Bayer to Sell More Assets to Win Approval for Monsanto Deal -- 2nd Update

February 28 2018 - 10:38AM

Dow Jones News

By Zeke Turner and Natalia Drozdiak

German chemical giant Bayer AG on Wednesday said it would sell

more assets to win antitrust approval for its $60 billion-plus

takeover of Monsanto Co., as it inches toward completing its

regulatory reviews.

Chief Executive Werner Baumann said the company was preparing

the sale of another bundle of assets after agreeing in October to

sell parts of its crop-science business to rival BASF SE for $7

billion.

"We have now also committed to divest our entire vegetable-seed

business, " Mr. Baumann said, adding that additional businesses may

be sold or licensed. He declined to say what the assets could be

worth of what share of Bayer's revenue they could represent.

Those assets could also be sold to BASF, according to people

familiar with the matter. In addition Bayer has agreed to grant

BASF a license for its digital-farming data, the people said.

The review by the European Commission, the bloc's antitrust

regulator, appears headed toward conditional approval, people

familiar with the matter say. The commission, which has flagged

concern that the deal could pressure farmers, is expected to decide

by April 5, though the regulator could issue its ruling

earlier.

Bayer has faced delays in winning antitrust approval in the U.S.

and Europe over its plans to buy the U.S. seed maker, a deal which

will create an industrial powerhouse and tilt the German company

heavily toward agriculture in a long-term bet on high-tech crops.

The delays are partly because of negotiations over asset sales and

the large amount of documents regulators have to wade through as

part of their probes. A review by the U.S. Department of Justice is

also ongoing.

Mr. Baumann expressed optimism that the deal would ultimately

win regulatory approval, with the Committee on Foreign Investment

in the U.S., or CFIUS, and authorities in Brazil already giving the

nod.

Bayer is now aiming to complete the takeover of the St.

Louis-based company in the second quarter, having previously hoped

to close in early 2018. The deal was struck in September 2016 amid

a wave of consolidation in the industry.

Bayer said the enterprise value of the Monsanto takeover has now

fallen to $62.5 billion, from $66 billion, after the U.S. company

paid down some of its debts.

The update on the deal came as Bayer reported

worse-than-expected fourth-quarter earnings and guidance, prompting

its shares to fall 3%.

The company said net profit fell 67% in the last three months of

2017 to EUR148 million ($181 million), compared with EUR453 million

a year earlier, and below forecasts of EUR745 million.

Earnings were hit by a EUR455 million charge related to U.S. tax

reform and ongoing difficulties with its crop-science business in

Brazil, a key agricultural market that has been batting its way out

of a recession.

All of Bayer's business units reported lower quarterly sales and

all but pharmaceuticals posted lower operating profit.

Full-year net profit rose nearly 62% to EUR7.34 billion. The

discrepancy with the weak fourth quarter is partly related to the

sell down of its stake in Covestro AG in late 2017.

This year Bayer executives hope to get a boost from the Monsanto

deal but on Wednesday the company said it expects sales and

earnings to remain at 2017 levels.

The forecast includes expected supply interruptions because of

plant maintenance. Adjusted for currency effects and changes to its

portfolio, including the takeover, Bayer said it expects sales to

increase by a low-to mid-single-digit percentage.

However, Bayer said it remains in good financial shape for the

Monsanto takeover. It has reduced its net debt by nearly 70% over

the past year to EUR3.6 billion, largely because of the sale of

most of its stake in Covestro. Bayer continues to hold 14.2% in the

plastics company, which it separated from in 2015. Its pension

trust holds another 8.9%, the company said.

--Nathan Allen contributed to this article.

Write to Zeke Turner at Zeke.Turner@wsj.com and Natalia Drozdiak

at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

February 28, 2018 10:23 ET (15:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

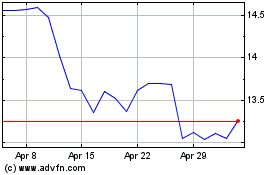

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

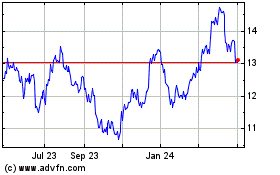

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024