Ramco-Gershenson Properties Trust (NYSE:RPT) today

announced its financial and operating results for the three and

twelve months ended December 31, 2017.

FOURTH QUARTER FINANCIAL AND OPERATING

RESULTS:

- Net income available to common shareholders of $0.24 per

diluted share, compared to $0.07 per diluted share for the same

period in 2016.

- Funds from Operations ("FFO") of $0.30 per diluted share,

compared to $0.33 per diluted share for the same period in

2016.

- Operating Funds from Operations (“Operating FFO”) of $0.31 per

diluted share, compared to $0.34 per diluted share for the same

period in 2016.

- Generated same property NOI growth with redevelopment of 2.3%

for the three months ended December 31, 2017.

- Sold $101.4 million of non-core shopping centers.

- Signed 40 comparable leases encompassing 206,502 square feet at

a positive leasing spread of 8.9% with an annualized base rent

("ABR") of $14.47 per square feet, including seven new leases with

an ABR of $18.06 per square feet and positive leasing spread of

16.8%.

- Increased ABR to $15.16 per square foot, excluding ground

leases, compared to $14.20 for the same period in 2016.

2017 FULL-YEAR

HIGHLIGHTS:

- Generated same-center NOI growth with redevelopment of 2.4% for

the twelve months ended December 31, 2017.

- Signed 186 comparable leases encompassing 1,073,197 square feet

at a positive leasing spread of 8.8%, including 24 new leases with

an ABR of $19.38 per square feet and positive leasing spread of

18.0%.

- Acquired one dynamic town center and one urban in-fill property

for a purchase price totaling $168.3 million.

- Sold $225.7 million of non-core shopping centers.

- Completed approximately $15.5 million in redevelopment

projects.

- Posted portfolio leased occupancy of 93.3%, compared to 94.4%

for the same period in 2016, primarily the result of bankruptcy

closures in 2017.

- Reduced Michigan rental exposure to 20.0% of total ABR.

"In 2017, we completed the sale of $226 million

of non-core properties diversifying our portfolio in strategic

non-coastal markets,” said Dennis Gershenson, President and

Chief Executive Officer. “In 2018, our focus is on operating

fundamentals, including growing occupancy, increasing our portfolio

ABR and completing in-process redevelopment projects to maximize

the value of our rebalanced portfolio."

FINANCIAL RESULTS:

For the three months ended December 31,

2017:

- Net income available to common shareholders of $19.2 million,

or $0.24 per diluted share, compared to $5.2 million, or $0.07 per

diluted share for the same period in 2016.

- FFO of $26.5 million, or $0.30 per diluted share, compared to

$29.1 million, or $0.33 per diluted share for the same period in

2016.

- Operating FFO of $27.7 million, or $0.31 per diluted share,

compared to $29.5 million or $0.34 per diluted share for the same

period in 2016.

For the twelve months ended December 31,

2017:

- Net income available to common shareholders of $62.4 million,

or $0.78 per diluted share, compared to $53.0 million, or $0.66 per

diluted share for the same period in 2016.

- FFO of $118.6 million, or $1.34 per diluted share, compared to

$118.7 million, or $1.35 per diluted share for the same period in

2016.

- Operating FFO of $119.6 million, or $1.36 per diluted share,

compared to $119.9 million or $1.36 per diluted share for the same

period in 2016.

BALANCE SHEET METRICS AND CAPITAL MARKETS

ACTIVITY:

- Net debt to annualized proforma adjusted EBITDA of 6.7X,

interest coverage of 3.6X, and fixed charge coverage of 3.0X.

INVESTMENT

ACTIVITY:Dispositions

During the fourth quarter, the Company sold four

shopping centers which are not part of the Company’s long-term

portfolio strategy, at a gross sales price of $101.4 million. The

properties sold are:

- Millennium Park Livonia, Michigan, a 273,000 square foot power

center anchored by Meijer (shadow), Costco (shadow), The Home

Depot, Marshalls, Michaels and Five Below;

- Village Plaza, Lakeland, Florida, a 158,000 square foot center

anchored by Hobby Lobby, Big Lots and Party City;

- Liberty Square, Wauconda, Illinois, a 107,000 square foot

Jewel-Osco anchored center; and

- Rolling Meadows, Rolling Meadows, Illinois, a 134,000 square

foot Jewel-Osco anchored center.

The Company’s total shopping center dispositions

for the year totaled $225.7 million.

