UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of The Securities Exchange Act of 1934

Turner

Valley Oil & Gas, Inc.

|

|

|

|

|

|

(Exact

name of Registrant as specified in its charter)

|

|

|

Nevada

|

|

45-8510376

|

|

|

|

|

|

(State

or jurisdiction of formation)

|

|

(I.R.S.

Employer Identification No.)

|

Attn:

Steve Helm

3270

Sul Ross St., Houston Texas 77098

713-588-9453

Securities

to be registered pursuant to Section 12(b) of the Act:

|

Title

of each class each class is to be registered

|

|

Name

of each exchange on which to be so registered

|

|

|

|

|

|

Class

A Common Stock (par: $0.001)

|

|

OTC

Markets

|

Securities

to be registered pursuant to Section 12(g) of the Act:

None

(Title

of class)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company.

|

Large

accelerated filer

|

☐

|

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

|

Smaller

reporting company

|

☒

|

|

(Do

not check if a smaller reporting company)

|

|

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table

of Contents

Item

1. Business.

OVERVIEW

AND RECENT DEVELOPMENTS

Turner

Valley Oil and Gas, Inc. (“Turner” or the “Company”) was incorporated under the laws of Nevada on April

21, 1999 as NetParts.com. The Company was originally organized to create a series of specialized auto salvage yards whereby the

salvageable components would be inventoried on a computer and listed on the internet. The Company, however, changed their operations

and its name on July 24, 2003 to Turner Valley Oil & Gas Corporation and entered the oil and gas industry through multiple

oil and gas leases located in the Western Canada. In 2009, the Company received the last oil and gas revenues and has subsequently

written off the remaining assets. In 2017, the Management is once again seeking to restructure the Company.

The

Company has finalized its phase 1 infrastructure and shipping acquisition agreement in conjunction with the Preferred Stock

placement with Network 1 Securities, Inc. (“Network 1”). The Company has executed a conditional Purchase and Sale

Agreement (“Agreement”) through a portfolio company of a multi-generational family office based in Dubai, United

Arab Emirates. This agreement remains subject to closing conditions which Turner and counterparties are working to meet by

early March 2018. This family office has investments and operating businesses that include dry shipping, crude shipping,

natural resource development, construction, civil engineering, and banking. Their investment into Turner will focus on

bitumen (also known as asphalt), and the supply chain and transportation of bitumen.

Turner

has structured the Preferred Stock placement to exchange Series A shares with cash and assets from the anchor investor and third

party sellers. The transaction includes the issuance of 25,000,000 Series A Preferred Shares, convertible at a ratio of 2 to 1,

with a minimum price per share of $1.00 in exchange for vessels and capital. This structure protects both insiders and retail investors

from dilution to Turner’s common stock structure.

This

transaction allows for capital to be deployed as a bolt on to each vessel as they come under Turner’s control. Already,

two (2) ships have been committed to the placement under the Series A Preferred Share structure. The initial commitment under

the Agreement is approximately $15 Million of cash and assets. The vessels are undergoing third party appraisal which will determine

their fair value. The remaining balance of the initial raise will be used to secure additional shipping vessels during the extend

phase of Turner’s shipping acquisition.

The

newly expanded company will focus on all segments of the bitumen industry, including real assets, energy, infrastructure, and

the supply chain. Turner has agreed to amend its previous name change plans to reflect the new business model moving forward.

As a result, a proposed name change for shareholder approval to PrimeStar Bitumen, Inc. is forthcoming. A ticker symbol change

will also initiate once the name change is approved by FINRA.

Upon

completion of the transfer of committed assets and capital, Turner expects to expand its Board of Directors by appointing several

new members in addition to current board member and Turner CEO, Steve Helm. Furthermore, new management, with decades of shipping

experience, are expected to join the Board of Directors. Included in this transition will be a new CEO, administration, and the

current Chairman of the family office will take on the same title at the new company.

EMPLOYEES

As

of September 30, 2017, the Company had two officers and no additional employees or financial obligations associated with previous

employment agreements.

TAXATION

OF THE COMPANY

Turner

Valley Oil and Gas, Inc. has not earned taxable income since the change of control in 2007 and is not a current tax filer.

Regulatory

Matters

Not

applicable

Legal

Proceedings

None

Item

1A. Risk Factors.

This

investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below

and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and

financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your

investment.

Risks

Related to Our Company

Turner

has going concern conditions.

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has

suffered recurring operating losses and is dependent upon raising capital to continue operations. The financial statements do

not include any adjustments that might result from the outcome of this uncertainty.

Turner

have a limited operating history which may not be an indicator of our future results.

We

are transitioning Turner from one industry to another with a limited capital base. Turner has sought opportunities to take the

company forward and the financial alternatives needed to launch those ventures. We have no operating history investors may use

to evaluate our future performance. As a result of our limited operating history, our plan for rapid growth, and the increasingly

competitive nature of the markets in which we operate, the historical financial data is of limited value in evaluating our future

revenue and operating expenses. Our planned expense levels will be based in part on expectations concerning future revenue, which

is difficult to forecast accurately based on current plans of expansion and growth. We may be unable to adjust spending in a timely

manner to compensate for any unexpected shortfall in revenue. Further, general and administrative expenses may increase significantly

as we expand operations. To the extent that these expenses precede, or are not rapidly followed by, a corresponding increase in

revenue, our business, operating results, and financial condition will suffer.

Turner

may not achieve profitability or positive cash flow.

Our

ability to achieve and maintain profitability and positive cash flow will be dependent upon such factors as our ability to enter

a new business sector and successfully operate in that sector. Based upon current plans, we expect to incur operating losses in

future periods until Turner is established in a new sector because we expect to incur expenses that will exceed revenues until

this transition takes place. We cannot guarantee that we will be successful in generating sufficient revenues to support operations

in the future.

