Insight Enterprises, Inc.

(Nasdaq:NSIT) (the

“Company”) today reported results of operations for the quarter and

full year ended December 31, 2017.

- Net sales up 22% year over year to $1.8 billion for the fourth

quarter and also up 22% for the full year

- Net sales up 30% year over year in North America for the fourth

quarter and full year

- Gross profit up 22% year over year to $232.9 million for the

fourth quarter and up 24% for the full year

- Earnings from operations up 12% year over year to $45.5 million

for the fourth quarter and up 20% for the full year

- Adjusted earnings from operations up 5% year over year for the

fourth quarter and up 24% for the full year

In the fourth quarter of 2017, consolidated net sales increased

22% year over year, reflecting growth in the Company’s core

business of 12% and the addition of Datalink, which the Company

acquired in January 2017. Gross profit also grew 22% year

over year, with gross margins increasing 10 basis points in the

quarter. Selling and administrative expenses increased 27%

year over year, primarily related to the addition of

Datalink. Overall, earnings from operations increased 12%

year over year and Adjusted earnings from operations increased 5%

year over year.

The Company’s fourth quarter results reflect additional income

tax expense of $13.4 million recognized as a result of the U.S. Tax

Cuts and Jobs Act that was enacted in December 2017. The

incremental income tax expense primarily relates to the

remeasurement of the Company’s deferred tax asset balances and

withholding taxes. The Company expects its effective tax rate

will be between 27% and 28% for the full year 2018, primarily

related to a 14% decrease in the U.S. federal income tax rate as a

result of the U.S. Tax Cuts and Jobs Act.

“Our fourth quarter results reflect a strong close to a very

good year,” stated Ken Lamneck, President and Chief Executive

Officer. “We reported strong organic growth in our core

business in 2017 and gained market share from competitors in North

America, according to third party data, reflecting growth in data

center solutions as well as devices. Our acquisition of

Datalink in January 2017 complemented the growth in our core

business. We realized expense synergies ahead of our

expectations and are pleased with the overall financial results of

the Datalink business in its first year as part of Insight. I

am pleased to report that gross profit growing faster than sales

and tight cost management across the business in 2017 produced an

impressive increase in earnings from operations year over year,”

stated Lamneck.

For the full year 2017, consolidated net sales were $6.7

billion, up 22% year over year, reflecting strong growth in the

Company’s core business and the addition of Datalink. Gross

profit was $918.6 million in 2017, and grew faster than net sales

at 24% year over year. That increase drove margins up 20

basis points to 13.7% for the full year 2017. Selling and

administrative expenses increased 24% year over year, primarily

related to the addition of Datalink. Selling and

administrative expenses in the Company’s core business increased 5%

year over year. Overall, earnings from operations increased

20% year over year and Adjusted earnings from operations increased

24% year over year.

“Our plans for 2018 are focused on driving growth in excess of

the market across our operating segments,” stated Lamneck.

“The IT industry is healthy and growing. More than ever,

clients are challenged to efficiently manage their day-to-day IT

operations while they leverage technology to transform their

business to bring value to their own customers. We have a

full suite of solutions that we developed over time and have

acquired through recent acquisitions, which position us to provide

value to our clients throughout their technology journey and

provide a strong foundation for us to compete in the marketplace in

2018,” stated Lamneck.

KEY HIGHLIGHTS

Results for the Quarter:

- Consolidated net sales of $1.8 billion for the fourth quarter

of 2017 increased 22% compared to the fourth quarter of 2016.

- Net sales in North America of $1.4 billion were up 30% year

over year;

- Net sales in EMEA of $366.8 million increased 1% year over

year; and

- Net sales in APAC of $38.9 million were down 20% year to

year.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated net sales increased 19% year over year, with

net sales growth in North America of 30% year over year and a

decline in net sales in EMEA and APAC of 6% and 22%, respectively,

year to year.

- Consolidated gross profit of $232.9 million increased 22%

compared to the fourth quarter of 2016, with consolidated gross

margin increasing 10 basis points to 13.1% of net sales.

- Gross profit in North America of $174.6 million (12.7% gross

margin) increased 31% year over year;

- Gross profit in EMEA of $50.4 million (13.7% gross margin)

increased 3% year over year; and

- Gross profit in APAC of $7.9 million (20.3% gross margin)

decreased 7% year to year, with margin expansion of 270 basis

points.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated gross profit increased 19% year over year, and

gross profit in North America increased 30% year over year, while

gross profit in EMEA and APAC decreased 5% and 10%, respectively,

year to year.

- Consolidated earnings from operations increased 12% compared to

the fourth quarter of 2016 to $45.5 million, or 2.6% of net

sales.

- Earnings from operations in North America increased 28% year

over year to $37.2 million, or 2.7% of net sales;

- Earnings from operations in EMEA decreased 23% year to year to

$7.1 million, or 1.9% of net sales; and

- Earnings from operations in APAC decreased 48% year to year to

$1.2 million, or 3.0% of net sales.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated earnings from operations increased 9% year over

year, and earnings from operations in North America increased 27%

year over year while earnings from operations decreased in EMEA and

APAC by 30% and 50%, respectively, year to year.

- Adjusted consolidated earnings from operations increased 5%

year over year to $48.3 million, or 2.7% of net sales for the

fourth quarter of 2017.

- Consolidated net earnings and diluted earnings per share for

the fourth quarter of 2017 were $14.2 million and $0.39,

respectively, at an effective tax rate of 64.8%, which includes

income tax expense of $13.4 million recognized during the quarter

as a result of U.S. federal tax reform enacted in December

2017.

- Adjusted consolidated net earnings and Adjusted diluted

earnings per share for the fourth quarter of 2017 were $29.5

million and $0.81, respectively.

Results for the Year:

- Consolidated net sales of $6.7 billion for 2017 increased 22%

compared to 2016.