Redevelopment

At December 31, 2017, the Company's active

redevelopment pipeline consisted of seven projects with an

estimated total cost of $73.7 million, which are expected to

stabilize in 2018 at an estimated weighted average return on cost

of between 9% - 10%.

FINANCING ACTIVITY:

The Company closed a $75.0 million private

placement of senior unsecured notes in December 2017. The

notes were issued in three tranches with terms of 5, 10, and 12

years and a weighted average interest rate of 4.46%. Proceeds

were used to pay off two mortgages totaling $36.7 million with an

average interest rate of 4.64% as well as for general corporate

purposes.

In addition, during the quarter, the Company

amended and repriced its $75.0 million term loan due 2021.

The transaction reduced the loan's interest rate by 35 basis points

for the remainder of the term.

DIVIDEND:

In the fourth quarter, the Company declared a

regular cash dividend of $0.22 per common share for the period

October 1, 2017 through December 31, 2017 and a Series D

convertible perpetual preferred share dividend of $0.90625 per

share for the same period. The dividends were paid on January

2, 2018 to shareholders of record as of December 20,

2017. During the year, the Company declared dividends of

$0.88 per common share. The Operating FFO payout ratio for the full

year was 64.7%.

GUIDANCE:

The Company affirmed its 2018 FFO and Operating

FFO guidance of $1.31 to $1.37 per share, as well as certain other

key assumptions:

- Same Property NOI growth including redevelopment of 2.25% to

3.75%.

- Redevelopment Expenditures of $40.0 to $50.0 million.

- Year End Physical Occupancy of 93% - 94%.

|

|

|

|

|

|

|

Measure |

|

Low |

|

High |

| Cash NOI |

|

$1.99 |

|

$2.02 |

| Non-cash

adjustments |

|

0.08 |

|

0.08 |

| General and

administrative |

|

(0.26) |

|

(0.24) |

| Interest expense |

|

(0.50) |

|

(0.49) |

| Total Operating

FFO |

|

$1.31 |

|

$1.37 |

|

|

|

|

|

|

CONFERENCE CALL/WEBCAST:

Ramco-Gershenson Properties Trust will host a

live broadcast of its fourth quarter conference call on Wednesday,

February 21, 2018 at 10:00 a.m. eastern time, to discuss its

financial and operating results as well as its 2018 guidance.

The live broadcast will be available on-line at www.rgpt.com and

www.investorcalendar.com and also by telephone at (877) 407-9205,

no pass code needed. A replay will be available shortly after

the call on the aforementioned websites (for ninety days) or by

telephone at (877) 481-4010, (Conference ID: 23919) through

February 28, 2018.

SUPPLEMENTAL MATERIALS:

The Company’s quarterly financial and operating

supplement is available on its corporate web site at

www.rgpt.com. If you wish to receive a copy via email, please

send requests to dhendershot@rgpt.com.

ABOUT RAMCO-GERSHENSON PROPERTIES

TRUST:

Ramco-Gershenson Properties Trust (NYSE:RPT) is

a premier, national publicly-traded shopping center real estate

investment trust (REIT) based in Farmington Hills, Michigan.

The Company's primary business is the ownership and

management of regional dominant and urban-oriented, infill shopping

centers in key growth markets in the 40 largest metropolitan

markets in the United States. At December 31, 2017, the

Company owned interests in and managed a portfolio of 56 shopping

centers and three joint venture properties. At December 31,

2017, the Company's consolidated portfolio was 93.3% leased.

Ramco-Gershenson is a fully-integrated qualified REIT that is

self-administered and self-managed. For additional information

about the Company please visit www.rgpt.com or follow

Ramco-Gershenson on Twitter @RamcoGershenson and

facebook.com/ramcogershenson/. This press release may contain

forward-looking statements that represent the Company’s

expectations and projections for the future. Management of

Ramco-Gershenson believes the expectations reflected in any

forward-looking statements made in this press release are based on

reasonable assumptions. Certain factors could occur that might

cause actual results to vary, including deterioration in national

economic conditions, weakening of real estate markets, decreases in

the availability of credit, increases in interest rates, adverse

changes in the retail industry, our continuing ability to qualify

as a REIT and other factors discussed in the Company’s reports

filed with the Securities and Exchange Commission.

