Successfully Completed Split-Off From Liberty Global

Exceeded Target with 465,000 Homes Upgraded / Added in 2017

Financial Results Impacted By Hurricanes Irma and Maria

Puerto Rican Restoration On-Track; Over 450,000 Subscribers

Online

Announced Acquisition of Leading Costa Rican Cable Operator

Liberty Latin America Ltd. ("Liberty Latin America") (NASDAQ:

LILA and LILAK, OTC Link: LILAB) today announced its financial and

operating results for the three months ("Q4") and twelve months

("2017" or "FY 2017") ended December 31, 2017.

CEO Balan Nair stated, "We are entering an exciting new

phase for Liberty Latin America having completed the split-off from

Liberty Global. We believe we have a significant opportunity to

grow through our unique asset base, encompassing a comprehensive

range of telecommunications services from our extensive subsea

network and B2B operations to our high-speed consumer mobile and

fixed networks. Our assets are well-positioned across a region that

remains underpenetrated and underserved by high-speed

telecommunications products."

"To drive this growth, we are committed to building the best

networks and delivering innovative products to enhance the

experience for our customers. In 2017, we upgraded or newly built

approximately 465,000 homes and there is more room to grow with a

fifth of our network footprint at Cable & Wireless still served

by low-speed copper connections and many homes in our markets yet

to be passed. We also accelerated the roll-out of our WiFi Connect

Boxes during the year, with 40% of our customers in Chile now

benefiting from a market-leading in-home broadband connectivity

experience."

"In addition to the organic growth potential in our existing

markets, we also see a significant consolidation opportunity across

a fragmented region where we can leverage our scale to drive

synergies and improve operating performance. Our recently announced

acquisition in Costa Rica is a clear example of the high quality

assets available in the region and the potential for us to add

value through the application of our operating model."

"Looking to 2018, it will be a challenging year as we work

towards recovery in several of our Caribbean markets following the

hurricanes, however, we are on-track to getting our networks and

customers back on-line. Combined with strong ongoing performance in

Chile and momentum building at Cable & Wireless, we are

establishing an exciting platform for sustainable growth."

Key Business Highlights

- VTR delivered another year of strong

performance:

- Reported rebased revenue and OCF1

growth of 6% and 8%, respectively

- Best broadband additions in a decade

with 90,000 internet additions in 2017

- Built / upgraded 196,000 homes in 2017;

~50% higher than 2016

- C&W building operating momentum:

- 45,000 RGUs added in 2017; Q4 strongest

quarter since acquisition with 30,000 RGUs added

- 254,000 homes added / upgraded in 2017;

creating a platform for future growth

- Mobile data growing – upgraded or added

390,000 LTE subscribers in 2017

- Liberty Puerto Rico rebuild on-track:

- Over 450,000 subscribers back on-line

as of February 8, 2018; 530 miles of cable restored

- Operations turned OCF positive in

December 2017

- Successfully negotiated leverage

maintenance covenant holiday for one year

Liberty Latin America 2018 Financial Guidance2

In 2018, we expect:

- Greater than $1.4 billion of OCF;

and

- P&E additions as a percentage of

revenue between 19% and 21%.

Liberty Latin America Q4 2017

YoYGrowth/(Decline)*

FY 2017

YoYGrowth/(Decline)*

Subscribers

Organic RGU net additions (31,200 ) N.M. 65,900 (30 %)

Financial (in USD

millions)

Revenue $ 850 (10 %) $ 3,590 (2 %) OCF $ 295 (23 %) $ 1,367 (6 %)

Property & equipment additions $ (273 ) $ (777 ) As a

percentage of revenue 32 % 22 % Operating loss $ (244 ) N.M.

$ (148 ) N.M. Adjusted FCF3 $ (6 ) N.M. $ (92 ) N.M. Cash

provided by operating activities $ 181 $ 574 Cash used by investing

activities $ (186 ) $ (640 ) Cash provided by financing activities

$ 5 $ 42 N.M. – Not Meaningful. * Revenue and OCF YoY growth

rates are on a rebased basis(4).

Definitions for OCF and Adjusted FCF were changed effective

December 31, 2017. All prior year amounts reflect these new

definitions.

- Under our new definition we are now

including charges from Liberty Global in OCF. During 2017 and 2016,

these charges were $12.0 million and $8.5 million, respectively. We

will continue to incur charges from Liberty Global post split-off

under a framework services agreement.

- With respect to Adjusted FCF, under our

new definition we are deducting distributions to non-controlling

interests, which are reflected as a component of cash provided by

financing activities. During 2017 and 2016, these distributions

were $45.9 million and $61.9 million, respectively.

Subscriber Growth5

Three months ended Year

ended December 31, December 31, 2017

2016 2017 2016

Organic RGU net additions (losses) by product Video (21,000

) (6,200 ) (13,400 ) 11,600 Data 13,500 14,500 110,000 100,200

Voice (23,700 ) (8,500 ) (30,700 ) (17,800 ) Total (31,200 ) (200 )

65,900 94,000

Organic RGU net additions

(losses) by segment C&W 30,100 (20,400 ) 44,600 (4,700 )

Chile 3,700 10,300 81,900 76,500 Puerto Rico (65,000 ) 9,900

(60,600 ) 22,200 Total (31,200 ) (200 ) 65,900 94,000

Organic Mobile SIM additions (losses) by

product Postpaid 400 3,300 29,200 33,100 Prepaid (33,600 )

58,600 (86,900 ) 14,300 Total (33,200 ) 61,900

(57,700 ) 47,400

Organic Mobile SIM additions

(losses) by segment C&W (41,900 ) 48,500 (106,400 ) 13,200

Chile 8,700 13,400 48,700 34,200

Total

(33,200 ) 61,900 (57,700 ) 47,400

- Product

Additions: Organic fixed RGU losses of 31,000 in Q4

2017.

- C&W:

Added 30,000 RGUs during Q4, including 21,000 broadband and 6,000

fixed telephony RGUs.

- Broadband additions were driven by

network upgrades, leading to gains of 15,000 RGUs in Jamaica. In

Panama, we recorded an overall decline of 1,000 subscribers as

higher sales of Mast3r bundles were offset by churn on our legacy

products.

