UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2018

GRUPO AEROPORTUARIO DEL CENTRO NORTE, S.A.B.

DE C.V.

(CENTRAL NORTH AIRPORT GROUP)

_________________________________________________________________

(Translation of Registrant’s Name Into

English)

México

_________________________________________________________________

(Jurisdiction of incorporation or organization)

Torre Latitud, L501, Piso 5

Av. Lázaro Cárdenas 2225

Col. Valle Oriente, San Pedro Garza García

Nuevo León, México

_________________________________________________________________

(Address of principal executive offices)

(Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Indicate by check mark whether the registrant

by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.)

(If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

OMA announces Fourth Quarter and Full Year 2017

Operational

and Financial Results

Monterrey, Mexico, February 22, 2018

— Mexican airport

operator Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known as OMA (NASDAQ: OMAB; BMV: OMA), today reported its unaudited,

consolidated results for the fourth quarter and full year 2017.

1

Fourth quarter and full year 2017 summary

OMA recorded an increase of 1.8% in passenger traffic in 4Q17,

despite the deceleration of the rate of traffic growth in Mexico, and recorded a 4.8% increase in traffic for the full year. The

sum of aeronautical and non-aeronautical revenues rose 4.6% in the quarter and 11.5% in the full year. Adjusted EBITDA rose 13.6%

in 4Q17, with an Adjusted EBITDA margin of 67.5% -- the highest quarterly margin in OMA’s history. For the year, Adjusted

EBITDA increased 15.2%, with an Adjusted EBITDA margin of 66.0% -- also a record. Operating income rose 13.8% in 4Q17, and consolidated

net income increased 9.5%. For the full year, operating income and net income grew 16.4% and 13.9%, respectively.

1

Unless otherwise stated, all references are to the fourth quarter

of 2017 (4Q17) or full year 2017, and all percentage changes are with respect to the same period of the prior year. The exchange

rates used to convert foreign currency amounts were Ps. 19.7354 as of December 31, 2017 and Ps. 20.6640 as of December 31, 2016.

The principal results of the fourth quarter include:

|

|

§

|

Total terminal passenger traffic increased 1.8% to 5.0 million. Domestic traffic increased 2.0%

and international traffic increased 0.6%. The Monterrey and Culiacán airports contributed the most to passenger growth.

|

|

|

§

|

Aeronautical revenues increased 3.4%, principally as a result of traffic growth and an increase

in tariffs in 2Q17.

|

|

|

§

|

Aeronautical revenues per passenger increased 1.6% to Ps. 217.6.

|

|

|

§

|

Non-aeronautical revenues increased 8.0%, principally from growth in commercial activities, particularly

car rental, restaurants, and parking, as well as diversification businesses, especially hotel services.

|

|

|

§

|

Non-aeronautical revenues per passenger increased 6.1% to Ps. 77.9.

|

|

|

§

|

Adjusted

EBITDA

2

increased 13.6% to Ps. 999 million. The Adjusted EBITDA margin reached 67.5%, a record

for highest margin in a quarter.

|

|

|

§

|

Consolidated net income increased 9.5% to Ps. 625 million. Earnings per share increased 9.5% to

Ps. 1.58, based on weighted average shares outstanding, while earnings per American Depositary Share (ADS) rose 14.7% to US$ 0.64.

|

|

|

§

|

Capex, major maintenance, and other smaller expenditures included in the Master Development Programs

(MDP) and strategic investments totaled Ps. 590 million.

|

Full year 2017 highlights include:

|

|

§

|

OMA generated growth in its financial and operating results, with new records for passenger traffic,

revenues, Adjusted EBITDA, Adjusted EBITDA margin, and consolidated net income in 2017.

|

|

|

§

|

Total passenger traffic increased 4.8% to 19.7 million passengers.

|

|

|

§

|

Passenger volume growth contributed to a 12.2% increase in aeronautical revenues and a 9.3% increase

in non-aeronautical revenues. The sum of aeronautical and non-aeronautical revenues reached Ps. 5,803 million (+11.5%).

|

|

|

§

|

Cost of services and G&A expense increased only 1.7%, as a result of strict controls on business

operations. As a result, Adjusted EBITDA reached Ps. 3,829 million (+15.2%), with an Adjusted EBITDA margin of 66.0%. Operating

income increased 13.8%. The effective tax rate was 27.6%.