Our

Company’s success is dependent upon closing of the executed purchase and sale agreement.

Our

ability to move forward in the bitumen shipping business is dependent upon several conditions occurring prior to

closing, detailed in the purchase and sale agreement. These conditions include; filing Form 10 with the Securities and

Exchange Commission (SEC), assignment of new board members, name change and appointment of new officers.

Turner

management has not operated a bitumen transportation company.

Our

ability to achieve and maintain profitability and positive cash flow in an industry in which Turner management has not operated

cannot be forecast with any accuracy. Future management has been identified but there is no guarantee they will transition to

Turner successfully. If Turner fails to acquire the bitumen vessels or new management contracted under the purchase and sale agreement

it will likely have a detrimental effect on future expectations.

Our

business is subject to changing regulations related to corporate governance and public disclosure that have increased both our

costs and the risk of noncompliance.

Because

our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange

entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities,

including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue

to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably

the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting

in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities

to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many

cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory

and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated

by ongoing revisions to our disclosure and governance practices.

Risks

Related to Our Securities

Our

stock price may be volatile, which may result in losses to our shareholders.

The

stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on

the OTC Pink and other similarly-tiered quotation boards have been volatile in the past and have experienced sharp share price

and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response

to many factors, including the following, some of which are beyond our control.

We

cannot predict the extent to which an active public market for trading our common stock will be sustained. This situation is attributable

to a number of factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers,

institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the

attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase

of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may

be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer

which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect

on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will

develop or be sustained, or that current trading levels will be sustained.

Because

the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling

to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment

to decline.

Our

shares are classified as penny stocks and are covered by Section 15(g) of the Exchange Act, which imposes additional sales practice

requirements on brokers-dealers who sell our securities. For sales of our securities, broker dealers must make a special suitability

determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the

foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This

could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial

Industry Regulatory Authority (FINRA) sales practice requirements may limit your ability to buy and sell our common stock, which

could depress the price of our shares.

FINRA

rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending

that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers,

broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and

investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability

such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more

difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell

our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Our

common stock is subject to the “penny stock” rules of the SEC and the trading market in our securities is limited,

which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The

Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for

the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price

of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules

require:

|

|

●

|

that

a broker or dealer approve a person’s account for transactions in penny stocks;

and

|

|

|

●

|

the

broker or dealer receive from the investor a written agreement to the transaction, setting

forth the identity and quantity of the penny stock to be purchased.

|

In

order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

|

●

|

obtain

financial information and investment experience objectives of the person; and

|

|

|

●

|

make

a reasonable determination that the transaction in penny stocks are suitable for that

person and the person has sufficient knowledge and experience in financial matters to

be capable of evaluating the risks of transactions in penny stocks.

|

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission

relating to the penny stock market, which, in highlight form:

|

|

●

|

sets

forth the basis on which the broker or dealer made the suitability determination; and

|

|

|

●

|

that

the broker or dealer received a signed, written agreement from the investor prior to

the transaction.

|

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make

it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the

commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the

rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to

be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny

stocks.

Risks

Related to Our Industry

Risks

related to the energy transportation and shipping industry Turner is entering contains a number of risks that have been considered

carefully. The highly cyclical nature of the industry may lead to volatile changes in charter rates and vessel values, which could

adversely affect the Company’s earnings and available cash.

The

tanker industry is both cyclical and volatile in terms of charter rates and profitability. Fluctuations in charter rates and vessel

values result from changes in supply and demand both for tanker capacity and for oil and oil products. Factors affecting these

changes in supply and demand are generally outside of the Company’s control. The nature, timing and degree of changes in

industry conditions are unpredictable and could adversely affect the values of the Company’s vessels or result in significant

fluctuations in the amount of charter revenues the Company earns, which could result in significant volatility in quarterly results

and cash flows. Factors influencing the demand for tanker capacity include:

|

|

●

|

Supply

and demand for, and availability of, energy resources such as oil, oil products and natural

gas, which affect customers’ need for vessel capacity;

|

|

|

●

|

Global

and regional economic and political conditions, including armed conflicts, terrorist

activities and strikes, that among other things could impact the supply of oil, as well

as trading patterns and the demand for various vessel types;

|

|

|

●

|

Regional

availability of refining capacity and inventories;

|

|

|

●

|

Changes

in the production levels of crude oil (including in particular production by OPEC, the

United States and other key producers);

|

|

|

●

|

Changes

in seaborne and other transportation patterns, including changes in the distances that

cargoes are transported, changes in the price of crude oil and changes to the West Texas

Intermediate and Brent Crude Oil pricing benchmarks;

|

|

|

●

|

Environmental

and other legal and regulatory developments and concerns;

|

|

|

●

|

Construction

or expansion of new or existing pipelines or railways;

|

|

|

●

|

Weather

and natural disasters;

|

|

|

●

|

Competition

from alternative sources of energy; and

|

|

|

●

|

International

sanctions, embargoes, import and export restrictions or nationalizations and wars.

|

|

|

●

|

The

number of newbuilding deliveries;

|

|

|

●

|

The

scrapping rate of older vessels;

|

|

|

●

|

The

number of vessels being used for storage;

|

|

|

●

|

The

conversion of vessels from transporting oil and oil products to carrying dry bulk cargo

or vice versa;

|

|

|

●

|

The

number of vessels that are removed from service;

|

|

|

●

|

Availability

and pricing of other energy sources such as natural gas for which tankers can be used

or to which Construction capacity may be dedicated;

|

Many

of the factors that influence the demand for tanker capacity will also, in the longer term, effectively influence the supply of

tanker capacity, since decisions to build new capacity, invest in capital repairs, or to retain in service older obsolescent capacity

are influenced by the general state of the marine transportation industry from time to time. The market value of vessels fluctuates

significantly, which could adversely affect liquidity or otherwise adversely affect its financial condition. The market value

of vessels has fluctuated over time. The fluctuation in market value of vessels over time is based upon various factors, including:

