Record Annual Cash Flow; Dividend Raised

16% to $5.80 Per Share

Watsco, Inc. (NYSE:WSO) reported record operating results for the

fourth quarter and year ended December 31, 2017.

The record operating results reflect continued

investment in technologies designed to revolutionize Watsco’s

customer-experience, making it easier to do business and helping

customers grow their businesses more profitably. Most notably, the

digitization of Watsco’s marketplace via e-commerce through

iOS/Android-enabled apps and websites with the industry’s most

in-depth database of product information made significant progress

in 2017. Customer adoption increased enabling more contractors to

interact with us 24 hours a day to find products, place orders and

obtain technical support. Employees are also empowered with better

data, processes and capabilities to serve their customers’

needs.

In addition to record operating performance,

Watsco generated record operating cash flow of $302 million in 2017

on net income of $257 million. Watsco also raised $248 million

during 2017 from the sale of shares of its common stock under its

previously announced “at-the-market” (ATM) stock offering program,

sharply reducing debt and positioning the Company to capitalize on

long-term growth opportunities.

Watsco also announced today that its Board of

Directors approved a 16% increase in its annual dividend to $5.80

per share for each outstanding share of its Common and Class B

common stock. The increase will be reflected in the Company’s next

regular dividend payment beginning in April 2018.

Fourth Quarter Results

Key performance metrics:

- 47% increase in earnings per share to a record $1.19 (includes

29 cent benefit from tax reform)

- 46% increase in net income to a record $43 million (includes

$10 million benefit from tax reform)

- 6% increase in operating income to $61 million (6.4% operating

margin)

- Operating cash flow of $117 million

- $243 million of proceeds from ATM share offering

- 91% reduction in debt to $22 million at December 31, 2017

Sales trends:

- 6% increase in sales to $964 million

- 7% increase in HVAC equipment (67% of sales)

- 4% increase in other HVAC products (29% of sales)

- 4% decrease in commercial refrigeration products (4% of

sales)

Albert Nahmad, Watsco’s Chairman and Chief

Executive Officer stated: “Watsco delivered another record quarter

with a resumption of strong sales growth rates for residential and

commercial HVAC systems from increasing unit demand and an improved

mix of higher-efficiency systems. Results also reflect further

investments in technology and 150 new customer-facing employees

during the course of the year to drive sales growth and market

share.”

Mr. Nahmad added: “We are pleased to reward

shareholders by raising our annual dividend to $5.80 per share,

reflecting our continued confidence to generate strong cash flow

while investing in our business. We believe the sale of Watsco

shares under the ATM program is both innovative and important as it

positions the Company for almost any size investment over the

long-term and is consistent with our conservative mindset about

debt.”

It is important to note that the fourth quarter

of each calendar year is highly seasonal due to the nature and

timing of the replacement of HVAC systems, which is strongest in

the second and third quarters. Accordingly, the Company’s fourth

quarter financial results are disproportionately affected by

seasonality.

Full Year Results

Key performance metrics:

- 13% increase in earnings per share to a record $5.81 (includes

27 cent benefit from tax reform)

- 14% increase in net income to a record $208 million (includes

$10 million benefit from tax reform)

- 2% increase in operating income to a record $354 million (8.2%

operating margin)

- 9% increase in operating cash flow to a record $302

million

Sales trends:

- 3% increase in sales to a record $4.34 billion

- 4% increase in HVAC equipment (67% of sales)

- 1% increase in other HVAC products (28% of sales)

- Flat sales for commercial refrigeration products (5% of

sales)

Cash Flow & Dividends

Operating cash flow for the full year increased

9% to a record $302 million. Since 2000, Watsco’s cash flow was

approximately $2.2 billion compared to net income of approximately

$2.0 billion, surpassing the Company’s stated goal of generating

cash flow in excess of net income.

Dividends paid in 2017 increased 29% to $164

million. On February 6, 2018, Watsco’s Board of Directors approved

a 16% increase in its annual dividend to $5.80 per share on each

outstanding share of its Common and Class B common stock. The

increase will be reflected in the Company’s dividend payment on

April 30, 2018.