|

2

Adjusted EBITDA excludes the non-cash maintenance provision, construction

revenue, and construction expense. OMA provides a full reconciliation of Adjusted EBITDA to Net Income in the corresponding section

of this report; see also the Notes to the Financial Information.

|

|

§

|

Consolidated net income increased 13.9% to Ps. 2,137 million. Earnings per share were Ps. 5.40

and earnings per ADS were US$2.19. In order to develop passenger terminal and operating infrastructure and to improve service quality

in OMA’s 13 airports, total investments in accordance with the Master Development Programs and strategic investments were

Ps. 1,684 million. The full year return on capital was 29.6%.

|

|

|

§

|

OMA continued to position itself as a sustainable enterprise and a leader in the airport operation

sector, with recognitions for quality, workplace safety, environment, and social responsibility, including:

|

|

|

§

|

Selection as part of the Dow Jones Sustainability MILA Pacific Alliance Index, which includes the

companies with the highest sustainability rankings in the four Latin American countries of the Pacific Alliance: Mexico, Colombia,

Peru, and Chile.

|

|

|

§

|

Inclusion in the Dow Jones Sustainability Emerging Markets Index (“DJSI”) for the second

consecutive year, and in the Mexican Stock Exchange’s IPC Sustainable Index (

“IPC Sustentable”

) for the

seventh consecutive year.

|

|

|

§

|

Recognition as “A Great Place to Work” for the seventh consecutive year, as being one

of the 100 best companies to work for in Mexico and ranked number 1 in northeastern Mexico. In addition OMA was certified as a

Socially Responsible Company (“ESR”) for the 10th year, by the Mexican Center for Philanthropy.

|

|

|

§

|

OMA was included in the Mexican Stock Exchange’s benchmark IPC index, for the third consecutive

year.

|

4Q17 Operating Results

Operations, Passengers, and Cargo

The total

supply of seats

decreased 2.1% in 4Q17, as

a result of the closing of routes and reductions in frequencies during the full year 2017.

Notwithstanding this, airlines opened a total of 19 routes in

the fourth quarter, including 11 domestic routes and 8 international routes. Six domestic routes closed in 4Q17.

Total passenger traffic

increased 1.8% (+89,262 passengers).

Of total passenger traffic, 87.9% was domestic and 12.1% was international. Commercial aviation accounted for 99.0% of passenger

traffic. Monterrey generated 50.2% of passenger traffic, Culiacán 10.6%, and Chihuahua 7.1%.

Domestic passenger traffic

increased 2.0% (+85,478 passengers).

Six airports increased traffic. The airports with the largest variations were:

|

|

§

|

Monterrey

(+6.0%; +122,705 passengers) had the largest increase, as a result of increased

traffic on its Cancún, Querétaro, Mexicali, Toluca, Puerto Vallarta, Guadalajara, Ciudad Juárez, Ciudad Obregón,

and Puebla routes.

|

|

|

§

|

Culiacán

(+9.7%; +46,552) had increased traffic on its Guadalajara, Tijuana, and

Mexicali routes.

|

|

|

§

|

Reynosa

(-26.8%; -39,718); Torreón (-11.4%; -18,212); Acapulco (-7.7%; -12,841);

Mazatlán (-6.0%;

|

-11,083); and Durango (-8.9%; -8,188) had

decreased traffic as a result of reductions on their Mexico City routes.

International passenger traffic

increased 0.6%, and eight

airports recorded increases in international traffic. Monterrey (+0.9%; +2,987 passengers) had the largest increase, principally

as a result of higher traffic on the Atlanta route; and Culiacán (-42.6%; -3,838) had the largest reduction as a result

of lower traffic, particularly on its Phoenix route.

See

Annex Table 1

for more detail on passenger traffic

by airport.

Air cargo

volumes increased 1.9%. Of total air cargo

volume, 63.3% was domestic and 36.7% was international.

Commercial Operations

OMA implements its commercial strategy through continuous improvement

in the services offerings in its airports. This strategy resulted in the opening of 29 commercial initiatives in 4Q17, including

car rental, restaurants, retail stores, a VIP lounge, banking services, and hotel promotion. The commercial space occupancy rate

was 98.5% in 4Q17.

