Amended Statement of Beneficial Ownership (sc 13d/a)

March 02 2018 - 9:18AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a) AND

AMENDMENTS

THERETO FILED PURSUANT TO RULE 13d-2(a)

The

ONE Group Hospitality, Inc.

(Name

of Issuer)

Common

Stock, par value $0.0001 per share

(Title

of Class of Securities)

88338K103

(CUSIP

Number)

Mr.

Gregory Harnish

Anson

Funds

155

University Avenue, Suite 207

Toronto,

ON MSH 387

(416)

572-1766

With

a copy to:

David

E. Danovitch, Esq.

Robinson

Brog Leinwand Greene Genovese & Gluck P.C.

875

Third Avenue, 9

th

Floor

New

York, New York 10022

(212)-603-6300

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

March

2, 2018

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

☑.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §

240.13d-7 for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 88338K103

|

13D/A

|

Page

2

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Anson

Investments Master Fund LP

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman

Islands

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(1)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

IA,

PN

|

|

|

|

(1)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

3

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Anson

Funds Management LP

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Texas

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(2)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

IA,

PN

|

|

|

|

(2)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

4

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Anson

Management GP LLC

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Texas

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(3)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

HC,

OO

|

|

|

|

(3)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

5

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Bruce

R. Winson

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States Citizen

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(4)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

HC,

IN

|

|

|

|

(4)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

6

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Anson

Advisors Inc.

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Ontario,

Canada

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(5)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

CO

|

|

|

(5)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

7

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Adam

Spears

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Canadian

Citizen

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(6)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

IN

|

|

|

(6)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

8

of 10 Pages

|

|

1

|

NAME

OF REPORTING PERSON

Moez

Kassam

|

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

☐

(b)

☐

|

|

3

|

SEC

USE ONLY

|

|

|

4

|

SOURCE

OF FUNDS

WC

|

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Canadian

Citizen

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE

VOTING POWER

0

|

|

8

|

SHARED

VOTING POWER

1,472,921

|

|

9

|

SOLE

DISPOSITIVE POWER

0

|

|

10

|

SHARED

DISPOSITIVE POWER

1,472,921

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY REPORTING PERSON

2,112,921

(7)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.2%

|

|

|

14

|

TYPE

OF REPORTING PERSON

IN

|

|

|

(7)

|

This

number includes 640,000 shares of Common Stock issuable upon exercise of certain warrants owned by the Reporting Persons.

|

|

CUSIP No. 88338K103

|

13D/A

|

Page

9

of 10 Pages

|

On

December 31, 2016 Anson Funds Management LP (d/b/a Anson Group), a Texas limited partnership, Anson Management GP LLC, a Texas

limited liability company, Mr. Bruce R. Winson, the principal of Anson Funds Management LP and Anson Management GP LLC, Anson

Advisors Inc. (d/b/a Anson Funds), an Ontario, Canada corporation, Mr. Adam Spears, a director of Anson Advisors Inc., and Mr.

Moez Kassam, a director of Anson Advisors Inc. (collectively, the “Initial Reporting Persons”), jointly filed a Statement

of Beneficial Ownership on a Form 13G pursuant to Rule 240.13d-1(b) of the Securities Exchange Act of 1934 (the “Act”)

with the Securities and Exchange Commission (the “SEC”). On August 4, 2017, the Initial Reporting Persons, as well

as Anson Investments Master Fund LP, a Cayman Islands limited partnership, who was originally eligible to file with the Initial

Reporting Persons on the Original 13G (the Anson Investments Master Fund together with the Initial Reporting Persons are hereafter

collectively referred to as the “Reporting Persons”), jointly filed a Statement of Beneficial Ownership on Schedule

13D (the “Original Schedule 13D”) pursuant to Rule 240.13d-1(e) of the Act to reflect an intention by the Initial

Reporting Persons to hold the securities with a purpose or effect of changing or influencing control of the issuer. The Original

Schedule 13D was amended by Amendment No. 1 to the Original Schedule 13D filed with the SEC on November 16, 2017 by the Reporting

Persons, to reflect a change in the percentage of ownership of shares by the Reporting Persons.

