UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☐

|

Definitive Additional Materials

|

|

|

☒

|

Soliciting Material Under Rule 14a-12

|

|

RLJ LODGING TRUST

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

L & B REAL ESTATE OPPORTUNITY FUND, LP

LAND & BUILDINGS ABSOLUTE VALUE II LLC

LAND & BUILDINGS INVESTMENT MANAGEMENT,

LLC

LAND & BUILDINGS GP LP

JONATHAN LITT

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Land & Buildings Investment

Management, LLC, together with the other participants named herein (collectively, “Land & Buildings”), intends

to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit

proxies for the election of its slate of director nominees at the 2018 annual meeting of shareholders of RLJ Lodging Trust, a Maryland

corporation.

On February 14, 2018, Land & Buildings issued the following press release:

Land and Buildings Issues Letter

to RLJ Lodging Trust Shareholders Regarding

Appointment of New Director

– Believes that the RLJ Board

Has Chosen to Disenfranchise Shareholders Rather Than

Seriously Consider Several Highly-Qualified Directors Put Forth by Land

& Buildings –

– Given Dismal Performance

Following Numerous Capital Allocation Missteps, the Most Glaring Need

in the Boardroom is Relevant Capital Market and REIT Experience

– Which the

Appointment of Robert McCarthy Fails to Address –

– Land &

Buildings Has Preserved its Rights to Effect Change through the Nomination of Director

Candidates for Election at the 2018

Annual Meeting –

Stamford, CT

(February 14, 2018) – Land

and Buildings Investment Management, LLC (together with its affiliates, “Land and Buildings”) today issued the following

letter to shareholders of RLJ Lodging Trust (NYSE: RLJ) (“RLJ” or the “Company”):

February 14, 2018

Dear Fellow RLJ Lodging Trust Shareholders:

The RLJ Board of Directors (the “Board”)

appears to be more focused on entrenchment and self-preservation than on maximizing value for all shareholders. Rather than seriously

considering several exceptionally qualified directors – with relevant public market and REIT experience – that Land

& Buildings recommended for appointment to the Board, they chose the former Chief Operating Officer (COO) of Marriott International,

Robert McCarthy.

While we agree that the RLJ management team, CEO Ross

Bierkan and CFO/COO Leslie Hale, are in desperate need of both capital allocation and operating experience – given the horrible

performance of RLJ shares following numerous capital allocation missteps – the most glaring need in the boardroom is relevant

capital markets and REIT experience. Specifically, the rejection of an all cash offer from Blackstone for well north of $24 per

share over the Summer of 2017, issuing equity at a substantial discount to net asset value to help the FelCor acquisition, delays

in selling assets to reduce high debt levels, and the lack of transparency on synergies related to the merger with FelCor, all

highlight the desperate need for additional oversight at the Company and in particular, directors with relevant capital markets

and REIT experience.

The interests of Executive Chairman Robert Johnson, CEO

Ross Bierkan and CFO/COO Leslie Hale are clearly misaligned with the interests of RLJ shareholders given the outsized compensation

they earned in 2016 of $3.6 million, $4.4 million and $4 million, respectively.

It continues to be our strong desire to work collaboratively

with the Board to bring the necessary experience and skill sets that are currently lacking in the boardroom in order to right the

ship and maximize value for all shareholders. Unfortunately, it is becoming increasingly evident what game the Board is playing:

namely, disenfranchising shareholders and working to preserve the troubling status quo. As such, Land & Buildings has preserved

its rights to seek the election of director candidates at the upcoming 2018 Annual Meeting through its prior submission of a nomination

of a slate of director candidates to the Company.

Sincerely,

Jonathan Litt

Founder & Chief Investment Officer

Land & Buildings

###

About

Land and Buildings:

Land & Buildings is a registered investment manager

specializing in publicly traded real estate and real estate related securities. Land & Buildings seeks to deliver attractive

risk adjusted returns by opportunistically investing in securities of global real estate and real estate related companies, leveraging

its investment professionals' deep experience, research expertise and industry relationships.

Media Contact:

Dan Zacchei / Joe Germani

Sloane & Company

212-486-9500

CERTAIN INFORMATION CONCERNING

THE PARTICIPANTS

Land & Buildings Investment Management, LLC, together with the

other participants named herein (collectively, "Land & Buildings"), intends to file a preliminary proxy statement

and accompanying proxy card with the Securities and Exchange Commission ("SEC") to be used to solicit votes for the election

of its slate of director nominees at the 2018 annual meeting of shareholders of RLJ Lodging Trust, a Maryland corporation (“RLJ”

or, the “Company”).

LAND & BUILDINGS STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS

IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR

COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be

Land & Buildings Investment Management, LLC, a Delaware limited liability company (“L&B Management”), Land

& Buildings Capital Growth Fund, LP, a Delaware limited partnership (“L&B Capital” ), L & B Real Estate

Opportunity Fund, LP, a Delaware limited partnership (“L&B Opportunity”), Land & Buildings Absolute Value II

LLC, a Delaware limited liability company (“L&B Value”), Land & Buildings GP LP, a Delaware limited partnership

(“L&B GP”), and Jonathan Litt.

As of the date hereof, L&B Capital directly owns 661,028 shares

of Common Stock, $0.01 par value, of the Company (the "Shares”). As of the date hereof, L&B Opportunity directly

owns 1,167,945 Shares. As of the date hereof, L&B Value directly owns 193,934 Shares. As of the date hereof, 1,348,765 Shares

were held in certain accounts managed by L&B Management (the “Managed Accounts”). L&B GP, as the general partner

of each of L&B Capital, which is the sole member of L&B Value and L&B Opportunity, may be deemed the beneficial owner

of the (i) 661,028 Shares owned by L&B Capital, (ii) 1,167,945 Shares owned by L&B Opportunity and (iii) 193,934 Shares

owned by L&B Value. L&B Management, as the investment manager of each of L&B Capital, L&B Opportunity, and L&B

Value and as the investment advisor of the Managed Accounts, may be deemed the beneficial owner of the (i) 661,028 Shares owned

by L&B Capital, (ii) 1,167,945 Shares owned by L&B Opportunity, (iii) 193,934 Shares owned by L&B Value and (iv) 1,348,765

Shares held in the Managed Accounts. Mr. Litt, as the managing principal of L&B Management, may be deemed the beneficial owner

of the (i) 661,028 Shares owned by L&B Capital, (ii) 1,167,945 Shares owned by L&B Opportunity, (iii) 193,934 Shares owned

by L&B Value and (iv) 1,348,765 Shares held in the Managed Accounts.

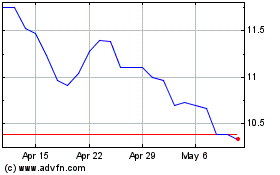

RLJ Lodging (NYSE:RLJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

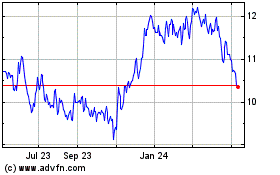

RLJ Lodging (NYSE:RLJ)

Historical Stock Chart

From Apr 2023 to Apr 2024