- Net sales in North America of $5.2 billion were up 30% year

over year;

- Net sales in EMEA of $1.4 billion increased 1% year over year;

and

- Net sales in APAC of $166.5 million decreased 5% year to

year.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated net sales increased 22% year over year, with

net sales growth in North America and EMEA of 30% and 2%,

respectively, year over year, while net sales in APAC decreased 7%

year to year.

- Consolidated gross profit of $918.6 million increased 24%

compared to 2016, with consolidated gross margin increasing

approximately 20 basis points to 13.7% of net sales.

- Gross profit in North America of $691.7 million (13.3% gross

margin) increased 32% year over year;

- Gross profit in EMEA of $190.3 million (14.0% gross margin)

increased 2% year over year; and

- Gross profit in APAC of $36.6 million (22.0% gross margin)

increased 15% year over year.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated gross profit increased 24% year over year, and

gross profit in North America, EMEA and APAC increased 31%, 4% and

13%, respectively, year over year.

- Consolidated earnings from operations increased 20% compared to

2016 to $179.3 million, or 2.7% of net sales.

- Earnings from operations in North America increased 31% year

over year to $153.7 million, or 3.0% of net sales;

- Earnings from operations in EMEA decreased 27% year to year to

$17.4 million, or 1.3% of net sales; and

- Earnings from operations in APAC increased 3% year over year to

$8.2 million, or 5.0% of net sales.

- Excluding the effects of fluctuating foreign currency exchange

rates, consolidated earnings from operations increased 20% year

over year, and earnings from operations in North America and APAC

increased 31% and 2%, respectively, year over year, while earnings

from operations in EMEA declined 27% year to year.

- Adjusted consolidated earnings from operations increased 24%

year over year to $195.2 million, or 2.9% of net sales, for

2017.

- Consolidated net earnings and diluted earnings per share for

2017 were $90.7 million and $2.50, respectively, at an effective

tax rate of 43.0%, which reflects the income tax expense recorded

in the fourth quarter of 2017 as a result of U.S. federal tax

reform, noted previously, and non-deductible acquisition-related

expenses incurred during the year.

- Adjusted consolidated net earnings and Adjusted diluted

earnings per share for 2017 were $117.5 million and $3.24,

respectively.

As services have become a larger portion of the Company’s

consolidated net sales, for the year ended December 31, 2017, the

Company began reporting net sales from the provision of services

and the related costs of goods sold separately from net sales of

products and the related costs of goods. For comparability

purposes, net sales and costs of goods sold for the 2016 periods

have been expanded to conform to the current year

presentation. These changes in presentation had no effect on

previously reported total net sales, total costs of goods sold or

gross profit amounts.

In conjunction with these changes in presentation, because fees

earned from activities reported net are considered services

revenues, the Company reclassified certain revenue streams for

which the Company acts as the agent in the transaction to net sales

from services. Previously, the Company included these net

revenue streams within its software and, to a lesser extent,

hardware sales mix categories based on the type of product being

sold (e.g., fees earned for the sale of software maintenance and

certain software licenses were included in software sales and fees

earned for the sale of certain third-party provided training and

warranty services were included in hardware sales when the Company

historically disclosed and analyzed its sales mix). For

comparability purposes, the Company’s sales mix among its hardware,

software and services categories for the three months and year

ended December 31, 2016, as presented in the Financial Summary

Table in this press release, has been reclassified to conform to

the current year presentation. These reclassifications had no

effect on previously reported total net sales amounts.

In discussing financial results for the three months and years

ended December 31, 2017 and 2016 in this press release, the Company

refers to certain financial measures that are not prepared in

accordance with United States generally accepted accounting

principles (“GAAP”). When referring to non-GAAP measures, the

Company refers to such measures as “Adjusted.” See “Use of

Non-GAAP Financial Measures” for additional information. A

tabular reconciliation of financial measures prepared in accordance

with GAAP to the non-GAAP financial measures is included at the end

of this press release.

The Company refers to changes in net sales, gross profit and

earnings from operations on a consolidated basis and in North

America, EMEA and APAC excluding the effects of fluctuating foreign

currency exchange rates. In computing these changes and

percentages, the Company compares the current year amount as

translated into U.S. dollars under the applicable accounting

standards to the prior year amount in local currency translated

into U.S. dollars utilizing the weighted average translation rate

for the current period.

The tax effect of Adjusted amounts referenced herein were

computed using the statutory tax rate for the taxing jurisdictions

in the operating segment in which the related expenses were

recorded, adjusted for the effects of valuation allowances on net

operating losses in certain jurisdictions.

STOCK REPURCHASE PROGRAM

On February 13, 2018, the Company’s Board of Directors

authorized the repurchase of up to $50 million of the

Company’s common stock. The Company’s share repurchases will

be made on the open market, subject to Rule 10b-18 or in privately

negotiated transactions, through block trades, through 10b5-1 plans

or otherwise, at management’s discretion. The amount of

shares purchased and the timing of the purchases will be based on

market conditions, working capital requirements, general business

conditions and other factors. The Company intends to retire

the repurchased shares.

GUIDANCE

For the full year 2018, the Company expects to deliver net sales

growth in the low single digit range compared to 2017. The

Company also expects Adjusted diluted earnings per share for the

full year 2018 to be between $3.90 and $4.00.

This outlook assumes:

- the effects of the Company’s adoption of the new revenue

recognition standard effective January 1, 2018;

- an effective tax rate between 27% and 28%; and

- capital expenditures of $15 to $20 million.

This outlook does not include the completion of the Company’s

recently authorized share repurchase program and assumes no

severance and restructuring or acquisition-related expenses.

