Balchem Corporation (NASDAQ:BCPC) today reported for the fourth

quarter 2017 record quarterly net earnings of $42.0 million,

compared to net earnings of $15.9 million for the fourth quarter

2016. Record adjusted net earnings(a) were $21.9 million, compared

to $21.4 million in the prior year quarter. Record Adjusted

EBITDA(a) was $40.0 million, compared to $37.7 million in the prior

year quarter.

Fourth Quarter 2017 Financial Highlights:

- Fourth quarter net sales of $159.3 million in 2017, an increase

of 13.2%, compared to the fourth quarter of 2016.

- Year over year sales growth in each of our four Segments, with

record sales for our Human Nutrition & Health segment and

record fourth quarter sales for our Specialty Products segment,

resulting in earnings from operations growth in three of the four

segments.

- Record fourth quarter net earnings were $42.0 million, an

increase of $26.1 million, or 163.6% from the prior year, resulting

in earnings per share of $1.30, with the earnings favorably

impacted by a one-time $24.9 million tax benefit, primarily due to

the revaluation of deferred tax assets and liabilities associated

with the Tax Cuts and Jobs Act. Fourth quarter adjusted net

earnings of $21.9 million increased $0.5 million or 2.4% from the

prior year, resulting in adjusted earnings per share(a) of

$0.68.

- Fourth quarter adjusted EBITDA of $40.0 million increased $2.3

million or 6.1% from the prior year.

- Fourth quarter cash flows from operations were $31.2 million

for 2017 compared to $27.8 million for 2016. Scheduled and

accelerated principal payments made of $16.8 million on long-term

debt, with our revolver continuing to be fully available to provide

flexibility for both organic and acquisitive growth.

Full Year 2017 Financial

Highlights:

- Record full year sales of $594.8 million, an increase of 7.5%

over the prior year.

- Record net earnings of $90.1 million, resulting in record

earnings per share of $2.79, along with record adjusted net

earnings of $81.7 million and record adjusted earnings per share(a)

of $2.53.

- Adjusted EBITDA of $147.8 million compared with $149.3 million

from the prior year.

- Record full year 2017 cash flows from operations were $110.6

million compared to $107.6 million in 2016.

Recent Highlights:

- Paid a $13.4 million dividend on common stock of $0.42 per

share, which was nearly an 11% per share increase over the prior

year cash dividend. This dividend represented the ninth consecutive

increase in the annual dividend.

- The National Institutes of Health granted $2.6M to the

University of North Carolina Nutrition Research Institute for Dr.

Steven Zeisel to develop a test to determine the level of choline

present in humans. This grant followed a successful pilot study

performed by Dr. Zeisel, which was funded by Balchem.

- The American Academy of Pediatrics has identified choline as

one of the most essential brain building nutrients for infants and

young children in their first 1,000 days of life.

Ted Harris, Chairman, CEO, and President of

Balchem said, “We are very proud to report these fourth quarter

results as well as another full year of sales and earnings growth.

Our results in the fourth quarter reflected strong sales growth,

all-time record net earnings, and continued solid cash

generation.”

Mr. Harris added, “While we faced certain

headwinds in 2017, we are pleased with the strategic progress we

have made as a company, including the two acquisitions we made, the

earnings growth we delivered in three of our four business

segments, and the record cash flows from operations we

generated.”

