Additional Proxy Soliciting Materials (definitive) (defa14a)

February 27 2018 - 8:58AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(

d

) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 23

, 2018

Stanley F

urniture Company, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

No. 0-14938

|

54-1272589

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

200 North Hamilton Street

, No. 200

High Point, North Carolina

|

|

27260

|

|

(Address of principal executive offices)

|

|

(Zip

Code)

|

|

|

|

|

|

Registrant

’s telephone number, including area code:

(336

)

884-770

0

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defin

ed in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to

use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01

Entry into a Material Definitive Agreement.

As previously reported, on December

7, 2017, Stanley Furniture Company, Inc. (the “Company”) entered into a letter of consent (the “Consent”) with Wells Fargo Bank, National Association (“Wells Fargo”), the lender under the Company’s current revolving credit facility, pursuant to which Wells Fargo consented to, and waived any events of default relating to the Company’s entry into the asset purchase agreement (the “Asset Purchase Agreement”) to sell substantially all of its assets (the “Asset Sale”) to Churchill Downs LLC (“Buyer”).

Pursuan

t to the terms of the Consent, the Company’s borrowing capacity under its existing revolving credit facility has been limited to $2 million (including the amount of any letters of credit) until February 28, 2018. The Consent also provided, among other things, that a failure to close the Asset Sale as contemplated by the Asset Purchase Agreement on or prior to February 28, 2018 constitutes an additional “event of default” under the Company’s credit facility.

On February

23, 2018, the Company and Wells Fargo entered into an additional consent letter pursuant to which Wells Fargo agrees to extend the period of time to close the Asset Sale and the $2 million limit on borrowing capacity until March 15, 2018 and provides that failure to close the Asset Sale on or prior to March 15, 2018 constitutes an additional “event of default” under the Company’s credit agreement.

Item

2.02

Results of Operations and Financial Condition.

During February 2018

, the Company, Inc. completed the sale of additional slow-moving inventory. The sale price for this inventory was less than the cost for this inventory and, as a result, the Company expects to record approximately $0.8 million in additional charges for obsolete and slow moving inventory in the fourth quarter of 2017. As a result, the Company now expects to report a net loss for the fourth quarter of 2017 of approximately $7.5 million rather than the previously expected net loss $6.7 million announced on January 23, 2018.

Forward-Looking Statements

Certain statements made

in this report are not based on historical facts, but are forward-looking statements. These statements can be identified by the use of forward-looking terminology such as “believes,” “estimates,” “expects,” “may,” “will,” “should,” “could,” or “anticipates,” or the negative thereof or other variations thereon or comparable terminology. These statements reflect our reasonable judgment with respect to future events and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those in the forward-looking statements. Such risks and uncertainties include the Company’s year-end audit has not been finalized and net loss may differ from the expected amount set forth above, as well as the other risks and uncertainties identified in filings by the Company with the Securities and Exchange Commission (“SEC”), including its periodic reports on Form 10-K and Form 10-Q. Any forward-looking statement speaks only as of the date of this report and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Regi

strant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

STANLEY FURNITURE COMPANY, INC.

|

|

|

|

|

|

|

|

Date:

February 27, 2018

|

By:

/s/ Anita W. Wimmer

|

|

|

Anita W. Wimmer

Vice President of Finance

(Principal Financial and Accounting Officer)

|

3

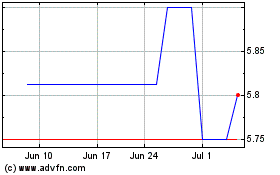

Stanley Furniture (QB) (USOTC:STLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

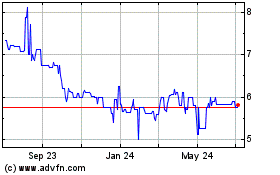

Stanley Furniture (QB) (USOTC:STLY)

Historical Stock Chart

From Apr 2023 to Apr 2024