Due to the inherent difficulty of forecasting these types of

expenses, which impact net earnings and diluted earnings per share,

the Company is unable to reasonably estimate the related impact of

such expenses, if any, to net earnings and diluted earnings per

share. Accordingly, the Company is unable to provide a

reconciliation of GAAP to non-GAAP diluted earnings per share for

the full year 2018 forecast.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live web cast today

at 5:00 p.m. ET to discuss fourth quarter and full year 2017

results of operations. A live web cast of the conference call

(in listen-only mode) will be available on the Company’s web site

at http://nsit.client.shareholder.com/events.cfm, and a replay of

the web cast will be available on the Company’s web site for a

limited time following the call. To listen to the live web

cast by telephone, call 1-877-402-8904 if located in the U.S.,

678-809-1029 for international callers, and enter the access code

2789109. NSIT-F

USE OF NON-GAAP FINANCIAL

MEASURES

The non-GAAP financial measures (referred to as Adjusted

consolidated earnings from operations, Adjusted consolidated net

earnings and Adjusted diluted earnings per share) exclude (i)

severance and restructuring expenses, (ii) certain

acquisition-related expenses, (iii) a loss on the sale of the

Company’s Russia business in the year ended December 31, 2017, (iv)

a gain on the sale of real estate in the year ended December 31,

2016 and (v) the tax effects of each of these items as well as

income tax expense recognized as a result of U.S. federal tax

reform laws enacted in December 2017. The Company excludes

these items when internally evaluating earnings from operations,

tax expense, net earnings and diluted earnings per share for the

Company and earnings from operations for each of the Company’s

operating segments. These non-GAAP measures are used to

evaluate financial performance against budgeted amounts, to

calculate incentive compensation, to assist in forecasting future

performance and to compare the Company’s results to those of the

Company’s competitors. The Company believes that these

non-GAAP financial measures are useful to investors because they

allow for greater transparency, facilitate comparisons to prior

periods and the Company’s competitors’ results and assist in

forecasting performance for future periods. These non-GAAP

financial measures are not prepared in accordance with GAAP and may

be different from non-GAAP financial measures presented by other

companies. Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP.

Financial Summary

Table(dollars in thousands, except per share

data)(Unaudited)

