Sturm, Ruger & Company, Inc. (NYSE:RGR) announced today that

for 2017 the Company reported net sales of $522.3 million and

diluted earnings of $2.91 per share, compared with net sales of

$664.3 million and diluted earnings of $4.59 per share in 2016.

For the fourth quarter of 2017, net sales were $118.2 million

and diluted earnings were $0.59 per share. The recently enacted

“Tax Cuts and Jobs Act” positively impacted earnings by $0.03 per

share. For the corresponding period in 2016, net sales were $161.8

million and diluted earnings were $1.10 per share.

The Company also announced today that its Board of Directors

declared a dividend of 23¢ per share for the fourth quarter, for

shareholders of record as of March 15, 2018, payable on March 30,

2018. This dividend varies every quarter because the Company pays a

percentage of earnings rather than a fixed amount per share. This

dividend is approximately 40% of net income.

Chief Executive Officer Christopher J. Killoy made the following

observations related to the Company’s 2017 results:

- In 2017, net sales decreased 21% and

earnings per share decreased 37% from 2016. The decrease in

earnings is attributable to the sales decline and the unfavorable

de-leveraging of fixed manufacturing costs due to the decline in

production volumes.

- The estimated sell-through of the

Company’s products from the independent distributors to retailers

decreased 17% in 2017 from 2016. For the same period, the National

Instant Criminal Background Check System background checks (as

adjusted by the National Shooting Sports Foundation) decreased 11%.

The decrease in estimated sell-through of the Company’s products

from the independent distributors to retailers is attributable

to:

- Decreased overall consumer demand in

2017 due to stronger-than-normal demand during most of 2016, likely

bolstered by the political campaigns for the November 2016

elections,

- Reduced purchasing by retailers in an

effort to reduce their inventories and generate cash,

- Aggressive price discounting and

lucrative consumer rebates offered by many of our competitors,

and

- Excess industry manufacturing capacity,

which exacerbated the above factors.

- New products represented $137.8 million

or 27% of firearms sales in 2017, compared to $192.6 million or 29%

of firearms sales in 2016. New product sales include only major new

products that were introduced in the past two years. In 2017, new

products included the Precision Rifle, the Mark IV pistols, the LCP

II pistol, and the American pistol. In December 2017, the Company

introduced the Pistol Caliber Carbine, the Security-9 pistol, and

the EC9s pistol. Due to the timing of these launches, these new

products had only a minimal impact on the 2017 financial

results.

- Cash generated from operations during

2017 was $101 million. At December 31, 2017, our cash totaled $63

million. Our current ratio is 3.2 to 1 and we have no debt.

- In 2017, capital expenditures totaled

$34 million. We expect our 2018 capital expenditures to total

approximately $15 million.

- In 2017, the Company returned $89

million to its shareholders through:

- The payment of $24 million of

dividends, and

- The repurchase of 1.3 million shares of

our common stock in the open market at an average price of $49.10

per share, for a total of $65 million.

- At December 31, 2017, stockholders’

equity was $230.1 million, which equates to a book value of $13.21

per share, of which $3.64 per share was cash.

Today, the Company filed its Annual Report on Form 10-K for

2017. The financial statements included in this Annual Report on

Form 10-K are attached to this press release.

Tomorrow, February 22, 2018, Sturm, Ruger will host a webcast at

9:00 a.m. ET to discuss the 2017 operating results. Interested

parties can access the webcast at Ruger.com/corporate or by dialing

855-871-7398, participant code

9195594.

The Annual Report on Form 10-K is available on the SEC website

at www.sec.gov and the Ruger website at Ruger.com/corporate.

Investors are urged to read the complete Annual Report on Form 10-K

to ensure that they have adequate information to make informed

investment judgments.

About Sturm, Ruger

Sturm, Ruger & Co., Inc. is one of the nation’s leading

manufacturers of rugged, reliable firearms for the commercial

sporting market. As a full-line manufacturer of American-made

firearms, Ruger offers consumers over 400 variations of more than

30 product lines. For more than 60 years, Ruger has been a model of

corporate and community responsibility. Our motto, “Arms Makers for

Responsible Citizens,” echoes the importance of these principles as

we work hard to deliver quality and innovative firearms.

The Company may, from time to time, make forward-looking

statements and projections concerning future expectations. Such

statements are based on current expectations and are subject to

certain qualifying risks and uncertainties, such as market demand,

sales levels of firearms, anticipated castings sales and earnings,

the need for external financing for operations or capital

expenditures, the results of pending litigation against the

Company, the impact of future firearms control and environmental

legislation, and accounting estimates, any one or more of which

could cause actual results to differ materially from those

projected. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

made. The Company undertakes no obligation to publish revised

forward-looking statements to reflect events or circumstances after

the date such forward-looking statements are made or to reflect the

occurrence of subsequent unanticipated events.

STURM, RUGER & COMPANY, INC. Consolidated Balance

Sheets

(Dollars in thousands, except per share

data)

December 31,

2017 2016

Assets Current Assets Cash and cash

equivalents $ 63,487 $ 87,126 Trade receivables, net 60,082 69,442

Gross inventories 87,592 99,417 Less LIFO reserve (45,180 )

(42,542 ) Less excess and obsolescence reserve (2,698 )

(2,340 ) Net inventories 39,714

54,535 Prepaid expenses and other current

assets 3,501 3,660 Total Current

Assets 166,784 214,763 Property, Plant, and Equipment

365,013 331,639 Less allowances for depreciation (261,218 )

(227,398 ) Net property, plant and equipment

103,795 104,241 Deferred income

taxes - 334 Other assets 13,739 27,541

Total Assets $ 284,318 $ 346,879

STURM, RUGER & COMPANY, INC.

Consolidated Balance Sheets (Continued)

(Dollars in thousands, except per share

data)

December 31,

2017

2016

Liabilities and Stockholders’ Equity

Current Liabilities Trade accounts payable and

accrued expenses $ 32,422 $ 48,493 Product liability 729 1,733

Employee compensation and benefits 14,315 25,467 Workers’

compensation 5,211 5,200

Total Current Liabilities 52,677 80,893 Product liability 90

86 Deferred income taxes 1,402 - Contingent liabilities - -

Stockholders’ Equity Common stock, non-voting, par value $1:

Authorized shares – 50,000; none issued Common stock, par value $1:

Authorized shares – 40,000,000 2017 – 24,092,488 issued, 17,427,090

outstanding 2016 – 24,034,201 issued, 18,688,511 outstanding 24,092

24,034 Additional paid-in capital 28,329 27,211 Retained earnings

321,323 293,400 Less: Treasury stock – at cost 2017 – 6,665,398

shares 2016 – 5,345,690 shares (143,595 )

(78,745 ) Total Stockholders’ Equity 230,149

265,900 Total Liabilities and

Stockholders’ Equity $ 284,318 $ 346,879

STURM, RUGER & COMPANY, INC.

Consolidated Statements of Income and Comprehensive

Income

(In thousands, except per share data)

Year ended

December 31,

2017 2016 2015 Net

firearms sales $ 517,701 $ 658,433 $ 544,850 Net castings sales

4,555 5,895

6,244 Total net sales 522,256 664,328 551,094 Cost of

products sold 368,248 444,774 378,934

Gross profit 154,008

219,554 172,160

Operating Expenses: Selling 49,232 56,146 49,864 General and

administrative 28,396 29,004 27,864 Other operating income, net

31 (5 ) (113 )

Total operating expenses 77,659 85,145 77,615

Operating income 76,349

134,409 94,545

Other income: Royalty income 506 1,142 1,084 Interest income

27 14 5 Interest expense (152 ) (186 ) (156 ) Other income, net

916 542 622

Total other income, net 1,297 1,512 1,555

Income before income taxes

77,646 135,921

96,100 Income taxes 25,504 48,449 33,974

Net income and

comprehensive income $ 52,142 $ 87,472 $ 62,126

Basic Earnings Per Share

$ 2.94 $ 4.62 $ 3.32

Diluted Earnings Per Share $ 2.91 $

4.59 $ 3.21 Cash Dividends Per Share

$ 1.36 $ 1.73 $ 1.10

STURM, RUGER & COMPANY, INC.