- Excluding DTH losses of 4,000 in

Panama, our fixed video RGUs grew by 7,000 across C&W's

markets. This performance represented an improvement compared to

prior quarters as we drove increased uptake of our bundle

propositions and promoted Flow Sports - the leading sports channel

in the English speaking Caribbean.

- Fixed voice additions resulted from our

increased focus on promoting bundles, particularly in Jamaica and

Trinidad.

- Mobile:

subscribers declined by 42,000 in Q4 as continued growth in Jamaica

(23,000 additions) was more than offset by declines in Panama

(61,000 decline) and the Bahamas (11,000 decline). The decline in

Panama reflects our ongoing focus on higher ARPU customers and

competitive intensity in the market, while increased competition

continued to impact the Bahamas.

- Chile: VTR

added 4,000 RGUs in Q4, a seasonally slower period, driven by

17,000 broadband subscriber additions, partially offset by

fixed-line voice attrition. The strong broadband performance

reflects our speed leadership in Chile.

- Mobile: We

added 9,000 postpaid subscribers in Q4 as we continued to penetrate

our fixed subscriber base with our mobile product.

- Puerto

Rico: Our subscriber base fell by 65,000 in Q4. This figure

represents the net number of subscribers that disconnected from our

services during the quarter.

Revenue Highlights

C&W was acquired on May 16, 2016, and accordingly, is

included in our financial results under our U.S. GAAP accounting

policies since the acquisition date. The following table presents

(i) revenue of each of our reportable segments for the comparative

periods and (ii) the percentage change from period-to-period on

both a reported and rebased basis:

Three months ended

Increase/(decrease) Year ended

Increase/(decrease) December 31, December 31,

2017 2016 % Rebased %

2017 2016 % Rebased %

in millions, except % amounts C&W $ 584.9 $ 590.7

(1.0 ) (2.6 ) $ 2,322.1 $ 1,444.8 60.7 (1.3 ) Chile 250.3 227.6

10.0 4.7 952.9 859.5 10.9 6.4 Puerto Rico 16.9 105.2 (83.9 ) (83.9

) 320.5 420.8 (23.8 ) (23.8 ) Intersegment eliminations (2.0 ) (0.6

)

N.M.

N.M.

(5.5 ) (1.3 )

N.M.

N.M.

Total $ 850.1 $ 922.9 (7.9 ) (9.9 ) $ 3,590.0

$ 2,723.8 31.8 (2.1 )

N.M. – Not Meaningful.

- Reported revenue for the three and

twelve months ended December 31, 2017 declined by 8% and grew

by 32%, respectively.

- The Q4 reported decline reflects the

negative impact of Hurricanes Irma and Maria, partially offset by

beneficial exchange rate movements, organic revenue growth at VTR

and inclusion of certain previously carved-out entities at C&W.

The 2017 reported growth was primarily driven by the acquisition of

C&W in the second quarter of 2016.

- In September 2017, Hurricanes Irma and

Maria impacted a number of our markets in the Caribbean. During the

three months ended December 31, 2017, the hurricanes negatively

impacted Liberty Puerto Rico’s and C&W's revenue by an

estimated $90 million and $7 million, respectively. For FY 2017,

the effects of the hurricanes negatively impacted Liberty Puerto

Rico’s and C&W's revenue by an estimated $109 million and $10

million, respectively.

- From a rebased perspective, revenue

declined by 10% and 2% for the three and twelve months ended

December 31, 2017, respectively, driven by the impact of

Hurricanes Irma and Maria partially offset by rebased growth in

Chile.

Q4 2017 Rebased Revenue Growth - Segment

Highlights

- C&W:

Rebased revenue declined 3% overall.

- Lower revenue was driven by (i) a

decline in Bahamas' mobile performance where we continue to be

impacted by the entry of a new mobile competitor, (ii) reduced

fixed-line revenue in Caribbean markets impacted by the hurricanes

and lower carrier revenue in Jamaica, and (iii) a fall in low

margin project-related B2B revenue in Panama compared to a very

strong performance in Q4 2016. This decline was partly offset by

(a) continued growth in Jamaica's mobile revenue, (b) increased

penetration of high-speed fixed services, particularly in Panama

and Jamaica and (c) growth in our wholesale capacity business.

- Chile:

Rebased revenue growth of 5% was primarily related to increases in

(i) residential cable subscription revenue, mainly from higher ARPU

per RGU and an increase in the average number of subscribers, (ii)

mobile subscription revenue, driven by subscriber growth and (iii)

B2B subscription revenue due to growth in SOHO RGUs.

- Puerto

Rico: Rebased revenue decline of 84% was driven by impacts

related to Hurricanes Irma and Maria.

- In 2018, we anticipate there will be a

continued adverse impact on our financial performance as we rebuild

our business, however we are making good progress reconnecting our

customers, with over 450,000 RGUs back online as of February 8,

2018.

Operating Income (Loss)

- Operating income (loss) was ($244

million) and $141 million in Q4 2017 and Q4 2016, respectively, and

($148 million) and $319 million for the year ended December 31,

2017 and 2016, respectively.

- The FY 2017 decrease was primarily

driven by increases in impairments and depreciation and

amortization, which were partially offset by higher OCF as further

described below. During 2017, we recorded $660 million of

impairments, primarily resulting from the hurricanes and our annual

goodwill testing at C&W. The increase in depreciation and

amortization was primarily driven by the acquisition of

C&W.

Operating Cash Flow Highlights

The following table presents (i) OCF of each of our reportable

segments for the comparative periods and (ii) the percentage change

from period to period on both a reported and rebased basis:

Three months ended

Increase/(decrease) Year ended

Increase/(decrease) December 31, December 31,

2017 2016 % Rebased %

2017 2016 % Rebased %

in millions, except % amounts C&W $ 215.2 $ 226.4

(4.9 ) (6.2 ) $ 876.3 $ 541.9 61.7 (3.8 ) Chile 101.4 94.3 7.5 2.4

383.3 339.3 13.0 8.3 Puerto Rico (12.1 ) 58.9

N.M.

N.M.

132.6 211.8 (37.4 ) (37.4 ) Corporate and other (9.7 ) (5.2 ) 86.5

N.M.