| |

| Results for Period Ended December 31, 2017

(unaudited) |

| ($000 Omitted Except for Net Earnings per Share) |

| |

| For the Three Months Ended December

31, |

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

2016 |

| |

Unaudited |

| Net sales |

$ |

159,264 |

|

|

$ |

140,760 |

| Gross margin |

|

51,638 |

|

|

|

46,932 |

| Operating expenses |

|

24,972 |

|

|

|

22,341 |

| Earnings from

operations |

|

26,666 |

|

|

|

24,591 |

| Other expense |

|

2,144 |

|

|

|

1,792 |

| Earnings before income

tax expense |

|

24,522 |

|

|

|

22,799 |

| Income tax

expense |

|

(17,453 |

) |

|

|

6,875 |

| Net earnings |

$ |

41,975 |

|

|

$ |

15,924 |

| |

|

|

|

|

|

| Diluted net earnings

per common share |

$ |

1.30 |

|

|

$ |

0.50 |

| |

|

|

| Adjusted

EBITDA(a) |

$ |

39,992 |

|

|

$ |

37,684 |

| Adjusted net

earnings(a) |

$ |

21,889 |

|

|

$ |

21,382 |

| Adjusted net earnings

per common share(a) |

$ |

0.68 |

|

|

$ |

0.67 |

| |

|

|

| Shares used in the

calculations of diluted and adjusted net earnings per common

share |

|

32,305 |

|

|

|

32,074 |

| |

|

|

|

|

|

|

| |

| For the Year Ended December 31, |

|

|

|

|

|

|

|

2017 |

|

|

|

2016 |

| |

Unaudited |

| Net sales |

$ |

594,790 |

|

|

$ |

553,204 |

| Gross margin |

|

189,009 |

|

|

|

180,861 |

| Operating expenses |

|

91,754 |

|

|

|

90,023 |

| Earnings from

operations |

|

97,255 |

|

|

|

90,838 |

| Other expense |

|

8,767 |

|

|

|

7,904 |

| Earnings before income

tax expense |

|

88,488 |

|

|

|

82,934 |

| Income tax

expense |

|

(1,583 |

) |

|

|

26,962 |

| Net earnings |

$ |

90,071 |

|

|

$ |

55,972 |

| |

|

|

|

|

|

| Diluted net earnings

per common share |

$ |

2.79 |

|

|

$ |

1.75 |

| |

|

|

| Adjusted EBITDA(a) |

$ |

147,833 |

|

|

$ |

149,263 |

| Adjusted net

earnings(a) |

$ |

81,689 |

|

|

$ |

80,363 |

| Adjusted net earnings

per common share(a) |

$ |

2.53 |

|

|

$ |

2.52 |

| |

|

|

| Shares used in the

calculation of diluted and adjusted net earnings per common

share |

|

32,230 |

|

|

|

31,923 |

| |

|

|

(a)See “Non-GAAP Financial Information” for a

reconciliation of GAAP and non-GAAP financial measures.

Segment Financial Results for the Fourth Quarter of

2017:

The Human Nutrition &

Health segment generated record sales of $83.3 million, an

increase of $7.4 million or 9.8% compared to the prior year

quarter. The increase was primarily driven by added sales from the

IFP acquisition, strong choline nutrients and chelated minerals

volumes, and higher powder systems’ product sales into food and

beverage markets, partially offset by lower flavor systems’ sales.

Fourth quarter earnings from operations for this segment of $12.1

million increased $1.8 million, or 17.2%, from $10.3 million in the

prior year, with the benefits of the aforementioned sales growth

and a favorable mix contributing to improved margins and

profitability. Excluding the effect of non-cash expense associated

with amortization of acquired intangible assets for 2017 and 2016

of $5.8 million and $6.1 million, respectively, adjusted earnings

from operations(a) for this segment were $17.9 million, compared to

$16.4 million in the prior year quarter.

The Animal Nutrition &

Health segment sales of $44.6 million increased 4.7%, or

$2.0 million. The increased sales were primarily due to higher

monogastric species sales, partially offset by lower ruminant

species sales. Earnings from operations for the Animal Nutrition

& Health segment were slightly higher at $8.1 million as

compared to the prior year comparable quarter, as the

aforementioned higher sales were offset by mix. On a sequential

basis, results for the Animal Nutrition & Health segment

improved significantly, with sales up $6.5 million, or 17.2%, and

earnings from operations up $2.9 million, or 56.7%, on higher sales

and improved margins for both ruminant and monogastric species.

The Specialty Products segment

generated record fourth quarter sales of $16.5 million, a $0.3

million or 2.1% increase from the comparable prior year quarter,

driven by higher ethylene oxide sales for medical device

sterilization. Quarterly earnings from operations for this segment

were $4.8 million, versus $5.3 million in the prior year comparable

quarter, a decrease of $0.5 million or 9.3%, primarily due to mix

and higher raw

material costs. Excluding the effect of non-cash

expense associated with amortization of acquired intangible assets

for 2017 and 2016 of $0.8 million, adjusted earnings from

operations for this segment were $5.6 million, compared to $6.1

million in the prior year quarter.

