Amended Current Report Filing (8-k/a)

February 22 2018 - 5:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

CURRENT REPORT

|

|

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 20, 2018

|

|

|

|

|

LendingClub Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Commission File Number: 001-36771

|

|

|

|

|

Delaware

|

51-0605731

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

71 Stevenson St., Suite 300, San Francisco, CA 94105

|

|

(Address of principal executive offices and zip code)

|

|

(415) 632-5600

(Registrant's telephone number, including area code)

|

|

N/A

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging growth company

|

¨

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

¨

|

EXPLANATORY NOTE

LendingClub Corporation is filing this Amendment No. 1 to Current Report on Form 8-K to amend the Current Report on Form 8-K filed by LendingClub Corporation on February 22, 2018 (the "Original 8-K") for the sole purpose of correcting: (i) a typographical error in the introductory paragraph under Item 8.01 of the Original 8-K and (ii) a typographical error with respect to the interest rate for loan grade A1 in the first table under Item 8.01 of the Original 8-K. As corrected, under the updated interest rates, the interest rate for loan grade D1 has increased 0.38% and the interest rate for loan grade A1 is 5.31%. All other information in the Original 8-K is unchanged.

Effective February 20, 2018, interest rates on the LendingClub Corporation ("LendingClub") platform have been updated. Notable changes include an increase of 0.38% for loan grade D1, 0.39% for loan grades D2-D4, 0.40% for loan grade D5, and 0.47% for loan grade E5.

In addition, LendingClub's Chief Investment Officer released his quarterly update, which can be accessed on LendingClub's blog at

blog.lendingclub.com

. The contents of this blog are not incorporated into this filing.

Set forth below is a chart showing the interest rates assigned to standard program loans for each of the LendingClub loan grades.

|

|

|

|

|

|

|

|

Loan Grade

|

|

Interest Rate

|

|

|

A1

|

|

5.31

|

%

|

|

A2

|

|

6.07

|

%

|

|

A3

|

|

6.71

|

%

|

|

A4

|

|

7.34

|

%

|

|

A5

|

|

7.96

|

%

|

|

B1

|

|

9.43

|

%

|

|

B2

|

|

9.92

|

%

|

|

B3

|

|

10.41

|

%

|

|

B4

|

|

10.90

|

%

|

|

B5

|

|

11.98

|

%

|

|

C1

|

|

12.61

|

%

|

|

C2

|

|

13.58

|

%

|

|

C3

|

|

14.07

|

%

|

|

C4

|

|

15.04

|

%

|

|

C5

|

|

16.01

|

%

|

|

D1

|

|

17.47

|

%

|

|

D2

|

|

18.45

|

%

|

|

D3

|

|

19.42

|

%

|

|

D4

|

|

20.39

|

%

|

|

D5

|

|

21.85

|

%

|

|

E1

|

|

22.90

|

%

|

|

E2

|

|

23.87

|

%

|

|

E3

|

|

24.84

|

%

|

|

E4

|

|

25.81

|

%

|

|

E5

|

|

26.77

|

%

|

|

F1

|

|

28.72

|

%

|

|

F2

|

|

29.69

|

%

|

|

F3

|

|

30.17

|

%

|

|

F4

|

|

30.65

|

%

|

|

F5

|

|

30.75

|

%

|

|

G1

|

|

30.79

|

%

|

|

G2

|

|

30.84

|

%

|

|

G3

|

|

30.89

|

%

|

|

G4

|

|

30.94

|

%

|

|

G5

|

|

30.99

|

%

|

Illustration of Servicing Fee and Annual Returns for Fully Performing Loans of Each Loan Grade

The following tables illustrate hypothetical annual return information with respect to our Member Payment Dependent Notes, grouped by LendingClub grade and term. The information in these tables is not based on actual results for investors and is presented only to illustrate the effects of LendingClub’s 1.00% servicing fee by grade on hypothetical annual Member Payment Dependent Note returns. By column, each table presents:

•

loan grades;

•

the annual stated interest rate;

|

|

|

|

•

|

the reduction in the annual return due to LendingClub's 1.00% servicing fee on both interest and principal payments; and

|

•

the hypothetical annual returns on Notes, net of LendingClub's servicing fee.

