- Reported billings up 0.6% at £55.563

billion, down 3.9% in constant currency and down 5.4%

like-for-like

- Reported revenue up 6.1% at £15.265

billion, up 1.7% at $19.703 billion, down 0.6% at €17.427 billion

and up 4.9% at ¥2.209 trillion

- Constant currency revenue up 1.6%,

like-for-like revenue down 0.3%

- Constant currency revenue less

pass-through costs1 (previously known as net sales)

up 1.4%, like-for-like down 0.9%

- Reported revenue less pass-through

costs1 margin (previously known as net sales margin)

of 17.3%, down 0.1 margin points against last year, flat on a

constant currency and like-for-like basis, in line with the revised

full year margin target

- Headline EBITDA £2.534 billion, up

4.7%, up 1.2% in constant currency

- Headline profit before interest and

tax £2.267 billion, up 4.9% and up 1.5% in constant

currency

- Headline profit before tax £2.093

billion, up 5.4% and up 1.9% in constant currency

- Profit before tax £2.109 billion, up

11.6%, up 7.7% in constant currency

- Profit after tax £1.912 billion, up

27.4%, up 22.6% in constant currency

- Headline diluted earnings per share

of 120.4p, up 6.4%, up 2.7% in constant currency

- Return on equity at 16.9% in 2017,

up significantly from 16.2% in 2016 versus a weighted average cost

of capital of 6.3% in 2017, down from 6.4% in 2016

- Dividends per share of 60.0p, up

6.0%, a pay-out ratio of 50% in line with last year and the target

pay-out ratio

- Net debt £4.483 billion at 31

December 2017, an increase of £352 million on same date in 2016,

with average net debt in 2017 at £5.143 billion against £4.340

billion in 2016, primarily reflecting the weakness of sterling,

with the average net debt to EBITDA ratio at 2.0x, the top-end of

the target range

- Net new business of $6.330 billion

in the year continuing the good overall performance seen in the

first nine months and leading positions in the net new business

tables

- Above budget, but slow start to

2018, with January like-for-like revenue flat and revenue less

pass-through costs1 down 1.2%

- Acceleration of strategic focus on

simplification of structure, client and country management and

enterprise-wide alignment of digital systems, platforms and

capabilities

WPP (NYSE:WPP) today reported its 2017 Preliminary Results.

Commenting on the 2017 results announcement Sir Martin

Sorrell, CEO of WPP, said:

“2017 for us was not a pretty year, with flat like-for-like,

top-line growth, and operating margins and operating profits also

flat, or up marginally.

“The major factors influencing this performance were probably

the long-term impact of technological disruption and more the

short-term focus of zero-based budgeters, activist investors and

private equity than, we believe, the suggested disintermediation of

agencies by Google and Facebook or digital competition from

consultants.

“In this environment, the most successful agency groups will be

those who offer simplicity and flexibility of structure to deliver

efficient, effective solutions – and therefore growth – for their

clients. With this in mind, we are now accelerating the

implementation of our strategy for the Group.

“No company in the world of marketing or business transformation

has a greater or more varied repertory of talent and capabilities

than WPP. Our strength, however, resides not only in the scale and

variety of those skills, but in our unique ability to combine them

in service of our clients’ growth – which is why most of the

world’s leading companies choose WPP to provide them with

communications services.

“For many years we have placed ‘horizontality’ at the heart of

our strategy by presenting clients with tailor-made and seamlessly

integrated offers to meet their specific requirements. Over the

last year, we have begun to apply that philosophy to the structure

of the Group itself by simplifying a number of our operations.

“As our industry continues to undergo fundamental change, we are

upping the pace of WPP’s development from a group of individual

companies to a cohesive global team dedicated to the core purpose

of driving growth for clients.

“As we build an increasingly unified WPP, we are focusing on a

number of areas that will allow us to deploy our deep expertise

with greater flexibility, efficiency and speed. These include:

further simplification of our structure; stronger client

co-ordination across the whole of WPP, including greater

responsibility and authority for global client teams and country

managers; the development of key cross-Group capabilities in

digital marketing, digital production, eCommerce and shopper

marketing; further sharing of functions, systems and platforms

across the Group; and the development and implementation of senior

executive incentives to align them even more closely to Group

performance.

“We start this new phase of our journey from a position of

market leadership, and with total confidence in the enduring value

of what we offer our clients. We will report at every opportunity

on our progress.”

