2017 Financial and Operational

Highlights

Fourth Quarter

- Revenues $801.3 million – up 20.2

percent year-over year

- Gross profit $100.7 million – up 23.9

percent year-over-year

- Diluted earnings per share $0.811 – up

103 percent year-over-year

Fiscal Year

- Revenues $2.99 billion – up 18.9

percent year-over year

- Gross profit $314.9 million – up 4.5

percent year-over-year

- SG&A expenses at 7.5 percent of

revenue – down 125 basis points year-over-year

- Diluted earnings per share $1.711 – up

20.5 percent year-over-year

- Backlog increased 6.7 percent

year-over-year to a year-end record $3.72 billion

Granite Construction Incorporated (NYSE:GVA) today reported net

income of $69.1 million for the year ended December 31, 2017

compared with net income of $57.1 million in the prior year.

Diluted earnings per share (EPS) for the year was $1.71 compared to

$1.42 per share in 2016.

Granite reported net income of $32.8 million for the quarter

ended December 31, 2017, compared with net income of $16.2

million in the fourth quarter of 2016. Diluted EPS in the quarter

was $0.81 compared to $0.40 per share in the prior-year period.

“Granite delivered outstanding revenue growth and improved

profitability in 2017, thanks to the continued focus of our

employees and teams on execution, quality and safety,” said James

H. Roberts, President and Chief Executive Officer of Granite

Construction Incorporated. "A mild start to winter across much of

the West allowed our teams to work efficiently to execute on last

quarter's all-time record backlog. With today's steady economic

trends and steady-to-improving funding environments, along with our

ongoing focus on operating efficiency, we expect to continue to

drive strong cash flow generation and help deliver significant

profit improvement in 2018 and beyond.

"The Construction segment in 2017 produced a third consecutive

year with gross profit margin in line with our mid-teens

expectations, and a strong year-end performance enabled our

Construction Materials segment to deliver solid quarterly and

annual profit and margin improvement. As we have seen for much of

the past couple years, the Large Project Construction segment was

the most challenging, but we expect significant improvement in the

back half of 2018,” Roberts continued.

Fiscal Year 2017 Results

Total Company

- Revenues for 2017 were $2.99 billion,

up 18.9 percent from 2016.

- Gross profit increased 4.5 percent

year-over-year to $314.9 million, driven by improved performance in

the Construction and Construction Materials segments.

- Gross profit margin was 10.5 percent

compared with 12.0 percent in 2016.

- Selling, general and administrative

expenses (SG&A) were $222.8 million, up 1.6 percent from $219.3

million last year. Reflecting our ongoing commitment to cost

management, the modest increase was attributable primarily to

personnel-related costs.

- Backlog ended at a year-end record

$3.72 billion, up 6.7 percent from $3.48 billion in 2016.

- 2017 net income was $69.1 million, up

21.0 percent from the prior year.

- 2017 EBITDA2 was $170.2 million, with

resulting EBITDA margin of 5.7 percent.

- Improved working capital and operating

cash flow trends helped strengthen the balance sheet, as we

finished the year with $366.5 million in cash and marketable

securities, as of December 31, 2017.

Construction

- Construction revenue in 2017 was $1.66

billion, up 21.9 percent from $1.37 billion in 2016, driven by

improved performance in certain Western markets, supported by

steady private, non-residential construction demand.

- Gross profit increased to $247.0

million in 2017, up 18.1 percent from the prior year, with

resulting gross profit margin in line with our mid-teens

expectations at 14.8 percent, down about 50 basis points

year-over-year.

- Construction backlog ended the year at

$897.0 million, down 13.0 percent year-over-year, as mild late-2017

weather allowed us to work later in the year. Bidding opportunities

and bookings also declined in the quarter, particularly in

California. Early in 2018, we have begun to see an increase in

lettings and related spending, as expected.

Large Project Construction

- Large Project Construction revenue

increased 16.2 percent to $1.03 billion from $888.2 million in

2016, as Granite teams advanced work on our diverse project

portfolio.

- Gross profit margin was 2.9 percent

compared with 7.2 percent in 2016, as performance continued to be

impacted by accelerated work on a number of challenging, mature

projects, as well as extended timeframes for dispute resolution

with owners and designers.

