Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 22 2018 - 6:09AM

Edgar (US Regulatory)

FREE WRITING PROSPECTUS

Filed Pursuant to Rule 433

Registration

No. 333-214446

February 21, 2018

WESTERN GAS PARTNERS, LP

Terms

Applicable to the Senior Notes due 2028

|

|

|

|

|

Issuer:

|

|

Western Gas Partners, LP

|

|

|

|

|

Security Type:

|

|

Senior Unsecured Notes

|

|

|

|

|

Legal Format:

|

|

SEC Registered

|

|

|

|

|

Pricing Date:

|

|

February 21, 2018

|

|

|

|

|

Settlement Date (T+7):

|

|

March 2, 2018

|

|

|

|

|

Net Proceeds Before Expenses:

|

|

$395,140,000

|

|

|

|

|

Maturity Date:

|

|

March 1, 2028

|

|

|

|

|

Principal Amount:

|

|

$400,000,000

|

|

|

|

|

Benchmark Treasury:

|

|

2.750% due February 15, 2028

|

|

|

|

|

Benchmark Price / Yield:

|

|

98-10

/ 2.946%

|

|

|

|

|

Spread to Benchmark:

|

|

T+162.5 bps

|

|

|

|

|

Yield to Maturity:

|

|

4.571%

|

|

|

|

|

Coupon:

|

|

4.500%

|

|

|

|

|

Public Offering Price:

|

|

99.435%

|

|

|

|

|

Optional Redemption:

|

|

Redeemable at any time before December 1, 2027 in an amount equal to the principal amount plus a make-whole premium, using a discount rate of T + 25 bps, plus accrued and unpaid interest. Redeemable at any time on or after

December 1, 2027 in an amount equal to the principal amount plus accrued and unpaid interest.

|

|

|

|

|

Interest Payment Dates:

|

|

March 1 and September 1, beginning on September 1, 2018

|

|

|

|

|

CUSIP / ISIN:

|

|

958254 AH7 / US958254AH78

|

|

|

|

|

Joint Book-Running Managers:

|

|

Mizuho Securities USA LLC

Credit Suisse

Securities (USA) LLC

MUFG Securities Americas Inc.

TD

Securities (USA) LLC

Barclays Capital Inc.

Deutsche Bank

Securities Inc.

Morgan Stanley & Co. LLC

PNC Capital

Markets LLC

RBC Capital Markets, LLC

Scotia Capital (USA)

Inc.

U.S. Bancorp Investments, Inc.

Wells Fargo Securities,

LLC

|

|

|

|

|

|

|

|

|

Co-Managers:

|

|

BMO Capital Markets Corp.

BB&T Capital

Markets, a division of BB&T Securities, LLC

Capital One Securities, Inc.

Comerica Securities, Inc.

SG Americas Securities,

LLC

|

|

|

|

|

Terms Applicable to the Senior Notes due 2048

|

|

|

|

|

|

|

Issuer:

|

|

Western Gas Partners, LP

|

|

|

|

|

Security Type:

|

|

Senior Unsecured Notes

|

|

|

|

|

Legal Format:

|

|

SEC Registered

|

|

|

|

|

Pricing Date:

|

|

February 21, 2018

|

|

|

|

|

Settlement Date (T+7):

|

|

March 2, 2018

|

|

|

|

|

Net Proceeds Before Expenses:

|

|

$688,058,000

|

|

|

|

|

Maturity Date:

|

|

March 1, 2048

|

|

|

|

|

Principal Amount:

|

|

$700,000,000

|

|

|

|

|

Benchmark Treasury:

|

|

2.750% due November 15, 2047

|

|

|

|

|

Benchmark Price / Yield:

|

|

90-27

/ 3.231%

|

|

|

|

|

Spread to Benchmark:

|

|

T+212.5 bps

|

|

|

|

|

Yield to Maturity:

|

|

5.356%

|

|

|

|

|

Coupon:

|

|

5.300%

|

|

|

|

|

Public Offering Price:

|

|

99.169%

|

|

|

|

|

Optional Redemption:

|

|

Redeemable at any time before September 1, 2047 in an amount equal to the principal amount plus a make-whole premium, using a discount rate of T + 35 bps, plus accrued and unpaid interest. Redeemable at any time on or

after September 1, 2047 in an amount equal to the principal amount plus accrued and unpaid interest.

|

|

|

|

|

Interest Payment Dates:

|

|

March 1 and September 1, beginning on September 1, 2018

|

|

|

|

|

CUSIP / ISIN:

|

|

958254 AJ3 / US958254AJ35

|

|

|

|

|

Joint Book-Running Managers:

|

|

Mizuho Securities USA LLC

Credit Suisse

Securities (USA) LLC

MUFG Securities Americas Inc.

TD

Securities (USA) LLC

Barclays Capital Inc.

Deutsche Bank

Securities Inc.

Morgan Stanley & Co. LLC

PNC Capital

Markets LLC

RBC Capital Markets, LLC

Scotia Capital (USA)

Inc.

U.S. Bancorp Investments, Inc.

Wells Fargo Securities,

LLC

|

|

|

|

|

|

|

|

|

Co-Managers:

|

|

BMO Capital Markets Corp.

BB&T Capital

Markets, a division of BB&T Securities, LLC

Capital One Securities, Inc.

Comerica Securities, Inc.

SG Americas Securities,

LLC

|

After giving effect to the issuance and sale of the notes and the application of the net proceeds as set forth under “Use

of Proceeds,” as of February 20, 2018, we would have been able to incur the full $1.5 billion of indebtedness under our recently amended revolving credit facility.

The Issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for the offering

to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get

these documents for free by visiting EDGAR on the SEC web site at http://www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Mizuho

Securities USA LLC toll-free at

1-866-271-7403,

Credit Suisse Securities (USA) LLC toll-free at

1-800-221-1037,

MUFG Securities Americas Inc. toll-free at

1-877-649-6848

or TD Securities (USA) LLC toll-free at

1-855-495-9846.

This Pricing Supplement is qualified in its entirety by reference to the related

preliminary prospectus supplement dated February 21, 2018 (the “Preliminary Prospectus Supplement”). The information in this Pricing Supplement supplements the Preliminary Prospectus Supplement and supersedes the information in the

Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement.

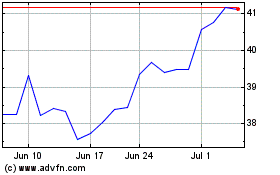

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Mar 2024 to Apr 2024

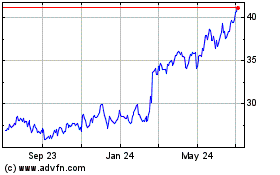

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Apr 2023 to Apr 2024