| |

Three Months Ended December

31, |

Years Ended December 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

change |

|

|

2017 |

|

|

|

2016 |

|

|

change |

| Insight Enterprises, Inc. |

| Net sales: |

|

|

|

|

|

|

|

Products |

$ |

1,612,338 |

|

|

$ |

1,344,024 |

|

|

20 |

% |

|

|

$ |

6,038,744 |

|

|

$ |

4,997,263 |

|

|

21 |

% |

|

Services |

$ |

171,737 |

|

|

$ |

123,559 |

|

|

39 |

% |

|

|

$ |

664,879 |

|

|

$ |

488,252 |

|

|

36 |

% |

|

Total net sales |

$ |

1,784,075 |

|

|

$ |

1,467,583 |

|

|

22 |

% |

|

|

$ |

6,703,623 |

|

|

$ |

5,485,515 |

|

|

22 |

% |

|

Gross profit |

$ |

232,883 |

|

|

$ |

190,969 |

|

|

22 |

% |

|

|

$ |

918,570 |

|

|

$ |

743,102 |

|

|

24 |

% |

|

Gross margin |

|

13.1 |

% |

|

|

13.0 |

% |

|

10 bps |

|

|

|

|

13.7 |

% |

|

|

13.5 |

% |

|

20 bps |

|

|

Selling and administrative expenses |

$ |

184,554 |

|

|

$ |

145,066 |

|

|

27 |

% |

|

|

$ |

723,328 |

|

|

$ |

585,243 |

|

|

24 |

% |

|

Severance and restructuring expenses |

$ |

2,791 |

|

|

$ |

1,527 |

|

|

83 |

% |

|

|

$ |

9,002 |

|

|

$ |

4,580 |

|

|

97 |

% |

|

Loss on sale of foreign entity |

$ |

- |

|

|

$ |

- |

|

|

- |

|

|

|

$ |

3,646 |

|

|

$ |

- |

|

|

* |

|

|

Acquisition-related expenses |

$ |

- |

|

|

$ |

3,706 |

|

|

* |

|

|

|

$ |

3,329 |

|

|

$ |

4,447 |

|

|

(25 |

%) |

|

Earnings from operations |

$ |

45,538 |

|

|

$ |

40,670 |

|

|

12 |

% |

|

|

$ |

179,265 |

|

|

$ |

148,832 |

|

|

20 |

% |

|

Net earnings |

$ |

14,168 |

|

|

$ |

21,100 |

|

|

(33 |

%) |

|

|

$ |

90,683 |

|

|

$ |

84,690 |

|

|

7 |

% |

|

Diluted earnings per share |

$ |

0.39 |

|

|

$ |

0.59 |

|

|

(34 |

%) |

|

|

$ |

2.50 |

|

|

$ |

2.32 |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America |

|

Net sales: |

|

|

|

|

|

|

|

Products |

$ |

1,249,420 |

|

|

$ |

969,487 |

|

|

29 |

% |

|

|

$ |

4,662,473 |

|

|

$ |

3,601,697 |

|

|

29 |

% |

|

Services |

$ |

128,971 |

|

|

$ |

87,866 |

|

|

47 |

% |

|

|

$ |

519,261 |

|

|

$ |

370,131 |

|

|

40 |

% |

|

Total net sales |

$ |

1,378,391 |

|

|

$ |

1,057,353 |

|

|

30 |

% |

|

|

$ |

5,181,734 |

|

|

$ |

3,971,828 |

|

|

30 |

% |

|

Gross profit |

$ |

174,569 |

|

|

$ |

133,552 |

|

|

31 |

% |

|

|

$ |

691,677 |

|

|

$ |

525,481 |

|

|

32 |

% |

|

Gross margin |

|

12.7 |

% |

|

|

12.6 |

% |

|

10 bps |

|

|

|

|

13.3 |

% |

|

|

13.2 |

% |

|

10 bps |

|

|

Selling and administrative expenses |

$ |

135,369 |

|

|

$ |

100,169 |

|

|

35 |

% |

|

|

$ |

530,792 |

|

|

$ |

401,316 |

|

|

32 |

% |

|

Severance and restructuring expenses |

$ |

1,965 |

|

|

$ |

515 |

|

|

282 |

% |

|

|

$ |

4,010 |

|

|

$ |

2,966 |

|

|

35 |

% |

|

Acquisition-related expenses |

$ |

- |

|

|

$ |

3,703 |

|

|

* |

|

|

|

$ |

3,223 |

|

|

$ |

4,278 |

|

|

(25 |

%) |

|

Earnings from operations |

$ |

37,235 |

|

|

$ |

29,165 |

|

|

28 |

% |

|

|

$ |

153,652 |

|

|

$ |

116,921 |

|

|

31 |

% |

|

|

|

|

|

|

|

|

|

Sales Mix |

|

|

** |

|

|

|

|

** |

|

|

Hardware |

|

64 |

% |

|

|

62 |

% |

|

34 |

% |

|

|

|

65 |

% |

|

|

62 |

% |

|

37 |

% |

|

Software |

|

27 |

% |

|

|

30 |

% |

|

18 |

% |

|

|

|

25 |

% |

|

|

29 |

% |

|

14 |

% |

|

Services |

|

9 |

% |

|

|

8 |

% |

|

47 |

% |

|

|

|

10 |

% |

|

|

9 |

% |

|

40 |

% |

|

|

|

100 |

% |

|

|

100 |

% |

|

30 |

% |

|

|

|

100 |

% |

|

|

100 |

% |

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA |

|

Net sales: |

|

|

|

|

|

|

|

Products |

$ |

333,540 |

|

|

$ |

335,149 |

|

|

(1 |

%) |

|

|

$ |

1,246,952 |

|

|

$ |

1,243,932 |

|

|

- |

|

|

Services |

$ |

33,267 |

|

|

$ |

26,611 |

|

|

25 |

% |

|

|

$ |

108,464 |

|

|

$ |

94,628 |

|

|

15 |

% |

|

Total net sales |

$ |

366,807 |

|

|

$ |

361,760 |

|

|

1 |

% |

|

|

$ |

1,355,416 |

|

|

$ |

1,338,560 |

|

|

1 |

% |

|

Gross profit |

$ |

50,413 |

|

|

$ |

48,877 |

|

|

3 |

% |

|

|

$ |

190,310 |

|

|

$ |

185,687 |

|

|

2 |

% |

|

Gross margin |

|

13.7 |

% |

|

|

13.5 |

% |

|

20 bps |

|

|

|

|

14.0 |

% |

|

|

13.9 |

% |

|

10 bps |

|

|

Selling and administrative expenses |

$ |

42,442 |

|

|

$ |

38,606 |

|

|

10 |

% |

|

|

$ |

164,305 |

|

|

$ |

160,269 |

|

|

3 |

% |

|

Severance and restructuring expenses |

$ |

826 |

|

|

$ |

1,009 |

|

|

(18 |

%) |

|

|

$ |

4,888 |

|

|

$ |

1,496 |

|

|

227 |

% |

|

Loss on sale of foreign entity |

$ |

- |

|

|

$ |

- |

|

|

- |

|

|

|

$ |

3,646 |

|

|

$ |

- |

|

|

* |

|

|

Acquisition-related expenses |

$ |

- |

|

|

$ |

- |

|

|

- |

|

|

|

$ |

106 |

|

|

$ |

- |

|

|

* |

|

|

Earnings from operations |

$ |

7,145 |

|

|

$ |

9,262 |

|

|

(23 |

%) |

|

|

$ |

17,365 |

|

|

$ |

23,922 |

|

|

(27 |

%) |

|

|

|

|

|

|

|

|

|

Sales Mix |

|

|

** |

|

|

|

|

** |

|

|

Hardware |

|

37 |

% |

|

|

34 |

% |

|

12 |

% |

|

|

|

40 |

% |

|

|

36 |

% |

|

11 |

% |

|

Software |

|

54 |

% |

|

|

59 |

% |

|

(7 |

%) |

|

|

|

52 |

% |

|

|

57 |

% |

|

(7 |

%) |

|

Services |

|

9 |

% |

|

|

7 |

% |

|

25 |

% |

|

|

|

8 |

% |

|

|

7 |

% |

|

15 |

% |

|

|

|

100 |

% |

|

|

100 |

% |

|

1 |

% |

|

|

|

100 |

% |

|

|

100 |

% |

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Percentage change not considered meaningful.

** Change in sales mix represents

growth/decline in category net sales on a U.S. dollar basis and

does not exclude the effects of fluctuating foreign currency

exchange rates.

Financial Summary Table

(continued)(dollars in thousands, except

per share data)(Unaudited)