Jones Act vessel market values have, on average, generally declined over the past several years. In addition, as vessels grow

older, they generally decline in value. These factors will affect the value of the Company’s vessels at the time of any

vessel sale. If a vessel is sold at a sale price that is less than the vessel’s carrying amount on the Company’s financial

statements, the Company will incur a loss on the sale and a reduction in earnings and surplus. In addition, declining values of

the Company’s vessels could adversely affect the Company’s liquidity by limiting its ability to raise cash by refinancing

vessels. Declines in charter rates and other market deterioration could cause the Company to incur impairment charges.

The

Company evaluates events and changes in circumstances that have occurred to determine whether they indicate that the carrying

amount of the vessel assets might not be recoverable. This review for potential impairment indicators and projection of future

cash flows related to the vessels is complex and requires the Company to make various estimates, including future freight rates,

earnings from the vessels, market appraisals and discount rates. All of these items have historically been volatile. The Company

evaluates the recoverable amount of a vessel asset as the sum of its undiscounted estimated future cash flows. If the recoverable

amount is less than the vessel’s carrying amount, the vessel’s carrying amount is then compared to its estimated fair

value, which is determined using vessel appraisals or discounted estimated future cash flows. If the vessel’s carrying amount

is less than its fair value, it is deemed impaired. The carrying values of the Company’s vessels may differ significantly

from their fair market value. An increase in the supply of vessels without a commensurate increase in demand for such vessels

could cause charter rates to decline, which could adversely affect revenues, profitability and cash flows, as well as the value

of its vessels. The marine transportation industry has historically been highly cyclical, as the profitability and asset values

of companies in the industry have fluctuated based on changes in the supply and demand of vessels. Given the smaller number of

tankers operating in the U.S. domestic market, even a limited increase in capacity supply may negatively impact the market and

may have a material adverse effect on revenues, profitability and cash flows. Shipping is a business with inherent risks, and

insurance may not be adequate to cover its losses. Vessels and their cargoes are at risk of being damaged or lost because of events

including, but not limited to:

|

|

●

|

Port

or canal congestion; and

|

|

|

●

|

Environmental

and maritime regulations.

|

|

|

●

|

General

economic and market conditions affecting the tanker industry, including the availability

of vessel financing;

|

|

|

●

|

Number

of vessels in the Jones Act fleet;

|

|

|

●

|

Types

and sizes of vessels available;

|

|

|

●

|

Changes

in trading patterns affecting demand for particular sizes and types of vessels;

|

|

|

●

|

Prevailing

level of charter rates;

|

|

|

●

|

Competition

from other shipping companies and from other modes of transportation; and

|

|

|

●

|

Technological

advances in vessel design and propulsion.

|

In

addition, transporting crude oil is at risk of business interruptions due to labor strikes, port closings and boycotts. These

hazards may result in death or injury to persons; loss of revenues or property; environmental damage; higher insurance rates;

damage to customer relationships; and market disruptions, delay or rerouting, which may also subject the Company to litigation.

In addition, the operation of tankers has unique operational risks associated with the transportation of oil. An oil spill may

cause significant environmental damage and the associated costs could exceed the insurance coverage available to the Company.

Compared to other types of vessels, tankers are also exposed to a higher risk of damage and loss by fire, whether ignited by a

terrorist attack, collision, or other cause, due to the high flammability and high volume of the oil transported in tankers. Furthermore,

any such incident could seriously damage reputation and cause the Company either to lose business or to be less likely to enter

into new business (either because of customer concerns or changes in customer vetting processes). Any of these events could result

in loss of revenues, decreased cash flows and increased costs. While the Company carries insurance to protect against certain

risks involved in the conduct of its business, risks may arise against which the Company is not adequately insured. Any such failure

could have a material adverse effect on revenues, profitability and cash flows.

Shippers

must comply with complex foreign and U.S. laws and regulations, such as the U.S. Foreign Corrupt Practices Act, the U.K. Bribery

Act and other local laws prohibiting corrupt payments to government officials, anti-money laundering laws; and anti-competition

regulations. Moreover, the shipping industry is generally considered to present elevated risks in these areas. Violations of these

laws and regulations could result in fines and penalties, criminal sanctions, restrictions on the Company’s business operations

and on the Company’s ability to transport cargo to one or more countries, and could also materially affect the Company’s

brand, ability to attract and retain employees, international operations, business and operating results. Although the company

will maintain policies and procedures designed to achieve compliance with these laws and regulations, the company cannot be certain

that its employees, contractors, joint venture partners or agents will not violate these policies and procedures. Operations may

also subject its employees and agents to extortion attempts. Changes in fuel prices may adversely affect profits. Fuel is a significant,

if not the largest, expense in the Company’s shipping operations when vessels are under voyage charter.

Accordingly,

an increase in the price of fuel may adversely affect the Company’s profitability if these increases cannot be passed onto

customers. The price and supply of fuel is unpredictable and fluctuates based on events outside the Company’s control, including

geopolitical developments; supply and demand for oil and gas; actions by OPEC, and other oil and gas producers; war and unrest

in oil producing countries and regions; regional production patterns; and environmental concerns. Fuel may become much more expensive

in the future, which could reduce the profitability and competitiveness of the Company’s business compared to other forms

of transportation. Public health threats could have an adverse effect on the Company’s operations and financial results.

