Current Report Filing (8-k)

February 23 2018 - 9:18AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 23, 2018

SOUTH JERSEY INDUSTRIES, INC.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

New Jersey | | 1-6364 | | 22-1901645 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1 South Jersey Plaza, Folsom, NJ 08037

(Address of Principal Executive Offices) (Zip Code)

(609) 561-9000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On Friday, February 23, 2018, South Jersey Industries, Inc. (“SJI”) will deliver a presentation to the financial community via live webcast, in conjunction with the presentation of its Q4 2017 financial results and future prospects during the company's Q4 2017 Earnings Call. The slide presentation is attached hereto as Exhibit 99. SJI does not intend for this Item 7.01 or Exhibit 99, to be treated as “filed” under the Securities Exchange Act of 1934, as amended, or incorporated by reference into its filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

Exhibit 99. South Jersey Industries, Inc. slide presentation which will be made available to the financial community in conjunction with the company's Q4 2017 Earnings Call on February 23, 2018.

Exhibit Index

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | |

| SOUTH JERSEY INDUSTRIES, INC. | |

| | | |

Date: February 23, 2018 | By: | /s/ Stephen H. Clark | |

| | Stephen H. Clark | |

| | Executive Vice President & Chief Financial Officer | |

South Jersey Industries

Q4/FY 2017 Business Update

February 23, 2018

Certain statements contained in this presentation may qualify as “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934. All statements other than statements of historical fact should be considered forward-looking

statements made in good faith and are intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “expect”,

“estimate”, “forecast”, “goal”, “intend”, “objective”, “plan”, “project”, “seek”, “strategy”, “target”, “will”

and similar expressions are intended to identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause actual results to differ materially from

those expressed or implied in the statements. These risks and uncertainties include, but are not limited

to, the following: general economic conditions on an international, national, state and local level;

weather conditions in our marketing areas; changes in commodity costs; changes in the availability of

natural gas; “non-routine” or “extraordinary” disruptions in our distribution system; regulatory,

legislative and court decisions; competition; the availability and cost of capital; costs and effects of legal

proceedings and environmental liabilities; the failure of customers or suppliers to fulfill their contractual

obligations; and changes in business strategies. These cautionary statements should not be construed

by you to be exhaustive. While SJI believes these forward-looking statements to be reasonable, there

can be no assurance that they will approximate actual experience. Further, SJI undertakes no obligation

to update or revise any of its forward-looking statements, whether as a result of new information,

future events or otherwise.

Forward Looking Statements

2

Grow

Economic

Earnings

Improve

Quality of

Earnings

Maintain

Balance Sheet

Strength

Maintain Low

to Moderate

Risk Profile

2017 Highlights

Economic EPS of $1.23, Ahead of $1.14-1.20 Guidance

• Base Rate Case settlement added $6.0M to Economic Earnings

• AIRP II and SHARP investments totaling $94.5 million

• SJG added ~8,600 customers (gross)