The Industrial Products segment

sales of $14.9 million increased $8.7 million or 141.8% from the

prior year comparable quarter, primarily due to significantly

higher sales of choline and choline derivatives used in shale

fracking applications. Earnings from operations for the Industrial

Products segment were $2.0 million, an increase of $1.1 million, or

116.8%, compared with the prior year comparable quarter, and were

primarily a reflection of the aforementioned higher sales,

partially offset by certain higher raw material costs.

Consolidated gross margin for the quarter ended

December 31, 2017 of $51.6 million increased by $4.7 million or

10.0%, compared to $46.9 million for the prior year comparable

period. Gross margin as a percentage of sales decreased to 32.4% as

compared to 33.3% in the prior year comparative period. Adjusted

gross margin(a) for the quarter ended December 31, 2017 increased

10.1% to $52.4 million, as compared to $47.6 million for the prior

year comparable period. For the three months ended December 31,

2017, adjusted gross margin as a percentage of sales was 32.9%

compared to 33.8% in the prior year comparative period. The

decrease was primarily due to mix and higher raw material costs.

Operating expenses of $25.0 million for the fourth quarter were up

$2.6 million from the prior year comparable quarter, principally

due to the addition of IFP’s operating expenses, increased spending

in research and development, and certain compensation related

expenses. Excluding non-cash operating expense associated with

amortization of intangible assets of $5.9 million, operating

expenses were $18.8 million, or 11.8% of

sales.

Interest expense was $1.8 million in the fourth quarter of 2017.

Our effective tax rates for the three months ended December 31,

2017 and 2016 were (71.2%) and 30.2%, respectively. The company’s

effective tax rate for the three months ended December 31, 2017 is

lower primarily due to the impact of the Tax Cuts and Jobs Act (the

“Tax Reform Act”) and the excess tax benefits from stock-based

compensation, due to the adoption of ASU 2016-09, being recognized

as a decrease to the provision for income taxes (see Table 3). The

Tax Reform Act reduces the federal corporate tax rate from a

maximum of 35% to a flat 21% rate, modifies policies, credits, and

deductions and has international tax consequences. The rate

reduction is effective January 1, 2018. As a result, Balchem was

required to revalue its deferred tax assets and liabilities to

account for the future impact of lower corporate tax rates and

other provisions of the Tax Reform Act. During the fourth quarter

2017, Balchem recorded an income tax benefit of $24.9 million

related to the Tax Reform Act. The fourth quarter 2017 income tax

benefit may require further adjustments in 2018 due to anticipated

additional guidance from the U.S. Department of the Treasury,

changes in Balchem’s assumptions, completion of 2017 tax returns,

and further information and interpretations that become

available.

For the quarter ended December 31, 2017, cash

flows provided by operating activities were $31.2 million, and free

cash flow was $21.3 million. The $90.9 million of net working

capital on December 31, 2017 included a cash balance of $40.4

million, which reflects scheduled and accelerated principal

payments on long-term debt of $16.8 million, and capital

expenditures of $9.9 million in the fourth quarter of 2017. The

Company continues to invest in projects across all facilities to

improve capabilities and operating efficiencies.

Ted Harris said, “Our strong fourth quarter

results once again highlight the strength and resilience of our

business model. We are pleased with the quarterly sales growth in

all four of our segments, the record net earnings achieved, and

continued solid cash flows.”

Mr. Harris went on to add, “As we focus now on

2018, we will continue to drive strategic growth initiatives,

particularly in Human Nutrition & Health and Animal Nutrition

& Health, through both organic investments in new manufacturing

capabilities and new product development, as well as by pursuing

strategic acquisitions. In addition, the IFP integration is

progressing nicely, with significant synergies realized, and is

on

track to meet our expectations. The

further improvement in our balance sheet over the course of the

quarter and full availability of our revolver provide financial

strength as we continue to progress our aforementioned strategic

growth initiatives.”