(25.1 ) (17.4 ) 44.3

N.M.

Total $ 294.8 $ 374.4 (21.3 ) (22.9 ) $ 1,367.1

$ 1,075.6 27.1 (6.3 ) OCF Margin 34.7 %

40.6 % 38.1 % 39.5 %

N.M. – Not Meaningful.

- Reported OCF for the three and twelve

months ended December 31, 2017 declined by 21% and grew by

27%, respectively.

- The three month movement was primarily

due to the impacts of Hurricanes Irma and Maria, while the twelve

month change was driven by the C&W acquisition.

- In September 2017, Hurricanes Irma and

Maria impacted a number of our markets in the Caribbean. During the

three months ended December 31, 2017, the effects of the hurricanes

negatively impacted Liberty Puerto Rico’s and C&W's OCF by an

estimated $65 million and $8 million, respectively. In FY 2017, the

effects of the hurricanes negatively impacted Liberty Puerto Rico’s

and C&W's OCF by an estimated $80 million and $17 million,

respectively.

- The Q4 and FY 2017 growth rates were

negatively impacted by an $8 million and $13 million reversal in Q4

and FY 2016, respectively, of a previously-recorded provision and

related indemnification asset in connection with a favorable ruling

on an outstanding legal case in Puerto Rico.

- From a rebased perspective, including

the aforementioned negative impacts from Hurricanes Irma and Maria,

OCF declined by 23% and 6% for the three and twelve months ended

December 31, 2017.

- As previously identified, the FY 2017

rebased growth rate was negatively impacted by the C&W OCF

result in Q1 2016, which was not comparable to preceding and

subsequent quarters.

Q4 2017 Rebased OCF Growth - Segment

Highlights

- C&W:

Rebased OCF decline of 6% was driven by (i) the aforementioned

revenue drivers, (ii) negative impacts of Hurricanes Irma and Maria

and (iii) negative impacts totaling $9 million for the reassessment

of certain operating accruals and a provision for a non-cancellable

lease. These factors were partially offset by (a) improved margin

mix primarily associated with reduced low margin project-related

B2B revenue, and (b) favorable impact of a reduction in our bonus

accrual.

- Chile:

Rebased OCF increase of 2% was driven by the aforementioned solid

revenue growth slightly offset by increases in network related

expenses, marketing costs and programming and copyright costs.

- Puerto

Rico: Rebased OCF decline was driven by the aforementioned

negative impacts of Hurricanes Irma and Maria, and the legal ruling

benefit in the prior-year period.

Effective January 1, 2018, we will adopt a new accounting

standard with respect to certain defined benefit pension plans.

Specifically, certain components of our net periodic pension

benefit will be reclassified to non-operating income and, as such,

will no longer be included in OCF. During the year ended December

31, 2017, $14.5 million of such credits were included in OCF that

will be reclassified to non-operating income (expense) upon the

adoption of this new accounting standard.

Net Loss Attributable to Shareholders

- Net losses attributable to shareholders

were $401 million and $107 million for the three months ended

December 31, 2017 and 2016, respectively, and $778 million and $432

million for the year ended December 31, 2017 and 2016,

respectively.

Leverage and Liquidity (at December 31, 2017)

- Total capital

leases and principal amount of debt: $6,398 million.

- Leverage

ratios: Consolidated gross and net leverage ratios of 5.5x

and 5.1x, respectively. These ratios were calculated on a latest

quarter annualized ("LQA") basis and therefore impacted by the $73

million negative impact from Hurricanes Irma and Maria in Q4. This

impact increased gross and net leverage by approximately 1.1x and

1.0x, respectively.

- Average debt

tenor6: 6.1 years, with approximately 88% not due until 2022

or beyond.

- Borrowing

costs: Blended, fully-swapped borrowing cost of our debt was

6.3%. In February 2018, we entered into a new $1,875 million term

loan at C&W, which was used to refinance the existing C&W

$1,825 million term loan. The refinancing reduced our margin by 25

basis points to LIBOR + 3.25% and extended the tenor by one year to

January 2026. The incremental loan proceeds were used to repay

drawings under the C&W revolving credit facility.

- Liquidity:

Approximately $1.5 billion, including $530 million of cash and $938

million of aggregate unused borrowing capacity7 under our credit

facilities.

Forward-Looking Statements and Disclaimer

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements with respect to our strategies, future

growth prospects and opportunities; our expectations with respect

to subscribers, revenue, ARPU per RGU, OCF and Adjusted FCF;

statements regarding the impact of Hurricanes Irma and Maria on our

operations in the Caribbean, our plans regarding the markets

impacted by the hurricanes, the time it will take to restore

services in the markets impacted by the hurricanes and the amount

and timing of insurance proceeds; statements regarding the

development, enhancement and expansion of, our superior networks

and innovative and advanced products and services; plans and

expectations relating to new build and network extension

opportunities; opportunities with respect to our mobile, B2B and

subsea cable businesses, our estimates of future P&E additions

as a percentage of revenue; the strength of our balance sheet and

tenor of our debt; the potential value added by our acquisition of

a Costa Rican cable operator; and other information and statements

that are not historical fact. These forward-looking statements

involve certain risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

these statements. These risks and uncertainties include events that

are outside of our control, such as hurricanes and other natural

disasters, the continued use by subscribers and potential

subscribers of our services and their willingness to upgrade to our

more advanced offerings; our ability to meet challenges from

competition, to manage rapid technological change or to maintain or

increase rates to our subscribers or to pass through increased

costs to our subscribers; the effects of changes in laws or

regulation; general economic factors; our ability to obtain

regulatory approval and satisfy regulatory conditions associated

with acquisitions and dispositions; our ability to successfully

acquire and integrate new businesses and realize anticipated

efficiencies from acquired businesses; the availability of

attractive programming for our video services and the costs

associated with such programming; our ability to achieve forecasted

financial and operating targets; the outcome of any pending or

threatened litigation; the ability of our operating companies to

access cash of their respective subsidiaries; the impact of our

operating companies' future financial performance, or market

conditions generally, on the availability, terms and deployment of

capital; fluctuations in currency exchange and interest rates; the

ability of suppliers and vendors (including our third-party

wireless network provider under our MVNO arrangement) to timely

deliver quality products, equipment, software, services and access;

our ability to adequately forecast and plan future network

requirements including the costs and benefits associated with

network expansions; and other factors detailed from time to time in

our filings with the Securities and Exchange Commission, including

our most recently filed Form 10-K. These forward-looking statements

speak only as of the date of this release. We expressly disclaim

any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statement contained herein to

reflect any change in our expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based.