| |

Three Months Ended December

31, |

Years Ended December 31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

change |

|

|

2017 |

|

|

|

2016 |

|

|

change |

| APAC |

|

Net sales: |

|

|

|

|

|

|

|

Products |

$ |

29,378 |

|

|

$ |

39,388 |

|

|

(25 |

%) |

|

|

$ |

129,319 |

|

|

$ |

151,634 |

|

|

(15 |

%) |

|

Services |

$ |

9,499 |

|

|

$ |

9,082 |

|

|

5 |

% |

|

|

$ |

37,154 |

|

|

$ |

23,493 |

|

|

58 |

% |

|

Total net sales |

$ |

38,877 |

|

|

$ |

48,470 |

|

|

(20 |

%) |

|

|

$ |

166,473 |

|

|

$ |

175,127 |

|

|

(5 |

%) |

|

Gross profit |

$ |

7,901 |

|

|

$ |

8,540 |

|

|

(7 |

%) |

|

|

$ |

36,583 |

|

|

$ |

31,934 |

|

|

15 |

% |

|

Gross margin |

|

20.3 |

% |

|

|

17.6 |

% |

|

270 bps |

|

|

|

|

22.0 |

% |

|

|

18.2 |

% |

|

380 bps |

|

|

Selling and administrative expenses |

$ |

6,743 |

|

|

$ |

6,291 |

|

|

7 |

% |

|

|

$ |

28,231 |

|

|

$ |

23,658 |

|

|

19 |

% |

|

Severance and restructuring expenses |

$ |

- |

|

|

$ |

3 |

|

|

* |

|

|

|

$ |

104 |

|

|

$ |

118 |

|

|

(12 |

%) |

|

Acquisition-related expenses |

$ |

- |

|

|

$ |

3 |

|

|

* |

|

|

|

$ |

- |

|

|

$ |

169 |

|

|

* |

|

|

Earnings from operations |

$ |

1,158 |

|

|

$ |

2,243 |

|

|

(48 |

%) |

|

|

$ |

8,248 |

|

|

$ |

7,989 |

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

Sales Mix |

|

|

** |

|

|

|

|

** |

|

|

Hardware |

|

25 |

% |

|

|

11 |

% |

|

82 |

% |

|

|

|

17 |

% |

|

|

11 |

% |

|

48 |

% |

|

Software |

|

51 |

% |

|

|

70 |

% |

|

(42 |

%) |

|

|

|

61 |

% |

|

|

76 |

% |

|

(24 |

%) |

|

Services |

|

24 |

% |

|

|

19 |

% |

|

5 |

% |

|

|

|

22 |

% |

|

|

13 |

% |

|

58 |

% |

|

|

|

100 |

% |

|

|

100 |

% |

|

(20 |

%) |

|

|

|

100 |

% |

|

|

100 |

% |

|

(5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Percentage change not considered meaningful.** Change in

sales mix represents growth/decline in category net sales on a U.S.

dollar basis and does not exclude the effects of fluctuating

foreign currency exchange rates.

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference

call and web cast are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements, including the Company’s

expected 2018 financial results, including sales growth rates and

Adjusted diluted earnings per share for the full year 2018, and the

assumptions relating thereto, including the Company’s anticipated

effective tax rate and capital expenditures for 2018, the Company’s

plans for driving growth and the strength of its position to

compete in the marketplace in 2018, the Company’s plans to leverage

its four solutions areas strategy, focus on profitability and

invest in digital marketing, cloud and ecommerce platforms, the

Company’s expected working capital trends, gross margin and APAC

growth trends and the Company’s plans concerning its recently

authorized share repurchase program, are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified. Future events and actual results could differ

materially from those set forth in, contemplated by, or underlying

the forward-looking statements. There can be no assurances

that the results discussed by the forward-looking statements will

be achieved, and actual results may differ materially from those

set forth in the forward-looking statements. Some of the

important factors that could cause the Company’s actual results to

differ materially from those projected in any forward-looking

statements, include, but are not limited to, the following, which

are discussed in “Risk Factors” in Part I, Item 1A of the Company’s

Annual Report on Form 10-K for the year ended December 31, 2016 and

in other of the Company’s subsequent filings with the Securities

and Exchange Commission:

- actions of the Company’s competitors, including manufacturers

and publishers of products the Company sells;

- the Company’s reliance on partners for product availability,

competitive products to sell and related marketing funds and

purchasing incentives, the amounts and terms of which can fluctuate

significantly year over year;

- changes in the information technology (“IT”) industry and/or

rapid changes in technology;

- risks associated with the integration and operation of acquired

businesses;

- possible significant fluctuations in the Company’s future

operating results;

- the risks associated with the Company’s international

operations;

- general economic conditions;

- increased debt and interest expense and decreased availability

of funds under the Company’s financing facilities;

- the security of the Company’s electronic and other confidential

information;

- disruptions in the Company’s IT systems and voice and data

networks;

- failure to comply with the terms and conditions of the

Company’s commercial and public sector contracts;

- accounts receivable risks, including increased credit loss

experience or extended payment terms with the Company’s

clients;

- the Company’s reliance on independent shipping companies;

- the Company’s dependence on certain personnel;

- natural disasters or other adverse occurrences;

- exposure to changes in, interpretations of, or enforcement

trends related to tax rules and regulations;

- intellectual property infringement claims and challenges to the

Company’s registered trademarks and trade names; and

- legal proceedings and audits and failure to comply with laws

and regulations.

Additionally, there may be other risks that are otherwise

described from time to time in the reports that the Company files

with the Securities and Exchange Commission. Any

forward-looking statements in this release should be considered in

light of various important factors, including the risks and

uncertainties listed above, as well as others. The Company

assumes no obligation to update, and, except as may be required by

law, does not intend to update, any forward-looking

statements. The Company does not endorse any projections

regarding future performance that may be made by third parties.

|

Contacts: |

Glynis

Bryan |

Helen

Johnson |

| |

Chief Financial

Officer |

Senior VP, Finance |

| |

Tel.

480.333.3390 |

Tel.

480.333.3234 |

| |

Email

glynis.bryan@insight.com |

Email

helen.johnson@insight.com |

INSIGHT ENTERPRISES, INC.

