Gecina Sells The “Dock-en-Seine” Building in Paris Region to BNP Paribas REIM

February 19 2018 - 11:57AM

Business Wire

Regulatory News:

The SCPI Accimmo Pierre, managed by BNP Paribas REIM France, has

acquired the Dock-en-Seine building complex of nearly

16,000 s qm from Gecina (Paris:GFC), for around 130M€. The deal had

been secured back in December 2017.

Situated at the gateway to Paris, the asset enjoys an ideal

location at the heart of the Saint-Ouen Docks mixed development

zone, a new 100-hectare eco-district on the embankment of the

Seine. The building is also well connected in terms of public

transportation, served by line 13 of the Paris underground as well

as the future extension of line 14.

A landmark building at the Docks of Saint-Ouen

Completed in 2013, “Dock-en-Seine” is a building complex with a

strong architectural identity. Designed by the architect Franklin

Azzi, the building offers light-filled spaces with an area of about

1,920 s qm for the full-sized floors as well as a large range of

services for occupiers: staff canteen, cafeteria, indoor garden and

furnished terraces. All this comes with an outstanding level of

environmental performance, meeting international standards (NF HQE

Construction Exceptional, HQE Exploitation Excellent, BBC

Effinergie - RT 2005).

The office building is entirely leased to two blue-chip

occupiers: Kérudys (SVP group) and RSI (Régime Social des

Indépendants).

“The fully owned Dock-en-Seine building is a solid

investment for SCPI Accimmo Pierre, thanks to its fully guaranteed

rental status. Its outstanding connections make it part of the

dynamism of the Grand Paris project” explains Guillaume Delattre,

Deputy General Manager of BNP Paribas REIM France, in charge of

Investments.

"For Gecina, the sale of this building, in conditions that

comply with the Group's requirements, is part of the sales plan

announced upon the acquisition of Eurosic," comments Méka Brunel,

Gecina's Chief Executive Officer.

In this transaction, BNP Paribas REIM France was advised by

Thibierge; Gecina was advised by BNP Paribas Real Estate

Transaction France as part of a co-exclusive mandate with Catella

and the Oudot & Associés study.

Gecina, living the city in a different way

Gecina owns, manages and develops property holdings worth 19.5

billion euros at end-August 2017, with nearly 92% located in the

Paris Region. The Group is building its business around France’s

leading office portfolio and a diversification division with

residential assets and student residences. Gecina has put

sustainable innovation at the heart of its strategy to create

value, anticipate its customers’ expectations and invest while

respecting the environment, thanks to the dedication and expertise

of its staff.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, Euronext 100,

FTSE4Good, DJSI Europe and World, Stoxx Global ESG Leaders and

Vigeo indices. In line with its community commitments, Gecina has

created a company foundation, which is focused on protecting the

environment and supporting all forms of disability.

www.gecina.fr

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180219005400/en/

GECINAFinancial communicationsSamuel

Henry-DiesbachTel: +33 (0)1 40 40 52

22samuelhenry-diesbach@gecina.frorVirginie SterlingTel: +33 (0)1 40

40 62 48virginiesterling@gecina.frorPress relationsJulien

LandfriedTel: +33 (0)1 40 40 65

74julienlandfried@gecina.frorArmelle MicloTel: +33 (0)1 40 40 51

98armellemiclo@gecina.fr

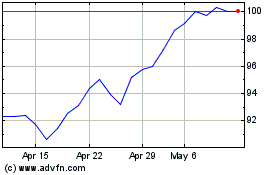

Gecina Nom (EU:GFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

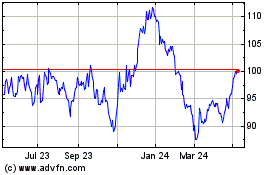

Gecina Nom (EU:GFC)

Historical Stock Chart

From Apr 2023 to Apr 2024