About Liberty Latin America

Liberty Latin America is a leading telecommunications company

operating in over 20 countries across Latin America and the

Caribbean under the consumer brands VTR, Flow, Liberty, Más Móvil

and BTC. The communications and entertainment services that we

offer to our residential and business customers in the region

include combinations of services comprised of digital video,

broadband internet, telephony and mobile services. Our business

products and services include enterprise-grade connectivity, data

center, hosting and managed solutions, as well as information

technology solutions with customers ranging from small and medium

enterprises to international companies and governmental agencies.

In addition, Liberty Latin America operates a sub-sea and

terrestrial fiber optic cable network that connects over 40 markets

in the region.

Liberty Latin America has three separate classes of common

shares, which are traded on the NASDAQ Global Select Market under

the symbols "LILA" (Class A) and "LILAK" (Class C), and on the OTC

link under the symbol "LILAB" (Class B).

For more information, please visit www.lla.com.

Footnotes

1.

For the definition of Operating Cash Flow

("OCF") and required reconciliations, please see OCF Definition and

Reconciliation below.

2.

OCF guidance is based on FX rates as of

February 9, 2018.

3.

For the definition of Adjusted Free Cash

Flow (“Adjusted FCF”) and required reconciliations, please see

Adjusted Free Cash Flow Definition and Reconciliation below. For

more detailed information concerning our operating, investing and

financing cash flows, see the consolidated statements of cash flows

included in our Form 10-K.

4.

The indicated growth rates are rebased for

acquisitions and FX. Please see Revenue and Operating Cash Flow for

information on rebased growth.

5.

Please see Footnotes for Operating Data

and Subscriber Variance Tables for the definition of RGUs. Organic

figures exclude RGUs of acquired entities at the date of

acquisition and other nonorganic adjustments, but include the

impact of changes in RGUs from the date of acquisition. All

subscriber/RGU additions or losses refer to net organic changes,

unless otherwise noted.

6.

For purposes of calculating our average

tenor, total debt excludes vendor financing.

7.

Our aggregate unused borrowing capacity of

$938 million represents the maximum undrawn commitments under our

subsidiaries' applicable facilities without regard to covenant

compliance calculations or other conditions precedent to borrowing.

Upon completion of the relevant December 31, 2017 compliance

reporting requirements for our credit facilities, and assuming no

further changes from quarter-end borrowing levels, we anticipate

the full amount of unused borrowing capacity will continue to be

available to be borrowed under each of the respective subsidiary

facilities. For information regarding limitations on C&W's

ability to access this cash, see the discussion under "Liquidity

and Capital Resources" in our Form 10-K.

Balance Sheets, Statements of Operations and Statements of

Cash Flows

The consolidated balance sheets, statements of operations and

statements of cash flows of Liberty Latin America are included in

our Annual Report on Form 10-K.

Rebase Information

For purposes of calculating rebased growth rates on a comparable

basis for all businesses that we owned during 2017, we have

adjusted our historical revenue and OCF for the three and twelve

months ended December 31, 2016 to (i) include the pre-acquisition

revenue and OCF of certain entities acquired during 2016 and 2017

in our rebased amounts for the three and twelve months ended

December 31, 2016 to the same extent that the revenue and OCF of

such entities are included in our results for the three and twelve

months ended December 31, 2017 and (ii) reflect the translation of

our rebased amounts for the three and twelve months ended December

31, 2016 at the applicable average foreign currency exchange rates

that were used to translate our results for the three and twelve

months ended December 31, 2017. We have included the Carve-out

entities in the determination of our rebased revenue and OCF for

the three months ended December 31, 2016. We have included C&W

and the Carve-out entities in whole or in part in the determination

of our rebased revenue and OCF for the twelve months ended December

31, 2016. We have reflected the revenue and OCF of the acquired

entities in our 2016 rebased amounts based on what we believe to be

the most reliable information that is currently available to us

(generally pre-acquisition financial statements), as adjusted for

the estimated effects of (a) any significant differences between

U.S. GAAP and local generally accepted accounting principles, (b)

any significant effects of acquisition accounting adjustments, (c)

any significant differences between our accounting policies and

those of the acquired entities and (d) other items we deem

appropriate. We do not adjust pre-acquisition periods to eliminate

nonrecurring items or to give retroactive effect to any changes in

estimates that might be implemented during post-acquisition

periods. As we did not own or operate the acquired businesses

during the pre-acquisition periods, no assurance can be given that

we have identified all adjustments necessary to present the revenue

and OCF of these entities on a basis that is comparable to the

corresponding post-acquisition amounts that are included in our

historical results or that the pre-acquisition financial statements

we have relied upon do not contain undetected errors. The

adjustments reflected in our rebased amounts have not been prepared

with a view towards complying with Article 11 of Regulation S-X. In

addition, the rebased growth percentages are not necessarily

indicative of the revenue and OCF that would have occurred if these

transactions had occurred on the dates assumed for purposes of

calculating our rebased amounts or the revenue and OCF that will

occur in the future. The rebased growth percentages have been

presented as a basis for assessing growth rates on a comparable

basis, and are not presented as a measure of our pro forma

financial performance. The following table provides adjustments

made to the 2016 amounts to derive our rebased growth rates:

Revenue OCF

Three months endedDecember

31,

Year endedDecember 31,

Three months endedDecember

31,

Year endedDecember 31,

2016 2016 2016 2016 in millions

Acquisitions $ 8.7 $ 917.2 $ 3.1 $ 373.9 Foreign Currency

12.3 24.4 4.7 9.6 Total $ 21.0 $ 941.6

$ 7.8 $ 383.5

OCF Definition and Reconciliation

As used herein, OCF has the same meaning as the term "Adjusted

OIBDA" that is referenced in our Form 10-K. OCF is the primary

measure used by our chief operating decision maker to evaluate

segment operating performance. OCF is also a key factor that is

used by our internal decision makers to (i) determine how to

allocate resources to segments and (ii) evaluate the effectiveness

of our management for purposes of annual and other incentive

compensation plans. As we use the term, OCF is defined as operating

income before depreciation and amortization, share-based

compensation, provisions and provision releases related to

significant litigation and impairment, restructuring and other

operating items. Other operating items include (i) gains and

losses on the disposition of long-lived assets, (ii) third-party

costs directly associated with successful and unsuccessful

acquisitions and dispositions, including legal, advisory and due

diligence fees, as applicable, and (iii) other acquisition-related

items, such as gains and losses on the settlement of contingent

consideration. Our internal decision makers believe OCF is a

meaningful measure because it represents a transparent view of our

recurring operating performance that is unaffected by our capital

structure and allows management to (i) readily view operating

trends, (ii) perform analytical comparisons and benchmarking

between segments and (iii) identify strategies to improve operating

performance in the different countries in which we

operate. Effective December 31, 2017, we include certain

charges previously allocated to us by Liberty Global in the

calculation of OCF. These charges represent fees for certain

services provided to us and totaled $12.0 million and $8.5 million

for the years ended December 31, 2017 and 2016, respectively.

We believe changing the definition of OCF to include these charges

is meaningful given they represent operating costs we will continue

to incur subsequent to the split-off as a standalone public

company. This change has been given effect for all periods

presented. We believe our OCF measure is useful to investors

because it is one of the bases for comparing our performance with

the performance of other companies in the same or similar

industries, although our measure may not be directly comparable to

similar measures used by other public companies. OCF should be

viewed as a measure of operating performance that is a supplement

to, and not a substitute for, operating income, net earnings or

loss, cash flow from operating activities and other U.S. GAAP

measures of income or cash flows. A reconciliation of our

operating income (loss) to total segment OCF is presented in the

following table:

Three months ended Year ended

December 31, December 31, 2017

2016 2017 2016 in millions

Operating income (loss) $ (243.6 ) $ 141.2 $ (148.4 ) $

319.1 Share-based compensation expense 2.3 4.7 14.2 15.4

Depreciation and amortization 207.2 208.2 793.7 587.3 Impairment,

restructuring and other operating items, net 328.9 20.3

707.6 153.8 Total OCF $ 294.8 $ 374.4 $

1,367.1 $ 1,075.6

Summary of Debt, Capital Lease Obligations & Cash and

Cash Equivalents

The following table details the U.S. dollar equivalent balances

of the outstanding principal amount of our debt, capital lease

obligations and cash and cash equivalents at December 31,

2017:

Capital Debt &

Capital Cash Lease Lease and

Cash Debt Obligations Obligations

Equivalents in millions Liberty Latin America1

$ — $ — $ — $ 133.4 C&W 3,900.6 16.7 3,917.3 266.1 VTR 1,497.4

0.8 1,498.2 89.4 Liberty Puerto Rico 982.5 — 982.5

41.0 Total $ 6,380.5 $ 17.5 $ 6,398.0 $

529.9 1. Represents the amount held by Liberty Latin America

on a standalone basis plus the aggregate amount held by

subsidiaries of Liberty Latin America that are outside of our

borrowing groups. Subsidiaries of Liberty Latin America that are

outside our borrowing groups rely on funds provided by our

borrowing groups to satisfy their liquidity needs.

Property and Equipment Additions and Capital

Expenditures

The table below highlights the categories of the property and

equipment additions for the indicated periods and reconciles those

additions to the capital expenditures that are presented in the

consolidated statements of cash flows included in our Form

10-K.

Three months ended Year

ended December 31, December 31, 2017

2016 2017 2016 in millions,

except % amounts Customer premises equipment $ 29.3 $

27.6 $ 143.5 $ 137.7 New Build & Upgrade 57.5 9.2 96.9 44.0

Capacity 7.1 7.1 32.1 37.6 Baseline 14.8 13.7 41.1 44.5 Product

& Enablers 13.3 7.9 31.3 21.8 C&W P&E Additions 151.2

137.7 431.8 282.6 Property and

equipment additions 273.2 203.2 776.7 568.2 Assets acquired under

capital-related vendor financing arrangements (7.7 ) (11.8 ) (54.9

) (45.5 ) Assets acquired under capital leases (0.5 ) (2.4 ) (4.2 )

(7.4 ) Changes in current liabilities related to capital

expenditures (73.2 ) (41.1 ) (78.3 ) (24.9 ) Capital expenditures1

$ 191.8 $ 147.9 $ 639.3 $ 490.4

Property and equipment additions as % of revenue 32.1 % 22.0 % 21.6

% 20.9 % 1. The capital expenditures that we report in our

consolidated statements of cash flows do not include amounts that

are financed under capital-related vendor financing or capital

lease arrangements. Instead, these amounts are reflected as

non-cash additions to our property and equipment when the

underlying assets are delivered and as repayments of debt when the

related principal is repaid.

Adjusted Free Cash Flow Definition and Reconciliation

We define Adjusted FCF as net cash provided by our operating

activities, plus (i) cash payments for third-party costs directly

associated with successful and unsuccessful acquisitions and

dispositions and (ii) expenses financed by an intermediary, less

(a) capital expenditures, (b) distributions to noncontrolling

interest owners, (c) principal payments on amounts financed by

vendors and intermediaries and (d) principal payments on capital

leases. We changed the way we define Adjusted FCF effective

December 31, 2017 to deduct distributions to noncontrolling

interest owners. This change was given effect for all periods

presented. We believe that our presentation of Adjusted FCF

provides useful information to our investors because this measure

can be used to gauge our ability to service debt and fund new

investment opportunities. Adjusted FCF should not be understood to

represent our ability to fund discretionary amounts, as we have

various mandatory and contractual obligations, including debt

repayments, which are not deducted to arrive at this amount.