AND SUBSIDIARIESConsolidated Statements of

Operations(In thousands, except per share

data)(Unaudited)

|

|

|

Three Months Ended December

31, |

|

|

|

Years Ended December

31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| Net sales: |

|

|

|

|

|

Products |

$ |

1,612,338 |

|

|

$ |

1,344,024 |

|

|

$ |

6,038,744 |

|

|

$ |

4,997,263 |

|

|

Services |

|

171,737 |

|

|

|

123,559 |

|

|

|

664,879 |

|

|

|

488,252 |

|

| Total net

sales |

|

1,784,075 |

|

|

|

1,467,583 |

|

|

|

6,703,623 |

|

|

|

5,485,515 |

|

| Costs of goods

sold: |

|

|

|

|

|

Products |

|

1,475,916 |

|

|

|

1,234,039 |

|

|

|

5,512,402 |

|

|

|

4,571,462 |

|

|

Services |

|

75,276 |

|

|

|

42,575 |

|

|

|

272,651 |

|

|

|

170,951 |

|

| Total

costs of goods sold |

|

1,551,192 |

|

|

|

1,276,614 |

|

|

|

5,785,053 |

|

|

|

4,742,413 |

|

| Gross

profit |

|

232,883 |

|

|

|

190,969 |

|

|

|

918,570 |

|

|

|

743,102 |

|

| Operating

expenses: |

|

|

|

|

| Selling and

administrative expenses |

|

184,554 |

|

|

|

145,066 |

|

|

|

723,328 |

|

|

|

585,243 |

|

| Severance and

restructuring expenses |

|

2,791 |

|

|

|

1,527 |

|

|

|

9,002 |

|

|

|

4,580 |

|

| Loss on sale of

foreign entity |

|

- |

|

|

|

- |

|

|

|

3,646 |

|

|

|

- |

|

|

Acquisition-related expenses |

|

- |

|

|

|

3,706 |

|

|

|

3,329 |

|

|

|

4,447 |

|

| Earnings

from operations |

|

45,538 |

|

|

|

40,670 |

|

|

|

179,265 |

|

|

|

148,832 |

|

| Non-operating (income)

expense: |

|

|

|

|

| Interest

income |

|

(346 |

) |

|

|

(282 |

) |

|

|

(1,209 |

) |

|

|

(1,066 |

) |

| Interest

expense |

|

5,360 |

|

|

|

2,271 |

|

|

|

19,174 |

|

|

|

8,628 |

|

| Net foreign

currency exchange (gain) loss |

|

(117 |

) |

|

|

(520 |

) |

|

|

855 |

|

|

|

522 |

|

| Other expense,

net |

|

367 |

|

|

|

311 |

|

|

|

1,347 |

|

|

|

1,290 |

|

| Earnings

before income taxes |

|

40,274 |

|

|

|

38,890 |

|

|

|

159,098 |

|

|

|

139,458 |

|

| Income tax expense |

|

26,106 |

|

|

|

17,790 |

|

|

|

68,415 |

|

|

|

54,768 |

|

|

Net earnings |

$ |

14,168 |

|

|

$ |

21,100 |

|

|

$ |

90,683 |

|

|

$ |

84,690 |

|

| |

|

|

|

|

| |

|

|

|

|

| Net earnings per

share: |

|

|

|

|

|

Basic |

$ |

0.40 |

|

|

$ |

0.59 |

|

|

$ |

2.54 |

|

|

$ |

2.35 |

|

|

Diluted |

$ |

0.39 |

|

|

$ |

0.59 |

|

|

$ |

2.50 |

|

|

$ |

2.32 |

|

| |

|

|

|

|

| |

|

|

|

|

| Shares used in per

share calculations: |

|

|

|

|

|

Basic |

|

35,809 |

|

|

|

35,479 |

|

|

|

35,741 |

|

|

|

36,102 |

|

|

Diluted |

|

36,272 |

|

|

|

35,963 |

|

|

|

36,207 |

|

|

|

36,438 |

|

INSIGHT ENTERPRISES, INC. AND

SUBSIDIARIESConsolidated Balance

Sheets(In

thousands)(Unaudited)

| |

|

December 31, |

|

| |

|

2017 |

|

|

|

2016 |

|

|

ASSETS |

|

|

| Current

assets: |

|

|

| Cash and

cash equivalents |

$ |

105,831 |

|

|

$ |

202,882 |

|

| Accounts

receivable, net |

|

1,814,560 |

|

|

|

1,436,742 |

|

|

Inventories |

|

194,529 |

|

|

|

148,203 |

|

|

Inventories not available for sale |

|

36,956 |

|

|

|

68,619 |

|

| Other

current assets |

|

152,467 |

|

|

|

127,159 |

|

|

Total current assets |

|

2,304,343 |

|

|

|

1,983,605 |

|

| |

|

|

| Property and equipment,

net |

|

75,252 |

|

|

|

70,910 |

|

| Goodwill |

|

131,431 |

|

|

|

62,645 |

|

| Intangible assets,

net |

|

100,778 |

|

|

|

20,707 |

|

| Deferred income

taxes |

|

17,064 |

|

|

|

52,347 |

|

| Other assets |

|

56,783 |

|

|

|

29,086 |

|

| |

$ |

2,685,651 |

|

|

$ |

2,219,300 |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

| Current

liabilities: |

|

|

| Accounts

payable – trade |

$ |

899,075 |

|

|

$ |

1,070,259 |

|

| Accounts

payable – inventory financing facility |

|

319,468 |

|

|

|

154,930 |

|

| Accrued

expenses and other current liabilities |

|

175,860 |

|

|

|

151,895 |

|

| Current

portion of long-term debt |

|

16,592 |

|

|

|

480 |

|

| Deferred

revenue |

|

88,979 |

|

|

|

61,098 |

|

|

Total current liabilities |

|

1,499,974 |

|

|

|

1,438,662 |

|

| |

|

|

| Long-term debt |

|

296,576 |

|

|

|

40,251 |

|

| Deferred income

taxes |

|

717 |

|

|

|

900 |

|

| Other liabilities |

|

44,915 |

|

|

|

26,044 |

|

| |

|

1,842,182 |

|

|

|

1,505,857 |

|

| Stockholders’