Whereas,

pursuant to § 240.13d-1(h) of the Act, the Reporting Persons qualify to file a Statement of Beneficial Ownership on a Form

13G under Rule 240.13d-1(b) of the Act which, among other things, requires that the Reporting Persons “acquired such securities

in the ordinary course of business and not with the purpose nor with the effect of changing or influencing the control of the

issuer, nor in connection with or as a participant in any transaction having such purpose or effect” This Amendment No.

2 to the Original Schedule 13D (this “Amendment No. 2”) constitutes the final amendment to the Reporting Persons’

Schedule 13D and an exit filing for the Reporting Persons,

Item

4. Purpose of Transaction.

Item

4 of the Schedule 13D is hereby amended and supplemented by adding the following information:

The

purpose of the holding of the securities of the Issuer by the Reporting Persons is solely for investment purposes,

and, pursuant to Section 240.13d-1(b) is in the “ordinary course of the business” of the Reporting Persons

and “not with the purpose nor with the effect of changing or influencing the control of the issuer, nor in connection

with or as a participant in any transaction having such purpose or effect, including any transaction subject to

§ 240.13d-1(b) and § 240.13d-1(c) of the Act, other than activities solely in connection with a nomination under

§ 240.14a-11 of the Act.”

Exhibits

|

CUSIP No. 88338K103

|

13D/A

|

Page

10

of 10 Pages

|

SIGNATURE

After

reasonable inquiry and to the best of our knowledge and belief, the undersigned certifies that the information set forth in this

Amendment No. 2 is true, complete and correct.

In

accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended, the persons named below agree to

the joint filing on behalf of each of them of this Amendment No. 2 with respect to the shares of Common Stock of the Company.

Dated:

March 2, 2018

|

|

ANSON INVESTMENTS

MASTER FUND LP

|

|

|

|

|

|

By: ANSON

ADVISORS INC.

|

|

|

|

|

|

|

By:

|

/s/

Adam Spears

|

|

|

|

Adam

Spears

|

|

|

|

Director

|

|

|

|

|

|

|

By:

|

/s/

Moez Kassam

|

|

|

|

Moez

Kassam

|

|

|

|

Director

|

|

|

ANSON FUNDS

MANAGEMENT LP

|

|

|

|

|

|

By:

Anson Management

GP LLC, its general partner

|

|

|

|

|

|

|

By:

|

/s/

Bruce R. Winson

|

|

|

|

Bruce

R. Winson

|

|

|

|

Manager

|

|

|

|

|

|

|

ANSON MANAGEMENT

GP LLC

|

|

|

|

|

|

|

By:

|

/s/

Bruce R. Winson

|

|

|

|

Bruce

R. Winson

|

|

|

|

Manager

|

|

|

|

|

|

|

/s/

Bruce R. Winson

|

|

|

Bruce

R. Winson

|

|

|

|

|

|

|

ANSON ADVISORS

INC.

|

|

|

|

|

|

|

By:

|

/s/

Adam Spears

|

|

|

|

Adam

Spears

|

|

|

|

Director

|

|

|

|

|

|

|

By:

|

/s/

Moez Kassam

|

|

|

|

Moez

Kassam

|

|

|

|

Director

|

|

|

|

|

|

|

/s/

Adam Spears

|

|

|

Adam

Spears

|

|

|

|

|

|

/s/

Moez Kassam

|

|

|

Moez

Kassam

|

ONE Group Hospitality (NASDAQ:STKS)

Historical Stock Chart

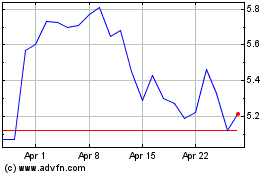

From Mar 2024 to Apr 2024

ONE Group Hospitality (NASDAQ:STKS)

Historical Stock Chart

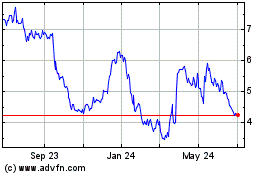

From Apr 2023 to Apr 2024