Investors should view adjusted free cash flow as a supplement to,

and not a substitute for, U.S. GAAP measures of liquidity included

in our consolidated statements of cash flows. The following table

provides the reconciliation of our net cash provided by operating

activities to Adjusted FCF for the indicated periods:

Three months ended Year ended

December 31, December 31, 2017

2016 2017 2016 in millions

Net cash provided by operating activities $ 180.8 $ 240.7 $

573.9 $ 468.2 Cash payments for direct acquisition and disposition

costs 1.4 23.3 4.2 86.0 Expenses financed by an intermediary1 25.8

1.9 82.7 3.0 Capital expenditures (191.8 ) (147.9 ) (639.3 ) (490.4

) Distributions to noncontrolling interest owners (12.6 ) (6.3 )

(45.9 ) (61.9 ) Principal payments on amounts financed by vendors

and intermediaries (7.3 ) — (59.4 ) — Principal payments on capital

leases (1.9 ) (1.7 ) (8.6 ) (5.2 ) Adjusted FCF $ (5.6 ) $ 110.0

$ (92.4 ) $ (0.3 ) 1. For purposes of our

consolidated statements of cash flows, expenses financed by an

intermediary are treated as hypothetical operating cash outflows

and hypothetical financing cash inflows when the expenses are

incurred. When we pay the financing intermediary, we record

financing cash outflows in our consolidated statements of cash

flows. For purposes of our Adjusted Free Cash Flow definition, we

add back the hypothetical operating cash outflow when these

financed expenses are incurred and deduct the financing cash

outflows when we pay the financing intermediary.

ARPU per Customer Relationship

The following table provides ARPU per customer relationship for

the indicated periods:

Three months ended December 31,

FX-Neutral1 2017

2016 % Change % Change Liberty Latin

America2,3 $ 49.87 $ 47.97 4.0 % 0.8 % C&W2 $ 44.80 $ 43.74 2.4

% 2.3 % Chile CLP 33,659 CLP 33,953 (0.9 %) (0.9 %) 1. The

FX-neutral change represents the percentage change on a

year-over-year basis adjusted for FX impacts and is calculated by

adjusting the prior-year figures to reflect translation at the

foreign currency rates used to translate the current year amounts.

2. As a part of our ongoing effort to conform C&W's subscriber

counting policies to our policies, we have reflected nonorganic

reductions totaling 223,000 to C&W's customer count during the

twelve months ended December 31, 2017. In order to provide a more

meaningful comparison of ARPU, we have reflected all of these

nonorganic reductions in the customer figures used to calculate

ARPU for the three months ended December 31, 2017 and 2016. 3. Due

to the uncertainties surrounding our Q4 2017 customer count in

Puerto Rico as a result of the hurricanes, we have omitted Puerto

Rico ARPU for the three months ended December 31, 2017 and December

31, 2016. For the three months ended December 31, 2016, Puerto Rico

ARPU was $78.36. In order to provide a more meaningful comparison,

Puerto Rico ARPU has been omitted from consolidated Liberty Latin

America ARPU for the three months ended December 31, 2017 and 2016.

Including Puerto Rico, Liberty Latin America ARPU was $52.51 for

the three months ended December 31, 2016.

Mobile ARPU

The following tables provide ARPU per mobile subscriber for the

indicated periods:

Three months endedDecember

31,

FX-Neutral 2017 2016 %

Change % Change Including interconnect revenue $

17.45 $ 17.01 2.6 % 2.2 % Excluding interconnect revenue $ 16.21 $

15.80 2.6 % 2.2 %

Subscriber Tables

Consolidated Operating Data — December 31, 2017

Video

HomesPassed

Two-wayHomesPassed

Fixed-lineCustomerRelationships

Basic VideoSubscribers

EnhancedVideoSubscribers

DTHSubscribers

TotalVideo

InternetSubscribers

TelephonySubscribers

TotalRGUs

Total Mobile

Subscribers1

C&W: Panama 541,500 541,500 179,200 — 47,900 29,700 77,600

104,500 125,200 307,300 1,682,300 Jamaica2 458,300 448,300 233,300

— 102,500 — 102,500 168,500 176,900 447,900 953,700 The Bahamas

128,900 128,900 47,400 — 6,200 — 6,200 26,600 47,400 80,200 254,900

Barbados 124,500 124,500 85,500 — 17,700 — 17,700 62,000 75,100

154,800 124,300 Trinidad and Tobago 316,000 316,000 156,300 —

107,400 — 107,400 124,300 49,500 281,200 — Other3 362,400

342,600 207,900 11,700 66,700 —

78,400 129,200 102,800 310,400 401,300

C&W total 1,931,600 1,901,800 909,600 11,700 348,400 29,700

389,800 615,100 576,900 1,581,800 3,416,500 Chile 3,394,700

2,912,800 1,406,900 67,500 999,900 — 1,067,400 1,181,600 628,400

2,877,400 214,900 Puerto Rico3 1,076,900 1,076,900

377,700 — 232,100 — 232,100

313,100 193,300 738,500 — Total 6,403,200

5,891,500 2,694,200 79,200 1,580,400

29,700 1,689,300 2,109,800 1,398,600

5,197,700 3,631,400

Organic

Subscriber Variance Table - December 31, 2017 vs September 30,

2017 Video

HomesPassed Two-wayHomes

Passed

Fixed-lineCustomerRelationships

Basic VideoSubscribers

EnhancedVideoSubscribers

DTHSubscribers

TotalVideo

InternetSubscribers

TelephonySubscribers TotalRGUs Total

Mobile Subscribers1 C&W: Panama 6,400 31,300

(7,400 ) — 2,300 (4,300 ) (2,000 ) (600 ) (1,900 ) (4,500 ) (60,900

) Jamaica 24,800 24,800 9,900 — 5,300 — 5,300 14,800 9,400 29,500

23,200 The Bahamas — — (2,100 ) — 300 — 300 400 (2,100 ) (1,400 )

(11,200 ) Barbados 800 800 500 — 900 — 900 1,200 600 2,700 —

Trinidad and Tobago 900 900 (900 ) — (900 ) — (900 ) 900 3,100

3,100 — Other3 3,400 3,400 1,000 400

(800 ) — (400 ) 4,400 (3,300 ) 700 7,000

C&W total 36,300 61,200 1,000 400 7,100 (4,300 ) 3,200

21,100 5,800 30,100 (41,900 ) VTR 34,000 44,700 11,600 (2,400 )