Three Year Term

|

|

|

|

|

|

|

|

|

|

|

Loan

Grade

|

|

Interest

Rate

|

|

Reduction in

Note Return

due to 1.00%

Servicing Fee*

|

|

Note Returns After

LendingClub's

Servicing Fee

|

|

A1

|

|

5.31%

|

|

0.67%

|

|

4.64%

|

|

A2

|

|

6.07%

|

|

0.67%

|

|

5.40%

|

|

A3

|

|

6.71%

|

|

0.68%

|

|

6.03%

|

|

A4

|

|

7.34%

|

|

0.68%

|

|

6.66%

|

|

A5

|

|

7.96%

|

|

0.68%

|

|

7.28%

|

|

B1

|

|

9.43%

|

|

0.69%

|

|

8.74%

|

|

B2

|

|

9.92%

|

|

0.69%

|

|

9.23%

|

|

B3

|

|

10.41%

|

|

0.69%

|

|

9.72%

|

|

B4

|

|

10.90%

|

|

0.69%

|

|

10.21%

|

|

B5

|

|

11.98%

|

|

0.70%

|

|

11.28%

|

|

C1

|

|

12.61%

|

|

0.70%

|

|

11.91%

|

|

C2

|

|

13.58%

|

|

0.70%

|

|

12.88%

|

|

C3

|

|

14.07%

|

|

0.71%

|

|

13.36%

|

|

C4

|

|

15.04%

|

|

0.71%

|

|

14.33%

|

|

C5

|

|

16.01%

|

|

0.71%

|

|

15.30%

|

|

D1

|

|

17.47%

|

|

0.72%

|

|

16.75%

|

|

D2

|

|

18.45%

|

|

0.72%

|

|

17.73%

|

|

D3

|

|

19.42%

|

|

0.73%

|

|

18.69%

|

|

D4

|

|

20.39%

|

|

0.73%

|

|

19.66%

|

|

D5

|

|

21.85%

|

|

0.74%

|

|

21.11%

|

|

E1

|

|

22.90%

|

|

0.74%

|

|

22.16%

|

|

E2

|

|

23.87%

|

|

0.75%

|

|

23.12%

|

|

E3

|

|

24.84%

|

|

0.75%

|

|

24.09%

|

|

E4

|

|

25.81%

|

|

0.76%

|

|

25.05%

|

|

E5

|

|

26.77%

|

|

0.76%

|

|

26.01%

|

|

F1

|

|

28.72%

|

|

0.77%

|

|

27.95%

|

|

F2

|

|

29.69%

|

|

0.78%

|

|

28.91%

|

|

F3

|

|

30.17%

|

|

0.78%

|

|

29.39%

|

|

F4

|

|

30.65%

|

|

0.78%

|

|

29.87%

|

|

F5

|

|

30.75%

|

|

0.78%

|

|

29.97%

|

|

G1

|

|

30.79%

|

|

0.78%

|

|

30.01%

|

|

G2

|

|

30.84%

|

|

0.78%

|

|

30.06%

|

|

G3

|

|

30.89%

|

|

0.78%

|

|

30.11%

|

|

G4

|

|

30.94%

|

|

0.78%

|

|

30.16%

|

|

G5

|

|

30.99%

|

|

0.78%

|

|

30.21%

|

* Impact of Note servicing fees is computed using the loan’s contractual cashflows; no charge-off losses or prepayments are projected over the loan’s life that would otherwise affect the loan’s projected cashflows.