Hotel Services

|

|

§

|

The

NH Collection Terminal 2 Hotel

had an 89.2% occupancy rate compared to 79.1% in 4Q16;

this was the highest occupancy rate in its history. The average room rate was Ps. 2,324 per night. Revenues increased 11.4% to

Ps. 66 million.

|

|

|

§

|

The

Hilton Garden Inn

had a 76.8% occupancy rate, with an average room rate of Ps. 1,960.

Revenues increased 4.5% to Ps. 23 million.

|

OMA Carga Operations

|

|

§

|

OMA Carga

increased both air and land freight logistics activities, recording a 9.1% increase

in revenues to Ps. 41 million. Freight handled grew 38.6% to 10,105 metric tons.

|

Industrial Services

|

|

§

|

OMA VYNMSA Aero Industrial Park

: The three operating warehouses generated Ps. 4 million

in revenues. Two new leases were signed during the quarter: 1) a 5-year lease for a 5,000 m

2

warehouse that will start generating revenues in April 2018, and which is currently under construction; 2) a 7-year lease for a

4,200m

2

warehouse, which began construction in January

2018 and will start generating revenues in September 2018. In addition, a 10,500 m

2

warehouse is in the commercialization phase.

|

Consolidated Financial Results

Revenues

Aeronautical revenues

increased 3.4% to Ps. 1,090 million,

principally as a result of higher traffic volumes and increases in specific tariffs in 2Q17. Revenue from domestic passenger charges

increased 4.6%, revenue from international passenger charges decreased 2.2% as a result of exchange rate fluctuations, and other

aeronautical services revenue increased 6.7%.

Monterrey contributed 48.5% of aeronautical revenues, Culiacán

10.1%, Chihuahua 7.1%, and Ciudad Juárez 5.6%.

Aeronautical revenues per passenger were Ps. 217.6, an increase

of 1.6%.

Non-aeronautical revenues

increased 8.0% to Ps. 390 million,

and represented 26.4% of the sum of aeronautical and non-aeronautical revenues. The increase reflected principally the expansion

of commercial activities.

Non-aeronautical revenues per passenger increased 6.1% to Ps.

77.9. Non-aeronautical revenues per passenger, excluding diversification activities, increased 6.5% to Ps. 50.4.

Commercial activities

contributed an incremental Ps.

15 million (+8.6%). The line items that had the largest variations were:

|

|

§

|

Car rental

(+28.5%; +Ps. 6 million), as a result of better contractual terms and the leasing

of sixteen new locales in 4Q17.

|

|

|

§

|

Restaurants

(+21.7%; Ps. +6 million), as a result of the maturation of restaurants opened

in 2016, an improvement in the commercial offering in the Monterrey airport in 3Q17, and the opening of five new establishments

during 4Q17.

|

|

|

§

|

Parking

(+6.5%; +Ps. 3 million), as a result of increased capacity in the Monterrey and

Chihuahua airports.

|

Diversification activities

contributed an additional

Ps. 9 million (+7.2%). The most important contributions came from hotel services (+9.6%; +Ps. 8 million) and OMA Carga (+9.1%;

+Ps. 3 million).

Complementary activities

generated an increase of Ps.

4 million (+8.0%).

Construction revenues

, which represent the value of improvements

to concessioned assets, were Ps. 408 million (+136.7%) during the quarter. They are equal to

construction costs

recognized,

and generate neither a gain nor a loss. Construction revenues and costs are a function of the advance in execution of projects

in the Master Development Programs (MDP) in the 13 airports, and variations depend on the rate of project execution. The increase

in 4Q17 reflects the large number of MDP projects currently underway. (

See Notes to the Financial Information and discussion

of MDP expenditures below.

)

Total revenues

, including construction revenues, increased

18.9% to Ps. 1,888 million.

Costs and Operating Expenses

The total

cost of airport services and general and administrative

expenses (G&A)

, excluding those related to the hotels and industrial park, decreased 14.1%. The decrease was largely because

of decreases in other costs and expenses, which included payment of licensing fees to SAP and implementation expenses from the

transition to the new system. In addition, the cost for utilities increased, principally as a result of higher electricity rates.

Hotel costs and expenses increased 12.2%, in line with operations

and occupancy rates.

