UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 40‑F

o

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number: 001-37915

_______________________

FORTIS INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Newfoundland and Labrador, Canada

|

4911

|

98-0352146

|

|

(Province of other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial Classification

Code Number)

|

(I.R.S. Employer Identification Number)

|

Fortis Place, Suite 1100

5 Springdale Street

St. John

'

s, Newfoundland and Labrador

Canada A1E 0E4

(Address and telephone number of Registrant

'

s principal executive offices)

_______________________

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 590‑9070

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Common Shares, without par value

|

New York Stock Exchange

|

|

(Title of Class)

|

(Name of exchange on which registered)

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

For annual reports, indicate by check mark the information filed with this Form:

x

Annual information form

x

Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

421,137,419 Common Shares as of December 31, 2017

Indicate by check mark whether the Registrant by filing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934 (the "Exchange Act"). If "Yes" is marked, indicate the file number assigned to the Registrant in connection with such Rule.

Yes

o

82-_____ No

x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes

x

No

o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company

o

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

o

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

Fortis Inc. (the "Corporation" or "Fortis") is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act. The Corporation is a "foreign private issuer" as defined in Rule 405 under the Securities Act of 1933, as amended. Equity securities of the Corporation are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

FORWARD LOOKING INFORMATION

This Annual Report on Form 40-F and the exhibits attached hereto (the "Form 40-F") contain "forward-looking information" within the meaning of applicable Canadian securities laws and "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, collectively referred to as "forward-looking information". Forward-looking information reflects expectations of the Corporation's management regarding future growth, results of operations, performance, business prospects and opportunities. Wherever possible, words such as "anticipates", "believes", "budgets", "could", "estimates", "expects", "forecasts", "intends", "may", "might", "plans", "projects", "schedule", "should", "target", "will", "would" and the negative of these terms and other similar terminology or expressions have been used to identify the forward-looking information, which includes, without limitation: the Corporation's forecast gross consolidated and segmented capital expenditures for 2018 and the period 2018 to 2022 and the expected associated increase to rate base; the expectation that long-term sustainable growth in rate base will support continuing growth in earnings and dividends; target average annual dividend growth through 2022; the impact of U.S. Tax Reform on the Corporation's annual earnings per share, cash flows at the Corporation's U.S. regulated utilities and rate base growth; the expectation that allocated revenues recognized by ITC Holdings Corp. ("ITC") from Canadian entities reserving transmission over the Ontario or Manitoba interface are not expected to be material to ITC; the expectation that Tucson Electric Power ("TEP") has sufficient generating capacity, together with existing power purchase agreements and expected generation plant additions, to satisfy the requirements of its customer base and meet future peak demand requirements; the expectation that changes in energy supply costs may increase electricity prices in a manner that adversely affects Newfoundland Power's sales; the expected timing of filing of regulatory applications and receipt and outcome of regulatory decisions; the expected timing of the commissioning of the 8.75-megawatt engine at Fortis Turks and Caicos; TEP's expected share of mine reclamation costs; the expectation that the Corporation will remain at the forefront of emerging technologies; expected consolidated fixed-term debt maturities and repayments over the next five years; the expectation that the Corporation and its subsidiaries will continue to have reasonable access to long-term capital in 2018; statements relating to Fortis Turks and Caicos' recovery of lost revenue as a result of the impact of Hurricane Irma and the timing thereof; the nature, timing, funding source sand expected costs of certain capital projects including,

without limitation, the ITC Multi-Value Regional Transmission Projects and 34.6 to 69 kilovolt Conversion Project, UNS Energy flexible generation resource investment and Gila River Generating Station Unit 2, FortisBC Energy expansion of the Tilbury liquefied natural gas ("LNG") facility, Eagle Mountain Woodfibre Gas Pipeline Project, Lower Mainland System Upgrade and Pipeline Integrity Management Program and additional opportunities beyond the base plan including the Wataynikaneyap Project, the Lake Erie Connector Project and additional LNG infrastructure investment in British Columbia; the expectation that subsidiary operating expenses and interest costs will be paid out of subsidiary operating cash flows; the expectation that cash required to complete subsidiary capital expenditure programs will be sourced from a combination of borrowings under credit facilities, long-term debt offerings and equity injections from Fortis; the expectation that maintaining the targeted capital structure of the Corporation's regulated operating subsidiaries will not have an impact on its ability to pay dividends in the foreseeable future; the expectation that cash required of Fortis to support subsidiary capital expenditure programs and finance acquisitions will be derived from a combination of borrowings under the Corporation's committed corporate credit facility and proceeds from the issuance of common shares, preference shares and long-term debt; expected consolidated fixed-term debt maturities and repayments in 2018 and over the next five years; the expectation that the Corporation and its subsidiaries will remain compliant with debt covenants throughout 2018; statements related to the at-the-market Program including but not limited to the timing, receipt of regulatory approvals and the entering into arrangements with agents; the intent of management to refinance certain borrowings under Corporation's and subsidiaries' long-term committed credit facilities with long-term permanent financing; and the expectation that the adoption of future accounting pronouncements will not have a material impact on the Corporation's consolidated financial statements.

