Current Report Filing (8-k)

February 23 2018 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February

22, 2018

3D SYSTEMS CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-34220

|

|

95-4431352

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

333 Three D Systems Circle

Rock Hill, SC

|

|

29730

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(803) 326-3900

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On February 22, 2018, the Compensation Committee of the Board of Directors (the “Committee”)

of 3D Systems Corporation (the “Company”) adopted the Company’s Change of Control Severance Policy (the “COC

Severance Policy”). The COC Severance Policy is intended to provide eligible officers of the Company with reasonable financial

security in their employment and position with the Company, without distraction from uncertainties regarding their employment created

by the possibility of a potential or actual change of control of the Company.

The COC Severance Policy applies to the Company’s Chief Executive Officer and all

Executive Vice Presidents and Senior Vice Presidents (each, a “Participant”), which includes all of the Company’s

named executive officers.

A Participant is entitled to benefits under the COC Severance Policy in the event of

a termination of the Participant’s employment with the Company by the Company without “Cause” or by the Participant

for “Constructive Discharge” either (a) on or before the second anniversary of the date of a “Change of

Control” (as such terms are defined in the COC Severance Policy) or (b) in certain circumstances, within six months

prior to the date that the Change of Control occurs (a “Qualifying Termination”).

In the event of a Qualifying Termination, a Participant will receive a lump sum cash

payment equal to: (i) a multiple (which is 2.0 for the Chief Executive Officer and 1.5 for all other Participants) times the

sum of the Participant’s base salary and target annual bonus, (ii) a pro rata portion of the Participant’s target

annual bonus for the fiscal year in which the termination occurs, and (iii) the difference between the monthly COBRA rate and the

active employee premium rate for the applicable group health coverage (i.e., medical, dental and vision) as elected by the Participant

(for the Participant and his or her eligible dependents) at the time of the Qualifying Termination multiplied by a number of months

equal to 24 for the Chief Executive Officer and 18 for each other Participant. A Participant’s right to receive this payment

and benefits is subject to his or her execution of a general release of claims against the Company.

In addition, the COC Severance Policy provides that all outstanding

performance-based equity awards granted after the effective date of the COC Severance Policy shall be converted in their

entirety to timed-based equity awards upon the occurrence of a Change of Control based on the assumption that the performance

goals are achieved at target. The vesting of performance-based equity awards that are converted to time-based equity

awards shall occur upon the same vesting schedule upon which the former performance metrics would have been measured and

shall vest in full upon a Qualifying Termination. Additionally, if a Participant incurs a Qualifying Termination, all

outstanding time-based awards equity awards, including converted performance-based equity awards, that are held by a

Participant and were granted after the effective date of the COC Severance Policy shall become fully vested and all

forfeiture restrictions shall lapse.

If a Participant is entitled to a payment or benefit whether payable under the COC Severance

Policy or any other plan, arrangement or agreement with the Company that is subject to the excise tax imposed on certain so-called

“excess parachute payments” under Section 4999 of the Internal Revenue Code of 1986, as amended, such payment

or benefit will be reduced to the maximum amount that may be paid without being subject to such excise tax, but only if the after-tax

benefit of the reduced amount is greater than the after-tax benefit of the unreduced amount.

The COC Severance policy does not change the terms of any plans or arrangements that

may provide for severance benefits in case of a termination of employment not in connection with a Change of Control. The

COC Severance Plan also includes provisions intended to avoid duplication of benefits with the severance benefits that otherwise

may be payable under any other plan or arrangement upon a Qualifying Termination.

The above summary is qualified by reference to the text of the COC Severance Policy that

is filed herewith as Exhibit 10.1 and incorporated herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

10.1 3D Systems Corporation Change of Control Severance Policy

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

3D SYSTEMS CORPORATION

|

|

Date: February 23, 2018

|

|

|

|

|

|

/s/

ANDREW M. JOHNSON

|

|

|

|

(Signature)

|

|

|

|

Name: Andrew M. Johnson

|

|

|

|

Title:

Executive Vice President, Chief Legal Officer and Secretary

|

|

|

|

|

EXHIBIT INDEX

5

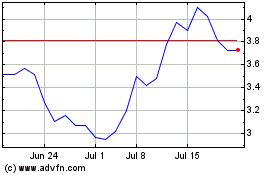

3D Systems (NYSE:DDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

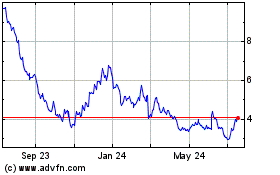

3D Systems (NYSE:DDD)

Historical Stock Chart

From Apr 2023 to Apr 2024