Fourth quarter revenues of $399.3 million, up 27.4%

year-over-year

EPAM Systems, Inc. (NYSE:EPAM), a leading global provider of

digital platform engineering and software development services,

today announced results for its fourth quarter and full year ended

December 31, 2017.

“We are pleased with our strong 2017 results,

ending with 25% year-over-year growth and $1.45 billion in annual

revenues, reflecting our continued evolution into a leading,

end-to-end digital solutions service provider,” said Arkadiy

Dobkin, EPAM CEO & President. “We expect that our focus on

solving our customers’ most complex digital challenges, along with

our ability to bring new capabilities and our commitment to

accelerating time-to-market in innovative practical solutions, will

continue to drive demand.”

Fourth Quarter 2017

Highlights

•

Revenues increased

to $399.3 million, a year-over-year increase of $85.8 million or

27.4% demonstrating strong broad-based demand across the industries

we serve and geographies in which we operate. In constant currency,

revenue was up 23.8% year-over-year;

•

GAAP income from

operations was $52.1 million, an increase of $14.7 million or 39.2%

compared to $37.4 million in the fourth quarter of 2016;

•

Non-GAAP income

from operations was $66.9 million, an increase of $15.4 million or

30.1% compared to $51.5 million in the fourth quarter of 2016;

• Provision for

income taxes includes a provisional $74.6 million charge related to

US tax reform;

•

Diluted earnings

per share (“EPS”) on a GAAP basis was $(0.58), a decrease from

$0.46 in the fourth quarter of 2016. Diluted EPS on a GAAP

basis excluding the provisional charge related to U.S. tax reform

was $0.78; and

• Non-GAAP

diluted EPS was $1.01, an increase of $0.24 or 31.2% from $0.77 in

the fourth quarter of 2016.

Full Year 2017 Highlights

•

Revenues increased

to $1.45 billion, a year-over-year increase of $290.3 million or

25.0%. In constant currency, revenue was up 23.9%

year-over-year;

•

GAAP income from

operations was $172.9 million, an increase of $39.2 million or

29.4% compared to $133.7 million in 2016;

•

Non-GAAP income

from operations was $234.7 million, an increase of $42.9 million or

22.3% compared to $191.8 million in 2016;

•

Diluted EPS on a

GAAP basis was $1.32, compared to $1.87 in 2016. Diluted EPS

on a GAAP basis excluding the provisional charge related to U.S.

tax reform was $2.68; and

• Non-GAAP

diluted EPS was $3.46, an increase of $0.56 or 19.3%, from $2.90 in

2016.

Cash Flow and Other Metrics

•

Cash from operations was $71.4 million in the fourth quarter of

2017, up from $53.7 million in the fourth quarter of 2016; and was

$195.4 million in 2017, up from $164.8 million in 2016;

•

Cash and cash

equivalents totaled $582.6 million as of December 31, 2017, an

increase of $220.6 million or 60.9% from $362.0 million as of

December 31, 2016; and

•

Total headcount

was approximately 25,900 as of December 31, 2017. Included in this

number were approximately 22,900 delivery professionals, an

increase of 16.9% over the previous year.

2018 Outlook - Full Year and First Quarter

Full Year

•

Revenue growth for 2018 will be at least 24%, including an

estimated 2% for currency tailwinds. We expect constant currency

growth will be at least 22%;

• We

expect GAAP income from operations to be in the range of 12% to 13%

of revenues and non-GAAP income from operations to be in the range

of 16% to 17% of revenues;

• We

expect our GAAP effective tax rate to be approximately 15% and our

non-GAAP effective tax rate to be approximately 22%; and

• We

expect GAAP diluted EPS will be at least $3.38 for the full year,

and non-GAAP diluted EPS will be at least $4.03 for the full year

based on an expected weighted average share count of 57.3 million

diluted shares outstanding.

First Quarter

• Revenues will be at

least $414 million for the first quarter, reflecting a

year-over-year growth rate of at least 27% including an estimated

4% for currency tailwinds. We expect constant currency growth will

be at least 23%;

• For the first

quarter, we expect GAAP income from operations to be in the range

of 11.5% to 12.5% of revenues and non-GAAP income from operations

to be in the range of 15% to 16% of revenues;

• We expect our GAAP

effective tax rate to be approximately 11% and our non-GAAP

effective tax rate to be approximately 22%; and

• We expect GAAP

diluted EPS will be at least $0.76 for the quarter, and

non-GAAP diluted EPS will be at least $0.90 for the quarter based

on an expected weighted average share count of 56.5 million diluted

shares outstanding.

Conference Call Information

EPAM will host a conference call to discuss

results on Friday, February 16, 2018 at 8:00 a.m. Eastern

time. The live conference call will be available by dialing +1

(877) 407-0784 or +1 (201) 689-8560 (outside of the U.S.). A

webcast of the conference call can be accessed at the Investor

Relations section of the Company’s website

at http://investors.epam.com. A replay will be available

approximately one hour after the call by dialing +1 (844) 512-2921

or +1 (412) 317-6671 (outside of the U.S.) and entering the

conference ID 13674698. The replay will be available until March 2,

2018.

About EPAM SystemsSince 1993, EPAM Systems,

Inc. (NYSE:EPAM), has leveraged its core engineering expertise to

become a leading global product development and digital platform

engineering services company. Through its ‘Engineering DNA’ and

innovative strategy, consulting, and design capabilities, EPAM

works in collaboration with its customers to deliver innovative

solutions that turn complex business challenges into real business

opportunities. EPAM’s global teams serve customers in over 25

countries across North America, Europe, Asia and Australia. EPAM is

a recognized market leader among independent research agencies and

was ranked #12 in FORBES 25 Fastest Growing Public Tech

Companies, as a top information technology services company

on FORTUNE’S 100 Fastest Growing Companies, and as a

top UK Digital Design & Build Agency. Learn more

at http://www.epam.com/ and follow us on

Twitter @EPAMSYSTEMS and LinkedIn.

Non-GAAP Financial Measures

EPAM supplements results reported in accordance

with United States generally accepted accounting principles,

referred to as GAAP, with non-GAAP financial measures. Management

believes these measures help illustrate underlying trends in EPAM’s

business and uses the measures to establish budgets and operational

goals, communicate internally and externally, for managing EPAM’s

business and evaluating its performance. Management also believes

these measures help investors compare EPAM’s operating performance

with its results in prior periods. EPAM anticipates that it will

continue to report both GAAP and certain non-GAAP financial

measures in its financial results, including non-GAAP results that

exclude stock-based compensation expense, write-offs and

recoveries, amortization of purchased intangible assets, goodwill

impairment, legal settlements, foreign exchange gains and losses,

acquisition-related costs, certain other one-time charges, the

impact of U.S. tax reform, excess tax benefits related to stock

compensation and the related effect on income taxes. Management

also supplemented results with the non-GAAP financial measure

“Diluted EPS on a GAAP basis excluding U.S. Tax Reform.” This

measure excludes the one-time charge associated with U.S. Tax

Reform. Management also compares operating results on a basis of

“constant currency,” which is also a non-GAAP financial measure.

This measure excludes the effect of foreign currency exchange rate

fluctuations by translating the current period revenues and

expenses into U.S. dollars at the weighted average exchange rates

of the prior period of comparison. Because EPAM’s reported non-GAAP

financial measures are not calculated according to GAAP, these

measures are not comparable to GAAP and may not be comparable to

similarly described non-GAAP measures reported by other companies

within EPAM’s industry. Consequently, EPAM’s non-GAAP financial

measures should not be evaluated in isolation or supplant

comparable GAAP measures, but, rather, should be considered

together with the information in EPAM’s consolidated financial

statements, which are prepared in accordance with GAAP.

Forward-Looking Statements

This press release includes statements which may

constitute forward-looking statements made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995, the accuracy of which are necessarily subject to risks,

uncertainties, and assumptions as to future events that may not

prove to be accurate. Factors that could cause actual results to

differ materially from those expressed or implied include general

economic conditions and the factors discussed in our most recent

Annual Report on Form 10-K and other filings with the Securities

and Exchange Commission. EPAM undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as may be required

under applicable securities law.

Contact:EPAM Systems, Inc.David Straube, Head

of Investor RelationsPhone: +1-267-759-9000

x59419david_straube@epam.com

EPAM SYSTEMS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE

INCOME(Unaudited)(US Dollars

in thousands, except share and per share

data)

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues |

$ |

399,297 |

|

|

$ |

313,525 |

|

|

$ |

1,450,448 |

|

|

$ |

1,160,132 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Cost of

revenues (exclusive of depreciation and amortization) |

254,121 |

|

|

198,226 |

|

|

921,352 |

|

|

737,186 |

|

| Selling,

general and administrative expenses |

84,793 |

|

|

71,432 |

|

|

324,855 |

|

|

264,658 |

|

|

Depreciation and amortization expense |

7,696 |

|

|

6,237 |

|

|

28,562 |

|

|

23,387 |

|

| Other

operating expenses, net |

637 |

|

|

247 |

|

|

2,733 |

|

|

1,205 |

|

| Income from

operations |

52,050 |

|

|

37,383 |

|

|

172,946 |

|

|

133,696 |

|

| Interest and other

income, net |

1,799 |

|

|

1,432 |

|

|

4,601 |

|

|

4,848 |

|

| Foreign exchange

loss |

(1,772 |

) |

|

(6,765 |

) |

|

(3,242 |

) |

|

(12,078 |

) |

| Income before

provision for income taxes |

52,077 |

|

|

32,050 |

|

|

174,305 |

|

|

126,466 |

|

| Provision for income

taxes |

82,951 |

|

|

7,287 |

|

|

101,545 |

|

|

27,200 |

|

| Net

(loss)/income |

$ |

(30,874 |

) |

|

$ |

24,763 |

|

|

$ |

72,760 |

|

|

$ |

99,266 |

|

| Foreign currency

translation adjustments |

3,425 |

|

|

(5,209 |

) |

|

20,065 |

|

|

(2,538 |

) |

| Comprehensive

(loss)/income |

$ |

(27,449 |

) |

|

$ |

19,554 |

|

|

$ |

92,825 |

|

|

$ |

96,728 |

|

| |

|

|

|

|

|

|

|

| Net

(loss)/income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.58 |

) |

|

$ |

0.49 |

|

|

$ |

1.40 |

|

|

$ |

1.97 |

|

|

Diluted |

$ |

(0.58 |

) |

|

$ |

0.46 |

|

|

$ |

1.32 |

|

|

$ |

1.87 |

|

| Shares used in

calculation of net (loss)/income per share: |

|

|

|

|

|

|

|

|

Basic |

52,879 |

|

|

50,717 |

|

|

52,077 |

|

|

50,309 |

|

|

Diluted |

52,879 |

|

|

53,380 |

|

|

54,984 |

|

|

53,215 |

|

EPAM SYSTEMS, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited)(US Dollars in

thousands, except share and per share data)

| |

As of December 31,

2017 |

|

As of December 31,

2016 |

|

Assets |

|

|

|

| Current assets |

|

|

|

| Cash and

cash equivalents |

$ |

582,585 |

|

|

$ |

362,025 |

|

| Accounts

receivable, net of allowance of $1,186 and $1,434,

respectively |

265,639 |

|

|

199,982 |

|

| Unbilled

revenues |

86,500 |

|

|

63,325 |

|

| Prepaid

and other current assets, net of allowance of $45 and $644,

respectively |

23,196 |

|

|

18,493 |

|

| Employee

loans, current, net of allowance of $0 and $0, respectively |

2,113 |

|

|

2,726 |

|

| Total

current assets |

960,033 |

|

|

646,551 |

|

| Property and equipment,

net |

86,419 |

|

|

73,616 |

|

| Employee loans,

noncurrent, net of allowance of $0 and $0, respectively |

2,097 |

|

|

3,252 |

|

| Intangible assets,

net |

44,511 |

|

|

51,260 |

|

| Goodwill |

119,531 |

|

|

109,289 |

|

| Deferred tax

assets |

24,974 |

|

|

31,005 |

|

| Other noncurrent

assets, net of allowance of $140 and $132, respectively |

12,691 |

|

|

10,838 |

|

| Total

assets |

$ |

1,250,256 |

|

|

$ |

925,811 |

|

| |

|

|

|

|

Liabilities |

|

|

|

| Current

liabilities |

|

|

|

| Accounts

payable |

$ |

5,574 |

|

|

$ |

3,213 |

|

| Accrued

expenses and other current liabilities |

89,812 |

|

|

49,895 |

|

| Due to

employees |

38,757 |

|

|

32,203 |

|

| Deferred

compensation due to employees |

5,964 |

|

|

5,900 |

|

| Taxes

payable, current |

40,860 |

|

|

25,008 |

|

| Total

current liabilities |

180,967 |

|

|

116,219 |

|

| Long-term debt |

25,033 |

|

|

25,048 |

|

| Taxes payable,

noncurrent |

59,874 |

|

|

— |

|

| Other noncurrent

liabilities |

9,435 |

|

|

3,132 |

|

| Total

liabilities |

275,309 |

|

|

144,399 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity |

|

|

|

| Common stock, $0.001

par value; 160,000,000 authorized; 53,003,420 and 51,117,422

shares issued, 52,983,685 and 51,097,687 shares outstanding

at December 31, 2017 and December 31, 2016, respectively |

53 |

|

|

50 |

|

| Additional paid-in

capital |

473,874 |

|

|

374,907 |

|

| Retained earnings |

518,820 |

|

|

444,320 |

|

| Treasury stock |

(177 |

) |

|

(177 |

) |

| Accumulated other

comprehensive loss |

(17,623 |

) |

|

(37,688 |

) |

| Total

stockholders’ equity |

974,947 |

|

|

781,412 |

|

| Total

liabilities and stockholders’ equity |

$ |

1,250,256 |

|

|

$ |

925,811 |

|

EPAM SYSTEMS, INC. AND

SUBSIDIARIESReconciliations of Non-GAAP Financial

Measures to Comparable GAAP Financial Measures(US

Dollars in thousands, except percent and per share

amounts)(Unaudited)

Reconciliation of revenue growth at constant

currency to revenue growth as reported under GAAP is presented in

the table below:

| |

Three Months Ended December 31,

2017 |

|

Year Ended December 31,

2017 |

| Revenue growth

at constant currency (1) |

23.8% |

|

|

23.9% |

|

| Foreign

exchange rates impact |

3.6% |

|

|

1.1% |

|

|

Revenue growth as reported |

27.4% |

|

|

25.0% |

|

|

(1 |

) |

Constant

currency revenue results are calculated by translating current

period revenue in local currency into U.S. dollars at the weighted

average exchange rates of the comparable prior period. |

Reconciliation of various income statement amounts from GAAP to

non-GAAP for the three months and years ended December 31, 2017 and

2016:

| |

Three Months Ended December 31,

2017 |

|

Year Ended December 31, 2017 |

| |

GAAP |

|

Adjustments |

|

Non-GAAP |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

| Cost of

revenues(exclusive of depreciation and amortization)(2) |

$ |

254,121 |

|

|

$ |

(6,416 |

) |

|

$ |

247,705 |

|

|

$ |

921,352 |

|

|

$ |

(20,868 |

) |

|

$ |

900,484 |

|

| Selling, general and

administrative expenses(3) |

$ |

84,793 |

|

|

$ |

(6,641 |

) |

|

$ |

78,152 |

|

|

$ |

324,855 |

|

|

$ |

(33,039 |

) |

|

$ |

291,816 |

|

| Income

from operations(4) |

$ |

52,050 |

|

|

$ |

14,897 |

|

|

$ |

66,947 |

|

|

$ |

172,946 |

|

|

$ |

61,711 |

|

|

$ |

234,657 |

|

| Operating

margin |

13.0 |

% |

|

3.8 |

% |

|

16.8 |

% |

|

11.9 |

% |

|

4.3 |

% |

|

16.2 |

% |

| Net

(loss)/income(5) |

$ |

(30,874 |

) |

|

$ |

87,500 |

|

|

$ |

56,626 |

|

|

$ |

72,760 |

|

|

$ |

117,542 |

|

|

$ |

190,302 |

|

| Weighted average

diluted shares outstanding(6) |

52,879 |

|

|

3,065 |

|

|

55,944 |

|

|

54,984 |

|

|

— |

|

|

54,984 |

|

| Diluted (loss)/earnings

per share |

$ |

(0.58 |

) |

|

|

|

$ |

1.01 |

|

|

$ |

1.32 |

|

|

|

|

$ |

3.46 |

|

| |

Three Months Ended December 31,

2016 |

|

Year Ended December 31, 2016 |

| |

GAAP |

|

Adjustments |

|

Non-GAAP |

|

GAAP |

|

Adjustments |

|

Non-GAAP |

| Cost of revenues

(exclusive of depreciation and amortization)(2) |

$ |

198,226 |

|

|

$ |

(4,019 |

) |

|

$ |

194,207 |

|

|

$ |

737,186 |

|

|

$ |

(16,619 |

) |

|

$ |

720,567 |

|

| Selling, general and

administrative expenses(3) |

$ |

71,432 |

|

|

$ |

(8,097 |

) |

|

$ |

63,335 |

|

|

$ |

264,658 |

|

|

$ |

(33,331 |

) |

|

$ |

231,327 |

|

| Income

from operations(4) |

$ |

37,383 |

|

|

$ |

14,083 |

|

|

$ |

51,466 |

|

|

$ |

133,696 |

|

|

$ |

58,120 |

|

|

$ |

191,816 |

|

| Operating

margin |

11.9 |

% |

|

4.5 |

% |

|

16.4 |

% |

|

11.5 |

% |

|

5.0 |

% |

|

16.5 |

% |

| Net

income(5) |

$ |

24,763 |

|

|

$ |

16,290 |

|

|

$ |

41,053 |

|

|

$ |

99,266 |

|

|

$ |

55,184 |

|

|

$ |

154,450 |

|

| Weighted average

diluted shares outstanding(6) |

53,380 |

|

|

— |

|

|

53,380 |

|

|

53,215 |

|

|

— |

|

|

53,215 |

|

| Diluted earnings per

share |

$ |

0.46 |

|

|

|

|

$ |

0.77 |

|

|

$ |

1.87 |

|

|

|

|

$ |

2.90 |

|

| Items (2)

through (5) above are detailed in the table below with the specific

cross-reference noted in the appropriate item. |

| |

Three Months Ended December

31, |

|

Year Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Stock-based compensation expenses - non-acquisition related |

$ |

6,416 |

|

|

$ |

4,019 |

|

|

$ |

20,868 |

|

|

$ |

16,619 |

|

| Total

adjustments to GAAP cost of revenues(2) |

6,416 |

|

|

4,019 |

|

|

20,868 |

|

|

16,619 |

|

|

Stock-based compensation expenses - acquisition related |

72 |

|

|

3,014 |

|

|

8,139 |

|

|

12,884 |

|

|

Stock-based compensation expenses - all other |

5,999 |

|

|

4,691 |

|

|

23,400 |

|

|

19,741 |

|

| Other

acquisition-related expenses |

570 |

|

|

392 |

|

|

1,500 |

|

|

706 |

|

| Total

adjustments to GAAP selling, general and administrative

expenses(3) |

6,641 |

|

|

8,097 |

|

|

33,039 |

|

|

33,331 |

|

|

Amortization of purchased intangible assets |

1,856 |

|

|

1,967 |

|

|

7,562 |

|

|

8,170 |

|

| One-time

(recoveries)/charges |

(16 |

) |

|

— |

|

|

242 |

|

|

— |

|

| Total

adjustments to GAAP income from operations(4) |

$ |

14,897 |

|

|

$ |

14,083 |

|

|

$ |

61,711 |

|

|

$ |

58,120 |

|

| Foreign

exchange loss |

1,772 |

|

|

6,765 |

|

|

3,242 |

|

|

12,078 |

|

| Provision

for income taxes: |

|

|

|

|

|

|

|

| Tax

effect on non-GAAP adjustments |

(2,946 |

) |

|

(4,558 |

) |

|

(12,736 |

) |

|

(15,014 |

) |

| Charge

related to US tax reform |

74,632 |

|

|

— |

|

|

74,632 |

|

|

— |

|

| Excess

tax benefits related to stock-based compensation(a) |

(855 |

) |

|

— |

|

|

(9,307 |

) |

|

— |

|

| Total

adjustments to GAAP net (loss) income(5) |

$ |

87,500 |

|

|

$ |

16,290 |

|

|

$ |

117,542 |

|

|

$ |

55,184 |

|

| |

(a) |

Effective

January 1, 2017 with the adoption of ASU 2016-09, the Company is

prospectively presenting excess tax benefits related to stock-based

compensation in the Provision for income taxes. Prior toJanuary 1,

2017, the Company recorded these benefits in Additional

paid-in-capital. |

|

(6 |

) |

There was a

3,065 increase to the shares used in the calculation of diluted

earnings per share on a non-GAAP basis during the three months

ended December 31, 2017 as these shares were excluded from the

calculation of diluted loss per share on a GAAP basis due to the

anti-dilutive effect of these shares as a result of the net loss in

the period. There were no adjustments to GAAP weighted-average

diluted common shares outstanding in the calculation of diluted

earnings per share on a non-GAAP basis during the three months

ended December 31, 2016 and twelve months ended December 31, 2017

and 2016. |

Reconciliation of diluted EPS on a GAAP basis to diluted EPS on

a GAAP basis without the impact of U.S. Tax Reform for the three

months and year ended December 31, 2017:

| |

Three Months Ended December 31,

2017 |

|

Year Ended December 31, 2017 |

| |

GAAP |

|

Adjustments |

|

GAAP excluding Tax Reform |

|

GAAP |

|

Adjustments |

|

GAAP excluding Tax Reform |

| Net

(loss)/income(7) |

$ |

(30,874 |

) |

|

$ |

74,632 |

|

|

$ |

43,758 |

|

|

$ |

72,760 |

|

|

$ |

74,632 |

|

|

$ |

147,392 |

|

| Weighted average

diluted shares outstanding(8) |

52,879 |

|

|

3,065 |

|

|

55,944 |

|

|

54,984 |

|

|

— |

|

|

54,984 |

|

| Diluted (loss)/earnings

per share |

$ |

(0.58 |

) |

|

|

|

$ |

0.78 |

|

|

$ |

1.32 |

|

|

|

|

$ |

2.68 |

|

|

(7 |

) |

The total adjustments

to GAAP net (loss)/income include a $74.6 million provisional

charge related to U.S. Tax Reform comprised of: (i) $64.3 million

one-time transition tax on accumulated foreign subsidiary earnings

not previously subject to U.S. income tax and (ii) $10.3 million

resulting from the revaluation of our U.S. net deferred tax assets

to the new U.S. federal statutory tax rate of 21%. |

|

(8 |

) |

There was a 3,065

increase to the shares used in the calculation of diluted earnings

per share excluding tax reform during the three months ended

December 31, 2017 as these shares were excluded from the

calculation of diluted loss per share on a GAAP basis due to the

anti-dilutive effect of these shares as a result of the net loss in

the period. There were no adjustments to GAAP weighted-average

diluted common shares outstanding in the calculation of diluted

earnings per shares excluding tax reform during the twelve months

ended December 31, 2017. |

EPAM SYSTEMS, INC. AND

SUBSIDIARIESReconciliations of Guidance Non-GAAP

Measures to Comparable GAAP Measures(in percent,

except per share amounts)(Unaudited)

The below guidance constitutes forward-looking

statements within the meaning of the federal securities laws and is

based on a number of assumptions that are subject to change and

many of which are outside the control of the Company. Actual

results may differ materially from the Company’s expectations

depending on factors discussed in the Company’s filings with the

Securities and Exchange Commission.

Reconciliation of projected revenue growth in

constant currency is presented in the table below:

| |

First Quarter 2018 |

|

Full Year 2018 |

| Revenue growth

at constant currency (at least)(9) |

23% |

|

|

22% |

|

| Foreign

exchange rates impact |

4% |

|

|

2% |

|

|

Revenue growth (at least) |

27% |

|

|

24% |

|

|

(9 |

) |

Constant

currency revenue results are calculated by translating current

period projected revenues in local currency into U.S. dollars at

the weighted average exchange rates of the comparable prior

period. |

Reconciliation of GAAP to non-GAAP income from operations as a

percentage of revenues is presented in the table below:

| |

First Quarter 2018 |

|

Full Year 2018 |

| GAAP income

from operations as a percentage of revenues |

11.5% to 12.5% |

|

12% to 13% |

| Stock-based

compensation expenses |

3.2% |

|

|

3.1% |

|

| Included

in cost of revenues |

1.4% |

|

|

1.3% |

|

| Included

in selling, general and administrative expenses |

1.8% |

|

|

1.8% |

|

| Amortization of

purchased intangible assets |

0.4% |

|

|

0.4% |

|

| Other

acquisition-related expenses |

0.1% |

|

|

0.1% |

|

|

Non-GAAP income from operations as a percentage of

revenues |

15% to 16% |

|

16% to 17% |

Reconciliation of GAAP to non-GAAP effective tax rate is

presented in the table below:

| |

First Quarter 2018 |

|

Full Year 2018 |

| GAAP effective

tax rate |

11% |

|

|

15% |

|

| Effect on non-GAAP

adjustments |

3.1% |

|

|

1.7% |

|

| Excess tax benefits

related to stock-based compensation |

7.9% |

|

|

5.3% |

|

|

Non-GAAP effective tax rate |

22% |

|

|

22% |

|

Reconciliation of GAAP to non-GAAP diluted

earnings per share is presented in the table below:

| |

First Quarter 2018 |

|

Full Year 2018 |

| GAAP diluted

earnings per share (at least) |

$ |

0.76 |

|

|

$ |

3.38 |

|

| Stock-based

compensation expenses |

0.24 |

|

|

0.96 |

|

| Included

in cost of revenues |

0.10 |

|

|

0.41 |

|

| Included

in selling, general and administrative expenses |

0.14 |

|

|

0.55 |

|

| Amortization of

purchased intangible assets |

0.03 |

|

|

0.11 |

|

| Foreign exchange

loss |

0.03 |

|

|

0.12 |

|

| Provision for income

taxes: |

|

|

|

| Tax effect on

non-GAAP adjustments |

(0.07 |

) |

|

(0.26 |

) |

| Excess tax

benefits related to stock-based compensation |

(0.09 |

) |

|

(0.28 |

) |

| Non-GAAP

diluted earnings per share (at least) |

$ |

0.90 |

|

|

$ |

4.03 |

|

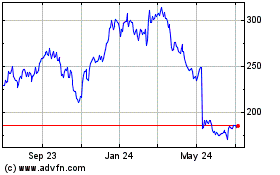

EPAM Systems (NYSE:EPAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

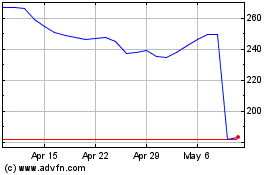

EPAM Systems (NYSE:EPAM)

Historical Stock Chart

From Apr 2023 to Apr 2024