Public

health threats and other highly communicable diseases, outbreaks of which have already occurred in various parts of the world

near where shippers operate, could adversely impact the Company’s operations, the operations of the Company’s customers

and the global economy, including the worldwide demand for crude oil and the level of demand for services. Any quarantine of personnel,

restrictions on travel to or from countries in which the Company operates, or inability to access certain areas could adversely

affect the Company’s operations. Travel restrictions, operational problems or large-scale social unrest in any part of the

world in which the Company operates, or any reduction in the demand for tanker services caused by public health threats in the

future, may impact operations and adversely affect the Company’s financial results.

Acts

of piracy on ocean-going vessels could adversely affect the Company’s business. The frequency of pirate attacks on seagoing

vessels remains high, particularly in the western part of the Indian Ocean, off the west coast of Africa and in the South China

Sea. If piracy attacks result in regions in which the Company’s vessels are deployed being characterized by insurers as

“war risk” zones, as the Gulf of Aden has been, or Joint War Committee “war and strikes” listed areas,

premiums payable for insurance coverage could increase significantly, and such insurance coverage may become difficult to obtain.

Crew costs could also increase in such circumstances due to risks of piracy attacks. In addition, while he Company believes the

charterer remains liable for charter payments when a vessel is seized by pirates, the charterer may dispute this and withhold

charter hire until the vessel is released. A charterer may also claim that a vessel seized by pirates was not “on-hire”

for a certain number of days and it is therefore entitled to cancel the charter party, a claim the Company would dispute. The

Company may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on the

Company. In addition, hijacking as a result of an act of piracy against the Company’s vessels, or an increase in the cost

(or unavailability) of insurance for those vessels, could have a material adverse impact on business, financial condition, results

of operations and cash flows. Such attacks may also impact the Company’s customers, which could impair their ability to

make payments to the Company under its charters. Terrorist attacks and international hostilities and instability can affect the

tanker industry, which could adversely affect business. Terrorist attacks, the outbreak of war, or the existence of international

hostilities could damage the world economy, adversely affect the availability of and demand for crude oil and petroleum products

and adversely affect both the Company’s ability to charter its vessels and the charter rates payable under any such charters.

In addition, the Company operates in a sector of the economy that is likely to be adversely impacted by the effects of political

instability, terrorist or other attacks, war or international hostilities. In the past, political instability has also resulted

in attacks on vessels, mining of waterways and other efforts to disrupt international shipping, particularly in the Arabian Gulf

region. These factors could also increase the costs to the Company of conducting its business, particularly crew, insurance and

security costs, and prevent or restrict the Company from obtaining insurance coverage, all of which could have a material adverse

effect on business, financial condition, results of operations and cash flows.

Item

2. Financial Information.

The

following discussion should be read in conjunction with the financial statements and related notes that appear elsewhere in this

prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could

differ materially from those anticipated in these forward-looking statements. All forward-looking statements speak only as of

the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances

that exist after the date on which they are made.

Management’s

Discussion and Analysis or Plan of Operations

Certain

statements in this Report constitute “forward-looking statements.” Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors

that might cause such a difference include, among others, uncertainties relating to general economic and business conditions;

industry trends; changes in demand for our products and services; uncertainties relating to customer plans and commitments and

the timing of orders received from customers; announcements or changes in our pricing policies or that of our competitors; unanticipated

delays in the development, market acceptance or installation of our products and services; changes in government regulations;

availability of management and other key personnel; availability, terms and deployment of capital; relationships with third-party

equipment suppliers; and worldwide political stability and economic growth. The words “believe”, “expect”,

“anticipate”, “intend” and “plan” and similar expressions identify forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement

was made.

Plan

of Operations

Years

ended December 31, 2016 and 2015

The

Company did not generate any revenues during the years ended December 31, 2016 and 2015.

Cost

of Revenues

The

Company did not incur any cost of revenues in the years ended December 31, 2016 and 2015.

Operating

Expenses

Total

operating expenses for the year ended December 31, 2016 as compared to the year ended December 31, 2015, were $44,750 and $22,265,

respectively. The increase in operating expenses for the year ended December 31, 2016 is due to recognition of $35,200 in stock-based

compensation costs.

Interest

Expense

Total

interest expense for the year ended December 31, 2016 as compared to the year ended December 31, 2015, were $34,130 and $23,239,

respectively. The increase in interest expense for the year ended December 31, 2016 is primary due to additional interest expense

recorded by the Company for the fair value of common stock issued in excess of the carrying value of the debt converted.

Nine

Months ended September 30, 2017 and 2016

Revenues

The

Company did not generate any revenues during the nine months ended September 30, 2017 and 2016.

Cost

of Revenues

The

Company did not incur any cost of revenues for the nine month ended September 30, 2017 and 2016.

Operating

Expenses

Operating

expenses for the nine months ended September 30, 2017 and 2016 were $59,924 and $39,547, respectively. The increase

in operating expenses for the nine months ended September 30, 2017 is due to engaging number of experts and consultants to

pursue the Company’s acquisition in the bitumen shipping business.

Interest

Expense

Interest

expense for the nine months ended September 30, 2017 and 2016 was $171,108 and $29,598, respectively. The increase in interest

expense for the nine months ended September 30, 2017 is primarily due to additional interest expense of $161,141 recorded by the

Company for the fair value of common stock issued in excess of the carrying value of the debt converted.

Liquidity

and Capital Resources

Liquidity

is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise

operate on an ongoing basis. We have not generated revenues to fund our operating expenses. Current operating expenses and cash

needs are to pay accounting, stock transfer and attorney’s fees as the company does not have employee on the payroll or

additional expenses. At this time, the Company is dependent on directors funding and consultants willing to take common stock

as compensation to support its operations.