- Large project backlog totaled $2.8

billion, up 15.0 percent year-over-year, which includes the

contribution of project wins aligned with our strategy to balance

our portfolio with more Granite-controlled, lower-risk work over

the past couple years.

Construction Materials

- Construction Materials revenue

increased 12.1 percent to $292.8 million compared with $261.2

million last year, primarily attributable to increased demand

across geographies, as well as modest price increases.

- Gross profit margin in 2017 was 13.0

percent, compared with 10.7 percent in 2016, as overall

public-market demand improved. Profitability also was impacted

positively late in the year, as steady demand and mild late-2017

weather allowed us to work later and more efficiently than in

2016.

Fourth Quarter 2017 Results

Total Company

- Revenues increased 20.2 percent to

$801.3 million compared with $666.7 million in the fourth quarter

of 2016.

- Gross profit increased 23.9 percent

year-over-year to $100.7 million, driven primarily by the strong

performance of our vertically integrated business in the West, as

mild late-2017 weather allowed us to work later and more

efficiently than in 2016.

- Gross profit margin was 12.6 percent

compared with 12.2 percent in 2016.

- SG&A expenses decreased $0.3

million from 2016, to $59.1 million.

Construction

- Construction segment revenue increased

19.4 percent to $429.4 million, compared with $359.7 million in the

fourth quarter of 2016. Revenue growth was fueled by record segment

backlog entering the quarter, combined with mild late-2017 weather,

which allowed our teams to work later and more efficiently than the

prior year.

- Gross profit margin, at 15.2 percent,

remained very healthy and in line with our mid-teens expectations.

Customer and project mix late in the year included low-risk,

high-revenue work with below-trend margins.

Large Project Construction

- Large Project Construction segment

revenue increased 18.2 percent to $290.9 million, compared with

$246.1 million in the fourth quarter of 2016, based on execution on

our broad project portfolio.

- Gross profit margin was 7.0 percent, up

more than 150 basis points from 5.5 percent last year, as segment

performance continues to reflect the impact of accelerated work on

a number of challenging, mature projects, as well as extended

timeframes for dispute resolution with owners and designers.

Construction Materials

- Construction Materials revenue

increased 33.0 percent to $80.9 million, compared with $60.9

million in the fourth quarter of 2016. Revenue growth was driven by

the combination of strong market conditions aligned to mild

late-2017 weather in the West, which allowed our businesses to

operate efficiently to address steady demand late in the year.

- Gross profit margin for the quarter was

18.7 percent, compared with 10.0 percent in 2016. Operational

performance remains solid, as we target continued improvement in

pricing and production efficiency.

Definitive Agreement to Acquire Layne Christensen

On February 14, 2018, Granite announced an agreement

to acquire Layne Christensen Company (NASDAQ:LAYN) in a

$565-million stock merger, including the assumption of net debt.

"This complementary transaction is the next logical step in the

evolution of Granite’s strategy, and creates a platform for growth

that will deliver significant benefits for shareholders, employees,

and customers," said Roberts. "The addition of Layne, a leading

water management, construction and drilling company with the #1

position in well drilling and a #2 position in cured-in-place pipe

(CIPP) rehabilitation, significantly enhances Granite's presence in

the large, growing water infrastructure market."

The transaction is expected to close in the second quarter of

2018.

Outlook

"With voters and legislators making a concerted push for

generational commitments to infrastructure investment at the state,

regional, and local level, we are only now seeing the early

benefits of the long-term public infrastructure funding commitments

that were made last year,” Roberts continued.

"Granite teams are extremely well positioned to deliver steady

growth and significantly improved profitability in 2018 and beyond.

We continue to invest in opportunities for our people, leveraging

their immense talents to create and sustain value from both

year-end record backlog of $3.72 billion and significant, long-term

growth opportunities across geographies and end markets," Roberts

said.

The Company’s current expectations for 20183 are:

- High-single to low-double digit

consolidated revenue growth

- Consolidated EBITDA margin2 of 7.0% to

8.0%

(1) Net Income includes a $3.7 million provisional benefit, or

$0.09 per share, from the revaluation of deferred tax assets and

liabilities required by the recently passed H.R. 1, commonly

referred to as the Tax Cuts and Jobs Act.

(2) Please refer to a description and reconciliation in the

attached EBITDA Reconciliation table.

(3) Granite only. Does not include or reflect potential impact

from the acquisition announced February 14, 2018.

Conference Call

Granite will conduct a conference call today, Friday,

February 16, 2018, at 8 a.m. Pacific Time/11 a.m. Eastern Time

to discuss the results of the quarter ended December 31, 2017.

Access to a live audio webcast is available on its Investor

Relations website, investor.graniteconstruction.com. An archive of

the webcast will be available on the website approximately one hour

after the call. The live call also is available by calling

1-877-328-5503; international callers may dial 1-412-317-5472. A

replay will be available after the live call through February 23,

2018, by calling 1-877-344-7529, replay access code 10116934;

international callers may dial 1-412-317-0088.

About Granite

Through its offices and subsidiaries nationwide, Granite

Construction Incorporated (NYSE: GVA) is one of the nation’s

largest infrastructure contractors and construction materials

producers. Granite specializes in complex infrastructure projects,

including transportation, industrial and federal contracting, and

is a proven leader in alternative procurement project delivery.

Granite is an award-winning firm in safety, quality and

environmental stewardship, and has been honored as one of the

World’s Most Ethical Companies by Ethisphere Institute for nine

consecutive years. Granite is listed on the New York Stock Exchange

and is part of the S&P MidCap 400 Index, the MSCI KLD 400

Social Index and the Russell 2000 Index. For more information,

visit graniteconstruction.com.

Forward-looking Statements

All statements included or incorporated by reference in this

communication, other than statements or characterizations of

historical fact, are forward-looking statements within the meaning

of the federal securities laws, including Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on Granite’s current expectations, estimates

and projections about its business and industry, management’s

beliefs, and certain assumptions made by Granite and Layne, all of

which are subject to change. Forward-looking statements can often

be identified by words such as “anticipates,” “expects,” “intends,”

“plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,”

“will,” “should,” “would,” “could,” “potential,” “continue,”

“ongoing,” similar expressions, and variations or negatives of

these words. Examples of such forward-looking statements include,

but are not limited to: (1) references to the anticipated benefits

of the proposed transaction; (2) the expected future capabilities

and served markets of the individual and/or combined companies; (3)

projections of financial results, whether by specific market

segment, or as a whole, and whether for each individual company or

the combined company; (4) market expansion opportunities and

segments that may benefit from sales growth as a result of changes

in market share or existing markets; (5) the financing components

of the proposed transaction; (6) potential credit scenarios,

together with sources and uses of cash; and (7) the expected date

of closing of the transaction.

These forward-looking statements are not guarantees of future

results and are subject to risks, uncertainties and assumptions

that could cause actual results to differ materially and adversely

from those expressed in any forward-looking statement. Important

risk factors that may cause such a difference in connection with

the proposed transaction include, but are not limited to, the

following factors: (1) the risk that the conditions to the closing

of the transaction are not satisfied, including the risk that

required approvals for the transaction from governmental

authorities or the stockholders of Layne are not obtained; (2)

litigation relating to the transaction; (3) uncertainties as to the

timing of the consummation of the transaction and the ability of

each party to consummate the transaction; (4) risks that the

proposed transaction disrupts the current plans and operations of

Granite or Layne; (5) the ability of Granite or Layne to retain and

hire key personnel; (6) competitive responses to the proposed

transaction and the impact of competitive products; (7) unexpected

costs, charges or expenses resulting from the transaction; (8)

potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the transaction;

(9) the combined companies’ ability to achieve the growth prospects

and synergies expected from the transaction, as well as delays,

challenges and expenses associated with integrating the combined

companies’ existing businesses; (10) the terms and availability of

the indebtedness planned to be incurred in connection with the

transaction; and (11) legislative, regulatory and economic

developments, including changing business conditions in the

construction industry and overall economy as well as the financial

performance and expectations of Granite and Layne’s existing and

prospective customers. These risks, as well as other risks

associated with the proposed transaction, will be more fully

discussed in the proxy statement/prospectus that will be included

in the Registration Statement on Form S-4 that Granite will file

with the Securities and Exchange Commission (“SEC”) in connection

with the proposed transaction. Investors and potential investors

are urged not to place undue reliance on forward-looking statements

in this document, which speak only as of this date. Neither Granite

nor Layne undertakes any obligation to revise or update publicly

any forward-looking statement to reflect future events or

circumstances. Nothing contained herein constitutes or will be

deemed to constitute a forecast, projection or estimate of the

future financial performance of Granite, Layne, or the combined

company, following the implementation of the proposed transaction

or otherwise.

In addition, actual results are subject to other risks and

uncertainties that relate more broadly to Granite’s overall

business, including those more fully described in Granite’s filings

with the SEC including its annual report on Form 10-K for the

fiscal year ended December 31, 2016, and Layne’s overall business

and financial condition, including those more fully described in

Layne’s filings with the SEC including its annual report on Form

10-K for the fiscal year ended January 31, 2017.

No Offer or Solicitation

This document does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Additional Information and Where to Find It

In connection with the proposed transaction, Granite will file a

registration statement on Form S-4, which will include a

preliminary prospectus of Granite and a preliminary proxy statement

of Layne (the “proxy statement/prospectus”), and each party will

file other documents regarding the proposed transaction with the

SEC. The registration statement has not yet become effective and

the proxy statement/prospectus included therein is in preliminary

form. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. A definitive proxy statement/prospectus will be sent

to Layne’s stockholders.

You may obtain copies of all documents filed with the SEC

regarding this transaction, free of charge, at the SEC’s website

(www.sec.gov). In addition, investors and stockholders will be able

to obtain free copies of the proxy statement/prospectus and other

documents filed with the SEC by Granite on Granite’s Investor

Relations website (investor.Granite.com) or by writing to Granite,

Investor Relations, 585 West Beach Street, Watsonville, CA 95076

(for documents filed with the SEC by Granite), or by Layne on

Layne’s Investor Relations website (investor.laynechristensen.com)

or by writing to Layne Company, Investor Relations, 1800 Hughes

Landing Boulevard, Suite 800, The Woodlands, TX 77380 (for

documents filed with the SEC by Layne).

Participants in the Solicitation

Granite, Layne, and certain of their respective directors,

executive officers, other members of management and employees and

agents retained, may, under SEC rules, be deemed to be participants

in the solicitation of proxies from Layne stockholders in

connection with the proposed transaction. Information regarding the

persons who may, under SEC rules, be deemed participants in the

solicitation of Layne stockholders in connection with the proposed

transaction will be set forth in the proxy statement/prospectus

when it is filed with the SEC. You can find more detailed

information about Granite’s executive officers and directors in its

definitive proxy statement filed with the SEC on April 25, 2017.

You can find more detailed information about Layne’s executive

officers and directors in its definitive proxy statement filed with

the SEC on April 28, 2017. Additional information about Granite’s

executive officers and directors and Layne’s executive officers and

directors will be provided in the above-referenced Registration

Statement on Form S-4 when it becomes available.

GRANITE CONSTRUCTION INCORPORATED CONSOLIDATED

BALANCE SHEETS (Unaudited - in thousands, except share and

per share data)

December 31, December 31,

2017 2016

ASSETS

Current assets Cash and cash equivalents $ 233,711 $ 189,326

Short-term marketable securities 67,775 64,884 Receivables, net

479,791 419,345 Costs and estimated earnings in excess of billings

103,965 73,102 Inventories 62,497 55,245 Equity in construction

joint ventures 247,826 247,182 Other current assets

36,513 39,908 Total current assets 1,232,078

1,088,992 Property and equipment, net 407,418 406,650 Long-term

marketable securities 65,015 62,895 Investments in affiliates

38,469 35,668 Goodwill 53,799 53,799 Other noncurrent assets

75,199 85,449 Total assets $

1,871,978 $ 1,733,453

LIABILITIES AND EQUITY

Current liabilities Current maturities of long-term debt $ 46,048 $

14,796 Accounts payable 237,673 199,029 Billings in excess of costs

and estimated earnings 135,146 97,522 Accrued expenses and other

current liabilities 236,407 218,587

Total current liabilities 655,274 529,934 Long-term debt

178,453 229,498 Deferred income taxes 1,361 5,441 Other long-term

liabilities 44,085 45,989 Equity Preferred stock, $0.01 par value,

authorized 3,000,000 shares, none outstanding — — Common stock,

$0.01 par value, authorized 150,000,000 shares; issued and

outstanding 39,871,314 shares as of December 31, 2017 and

39,621,140 shares as of December 31, 2016 399 396 Additional

paid-in capital 160,376 150,337 Accumulated other comprehensive

income (loss) 634 (371 ) Retained earnings 783,699

735,626 Total Granite Construction

Incorporated shareholders’ equity 945,108

885,988 Non-controlling interests

47,697 36,603 Total equity

992,805 922,591 Total liabilities and equity

$ 1,871,978 $ 1,733,453

GRANITE

CONSTRUCTION INCORPORATED CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited - in thousands, except per share

data)

Three Months EndedDecember

31,

Years Ended December 31,

2017 2016 2017

2016 Revenue Construction $ 429,444 $

359,741 $ 1,664,708 $ 1,365,198 Large Project Construction 290,888

246,077 1,032,229 888,193 Construction Materials

80,942 60,863 292,776

261,226 Total revenue

801,274 666,681 2,989,713

2,514,617 Cost of revenue Construction

364,231 298,045 1,417,694 1,155,983 Large Project Construction

270,530 232,618 1,002,436 824,056 Construction Materials

65,806 54,768

254,650 233,208 Total cost of revenue

700,567 585,431

2,674,780 2,213,247 Gross profit

100,707 81,250 314,933 301,370 SG&A expenses 59,068 59,342

222,811 219,299

Restructuring gains

(1,394 ) (1,000 ) (2,411 ) (1,925 ) Gain on sales of property and

equipment (1,352 ) (5,994 )

(4,182 ) (8,358 ) Operating income

44,385 28,902

98,715 92,354 Other (income) expense

Interest income (1,386 ) (801 ) (4,742 ) (3,225 ) Interest expense

2,703 3,096 10,800 12,366 Equity in income of affiliates (2,200 )

(2,594 ) (7,107 ) (7,177 ) Other income, net (1,878 )

(685 ) (4,699 ) (5,972 )

Total other income (2,761 ) (984 )

(5,748 ) (4,008 ) Income before

provision for income taxes 47,146 29,886 104,463 96,362 Provision

for income taxes 11,821 10,622

28,662 30,162 Net

income 35,325 19,264 75,801 66,200 Amount attributable to

non-controlling interests (2,552 )

(3,091 ) (6,703 ) (9,078 ) Net income

attributable to Granite Construction Incorporated $ 32,773

$ 16,173 $ 69,098 $

57,122 Net income per share attributable to common

shareholders: Basic $ 0.82 $ 0.41 $ 1.74 $ 1.44 Diluted $ 0.81 $

0.40 $ 1.71 $ 1.42 Weighted average shares of common stock: Basic

39,857 39,610 39,795 39,557 Diluted 40,387 40,306 40,372 40,225

GRANITE CONSTRUCTION INCORPORATED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited - in thousands)

Years Ended December 31, 2017

2016 Operating activities Net income $ 75,801 $

66,200 Adjustments to reconcile net income to net cash provided by

operating activities: Non-cash restructuring gains (939 ) (1,000 )

Depreciation, depletion and amortization 66,345 64,375 Gain on

sales of property and equipment (4,182 ) (8,358 ) Change in

deferred income taxes (4,824 ) 9,842 Stock-based compensation

15,764 13,383 Equity in net loss (income) from unconsolidated

construction joint ventures 14,634 (15,614 ) Net income from

affiliates (7,107 ) (7,177 ) Changes in assets and liabilities:

(9,297 ) (48,505 ) Net cash provided by operating

activities 146,195 73,146 Investing

activities Purchases of marketable securities (124,543 ) (129,685 )

Maturities of marketable securities 120,000 50,000 Proceeds from

called marketable securities — 55,000 Purchases of property and

equipment (67,695 ) (90,970 ) Proceeds from sales of property and

equipment 10,202 12,946 Collection of notes receivable 1,052 4,331

Other investing activities, net 1,798 1,988

Net cash used in investing activities (59,186 )

(96,390 ) Financing activities Proceeds from long-term debt

25,000 30,000 Debt principal payments (45,000 ) (45,025 ) Cash

dividends paid (20,687 ) (20,563 ) Purchases of common stock (6,977

) (5,227 ) Contributions from non-controlling partners 11,500 5,250

Distributions to non-controlling partners (7,109 ) (5,258 ) Other

financing activities 649 557 Net cash

used in financing activities (42,624 ) (40,266 )