Key figures

£ million

2017

∆ reported2

∆ constant3

2016 Billings 55,563 0.6%

-3.9%

55,245 Revenue

15,265 6.1% 1.6%

14,389

Revenue less pass-through costs1 13,140

6.0% 1.4%

12,398

Headline EBITDA4

2,534 4.7% 1.2%

2,420

Headline PBIT5

2,267 4.9% 1.5%

2,160

Revenue less pass-through costs1 margin

17.3% -0.1* 0.0*

17.4% Profit

before tax 2,109 11.6% 7.7%

1,891 Profit after tax 1,912

27.4% 22.6%

1,502

Headline diluted EPS6

120.4p 6.4% 2.7%

113.2p

Diluted EPS7

142.4p 31.9% 26.9%

108.0p

Dividends per share 60.0p 6.0%

6.0%

56.60p

* Margin points, also flat

like-for-like

Full Year highlights

- Reported billings at £55.563

billion, down 3.9% in constant currency and down 5.4%

like-for-like

- Reported revenue growth of 6.1%,

with like-for-like growth of -0.3%, 1.9% growth from acquisitions

and 4.5% from currency

- Constant currency revenue growth in

all regions, led by strong growth in the United Kingdom and

growth in Western Continental Europe and Asia Pacific, Latin

America, Africa & the Middle East and Central & Eastern

Europe. Sectors, including advertising and media investment

management showed strong growth along with public relations and

public affairs and sub-sector specialist communications (including

direct, digital and interactive). Data investment management and

sub-sectors brand consulting and health & wellness were

softer

- Constant currency revenue less

pass-through costs1 growth in all regions,

especially the United Kingdom and except North America. All

sectors, especially advertising and media investment management

were up, except data investment management. On a full year basis,

the gap in the growth rates between revenue and revenue less

pass-through costs1 was fairly consistent at 0.2%

- Headline EBITDA of £2.534 billion,

up 4.7%, and up 1.2% in constant currency, reflecting full year

currency tailwinds, which moderated significantly in the second

half of the year

- Headline PBIT increase of 4.9%

to £2.267 billion, up 1.5% in constant currency, again reflecting

currency tailwinds in the full year, which moderated in the second

half of the year, with staff costs increasing faster, offset to

some degree by control of general & administrative costs,

including establishment costs

- Revenue less pass-through

costs1 margin, a more helpful comparator than

revenue margin down 0.1 margin points, but still a leading industry

margin of 17.3% and flat in constant currency and like-for-like,

in-line with the revised target guidance after quarter three

- Exceptional gains of £129

million, largely representing the gain on the sale of the

Group’s minority interests in Asatsu-DK to Bain Capital and

Infoscout to Vista Equity Partners. A 25% equity interest in

Asatsu-DK may be purchased shortly at a cost of approximately $60

million

- Headline diluted EPS of 120.4p up

6.4%, up 2.7% in constant currency and reported diluted EPS up

31.9%, up 26.9% in constant currency, the latter reflecting the

benefit of an exceptional tax credit of £206 million

- Final ordinary dividend of 37.3p up

0.7% and full year dividends of 60.0p per share up 6.0%

- Dividend pay-out ratio of 50% in

2017, the same as 2016 and in line with the targeted dividend

pay-out ratio of 50%

- Return on equity8 up

significantly at 16.9% in 2017, compared with 16.2% in 2016,

versus a lower weighted average cost of capital of 6.3% in 2017

compared with 6.4% in 2016.

- Average net debt up £584

million, at £5.143 billion compared to last year, at 2017

exchange rates, continuing to reflect the significant net

acquisition spend, share re-purchases and dividends of £1.485

billion in 2017

- Creative and effectiveness

leadership recognised yet again in 2017 with the award of the

Cannes Lion to WPP for most creative Holding Company for the

seventh successive year since the award’s inception. Three WPP

agency networks, Ogilvy & Mather Worldwide, Y&R and Grey

finished in the top six networks at Cannes in 2017, in positions

two, four and six. For the sixth consecutive year, WPP was also

awarded the EFFIE as the most effective Holding Company

- Continued implementation of growth

strategy with revenue ratios for fast growth markets and new

media raised to 40-45% over the next three to four years, and

currently at around 30% and over 40% respectively. Quantitative

revenue target of 50% already achieved

Current trading and outlook

- January 2018 | Like-for-like

revenue flat with last year for the month, slightly ahead of

budget, with like-for-like revenue less pass-through costs1, down

1.2%, also ahead of budget and against more difficult comparatives

in the first quarter of last year

- FY 2018 budget | Given

optimistic revenue and revenue less pass-through costs1 forecasting

in the last three quarters of 2017 and so as to ensure costs are

more effectively controlled, the budgets for 2018, on a

like-for-like basis, have been set at around flat for both revenue

and revenue less pass-through costs1, with a headline operating

margin target also flat, in constant currency

- Dual focus in 2018 | 1. Revenue

and revenue less pass-through costs1 growth from leading position

in horizontality, faster growing geographic markets and digital,

premier parent company creative and effectiveness position, new

business and strategically targeted acquisitions; 2. Continued

emphasis on balancing revenue growth with headcount increases and

improvement in staff costs/revenue less pass-through costs1 ratio

to enhance operating margins

- Long-term targets | Above

industry revenue growth, due to effective implementation of

horizontality, geographically superior position in new markets and

functional strength in new media, data investment management,

including data analytics and the application of new technology,

creativity, effectiveness and horizontality; improvement in staff

costs/revenue less pass-through costs1 ratio of 0 - 0.2 margin

points or more depending on revenue less pass-through costs1

growth; revenue less pass-through costs1 operating margin expansion

of 0 - 0.3 margin points or more on a constant currency basis, with

an ultimate goal of almost 20%; and headline diluted EPS growth of

5% to 10% p.a. from revenue and revenue less pass-through costs1

growth, margin expansion, strategically targeted small- and

medium-sized acquisitions and share buy-backs

In this press release not all of the figures and ratios used are

readily available from the unaudited preliminary results included

in Appendix 1. These non-GAAP measures, including constant currency

and like-for-like growth, revenue less pass-through costs1 and

headline profit measures, management believes are both useful and

necessary to better understand the Group’s results. Where required,

details of how these have been arrived at are shown in the

Appendices.

Review of Group results

Revenue and Revenue less pass-through costs1

Revenue analysis

£ million

2017 ∆ reported

∆ constant9

∆ LFL10

Acquisitions

2016 First half

7,404 13.3% 1.9% -0.3% 2.2%

6,536 Second half 7,861

0.1% 1.3% -0.3% 1.6%

7,853

Full year 15,265 6.1% 1.6%

-0.3% 1.9%

14,389

Revenue less pass-through costs1

analysis

£ million

2017 ∆ reported ∆ constant

∆ LFL Acquisitions

2016 First

half 6,362 13.7% 2.2% -0.5%

2.7%

5,594 Second half

6,778 -0.4% 0.8% -1.2% 2.0%

6,804 Full year 13,140

6.0% 1.4% -0.9% 2.3%

12,398

Reported billings at £55.563 billion, up 0.6%, down 3.9% in

constant currency and down 5.4% like-for-like. Estimated net new

business billings of $6.330 billion were won in the year,

continuing the good performance seen in the first nine months and

reflected in the leading positions in net new business tables.

Generally, the Group continues to benefit from consolidation trends

in the industry, winning assignments from existing and new clients,

including several very large industry-leading advertising, digital,

media, pharmaceutical, eCommerce and shopper marketing

assignments.

Reportable revenue was up 6.1% at £15.265 billion. Revenue on a

constant currency basis was up 1.6% compared with last year, the

difference to the reportable number reflecting the weakness of the

pound sterling against most currencies, particularly in the first

half of the year, with some strengthening in the second half. As a

number of our competitors report in US dollars, euros and yen,

appendices 2, 3 and 4 show WPP’s Preliminary results in reportable

US dollars, euros and yen respectively. This shows that US dollar

reportable revenue was up 1.7% to $19.703 billion and headline

earnings before interest and taxes up 3.1% to $2.953 billion, which

compares with the $15.274 billion and $2.177 billion respectively

of the second largest11 direct (United States-based) competitor.

Euro reportable revenue was down 0.6% to €17.427 billion and

headline earnings before interest and taxes down 1.0% to €2.579

billion, which compares with €9.690 billion and €1.620 billion

respectively of the third largest11 direct (European-based)

competitor and yen reportable revenue was up 4.9% to ¥2.209

trillion and headline earnings before interest and taxes up 6.2% to

¥331 billion, which compares with ¥929 billion and ¥164 billion of

our fourth largest11 direct (Japan-based) competitor.

On a like-for-like basis, which excludes the impact of currency

and acquisitions, revenue was down 0.3%, with revenue less

pass-through costs1 down 0.9%. In the fourth quarter, like-for-like

revenue was up 1.2%, the strongest quarter of the year. North

America and the United Kingdom performed well, both recording their

strongest quarterly growth of the year, with Western Continental

Europe and Latin America weaker. Asia Pacific improved over the

first and third quarter, with Africa & the Middle East down

similar to the first nine months. Like-for-like revenue less

pass-through costs1 growth was weaker than revenue growth, down

1.3% in the fourth quarter, particularly in North America, with the

United Kingdom stronger.