Quarterly Conference CallA

quarterly conference call will be held on Tuesday, February 27,

2018, at 11:00 AM Eastern Time (ET) to review fourth quarter 2017

results. Ted Harris, Chairman of the Board, CEO and President,

Terry Coelho, CFO, and Bill Backus, CAO, will host the call. We

invite you to listen to the conference by calling toll-free

1-877-407-8289 (local dial-in 1-201-689-8341), five minutes prior

to the scheduled start time of the conference call. The conference

call will be available for replay two hours after the conclusion of

the call through end of day Tuesday, March 13, 2018. To access the

replay of the conference call, dial 1-877-660-6853 (local dial-in

1-201-612-7415), and use conference ID #13676648.

Segment InformationBalchem

Corporation reports four business segments: Human Nutrition &

Health; Animal Nutrition & Health; Specialty Products; and

Industrial Products. The Human Nutrition & Health segment

delivers customized food and beverage ingredient systems, as well

as key nutrients into a variety of applications across the food,

supplement and pharmaceutical industries. The Animal Nutrition

& Health segment manufactures and supplies products to numerous

animal health markets. Through Specialty Products, Balchem provides

specialty-packaged chemicals for use in healthcare and other

industries, and also provides chelated minerals to the

micronutrient agricultural market. The Industrial Products segment

manufactures and supplies certain derivative products into

industrial applications.

Forward-Looking StatementsThis

release contains forward-looking statements, which reflect

Balchem’s expectation or belief concerning future events that

involve risks and uncertainties. Balchem can give no assurance that

the expectations reflected in forward-looking statements will prove

correct and various factors could cause results to differ

materially from Balchem’s expectations, including risks and factors

identified in Balchem’s annual report on Form 10-K for the year

ended December 31, 2016. Forward-looking statements are qualified

in their entirety by the above cautionary statement. Balchem

assumes no duty to update its outlook or other forward-looking

statements as of any future date.

Contact: Mary Ann Brush, Balchem

Corporation (Telephone: 845-326-5600)

Selected Financial Data($ in

000’s)

| Business

Segment Net Sales: |

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

December 31, |

|

December 31, |

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

2016 |

| Human Nutrition &

Health |

$ |

83,273 |

|

$ |

75,853 |

|

$ |

15,796 |

|

$ |

297,134 |

| Animal Nutrition &

Health |

|

44,552 |

|

|

42,540 |

|

|

157,688 |

|

|

161,119 |

| Specialty Products |

|

16,542 |

|

|

16,207 |

|

|

73,355 |

|

|

70,126 |

|

Industrial Products |

|

14,897 |

|

|

6,160 |

|

|

47,951 |

|

|

24,825 |

|

Total |

$ |

159,264 |

|

$ |

140,760 |

|

$ |

594,790 |

|

$ |

553,204 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Business

Segment Earnings Before Income Taxes: |

|

|

|

|

Three Months Ended |

Year Ended |

|

|

December 31, |

December 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Human Nutrition &

Health |

$ |

12,068 |

|

|

$ |

10,300 |

|

|

$ |

44,010 |

|

|

$ |

38,156 |

|

| Animal Nutrition &

Health |

|

8,073 |

|

|

|

8,063 |

|

|

|

22,292 |

|

|

|

28,686 |

|

| Specialty Products |

|

4,824 |

|

|

|

5,321 |

|

|

|

24,949 |

|

|

|

22,862 |

|

| Industrial

Products |

|

2,016 |

|

|

|

930 |

|

|

|

6,413 |

|

|

|

1,949 |

|

| Transaction costs,

integration costs and legal settlement |

|

(315 |

) |

|

|

(23 |

) |

|

|

(2,496 |

) |

|

|

(815 |

) |

| Indemnification

settlement |

|

- |

|

|

|

- |

|

|

|

2,087 |

|

|

|

- |

|

| Interest and other

expense |

|

(2,144 |

) |

|

|

(1,792 |

) |

|

|

(8,767 |

) |

|

|

(7,904 |

) |

|

Total |

$ |

24,522 |

|

|

$ |

22,799 |

|

|

$ |

88,488 |

|

|

$ |

82,934 |

|

| Selected

Balance Sheet Items |

December 31, |

|

December 31, |

|

|

2017 |

|

2016 |

| Cash and Cash

Equivalents |

$ |

40,416 |

|

$ |

38,643 |

| Accounts Receivable,

net |

|

91,226 |

|

|

83,252 |

| Inventories |

|

60,696 |

|

|

57,245 |

| Other Current

Assets |

|

6,998 |

|

|

9,302 |

| Total Current

Assets |

|

199,336 |

|

|

188,442 |

| |

|

|

|

|

|

| Property, Plant &

Equipment, net |

|

189,793 |

|

|

165,754 |

| Goodwill |

|

441,361 |

|

|

439,811 |

| Intangible Assets With

Finite Lives, net |

|

128,073 |

|

|

147,484 |

| Other Assets |

|

5,073 |

|

|

7,135 |

| Total Assets |

$ |

963,636 |

|

$ |

948,626 |

| |

|

|

|

|

|

| Current

Liabilities |

$ |

73,396 |

|

$ |

66,008 |

| Current Portion of Long

Term-Debt |

|

35,000 |

|

|

35,000 |

| Long-Term Debt |

|

183,964 |

|

|

226,490 |

| Revolving Loan –

Long-Term |

|

- |

|

|

19,000 |

| Deferred Income

Taxes |

|

48,548 |

|

|

74,199 |

| Long-Term

Obligations |

|

5,847 |

|

|

6,896 |

| Total Liabilities |

|

346,755 |

|

|

427,593 |

| |

|

|

|

|

|

| Stockholders'

Equity |

|

616,881 |

|

|

521,033 |

| |

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

$ |

963,636 |

|

$ |

948,626 |

| |

|

|

|

|

|

| |

| Balchem CorporationCondensed

Consolidated Statements of Cash Flows(Dollars in

thousands)(unaudited) |

|

|

Year Ended December

31, |

|

|

|

2017 |

|

|

2016 |

|

| |

|

| Cash flows from

operating activities: |

|

| Net

earnings |

$ |

90,071 |

|

|

55,972 |

|

| Adjustments to

reconcile net earnings to net cash provided by operating

activities: |

|

|

| Depreciation and

amortization |

|

44,379 |

|

|

46,202 |

|

| Stock

compensation expense |

|

6,264 |

|

|

7,024 |

|

| Other

adjustments |

|

(28,114 |

) |

|

(6,319 |

) |

| Changes in

assets and liabilities |

|

(1,982 |

) |

|

4,733 |

|

|

Net cash provided by operating

activities |

|

110,618 |

|

|

107,612 |

|

|

|

|

|

| Cash flow from

investing activities: |

|

|

| Cash paid for

acquisition, net of cash acquired |

|

(17,393 |

) |

|

(110,601 |

) |

| Capital

expenditures and intangible assets acquired |

|

(28,095 |

) |

|

(23,993 |

) |

| Insurance

proceeds |

|

2,792 |

|

|

1,000 |

|

|

Net cash used in investing activities |

|

(42,696 |

) |

|

(133,594 |

) |

| |

|

|

| Cash flows from

financing activities: |

|

|

| Proceeds from

long-term and revolving debt |

|

25,000 |

|

|

72,500 |

|

| Principal

payments on long-term and revolving debt |

|

(89,384 |

) |

|

(89,384 |

) |

| Proceeds from

stock options exercised |

|

9,732 |

|

|

7,192 |

|

| Excess tax

benefits from stock compensation |

|

- |

|

|

2,546 |

|

| Dividends

paid |

|

(12,069 |

) |

|

(10,720 |

) |

| Other |

|

(1,905 |

) |

|

(1,588 |

) |

|

Net cash used in financing activities |

|

(68,626 |

) |

|

(19,454 |

) |

| |

|

|

| Effect of

exchange rate changes on cash |

|

2,477 |

|

|

(716 |

) |

| |

|

|

|

Increase/(Decrease) in cash and cash

equivalents |

|

1,773 |

|

|

(46,152 |

) |

| |

|

|

| Cash and cash

equivalents, beginning of period |

|

38,643 |

|

|

84,795 |

|

| Cash and cash

equivalents, end of period |

$ |

40,416 |

|

$ |

38,643 |

|

| |

|

|

Non-GAAP Financial Information

In addition to disclosing financial results in

accordance with United States (U.S.) generally accepted accounting

principles (GAAP), this earnings release contains non-GAAP

financial measures that we believe are helpful in understanding and

comparing our past financial performance and our future results.

The non-GAAP financial measures disclosed by the company exclude

certain business combination accounting adjustments and certain

other items related to acquisitions, certain unallocated equity

compensation, and certain one-time or unusual transactions. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with GAAP, and the financial results calculated in accordance with

GAAP and reconciliations from these results should be carefully

evaluated. Management believes that these non-GAAP measures provide

useful information about the Company's core operating results and

thus are appropriate to enhance the overall understanding of the

Company's past financial performance and its prospects for the

future. The non-GAAP financial measures in this press release

include adjusted gross margin, adjusted earnings from operations,

adjusted net earnings and the related adjusted per diluted share

amounts, EBITDA, adjusted EBITDA, adjusted income tax expense, and

free cash flow. EBITDA is defined as earnings before interest,

other expense/income, taxes, depreciation and amortization.

Adjusted EBITDA is defined as earnings before interest, other

expense/income, taxes, depreciation, amortization, stock-based

compensation, acquisition-related expenses, indemnification

settlements, legal settlements, and the fair valuation of acquired

inventory. Adjusted income tax expense is defined as income

tax expense adjusted for the impact of ASU 2016-09. Free cash flow

is defined as net cash provided by operating activities less

capital expenditures.

Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP

financial measures.

Table 1

| Reconciliation of Non-GAAP Measures to

GAAP(Dollars in thousands, except per share

data)(unaudited) |

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

December 31, |

|

December 31, |

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

| |

|

|

|

|

|

|

|

|

| Reconciliation of

adjusted gross margin |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| GAAP gross margin |

$ |

51,638 |

|

|

$ |

46,932 |

|

|

$ |

189,009 |

|

|

$ |

180,861 |

|

| Inventory valuation

adjustment (1) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,363 |

|

| Amortization of

intangible assets (2) |

|

715 |

|

|

|

639 |

|

|

|

2,737 |

|

|

|

2,409 |

|

| Adjusted gross

margin |

$ |

52,353 |

|

|

$ |

47,571 |

|

|

$ |

191,746 |

|

|

$ |

188,633 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

adjusted earnings from operations |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| GAAP earnings from

operations |

|

26,666 |

|

|

|

24,591 |

|

|

|

97,255 |

|

|

|

90,838 |

|

| Inventory valuation

adjustment (1) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,363 |

|

| Amortization of

intangible assets (2) |

|

6,639 |

|

|

|

7,546 |

|

|

|

26,784 |

|

|

|

29,773 |

|

| Transaction costs,

integration costs and legal settlement (3) |

|

315 |

|

|

|

23 |

|

|

|

2,496 |

|

|

|

815 |

|

| Indemnification

settlement (4) |

|

- |

|

|

|

- |

|

|

|

(2,087 |

) |

|

|

- |

|

| Adjusted earnings from

operations |

|

33,620 |

|

|

|

32,160 |

|

|

|

124,448 |

|

|

|

126,789 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of

adjusted net earnings |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| GAAP net earnings |

|

41,975 |

|

|

|

15,924 |

|

|

|

90,071 |

|

|

|

55,972 |

|

| Inventory valuation

adjustment (1) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,363 |

|

| Amortization of

intangible assets (2) |

|

6,753 |

|

|

|

7,673 |

|

|

|

27,258 |

|

|

|

30,299 |

|

| Transaction costs,

integration costs and legal settlement (3) |

|

315 |

|

|

|

23 |

|

|

|

2,496 |

|

|

|

815 |

|

| Indemnification

settlement (4) |

|

- |

|

|

|

- |

|

|

|

(2,087 |

) |

|

|

- |

|

| Income tax adjustment

(5) |

|

(27,154 |

) |

|

|

(2,238 |

) |

|

|

(36,049 |

) |

|

|

(12,086 |

) |

| Adjusted net

earnings |

$ |

21,889 |

|

|

$ |

21,382 |

|

|

$ |

81,689 |

|

|

$ |

80,363 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Adjusted net earnings

per common share – diluted |

$ |

0.68 |

|

|

$ |

0.67 |

|

|

$ |

2.53 |

|

|

$ |

2.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Inventory valuation adjustment: Business

combination accounting principles require us to measure acquired

inventory at fair value. The fair value of inventory reflects the

acquired company’s cost of manufacturing plus a portion of the

expected profit margin. The non-GAAP adjustment to our cost of

sales excludes the expected profit margin component that is

recorded under business combination accounting principles. We

believe the adjustment is useful to investors as an additional

means to reflect cost of sales and gross margin trends of our

business.

2 Amortization of intangible assets:

Amortization of intangible assets consists of amortization of

customer relationships, trademarks and trade names, developed

technology, regulatory registration costs, patents and trade

secrets, and other intangibles acquired primarily in connection

with business combinations. We record expense relating to the

amortization of these intangibles in our GAAP financial statements.

Amortization expenses for our intangible assets are inconsistent in

amount and are significantly impacted by the timing and valuation

of an acquisition. Consequently, our non-GAAP

adjustments exclude these expenses to facilitate

an evaluation of our current operating performance and comparisons

to our past operating performance.

3 Transaction costs, integration costs and legal

settlement: Transaction and integration costs related to

acquisitions are expensed in our GAAP financial statements. Legal

settlements related to acquisitions are included as expense offset

in our GAAP financial statements. Management excludes these items

for the purposes of calculating Adjusted EBITDA and other non-GAAP

financial measures. We believe that excluding these items from our

non-GAAP financial measures is useful to investors because these

are items associated with each transaction, and are inconsistent in

amount and frequency causing comparison of current and historical

financial results to be difficult.

4 Indemnification settlement: Indemnification

settlement related to a favorable settlement we received relating

to the SensoryEffects acquisition which is included in our GAAP

financial statements. Management excluded this settlement for the

purposes of calculating Adjusted EBITDA and other non-GAAP

financial measures. We believe that excluding the settlement from

our non-GAAP financial measures is useful to investors because this

type of settlement is infrequent causing comparison of current and

historical financial results to be difficult.

5 Income tax adjustment: For purposes of

calculating adjusted net earnings and adjusted diluted earnings per

share, we adjust the provision for (benefit from) income taxes to

tax effect the taxable and deductible non-GAAP adjustments

described above as they have a significant impact on our income tax

(benefit) provision. Additionally, the income tax adjustment is

adjusted for the impact of adopting ASU 2016-09, “Improvements to

Employee Share-Based Payment Accounting”, and the impact of the Tax

Cuts and Jobs Act (the “Tax Reform Act”), enacted on December 22,

2017 by the U.S. government, and uses our non-GAAP effective rate

applied to both our GAAP earnings before income tax expense and

non-GAAP adjustments described above. The income tax adjustment for

the three months ended December 31, 2017 and 2016, respectively, is

calculated as the difference between the December 31, 2017 and 2016

year-to-date income tax adjustment, respectively, and the September

30, 2017 and 2016 year-to-date income tax adjustment, respectively.

See Table 3 for the calculation of our non-GAAP effective tax

rate.

The following table sets forth a reconciliation

of Net Income calculated using amounts determined in accordance

with GAAP to EBITDA and to Adjusted EBITDA for the three and twelve

months ended December 31, 2017 and 2016.

Table 2

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

YearEnded December 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

2017 |

|

|

|

2016 |

| Net

income - as reported |

$ |

41,975 |

|

|

$ |

15,924 |

|

$ |

90,071 |

|

|

$ |

55,972 |

| Add

back: |

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

(17,453 |

) |

|

|

6,875 |

|

|

(1,583 |

) |

|

|

26,962 |

| Other

expense |

|

2,144 |

|

|

|

1,792 |

|

|

8,767 |

|

|

|

7,904 |

|

Depreciation and amortization |

|

11,095 |

|

|

|

11,691 |

|

|

43,905 |

|

|

|

45,676 |

|

EBITDA |

|

37,761 |

|

|

|

36,282 |

|

|

141,160 |

|

|

|

136,514 |

| Add back

certain items: |

|

|

|

|

|

|

|

|

|

| Non-cash

compensation expense related to equity awards |

|

1,916 |

|

|

|

1,379 |

|

|

6,264 |

|

|

|

6,571 |

|

Transaction costs, integration costs and legal settlement |

|

315 |

|

|

|

23 |

|

|

2,496 |

|

|

|

815 |

|

Indemnification settlement |

|

- |

|

|

|

- |

|

|

(2,087 |

) |

|

|

- |

|

Inventory fair value |

|

- |

|

|

|

- |

|

|

- |

|

|

|

5,363 |

| Adjusted

EBITDA |

$ |

39,992 |

|

|

$ |

37,684 |

|

$ |

147,833 |

|

|

$ |

149,263 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table sets forth a reconciliation

of our GAAP effective income tax rate to our non-GAAP effective

income tax rate for the twelve months ended December 31, 2017 and

2016.

Table 3

|

|

|

|

|

|

|

Twelve MonthsEnded December 31, |

|

|

|

2017 |

|

|

Effective Tax Rate |

|

|

|

2016 |

|

Effective Tax Rate |

|

| GAAP

Income Tax Expense |

$ |

(1,583 |

) |

|

(1.8 |

%) |

|

$ |

26,962 |

|

32.5 |

% |

| Impact

of ASU 2016-09 adoption(6) |

|

2,589 |

|

|

|

|

|

|

|

| Impact

of the Tax Reform Act |

|

24,945 |

|

|

|

|

- |

|

|

| Adjusted

Income Tax Expense |

$ |

25,951 |

|

|

29.3 |

% |

|

$ |

26,962 |

|

32.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(6)In March 2016, the FASB issued ASU No.

2016-09, “Improvements to Employee Share-Based Payment Accounting”

(“ASU 2016-09”), which addresses the accounting for share-based

payment transactions, including the income tax consequences,

classification of awards as either equity or liabilities, and

classification on the statement of cash flows. The Company adopted

ASU 2016-09 on January 1, 2017 prospectively (prior

periods have not been restated). The primary impact of

adoption was the recognition during the three and twelve months

ended December 31, 2017, of excess tax benefits as a reduction

to the provision for income taxes and the classification of these

excess tax benefits in operating activities in the consolidated

statement of cash flows instead of financing activities. The

presentation requirements for cash flows related to employee taxes

paid for withheld shares had no impact to any of the periods

presented in the consolidated statement of cash flows, since such

cash flows have historically been presented in financing

activities. The Company also elected to continue estimating

forfeitures when determining the amount of stock-based compensation

costs to be recognized in each period. No other provisions of ASU

2016-09 had a material impact on the Company’s financial statements

or disclosures.

The following table sets forth a reconciliation

of net cash provided by operating activities to free cash flow for

the three and twelve months ended December 31, 2017 and 2016.

Table 4

|

|

|

|

|

|

|

Three MonthsEnded December 31, |

|

YearEnded December 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Net cash

provided by operating activities |

$ |

31,164 |

|

|

$ |

27,795 |

|

|

$ |

110,618 |

|

|

$ |

107,612 |

|

| Capital

expenditures |

|

(9,850 |

) |

|

|

(4,233 |

) |

|

|

(27,526 |

) |

|

|

(23,034 |

) |

| Free

cash flow |

$ |

21,314 |

|

|

$ |

23,562 |

|

|

$ |

83,092 |

|

|

$ |

84,578 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

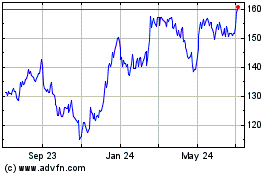

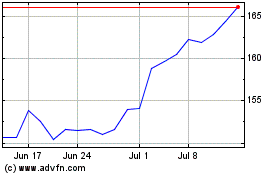

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Balchem (NASDAQ:BCPC)

Historical Stock Chart

From Apr 2023 to Apr 2024