Following

table summarizes the Company’s cash flows for the years ended December 31, 2016 and 2015 and for the nine months ended September

30, 2017 and 2016:

|

|

|

For the Nine Months

|

|

|

For the Years

|

|

|

|

|

ended

September 30,

|

|

|

ended

December 31,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating

activities

|

|

$

|

(262

|

)

|

|

$

|

(5,670

|

)

|

|

$

|

(8,320

|

)

|

|

$

|

(12,278

|

)

|

|

Net cash used in investing activities

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Net cash provided by financing activities

|

|

|

100

|

|

|

|

5,910

|

|

|

|

8,560

|

|

|

|

12,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

$

|

(162

|

)

|

|

$

|

240

|

|

|

$

|

240

|

|

|

$

|

22

|

|

Years

ended December 31, 2016 and 2015

Net

cash used in operating activities was approximately $8,320 for the year ended December 31, 2016 as compared to approximately $12,278

for the year ended December 31, 2015.

Net

cash provided by financing activities for the year ended December 31, 2016 was $8,560 as compared to $12,300 for the year

ended December 31, 2015. During 2016, we received proceeds of $3,880 from advance from a related party. During fiscal 2015,

we received proceeds of $12,300 from a note payable from a related party.

Nine

Months ended September 30, 2017 and 2016

Net

cash used in operating activities was approximately $262 for the nine months ended September 30, 2017 as compared to approximately

$5,670 for the nine months ended September 30, 2016

Net

cash provided by financing activities for nine months ended September 30, 2017 was $100 as compared to $5,910 for nine months

ended September 30, 2016. During nine months ended September 30, 2017, we received proceeds of $100 from advance from a related

party. During the nine months ended September 30, 2016, we received proceeds of approximately $5,910 from advances from a related

party.

Going

Concern Consideration

As

reflected in the accompanying financial statements, the Company has generated no revenues from operations and has experienced

sustained losses. These raise doubt about the Company’s ability to continue as a going concern. The ability of the Company

to continue as a going concern is dependent on the Company’s ability to raise additional capital and implement its business

plan. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as

a going concern. Management believes the purchase and sale agreement negotiated and executed by Turner in the fourth quarter of

2017 provides a sustainable path forward to secure exposure to stable revenues, secure additional funding and implement its strategic

plans provide the opportunity for the Company to continue as a going concern.

Critical

Accounting Policies

The

discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have

been prepared in accordance with U.S. generally accepted accounting principles. The preparation of our financial statements requires

us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related

disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience

and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis

for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual

results may differ from these estimates under different assumptions or conditions.

Management

believes the following critical accounting policies affect the significant judgments and estimates used in the preparation of

the financial statements.

Use

of Estimates

In

preparing the consolidated financial statements, management is required to make estimates and assumptions that affect the reported

amounts of assets and liabilities as of the date of the consolidated balance sheet, and revenues and expenses for the period then

ended. Actual results may differ significantly from those estimates. Significant estimates made by management include, but are

not limited to, stock-based compensation and fair value of common stock issued.

Fair

Value of Financial Instruments

The

Company adopted ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”), for assets and liabilities

measured at fair value on a recurring basis. ASC 820 establishes a common definition for fair value to be applied to existing

generally accepted accounting principles that require the use of fair value measurements, establishes a framework for measuring

fair value and expands disclosure about such fair value measurements. The adoption of ASC 820 did not have an impact on the Company’s

financial position or operating results, but did expand certain disclosures.

ASC

820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date. Additionally, ASC 820 requires the use of valuation techniques that maximize

the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized below:

Level

1: Observable inputs such as quoted market prices in active markets for identical assets or liabilities

Level

2: Observable market-based inputs or unobservable inputs that are corroborated by market data

Level

3: Unobservable inputs for which there is little or no market data, which require the use of the reporting entity’s own

assumptions.

The

Company analyzes all financial instruments with features of both liabilities and equity under the FASB’s accounting standard

for such instruments. Under this standard, financial assets and liabilities are classified in their entirety based on the lowest

level of input that is significant to the fair value measurement. Depending on the product and the terms of the transaction, the

fair value of notes payable and derivative liabilities were modeled using a series of techniques, including closed-form analytic

formula, such as the Black-Scholes option-pricing model.

Stock-Based

Compensation

Stock-based

compensation is accounted for based on the requirements of the Share-Based Payment Topic of ASC 718 which requires recognition

in the consolidated financial statements of the cost of employee and director services received in exchange for an award of equity

instruments over the period the employee or director is required to perform the services in exchange for the award (presumptively,

the vesting period). The ASC also requires measurement of the cost of employee and director services received in exchange for

an award based on the grant-date fair value of the award.

Pursuant

to ASC Topic 505-50, for share-based payments to consultants and other third-parties, compensation expense is determined at the

“measurement date.” The expense is recognized over the vesting period of the award. Until the measurement date is

reached, the total amount of compensation expense remains uncertain. The Company initially records compensation expense based

on the fair value of the award at the reporting date.

Off-Balance

Sheet Arrangements

The

Company has no off-balance sheet arrangements.

Item

3. Properties.

The

Company currently maintains a corporate office at 3270 Sul Ross St. Houston, Texas 77098.

Item

4. Security Ownership of Certain Beneficial Owners and Management

The

following table lists, as of September 30, 2017, the number of shares of common stock of our Company that are beneficially owned

by: (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock;

(ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial

ownership of common stock by our principal shareholders and management is based upon information furnished by each person using

beneficial ownership‚ concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is

deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct

the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person

is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within

60 days.

Under

the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities,

and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial

interest. Except as noted below, each person has sole voting and investment power.

The

percentages below are calculated based on 104,014,137 shares of our common stock issued and outstanding as of September 30, 2017.