Operating profitability

Headline EBITDA was up 4.7% to £2.534 billion, from £2.420

billion the previous year and up 1.2% in constant currency. Group

revenue is more weighted to the second half of the year across all

regions and sectors, and, particularly, in the faster growing

markets of Asia Pacific and Latin America. As a result, the Group’s

profitability and margin continue to be skewed to the second half

of the year, with the Group earning approximately one-third of its

profits in the first half and two-thirds in the second half.

Headline operating profit for 2017 was up 4.9% to £2.267 billion,

from £2.160 billion and up 1.5% in constant currencies.

Revenue less pass-through costs1 margin was down 0.1 margin

points to 17.3%, flat in constant currency and like-for-like, in

line with the Group’s full year revised margin target. The revenue

less pass-through costs1 margin of 17.3% is after charging £40

million ($52 million) of severance costs, compared with £34 million

($49 million) in 2016 and £324 million ($418 million) of incentive

payments, versus £367 million ($486 million) in 2016. Constant

currency and like-for-like operating margins were flat with the

prior year.

As outlined in previous Preliminary Announcements for the last

few years, due to the increasing scale of digital media purchases

within the Group’s media investment management businesses and of

direct costs in data investment management, revenue less

pass-through costs1 are, in our view, a helpful reflection of top

line growth, although currently, only one of our competitors

partially reports revenue less pass-through costs1. As a result of

changes in reporting standards effective 1 January 2018, in

relation to revenue recognition, standardised reporting of revenue

less pass-through costs1 will probably become more common in our

industry. The differences are shown below in a table that compares

the Group’s like-for-like revenue and revenue less pass-through

costs1 against our direct competitors’ like-for-like revenue only

performance over the last two years.

Full Year

WPPRevenue

WPPRevenue lesspass-throughcosts1

OMC

Revenue

Pub

Revenue

IPG

Revenue

Dentsu

Grossprofit

Havas

Revenue

Revenue (local ‘m) £15,265 £13,140 $15,274

€9,690 $7,882 ¥877,622 €2,259 Revenue

($'m) $19,703 $16,958 $15,274 $10,941

$7,882 $7,826 $2,551 Growth Rates (%)*

-0.3 -0.9 3.0 0.8 1.8 0.1

-0.8 Quarterly like-for-like growth%*

Q1/16 5.1

3.2 3.8 2.9 6.7 5.1 3.4 Q2/16

3.5 4.3 3.4 2.7 3.7 9.5

2.7 Q3/16 3.2 2.8 3.2 0.2

4.3 2.7 2.0 Q4/16 0.5 2.1 3.6

-2.5 5.3 3.9 4.2 Q1/17 0.2

0.8 4.4 -1.2 2.7 3.9 0.1

Q2/17 -0.8 -1.7 3.5 0.8 0.4

-4.8 -0.9 Q3/17 -2.0 -1.1 2.8

1.2 0.5 -2.1 0.1 Q4/17 1.2

-1.3 1.6 2.2 3.3 2.8 -2.1

2 Years cumulative like-for-like growth %

Q1/16 10.3

5.7 8.9 3.8 12.4 11.3

10.5 Q2/16 8.0 6.4 8.7 4.1 10.4

16.0 8.2 Q3/16 7.8 6.1 9.3

0.9 11.4 6.9 7.5 Q4/16 7.2

7.0 8.4 0.3 10.5 14.5 7.3

Q1/17 5.3 4.0 8.2 1.7 9.4

9.0 3.5 Q2/17 2.7 2.6 6.9 3.5

4.1 4.7 1.8 Q3/17 1.2 1.7

6.0 1.4 4.8 0.6 2.1 Q4/17 1.7

0.8 5.2 -0.3 8.6 6.7 2.1

* The above like-for-like/organic revenue figures are extracted

from the published quarterly and full year trading statements

issued by Omnicom Group (“OMC”), Publicis Groupe (“Pub”),

Interpublic Group (“IPG”), Dentsu and Havas (included in Vivendi

results)

On a reported basis, operating margins, before all incentives12

and income from associates, were 18.9%, down 1.0 margin point,

compared with 19.9% last year. The Group’s staff costs to revenue

less pass-through costs1 ratio, including severance and incentives,

increased by 0.5 margin points to 63.3% compared to 62.8% in 2016,

as staff costs were not reduced in line with the fall in revenue

less pass-through costs1. However, the Group was able to manage its

general and administrative costs, including property, relatively

effectively, with improvements across most categories.

Headline operating costs13 rose by 6.6%, rose by 1.8% in

constant currency, but down 0.6% like-for-like. Reported staff

costs, excluding incentives, increased by 7.8%, up 2.8% in constant

currency. Incentive payments amounted to £324 million ($421

million), which were 13.1% of headline operating profit before

incentives and income from associates, compared with £367 million

($486 million) or 14.9% in 2016. Achievement of target, at an

individual Company level, generally generates 15% of operating

profit before bonus as an incentive pool, 20% at maximum and 25% at

super maximum.

On a like-for-like basis, the average number of people in the

Group, excluding associates, in 2017 was 134,428 compared to

136,409 in 2016, a decrease of 1.5%. On the same basis, the total

number of people in the Group, excluding associates, at 31 December

2017 was 134,413 compared to 136,775 at 31 December 2016, a

decrease of 2,362 or 1.7%.

Exceptional gains and restructuring costs

In 2017 the Group generated exceptional gains of £129 million,

largely representing the gain on the sale of the Group’s minority

interests in Asatsu-DK to Bain Capital and Infoscout to Vista

Equity Partners. A 25% equity interest in Asatsu-DK may be

purchased shortly at a cost of approximately $60 million. These

were partly offset by investment write-downs of £96 million,

principally in relation to comScore Inc., resulting in a net gain

of £33 million, which in accordance with prior practice, has been

excluded from headline profit. The Group took a £57 million

restructuring provision, primarily against severance provisions in

mature markets and the Group’s IT transformation costs.

Interest and taxes

Net finance costs (excluding the revaluation of financial

instruments) were up marginally at £174.6 million, compared with

£174.1 million in 2016, an increase of £0.5 million. This is due to

the weakness in sterling resulting in higher translation costs on

non-sterling debt and the cost of higher average net debt being

offset by the beneficial impact of lower bond coupon costs

resulting from refinancing maturing debt at cheaper rates and

higher investment income.