Watsco has paid dividends for over 40

consecutive years with the philosophy of sharing increasing amounts

of cash flow through higher dividends while maintaining a

conservative financial position. Future increases in dividends, if

any, will be considered in light of investment opportunities, cash

flow, general economic conditions and the Company’s overall

financial condition.

Watsco raised $248 million in 2017 from the sale

of 1.5 million shares of Common stock under its ATM program. The

cash proceeds were used to reduce long-term debt. As of December

31, 2017, the Company’s debt-to-total capitalization was 1%.

Technology Strategy

Watsco has launched a variety of technologies

and process enhancements to transform how HVAC contractor customers

are served in the marketplace. Watsco believes that speed,

productivity and efficiency will be ever more critical as the

digital era progresses and is investing to ensure an unparalleled

customer-experience. Since 2012, Watsco’s technology team has grown

from approximately 60 employees to 180 employees and the present

annual run-rate for technology-related spending is

approximately $23 million.

Watsco estimates that over 250,000 contractors

and technicians visit or call one of its 560 locations each year to

get information and buy products, resulting in over 7 million sale

transactions. Innovations to enhance the customer-experience

include:

- Mobile apps, websites and e-commerce platforms that employ the

industry’s leading, data-rich repository of product

information.

- Business intelligence and data analytics expertise to enable

insightful assistance and decision-making by 600+ managers.

- Proprietary order fulfillment software to improve speed,

accuracy and convenience of the pick, pack and ship process.

- Predictive analytics-driven demand planning and inventory

optimization software to improve order fill-rates, increase

inventory turns, reduce real estate requirements and improve

long-term productivity.

Key performance indicators relative to these

technology platforms include:

| |

|

|

|

| E-Commerce and App

Usage |

|

|

Progress in 2017 |

| E-commerce sales |

|

|

50% growth in online

sales to over $900 million |

| E-commerce

transactions |

|

|

57% increase in

transactions |

| E-commerce run-rate at

end of year |

|

|

25% of sales versus 15%

at the end of 2016 |

| Unique iOS or Android

app users |

|

|

34% increase in

users |

| Products (SKUs)

digitized and available on-line |

|

|

30% increase to over

650,000 SKUs |

| Line items per order

on-line versus in-store |

|

|

33% more line items per

order |

| Sales attrition rate

for users versus non-users |

|

|

Attrition rate is 2.5X

less for active users |

| |

|

|

|

| Business Intelligence

(BI) Platform |

|

|

|

| Increase in internal BI

users |

|

|

11% increase to over

1,500 weekly-users |

| Average number of BI

queries per week per user |

|

|

30% increase in

queries |

| Number of total user

inquiries during the year |

|

|

46% increase to 17.9

million queries |

| |

|

|

|

| Warehouse

Efficiency |

|

|

|

| Number of wireless

locations |

|

|

461 locations Wi-Fi

enabled versus 359 last year |

| Locations with Order

Fulfillment (OF) software |

|

|

329 locations versus

150 locations last year |

| Number of orders filled

with OF |

|

|

2.1 million versus

750,000 last year |

| Delivery truck miles

tracked and analyzed |

|

|

4.2 million miles

versus 880,000 miles last year |

| Locations with express

pickup |

|

|

134 locations versus 68

locations last year |

| |

|

|

|

| Supply Chain

Optimization |

|

|

|

| Inventory turns for

fully-adopted locations |

|

|

80 basis-point

improvement over last 2 years |

| Fill-rates for

fully-adopted locations |

|

|

Fill-rates of 97% (up

300 basis-points from inception) |

| Reduction of real

estate requirements |

|

|

487,000 square feet (1

million square feet over 2 years) |

| |

|

|

|

A.J. Nahmad, Watsco’s President said, “We are

proud of the progress we’ve made in regard to digitizing our

business, but we’ve merely scratched the surface of what is

possible in terms of value creation and realization. When our

customers win, we win. To that end, our culture is one of

continuous improvement, which will consistently enhance our

customers’ businesses.”