We do not have any outstanding options, or other securities exercisable for or convertible into shares of our common stock.

|

|

|

|

|

|

Amount and Nature of Beneficial

Ownership

|

|

|

Percent of

|

|

|

Name

of Beneficial Owner

|

|

|

Title

of Class

|

|

|

|

(1)

|

|

|

|

Class

(2)

|

|

|

Steve Helm (3)

|

|

Common

|

|

|

|

11,750,000

|

|

|

|

11.3

|

%

|

|

|

1.

|

The

number and percentage of shares beneficially owned is determined under the rules of the

SEC and the information is not necessarily indicative of beneficial ownership for any

other purpose. Under such rules, beneficial ownership includes any shares as to which

the individual has sole or shared voting power or investment power and also any shares,

which the individual has the right to acquire within 60 days through the exercise of

any stock option or other right. The persons named in the table have sole voting and

investment power with respect to all shares of common stock shown as beneficially owned

by them, subject to community property laws where applicable and the information contained

in the footnotes to this table.

|

|

|

2.

|

Based

on 104,014,137 issued and outstanding shares of common stock as of September 30, 2017.

|

|

|

3.

|

Steve

Helm is the Company’s CEO and Chairman of the Company’s Board.

|

Item

5. Directors and Executive Officers

Directors

and Executive Officers

The

table below sets forth the name and age of each executive officer of the Company and the date such executive officer was elected

to his current position with the Company. The term of office of each executive officer continues until the first meeting of the

Board of Directors of the Company immediately following the next annual meeting of its stockholders, and until the election and

qualification of his or her successor. There is no family relationship between the executive officers.

|

Name

|

|

Age

|

|

|

Position

Held

|

|

Since

|

|

|

Steve Helm

|

|

|

58

|

|

|

President and CEO

|

|

September 2013

|

|

|

Richard Adams

|

|

|

49

|

|

|

Chief Financial Officer

|

|

April 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steve

Helm

The

current chairman, sole member of the Board of Directors president and secretary of the Company, Steve Helm, was hired on September

10, 2013.

Over

the past 24 years, Steve Helm has served as a commercial real estate executive materially involved in the areas of finance, development/acquisition

and property management. Prior to joining New Regional Planning as its CFO, from 2004 -2009 Steve served as Regional Director

for Imperial Capital Bank/Bancorp (NYSE), launching the Texas/Rocky Mountain commercial real estate lending platform as part of

the firm’s national expansion.

In

that capacity, he opened and managed four commercial real estate loan production offices (Dallas, Austin, Denver & Kansas

City) covering the Texas, New Mexico, Oklahoma, Arkansas, Colorado and Kansas market areas and funded in excess of $500 million

of structured debt (construction & bridge) and portfolio permanent credit facilities from $500K to $20 million for all core

property types. Prior to Imperial, Steve was President of the family business, The Helm Companies, directing the ground up development,

re-development, financing and management of small retail and Class A, B & C multifamily.

During

his tenure with the family enterprise, Steve secured over $60 million of FHA (221 D-4 & 223F) and conventional bank debt as

well as LIHTC, private and mezzanine equity financing and supervised the management of a multifamily portfolio of 6 properties

comprising over 900 units. Steve has earned the National Apartment Assoc. CAPS Designation and is a CPM Candidate. Steve holds

an MBA from the Cox School of Business, Southern Methodist University and a BBA – Finance from the University of Texas at

Austin.

Rick

Adams

Mr.

Adams brings 25 years of experience from merchant banking, investing, trading, consulting and operations. During this time Mr.

Adams has structured and managed transactions and companies across the energy sector including upstream, midstream and field services.

Mr.

Adams earned a Bachelor’s of Business Administration from Baylor University in Economics and Statistics as well as a Masters

of Business Administration in Finance from University of St. Thomas. He has served as the chief executive for production companies

both public and private while providing consulting and capital advisory services for more than 12 years. Mr. Adams continues to

offer capital advisory services to the energy and mining sectors from Houston, Texas.

Compliance

with Section 16(a) of the Securities Exchange Act.

Section

16(a) of the Securities Exchange Act of 1934 requires executive officers and directors, and persons who beneficially own more

than 10% of any class of the Company’s equity securities to file initial reports of ownership and reports of changes in ownership

with the Securities and Exchange Commission (“SEC”). Executive officers, directors and beneficial owners of more than

10% of any class of the Company’s equity securities are required by SEC regulations to furnish the Company with copies of all

Section 16(a) forms they file. Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to the Company under

Rule 16a-3(d) during fiscal 2002, and certain written representations from executive officers and directors, the Company is unaware

of any required reports that have not been timely filed.

Board

Composition

Our

bylaws provide that the Board of Directors shall consist of one or more members. Each director of the Company serves for a term

of one year or until the successor is elected at the Company’s annual shareholders’ meeting and is qualified, subject

to removal by the Company’s shareholders. Each officer serves, at the pleasure of the Board of Directors, for a term of

one year and until the successor is elected at the annual meeting of the Board of Directors and is qualified. Steve Helm is the

only active member of the Board of Directors.

Significant

Employees

Other

than the above-named officers and directors, we have no full-time employees whose services are materially significant to our business

and operations.

Family

Relationships

There

are no familial relationships among any of our officers or directors. None of our directors or officers is a director in any other

reporting companies. The Company is not aware of any proceedings to which any of the Company‚ officers or directors, or

any associate of any such officer or director, is a party adverse to the Company or any of the Company‚ subsidiaries or

has a material interest adverse to it or any of its subsidiaries.