The headline tax rate was 22.0% (2016 21.0%) and on reported

profit before tax was 9.3% (2016 20.6%), principally due to the

exceptional tax credit, primarily relating to the re-measurement of

deferred tax liabilities. The headline tax rate for 2018 is

expected to be up to 1% higher than 2017. Given the Group’s

geographic mix of profits and the changing international tax

environment, the tax rate is expected to increase slightly over the

next few years. The recent tax changes outlined in the United

States Tax Cuts and Jobs Act do not impact the Group’s tax rate

significantly, up or down, except for the tax credit mentioned

above.

Earnings and dividend

Headline profit before tax was up 5.4% to £2.093 billion from

£1.986 billion, or up 1.9% in constant currencies.

Reported profit before tax rose by 11.6% to £2.109 billion from

£1.891 billion. In constant currencies, reported profit before tax

rose by 7.7%.

Reported profit after tax rose by 27.4% to £1.912 billion from

£1.502 billion. In constant currencies, profits after tax rose

22.6%.

Profits attributable to share owners rose by 29.7% to £1.817

billion from £1.400 billion. In constant currencies, profits

attributable to share owners rose by 24.9%.

Headline diluted earnings per share rose by 6.4% to 120.4p from

113.2p. In constant currencies, earnings per share on the same

basis rose by 2.7%. Reported diluted earnings per share rose by

31.9% to 142.4p from 108.0p and increased 26.9% in constant

currencies.

As outlined in the June 2015 Preliminary Announcement, the

achievement of the previously targeted pay-out ratio of 45% one

year ahead of schedule, raised the question of whether the pay-out

ratio target should be increased further. Following that review,

your Board decided to increase the dividend pay-out ratio to a

target of 50%, to be achieved by 2017, and, as a result, declared

an increase of almost 23% in the 2016 interim dividend to 19.55p

per share, representing a pay-out ratio of 50% for the first half.

This had the effect of evening out the pay-out ratio between the

two half-year periods and consequently balancing out the dividend

payments themselves, although the pattern of profitability and

hence dividend payments seems likely to remain one-third in the

first half and two-thirds in the second half.

Given your Company’s performance in 2017, your Board proposes a

marginal increase in the final dividend to 37.3p per share, which,

together with the interim dividend of 22.7p per share, makes a

total of 60.0p per share for 2017, an overall increase of 6.0%.

This represents a dividend pay-out ratio of 50%, the same as last

year. The record date for the final dividend is 15 June 2018,

payable on 9 July 2018.

Further details of WPP’s financial performance are provided in

Appendices 1, 2, 3 and 4.

Regional review

The pattern of revenue and revenue less pass-through costs1

growth differed regionally. The tables below give details of

revenue and revenue less pass-through costs1, revenue and revenue

less pass-through costs1 growth by region for 2017, as well as the

proportion of Group revenue and revenue less pass-through costs1

and operating profit and operating margin by region;

Revenue analysis

£ million

2017 ∆ reported

∆ constant14

∆ LFL15

% group

2016 % group N. America

5,547 5.0% 0.3% -2.3% 36.3%

5,281 36.7% United Kingdom 1,986 6.4%

6.4% 4.9% 13.0% 1,866 13.0% W Cont.

Europe 3,160 7.4% 1.6% -0.3%

20.7% 2,943 20.4%

AP, LA, AME, CEE16

4,572 6.4% 1.1% 0.0% 30.0%

4,299 29.9%

Total Group 15,265

6.1% 1.6% -0.3%

100.0% 14,389 100.0%

Revenue less pass-through costs1

analysis

£ million

2017 ∆ reported ∆ constant

∆ LFL % group

2016 % group N.

America 4,799 4.2% -0.4% -3.2%

36.5% 4,604 37.1% United Kingdom 1,684

6.0% 6.0% 4.8% 12.8% 1,588 12.8%

W Cont. Europe 2,616 7.9% 1.9% 0.0%

19.9% 2,425 19.6% AP, LA, AME, CEE

4,041 6.9% 1.6% -0.8% 30.8%

3,781 30.5%

Total Group 13,140

6.0% 1.4% -0.9%

100.0% 12,398 100.0%

Operating profit analysis (Headline PBIT)

£ million

2017 % margin*

2016

% margin* N. America 937 19.5% 895

19.4% United Kingdom 280 16.6% 261

16.5% W Cont. Europe 376 14.4% 352

14.5% AP, LA, AME, CEE 674 16.7% 652

17.2%

Total Group 2,267

17.3% 2,160 17.4% * Headline

PBIT as a percentage of revenue less pass-through costs1

North America constant currency revenue was up 4.2% in

the final quarter and like-for-like up 1.6%, the strongest quarter

of the year, reflecting strong growth in media investment

management, brand consulting and parts of the Group’s direct,

digital and interactive operations, including eCommerce and shopper

marketing. On a full year basis, constant currency revenue was up

0.3%, with like-for-like down 2.3%. Constant currency revenue less

pass-through costs1 showed a similar pattern.

United Kingdom constant currency revenue was up 11.2% in

the final quarter and like-for-like up 8.4%, the strongest quarter

of the year. Media investment management, direct, digital &

interactive and public relations and public affairs were

particularly strong with data investment management, health &

wellness and the Group’s specialist communications businesses also

up. On a full year basis, constant currency revenue was up strongly

at 6.4%, with like-for-like up 4.9%, with the second half

significantly stronger than the first half, driven by new business

wins in the Group’s direct, digital & interactive businesses.

Full year revenue less pass-through costs1 were up 6.0% in constant

currency, with like-for-like up 4.8%.

Western Continental Europe constant currency revenue was

up 1.6% in the final quarter, partly the result of acquisitions,

with like-for-like revenue down 1.4%, reflecting volatility in

political and macro-economic conditions. Revenue less pass-through

costs1 followed a similar pattern, up 1.8% in constant currency,

but down 0.8% like-for-like. For the year, Western Continental

Europe constant currency revenue grew 1.6% with like-for-like down

0.3%. Revenue less pass-through costs1 growth was slightly

stronger, up 1.9% in constant currency and flat like-for-like.

Austria, Belgium, Denmark, Finland, Netherlands and Turkey showed

growth in the final quarter, but Germany, Greece, Ireland, Italy

and Switzerland were tougher.

In Asia Pacific, Latin America, Africa & the Middle East

and Central & Eastern Europe, on a constant currency basis,

revenue was down 1.0% in the fourth quarter and down 0.1%

like-for-like, largely as a result of stronger comparatives in the

fourth quarter of 2016, when constant currency revenue was up 11.9%

and like-for-like revenue up 3.9%, the strongest quarter of the

year. In the fourth quarter, Latin America, despite almost

4% growth, was weaker than the first nine months with Central

& Eastern Europe also tougher. The Next 1117

and CIVETS18 grew in the fourth quarter, with the

MIST19 more difficult. Constant currency revenue less

pass-through costs1 growth in the region was similar to revenue

growth, with like-for-like revenue less pass-through costs1 growth

for the region as a whole down 0.8%.