equity: |

|

|

| Preferred

stock |

|

- |

|

|

|

- |

|

| Common

stock |

|

358 |

|

|

|

355 |

|

|

Additional paid-in capital |

|

317,155 |

|

|

|

309,650 |

|

| Retained

earnings |

|

550,220 |

|

|

|

459,537 |

|

|

Accumulated other comprehensive loss – foreign currency translation

adjustments |

|

(24,264 |

) |

|

|

(56,099 |

) |

|

Total stockholders’ equity |

|

843,469 |

|

|

|

713,443 |

|

|

|

$ |

2,685,651 |

|

|

$ |

2,219,300 |

|

INSIGHT ENTERPRISES, INC. AND

SUBSIDIARIESConsolidated Statements of Cash

Flows (In

thousands)(Unaudited)

|

|

|

Years Ended December 31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

| Cash flows from

operating activities: |

|

|

| Net

earnings |

$ |

90,683 |

|

|

$ |

84,690 |

|

| Adjustments to

reconcile net earnings to net cash (used in) provided by operating

activities: |

|

|

|

Depreciation and amortization of property and equipment |

|

25,787 |

|

|

|

27,493 |

|

|

Amortization of intangible assets |

|

16,812 |

|

|

|

10,637 |

|

|

Provision for losses on accounts receivable |

|

5,245 |

|

|

|

2,452 |

|

|

Write-downs of inventories |

|

2,776 |

|

|

|

2,934 |

|

|

Write-off of property and equipment |

|

418 |

|

|

|

- |

|

|

Non-cash stock-based compensation |

|

12,826 |

|

|

|

11,058 |

|

|

Deferred income taxes |

|

19,139 |

|

|

|

10,517 |

|

|

Loss on sale of foreign entity |

|

3,646 |

|

|

|

- |

|

|

Gain on sale of real estate |

|

- |

|

|

|

(338 |

) |

| Changes in

assets and liabilities: |

|

|

|

Increase in accounts receivable |

|

(208,065 |

) |

|

|

(168,966 |

) |

|

Increase in inventories |

|

(14,046 |

) |

|

|

(50,712 |

) |

|

Decrease (increase) in other assets |

|

4,982 |

|

|

|

(50,130 |

) |

|

(Decrease) increase in accounts payable |

|

(237,457 |

) |

|

|

193,582 |

|

|

(Decrease) increase in deferred revenue |

|

(27,184 |

) |

|

|

10,633 |

|

|

(Decrease) increase in accrued expenses and other

liabilities |

|

(988 |

) |

|

|

12,278 |

|

|

Net cash (used in) provided by operating

activities |

|

(305,426 |

) |

|

|

96,128 |

|

| Cash flows from

investing activities: |

|

|

|

Acquisitions, net of cash and cash equivalents acquired |

|

(186,932 |

) |

|

|

(10,297 |

) |

| Purchases

of property and equipment |

|

(19,230 |

) |

|

|

(12,266 |

) |

| Proceeds

from sale of foreign entity |

|

1,517 |

|

|

|

- |

|

| Proceeds

from sale of real estate, net |

|

- |

|

|

|

1,378 |

|

|

Net cash used in investing activities |

|

(204,645 |

) |

|

|

(21,185 |

) |

| Cash flows from

financing activities: |

|

|

|

Borrowings on senior revolving credit facility |

|

1,151,216 |

|

|

|

772,218 |

|

|

Repayments on senior revolving credit facility |

|

(1,033,716 |

) |

|

|

(772,218 |

) |

|

Borrowings on accounts receivable securitization financing

facility |

|

3,961,389 |

|

|

|

2,802,000 |

|

|

Repayments on accounts receivable securitization financing

facility |

|

(3,975,889 |

) |

|

|

(2,851,500 |

) |

|

Borrowings under Term Loan A |

|

175,000 |

|

|

|

- |

|

|

Repayments under Term Loan A |

|

(8,750 |

) |

|

|

- |

|

|

Repayments under other financing agreements |

|

(5,636 |

) |

|

|

(1,309 |

) |

| Payments

on capital lease obligations |

|

(1,089 |

) |

|

|

(445 |

) |

| Net

borrowings (repayments) under inventory financing facility |

|

141,037 |

|

|

|

48,603 |

|

| Payment

of debt issuance costs |

|

(1,123 |

) |

|

|

(3,360 |

) |

| Payment

of payroll taxes on stock-based compensation through shares

withheld |

|

(5,318 |

) |

|

|

(2,219 |

) |

|

Repurchases of common stock |

|

- |

|

|

|

(50,000 |

) |

|

Net cash provided by (used in) financing

activities |

|

397,121 |

|

|

|

(58,230 |

) |

| Foreign currency

exchange effect on cash and cash equivalent balances |

|

15,899 |

|

|

|

(1,809 |

) |

| (Decrease) increase in

cash and cash equivalents |

|

(97,051 |

) |

|

|

14,904 |

|

| Cash and cash

equivalents at beginning of year |

|

202,882 |

|

|

|

187,978 |

|

| Cash and cash

equivalents at end of year |

$ |

105,831 |

|

|

$ |

202,882 |

|

INSIGHT ENTERPRISES, INC. AND

SUBSIDIARIESReconciliation of GAAP to Non-GAAP

Financial Measures (In thousands, except per share

data)(unaudited)

|

|

Three Months

Ended December 31, |

Years Ended December

31, |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| Adjusted Consolidated Earnings from

Operations: |

|

GAAP consolidated EFO |

$ |

45,538 |

|

|

$ |

40,670 |

|

|

|

$ |

179,265 |

|

|

$ |

148,832 |

|

|

|

Severance and restructuring expenses |

|

2,791 |

|

|

|

1,527 |

|

|

|

|

9,002 |

|

|

|

4,580 |

|

|

|

Loss on sale of foreign entity |

|

- |

|

|

|

- |

|

|

|

|

3,646 |

|

|

|

- |

|

|

|

Gain on sale of real estate for which a non-cash impairment charge

was previously reported |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(338 |

