HSBC to Issue Up to $7 Billion in Debt; Posts 4Q Pretax Profit

February 20 2018 - 12:35AM

Dow Jones News

By Chester Yung

Global bank HSBC Holdings PLC (0005.HK) said it planned an

additional Tier 1 capital issuance of $5 billion to $7 billion in

the first half of 2018.

HSBC also said it would make share repurchases "as and when

appropriate."

On Tuesday, the Asia-focused lender said it swung to a

fourth-quarter pretax profit of $2.3 billion from a year-earlier

pretax loss of $3.45 billion. It declared a total dividend of 51

cents a share for 2017.

The bank said its 2017 net profit surged to $9.68 billion from

$1.30 billion a year earlier, in part thanks to higher revenue from

Asia. Full-year revenue rose to $51.45 billion from $47.97

billion.

Chief Executive Stuart Gulliver described the earnings as "good

results," although as the bank's 2017 pretax profit of $17.17

billion missed expectations for $19.55 billion, based on a poll of

20 analysts conducted by FactSet.

HSBC's Hong Kong-listed shares rose 0.8% to HK$84.20 ($10.76) at

midday before the bank released results.

Last year, the bank said it would buy back an additional $1.0

billion worth of shares, bringing the program's total size to $3.5

billion since the second half of 2016.

The lender has undergone a major restructuring since 2011,

exiting from most of Latin America and placing more focus on Asia.

It faces potential hurdles from the U.K.'s decision to leave the

European Union. The U.K. and Hong Kong are the bank's two largest

markets.

Write to Chester Yung at chester.yung@wsj.com

(END) Dow Jones Newswires

February 20, 2018 00:20 ET (05:20 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

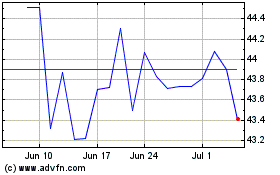

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

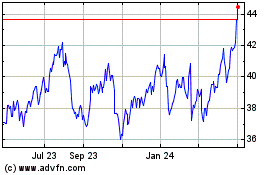

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024