In 2017, 30.0% of the Group’s revenue came from Asia Pacific,

Latin America, Africa & the Middle East and Central &

Eastern Europe, up marginally from 29.9% in 2016. With revenue less

pass-through costs1, the increase was slightly more, up to 30.8%

from 30.5% in 2016.

Business sector review

The pattern of revenue and revenue less pass-through costs1

growth also varied by communications services sector and operating

brand. The tables below give details of revenue and revenue less

pass-through costs1, revenue and revenue less pass-through costs1

growth by communications services sector, as well as the proportion

of Group revenue and revenue less pass-through costs1 for 2017 and

operating profit and operating margin by communications services

sector;

Revenue analysis

£ million

2017 ∆ reported

∆ constant20

∆ LFL21

% group

2016 % group

AMIM22

7,180 9.7% 5.1% -0.1% 47.0%

6,548 45.5% Data Inv. Mgt. 2,691 1.1%

-3.6% -2.9% 17.6% 2,661 18.5%

PR & PA23

1,172 6.4% 1.7% 0.7% 7.7%

1,101 7.7%

BC, HW & SC24

4,222 3.5% -0.9% 0.8% 27.7%

4,079 28.3%

Total Group 15,265

6.1% 1.6% -0.3%

100.0% 14,389 100.0%

Revenue less pass-through costs1

analysis

£ million

2017 ∆ reported ∆ constant

∆ LFL % group

2016 % group AMIM

5,852 8.1% 3.6% -2.3% 44.5%

5,413 43.6% Data Inv. Mgt. 2,052 2.9%

-1.9% -1.3% 15.6% 1,994 16.1% PR

& PA 1,141 5.8% 1.0% 0.2%

8.7% 1,079 8.7% BC, HW & SC 4,095

4.7% 0.3% 1.0% 31.2% 3,912 31.6%

Total Group 13,140 6.0%

1.4% -0.9% 100.0%

12,398 100.0%

Operating profit analysis (Headline PBIT)

£ million

2017 % margin*

2016

% margin* AMIM 1,109 19.0% 1,027

19.0% Data Inv. Mgt. 350 17.1% 351

17.6% PR & PA 183 16.1% 180 16.7%

BC, HW & SC 625 15.3% 602 15.4%

Total Group 2,267 17.3%

2,160 17.4% * Headline PBIT as a percentage of

revenue less pass-through costs1

In 2017, 41.7% of the Group’s revenue came from direct, digital

and interactive, up 2.8 percentage points from the previous year,

with like-for-like revenue growth of 2.5% in 2017.

Advertising and Media Investment Management

In constant currencies, advertising and media investment

management was the strongest performing sector overall, with

constant currency revenue up 5.1% in 2017, up 5.6% in quarter four.

On a like-for-like basis, revenue was up 1.8% in quarter four but

down 0.1% for the year. Media investment management showed strong

like-for-like revenue growth in all regions except Western

Continental Europe and the Middle East in quarter four, with

particularly strong growth in North America, the United Kingdom,

Asia Pacific and Latin America. The Group’s advertising businesses

remained difficult, particularly in North America.

The strong revenue and revenue less pass-through costs1 growth

across most of the Group’s media investment management businesses,

offset by slower growth in the Group’s advertising businesses in

most regions, resulted in the combined reported operating margin of

this sector flat with last year at 19.0%, up 0.2 margin points in

constant currency.

In 2017, J. Walter Thompson Company, Ogilvy & Mather,

Y&R and Grey generated net new business billings of $1.364

billion. In the same year, GroupM, the Group’s media investment

management company, which includes Mindshare, Wavemaker (the new

agency formed by the merger of MEC and Maxus), MediaCom, Essence,

Xaxis and [m]PLATFORM, together with tenthavenue, generated net new

business billings of $3.444 billion. The Group totalled $6.330

billion, compared with $6.757 billion in 2016.

Data Investment Management

On a like-for-like basis, data investment management revenue was

down 0.8% in the fourth quarter, a significant improvement over the

first nine months, with growth in the United Kingdom, Latin America

and Africa. On a full year basis, constant currency revenue was

down 3.6%, down 2.9% like-for-like, with revenue less pass-through

costs1, down 1.9% in constant currency and down 1.3% like-for-like.

Geographically, revenue less pass-through costs1 were up strongly

in the United Kingdom and Latin America, with North America and

Asia Pacific particularly difficult. Kantar Worldpanel and

Lightspeed showed strong like-for-like revenue less pass-through

costs1 growth, with Kantar Insights, Kantar Health and Kantar

Public less robust. Reported operating margins were down 0.5 margin

points (the same as the first half) to 17.1% and down 0.4 margin

points in constant currency.

Public Relations and Public Affairs

In constant currencies, the Group’s public relations and public

affairs businesses were weaker in the second half of the year with

constant currency revenue down 0.9% in the third quarter and down

0.8% in the fourth quarter. The United Kingdom and the Middle East

grew strongly in the fourth quarter offset by weaker conditions in

North America and Continental Europe. Full year revenue grew 1.7%

in constant currency and 0.7% like-for-like. Cohn & Wolfe, the

Group’s specialist public relations and public affairs businesses

Glover Park, Ogilvy Government Relations and Buchanan, performed

particularly well. Overall operating margins fell 0.6 margin points

to 16.1% and by 0.4 margin points in constant currency, as parts of

the Group’s North American businesses slowed in the second

half.

Brand Consulting, Health & Wellness and Specialist

Communications

The Group’s brand consulting, health & wellness and

specialist communications businesses (including direct, digital

& interactive), was the strongest performing sector in the

fourth quarter on a like-for-like basis, up 2.0%, driven by solid

growth in brand consulting and specialist communications. The

Group’s direct, digital and interactive businesses, especially VML,

Wunderman and Hogarth performed well. Operating margins, for the

sector as a whole, were down slightly by 0.1 margin points to 15.3%

and flat in constant currency, with operating margins negatively

affected as parts of the Group’s direct, digital and interactive,

brand consulting and health & wellness businesses in North

America slowed.

Client review

Excluding associates, the Group currently employs over 130,000

full-time people covering 112 countries, excluding Cuba and Iran

(through an affiliation agreement). It services 369 of the Fortune

Global 500 companies, all 30 of the Dow Jones 30, 71 of the NASDAQ

100 and 913 national or multi-national clients in three or more

disciplines. 629 clients are served in four disciplines and these

clients account for over 53% of Group revenue. This reflects the

increasing opportunities for co-ordination and co-operation or

horizontality between activities, both nationally and

internationally, and at a client and country level. The Group also

works with 477 clients in 6 or more countries. The Group estimates

that well over a third of new assignments in the year were

generated through the joint development of opportunities by two or

more Group companies. Horizontality across clients, countries and

regions and on which the Group has been working for many years, is

clearly becoming an increasingly important part of our client

strategies, particularly as clients continue to invest in brand in

slower-growth markets and both capacity and brand in faster-growth

markets.