Involvement

in Legal Proceedings

Item

6. Executive Compensation.

Name

&

Principal

Position

|

Year

|

Salary

|

Bonus

|

Stock

Compensation

Accrued

|

Non-Equity

Incentive

Plan

Compensation

|

Nonqualified

Deferred

Compensation

Earnings

|

All

Other

Compensation

|

Total

|

|

Steve Helm, CEO

|

2017

|

-

|

-

|

9,000

|

-

|

-

|

-

|

9,000

|

|

|

2016

|

-

|

-

|

32,900

|

-

|

-

|

-

|

32,900

|

|

|

2015

|

-

|

-

|

6,100

|

-

|

-

|

-

|

6,100

|

|

|

|

|

|

|

|

|

|

|

|

Rick Adams, CFO

|

2017

|

-

|

-

|

21,000

|

-

|

-

|

-

|

21,000

|

Both

the CEO and CFO currently receive no cash compensation but are compensated in common stock. The CEO receives 1,000,000 shares

per year for services under a plan adopted by the board of directors and the CFO’s compensation is contracted formula based

on hours served and market stock price per share.

Employment

Agreements

Each

officer of the company has negotiated compensation terms with the company. Steve Helms’s agreement was adopted by resolution

of the board of directors whereby he is compensated 1,000,000 shares per year. Rick Adams agreement was adopted by contract disclosed

by 8K on May 22, 2017. The Company has no other formal employment agreements.

Compensation

of Directors

Mr.

Steve Helm is the only member of the board of directors and he does not receive any compensation for this service.

Item

7. Certain Relationships and Related Transactions, and Director Independence

Related

Party Transactions

During

the years ended December 31, 2016 and 2015, the Company received advances of $3,880 and $0, respectively, from its CEO.

During

the year ended December 31, 2016, the Company issued 3,425,000 shares to its CEO for services. These shares were recorded at their

grant date fair value of $35,200 by using the closing price of the Company’s common stock.

During

the year ended December 31, 2016, the Company issued 1,325,000 shares to its CEO for $2,650.

For

the Nine Months ended September 30, 2017 and 2016

During

the nine months ended September 30, 2017 and 2016, the Company received advances of $100 and $3,880, respectively, from its CEO.

Promoters

and Certain Control Person

During

the past five fiscal years, we have not had any promoters at any time.

Director

Independence

Our

securities are currently listed with OTC Markets and traded under the ticker symbol TVOG. This national securities exchange has

a requirement that a majority of directors be independent. Our board of directors has undertaken a review of the independence

of each director by the standards for director independence set forth in the NASDAQ Marketplace Rules. Under these rules, a director

is not considered to be independent if he or she also is an executive officer or employee of the corporation. Transactions the

Company is currently in the process of executing will cure these issues resulting in a board of directors with a majority of independent

directors.

Item

8. Legal Proceedings.

Item

9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters.

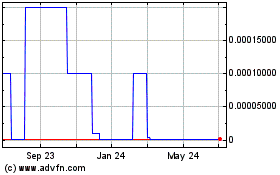

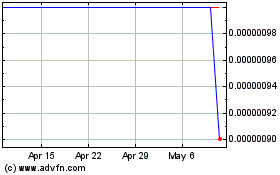

Our

common stock was is quoted by OTC Markets since June 6, 2014. The common stock is traded under the symbol “TVOG”.

As

of September 30, 2017, there were 104,014,137 shares of our common stock issued and outstanding, held by 2,028 stockholders of

record. Once this registration statement has been effective for 90 days, then all shares held by shareholders that are not affiliates

of the Company will be able to be sold, according to market conditions and market development.

We

have not issued any derivative securities, nor are there any warrants, options or other convertible securities outstanding.

We

have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the

foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors

and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed

relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

|

|

(e)

|

Securities

Authorized for Issuance under Equity Compensation Plans.

|

Both

the CEO and CFO are currently receive common stock compensation. The CEO receives 1,000,000 shares per year for services and the

CFO’s compensation is calculated based on hours required and market price per share.

Item

10. Recent Sales of Unregistered Securities.

Common

Stock

Turner

has issuances of unregistered securities which were exempt pursuant to Section 4(2) of the Securities Act, as they did not constitute

a public offering, nor was there advertising or commissions paid. Furthermore, no underwriters were used in connection with the

below issuances. Accordingly, the stock certificates representing these shares were issued with restrictive legends indicating

that the shares have not been registered and may not be traded until registered or otherwise exempt. All of the investors are

accredited investors as defined under the Securities Act.

Item

11. Description of Registrant’s Securities to be Registered.

The

following description of our capital stock is a summary and is qualified in its entirety by the provisions of our Certificate

of Incorporation, which has been filed as an exhibit to this registration statement.

Our

authorized capital stock (“Common Stock”), is 500,000,000 shares, with par value of, $0.001 per share.

Common

Stock

This

registration statement on Form 10 is to register shares of our common stock. We are authorized to issue 500,000,000 shares of

common stock, par value $0.001, of which 104,014,137 shares are issued and outstanding as of September 30, 2017. Each holder of

shares of our common stock is entitled to one vote for each share held of record on all matters submitted to the vote of stockholders,

including the election of Directors. The holders of shares of common stock have no preemptive, conversion, subscription or cumulative

voting rights. There is no provision in our Certificate of Incorporation or By-laws that would delay, defer, or prevent a change

in control of our Company.

Non-cumulative

Voting

Holders

of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding

shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in such event,

the holders of the remaining shares will not be able to elect any of our directors.

Transfer

Agent

Madison

Stock Transfer, Inc.

1688

East 16th Street

Brooklyn,

NY 11229

Main:

1-718-627-4453

Fax:

1-718-627-6341

Item

12. Indemnification of Directors and Officers.

Our

officers and directors are indemnified as provided by the Nevada Business Corporation Act and our Articles of Incorporation.