1,100 — (1,300 ) 17,100 (12,100 ) 3,700 8,700 Liberty Puerto Rico3

(30,000 ) (30,000 ) (30,500 ) — (22,900 ) — (22,900 )

(24,700 ) (17,400 ) (65,000 ) — Total change 40,300

75,900 (17,900 ) (2,000 ) (14,700 ) (4,300 ) (21,000 )

13,500 (23,700 ) (31,200 ) (33,200 )

1. Mobile subscribers are comprised of the

following:

Mobile Subscribers Consolidated

Operating Data Q4 Organic Subscriber Variance

Prepaid Postpaid Total

Prepaid Postpaid Total C&W:

Panama 1,523,600 158,700 1,682,300 (57,800 ) (3,100 ) (60,900 )

Jamaica 934,900 18,800 953,700 23,700 (500 ) 23,200 The Bahamas

228,100 26,800 254,900 (10,100 ) (1,100 ) (11,200 ) Barbados 97,300

27,000 124,300 400 (400 ) — Other 346,300 55,000

401,300 10,200 (3,200 ) 7,000 C&W total

3,130,200 286,300 3,416,500 (33,600 ) (8,300 ) (41,900 ) VTR 6,900

208,000 214,900 — 8,700 8,700

Total 3,137,100 494,300 3,631,400

(33,600 ) 400 (33,200 ) 2. In Q4 2017, we made a

39,100 adjustment to lower Jamaica's fixed-line telephony

subscribers to align with Liberty Latin America's policies. This

also reduced Jamaica's customer relationships by 39,100. 3. During

September 2017, Hurricanes Irma and Maria caused significant damage

to our operations in Puerto Rico, as well as certain geographies

within C&W, including the British Virgin Islands, Dominica and

Anguilla, and to a lesser extent, Turks & Caicos, the Bahamas,

Antigua and other smaller markets, resulting in disruptions to our

telecommunications services within these islands. With the

exception of the Bahamas, all of these C&W markets are included

in the “Other” category in the accompanying table. For Puerto Rico,

British Virgin Islands, Dominica and Anguilla, where we are still

in the process of assessing the impacts of the hurricanes on our

networks and subscriber counts, (i) the subscriber levels reflect

the pre-hurricane RGU (as defined below) counts as of August 31,

2017, adjusted for net known disconnects through December 31, 2017

and (ii) the homes passed levels reflect the pre-hurricane homes

passed counts as of August 31, 2017, adjusted for an estimated

30,000 homes in Puerto Rico that were destroyed in geographic areas

we currently do not anticipate rebuilding our network. As of

December 31, 2017, we have been able to restore service to

approximately 340,000 RGUs of our total 738,500 RGUs at Liberty

Puerto Rico. Additionally, services to most of our fixed-line

customers have not yet been restored in the British Virgin Islands,

Dominica and Anguilla. While mobile services have been largely

restored in these markets, we are still in the process of

completing the restoration of our mobile network infrastructure.

Glossary

ARPU – Average revenue per unit refers to the average

monthly subscription revenue (subscription revenue excludes

interconnect, mobile handset sales, late fees and installation

fees) per average customer relationship or mobile subscriber, as

applicable. ARPU per average customer relationship is calculated by

dividing the average monthly subscription revenue from residential

cable and SOHO services by the average of the opening and closing

balances for customer relationships for the period. ARPU per

average mobile subscriber is calculated by dividing residential

mobile and SOHO revenue for the indicated period by the average of

the opening and closing balances for mobile subscribers for the

period. Unless otherwise indicated, ARPU per customer relationship

or mobile subscriber is not adjusted for currency impacts. ARPU per

RGU refers to average monthly revenue per average RGU, which is

calculated by dividing the average monthly subscription revenue

from residential and SOHO services for the indicated period, by the

average of the opening and closing balances of the applicable RGUs

for the period. Unless otherwise noted, ARPU in this release is

considered to be ARPU per average customer relationship or mobile

subscriber, as applicable. Customer relationships, mobile

subscribers and RGUs of entities acquired during the period are

normalized.

B2B – Business-to-business subscription revenue

represents revenue from services to certain SOHO subscribers (fixed

and mobile). B2B non-subscription revenue includes business

broadband internet, video, telephony, mobile and data services

offered to medium to large enterprises and, on a wholesale basis,

to other operators.

Basic Video Subscriber – A home, residential multiple

dwelling unit or commercial unit that receives our video service

over our broadband network either via an analog video signal or via

a digital video signal without subscribing to any recurring monthly

service that requires the use of encryption-enabling technology.

Encryption-enabling technology includes smart cards, or other

integrated or virtual technologies that we use to provide our

enhanced service offerings. With the exception of RGUs that we

count on an equivalent billing unit ("EBU') basis, we count RGUs on

a unique premises basis. In other words, a subscriber with

multiple outlets in one premises is counted as one RGU and a

subscriber with two homes and a subscription to our video service

at each home is counted as two RGUs. We exclude DTH subscribers (as

defined below) from basic video subscribers.

Direct-to-Home ("DTH") Subscriber – A home, residential

multiple dwelling unit or commercial unit that receives our video

programming broadcast directly via satellite.

Enhanced Video Subscriber – A home, residential multiple

dwelling unit or commercial unit that receives our video service

over our broadband network or through a partner network via a

digital video signal while subscribing to any recurring monthly

service that requires the use of encryption-enabling technology.

Enhanced video subscribers that are not counted on an EBU basis are

counted on a unique premises basis. For example, a subscriber

with one or more set-top boxes that receives our video service in

one premises is generally counted as just one subscriber. An

enhanced video subscriber is not counted as a basic video

subscriber. As we migrate customers from basic to enhanced

video services, we report a decrease in our basic video subscribers

equal to the increase in our enhanced video subscribers.

Fixed-line Customer Relationships – The number of

customers who receive at least one of our video, internet or

telephony services that we count as RGUs, without regard to which

or to how many services they subscribe. To the extent that RGU

counts include EBU adjustments, we reflect corresponding

adjustments to our customer relationship counts. For further

information regarding our EBU calculation, see Additional General

Notes below. Fixed-line customer relationships generally are

counted on a unique premises basis. Accordingly, if an individual

receives our services in two premises (e.g., a primary home and a

vacation home), that individual generally will count as two

customer relationships. We exclude mobile-only customers from

customer relationships.