The

major maintenance provision

increased 11.0% to Ps.

91 million. The balance of the maintenance provision as of December 31, 2017 was Ps. 858 million, compared to Ps. 670 million at

the end of 2016.

The

airport concession tax

increased 1.2% as a result

of the growth in revenues.

The

technical assistance fee

decreased 1.9% to Ps. 35

million, principally as a result the effect of exchange rate fluctuations. (

See Notes to the Financial Information for the calculation

base

).

As a result of the foregoing,

total operating costs and expenses

increased 23.3% to Ps. 1,058 million. The increase resulted principally from the increase in construction costs and the provision

for major maintenance. Excluding those two line items, total costs and operating expenses were Ps. 559 million, a decrease of 7.3%.

Adjusted EBITDA and Operating Income

As a result of the Company’s continuing initiatives to

increase revenues and control costs and expenses,

Adjusted EBITDA

increased 13.6% to Ps. 999 million. The

Adjusted EBITDA

margin

was 67.5%, the highest quarterly margin in OMA’s history.

(See Notes to the Financial Information for additional

discussion of Adjusted EBITDA.)

Operating income

rose 13.8% to Ps. 830 million, with

an operating margin of 44.0%.

Financing (Expense) Income

Financing (Expense) Income decreased by Ps. 25 million to Ps.

19 million in 4Q17. The reduction was principally because of a decrease in interest income.

Taxes

Taxes

were Ps. 224 million. The effective tax rate was

26.4%.

Net Income

Consolidated net income

increased 9.5% to Ps. 625 million.

Earnings per share

, based on net income of the controlling

interest, increased 9.5% to Ps. 1.58; earnings per ADS increased 14.7% to US$0.64. Each ADS represents eight Series B shares.

MDP, Strategic Investment, and Quality Improvement Expenditures

OMA maintains its firm commitment to provide services of the

highest quality for its passengers and airline clients in all thirteen airports. As a result, we are constantly undertaking maintenance

projects, developing and optimizing infrastructure, acquiring and repairing equipment, and acquiring new technologies, in accordance

with domestic and international standards of quality, safety, and airport operation, in a framework of sustainability.

Total capital expenditures, major maintenance, and other non-capitalized

expenses included in the MDP and strategic investments

3

were Ps. 590 million, and included Ps. 410 million in improvements to concessioned assets, Ps. 32 million for major maintenance,

Ps. 4 million for other non-capitalized expenses, and Ps. 145 million for strategic investments.

The most important investment expenditures in 4Q17 included:

3

The amounts for MDP and strategic investments include works, services,

and paid and unpaid acquisitions; the latter are included in accounts payable for the period.

Debt

As of December 31, 2017,

total debt

was Ps. 4,633 million

and net debt was Ps. 2,300 million. The ratio of net debt to Adjusted EBITDA was 0.60 times. Of total debt, 97% was denominated

in Mexican pesos, and 3% in U.S. dollars.

Derivative Financial Instruments

As of the date of this report, OMA has no derivatives exposure.

Cash Flow Statement

For the full year 2017, operating activities generated cash

of Ps. 2,925 million, a 22.8% increase compared to 2016. The increase resulted principally from higher operating income and a reduction

in client accounts receivable, which were partially offset by higher tax payments.

Investing activities used cash of Ps. 1,531 million, as compared

to Ps. 471 million in 2016. Outflows increased principally for Capex, including Ps. 1,369 million for improvements to concessioned

assets and Ps. 215 million for property, plant and equipment.

Financing activities generated an outflow of Ps. 1,994 million,

31.7% higher than the prior year. Dividends paid increased by Ps. 203 million and share repurchases totaled Ps. 34 million.

As a result of the foregoing, cash decreased Ps. 601 million

during 2017. The balance of cash and cash equivalents was Ps. 2,333 million as of December 31, 2017.

Material and Subsequent Events

OMA included in the Dow Jones Sustainability MILA Pacific

Alliance Index.

In October 2017, OMA was selected for inclusion in this index that includes companies with the best sustainability

practices in the four countries of the Pacific Alliance: Mexico, Colombia, Peru, and Chile. The index was launched in the current

year by S&P Dow Jones Indices, the International Finance Corporation (IFC), RobecoSAM, the stock exchanges of the Integrated

Latin American Market (MILA), and includes 42 companies that are leaders in sustainability. Twelve of the index components are

from Mexico, and OMA is the only Mexican company in the transport sector.