Five Year Term

|

|

|

|

|

|

|

|

|

|

|

Loan

Grade

|

|

Interest

Rate

|

|

Reduction in

Note Return

due to 1.00%

Servicing Fee*

|

|

Note Returns After

Lending Club's

Servicing Fee

|

|

A1

|

|

5.31%

|

|

0.41%

|

|

4.90%

|

|

A2

|

|

6.07%

|

|

0.42%

|

|

5.65%

|

|

A3

|

|

6.71%

|

|

0.42%

|

|

6.29%

|

|

A4

|

|

7.34%

|

|

0.42%

|

|

6.92%

|

|

A5

|

|

7.96%

|

|

0.42%

|

|

7.54%

|

|

B1

|

|

9.43%

|

|

0.43%

|

|

9.00%

|

|

B2

|

|

9.92%

|

|

0.43%

|

|

9.49%

|

|

B3

|

|

10.41%

|

|

0.43%

|

|

9.98%

|

|

B4

|

|

10.90%

|

|

0.44%

|

|

10.46%

|

|

B5

|

|

11.98%

|

|

0.44%

|

|

11.54%

|

|

C1

|

|

12.61%

|

|

0.44%

|

|

12.17%

|

|

C2

|

|

13.58%

|

|

0.45%

|

|

13.13%

|

|

C3

|

|

14.07%

|

|

0.45%

|

|

13.62%

|

|

C4

|

|

15.04%

|

|

0.45%

|

|

14.59%

|

|

C5

|

|

16.01%

|

|

0.46%

|

|

15.55%

|

|

D1

|

|

17.47%

|

|

0.47%

|

|

17.00%

|

|

D2

|

|

18.45%

|

|

0.47%

|

|

17.98%

|

|

D3

|

|

19.42%

|

|

0.47%

|

|

18.95%

|

|

D4

|

|

20.39%

|

|

0.48%

|

|

19.91%

|

|

D5

|

|

21.85%

|

|

0.49%

|

|

21.36%

|

|

E1

|

|

22.90%

|

|

0.49%

|

|

22.41%

|

|

E2

|

|

23.87%

|

|

0.50%

|

|

23.37%

|

|

E3

|

|

24.84%

|

|

0.50%

|

|

24.34%

|

|

E4

|

|

25.81%

|

|

0.51%

|

|

25.30%

|

|

E5

|

|

26.77%

|

|

0.51%

|

|

26.26%

|

|

F1

|

|

28.72%

|

|

0.52%

|

|

28.20%

|

|

F2

|

|

29.69%

|

|

0.53%

|

|

29.16%

|

|

F3

|

|

30.17%

|

|

0.53%

|

|

29.64%

|

|

F4

|

|

30.65%

|

|

0.53%

|

|

30.12%

|

|

F5

|

|

30.75%

|

|

0.53%

|

|

30.22%

|

|

G1

|

|

30.79%

|

|

0.53%

|

|

30.26%

|

|

G2

|

|

30.84%

|

|

0.53%

|

|

30.31%

|

|

G3

|

|

30.89%

|

|

0.53%

|

|

30.36%

|

|

G4

|

|

30.94%

|

|

0.53%

|

|

30.41%

|

|

G5

|

|

30.99%

|

|

0.53%

|

|

30.46%

|

* Impact of Note servicing fees is computed using the loan’s contractual cashflows; no charge-off losses or prepayments are projected over the loan’s life that would otherwise affect the loan’s projected cashflows.

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

LendingClub Corporation

|

|

Date:

|

February 22, 2018

|

By:

|

/s/ Russell S. Elmer

|

|

|

|

|

Russell S. Elmer

|

|

|

|

|

General Counsel and Secretary

|

|

|

|

|

(duly authorized officer)

|

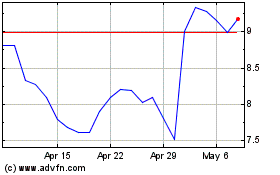

LendingClub (NYSE:LC)

Historical Stock Chart

From Mar 2024 to Apr 2024

LendingClub (NYSE:LC)

Historical Stock Chart

From Apr 2023 to Apr 2024