• FERC issued certificate of public convenience and necessity for the PennEast

Pipeline project

• Agreed to acquire Elizabethtown Gas and Elkton Gas

The Path to Growth

3

2018 Guidance

Business Line

Percent of

Total SJI Economic Earnings

2017A 2018 Target

South Jersey Gas 75% 63% - 67%

SJI Midstream 5% 2% - 5%

Non-Utility 20% 27% - 36%

2018 Economic EPS Guidance of $1.57 to $1.651

1 Excluding impact from pending acquisitions; inclusive of tax reform and January cold weather impacts.

4

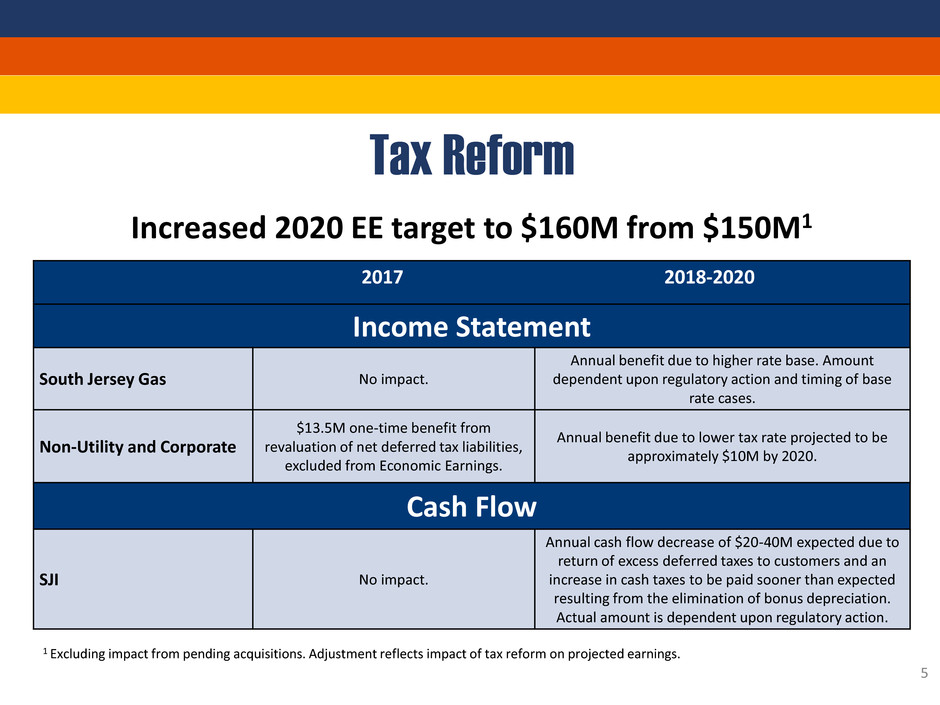

Tax Reform

1 Excluding impact from pending acquisitions. Adjustment reflects impact of tax reform on projected earnings.

Increased 2020 EE target to $160M from $150M1

2017 2018-2020

Income Statement

South Jersey Gas No impact.

Annual benefit due to higher rate base. Amount

dependent upon regulatory action and timing of base

rate cases.

Non-Utility and Corporate

$13.5M one-time benefit from

revaluation of net deferred tax liabilities,

excluded from Economic Earnings.

Annual benefit due to lower tax rate projected to be

approximately $10M by 2020.

Cash Flow

SJI No impact.

Annual cash flow decrease of $20-40M expected due to

return of excess deferred taxes to customers and an

increase in cash taxes to be paid sooner than expected

resulting from the elimination of bonus depreciation.

Actual amount is dependent upon regulatory action.

5

SJG Base Rate Case and

Infrastructure Investment

Base Rate Case Outcome

Rate of Return 6.8%

Return on Equity 9.6%

Equity-to-capital ratio 52.5%

Annual Net Income

Impact

$20.8M

2017 Incremental Net

Income Impact

$6.0M

2018 Incremental Net

Income Impact

$14.8M

AIRP II (Accelerated Infrastructure Replacement Program)

Earn ROI with annual roll-in to base rates each October

$4.7M increase in annual revenues effective Oct. 1,

based on $46.1M investment

Currently in year two of 5-year, $302.5M program

SHARP (Storm Hardening and Reliability Program)

Earn ROI with annual roll-in to base rates each October

$3.4M increase in annual revenues effective Oct. 1, based

on $33.3M investment

Phase II petition filed November 1

Proposed investment of $110M from 2018-2021

BL England

Proposed ≈ $115M pipeline to supply natural gas to the

former BL England generating facility

Legal appeal process continues, with a favorable

resolution anticipated

6

Capex Drives Economic Earnings

$1.9B of planned Cap Ex 2017-20201

Focused on regulated utility and FERC regulated growth

2017A-2020E

% Utility and FERC

regulated:

97%

1 Capital expenditures shown are inclusive of affiliate investments and reflect any projections for pending acquisition

2017A 2018E 2019E 2020E

Regulated Utility FERC regulated Non-Utility

$402M

$651M

$530M

$303M

7

$1,484M

$352M

$49M

Utility Customer Growth

12 Months Ending

December 31, 2017

Margin Growth from Customer Additions $2.4M

Conversions 6,108

New Construction 2,528

Total Gross Customer Additions 8,636

Net Customer Additions 6,008

Year Over Year Net Growth Rate 1.6%

8

PennEast Pipeline Project

• $200M investment, 20% equity

owner in $1.0B+, 1 BCF, 118-mile

interstate pipeline from Marcellus

region of PA into NJ

• Contributed $4.6M to 2017 earnings

from AFUDC

• FERC approved on January 19, 2018

• Additional state permits required

• Construction expected to begin in

2018

9

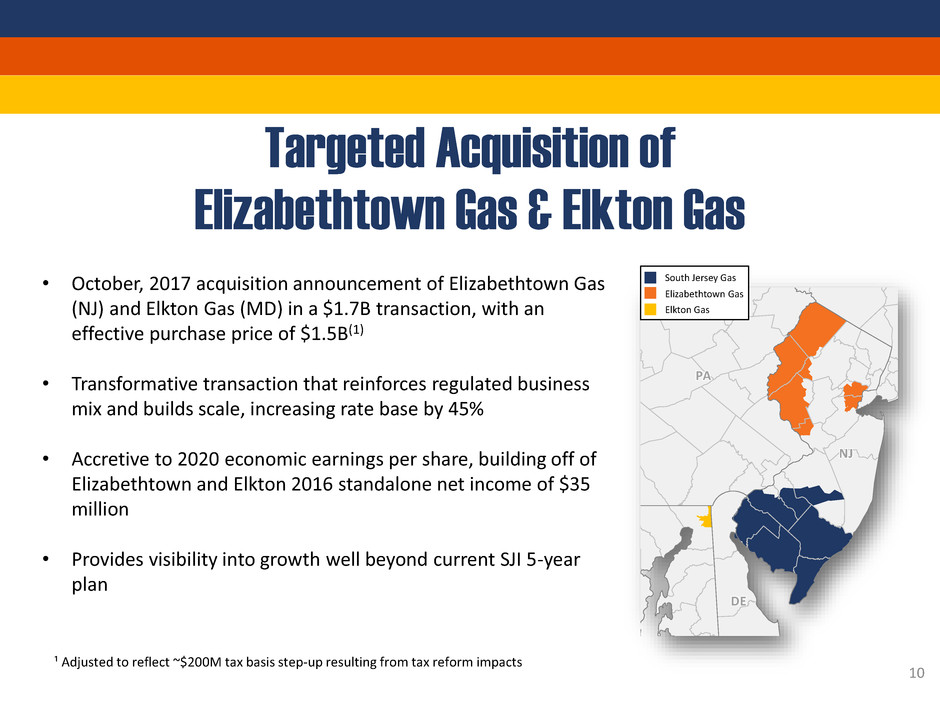

Targeted Acquisition of

Elizabethtown Gas & Elkton Gas

¹ Adjusted to reflect ~$200M tax basis step-up resulting from tax reform impacts 980388_1.wor - NY008P5T

NJJ

PA

DE

MD

NY

VA

South Jersey Gas

Elizabethtown Gas

Elkton Gas

• October, 2017 acquisition announcement of Elizabethtown Gas

(NJ) and Elkton Gas (MD) in a $1.7B transaction, with an

effective purchase price of $1.5B(1)

• Transformative transaction that reinforces regulated business

mix and builds scale, increasing rate base by 45%

• Accretive to 2020 economic earnings per share, building off of

Elizabethtown and Elkton 2016 standalone net income of $35

million

• Provides visibility into growth well beyond current SJI 5-year

plan

10

GAAP Earnings – 2017 v 2016

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

In millions except per share data

Gas Utility $29.6 $22.9 $6.7 $72.6 $69.0 $3.6

Midstream $0.9 ($0.1) $1.0 $4.6 ($0.2) $4.8

SJ Energy Group $5.1 $19.5 ($14.4) ($21.8) $33.6 ($55.4)