OMA included in The Sustainability Yearbook 2018.

Since

2004, this publication has recognized leading companies in the sustainability area around the world, by industry, in accordance

with criteria set by RobecoSAM. In 2018, OMA was one of only two Mexican companies included in this book, and one of 15 companies

globally in the transport sector recognized for their sustainability activities.

Rescission of advertising contract.

Effective December

3, 2017, OMA terminated its leasing agreement with the company that provided most of the advertising in OMA’s airports and

started legal proceedings to recover funds owed the Company.

OMA (NASDAQ: OMAB; BMV: OMA)

will hold its 4Q17 earnings conference call on February 26, 2018 at 12 pm Eastern time, 11 am Mexico City time.

The

conference call is accessible by calling

1-888-394-8218

toll-free from the U.S. or

1-323-701-0225

from outside the U.S. The conference ID is

8312253

.

The conference call will also be available by webcast at

http://ir.oma.aero/events.cfm

.

A

taped replay will be available through March 5, 2018 at 1-844-512-2921 toll free or + 1-412-317-6671, using the same conference

ID.

Annex Table 1

Annex Table 2

Annex Table 3

Annex Table 4

Annex Table 5

Annex Table 6

Annex Table 7

In accordance with the requirements of the Mexican Stock Exchange,

the analysts covering OMA are:

Notes to the Financial Information

Financial statements are prepared in accordance with International

Financial Reporting Standards (“IFRS”), and presented in accordance with IAS 34 “Interim Financial Reporting.”

In December 2015, OMA elected early adoption of the amendments

established by International Accounting Standard 27 (IAS 27), which allows for early adoption and retroactive application of the

equity method of accounting for investments in subsidiaries, associates and joint ventures in OMA’s separate (holding company)

financial statements. The change does not affect OMA’s consolidated results; it only affects the financial statements of

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., on a legal-entity basis, which is the basis on which the annual Shareholders’

Meeting will allocate results for the period.

Adjusted EBITDA:

OMA defines

Adjusted EBITDA as EBITDA less construction revenue plus construction expense and maintenance provision. Construction revenue and

construction cost do not affect cash flow generation and the maintenance provision corresponds to capital investments. Adjusted

EBITDA should be not considered as an alternative to net income, as an indicator of our operating performance, or as an alternative

to cash flow as an indicator of liquidity, or as an alternative to EBITDA.

Adjusted EBITDA margin:

OMA

calculates this margin as Adjusted EBITDA divided by the sum of aeronautical revenue and non-aeronautical revenue.

Aeronautical revenues:

are

revenues from rate-regulated services. These include revenue from airport services, regulated leases, and access fees from fourth

parties to provide complementary and ground transportation services. Airport service revenues include principally departing domestic

and international passenger charges (TUA), landing fees, aircraft parking charges, passenger and carry-on baggage screening, and

use of passenger jetways, among others. Revenue from fourth party access fees to provide complementary services include revenue

sharing for ramp services, aircraft towing, water loading and unloading, cabin cleaning, electricity supply, catering, security,

and aircraft maintenance, among others. Revenues from regulated leases include principally rental to airlines of office space,

hangars, and check-in and ticket sales counters. Revenues from access charges for providers of ground transportation services include

charges for taxis and buses.

Airport Concession Tax (DUAC):

This tax, the

Derecho de Uso de Activos Concesionados

, is equal to 5% of gross revenues, in accordance with the Federal

Royalties Law.

American Depositary Shares (ADS):

Securities issued by a U.S. depositary institution representing ownership interests in the deposited securities of non-U.S. companies.

Each OMA ADS represents eight Series B shares.

Capital expenditures, Capex:

includes investments in fixed assets (including investments in land, machinery, and equipment) and improvements to concessioned

properties.

Cargo unit:

equivalent to

100 kg of cargo.