Company Contact:Dawn L. Hendershot,

Senior Vice President Investor Relations and Public

Affairs31500 Northwestern Highway, Suite

300Farmington Hills, MI

48334dhendershot@rgpt.com (248)

592-6202

| RAMCO-GERSHENSON PROPERTIES TRUST |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands, except per share

amounts) |

| |

|

|

|

| |

December 31, 2017 |

|

December 31, 2016 |

| |

|

|

|

|

|

(as revised) |

|

|

ASSETS |

|

|

|

| Income producing

properties, at cost: |

|

|

|

| Land |

$ |

397,935 |

|

|

$ |

374,889 |

|

| Buildings

and improvements |

1,732,844 |

|

|

1,757,781 |

|

| Less

accumulated depreciation and amortization |

(351,632 |

) |

|

(345,204 |

) |

| Income producing

properties, net |

1,779,147 |

|

|

1,787,466 |

|

|

Construction in progress and land available for development or

sale |

58,243 |

|

|

61,224 |

|

| Real

estate held for sale |

— |

|

|

8,776 |

|

| Net real estate |

1,837,390 |

|

|

1,857,466 |

|

| Equity investments in

unconsolidated joint ventures |

3,493 |

|

|

3,150 |

|

| Cash and cash

equivalents |

8,081 |

|

|

3,582 |

|

| Restricted cash and

escrows |

4,810 |

|

|

11,144 |

|

| Accounts receivable,

net |

26,145 |

|

|

24,016 |

|

| Acquired lease

intangibles, net |

59,559 |

|

|

72,424 |

|

| Other assets, net |

90,916 |

|

|

89,716 |

|

| TOTAL

ASSETS |

$ |

2,030,394 |

|

|

$ |

2,061,498 |

|

| |

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

| Notes payable, net |

$ |

999,215 |

|

|

$ |

1,021,223 |

|

| Capital lease

obligation |

1,022 |

|

|

1,066 |

|

| Accounts payable and

accrued expenses |

56,750 |

|

|

57,357 |

|

| Acquired lease

intangibles, net |

60,197 |

|

|

63,734 |

|

| Other liabilities |

8,375 |

|

|

9,893 |

|

| Distributions

payable |

19,666 |

|

|

19,627 |

|

| TOTAL

LIABILITIES |

1,145,225 |

|

|

1,172,900 |

|

| |

|

|

|

| Commitments and

Contingencies |

|

|

|

| |

|

|

|

|

Ramco-Gershenson Properties Trust ("RPT") Shareholders'

Equity: |

|

|

|

|

Preferred shares, $0.01 par, 2,000 shares authorized: 7.25% Series

D Cumulative Convertible Perpetual Preferred Shares, (stated at

liquidation preference $50 per share), 1,849 shares issued and

outstanding as of December 31, 2017 and 2016, respectively |

92,427 |

|

|

92,427 |

|

|

Common shares of beneficial interest, $0.01 par, 120,000 shares

authorized, 79,366 and 79,272 shares issued and outstanding as of

December 31, 2017 and 2016, respectively |

794 |

|

|

793 |

|

| Additional paid-in

capital |

1,160,862 |

|

|

1,158,430 |

|

| Accumulated

distributions in excess of net income |

(392,619 |

) |

|

(384,934 |

) |

| Accumulated other

comprehensive income |

2,858 |

|

|

985 |

|

| TOTAL

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO RPT |

864,322 |

|

|

867,701 |

|

| Noncontrolling

interest |

20,847 |

|

|

20,897 |

|

| TOTAL

SHAREHOLDERS' EQUITY |

885,169 |

|

|

888,598 |

|

| TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

2,030,394 |

|

|

$ |

2,061,498 |

|

| |

|

|

|

|

|

|

|

| RAMCO-GERSHENSON PROPERTIES

TRUST |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (In thousands, except per share

amounts) |

|

| |

|

|

|

|

|

|

| |

Three Months |

|

Twelve Months |

|

| |

December 31, |

|

December 31, |

|

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

REVENUE |

|

|

|

|

|

|

|

|

| Minimum

rent |

$ |

48,392 |

|

|

$ |

48,253 |

|

|

$ |

198,362 |

|

|

$ |

192,793 |

|

|

|

Percentage rent |

134 |

|

|

90 |

|

|

704 |

|

|

600 |

|

|

| Recovery

income from tenants |

14,603 |

|

|

14,774 |

|

|

61,258 |

|

|

62,841 |

|

|

| Other

property income |

993 |

|

|

1,239 |

|

|

4,303 |

|

|

4,167 |

|

|

|

Management and other fee income |

141 |

|

|

98 |

|

|

455 |

|

|

529 |

|

|

| TOTAL

REVENUE |

64,263 |

|

|

64,454 |

|

|

265,082 |

|

|

260,930 |

|

|

| |

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

| Real

estate tax expense |

10,012 |

|

|

10,029 |

|

|

42,683 |

|

|

41,739 |

|

|

|

Recoverable operating expense |

6,954 |

|

|

8,355 |

|

|

27,653 |

|

|

29,581 |

|

|

|

Non-recoverable operating expense |

1,233 |

|

|

1,014 |

|

|

4,449 |

|

|

3,575 |

|

|

|

Depreciation and amortization |

22,053 |

|

|

21,986 |

|

|

91,335 |

|

|

91,793 |

|

|

|

Acquisition costs |

— |

|

|

198 |

|

|

— |

|

|

316 |

|

|

| General

and administrative expense |

7,383 |

|

|

4,967 |

|

|

26,159 |

|

|

22,041 |

|

|

| Provision

for impairment |

982 |

|

|

— |

|

|

9,404 |

|

|

977 |

|

|

| TOTAL

EXPENSES |

48,617 |

|

|

46,549 |

|

|

201,683 |

|

|

190,022 |

|

|

| |

|

|

|

|

|

|

|

|

| OPERATING

INCOME |

15,646 |

|

|

17,905 |

|

|

63,399 |

|

|

70,908 |

|

|

| |

|

|

|

|

|

|

|

|

| OTHER INCOME

AND EXPENSES |

|

|

|

|

|

|

|

|

| Other

expense, net |

(96 |

) |

|

129 |

|

|

(708 |

) |

|

(177 |

) |

|

| Gain on

sale of real estate |

16,843 |

|

|

96 |

|

|

52,764 |

|

|

35,781 |

|

|

| Earnings

from unconsolidated joint ventures |

50 |

|

|

117 |

|

|

273 |

|

|

454 |

|

|

| Interest

expense |

(10,995 |

) |

|

(10,696 |

) |

|

(44,866 |

) |

|

(44,514 |

) |

|

| Other

gain on unconsolidated joint ventures |

— |

|

|

— |

|

|

— |

|

|

215 |

|

|

| (Loss) on

extinguishment of debt |

— |

|

|

(409 |

) |

|

— |

|

|

(1,256 |

) |

|

| INCOME BEFORE

TAX |

21,448 |

|

|

7,142 |

|

|

70,862 |

|

|

61,411 |

|

|

| Income

tax provision |

(24 |

) |

|

(65 |

) |

|

(143 |

) |

|

(299 |

) |

|

| |

|

|

|

|

|

|

|

|

| NET

INCOME |

21,424 |

|

|

7,077 |

|

|

70,719 |

|

|

61,112 |

|

|

| Net

income attributable to noncontrolling partner interest |

(501 |

) |

|

(166 |

) |

|

(1,659 |

) |

|

(1,448 |

) |

|

| NET INCOME

ATTRIBUTABLE TO RPT |

20,923 |

|

|

6,911 |

|

|

69,060 |

|

|

59,664 |

|

|

| Preferred

share dividends |

(1,675 |

) |

|

(1,676 |

) |

|

(6,701 |

) |

|

(6,701 |

) |

|

| NET INCOME

AVAILABLE TO COMMON SHAREHOLDERS |

$ |

19,248 |

|

|

$ |

5,235 |

|

|

$ |

62,359 |

|

|

$ |

52,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.24 |

|

|

$ |

0.07 |

|

|

$ |

0.78 |

|

|

$ |

0.66 |

|

|

|

Diluted |

$ |

0.24 |

|

|

$ |

0.07 |

|

|

$ |

0.78 |

|

|

$ |

0.66 |

|

|

| |

|

|

|

|

|

|

|

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

Basic |

79,366 |

|

|

79,268 |

|

|

79,344 |

|

|

79,236 |

|

|

|

Diluted |

79,550 |

|

|

79,461 |

|

|

79,530 |

|

|

79,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RAMCO-GERSHENSON PROPERTIES

TRUST |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| FUNDS FROM OPERATIONS |

| (In thousands, except per share

data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Net income |

$ |

21,424 |

|

|

$ |

7,077 |

|

|

$ |

70,719 |

|

|

$ |

61,112 |

|

| Net income attributable

to noncontrolling partner interest |

(501 |

) |

|

(166 |

) |

|

(1,659 |

) |

|

(1,448 |

) |

| Preferred share

dividends |

(1,675 |

) |

|

(1,676 |

) |

|

(6,701 |

) |

|

(6,701 |

) |

| Net income available to

common shareholders |

19,248 |

|

|

5,235 |

|

|

62,359 |

|

|

52,963 |

|

| Adjustments: |

|

|

|

|

|

|

|

| Rental

property depreciation and amortization expense |

21,993 |

|

|

21,931 |

|

|

91,097 |

|

|

91,610 |

|

| Pro-rata

share of real estate depreciation from unconsolidated joint

ventures |

73 |

|

|

73 |

|

|

302 |

|

|

310 |

|

| Gain on

sale of depreciable real estate |

(16,945 |

) |

|

— |

|

|

(51,977 |

) |

|

(34,108 |

) |

| Gain on

sale of joint venture depreciable real estate |

— |

|

|

— |

|

|

— |

|

|

(26 |

) |

| Provision

for impairment on income-producing properties |

— |

|

|

— |

|

|

8,422 |

|

|

— |

|

| Other

gain on unconsolidated joint ventures |

— |

|

|

— |

|

|

— |

|

|

(215 |

) |

| FFO available

to common shareholders |

24,369 |

|

|

27,239 |

|

|

110,203 |

|

|

110,534 |

|

| |

|

|

|

|

|

|

|

|

Noncontrolling interest in Operating Partnership (1) |

501 |

|

|

166 |

|

|

1,659 |

|

|

1,448 |

|

| Preferred

share dividends (assuming conversion) (2) |

1,675 |

|

|

1,676 |

|

|

6,701 |

|

|

6,701 |

|

| FFO available

to common shareholders and dilutive securities |

$ |

26,545 |

|

|

$ |

29,081 |

|

|

$ |

118,563 |

|

|

$ |

118,683 |

|

| |

|

|

|

|

|

|

|

| (Gain)

loss on sale of land |

102 |

|

|

(96 |

) |

|

(787 |

) |

|

(1,673 |

) |

| Provision

for impairment on land available for development or sale |

982 |

|

|

— |

|

|

982 |

|

|

977 |

|

| Severance

expense |

60 |

|

|

43 |

|

|

715 |

|

|

492 |

|

| Loss on

early extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

1,256 |

|

|

Acquisition costs |

— |

|

|

198 |

|

|

— |

|

|

316 |

|

| Cost

associated with early extinguishment of debt |

30 |

|

|

281 |

|

|

110 |

|

|

(128 |

) |

| Operating FFO

available to common shareholders and dilutive

securities |

$ |

27,719 |

|

|

$ |

29,507 |

|

|

$ |

119,583 |

|

|

$ |

119,923 |

|

| |

|

|

|

|

|

|

|

| Weighted average common

shares |

79,366 |

|

|

79,268 |

|

|

79,344 |

|

|

79,236 |

|

| Shares issuable upon

conversion of Operating Partnership Units (1) |

1,916 |

|

|

1,917 |

|

|

1,917 |

|

|

1,943 |

|

| Dilutive effect of

restricted stock |

184 |

|

|

193 |

|

|

186 |

|

|

199 |

|

| Shares issuable upon

conversion of preferred shares (2) |

6,740 |

|

|

6,630 |

|

|

6,740 |

|

|

6,630 |

|

| Weighted

average equivalent shares outstanding, diluted |

88,206 |

|

|

88,008 |

|

|

88,187 |

|

|

88,008 |

|

| |

|

|

|

|

|

|

|

| FFO available

to common shareholders and dilutive securities per share,

diluted |

$ |

0.30 |

|

|

$ |

0.33 |

|

|

$ |

1.34 |

|

|

$ |

1.35 |

|

| |

|

|

|

|

|

|

|

| Operating FFO

available to common shareholders and dilutive securities per share,

diluted |

$ |

0.31 |

|

|

$ |

0.34 |

|

|

$ |

1.36 |

|

|

$ |

1.36 |

|

| |

|

|

|

|

|

|

|

| Dividend per common

share |

$ |

0.22 |

|

|

$ |

0.22 |

|

|

$ |

0.88 |

|

|

$ |

0.86 |

|

| Payout ratio -

Operating FFO |

71.0 |

% |

|

64.7 |

% |

|

64.7 |

% |

|

63.2 |

% |

|

|

|

|

|

|

|

|

|

(1) The total noncontrolling interest reflects OP units

convertible 1:1 into common shares.

(2) Series D convertible preferred shares

are paid annual dividends of $6.7 million and are currently

convertible into approximately 6.7 million shares of common stock.

They are dilutive only when earnings or FFO exceed approximately

$0.25 per diluted share per quarter and $1.00 per diluted share per

year. The conversion ratio is subject to adjustment based

upon a number of factors, and such adjustment could affect the

dilutive impact of the Series D convertible preferred shares on FFO

and earning per share in future periods.

| |

| |

| RAMCO-GERSHENSON PROPERTIES

TRUSTRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(amounts in thousands) |

| |

| Reconciliation of net income available to common

shareholders to Same Property NOI |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

December 31, |

|

December 31, |

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net income available to

common shareholders |

$ |

19,248 |

|

|

$ |

5,235 |

|

|

$ |

62,359 |

|

|

$ |

52,963 |

|

| Preferred

share dividends |

1,675 |

|

|

1,676 |

|

|

6,701 |

|

|

6,701 |

|

| Net

income attributable to noncontrolling partner interest |

501 |

|

|

166 |

|

|

1,659 |

|

|

1,448 |

|

| Income

tax provision |

24 |

|

|

65 |

|

|

143 |

|

|

299 |

|

| Interest

expense |

10,995 |

|

|

10,696 |

|

|

44,866 |

|

|

44,514 |

|

| Costs

associated with early extinguishment of debt |

— |

|

|

409 |

|

|

— |

|

|

1,256 |

|

| Earnings

from unconsolidated joint ventures |

(50 |

) |

|

(117 |

) |

|

(273 |

) |

|

(454 |

) |

| Gain on

sale of real estate |

(16,843 |

) |

|

(96 |

) |

|

(52,764 |

) |

|

(35,781 |

) |

| Gain on

remeasurement of unconsolidated joint venture |

— |

|

|

— |

|

|

— |

|

|

(215 |

) |

| Other

expense, net |

96 |

|

|

(129 |

) |

|

708 |

|

|

177 |

|

|

Management and other fee income |

(141 |

) |

|

(98 |

) |

|

(455 |

) |

|

(529 |

) |

|

Depreciation and amortization |

22,053 |

|

|

21,986 |

|

|

91,335 |

|

|

91,793 |

|

|

Acquisition costs |

— |

|

|

198 |

|

|

— |

|

|

316 |

|

| General

and administrative expenses |

7,383 |

|

|

4,967 |

|

|

26,159 |

|

|

22,041 |

|

| Provision

for impairment |

982 |

|

|

— |

|

|

9,404 |

|

|

977 |

|

| Lease

termination fees |

(23 |

) |

|

(71 |

) |

|

(83 |

) |

|

(139 |

) |

|

Amortization of lease inducements |

44 |

|

|

44 |

|

|

175 |

|

|

221 |

|

|

Amortization of acquired above and below market lease intangibles,

net |

(1,130 |

) |

|

(1,069 |

) |

|

(4,397 |

) |

|

(3,397 |

) |

|

Straight-line ground rent expense |

70 |

|

|

63 |

|

|

281 |

|

|

63 |

|

|

Amortization of acquired ground lease intangibles |

6 |

|

|

6 |

|

|

25 |

|

|

6 |

|

|

Straight-line rental income |

(872 |

) |

|

(948 |

) |

|

(2,669 |

) |

|

(2,383 |

) |

| NOI |

44,018 |

|

|

42,983 |

|

|

183,174 |

|

|

179,877 |

|

| NOI from

Other Investments |

(4,951 |

) |

|

(4,788 |

) |

|

(25,529 |

) |

|

(25,866 |

) |

| Same Property NOI with

Redevelopment |

39,067 |

|

|

38,195 |

|

|

157,645 |

|

|

154,011 |

|

| NOI from

Redevelopment (1) |

(6,016 |

) |

|

(5,850 |

) |

|

(23,991 |

) |

|

(21,954 |

) |

| Same Property NOI

without Redevelopment |

$ |

33,051 |

|

|

$ |

32,345 |

|

|

$ |

133,654 |

|

|

$ |

132,057 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) The NOI from Redevelopment adjustments represent

100% of the NOI related to Deerfield Towne Center, Hunter’s Square,

Woodbury Lakes and West Oaks, and a portion of the NOI

related to specific GLA at Spring Meadows, The Shoppes at Fox River

II, The Shops on Lane Avenue, Mission Bay, River City Marketplace

and Town & Country for the periods presented. Because of

the redevelopment activity, the center or specific space is not

considered comparable for the periods presented and adjusted out of

Same Property NOI with Redevelopment in arriving at Same Property

NOI without Redevelopment. |

| |

|

|

|

|

|

|

|

| |

| RAMCO-GERSHENSON PROPERTIES

TRUSTRECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(amounts in thousands) |

| |

|

|

Three Months Ended December 31, |

|

|

2017 |

|

2016 |

| Reconciliation

of net income to proforma adjusted EBITDA |

|

|

|

| Net income |

$ |

21,424 |

|

|

$ |

7,077 |

|

| Gain on sale of real

estate |

(16,843 |

) |

|

(96 |

) |

| Depreciation and

amortization |

22,053 |

|

|

21,986 |

|

| Pro-rata share of

depreciation from unconsolidated joint venture |

73 |

|

|

73 |

|

| Provision for

impairment |

982 |

|

|

— |

|

| Severance expense |

60 |

|

|

43 |

|

| Costs associated with

early extinguishment of debt |

— |

|

|

409 |

|

| Interest expense |

10,995 |

|

|

10,696 |

|

| Income tax

provision |

24 |

|

|

65 |

|

| Lease termination

income |

(23 |

) |

|

(71 |

) |

| Acquisition costs |

— |

|

|

198 |

|

| Adjusted EBITDA |

38,745 |

|

|

40,380 |

|

| Proforma adjustments

(1) |

(1,324 |

) |

|

(251 |

) |

| Proforma adjusted

EBITDA |

$ |

37,421 |

|

|

$ |

40,129 |

|

| Annualized proforma

adjusted EBITDA |

$ |

149,684 |

|

|

$ |

160,516 |

|

| |

|

|

|

| |

|

|

|

| Reconciliation

of Notes Payable, net to Net Debt |

|

|

|

| Notes payable, net |

$ |

999,215 |

|

|

$ |

1,021,223 |

|

| Unamortized

premium |

(3,967 |

) |

|

(5,120 |

) |

| Deferred financing

costs, net |

3,821 |

|

|

3,740 |

|

| Consolidated notional

debt |

999,069 |

|

|

1,019,843 |

|

| Pro-rata share of debt

from unconsolidated joint venture |

12,699 |

|

|

— |

|

| Capital lease

obligation |

1,022 |

|

|

1,066 |

|

| Cash and cash

equivalents |

(8,081 |

) |

|

(3,582 |

) |

| Net debt |

$ |

1,004,709 |

|

|

$ |

1,017,327 |

|

| |

|

|

|

| |

|

|

|

| Reconciliation

of interest expense to total fixed charges |

|

|

|

| Interest expense |

$ |

10,616 |

|

|

$ |

10,351 |

|

| Preferred share

dividends |

1,675 |

|

|

1,676 |

|

| Scheduled mortgage

principal payments |

758 |

|

|

777 |

|

| Total fixed

charges |

$ |

13,049 |

|

|

$ |

12,804 |

|

| |

|

|

|

| |

|

|

|

| Net debt to annualized

proforma adjusted EBITDA |

6.7 |

X |

|

6.3 |

X |

| Interest coverage ratio

(Adjusted EBITDA / interest expense) |

3.6 |

X |

|

3.9 |

X |

| Fixed

charge coverage ratio (Adjusted EBITDA / fixed charges) |

3.0 |

X |

|

3.2 |

X |

| |

|

|

|

| (1) 4Q17 excludes $1.3 million from acquisitions and

dispositions including our Millennium Park joint venture.

4Q16 excludes $0.3 million related to miscellaneous income. |

| |

Ramco-Gershenson Properties

TrustNon-GAAP Financial Definitions

Certain of our key performance indicators are

considered non-GAAP financial measures. Management uses these

measures along with our GAAP financial statements in order to

evaluate our operations results. We believe these additional

measures provide users of our financial information additional

comparable indicators of our industry, as well as our

performance.

Funds From Operations (FFO) Available to

Common Shareholders

As defined by the National Association of Real

Estate Investment Trusts (NAREIT), Funds From Operations (FFO)

represents net income computed in accordance with generally

accepted accounting principles, excluding gains (or losses) from

sales of depreciable property and impairment provisions on

depreciable real estate or on investments in non-consolidated

investees that are driven by measurable decreases in the fair value

of depreciable real estate held by the investee, plus depreciation

and amortization, (excluding amortization of financing

costs). Adjustments for unconsolidated partnerships and joint

ventures are calculated to reflect funds from operations on the

same basis. We have adopted the NAREIT definition in our

computation of FFO available to common shareholders.

Operating FFO Available to Common

Shareholders

In addition to FFO available to common

shareholders, we include Operating FFO available to common

shareholders as an additional measure of our financial and

operating performance. Operating FFO excludes acquisition

costs and periodic items such as gains (or losses) from sales of

land and impairment provisions on land available for development or

sale, bargain purchase gains, severance expense, accelerated

amortization of debt premiums and gains or losses on extinguishment

of debt that are not adjusted under the current NAREIT definition

of FFO. We provide a reconciliation of FFO to Operating FFO.

FFO and Operating FFO should not be considered alternatives to GAAP

net income available to common shareholders or as alternatives to

cash flow as measures of liquidity.

While we consider FFO available to common

shareholders and Operating FFO available to common shareholders

useful measures for reviewing our comparative operating and

financial performance between periods or to compare our performance

to different REITs, our computations of FFO and Operating FFO may

differ from the computations utilized by other real estate

companies, and therefore, may not be comparable. We

recognize the limitations of FFO and

Operating FFO when compared to GAAP net

income available to common shareholders. FFO and Operating

FFO available to common shareholders do not represent amounts

available for needed capital replacement or expansion, debt service

obligations, or other commitments and uncertainties. In addition,

FFO and Operating FFO do not represent cash generated from

operating activities in accordance with GAAP and are not

necessarily indicative of cash available to fund cash needs,

including the payment of dividends. FFO and Operating FFO are

simply used as for reviewing our comparative operating and

financial performance between periods or to compare our performance

to different REITs, our computations of FFO and Operating FFO may

differ from the computations utilized by other real estate

companies, and therefore, may not be comparable.

Adjusted EBITDA/Proforma Adjusted

EBITDA

Adjusted EBITDA is net income or loss plus

depreciation and amortization, interest expense net of deferred

financing costs, severance expense, income taxes, gain or loss on

sale of real estate, and impairments of real estate, if any.

Adjusted EBITDA should not be considered an alternative measure of

operating results or cash flow from operations as determined in

accordance with GAAP. Proforma Adjusted EBITDA further

adjusts for the effect of the acquisition or disposition of

properties during the period.

Same Property Operating

Income

Same Property Operating Income ("Same Property

NOI with Redevelopment") is a supplemental non-GAAP financial

measure of real estate companies' operating performance. Same

Property NOI with Redevelopment is considered by management to be a

relevant performance measure of our operations because it includes

only the NOI of comparable properties for the reporting

period. Same Property NOI with Redevelopment excludes

acquisitions and dispositions. Same Property NOI with

Redevelopment is calculated using consolidated operating income and

adjusted to exclude management and other fee income, depreciation

and amortization, general and administrative expense, provision for

impairment and non-comparable income/expense adjustments such as

straight-line rents, lease termination fees, above/below market

rents, and other non-comparable operating income and expense

adjustments.

In addition to Same Property NOI with

Redevelopment, the Company also believes Same Property NOI without

Redevelopment to be a relevant performance measure of our

operations. Same Property NOI without Redevelopment follows

the same methodology as Same Property NOI with Redevelopment,

however it excludes redevelopment activity that significantly

impacts the entire property, as well as lesser redevelopment

activity where we are adding GLA or retenanting a specific

space. A property is designated as redevelopment when

projected costs exceed $1.0 million, and the construction impacts

approximately 20% or more of the income producing property's gross

leasable area ("GLA") or the location and nature of the

construction significantly impacts or disrupts the daily operations

of the property. Redevelopment may also include a portion of

certain properties designated as same property for which we are

adding additional GLA or retenanting space.

Same Property NOI should not be considered an

alternative to net income in accordance with GAAP or as a measure

of liquidity. Our method of calculating Same Property NOI may

differ from methods used by other REITs and, accordingly, may not

be comparable to such other REITs.

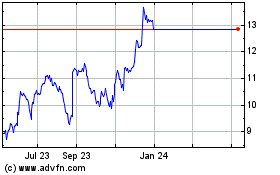

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Apr 2023 to Apr 2024