Consolidated Statements of Cash Flows

(In thousands)

Year ended December 31,

2017 2016 2015

Operating

Activities Net income $ 52,142 $ 87,472 $ 62,126

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation and amortization 34,264 35,355 36,235 Stock-based

compensation 3,659 3,054 4,530 Excess and obsolescence inventory

reserve 358 522 (1,468 ) Loss (gain) on sale of assets 31 59 (113 )

Deferred income taxes 1,736 1,836 (3,257 ) Changes in operating

assets and liabilities: Trade receivables 9,360 2,279 (21,986 )

Inventories 14,463 (17,958 ) 9,058 Trade accounts payable and

accrued expenses (16,060 ) 5,602 6,808 Employee compensation and

benefits (11,466 ) (3,186 ) 9,378 Product liability (1,000 ) 1,075

(101 ) Prepaid expenses, other assets and other liabilities

13,704

(6,348

)

6,553

Income taxes payable - (4,962 )

4,806 Cash provided by operating activities

101,191 104,800 112,569

Investing Activities

Property, plant, and equipment additions (33,596 ) (35,215 )

(28,705 ) Net proceeds from sale of assets 3

325 222 Cash used for

investing activities (33,593 ) (34,890 ) (28,483 )

Financing Activities Dividends paid (23,905 ) (32,815

) (20,569 ) Tax benefit from share-based compensation - 8,825 436

Repurchase of common stock (64,850 ) (14,018 ) (2,841 ) Payment of

employee withholding tax related to share-based compensation

(2,482

)

(14,001

)

(999

)

Proceeds from exercise of stock options -

- 211 Cash used for

financing activities (91,237 ) (52,009

) (23,762 ) (Decrease) increase in cash and

cash equivalents (23,639 ) 17,901 60,324 Cash and cash equivalents

at beginning of year 87,126

69,225 8,901 Cash and cash equivalents

at end of year $ 63,487 $ 87,126

$ 69,225

Non-GAAP Financial Measure

In an effort to provide investors with additional information

regarding its results, the Company refers to various United States

generally accepted accounting principles (“GAAP”) financial

measures and one non-GAAP financial measure, EBITDA, which

management believes provides useful information to investors. This

non-GAAP measure may not be comparable to similarly titled measures

being disclosed by other companies. In addition, the Company

believes that the non-GAAP financial measure should be considered

in addition to, and not in lieu of, GAAP financial measures. The

Company believes that EBITDA is useful to understanding its

operating results and the ongoing performance of its underlying

business, as EBITDA provides information on the Company’s ability

to meet its capital expenditure and working capital requirements,

and is also an indicator of profitability. The Company believes

that this reporting provides better transparency and comparability

to its operating results. The Company uses both GAAP and non-GAAP

financial measures to evaluate the Company’s financial

performance.

Non-GAAP Reconciliation – EBITDA

EBITDA

(Unaudited, dollars in thousands) Year ended December

31,

2017 2016 Net income $ 52,142 $

87,472 Income tax expense 25,504 48,449 Depreciation and

amortization expense 34,264 35,355 Interest expense 152 186

Interest income (27 ) (14 ) EBITDA

$ 112,035 $ 171,448

EBITDA is defined as earnings before interest, taxes, and

depreciation and amortization. The Company calculates this by

adding the amount of interest expense, income tax expense and

depreciation and amortization expenses that have been deducted from

net income back into net income, and subtracting the amount of

interest income that was included in net income from net income to

arrive at EBITDA. The Company’s EBITDA calculation also excludes

any one-time non-cash, non-operating expense.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180221006116/en/

Sturm, Ruger & Company, Inc.One Lacey PlaceSouthport, CT

06890www.ruger.com203-259-7843

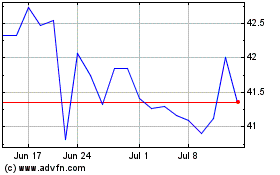

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

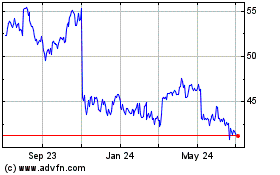

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Apr 2023 to Apr 2024