Amended Statement of Ownership (sc 13g/a)

February 14 2018 - 5:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULES 13d-1(b), (c), AND (d) AND AMENDMENTS

THERETO FILED

PURSUANT TO RULE 13d-2(b)

(Amendment No. 2)

1

|

Neurotrope, Inc.

|

|

(Name of Issuer)

|

|

Common Stock, par value $0.0001 per share

|

|

(Title of Class of Securities)

|

|

December 31, 2017

|

|

(Date of Event Which Requires Filing of this Statement)

|

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page.

The information required in the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however,

see

the

Notes

).

|

1

|

NAMES OF REPORTING PERSONS

Iroquois Master Fund Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5

|

SOLE VOTING POWER

- 0 -

|

|

6

|

SHARED VOTING POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

7

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

8

|

SHARED DISPOSITIVE POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

2.2%*

|

|

12

|

TYPE OF REPORTING PERSON

CO

|

* See Item 4 of this Schedule 13G.

|

1

|

NAMES OF REPORTING PERSONS

Iroquois Capital Investment Group LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5

|

SOLE VOTING POWER

- 0 -

|

|

6

|

SHARED VOTING POWER

0 shares of common stock

156,250 shares of common stock issuable upon exercise of

warrants*

|

|

7

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

8

|

SHARED DISPOSITIVE POWER

0 shares of common stock

156,250 shares of common stock issuable upon exercise of

warrants*

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 shares of common stock

156,250 shares of common stock issuable upon exercise of

warrants*

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.9%*

|

|

12

|

TYPE OF REPORTING PERSON

OO

|

* See Item 4 of this Schedule 13G.

|

1

|

NAMES OF REPORTING PERSONS

Iroquois Capital Management, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5

|

SOLE VOTING POWER

- 0 -

|

|

6

|

SHARED VOTING POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

7

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

8

|

SHARED DISPOSITIVE POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

2.2%*

|

|

12

|

TYPE OF REPORTING PERSON

IA, OO

|

* See Item 4 of this Schedule 13G.

|

1

|

NAMES OF REPORTING PERSONS

Richard Abbe

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5

|

SOLE VOTING POWER

0 shares of common stock

161,458 shares of common stock issuable upon exercise of

warrants*

|

|

6

|

SHARED VOTING POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

7

|

SOLE DISPOSITIVE POWER

0 shares of common stock

161,458 shares of common stock issuable upon exercise of

warrants*

|

|

8

|

SHARED DISPOSITIVE POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,931 shares of common stock

239,583 shares of common stock issuable upon exercise of

warrants*

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.1%*

|

|

12

|

TYPE OF REPORTING PERSON

IN

|

* See Item 4 of this Schedule 13G.

|

1

|

NAMES OF REPORTING PERSONS

Kimberly Page

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

95,931 shares of common stock

78,125 shares of common stock issuable upon exercise of

warrants*

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES

|

o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

2.2%*

|

|

12

|

TYPE OF REPORTING PERSON

IN

|

* See Item 4 of this Schedule 13G.

This Amendment No. 2 (this “Amendment”) amends the statement

on Schedule 13G filed on August 12, 2016 and amended on February 14, 2017 (the “Original Schedule 13G”) with respect

to the Common Stock, $0.001 par value (the “Common Stock”) of Neurotrope, Inc., a Nevada corporation (the “Company”).

Capitalized terms used herein and not otherwise defined in this Amendment have the meanings set forth in the Original Schedule

13G. This Amendment amends and restates Item 4 and Item 5 in their entirety as set forth below.

|

|

(a)

|

Amount beneficially owned:

|

|

|

As of the close of business on December 31, 2017:

|

|

|

|

|

|

|

(i)

|

Iroquois Master Fund beneficially owned 174,056 Shares consisting of (i) 95,931 Shares directly and beneficially owned by Iroquois Master Fund, and (ii) 78,125 Shares underlying certain warrants owned by Iroquois Master Fund. Such warrants are subject to a conversion cap that precludes Iroquois Master Fund from exercising such warrants to the extent that Iroquois Master Fund would, after such exercise, beneficially own (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended) in excess of 9.99% of the Shares outstanding (the “Beneficial Ownership Limitation”).