) |

|

|

Acquisition-related expenses |

|

- |

|

|

|

3,706 |

|

|

|

|

3,329 |

|

|

|

4,447 |

|

|

|

Adjusted non-GAAP consolidated EFO |

$ |

48,329 |

|

|

$ |

45,903 |

|

|

|

$ |

195,242 |

|

|

$ |

157,521 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Consolidated Net

Earnings: |

|

GAAP consolidated net earnings |

$ |

14,168 |

|

|

$ |

21,100 |

|

|

|

$ |

90,683 |

|

|

$ |

84,690 |

|

|

|

Severance and restructuring expenses |

|

2,791 |

|

|

|

1,527 |

|

|

|

|

9,002 |

|

|

|

4,580 |

|

|

|

Loss on sale of foreign entity |

|

- |

|

|

|

- |

|

|

|

|

3,646 |

|

|

|

- |

|

|

|

Gain on sale of real estate for which a non-cash impairment charge

was previously reported |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(338 |

) |

|

|

Acquisition-related expenses |

|

- |

|

|

|

3,706 |

|

|

|

|

3,329 |

|

|

|

4,447 |

|

|

|

Income taxes on non-GAAP adjustments |

|

(806 |

) |

|

|

(331 |

) |

|

|

|

(2,552 |

) |

|

|

(1,414 |

) |

|

|

Tax expense related to U.S. federal tax reform |

|

13,363 |

|

|

|

- |

|

|

|

|

13,363 |

|

|

|

- |

|

|

|

Adjusted non-GAAP consolidated net earnings |

$ |

29,516 |

|

|

$ |

26,002 |

|

|

|

$ |

117,471 |

|

|

$ |

91,965 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Consolidated Diluted

EPS: |

|

GAAP consolidated diluted EPS |

$ |

0.39 |

|

|

$ |

0.59 |

|

|

|

$ |

2.50 |

|

|

$ |

2.32 |

|

|

|

Severance and restructuring expenses |

|

0.08 |

|

|

|

0.04 |

|

|

|

|

0.25 |

|

|

|

0.13 |

|

|

|

Loss on sale of foreign entity |

|

- |

|

|

|

- |

|

|

|

|

0.10 |

|

|

|

- |

|

|

|

Gain on sale of real estate for which a non-cash impairment charge

was previously reported |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(0.01 |

) |

|

|

Acquisition-related expenses |

|

- |

|

|

|

0.10 |

|

|

|

|

0.09 |

|

|

|

0.12 |

|

|

|

Income taxes on non-GAAP adjustments |

|

(0.03 |

) |

|

|

(0.01 |

) |

|

|

|

(0.07 |

) |

|

|

(0.04 |

) |

|

|

Tax expense related to U.S. federal tax reform |

|

0.37 |

|

|

|

- |

|

|

|

|

0.37 |

|

|

|

- |

|

|

|

Adjusted non-GAAP consolidated diluted EPS |

$ |

0.81 |

|

|

$ |

0.72 |

|

|

|

$ |

3.24 |

|

|

$ |

2.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted North America Earnings from

Operations: |

|

GAAP EFO from North America segment |

$ |

37,235 |

|

|

$ |

29,165 |

|

|

|

$ |

153,652 |

|

|

$ |

116,921 |

|

|

|

Severance and restructuring expenses |

|

1,965 |

|

|

|

515 |

|

|

|

|

4,010 |

|

|

|

2,966 |

|

|

|

Gain on sale of real estate for which a non-cash impairment charge

was previously reported |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

(338 |

) |

|

|

Acquisition-related expenses |

|

- |

|

|

|

3,703 |

|

|

|

|

3,223 |

|

|

|

4,278 |

|

|

|

Adjusted non-GAAP EFO from North America segment |

$ |

39,200 |

|

|

$ |

33,383 |

|

|

|

$ |

160,885 |

|

|

$ |

123,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EMEA Earnings from

Operations: |

|

GAAP EFO from EMEA segment |

$ |

7,145 |

|

|

$ |

9,262 |

|

|

|

$ |

17,365 |

|

|

$ |

23,922 |

|

|

|

Severance and restructuring expenses |

|

826 |

|

|

|

1,009 |

|

|

|

|

4,888 |

|

|

|

1,496 |

|

|

|

Loss on sale of foreign entity |

|

- |

|

|

|

- |

|

|

|

|

3,646 |

|

|

|

- |

|

|

|

Acquisition-related expenses |

|

- |

|

|

|

- |

|

|

|

|

106 |

|

|

|

- |

|

|

|

Adjusted non-GAAP EFO from EMEA segment |

$ |

7,971 |

|

|

$ |

10,271 |

|

|

|

$ |

26,005 |

|

|

$ |

25,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSIGHT ENTERPRISES, INC. AND

SUBSIDIARIESReconciliation of GAAP to Non-GAAP

Financial Measures (Continued)(In thousands,

except per share data)(unaudited)

|

|

Three Months

Ended December 31, |

Years Ended December

31, |

|

|

|

2017 |

|

|

2016 |

|

|

|

2017 |

|

|

2016 |

|

| Adjusted APAC Earnings from

Operations: |

|

GAAP EFO from APAC segment |

$ |

1,158 |

|

$ |

2,243 |

|

|

$ |

8,248 |

|

$ |

7,989 |

|

|

Severance and restructuring expenses |

|

- |

|

|

3 |

|

|

|

104 |

|

|

118 |

|

|

Acquisition-related expenses |

|

- |

|

|

3 |

|

|

|

- |

|

|

169 |

|

|

Adjusted non-GAAP EFO from APAC segment |

$ |

1,158 |

|

$ |

2,249 |

|

|

$ |

8,352 |

|

$ |

8,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

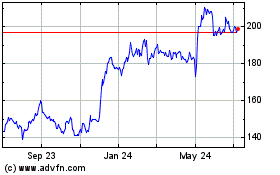

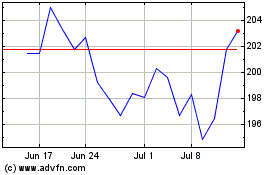

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Apr 2023 to Apr 2024