SJ Energy Services1,2 ($30.9) $3.9 ($34.8) ($59.8) $16.8 ($76.6)

Acquisition Expenses ($12.0) $0.0 ($12.0) ($12.0) $0.0 ($12.0)

SJI Other ($0.1) ($0.2) $0.1 $1.6 ($0.1) $1.7

Tax Adjustments3 $11.4 $0.0 $11.4 $11.4 $0.0 $11.4

SJI $4.0 $46.0 ($42.0) $(3.4) $119.1 ($122.5)

SJI EPS $0.05 $0.58 ($0.53) $(0.04) $1.56 ($1.60)

1 Includes after-tax charges related to legal proceedings

2 Reflects after-tax charges related to solar impairments and write-down of landfill assets

3 Represents one-time tax adjustments made throughout the year, most notably for Tax Reform, which was signed into law in December 2017

11

Economic Earnings – 2017 v 2016

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

In millions except per share data

Gas Utility $29.6 $22.9 $6.7 $72.6 $69.0 $3.6

Midstream $0.9 ($0.1) $1.0 $4.6 ($0.2) $4.8

SJ Energy Group $11.7 $7.3 $4.4 $21.3 $17.7 $3.6

SJ Energy Services ($2.8) $3.3 ($6.1) ($2.8) $16.5 ($19.3)

SJI Other $0.6 ($0.2) $0.8 $2.4 ($0.2) $2.6

SJI $40.0 $33.2 $6.8 $98.1 $102.8 ($4.7)

SJI EPS

$0.50 $0.42 $0.08 $1.23 $1.34 ($0.11)

*SJI uses the non-GAAP measure of Economic Earnings when discussing results. A full explanation and reconciliation of this non-GAAP measure is provided under

“Explanation and Reconciliation of Non-GAAP Financial Measures” in the Earnings Release.

12

South Jersey Gas

In millions¹ Q4 FY Performance Notes

2016 Net Income $22.9 $69.0

Customer Growth $0.8 $2.4 1.6% YOY customer growth

Accelerated Infrastructure

Investments

$1.4 $4.2

AIRP and SHARP investments

Rate Case Investments $6.0 $6.0 Rate Case investments roll-in to base rates

November 1

Off System Sales $0.1 $0.2

O&M Expenses² ($0.9) ($4.8) Resource investments supporting future growth;

increased reserve for uncollectible accounts

Depreciation³ ($0.7) ($2.4) Additional assets placed in service

Interest Charges – Net of Capitalized³ ($0.6) ($1.8)

Other $0.6 $0.2

2017 Net Income $29.6 $72.6

¹ Slide depicts changes to period over period net income, it is not intended to be a substitute for financial statements

² Excludes expenses where there is a corresponding credit in operating revenues (i.e., no impact on our financial results)

³ Expenses associated with accelerated infrastructure investments are reflected within that line item 13

South Jersey Energy Group

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

Economic Earnings, in millions

SJ ENERGY GROUP $11.7 $7.3 $4.4 $21.3 $17.7 $3.6

Retail Commodity ($0.7) $0.0 ($0.7) ($0.5) $1.3 ($1.8)

Fuel Management1 $1.7 $1.2 $0.5 $5.8 $4.2 $1.6

Wholesale Mktg / Asset

Optimization2

$10.7 $6.1 $4.6 $15.8 $12.2 $3.6

SJ Exploration $0.0 $0.0 $0.0 $0.2 $0.0 $0.2

1 Fuel Management benefited from the additional contract that came on-line earlier in the year

2 YTD improvement driven by optimization of storage and capacity. Results partly offset by record low spreads from warmer weather in Q1.

