D-BOX Technologies Announces Revenue Increase of 53% For Its Third Quarter and Strong Adjusted EBITDA

February 12 2018 - 8:00PM

D-BOX Technologies Inc. (TSX:DBO), a leader in immersive motion

technology, announced today for its third quarter ended December

31, 2017 revenues of $10.4 million, an increase of 53% over

last year and $1.1 million adjusted EBITDA.

FINANCIAL HIGHLIGHTS

- Quarterly revenue increased by 53% to $10,400K.

- Recurring revenues from the entertainment market increased 20%

for the quarter.

- Net income of $51K was generated for the quarter compared to a

net loss of $1,638K for the same quarter last year.

- Quarterly adjusted EBITDA* of $1,114K was achieved for the

quarter compared to $(225K) for the quarter last year.

- Cash flows generated by operating activities for the first

nine-months improved by $5,292K from cash used for operations of

$(4,819K) for the first nine months of last year.

| Interim consolidated financial

information |

| Third quarter and nine-month periods ended

December 31 (in thousands of dollars, except per share

amounts) |

|

|

Third quarter |

Nine-month periods |

|

|

2017 |

2016 |

|

2017 |

|

2016 |

|

|

Revenues |

10,400 |

6,803 |

|

26,194 |

|

20,796 |

|

|

Net income (loss) |

51 |

(1,638 |

) |

(1,773 |

) |

(3,178 |

) |

|

Adjusted EBITDA* |

1,114 |

(225 |

) |

1,667 |

|

(53 |

) |

|

Basic and diluted net income (loss) per share |

0.000 |

(0.009 |

) |

(0.010 |

) |

(0.018 |

) |

| Information from the consolidated balance

sheet |

|

|

As at December 31, 2017 |

As at March 31, 2017 |

|

Cash and cash equivalents |

7,798 |

|

8,867 |

|

* See the reconciliation table of

adjusted EBITDA to the net income (loss) below and the "Non-IFRS

measures" section in the Management Discussion and Analysis dated

February 12, 2018.

OPERATIONAL HIGHLIGHTS

- D-BOX pursued its expansion in Latin America with the addition

of 16 screens in Argentina, Brazil and for the first time in

Honduras.

- D-BOX launched its first VR Cinematic Experience which opened

at Scotiabank Theatre Ottawa in December.

- D-BOX collaborates with Cirque du Soleil and the NFL to offer a

first-of-its-kind NFL Experience in Times Square, NYC.

Commenting on the quarterly results, Mr. Claude

Mc Master, President and Chief Executive Officer of D‑BOX,

declared: "We are very pleased with the 53% growth in revenue for

the last quarter and our ability to generate strong adjusted

EBITDA. Our focus on growth is continuing to show significant

results."

ADDITIONAL INFORMATION WITH RESPECT TO THE THIRD QUARTER

ENDED DECEMBER 31, 2017

The financial information relating to the third

quarter ended December 31, 2017 should be read in conjunction with

the Corporation's unaudited interim condensed consolidated

financial statements and the Management Discussion and Analysis

dated February 12, 2018. These documents are available at

www.sedar.com.

OUTLOOK

D-BOX operates in two major areas: the

entertainment market and the simulation and training market which

have their respective sub-markets. In light of the business

development activities in each of these two markets, D-BOX

anticipates the long-term upward trend in revenue to continue.

The Corporation pursues the expansion of footprint to

increase recurring revenues. In combination with this expected

growth of revenue, D-BOX is increasing the level of its operating

expenses aiming, amongst others, to support the sales and marketing

of technological innovations. This strategy will help solidify

D‑BOX’s position in existing sub-markets and will facilitate

entering new ones.

D-BOX expertise in immersive motion and

true-to-life simulation positions the company to be an active

participant in the growing virtual reality market. The

company is actively developing new applications for VR and other

related market. D-BOX proprietary technology may also enhance

the expansion of VR by potentially reducing the motion dizziness

sometimes associated with VR experiences. D‑BOX is

particularly focused on this new trend as the size of the virtual

and augmented reality markets which may soon reach billions of

dollars according to many industry sources.

RECONCILIATION OF ADJUSTED EBITDA TO NET INCOME

(LOSS)**

The adjusted EBITDA provides useful and

complementary information which allows, among other things, the

evaluation of profitability and cash flows provided by operations.

It is comprised of net income (loss) but excludes items not

affecting cash and the following: non-recurring expenses

related to restructuring costs, foreign exchange loss (gain),

financial expenses (income) and income taxes. The following table

explains the reconciliation of adjusted EBITDA to the net income

(loss).

| |

Third quarter ended December 31 |

Nine-month periods ended December

31 |

|

2017 |

2016 |

|

2017 |

|

2016 |

|

|

Net income (loss) |

51 |

(1,638 |

) |

(1,773 |

) |

(3,178 |

) |

|

Amortization of property and equipment |

593 |

743 |

|

1,763 |

|

1,8551,112 |

|

|

Amortization of intangible assets |

161165 |

146149 |

|

487326 |

|

446300 |

|

|

Amortization of other assets |

1 |

7 |

|

3 |

|

9 |

|

|

Write-off of property and equipment |

— |

10 |

|

— |

|

10 |

|

|

Write-off of intangible assets |

52 |

— |

|

52 |

|

— |

|

|

Share-based payments |

70 |

32 |

|

206 |

|

94 |

|

|

Foreign exchange loss (gain) |

52 |

(18 |

) |

266 |

|

(28 |

) |

|

Restructuring costs |

— |

370 |

|

257 |

|

398 |

|

|

Financial expenses (income) |

134 |

123 |

|

401 |

|

341 |

|

|

Income taxes |

— |

— |

|

5 |

|

— |

|

|

Adjusted EBITDA |

1,114 |

(225 |

) |

1,667 |

|

(53 |

) |

** See the "Non-IFRS measures" section in the Management

Discussion and Analysis dated February 12, 2018.

ABOUT D-BOX

D-BOX is a company who redefines the

entertainment experience. We create hyper-realistic,

immersive entertainment experiences by moving the body and sparking

the imagination through motion. This expertise is one of the

reasons why we have collaborated with some of the best

companies of the world to deliver new ways to tell great

stories. Whether it’s movies, video games, virtual reality

applications, themed entertainment or professional simulation, our

mission is to move the world.

DISCLAIMER IN REGARDS TO FORWARD-LOOKING

STATEMENTS

Certain statements included herein, including

those that express management's expectations or estimates of our

future performance, constitute "forward-looking statements" within

the meaning of applicable securities laws. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management at this

time, are inherently subject to significant business, economic and

competitive uncertainties and contingencies. Investors are

cautioned not to put undue reliance on forward-looking statements.

D-BOX disclaims any intent or obligation to update publicly these

forward-looking statements, whether as a result of new information,

future events or otherwise.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Mr. Jean-François Lacroix Chief Financial Officer D-BOX

Technologies Inc. 450 876-1227 jflacroix@d-box.com

Investor Relations:Mr. Glen AkselrodFounder

Bristol Capital Ltd.905 326-1888 ext. 10glen@bristolir.com

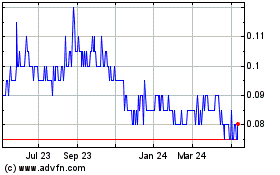

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

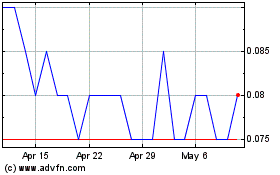

D Box Technologies (TSX:DBO)

Historical Stock Chart

From Apr 2023 to Apr 2024