Report of Foreign Issuer (6-k)

February 21 2018 - 5:44PM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated February 21, 2018

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural Real Estate Company

U

(Translation of Registrant’s Name)

1309 Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

U

(Address of principal executive offices)

Julio Cesar de Toledo Piza Neto,

Chief Executive Officer and Investor Relations Officer,

Tel. +55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309 Av.

Brigadeiro Faria Lima, 5

th

floor

São Paulo, São Paulo 01452-002, Brazil

U

(

Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

U

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

U

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

o

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

February 21, 2018

VIA EDGAR AND EMAIL

|

Re:

|

BrasilAgro—Brazilian Agricultural Real Estate Company

Annual Report on Form 20-F

for the Fiscal Year Ended June 30, 2017

Filed October 26, 2017

File No. 001-35723

|

Ms. Melissa Raminpour

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-7010

Dear Ms. Raminpour:

We make reference to the annual report on Form 20-F (No. 001-35723) of

BrasilAgro—Brazilian Agricultural Real Estate Company

(the “

Company

”) filed with the Securities and Exchange Commission (the “

Commission

”) on

October 26, 2017

(the “

Annual Report

”) and to the comments of the Staff (the “

Staff

”) of the Commission concerning the Annual Report contained in the letter from the Staff dated February 8, 2018 (the “

Comment Letter

”).

Set forth below is the Company’s response to the Staff’s comment as set forth in the Comment Letter.

To assist your review, we have retyped the text of the Staff’s comment in italics below.

Form 20-F for the Fiscal Year Ended June 30, 2017

Risk Factors

Substantially all of our revenue is derived from a small number of clients, and we currently face a risk of default by our main customer, page 9

1.

We note from the last paragraph that you face a risk of default from Brenco, your largest customer due to an ongoing investigation. We further note that your two largest customers represented over 58% of your 2017 revenues. Please tell us, and revise your accounts receivable footnote 7.1 as applicable, to state whether Brenco has defaulted to date on any receivables and where receivables from Brenco are currently classified in the aging analysis on page F-39. Also, please revise the notes to the financial statements to disclose the revenues from any customer that amount to 10% or more of your total revenues, and the identity of the segment reporting the revenues, in accordance with paragraph 34 of IFRS 8.

In response to the Staff’s comment, we respectfully advise the Staff that in fiscal year 2017 and as of today, Brenco (ETH Bioenergia) has not defaulted on the payment of any receivable.

In the table below, we present the aging of the receivables from Brenco (ETH Bioenergia), based on contractual terms.

|

|

|

As of June 30, 2017

|

|

Falling due:

|

|

(

in thousands of reais

)

|

|

|

|

|

|

Up to 30 days

|

|

318

|

|

30 to 90 days

|

|

449

|

|

181 to 360 days

|

|

6,117

|

|

Total

|

|

6.884

|

|

|

|

|

The Company respectfully advises the Staff that information similar to the above will be disclosed in future filings.

In addition, the two largest customers that represented over 58% of our 2017 revenues are Brenco (ETH Bioenergia) and Bunge. Revenues from Brenco (ETH Bioenergia) derive from the sale of sugarcane as describe in note 7.1 (c) on page F-40 and note 26 on page F-59 and are included in the

Agricultural Activity-sugarcane

segment in note 18 on page F-53. Revenues from Bunge derive from the sale of grains as described in note 7.1 (d) on page F-40 and are included in the

Agricultural Activity-grains

segment in note 18 on page F-53.

The Company respectfully advises the Staff that information required by paragraph 34 of IFRS 8 in relation to Brenco (ETH Bioenergia), Bunge and any other external customer for which revenues represent 10% or more of the Company’s total revenues will be disclosed in future filings.

093331-0894-10894-Active.17137183.1

Operating and Financial Review and Prospects

Tabular Disclosure of Contractual Obligations, page 57

2.

We note that your total amount of debt per the table of R$88,096 does not equal total debt per note 15 on page F-46 of R$112,175. Please reconcile these amounts. To the extent interest represents the difference, please revise your contractual obligations to include other long-term liabilities reflected in your balance sheet in accordance with Item 5.F.1 of Form 20-F.

We respectfully advise the Staff that the balance of Loans and financing of R$88,096 plus the balance of Lease obligations of R$24,079 as per the table of Contractual Obligations on page 57 reconcile with the total debt per note 15 on page F-46 of R$112,175.

The Company respectfully advises the Staff that, in future filings, it will revise the title or add and introduction of note 15 to the financial statement to clarify that the table also included lease obligations.

Financial Statements

Notes to the Financial Statements

17. Equity

(a) Capital (number of shares), page F-49

3.

Please clarify why only the amounts of shares reported as “other” in the table are considered in “total outstanding shares,” when shares are issued to other people and entities. In this regard, please explain to us why the shares issued to Cresud and the officers do not appear to be considered outstanding shares.

We respectfully advise the Staff that the table on page F-49 has been included to provide information as per local statutory requirements in Brazil, in relation to shares owned by related parties (as defined by the local regulator), such as controlling shareholder, board of directors, executives, offices and treasury shares.

093331-0894-10894-Active.17137183.1

The Company respectfully advises the Staff that it will revise the wording of the table to clarify, in future filings, as follows:

|

Shareholder

|

2017

|

|

Cresud S.A.C.I.F.Y.A. (a)

|

23,291,500

|

|

Board of Directors

|

161,900

|

|

Executive Board

|

159

|

|

Officers

|

162,059

|

|

Treasury

|

3,254,556

|

|

Other

|

30,180,801

|

|

Total outstanding shares

|

56,888,916

|

|

Other shares as percentage of total outstanding shares (%)

|

53

|

|

(a) Of

this

amount,

140,450

shares

are

held

by

Agro

Managers

S.A.

and

1,000

shares

are

held

by

Agro

Managers,

subsidiaries

of

Cresud

S.A.

|

|

|

|

Form 6-K furnished November 7, 2017

4.

We refer to the table reconciling EBITDA and Adjusted EBITDA to Gross Profit on page 9. Please be advised earnings is intended to represent net income as presented on the statement of operations, as the most comparable financial measure calculated in accordance with GAAP (IFRS), and EBITDA should only reflect adjustments for interest, taxes, depreciation, and amortization. In this regard, please revise EBITDA to reconcile to net income and remove adjustments other than interest, taxes, depreciation, and amortization, which may be included in Adjusted EBITDA.

We respectfully advise the Staff that the Company will revise the reconciliation of the table EBITDA and Adjusted EBITDA as the measure calculated in accordance with GAAP (IFRS), in future submissions of Form 6-Ks, as follows:

|

EBITDA (R$ thousand)

|

2017

|

|

Net Income

|

27.310

|

|

Interest

|

(33.444)

|

|

Tax

|

5.949

|

|

Depreciation and amortization

|

15.027

|

|

EBITDA

|

14.842

|

|

Adjusted Depreciation

1

|

5.394

|

|

Equity pickup

|

4.424

|

|

Elimination of gains on biological assets (grains and sugarcane planted)

|

7.894

|

|

Derivative Results

|

10.882

|

|

EBITDA Cresca²

|

(899)

|

|

Adjusted EBITDA

|

42.538

|

093331-0894-10894-Active.17137183.1

|

1- Adjusted Depreciation includes depreciation of harvested grains and sugarcane.

|

|

|

|

2- The amounts refer to Cresca’s administrative expenses. The operating result in Paraguay is consolidated to BrasilAgro.

|

* * * * * * * *

We are grateful for your assistance in this matter. Please do not hesitate to call with any questions or further comments you may have regarding this letter or if you wish to discuss the above responses.

The Company understands and acknowledges that:

·

the Company is responsible for the adequacy and accuracy of the disclosure in filings with the Commission;

·

staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and

·

the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

093331-0894-10894-Active.17137183.1

BRASILAGRO CIA. BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

/s/ André Guillaumon

_____________________________________

Name: André Guillaumon

Title: Chief Executive Officer

cc: Securities and Exchange Commission

Heather Clark

093331-0894-10894-Active.17137183.1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: February 21, 2018.

|

|

|

|

|

|

|

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

|

|

|

|

|

|

|

|

|

By:

|

/s/ André Guillaumon

|

|

|

|

Name:

|

André Guillaumon

|

|

|

|

Title:

|

Chief Executive Officer and Operation Officer

|

|

Date: February 21, 2018.

|

|

|

|

By:

|

/s/ Gustavo Javier Lopez

|

|

|

|

Name:

|

Gustavo Javier Lopez

|

|

|

|

Title:

|

Chief Administrative Officer and Investor Relations Officer

|

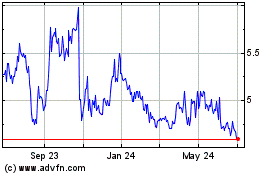

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Mar 2024 to Apr 2024

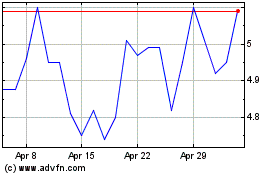

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Apr 2023 to Apr 2024