violation or the executive grantee engages in a detrimental activity (as defined in the LTIP Agreement) in the four-year period following the grant date, the executive will be required to pay the Company an amount equal to the after-tax proceeds received upon the sale or disposition of the equity award and any shares issued in respect thereof. In addition, the LTIP RSU Awards are subject to clawback in the event of a restatement of the Company’s financial results due to the executive’s fraud or intentional illegal conduct where such restatement results in fewer earned performance vesting RSUs, as well as any additional Company clawback policy.

Supplemental Bonus Awards

On February 28, 2018, the Compensation Committee, upon recommendation of the Compensation Committee, also approved a form of award agreement (the “Supplemental Bonus Award Agreement”) and granted to each of Messrs. Tuomi, Freedman and Tanner 34,231, 18,257 and 18,257 time vesting RSUs, respectively (collectively, the “Bonus RSUs”). The Bonus RSUs granted to Messrs. Tuomi, Freedman and Tanner will generally vest in equal annual installments on each of the first three

anniversaries of March 1, 2018, subject to the executive’s continued employment through the applicable vesting date. If the executive’s employment terminates for any reason other than as described below, all unvested Bonus RSUs will be forfeited.

The other terms of the Bonus RSUs, including the terms related to dividends or dividend equivalent payments, as applicable, restrictive covenants and clawback are substantially the same as with those applicable to the time vesting RSUs.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

INVITATION HOMES INC.

|

|

|

|

|

|

|

By:

|

/s/ Mark A. Solls

|

|

|

|

Name:

|

Mark A. Solls

|

|

|

|

Title:

|

Executive Vice President, Secretary

and Chief Legal Officer

|

Date: March 6, 2018

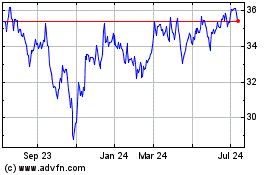

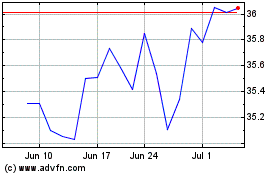

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Invitation Homes (NYSE:INVH)

Historical Stock Chart

From Apr 2023 to Apr 2024