Fully-swapped Borrowing Cost – Represents the weighted

average interest rate on our aggregate variable- and fixed-rate

indebtedness (excluding capital leases and including vendor

financing obligations), including the effects of derivative

instruments, original issue premiums or discounts and commitment

fees, but excluding the impact of financing costs.

Homes Passed – Homes, residential multiple dwelling units

or commercial units that can be connected to our networks without

materially extending the distribution plant, except for DTH homes.

Certain of our homes passed counts are based on census data that

can change based on either revisions to the data or from new census

results. We do not count homes passed for DTH.

Internet (Broadband) Subscriber – A home, residential

multiple dwelling unit or commercial unit that receives internet

services over our networks, or that we service through a partner

network. Our internet subscribers do not include customers that

receive services from dial-up connections.

Liquidity – Refers to cash and cash equivalents plus the

maximum undrawn commitments under subsidiary borrowing facilities,

without regard to covenant compliance calculations.

Mobile Subscribers – Our mobile subscriber count

represents the number of active subscriber identification module

(“SIM”) cards in service rather than services provided. For

example, if a mobile subscriber has both a data and voice plan on a

smartphone this would equate to one mobile subscriber.

Alternatively, a subscriber who has a voice and data plan for a

mobile handset and a data plan for a laptop (via a dongle) would be

counted as two mobile subscribers. Customers who do not pay a

recurring monthly fee are excluded from our mobile telephony

subscriber counts after periods of inactivity ranging from 30 to 60

days, based on industry standards within the respective country. In

a number of countries, our mobile subscribers receive mobile

services pursuant to prepaid contracts.

Net Leverage – Our gross and net debt ratios are defined

as total debt and net debt to annualized OCF of the latest quarter.

Net debt is defined as total debt less cash and cash equivalents.

For purposes of these calculations, debt is measured using swapped

foreign currency rates, consistent with the covenant calculation

requirements of our subsidiary debt agreements.

NPS – Net promoter score.

OCF Margin – Calculated by dividing OCF by total revenue

for the applicable period.

Revenue Generating Unit ("RGU") – RGU is separately a

basic video subscriber, enhanced video subscriber, DTH subscriber,

internet subscriber or telephony subscriber. A home, residential

multiple dwelling unit, or commercial unit may contain one or more

RGUs. For example, if a residential customer in Chile subscribed to

our enhanced video service, fixed-line telephony service and

broadband internet service, the customer would constitute three

RGUs. Total RGUs is the sum of basic video, enhanced video, DTH,

internet and telephony subscribers. RGUs generally are counted on a

unique premises basis such that a given premises does not count as

more than one RGU for any given service. On the other hand, if an

individual receives one of our services in two premises (e.g., a

primary home and a vacation home), that individual will count as

two RGUs for that service. Each bundled cable, internet or

telephony service is counted as a separate RGU regardless of the

nature of any bundling discount or promotion. Non-paying

subscribers are counted as subscribers during their free

promotional service period. Some of these subscribers may choose to

disconnect after their free service period. Services offered

without charge on a long-term basis (e.g., VIP subscribers or free

service to employees) generally are not counted as RGUs. We do not

include subscriptions to mobile services in our externally reported

RGU counts. In this regard, our RGU counts exclude our separately

reported postpaid and prepaid mobile subscribers.

SOHO – Small office/home office subscribers.

Telephony Subscriber – A home, residential multiple

dwelling unit or commercial unit that receives voice services over

our networks, or that we service through a partner network.

Telephony subscribers exclude mobile telephony subscribers.

Two-way Homes Passed – Homes passed by those sections of

our networks that are technologically capable of providing two-way

services, including video, internet and telephony services.

Additional General Notes

Most of our broadband communications subsidiaries provide

telephony, broadband internet, data, video or other B2B services.

Certain of our B2B service revenue is derived from SOHO subscribers

that pay a premium price to receive enhanced service levels along

with video, internet or telephony services that are the same or

similar to the mass marketed products offered to our residential

subscribers. All mass marketed products provided to SOHOs, whether

or not accompanied by enhanced service levels and/or premium

prices, are included in the respective RGU and customer counts of

our broadband communications operations, with only those services

provided at premium prices considered to be “SOHO RGUs” or “SOHO

customers.” To the extent our existing customers upgrade from a

residential product offering to a SOHO product offering, the number

of SOHO RGUs or SOHO customers will increase, but there is no

impact to our total RGU or customer counts. Due to system

limitations, SOHO customers of C&W are not included in our

respective RGU and customer counts as of December 31, 2017.

With the exception of our B2B SOHO subscribers, we generally do not

count customers of B2B services as customers or RGUs for external

reporting purposes.

Certain of our residential and commercial RGUs are counted on an

EBU basis, including residential multiple dwelling units and

commercial establishments, such as bars, hotels, and hospitals, in

Chile and Puerto Rico. Our EBUs are generally calculated by

dividing the bulk price charged to accounts in an area by the most

prevalent price charged to non-bulk residential customers in that

market for the comparable tier of service. As such, we may

experience variances in our EBU counts solely as a result of

changes in rates.

While we take appropriate steps to ensure that subscriber

statistics are presented on a consistent and accurate basis at any

given balance sheet date, the variability from country to country

in (i) the nature and pricing of products and services, (ii) the

distribution platform, (iii) billing systems, (iv) bad debt

collection experience and (v) other factors add complexity to the

subscriber counting process. We periodically review our subscriber

counting policies and underlying systems to improve the accuracy

and consistency of the data reported on a prospective basis.

Accordingly, we may from time to time make appropriate adjustments

to our subscriber statistics based on those reviews.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180214006446/en/

Liberty Latin AmericaInvestor RelationsKunal Patel, +1

786 376 9294

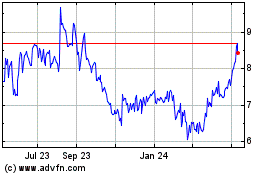

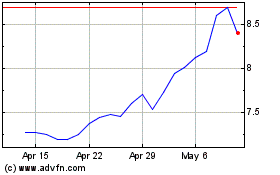

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Apr 2023 to Apr 2024