Under

the Nevada Business Corporation Act, director immunity from liability to a company or its shareholders for monetary liabilities

applies automatically unless it is specifically limited by a company’s Articles of Incorporation. Our Articles of Incorporation

do not specifically limit our directors’ immunity. Excepted from that immunity are: (a) a willful failure to deal fairly

with the company or its stockholders in connection with a matter in which the director has a material conflict of interest; (b)

a violation of criminal law, unless the director had reasonable cause to believe that his or her conduct was lawful or no reasonable

cause to believe that his or her conduct was unlawful; (c) a transaction from which the director derived an improper personal

profit; and (d) willful misconduct.

Our

Articles of Incorporation provide that we will indemnify our directors and officers to the fullest extent permitted by law, provided,

however, that we may modify the extent of such indemnification by individual contracts with our directors and officers; and, provided,

further, that we shall not be required to indemnify any director or officer in connection with any proceeding, or part thereof,

initiated by such person unless such indemnification: (a) is expressly required to be made by law, (b) the proceeding was authorized

by our board of directors, (c) is provided by us, in our sole discretion, pursuant to the powers vested in us under law or (d)

is required to be made pursuant to the bylaws.

Item

13. Financial Statements.

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

F-2

|

|

|

|

|

Balance Sheets as of December 31, 2016 and 2015

|

F-3

|

|

|

|

|

Statements of Operations for the Years Ended December 31, 2016 and 2015

|

F-4

|

|

|

|

|

Statements of Changes in Stockholders’ Deficit for the Years Ended December 31, 2016 and 2015

|

F-5

|

|

|

|

|

Statements of Cash Flows for the Years Ended December 31, 2016 and 2015

|

F-6

|

|

|

|

|

Notes to Financial Statements for Years Ended December 31, 2016 and 2015

|

F-7

|

|

|

|

|

Balance Sheets as of September 30, 2017 and December 31, 2016 (Unaudited)

|

F-13

|

|

|

|

|

Statements of Operations for the Nine Months Ended September 30, 2017 and 2016 (Unaudited)

|

F-14

|

|

|

|

|

Statements of Cash Flows for the Nine Months Ended September 30, 2017 and 2016 (Unaudited)

|

F-15

|

|

|

|

|

Notes to Financial Statements for the Nine Months Ended September 30, 2017 and 2016 (Unaudited)

|

F-16

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board

of Directors and Stockholders

Turner

Valley Oil and Gas, Inc.

Houston,

Texas

We

have audited the accompanying balance sheets of Turner Valley Oil and Gas, Inc. (the “Company”) as of December 31,

2016 and 2015, and the related statements of operations, changes in stockholders’ deficit, and cash flows for the years

then ended. The Company’s management is responsible for these financial statements. Our responsibility is to express

an opinion on these financial statements based on our audits.

We

conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those

standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are

free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control

over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing

audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness

of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting

principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

We believe that our audits provide a reasonable basis for our opinion.

In

our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Turner

Valley Oil and Gas, Inc. as of December 31, 2016 and 2015, and the results of its operations and its cash flows for the years

then ended, in conformity with accounting principles generally accepted in the United States of America.

The

accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed

in Note 3 to the financial statements, the Company has suffered recurring losses from operations and has a net capital deficiency

that raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters

are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this

uncertainty.

/s/

Briggs & Veselka Co.

Houston,

Texas

February

27, 2018

TURNER VALLEY OIL & GAS, INC.

Balance Sheets

As of December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

|

2015

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

262

|

|

|

$

|

22

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

262

|

|

|

$

|

22

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

23,975

|

|

|

$

|

16,646

|

|

|

Accrued expenses

|

|

|

35,667

|

|

|

|

51,263

|

|

|

Advances from related party

|

|

|

3,880

|

|

|

|

-

|

|

|

Loan payable

|

|

|

238,200

|

|

|

|

419,870

|

|

|

Total Liabilities

|

|

|

301,722

|

|

|

|

487,779

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001, 500,000,000 shares authorized, 86,086,470 and 80,336,470 shares issued and outstanding,

respectively

|

|

|

86,087

|

|

|

|

80,337

|

|

|

Preferred stock, par value $0.01, 4,000,000 shares authorized; 1,827,000 and 0 shares issued and outstanding, respectively

|

|

|

1,827

|

|

|

|

-

|

|

|

Additional paid in capital

|

|

|

5,012,618

|

|

|

|

4,755,018

|

|

|

Accumulated deficit

|

|

|

(5,401,992

|

)

|

|

|

(5,323,112

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Deficit

|

|

|

(301,460

|

)

|

|

|

(487,757

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

|

$

|

262

|

|

|

$

|

22

|

|

The accompanying notes are an integral part

to these financial statements.

TURNER VALLEY OIL & GAS, INC.

Statements of Operations

For the Years

Ended December 31, 2016 and 2015

|

|

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

|

|

|

Operating expense

|

|

$

|

44,750

|

|

|

$

|

22,265

|

|

|

Interest expense

|

|

|

34,130

|

|

|

|

23,239

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

78,880

|

|

|

$

|

45,504

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding

|

|

|

81,918,662

|

|

|

|

80,336,470

|

|

The accompanying notes are an integral part

to these financial statements.

|

TURNER VALLEY OIL & GAS, INC.

|

|

Statements of Changes in Stockholders’ Deficit

|

|

For

the Years Ended December 31, 2016 and 2015

|

|

|

|

Common Stock

|

|

|

Preferred Stock

|

|

|

Additional

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Paid-in Capital

|

|

|

Deficit

|

|

|

Total

|

|

|

Balances as at December 31, 2014

|

|

|

80,336,470

|

|

|

$

|

80,337

|

|

|

|

-

|

|

|

$

|

-

|

|

|

$

|

4,755,018

|

|

|

$

|

(5,277,608

|

)

|

|

$

|

(442,253

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(45,504

|

)

|

|

|

(45,504

|