|

|

|

(ii)

|

ICIG directly and beneficially owned 156,250 Shares consisting of (i) 0 Shares directly and beneficially owned by ICIG and (ii) 156,250 Shares underlying certain warrants owned by ICIG. Such warrants are subject to a conversion cap that precludes ICIG from exercising such warrants to the extent that ICIG would, after such exercise, beneficially own (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended) in excess of the Beneficial Ownership Limitation.

|

|

|

(iii)

|

Iroquois Capital beneficially owned 174,056 Shares by virtue of its relationship as the investment manager to Iroquois Master Fund.

|

|

|

(iv)

|

American Capital dissolved as

of December 31, 2017 and distributed securities held by it to its members.

|

|

|

(v)

|

Mr. Abbe beneficially owned 330,306 Shares by virtue of his relationship as the President of Iroquois Capital and managing member of ICIG plus 5,208 shares underlying certain warrants held indirectly by Mr. Abbe following the distribution of American Capital.

|

|

|

(vi)

|

Ms. Page beneficially owned 174,056 Shares by virtue of her relationship as a director of Iroquois Master Fund (see (i) above).

|

|

|

|

|

|

|

The filing of this Schedule 13G shall not be construed as an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, the beneficial owners of any of the Shares reported herein. Each of the Reporting Persons specifically disclaims beneficial ownership of the Shares reported herein that are not directly owned by such Reporting Person.

|

|

|

(b)

|

Percent of class:

|

|

|

|

|

|

|

|

The information required by Item 4(b) is set forth in Row (11) of

the cover page for each Reporting Person hereto and is incorporated herein by reference.

The percentages set forth in Row (11) of the cover page for each

Reporting Person is based upon 7,223,556 Shares, which represents (1) the 7,895,859 Shares outstanding, as of October 30, 2017,

which is the total number of Shares outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 3, 2017 plus (2) an aggregate of 239,583 Shares issuable upon the exercise of certain

warrants owned by Iroquois Master Fund, ICIG and Mr. Abbe.

|

|

|

(c)

|

Number of shares as to which each Reporting Person has:

|

|

|

|

|

|

|

|

The information required by Item 4(c) is set forth in Rows (5) - (9) of the cover page for each Reporting Person hereto and is incorporated herein by reference for each such Reporting Person.

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class

|

|

|

|

|

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following:

x

|

|

|

|

Item 10.

|

Certifications.

|

|

|

|

|

|

By signing below each of the undersigned certifies

that, to the best of its knowledge and belief, the securities referred to above were not acquired and are not held for the purpose

of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not

held in connection with or as a participant in any transaction having that purpose or effect.

SIGNATURE

After reasonable inquiry and to the best of his

knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

Dated: February 14, 2018

|

IROQUOIS MASTER FUND LTD.

|

|

|

|

|

|

By:

|

Iroquois Capital Management, LLC,

|

|

|

|

its investment manager

|

|

|

|

|

|

IROQUOIS CAPITAL INVESTMENT GROUP LLC

|

|

|

|

|

|

IROQUOIS CAPITAL MANAGEMENT, LLC

|

|

|

|

|

|

By:

|

/s/ Richard Abbe

|

|

|

|

Name:

|

Richard Abbe

|

|

|

|

Title:

|

President

|

|

|

|

|

|

/s/ Richard Abbe

|

|

|

RICHARD ABBE

|

|

|

|

|

|

/s/ Kimberly Page

|

|

|

KIMBERLY PAGE

|

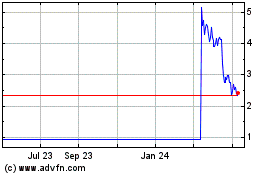

|

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

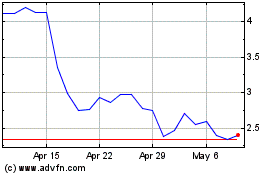

NextTrip (NASDAQ:NTRP)

Historical Stock Chart

From Apr 2023 to Apr 2024