Current Report Filing (8-k)

February 22 2018 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 21, 2018

MARTIN MIDSTREAM PARTNERS L.P.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

DELAWARE

(State of incorporation

or organization)

|

|

000-50056

(Commission file number)

|

|

05-0527861

(I.R.S. employer identification number)

|

|

|

|

|

|

4200 STONE ROAD

|

|

|

|

KILGORE, TEXAS

(Address of principal executive offices)

|

|

75662

(Zip code)

|

Registrant's telephone number, including area code: (903) 983-6200

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the

Exchange Act.

o

|

|

|

|

|

|

|

Item 1.01

|

|

Entry into a Material Definitive Agreement.

|

The information included or incorporated by reference in Item 2.03 of this Current Report (this “

Report

”) on Form 8-K is incorporated by reference into this Item 1.01 of this Report.

|

|

|

|

|

|

|

Item 2.03

|

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On February 21, 2018, Martin Operating Partnership L.P. (the "Operating Partnership"), Martin Midstream Partners L.P. (the "Partnership") and certain of their subsidiaries entered into a Sixth Amendment to the Third Amended and Restated Credit Agreement (the “Credit Agreement Amendment”), which amended that certain Third Amended and Restated Credit Agreement, dated as of March 28, 2013, by and among the Operating Partnership, as the borrower, the Partnership, certain of their subsidiaries, Royal Bank of Canada, as administrative agent and collateral agent for the Lenders and as L/C Issuer and a Lender, and the other Lenders as set forth therein, as amended (the “Credit Agreement”).

The Credit Agreement Amendment amends the Credit Agreement to, among other things, (i) create an inventory financing sublimit tranche, which is a part of and not in addition to the already existing commitments under the Credit Agreement, under which availability is subject to a borrowing base calculated by reference to eligible petroleum products inventory, (ii) exclude the amount of loans under the inventory financing sublimit tranche from our total outstanding indebtedness for purposes of determining leverage ratio covenants under the Credit Agreement, (iii) increase the maximum permitted leverage ratio (as defined in the Credit Agreement, being generally computed as the ratio of total funded debt to consolidated earnings before interest, taxes, depreciation, amortization and certain other non-cash charges) from 5.25 to 1.00, with a temporary springing provision to 5.50 to 1.00 under certain scenarios, to 5.75 to 1.00 for the first and second quarters of 2018, 5.50 to 1.00 for the next three quarters and 5.25 to 1.00, with the temporary springing provision to 5.50 to 1.00 going back into effect, thereafter and (iv) decrease the maximum permitted senior leverage ratio (as defined in the Credit Agreement, being generally computed as the ratio of total secured funded debt to consolidated earnings before interest, taxes, depreciation, amortization and certain other non-cash charges) from 3.50 to 1.00 to 3.25 to 1.00. The maximum amount of the inventory financing sublimit tranche is $10.0 million during the period between March 1 and June 30 of each year, and $75.0 million at all other times during each year.

The Credit Agreement and its revolving credit facility are the Partnership’s primary source of liquidity and matures March 28, 2020.

This summary of material terms of the Credit Agreement Amendment is not complete, and is qualified in its entirety by the full text of the Sixth Amendment, dated February 21, 2018, to the Third Amended and Restated Credit Agreement, dated as of March 28, 2013, by and among the Partnership, the Operating Partnership, certain of their subsidiaries, Royal Bank of Canada and the other Lenders as set forth therein, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(d)

Exhibits

In accordance with General Instruction B.2 of Form 8-K, the information set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

MARTIN MIDSTREAM PARTNERS L.P.

By: Martin Midstream GP LLC,

Its General Partner

|

|

Date: February 22, 2018

|

|

By: /s/ Robert D. Bondurant

|

|

|

|

Robert D. Bondurant

|

|

|

|

Executive Vice President, Treasurer, Principal Accounting Officer and

Chief Financial Officer

|

INDEX TO EXHIBITS

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

|

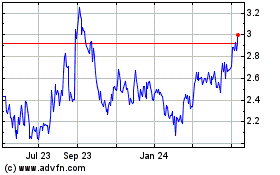

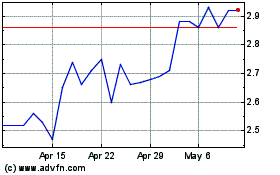

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024