Forward-looking information involves significant risks, uncertainties and assumptions. The Corporation cautions readers that a number of factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking information. These factors should be considered carefully and undue reliance should not be placed on the forward-looking information. For additional information with respect to certain of these risks or factors, reference should be made to the information detailed under the heading "Business Risk Management" on page 36 of management's discussion and analysis for the year ended December 31, 2017, which is filed as Exhibit 99.3 to this Form 40-F and incorporated by reference herein (the "Annual MD&A"), and to continuous disclosure materials filed from time to time by the Corporation with Canadian securities regulatory authorities and the U.S. Securities and Exchange Commission (the "SEC"). Key risk factors for 2018 include, but are not limited to:

|

|

|

|

•

|

uncertainty regarding the outcome of regulatory proceedings at the Corporation's utilities;

|

|

|

|

|

•

|

the impact of fluctuations in foreign exchange rates;

|

|

|

|

|

•

|

the impact of the

Tax Cuts and Jobs Act

on the Corporation's future results of operations and cash flows;

|

|

|

|

|

•

|

risk associated with the impacts of less favourable economic conditions on the Corporation's results of operations;

|

|

|

|

|

•

|

risk associated with the Corporation's ability to continue to comply with Section 404(a) of the Sarbanes-Oxley Act of 2002 and the related rules of the Securities and Exchange Commission and the Public Company Accounting Oversight Board;

|

|

|

|

|

•

|

risk associated with the completion of the Corporation's 2018 capital expenditure program, including completion of major capital projects in the timelines anticipated and at the expected amounts; and

|

|

|

|

|

•

|

uncertainty in the timing and access to capital markets to arrange sufficient and cost-effective financing to finance, among other things, capital expenditures and the repayment of maturing debt.

|

All forward-looking information in this Form 40-F is given as of the date of this Form 40-F and the Corporation disclaims any intention or obligation to revise or update any forward-looking information as a result of new information, future events or otherwise.

CURRENCY

The Corporation presents its consolidated financial statements in Canadian dollars unless otherwise specified. All dollar amounts in this Form 40-F are stated in Canadian dollars ("$" or "C$"), except where otherwise indicated. On February 13, 2018, the daily average exchange rate (as reported by the Bank of Canada) of United States dollars ("US$") into Canadian dollars was US$1.00 equals C$1.26.

CERTIFICATIONS

See Exhibits 99.4, 99.5, 99.6 and 99.7 to this Annual Report on Form 40-F.

DISCLOSURE CONTROLS AND PROCEDURES

Disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed in reports filed with, or submitted to, securities regulatory authorities is recorded, processed, summarized and reported within the time periods specified under Canadian and United States securities laws. As at December 31, 2017, an evaluation was carried out under the supervision of, and with the participation of, the Corporation's management, including the President and Chief Executive Officer and the Executive Vice President, Chief Financial Officer, of the effectiveness of the Corporation's disclosure controls and procedures, as defined in the applicable Canadian and United States securities laws. Based on that evaluation, the President and Chief Executive Officer and the Executive Vice President, Chief Financial Officer concluded that such disclosure controls and procedures are effective as at December 31, 2017.

MANAGEMENT'S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of the Corporation is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is designed by, or under the supervision of, the Corporation's President and Chief Executive Officer and the Executive Vice President, Chief Financial Officer and effected by the Corporation's board of directors (the "Board"), management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with US GAAP. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The Corporation's management, including the Corporation's President and Chief Executive Officer and the Executive Vice President, Chief Financial Officer, assessed the effectiveness of the Corporation's internal control over financial reporting as at December 31, 2017, based on the criteria set forth in Internal Control - Integrated Framework (2013) issued by the

Committee of Sponsoring Organizations of the Treadway Commission. Based on this assessment, management concluded that, as at December 31, 2017, the Corporation's internal control over financial reporting was effective.