Tax Cuts and Jobs Act of

2017

Income tax expense in 2017 reflects net tax

benefits of $10 million from a reduction in deferred income tax

liabilities partially offset by taxes related to undistributed

earnings of our international operations and other changes. The

impacts from tax reform in 2018 are being evaluated and we

currently estimate our 2018 effective income tax rate (net of taxes

attributable to non-controlling interest) will be in the range of

21% to 22%.

Investor Day

Watsco will host an investor and analyst meeting on Friday,

March 16, 2018 in Miami, Florida from 10:00 a.m. to 1:00

p.m. by invitation only. Leadership will provide a strategic

overview of the Company, including an update of the various

technology initiatives currently underway. A webcast will be

provided on the Company’s website at

http://investors.watsco.com.

Conference Call Information

Date: February 8, 2018Time: 10:00

a.m. (ET)Webcast: http://investors.watsco.comDial-in

number: United States (844) 883-3908 / International (412)

317-9254

A replay of the conference call will be

available on the Company's website.

About Watsco

Watsco provides comfort to homes and businesses

regardless of the outdoor climate. There are approximately 92

million central air conditioning and heating systems installed in

the United States that have been in service more than 10 years.

Older systems often operate below today’s government mandated

energy efficiency and environmental standards. Watsco has an

opportunity to accelerate the replacement of these systems at a

scale greater than its competitors as the movement toward reducing

energy consumption and its environmental impact continues. This is

especially important since heating and cooling accounts for

approximately half of the energy consumed in a typical U.S.

home.

Watsco’s traditional sales channel is the

industry’s largest and currently serves 88,000 contractor

businesses through 560 locations in the United States, Canada,

Mexico and Puerto Rico, and on an export basis to Latin America and

the Caribbean. Watsco is a technology company, operating scalable

platforms for mobile apps, e-commerce, business intelligence and

supply chain. Strategic goals are to accelerate sales and profit

growth, increase the speed and convenience of serving customers and

to extend its reach into new geographies and sales channels. Watsco

is also developing technologies to address the evolving buying

habits of consumers in the digital economy. Over the long-term,

Watsco believes its focus, scale and innovative culture offer

significant advantages to address the consumer market, which is

estimated to be $88 billion annually. Additional information about

Watsco may be found at http://www.watsco.com.

This document includes certain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements may be identified by

the use of words such as “will,” “would,” “anticipate,” “expect,”

“believe,” “plan,” “optimistic,” “goal” or “intend,” the negative

of these terms and similar references to future periods. These

statements are based on management's current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to changes in

economic, business, competitive market, new housing starts and

completions, capital spending in commercial construction, consumer

spending and debt levels, regulatory and other factors, including,

without limitation, the effects of supplier concentration,

competitive conditions within Watsco’s industry, seasonal nature of

sales of Watsco’s products, the ability of the Company to expand

its business, insurance coverage risks and final GAAP adjustments.

Forward-looking statements speak only as of the date the statement

was made. Watsco assumes no obligation to update forward-looking

information to reflect actual results, changes in assumptions or

changes in other factors affecting forward-looking information,

except as required by applicable law. Detailed information about

these factors and additional important factors can be found in the

documents that Watsco files with the Securities and Exchange

Commission, such as Form 10-K, Form 10-Q and Form 8-K.

WATSCO,

INC.Condensed Consolidated Results of

Operations(In thousands, except

per share data)(Unaudited)