14

South Jersey Energy Services

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

Economic Earnings, in millions

SJ ENERGY SERVICES ($2.8) $3.3 ($6.1) ($2.8) $16.5 ($19.3)

CHP1 $0.0 $0.5 ($0.5) $0.5 $6.2 ($5.7)

Solar2 ($2.1) ($0.8) ($1.3) $0.4 $3.0 ($2.6)

Landfills ($0.8) ($1.1) $0.3 ($3.7) ($2.6) ($1.1)

ITC3 $0.0 $4.5 ($4.5) $0.0 $9.1 ($9.1)

Other $0.1 $0.2 ($0.1) $0.0 $0.8 ($0.8)

1 CHP comparison YTD impacted by non-recurring $4.3M settlement that benefited 2016

2 Solar comparison YTD impacted by reduced revenue from MD projects and increased interest expense

3 No ITC in 2017 earnings

15

Appendix

Non-Utility GAAP Earnings – 2017 v 2016

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

GAAP Earnings, in millions

SJ ENERGY GROUP $5.1 $19.5 ($14.4) ($21.8) $33.6 ($55.4)

Retail Commodity $1.9 $3.0 ($1.1) $1.4 $7.4 ($6.0)

Fuel Management $1.7 $1.2 $0.5 $5.8 $4.2 $1.6

Wholesale Mktg / Asset

Optimization1

$1.5 $15.3 ($13.8) ($29.2) $21.9 ($51.1)

SJ Exploration $0.0 $0.0 $0.0 $0.2 $0.1 $0.1

17

1 YOY wholesale results impacted by previously noted legal disputes with suppliers

Non-Utility GAAP Earnings – 2017 v 2016

For the twelve months ended December 31

Q4 2017 Q4 2016 Variance FY 2017 FY 2016 Variance

GAAP Earnings, in millions

SJ ENERGY SERVICES1 $(30.9) $3.9 ($28.8) ($59.9) $16.8 ($70.6)

CHP ($17.4) $1.1 ($18.5) ($18.4) $6.5 ($24.9)

Solar $3.2 ($0.8) $4.0 ($21.7) $3.0 ($24.7)

Landfills ($11.5) ($1.1) ($10.4) ($14.4) ($2.6) ($11.8)

ITC $0.0 $4.5 ($4.5) $0.0 $9.1 ($9.1)

Other $0.8 $0.2 $0.6 $0.7 $0.8 ($0.1)

18

1 Reflects after-tax charges related to solar impairments and write-down of landfill assets

Fuel Supply Management

Counterparty Location

Capacity

(MW)

Volume

(Dth/day) Start Date Term

Starwood Marcus Hook, PA 750 80,000 In service 2016 - evergreen

LS Power West Deptford, NJ 738 36,000 In service 15 Years

LS Power II West Deptford, NJ 400 31,000 In service 15 Years

Moxie - Liberty Bradford Co, PA 825 137,655 In service 5 Years

Moxie - Patriot Lycoming Co, PA 825 137,655 In service 4 Years

Panda - Stonewall Leesburg, VA 750 110,000 In service 4 Years

Moxie - Freedom Luzerne, PA 1,029 157,000 2018 10 Years

Lordstown Trumbell, OH 1,029 160,000 2018 5 Years

Invenergy - Lackawanna Jessup, PA 1,045 210,000 2018 10 Years

Hickory Run Lawrence County, PA 1,000 162,000 2020 5 years

To Be Announced TBA 990 121,000 TBA 4 Years 19

Solar SREC Generation

MW DC Number of SRECs

26,193

55,766

111,908

136,379

224,737

240,333

-

50,000

100,000

150,000

200,000

250,000

300,000

0

50

100

150

200

250

2012 2013 2014 2015 2016 2017

SRECs generated MWs Installed

20

21

2017 GAAP to Economic Earnings Reconciliation

-$3,404

$98,065

$56,048

$34,308

$12,032

$10,303 $199

$11,420

-$5,000

$15,000

$35,000

$55,000

$75,000

$95,000

$115,000

$135,000

USD $Thousands

This regulatory filing also includes additional resources:

q42017quarterlyresultsfinal.pdf

South Jersey Industries (NYSE:SJI)

Historical Stock Chart

From Mar 2024 to Apr 2024

South Jersey Industries (NYSE:SJI)

Historical Stock Chart

From Apr 2023 to Apr 2024