Deloitte LLP, an independent registered public accounting firm, has audited the Corporation's Audited Consolidated Financial Statements for the fiscal year ended December 31, 2017 filed as Exhibit 99.2 to this Form 40-F (the "Annual Financial Statements") and has included its attestation report on management's assessment of the Corporation's internal control over financial reporting, which is found on page iv of the Annual Financial Statements.

ATTESTATION REPORT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte LLP's attestation report on management's assessment of the Corporation's internal control over financial reporting is found on page iv of the Annual Financial Statements.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

Management regularly reviews its system of internal control over financial reporting and makes changes to the Corporation's processes and systems to improve controls and increase efficiency, while ensuring that the Corporation maintains an effective internal control environment. Changes may include such activities as implementing new, more efficient systems, consolidating activities, and migrating processes.

During the year ended December 31, 2017, there have been no changes in the Corporation's internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Corporation's internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

The Corporation did not send any notices required by Rule 104 of Regulation BTR during the year ended December 31, 2017 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Corporation has a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act. The Audit Committee is composed of Tracey C. Ball (Chair), Lawrence T. Borgard, Maura J. Clark, Margarita K. Dilley, Douglas J. Haughey and Jo Mark Zurel, as described under "Audit Committee - Members"

on page 33 of the Corporation's annual information form for the year ended December 31, 2017, which is filed as Exhibit 99.1 to this Form 40-F and incorporated by reference herein (the "AIF").

AUDIT COMMITTEE FINANCIAL EXPERT

The Board has determined that the Corporation has at least one "audit committee financial expert" (as defined in paragraph (8) of General Instruction B to Form 40-F) and that Tracey C. Ball and Maura J. Clark are the Corporation's "audit committee financial experts" serving on the Audit Committee of the Board. Each of the Audit Committee financial experts is "independent" under applicable listing standards.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Deloitte LLP was appointed as the Corporation's auditor by the Corporation's shareholders at the annual and special meeting of shareholders of the Corporation held on May 4, 2017, prior to which Ernst & Young LLP served as the Corporation's auditors. Deloitte LLP served as the Corporation's independent public accountant for the fiscal year ended December 31, 2017 and Ernst & Young LLP served as the Corporation's independent public accountant for the fiscal year ended December 31, 2016. For a description of the total amount billed to the Corporation by Deloitte LLP and Ernst & Young LLP for services performed in the last two fiscal years by category of service (audit fees, audit-related fees, tax fees and all other fees), see "Audit Committee - External Auditor Service Fees" on page 34 of the AIF.

No audit-related fees, tax fees or other non-audit fees were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S‑X.

AUDIT COMMITTEE PRE‑APPROVAL POLICIES AND PROCEDURES

For a description of the pre-approval policies and procedures of the Corporation's Audit Committee, see "Audit Committee - Pre-Approval Policies and Procedures" on page 34 of the AIF.

CODE OF ETHICS

The Corporation has a "code of ethics" (as defined in paragraph (9) of General Instruction B to Form 40-F) that applies to its Chief Executive Officer, Chief Financial Officer, principal accounting officer, controller and persons performing similar functions. The Corporation's code of ethics is available on the Corporation's website at https://www.fortisinc.com/ or, without charge, upon request from the Corporate Secretary, Fortis Inc., Fortis Place, Suite 1100, 5 Springdale Street, St. John's, Newfoundland and Labrador, Canada A1E 0E4 (telephone (709) 737-2800).

During the fiscal year ended December 31, 2017, the Corporation amended its code of ethics and such amendments became effective on January 1, 2018. The key amendments are described below:

|

|

|

|

(a)

|

Section 4.0 -

Compliance with Laws and Standard of Business Conduct

- Section 4.2 of the code of ethics was amended to provide that no person subject to the code of ethics should take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts, or any other unfair-dealing practice;

|

|

|

|

|

(b)

|

Section 5.0 -

Corporate Property and Corporate Opportunities

- New Section 5.3 was added to the code of ethics to provide that employees are prohibited from (i) taking for themselves personally corporate opportunities that are discovered through the use of the Corporation's property, information or position; (ii) using the Corporation's property, information or position for personal gain; and (iii) competing with the Corporation. New Section 5.3 also provides that employees owe a duty to the Corporation to advance its legitimate interests when the opportunity to do so arises; and

|

|

|

|

|

(c)

|

Section 11.0 -

Conflicts of Interest

- Section 11.5 of the code of ethics was amended to provide that executive officers must consult with the Chief Executive Officer and the Chair of the Board and obtain prior approval from the Chair of the Board (or in the case of the Chair of the Board, the Chair of the Governance and Nominating Committee), and all other employees must obtain prior approval from the Chief Executive Officer, before agreeing to serve on the board of directors or similar body of a profit seeking enterprise or government agency.

|

During the fiscal year ended December 31, 2017, the Corporation has not granted a waiver from a provision of its code of ethics to its Chief Executive Officer, Chief Financial Officer, principal accounting officer, controller, or persons performing similar functions.

OFF‑BALANCE SHEET ARRANGEMENTS

The Corporation has not entered into any "off-balance sheet arrangements", as defined in General Instruction B(11) to Form 40-F, that have or are reasonably likely to have a current or future effect on the Corporation's financial condition, changes in financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

For tabular disclosure of the Corporation's contractual obligations, see page 25 of the Annual MD&A, under the heading "Liquidity and Capital

Resources - Contractual Obligations".

COMPARISON OF NYSE CORPORATE GOVERNANCE RULES

The Corporation is subject to a variety of corporate governance guidelines and requirements enacted by the Toronto Stock Exchange (the "TSX"), the Canadian securities regulatory authorities, the New York Stock Exchange (the "NYSE") and the SEC. The Corporation is listed on the NYSE and, although the Corporation is not required to comply with most of the NYSE corporate governance requirements to which the Corporation would be subject if it were a U.S. corporation, the Corporation's governance practices differ from those required of U.S. domestic issuers in only the following respects. The NYSE rules for U.S. domestic issuers require shareholder approval of all equity compensation plans (as defined in the NYSE rules) regardless of whether new issuances, treasury shares or shares that the Corporation has purchased in the open market are used. The TSX rules require shareholder approval of share compensation arrangements involving new issuances of shares, and of certain amendments to such arrangements, but do not require such approval if the compensation arrangements involve only shares purchased in the open market. The NYSE rules for U.S. domestic issuers also require shareholder approval of certain transactions or series of related transactions that result in the issuance of common shares, or securities convertible into or exercisable for common shares, that have, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding prior to the transaction or if the issuance of common shares, or securities convertible into or exercisable for common shares, are, or will be upon issuance, equal to or in excess of 20% of the number of common shares outstanding prior to the transaction. The TSX rules require shareholder approval of acquisition transactions resulting in dilution in excess of 25%. The TSX also has broad general discretion to require shareholder approval in connection with any issuances of listed securities. The Corporation complies with the TSX rules described in this paragraph.

UNDERTAKING

The Corporation undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40‑F arises; or transactions in said securities.

DISCLOSURE PURSUANT TO SECTION 13(r) OF THE EXCHANGE ACT

In accordance with Section 13(r) of the Exchange Act, the Corporation is required to include certain disclosures in its periodic reports if it or any of its affiliates knowingly engaged in certain specified activities during the period covered by the report. Neither the Corporation nor its affiliates have knowingly engaged in any transaction or dealing reportable under Section 13(r) of the Exchange Act during the year ended December 31, 2017.

INCORPORATION BY REFERENCE

Fortis' Annual Report on Form 40-F (other than the section entitled "Credit Ratings" in Exhibit 99.1) is incorporated by reference in Fortis' Registration Statements on Form S-8 (File No. 333-215777), Form F-3 (File No. 333-218032) and Form F-10 (File No. 333-214787).

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit

|

Description

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

|

99.4

|

|

|

99.5

|

|

|

99.6

|

|

|

99.7

|

|

|

99.8

|

|

|

99.9

|

|

|

99.10

|

|

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Corporation certifies that it meets all of the requirements for filing on Form 40‑F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

FORTIS INC.

|

|

|

|

|

|

/s/ Karl W. Smith

|

|

|

|

Karl W. Smith

Executive Vice President, Chief Financial Officer

|

|

|

|

Date: February 14, 2018

|

|

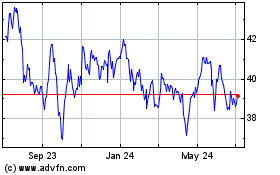

Fortis (NYSE:FTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

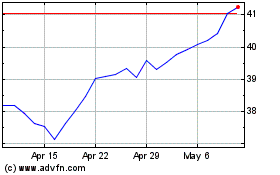

Fortis (NYSE:FTS)

Historical Stock Chart

From Apr 2023 to Apr 2024