| |

|

|

|

| |

Quarter Ended December 31, |

|

Year Ended December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenues |

$ |

964,345 |

|

|

$ |

913,611 |

|

|

$ |

4,341,955 |

|

|

$ |

4,220,702 |

|

| Cost of sales |

|

723,415 |

|

|

|

685,539 |

|

|

|

3,276,296 |

|

|

|

3,186,118 |

|

| Gross profit |

|

240,930 |

|

|

|

228,072 |

|

|

|

1,065,659 |

|

|

|

1,034,584 |

|

| Gross profit

margin |

|

25.0 |

% |

|

|

25.0 |

% |

|

|

24.5 |

% |

|

|

24.5 |

% |

| SG&A expenses |

|

181,156 |

|

|

|

169,998 |

|

|

|

715,671 |

|

|

|

688,952 |

|

| Other Income |

|

1,592 |

|

|

|

- |

|

|

|

3,886 |

|

|

|

- |

|

| Operating income |

|

61,366 |

|

|

|

58,074 |

|

|

|

353,874 |

|

|

|

345,632 |

|

| Operating margin |

|

6.4 |

% |

|

|

6.4 |

% |

|

|

8.2 |

% |

|

|

8.2 |

% |

| Interest expense,

net |

|

1,344 |

|

|

|

677 |

|

|

|

6,363 |

|

|

|

3,713 |

|

| Income before income

taxes |

|

60,022 |

|

|

|

57,397 |

|

|

|

347,511 |

|

|

|

341,919 |

|

| Income taxes |

|

7,366 |

|

|

|

17,530 |

|

|

|

90,221 |

|

|

|

105,936 |

|

| Net income |

|

52,656 |

|

|

|

39,867 |

|

|

|

257,290 |

|

|

|

235,983 |

|

| Less: net income

attributable tonon-controlling interest |

|

9,401 |

|

|

|

10,314 |

|

|

|

49,069 |

|

|

|

53,173 |

|

| Net income attributable

toWatsco |

$ |

43,255 |

|

|

$ |

29,553 |

|

|

$ |

208,221 |

|

|

$ |

182,810 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

share: |

|

|

|

|

|

|

|

| Net income attributable

toWatsco shareholders |

$ |

43,255 |

|

|

$ |

29,553 |

|

|

$ |

208,221 |

|

|

$ |

182,810 |

|

| Less: distributed

andundistributed earnings allocatedto non-vested restricted

commonstock |

|

3,724 |

|

|

|

3,050 |

|

|

|

17,427 |

|

|

|

14,801 |

|

| Earnings allocated to

Watscoshareholders |

$ |

39,531 |

|

|

$ |

26,503 |

|

|

$ |

190,794 |

|

|

$ |

168,009 |

|

| |

|

|

|

|

|

|

|

| Weighted-average Common

andClass B common shares andequivalent shares used tocalculate

diluted earnings pershare |

|

33,310,064 |

|

|

|

32,662,341 |

|

|

|

32,862,633 |

|

|

|

32,616,505 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

share forCommon and Class B commonstock |

$ |

1.19 |

|

|

$ |

0.81 |

|

|

$ |

5.81 |

|

|

$ |

5.15 |

|

|

|

WATSCO,

INC.Condensed Consolidated Balance

Sheets (Unaudited, in

thousands)

| |

|

|

|

| |

December 31, |

|

December 31, |

| |

2017 |

|

2016 |

| Cash and cash

equivalents |

$ |

80,496 |

|

$ |

56,010 |

| Accounts receivable,

net |

|

478,133 |

|

|

475,974 |

| Inventories |

|

761,314 |

|

|

685,011 |

| Other |

|

17,454 |

|

|

23,161 |

| Total

current assets |

|

1,337,397 |

|

|

1,240,156 |

| |

|

|

|

| Property and equipment,

net |

|

91,198 |

|

|

90,502 |

| Goodwill, intangibles,

net and other |

|

618,282 |

|

|

543,991 |

| Total

assets |

$ |

2,046,877 |

|

$ |

1,874,649 |

| |

|

|

|

| Accounts payable and

accrued expenses |

$ |

416,233 |

|

$ |

314,688 |

| Current portion of

long-term obligations |

|

244 |

|

|

200 |

| Total

current liabilities |

|

416,477 |

|

|

314,888 |

| |

|

|

|

| Borrowings under

revolving credit agreement |

|

21,800 |

|

|

235,294 |

| Deferred income taxes

and other liabilities |

|

57,623 |

|

|

72,719 |

| Total

liabilities |

|

495,900 |

|

|

622,901 |

| |

|

|

|

| Watsco's shareholders’

equity |

|

1,297,953 |

|

|

1,005,828 |

| