Pre-tax Earnings Improved for Fourth Quarter

and Full Year 2017

Broadway Financial Corporation (the “Company”) (NASDAQ Capital

Market: BYFC), parent company of Broadway Federal Bank, f.s.b. (the

“Bank”), today reported a net loss of $399 thousand, or

($0.01) per diluted share, for the fourth quarter of 2017,

reflecting an additional tax expense of $519 thousand due to the

enactment of the Tax Cuts and Jobs Act of 2017, which required

adjustment of the Company’s deferred tax asset to recognize the

decrease in the federal corporate income tax rate to 21% from 34%.

In comparison, the Company recorded net income of $2.2

million, or $0.08 per diluted share, for the fourth quarter of 2016

due to an income tax benefit of $2.2 million that resulted from the

reversal of the valuation allowance on the deferred tax assets.

Pre-tax earnings increased by $270 thousand during the fourth

quarter of 2017, compared to the fourth quarter of 2016, due to an

increase of $386 thousand in non-interest income and a loan loss

provision recapture of $150 thousand, which were partially offset

by a decrease of $256 thousand in net interest income and an

increase of $10 thousand in non-interest expense.

For the year ended December 31, 2017, the Company reported net

income of $1.9 million, or $0.07 per diluted share, compared to

$3.5 million, or $0.12 per diluted share, for the year ended

December 31, 2016. Pre-tax earnings increased by $2.5 million

during calendar year 2017, compared to calendar year 2016,

primarily due to an increase of $1.5 million in non-interest

income, an increase of $526 thousand in net interest income, and an

increase of $550 thousand in loan loss provision recaptures, which

were partially offset by an increase of $85 thousand in

non-interest expense.

Chief Executive Officer, Wayne Bradshaw, commented, “I am

pleased to announce that Broadway increased its pre-tax

profitability for the fourth quarter of 2017 and the full calendar

year relative to the comparable periods in 2016. Like many

corporations, we incurred a non-recurring charge to earnings during

the fourth quarter to recognize the impact of lower corporate

income tax rates from the new federal tax legislation, which

reduced the value of our deferred tax assets, and lowered our net

income.

“This performance is a direct reflection of the skill and

persistence of Broadway’s team, who have continued to improve the

strength of Broadway’s capital base and the quality of the Bank’s

loan portfolio, while ensuring that the Bank maintains compliance

with the full gamut of regulatory guidelines. I am pleased to

report that the Bank’s Total Capital Ratio increased to 19.88% at

the end of the year, and the Bank’s non-accrual loans decreased to

less than $1.8 million, or 0.49% of total loans.

“Looking forward to 2018, the challenges facing the Bank remain

much the same as I have articulated throughout 2017: a competitive

marketplace for loan originations and deposits, and a relatively

flat yield curve that depresses net interest margins. In addition,

maintaining compliance with loan concentration guidelines set by

the Bank’s primary regulator has required Broadway to complete

periodic loan sales, which has hampered the Bank’s efforts to

increase the size of the loan portfolio to generate earnings growth

and capture economies of scale. Specifically, during 2017, Broadway

profitably sold almost $97 million of performing multi-family

loans, including over $15 million in the fourth quarter, which

represented approximately 84% of the Bank’s originations for the

year. However, based on the pristine quality of the Bank’s

remaining loan portfolio and our employees’ rigorous efforts to

improve all facets of Broadway’s business, I am optimistic that the

Bank will be able to retain more of its loan originations in 2018

than it did in 2017, which should grow Broadway’s assets and

interest income but may result in lower gain on sale of loans.

“I wish to thank again our team for their dedication and

tireless efforts to build value, and Broadway’s stockholders for

their continuing support of our mission and business plans.”

Net Interest Income

For the fourth quarter of 2017, net interest income decreased by

$256 thousand to $2.6 million from $2.9 million for the same period

a year ago, primarily because of a decrease of 28 basis points in

net interest margin.

Interest income on loans receivable decreased by $268 thousand

to $3.4 million for the fourth quarter of 2017, from $3.6 million

for the fourth quarter of 2016. Lower interest income on loans

receivable for the fourth quarter of 2017 resulted from a decrease

of $14.6 million in the average balance of loans receivable, which

decreased interest income by $142 thousand. The decrease in the

average balance of loans receivable primarily resulted from loan

repayments. Additionally, the average yield on loans receivable

during the fourth quarter of 2017 decreased by 14 basis points

compared to the fourth quarter of 2016, which reduced interest

income by $126 thousand. The decrease in the average yield on loans

receivable primarily resulted from the payoff of loans with higher

rates than those originated over the last year. The lower rates on

loan originations primarily reflect the low interest rate

environment and competitive market conditions.

Interest income on securities increased by $25 thousand to $101

thousand for the fourth quarter of 2017, from $76 thousand for the

fourth quarter of 2016, due to an increase of $2.6 million in the

average balance of securities and an increase of 26 basis points in

the average yield on securities. Other interest income increased by

$24 thousand to $207 thousand for the fourth quarter of 2017, from

$183 thousand for the fourth quarter of 2016. The increase of $24

thousand in other interest income was due to an increase of $116

thousand in interest income on interest-bearing deposits in other

banks, primarily reflecting a higher average yield and a higher

average balance for the fourth quarter of 2017, which was partially

offset by a decrease of $92 thousand in dividend income earned on

the Bank’s investment in Federal Home Loan Bank (“FHLB”) stock.

Interest expense on deposits increased by $32 thousand to $616

thousand for the fourth quarter of 2017, from $584 thousand for the

fourth quarter of 2016. Higher interest expense on deposits for the

fourth quarter of 2017 primarily resulted from an increase of 3

basis points in the average cost of deposits, which increased

interest expense by $42 thousand. The increase in the overall rates

paid on deposits was partially offset by a change in the mix of

deposits, which decreased interest expense by $10 thousand, despite

an increase of $6.0 million in the average balance of deposits.

During the fourth quarter, the average balance of liquid deposits

(NOW, demand, money market and passbook accounts) increased $23.1

million, whereas the average balance of higher cost certificates of

deposit (“CDs”) decreased by $17.1 million.

Interest expense on borrowings increased by $5 thousand to $435

thousand for the fourth quarter of 2017, from $430 thousand for the

fourth quarter of 2016. Higher interest expense on borrowings for

the fourth quarter of 2017 primarily resulted from an increase of

55 basis points in the average cost of the Company’s junior

subordinated debentures.

For the year ended December 31, 2017, net interest income

increased by $526 thousand to $11.9 million, from $11.4 million for

the same period a year ago. Interest income on loans receivable

increased by $912 thousand to $15.4 million for the year ended

December 31, 2017, from $14.5 million for the same period a year

ago, primarily due to an increase of $40.0 million in the average

balance of loans receivable, which increased interest income by

$1.6 million. Partially offsetting this increase was the impact of

a decrease of 20 basis points in the average yield on loans

receivable to 4.04% for 2017, from 4.24% for 2016, which reduced

loan interest income by $726 thousand. Additionally, other interest

income increased by $90 thousand for the year ended December 31,

2017, primarily reflecting an increase of $205 thousand in interest

income on interest-bearing deposits, which was partially offset by

a decrease of $115 thousand in dividend income earned on the Bank’s

investment in FHLB stock.

Interest expense on deposits increased by $218 thousand to $2.4

million for the year ended December 31, 2017, from $2.2 million for

the same period a year ago, primarily due to an increase of $19.4

million in the average balance of deposits and an increase of 2

basis points in the average cost of deposits. Interest expense on

borrowings increased by $253 thousand to $2.0 million for the year

ended December 31, 2017, from $1.7 million for the same period a

year ago, primarily due to an increase of $17.3 million in the

average balance of FHLB borrowings, which was partially offset by

the impact of a decrease of 16 basis points in the average cost of

FHLB borrowings.

Loan Loss Provision Recapture

The Bank recorded a loan loss provision recapture of $150

thousand for the fourth quarter of 2017, whereas no loan loss

provision or recapture was recorded for the fourth quarter of 2016.

The loan loss provision recapture during the fourth quarter of 2017

was primarily due to a decrease in the requirements for the

allowance for loan losses (“ALLL”) on the existing portfolio as

loans paid off and as the overall credit quality of the loan

portfolio continued to improve. For calendar year 2017, the Bank

recorded loan loss provision recaptures of $1.1 million, primarily

due to payoffs and recoveries of problem loans. In comparison, the

Bank recorded loan loss provision recaptures of $550 thousand for

the year ended December 31, 2016. At December 31, 2017, the ALLL

was $4.1 million, or 1.20% of our gross loans receivable held for

investment, compared to $4.6 million, or 1.20% of our gross loans

receivable held for investment at December 31, 2016. Due to a

reduction in non-performing loans, which decreased from $2.9

million at the end of 2016 to $1.8 million at the end of 2017, the

ALLL as a percentage of non-performing loans increased to 230.4% at

the end 2017 from 156.4% at the end of 2016.

Non-interest Income

Non-interest income for the fourth quarter of 2017 totaled $544

thousand, compared to $158 thousand for the fourth quarter of 2016.

The increase in non-interest income of $386 thousand primarily

reflected a grant of $227 thousand that the Bank received from the

U.S. Department of the Treasury’s Community Development Financial

Institutions (CDFI) Fund. Additionally, the Bank recorded a gain of

$177 thousand from the sale of loans during the fourth quarter of

2017, whereas the Bank did not sell any loans during the fourth

quarter of 2016.

For the year ended December 31, 2017, non-interest income

totaled $2.5 million, compared to $1.0 million for the same period

a year ago. The increase of $1.5 million in non-interest income was

primarily due to an insurance litigation settlement of $1.2 million

and a gain of $560 thousand from the sale of loans during calendar

year 2017. These increases were partially offset by an unusually

large early withdrawal fee that generated income of $80 thousand, a

loan extension fee of $50 thousand, and a foreclosure forbearance

fee of $38 thousand that were included in the Bank’s results for

calendar year 2016.

Non-interest Expense

Total non-interest expense of $3.1 million for the fourth

quarter of 2017 was unchanged compared to the fourth quarter of

2016. While an increase in compensation and benefits expense,

higher stock-based compensation expense and a lower amount of

salary deferred as loan origination costs increased non-interest

expense by $215 thousand during the quarter, and a provision for

losses on REO, higher information services expense and increased

occupancy expense contributed an additional $127 thousand of

increased non-interest expense, these increases were largely offset

by a decrease of $346 thousand in professional services expense for

the fourth quarter of 2017 compared to the same period in 2016,

primarily because in December 2016, the Company incurred $374

thousand of legal and consulting fees in connection with the

repurchase of shares from the U.S. Treasury.

Similarly, total non-interest expense was $11.8 million for both

calendar 2017 and 2016. Overall non-interest expense increased by

$85 thousand as increases in other expense of $377 thousand,

occupancy expense of $82 thousand, and compensation and benefits

expense of $67 thousand, were partially offset by a decrease of

$438 thousand in professional services expense. Other expense

increased by $377 thousand primarily due to payments of $214

thousand for expenses related to three sales by the U.S. Treasury

of a portion of its holdings of the Company’s shares and an

increase of $152 thousand in REO provision for losses and expenses.

Professional services expense decreased by $438 thousand during

2017 primarily due to lower legal and consulting fees. As mentioned

above, the Company incurred $374 thousand in legal and consulting

fees in connection with the repurchase of shares from the U.S.

Treasury in December 2016.

Income Taxes

The Company recorded income tax expense of $643 thousand for the

fourth quarter of 2017 and $1.9 million for the year ended December

31, 2017, compared to income tax benefit of $2.2 million for the

fourth quarter and the year ended December 31, 2016. The tax

expense for the fourth quarter and year 2017 include an adjustment

of $519 thousand to record the Company’s deferred tax assets at the

lower federal corporate income tax rate of 21%. In contrast, the

Company recorded an income tax benefit of $2.2 million for the

comparable periods in 2016, which resulted from the reversal of the

remaining valuation allowance on deferred tax assets, based on an

analysis of the potential for full utilization of those assets. The

deferred tax assets totaled $5.1 million at December 31, 2017, and

$6.9 million at December 31, 2016.

Balance Sheet Summary

Total assets decreased by $15.4 million to $413.7 million at

December 31, 2017 from $429.1 million at December 31, 2016. The

decrease in total assets consisted of a decrease of $44.6 million

in net loans receivable held for investment and a decrease of $1.8

million in deferred tax assets, which were partially offset by an

increase of $22.4 million in loans receivable held for sale, an

increase of $4.3 million in securities available-for-sale, an

increase of $3.8 million in cash and cash equivalents and an

increase of $878 thousand in REO.

During 2017, we allocated $110.4 million, or 96%, of our loan

originations to loans held for sale and we transferred $9.3 million

of multi-family loans from the portfolio of loans held for

investment to the portfolio of loans held for sale as part of our

loan concentration risk management program. Also, during 2017, we

completed $96.9 million of multi-family loan sales that generated

the gain on loan sales of $560 thousand mentioned above. The Bank

had no loans receivable held for sale during 2016.

Loans receivable held for investment, net of the allowance for

loan losses, totaled $334.9 million at December 31, 2017, compared

to $379.5 million at December 31, 2016. During 2017, the Bank

originated for portfolio $5.0 million, primarily in multi-family

loans, and purchased $24.6 million in single family loans. In

comparison, during 2016, the Bank originated for portfolio $137.7

million, primarily in multi-family loans. Loan repayments during

2017 totaled $64.8 million, compared to $63.4 million during

2016.

An REO, recorded at $958 thousand during the third quarter, was

written down to $878 thousand during the fourth quarter due to a

decrease in fair value.

Deposits increased to $291.3 million at December 31, 2017 from

$287.4 million at December 31, 2016, which consisted of an increase

of $39.4 million in liquid deposits and a decrease of $35.5 million

in CDs. During 2017, a CD account of $30.3 million from one deposit

relationship was moved to a money market account. Excluding this

transfer, liquid deposits increased by $9.2 million and CDs

decreased by $5.3 million. The increase of $9.2 million in liquid

deposits consisted of an increase of $5.9 million in money market

accounts, an increase of $3.1 million in NOW accounts and an

increase of $195 thousand in passbook accounts. The decrease of

$5.3 million in CDs during 2017 was primarily due to a decrease of

$46.8 million in QwickRate CDs, which was partially offset by an

increase of $23.4 million in Certificate of Deposit Account

Registry Service (“CDARS”) accounts and an increase of $18.1

million in retail CDs.

Total borrowings at December 31, 2017 consisted of advances to

the Bank from the FHLB of $65.0 million, and subordinated

debentures issued by the Company of $5.1 million, compared to

advances from the FHLB of $85.0 million and subordinated debentures

of $5.1 million at December 31, 2016. During 2017, the Bank paid

off $49.5 million in maturing advances and borrowed $29.5 million

in new advances from the FHLB.

Stockholders' equity was $47.7 million, or 11.54% of the

Company’s total assets, at December 31, 2017, compared to $45.5

million, or 10.61% of the Company’s total assets, at December 31,

2016. The Company’s book value was $1.74 per share as of December

31, 2017, compared to $1.66 per share as of December 31, 2016.

At December 31, 2017, the Bank’s Total Capital ratio (Total

Capital to Total Risk-Weighted Assets) was 19.88% and its Leverage

ratio (Tier 1 Capital to Adjusted Total Assets) was 11.39%,

compared to a Total Capital ratio of 16.62% and a Leverage ratio of

10.60% at December 31, 2016.

About Broadway Financial Corporation

Broadway Financial Corporation conducts its operations through

its wholly-owned subsidiary, Broadway Federal Bank, f.s.b., which

is the leading community-oriented savings bank in Southern

California serving low-to-moderate income communities. We offer a

variety of residential and commercial real estate loan products for

consumers, businesses, and non-profit organizations, other loan

products, and a variety of deposit products, including checking,

savings and money market accounts, certificates of deposits and

retirement accounts. The Bank operates three full service branches,

two in the city of Los Angeles, California, and one located in the

nearby city of Inglewood, California.

Shareholders, analysts and others seeking information about the

Company are invited to write to: Broadway Financial Corporation,

Investor Relations, 5055 Wilshire Blvd., Suite 500, Los Angeles, CA

90036, or visit our website at www.broadwayfederalbank.com.

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are based upon our

management’s current expectations and involve risks and

uncertainties. Actual results or performance may differ materially

from those suggested, expressed, or implied by the forward-looking

statements due to a wide range of factors including, but not

limited to, the general business environment, the real estate

market, competitive conditions in the business and geographic areas

in which the Company conducts its business, regulatory actions or

changes, monetary and fiscal policy changes, and other risks

detailed in the Company’s reports filed with the Securities and

Exchange Commission, including the Company’s Annual Reports on Form

10-K and Quarterly Reports on Form 10-Q. The Company undertakes no

obligation to revise any forward-looking statement to reflect any

future events or circumstances, except to the extent required by

law.

BROADWAY FINANCIAL CORPORATION AND SUBSIDIARY

Selected Financial Data and Ratios (Unaudited) (Dollars

in thousands, except per share data) December 31,

2017 December 31, 2016 Selected Financial Condition

Data and Ratios: Cash and cash equivalents $ 22,219 $ 18,430

Securities available-for-sale, at fair value 17,494 13,202 Loans

receivable held for sale 22,370 - Loans receivable held for

investment 338,920 384,057 Allowance for loan losses (4,069

) (4,603 ) Loans receivable held for investment, net of

allowance 334,851 379,454 Total assets 413,704 429,083 Deposits

291,290 287,427 FHLB advances 65,000 85,000 Junior subordinated

debentures 5,100 5,100 Total stockholders' equity 47,731 45,526

Book value per share $ 1.74 $ 1.66 Equity to total assets

11.54 % 10.61 %

Asset Quality Ratios: Non-accrual

loans to total loans 0.49 % 0.77 % Non-performing assets to total

assets 0.64 % 0.69 % Allowance for loan losses to total gross loans

1.20 % 1.20 % Allowance for loan losses to total delinquent loans

1040.66 % 331.63 % Allowance for loan losses to non-performing

loans 230.41 % 156.35 %

Non-Performing Assets:

Non-accrual loans $ 1,766 $ 2,944 Loans delinquent 90 days or more

and still accruing - - Real estate acquired through foreclosure

878 - Total non-performing assets $

2,644 $ 2,944

Three Months

Ended December 31, Twelve Months Ended December 31,

Selected Operating Data and Ratios: 2017

2016 2017

2016 Interest income $ 3,670 $ 3,889 $ 16,287 $

15,290 Interest expense 1,051 1,014

4,348 3,877 Net interest income 2,619

2,875 11,939 11,413 Loan loss provision recapture 150

- 1,100 550 Net interest

income after loan loss provision recapture 2,769 2,875 13,039

11,963 Non-interest income 544 158 2,530 1,044 Non-interest expense

(3,069 ) (3,059 ) (11,837 ) (11,752 )

Income (loss) before income taxes 244 (26 ) 3,732 1,255 Income tax

expense (benefit) 643 (2,227 ) 1,863

(2,225 ) Net income (loss) $ (399 ) $ 2,201 $

1,869 $ 3,480 Earnings (loss) per common

share-basic and diluted $ (0.01 ) $ 0.08 $ 0.07 $ 0.12 Loan

originations (1) $ 16,008 (2) $ 46,944 $ 115,428 (2) $ 137,719 Loan

purchase $ 24,640 $ - $ 24,640 $ - Net recoveries to average

loans (0.01 )% (3) (0.01 )% (3) (0.15 )% (0.10 )% Return on average

assets (0.38 )% (3) 2.10 % (3) 0.43 % 0.86 % Return on average

equity (3.32 )% (3) 18.74 % (3) 3.96 % 7.41 % Net interest margin

2.53 % (3) 2.81 % (3) 2.79 % 2.90 %

(1) Does not include net deferred

origination costs.

(2) Includes loans held for sale

originations of $15.7 million and $110.4 million for the three and

twelve months ended December 31, 2017, respectively.

(3) Annualized

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180226006440/en/

Broadway Financial CorporationBrenda J. Battey, Chief Financial

Officer, (323)

556-3264investor.relations@broadwayfederalbank.com

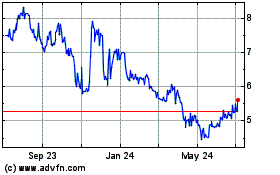

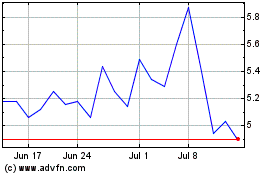

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024