Checked Baggage Screening:

During 2012, OMA began to operate checked baggage screening in its 13 airports in order to increase airport security and in compliance

with the requirements of the Civil Aviation General Directorate (DGAC). This screening uses the latest technology and is designed

to detect explosives in checked baggage. The cost of maintenance of the screening equipment is considered a regulated activity

and will be recovered through the

maximum rates, while the operational aspects are assessed

as a non-regulated service charge. In accordance with the Civil Aviation Law and the regulations issued by the DGAC, the primary

responsibility for damages and losses resulting from checked baggage lies with the airline. Notwithstanding the foregoing, OMA

may be found jointly liable with the airline through a legal proceeding if and when all of the following elements are proven: a)

occurrence of an illegal act, b) caused by the willful misconduct or bad faith of our subsidiary OMA Servicios Complementarios

del Centro Norte, S.A. de C.V., and c) related to or occurring during the baggage screening undertaken by OMA Servicios Complementarios

del Centro Norte, S.A. de C.V.

Construction revenue, construction

cost:

IFRIC 12 “Service Concession Arrangements” addresses how service concession operators should apply existing

International Financial Reporting Standards (IFRSs) to account for the obligations they undertake and rights they receive in service

concession arrangements. The concession contracts for each of OMA’s airport subsidiaries establishes that the concessionaire

is obligated to carry out construction or improvements to the infrastructure transferred in exchange for the rights over the concession

granted by the Federal Government. The latter will receive all the assets at the end of the concession period. As a result the

concessionaire should recognize, using the percentage of completion method, the revenues and costs associated with the improvements

to the concessioned assets. The amount of the revenues and costs so recognized should be the price that the concessionaire pays

or would pay in an arm’s length transaction for the execution of the works or the purchase of machinery and equipment, with

no profit recognized for the construction or improvement. The change does not affect operating income, net income, or EBITDA, but

does affect calculations of margins based on total revenues.

Earnings per share and ADS:

use the weighted average of shares or ADS outstanding for each period, excluding Treasury shares from the operation of the share

purchase program.

EBITDA:

For the purposes of

this report, OMA defines EBITDA as net income minus net comprehensive financing income, taxes, and depreciation and amortization.

EBITDA should be not considered as an alternative to net income, as an indicator of our operating performance, or as an alternative

to cash flow as an indicator of liquidity. Our management believes that EBITDA provides a useful measure of our performance that

is widely used by investors and analysts to evaluate our performance and compare it with other companies. However, it should be

noted that EBITDA is not defined under IFRS, and may be calculated differently by different companies.

Employee Benefits:

IFRS 19

(modified) “Employee Benefits” requires that cumulative actuarial gains and losses from pension obligations be recognized

immediately in comprehensive income. These gains and losses arise from the actuarial estimates used for calculating pension liabilities

as of the date of the financial statements.

IAS 34 “Interim Financial

Reporting”:

This norm establishes the minimum content that interim financial statements should include, as well as the

criteria for the formulation of the financial statements.

International Financial Reporting

Standards (IFRS):

Financial statements and other information are presented in accordance with IFRS and their Interpretations.

The financial statements for the year ended December 31, 2010 were the last statements prepared in accordance with Mexican Financial

Reporting Standards.

Major Maintenance Provision:

represents the obligation for future disbursements resulting from wear and tear or deterioration of the concessioned assets used

in operations including: runways, platforms, taxiways, and terminal buildings. The provision is increased periodically for the

wear and tear to the concessioned assets and the Company’s

estimates of the disbursements it needs to make. The use

of the provision corresponds to the outflows made for the conservation of these operational assets.

Master Development Plan (MDP):

The investment plan agreed to with the government every five years, under the terms of the concession agreement. These include

capital investments and maintenance for aeronautical activities, and exclude commercial and other non-aeronautical investments.

The investment horizon is 15 years, of which the next five years are committed investments.

Maximum Rate System:

The Ministry

of Communications and Transportation (SCT) regulates all our aeronautical revenues under a maximum rate system, which establishes

the maximum amount of revenues per workload unit (one terminal passenger or 100kg of cargo) that may be earned by each airport

each year from all regulated revenue sources. The concessionaire sets and registers the specific prices for services subject to

regulation, which may be adjusted every nine months as long as the combined revenue from regulated services per workload unit at

an airport does not exceed the maximum rate. The SCT reviews compliance with maximum rates on an annual basis after the close of

each year.

NH Collection T2 hotel:

The

NH Collection hotel in Terminal 2 of the Mexico City International Airport.