Increase (decrease) in cash and cash equivalents 44,385 (63,510 )

Cash and cash equivalents at beginning of year 189,326

252,836 Cash and cash equivalents at end of

year $ 233,711 $ 189,326

GRANITE CONSTRUCTION INCORPORATED Business Segment

Information (Unaudited - dollars in thousands)

Three Months Ended December 31,

Years Ended December 31,

Construction

Large

ProjectConstruction

ConstructionMaterials

Construction

Large

ProjectConstruction

ConstructionMaterials

2017 Revenue $ 429,444 $ 290,888 $

80,942 $ 1,664,708 $ 1,032,229 $ 292,776 Gross profit 65,213 20,358

15,136 247,014 29,793 38,126 Gross profit as a percent of revenue

15.2 % 7.0 % 18.7 % 14.8 % 2.9 % 13.0 % 2016 Revenue $

359,741 $ 246,077 $ 60,863 $ 1,365,198 $ 888,193 $ 261,226 Gross

profit 61,696 13,459 6,095 209,215 64,137 28,018 Gross profit as a

percent of revenue 17.2 % 5.5 % 10.0 %

15.3 % 7.2 % 10.7 %

GRANITE CONSTRUCTION

INCORPORATED Contract Backlog by Segment (Unaudited -

dollars in thousands)

December 31, 2017 December 31, 2016

Construction $ 896,955

24.1 % $ 1,030,487 29.6 % Large Project Construction

2,821,202 75.9 % 2,453,918 70.4

% Total $ 3,718,157 100.0 % $

3,484,405 100.0 %

GRANITE CONSTRUCTION

INCORPORATED EBITDA(1) (Unaudited - dollars in

thousands)

Three Months EndedDecember

31,

Years EndedDecember 31,

2017 2016 2017

2016 Net income attributable to Granite Construction

Incorporated $ 32,773 $ 16,173 $ 69,098 $ 57,122

Depreciation, depletion and amortization expense(2) 17,823 17,738

66,345 64,375 Provision for income taxes 11,821 10,622 28,662

30,162 Interest expense, net of interest income 1,317

2,295 6,058 9,141 EBITDA $ 63,734

$ 46,828 $ 170,163 $ 160,800

Consolidated EBITDA Margin(3) 8.0% 7.0% 5.7% 6.4%

Note: (1)We define EBITDA as GAAP net income

attributable to Granite Construction Incorporated, adjusted for

interest, taxes, depreciation, depletion and amortization. We

believe this non-GAAP financial measure and the associated margin

are useful in evaluating operating performance and are regularly

used by security analysts, institutional investors and other

interested parties in reviewing the Company. However, the reader is

cautioned that any non-GAAP financial measures provided by the

Company are provided in addition to, and not as alternatives for,

the Company's reported results prepared in accordance with GAAP.

The methods used by the Company to calculate its non-GAAP financial

measures may differ significantly from methods used by other

companies to compute similar measures. As a result, any non-GAAP

financial measures provided by the Company may not be comparable to

similar measures provided by other companies. (2)Amount includes

the sum of depreciation, depletion and amortization which are

classified as Cost of Revenue and Selling, General and

Administrative expenses in the consolidated statements of

operations of Granite Construction Incorporated. (3)Represents

EBITDA divided by consolidated revenue. Consolidated revenue was

$801,274 and $2,989,713 for three and twelve months ended December

31, 2017, respectively, and $666,681 and $2,514,617 for three and

twelve months ended December 31, 2016, respectively,

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180216005172/en/

Granite Construction IncorporatedMediaJacque Fourchy,

831-761-4741orInvestorsRon Botoff, 831-728-7532

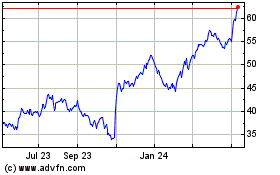

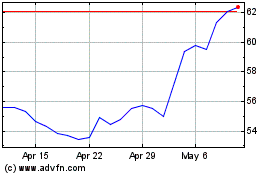

Granite Construction (NYSE:GVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Granite Construction (NYSE:GVA)

Historical Stock Chart

From Apr 2023 to Apr 2024