Cash flow highlights

In 2017, operating profit was £1.908 billion, depreciation,

amortisation and goodwill impairment £489 million, non-cash

share-based incentive charges £105 million, net interest paid £170

million, tax paid £425 million, capital expenditure £326 million

and other net cash outflows £41 million. Free cash flow available

for working capital requirements, debt repayment, acquisitions,

share buy-backs and dividends was, therefore, £1.540 billion.

This free cash flow was absorbed by £229 million in net cash

acquisition payments and investments (of which £199 million was for

earnout payments, with the balance of £30 million for investments

and new acquisition payments net of disposal proceeds), £504

million in share buy-backs and £752 million in dividends, a total

outflow of £1.485 billion. This resulted in a net cash inflow of

£55 million, before any changes in working capital.

A summary of the Group’s unaudited cash flow statement and notes

as at 31 December 2017 is provided in Appendix 1.

Acquisitions

In line with the Group’s strategic focus on new markets, new

media and data investment management, the Group completed 43

transactions in the year; 15 acquisitions and investments were in

new markets, 32 in quantitative and digital and 5 were driven by

individual client or agency needs. Out of all these transactions, 9

were in both new markets and quantitative and digital.

Specifically, in 2017, acquisitions and increased equity stakes

have been completed in advertising and media investment

management in the United States, Germany, the Middle East and

North Africa, Croatia, Russia, China and India; data investment

management in the United Kingdom and Ireland; brand

consulting in the United Kingdom and Italy; direct,

digital and interactive in the United States, the United

Kingdom, France, Ireland, Spain, the United Arab Emirates, Kenya,

China and Brazil.

A further 3 acquisitions and investments were made in the first

two months of 2018, with 1 in advertising and media investment

management; and 2 in direct, digital and interactive.

Balance sheet highlights

Average net debt in 2017 was £5.143 billion, compared to £4.559

billion in 2016, at 2017 exchange rates. On 31 December 2017 net

debt was £4.483 billion, against £4.131 billion on 31 December

2016, an increase of £352 million (an increase of £478 million at

2017 exchange rates). The increased period end debt figure reflects

the movement in working capital and provisions of £532 million.

This trend has continued in the first seven weeks of 2018, with

average net debt of £4.521 billion, compared with £4.213 billion in

the same period in 2017, an increase of £308 million (an increase

of £409 million at 2018 exchange rates). The net debt figure of

£4.483 billion at 31 December, compares with a current market

capitalisation of approximately £17.703 billion ($24.395 billion),

giving an enterprise value of £22.186 billion ($30.572 billion).

The average net debt to EBITDA ratio at 2.0x, is at the top-end of

the Group’s target range of 1.5-2.0x.

Your Board continues to examine ways of deploying its EBITDA of

over £2.5 billion (over $3.3 billion) and substantial free cash

flow of over £1.5 billion (over $1.9 billion) per annum, to enhance

share owner value balancing capital expenditure, acquisitions,

share buy-backs and dividends. The Group’s current market value of

£17.7 billion implies an EBITDA multiple of 7.0 times, on the basis

of the full year 2017 results. Including year-end net debt of

£4.483 billion, the Group’s enterprise value to EBITDA multiple is

8.8 times.

A summary of the Group’s unaudited balance sheet and notes as at

31 December 2017 is provided in Appendix 1.

Return of funds to share owners

Dividends paid in respect of 2017 will total approximately £758

million for the year. Funds returned to share owners in 2017

totalled £1.256 billion, including share buy-backs, an increase of

20% over 2016. In 2016 funds returned to share owners were £1.044

billion. In the last five years, £5.0 billion has been returned to

share owners and over the last ten years £6.6 billion.

In 2017, 32.4 million shares, or 2.5% of the issued share

capital, were purchased at a cost of £504 million and an average

price of £15.56.

Current trading

January 2018 like-for-like revenue was flat, ahead of budget,

with revenue less pass-through costs1 down 1.2%, also ahead of

budget and against more difficult comparatives in the first quarter

of last year.

Outlook

Macroeconomic and industry context

Global GDP growth may still have been generally sub-trend

(pre-Lehman) in 2017, in the low nominal 3% range, but forecasts

for 2018 have generally improved moving up in the 3-4% range. The

Davos consensus a month or so ago was almost universally bullish,

although that seemed to trigger a “Davos put” for markets, at least

temporarily. In any event, the United States economy is

strengthening driven by the three-pronged Trump policies of tax and

regulation reduction and infrastructure investment, with business

confidence at much higher levels than under previous

administrations. Prospects for Europe too are better with the big

four Continental European economies in generally better shape,

although the positive of a charismatic Macron-led France may be

outweighed by political uncertainties in Germany, Italy and Spain

and the UK economy seems to be increasingly challenged by Brexit.

All of which we will know more about very soon. Asia Pacific is

generally improving too with China, India and Japan in better shape

following economic and political reforms, buttressed by economies

like Indonesia, Vietnam and the Philippines. Even the political

prospects for the Korean Peninsula may have improved. Latin

American economies are also improving in Brazil, Argentina,

Colombia and Peru especially, although the Mexico election may

ruffle progress. Political changes also bode well for Africa and

the Middle East, although the latter, in particular, remains

volatile. Russia continues to progress, despite Western sanctions

and Central and Eastern Europe countries like Poland are responding

generally well to an improving Western Europe. The canary in the

coal mine seems to be inflation and its potential to trigger larger

and earlier than anticipated increases in interest rates and

consequent impact on stock and real markets. It clearly will happen

some time, the question being when.

From our point of view 2018 should in theory be a better year.

The sportingly and politically successful Pyeongchang Winter

Olympics, the Russian World Cup and the US Congressional mid-term

elections should all trigger more marketing investment, reflecting

a mini-quadrennial year. However, growth in marketing spend seems

to have decoupled somewhat from GDP growth in the mature markets in

the last year, perhaps temporarily. When top line growth is

examined carefully, for example for the S&P 500, it seems to be

concentrated in the technology and healthcare sectors. As a result,

in a low inflation and consequently low pricing power environment,

there is an understandable focus on cost. In turn, more long-term

technological disruption and the short-term focus of ZBB driven

companies, activist investors and private equity along with

relatively short-term executive tenures all result in increasing

the short-term cost focus. We do not believe that this approach is

tenable in the longer-term. Sales volume growth is critical,

particularly for fast moving consumer goods. We know that those

companies that invest in innovation and brand win. Our own brand

valuation survey, BrandZ, clearly shows companies that do so,

significantly outperform market indices. The emphasis has to shift

from cost to growth, for example, in terms of where the next

billion consumers will come from - certainly not the United States

or Western Europe, but most likely Asia Pacific, Latin America,

Africa & the Middle East and Central & Eastern Europe.

2017 for us was not a pretty year. Basically, like-for-like top

line growth was flat against original expectations of 2% growth and

operating margins and operating profits were flat or up

marginally.

Whether this was due to Google and Facebook disintermediating

agencies (our view not so), or consultants eating our digital lunch

(our view also not so, except in the more general area of helping

cut costs) or the low cost of money driving ZBB, activist and

private equity activity (our view the major contributor), it is

clear that we have to accelerate implementation of our strategy to

deal both with technological disruption and this short-term

focus.

An increasingly digital world impacts manufacturing through, for

example, 3D printing or robotics, media, for example, through

Google and Facebook and disruption through, for example, Amazon and

Alibaba. With limited GDP growth, low inflation, limited pricing

power and a consequent focus on cost, simplicity, agility and

flexibility of structure is a pre-requisite. To achieve this, we

are increasingly focused on accelerating the implementation of the

following:

- firstly, simplifying our verticals - in

advertising, for example, Ogilvy with John Seifert’s Next Chapter;

in media investment management, for example, GroupM with Kelly

Clark’s and Tim Castree’s Wavemaker; in data investment management,

for example, Kantar with Eric Salama’s Kantar First and Kantar

Consulting; in public relations and public affairs, for example,

Donna Imperato’s leadership of Burson Cohn & Wolfe and

Finsbury’s strategic partnership with Hering Schuppener and Glover

Park Group; in brand consulting, WPP Brand Consulting and

consolidation at Superunion; in health & wellness, with Mike

Hudnall’s WPP Health & Wellness and finally, in digital, for

example, Mark Read’s Wunderman with POSSIBLE, Salmon, Cognifide and

Acceleration and Jon Cook’s VML with Rockfish. These are all

examples of simplifying our offer more effectively. This escalation

will continue as we continue to work with clients on developing the

“agency of the future” and who, at the same time, demand faster,

better, cheaper.

- second, focusing on stronger client

co-ordination across the whole of WPP, with 51 client leaders

covering one-third of our revenues and overseeing our client

relationships on an integrated firm-wide basis, not solely on a

vertical by vertical or country by country basis.

- third, appointing country and

sub-regional leaders to ensure integration of our offers at a

country level, particularly with the growth of “piranha” or

“gladiator” brands at a local or regional level and to concentrate

on making sure we have not only the best local clients, but the

best people and acquisitions on a market by market basis.

- finally, at the same time,

“horizontalizing” certain capabilities or platforms that can

clearly provide client-differentiating services for both our

integrated offer and our brands. We have already started to build

these in the areas of finance, talent, information technology,

property and practices such as retail, brand valuation and

government. In addition, today, we are announcing and ensuring that

our global production management platform, Hogarth, is harnessed

across the whole of the Group. We are also examining how our

digital, eCommerce and shopper platforms and capabilities can be

most seamlessly connected. We are already involved in a fundamental

way with digital strategy, transformation with the majority of our

clients and we will be ensuring that these capabilities are even

more easily accessible and can be combined more effectively with

our vertical agencies.

Financial guidance

The budgets for 2018 have been prepared on the usual bottom-up

basis, but continue to reflect a faster growing United Kingdom and

the faster geographical markets of Asia Pacific, Latin America,

Africa & the Middle East and Central & Eastern Europe and

faster growing functional sectors and sub-sectors of media, public

relations & public affairs and direct, digital and interactive,

with a stronger second half of the year, reflecting the 2017

comparative. Given what proved to be top-line optimism in our

budgets last year, we have encouraged our operating companies to

budget extremely conservative revenue and revenue less pass-through

costs1. Consequently, our 2018 budgets show the following;

- Flat like-for-like revenue and revenue

less pass-through costs1

- Flat operating margin to revenue less

pass-through costs1 on a constant currency basis

In 2018, our prime focus will remain on growing revenue and

revenue less pass-through costs1 faster than the industry average,

driven by our leading position in horizontality, faster growing

geographic markets and digital, premier parent company creative and

effectiveness position, new business and strategically targeted

acquisitions. At the same time, we will concentrate on meeting our

operating margin objectives by managing absolute levels of costs

and increasing our flexibility in order to adapt our cost structure

to significant market changes. The initiatives taken by the parent

company in the areas of human resources, property, procurement,

information technology and practice development continue to improve

the flexibility of the Group’s cost base. Flexible staff costs

(including incentives, freelance and consultants) remain close to

historical highs of above 8% of revenue less pass-through costs1

and continue to position the Group extremely well should current

market conditions change.

The Group continues to improve co-operation and co-ordination

among its operating companies in order to add value to our clients’

businesses and our people’s careers, an objective which has been

specifically built into short-term incentive plans. We have decided

that up to half of operating company incentive pools are funded and

allocated on the basis of Group-wide performance and incentive

allocation criteria include specific Group-wide revenue less

pass-through costs1 objectives. Horizontality has been accelerated

through the appointment of 51 global client leaders for our major

clients, accounting for over one third of total revenue of almost

$20 billion and 20 regional and country managers in a growing

number of test markets and sub-regions, covering about half of the

112 countries in which we operate.

Emphasis has been laid on the areas of media investment

management, health & wellness, sustainability, government, new

technologies, new markets, retailing, shopper marketing, internal

communications, financial services and media and entertainment. The

Group continues to lead the industry, in co-ordinating

communications services geographically and functionally through

parent company initiatives and winning Group pitches. Whilst talent

and creativity (in the broadest sense) remain key potential

differentiators between us and our competitors, increasingly

differentiation can also be achieved in three additional ways –

through application of technology, for example, Xaxis, AppNexus and

Triad; through integration of data investment management, for

example, Kantar; and through investment in content, for example,

Imagine, Imagina, Vice, Media Rights Capital, Fullscreen,

Indigenous Media, China Media Capital, Bruin and Refinery29.

In addition, strong and considered points of view on the

adequacy of online and, indeed, offline measurement, on

viewability, on internet fraud and transparency, on online media

placement and brand safety and, finally, on fake news are all

examples where further differentiation is important and can be

secured through considered initiatives. With its leadership

position, as the world's largest media investment management

operation, GroupM has developed a strong united point of view with

its leading clients and associates, like AppNexus, in all these

areas and has aligned with Kantar's data investment management

resources, to provide better capabilities. These philosophical

differences and operational capabilities are extremely effective in

responding to the trade association and regulatory issues that have

been raised recently.

Our business remains geographically and functionally well

positioned to compete successfully and to deliver on our long-term

targets:

- Revenue and revenue less pass-through

costs1 growth greater than the industry average

- Improvement in revenue less

pass-through costs1 margin of between zero and 0.3 margin points or

more, excluding the impact of currency, depending on revenue less

pass-through costs1 growth, and staff costs to revenue less

pass-through costs1 ratio improvement of between zero and 0.2

margin points or more

- Annual headline diluted EPS growth of

5% to 10% p.a. delivered through revenue growth, margin expansion,

acquisitions and share buy-backs

Uses of funds

As capital expenditure remains relatively stable, our focus is

on the alternative uses of funds between acquisitions, share

buy-backs and dividends. We have increasingly come to the view,

that currently, the markets favour consistent increases in

dividends and higher sustainable pay-out ratios, along with

anti-dilutive progressive buy-backs and, of course,

sensibly-priced, small- to medium-sized strategic acquisitions.

Buy-back strategy

Share buy-backs will continue to be targeted to absorb any share

dilution from issues of options or restricted stock in the range of

2-3% of the issued share capital. In addition, the Company does

also have considerable free cash flow to take advantage of any

anomalies in market values.

Acquisition strategy

There is still a very significant pipeline of reasonably priced

small- and medium-sized potential acquisitions, with the exception

perhaps of digital in the United States, where prices seem to have

got ahead of themselves because of pressure on competitors to catch

up. This is clearly reflected in some of the operational issues

that are starting to surface elsewhere in the industry,

particularly in fast growing markets like China, Brazil and India.

Transactions will continue to be focused on our strategy of new

markets, new media and data investment management, including the

application of new technology, big data and content. Net

acquisition spend is currently targeted at around £300 to £400

million per annum. We will continue to seize opportunities in line

with our strategy to increase the Group’s exposure to:

- Faster growing geographic markets and

sectors

- New media and data investment

management, including the application of technology and big

data

Last but not least………

A powerhouse of talent

No company in the world has a greater or more varied repertory

of talent than WPP. And never has the availability of that talent

been more necessary.

In their continued search for profitable growth, marketing

companies around the world, as always, have two basic routes to

follow: to contain cost; and to add value. These are not

alternatives: the best companies master both.

To cut cost requires discipline and constant attention to

detail. The undoubted benefits it can deliver are finite: there

must always be a limit beyond which a business will suffer. To add

value requires a different set of skills; it demands a conscious

application of the human imagination; and its potential benefits

are limitless.

As marketing companies exhaust their restricted opportunities to

become more efficient - to prune costs, to buy more shrewdly - so

their need to add value to their offering becomes ever more

critical.

The powerhouse of talent that WPP represents exists precisely to

meet that need.

First, we recruit, train, reward and incentivise that talent.

And then we apply that talent, across all relevant skills,

according to the individual needs of each individual client.

To do this successfully, to be able to harness shared enthusiasm

across traditional disciplines, means breaking down some

traditional silos; which is why we call our method horizontality.

To the client, our service, however many distinct skills it may

comprise, must seem to be seamless.

In the immediate future, as demand for fully integrated

marketing services continues to increase, and as their benign

effect on client company results becomes ever more evident, WPP

will be simplifying its corporate structure; making access to that

powerhouse of talent even easier.

To access WPP's 2017 preliminary results financial tables,

please visit www.wpp.com/investor

This announcement has been filed at the Company Announcements

Office of the London Stock Exchange and is being distributed to all

owners of Ordinary shares and American Depository Receipts. Copies

are available to the public at the Company’s registered office.

The following cautionary statement is included for safe harbour

purposes in connection with the Private Securities Litigation

Reform Act of 1995 introduced in the United States of America. This

announcement may contain forward-looking statements within the

meaning of the US federal securities laws. These statements are

subject to risks and uncertainties that could cause actual results

to differ materially including adjustments arising from the annual

audit by management and the Company’s independent auditors. For

further information on factors which could impact the Company and

the statements contained herein, please refer to public filings by

the Company with the Securities and Exchange Commission. The

statements in this announcement should be considered in light of

these risks and uncertainties.

1 The Group has changed the description of ‘net sales’ to

‘revenue less pass-through costs’ based on the upcoming adoption of

new accounting standards and recently issued regulatory guidance

and observations. There has been no change in the way that this

measure is calculated 2 Percentage change in reported sterling 3

Percentage change at constant currency exchange rates 4 Headline

earnings before interest, tax, depreciation and amortisation 5

Headline profit before interest and tax 6 Diluted earnings per

share based on headline earnings 7 Diluted earnings per share based

on reported earnings 8 Return on equity is headline diluted EPS

divided by equity share owners funds per share 9 Percentage change

at constant currency exchange rates 10 Like-for-like growth at

constant currency exchange rates and excluding the effects of

acquisitions and disposals 11 Ranked by market capitalisation as at

1 March 2018 12 Short and long-term incentives and the cost of

share-based incentives 13 Costs of services and general and

administrative costs, excluding pass-through costs, goodwill

impairment, amortisation of acquired intangibles, investment gains

and write-downs (in 2017 exceptional gains were £129 million,

investment write-downs of £96 million, restructuring charges and

costs in relation to the IT transformation project were £57

million) 14 Percentage change at constant currency exchange rates

15 Like-for-like growth at constant currency exchange rates and

excluding the effects of acquisitions and disposals 16 Asia

Pacific, Latin America, Africa & Middle East and Central &

Eastern Europe 17 Bangladesh, Egypt, Indonesia, South Korea,

Mexico, Nigeria, Pakistan, Philippines, Vietnam and Turkey - the

Group has no operations in Iran (accounting for over $975 million

revenue, including associates) 18 Colombia, Indonesia, Vietnam,

Egypt, Turkey and South Africa (accounting for over $895 million

revenue, including associates) 19 Mexico, Indonesia, South Korea

and Turkey (accounting for over $695 million revenue, including

associates) 20 Percentage change at constant currency exchange

rates 21 Like-for-like growth at constant currency exchange rates

and excluding the effects of acquisitions and disposals 22

Advertising, Media Investment Management 23 Public Relations &

Public Affairs 24 Brand Consulting, Health & Wellness and

Specialist Communications (including direct, digital and

interactive)

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180301005625/en/

WPPFor further information:Sir Martin Sorrell, Paul Richardson,

Lisa Hau+44 20 7408 2204orChris Wade, Kevin McCormack, Fran

Butera+1 212 632 2235orJuliana Yeh+852 2280 3790wppinvestor.com

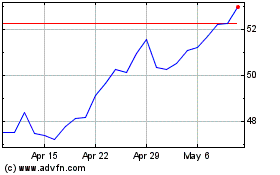

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024