Non-aeronautical revenues:

are revenues that are not subject to rate regulation. These include revenues derived from commercial activities such as parking,

advertising, car rentals, leasing of commercial space, freight management and handling, and other lease income, among others; diversification

activities, such as the Hotel NH Terminal 2; and complementary activities, such as checked baggage screening.

Passengers:

all references

to passenger traffic volumes are to terminal passengers.

Passengers that pay passenger

charges (TUA):

Departing passengers, excluding connecting passengers, diplomats, and infants.

Passenger charges (TUA,

Tarifa

de Uso de Aeropuerto

):

are paid by departing passengers (excluding connecting passengers, diplomats, and infants). Rates

are established for each airport and are different for domestic and international travel.

Prior period comparisons:

unless stated otherwise, all comparisons of operating or financial results are made with respect to the comparable prior year period.

Balance sheet numbers are compared to the balances at the end of the prior year.

Strategic investments:

refers

only to those investments that are additional to those in the Master Development Plan.

Technical Assistance Fee:

Until June 13, 2015, this fee was charged as the higher of US$3.0 million per year or 5% of EBITDA before technical assistance.

With the signing of an Amendment to the Technical Assistance and Technology Transfer Agreement effective June 14, 2015, the annual

fee is charged as the higher of US$ 3.0 million per year or 4% of EBITDA for the fourth three years and 3% for the final two years

of the agreement. For the purposes of this calculation, consolidated EBITDA before technical assistance takes into account only

the subsidiaries holding the airport concessions or that provide personnel services directly or indirectly to the airports.

Terminal passengers:

includes

passengers on the three types of aviation (commercial, charter, and general aviation), and excludes passengers in transit.

Unaudited financials:

financial

statements are unaudited statements for the periods covered by the report.

Workload Unit

: one terminal

passenger or one cargo unit.

This report may contain forward-looking information and

statements. Forward-looking statements are statements that are not historical facts. These statements are only predictions based

on our current information and expectations and projections about future events. Forward-looking statements may be identified by

the words “believe,” “expect,” “anticipate,” “target,” “estimate,”

or similar expressions. While OMA's management believes that the expectations reflected in such forward-looking statements are

reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties,

many of which are difficult to predict and are generally beyond the control of OMA, that could cause actual results and developments

to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These

risks and uncertainties include, but are not limited to, those discussed in our most recent annual report filed on Form 20-F under

the caption “Risk Factors.” OMA undertakes no obligation to update publicly its forward-looking statements, whether

as a result of new information, future events, or otherwise

.

About OMA

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V., known

as OMA, operates 13 international airports in nine states of central and northern Mexico. OMA’s airports serve Monterrey,

Mexico’s fourth largest metropolitan area, the tourist destinations of Acapulco, Mazatlán, and Zihuatanejo, and nine

other regional centers and border cities. OMA also operates the NH Collection Hotel inside Terminal 2 of the Mexico City airport

and the Hilton Garden Inn at the Monterrey airport. OMA employs over 1,000 persons in order to offer passengers and clients airport

and commercial services in facilities that comply with all applicable international safety, security, and ISO 9001:2008 environmental

standards. OMA is listed on the Mexican Stock Exchange (OMA) and on the NASDAQ Global Select Market (OMAB). For more information,

visit:

• Webpage

http://ir.oma.aero

• Twitter

http://twitter.com/OMAeropuertos

• Facebook

https://www.facebook.com/OMAeropuertos

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Grupo Aeroportuario del Centro

Norte, S.A.B. de C.V.

|

|

|

|

|

By:

|

/s/ Porfirio González Álvarez

|

|

|

|

Porfirio González Álvarez

|

|

|

Chief Executive Officer

|

Dated

February 23, 2018

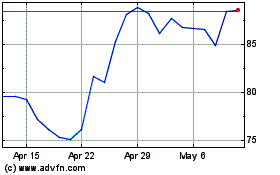

Grupo Aeroportuario del ... (NASDAQ:OMAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

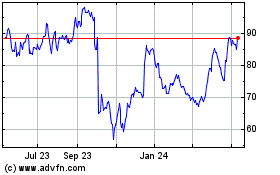

Grupo Aeroportuario del ... (NASDAQ:OMAB)

Historical Stock Chart

From Apr 2023 to Apr 2024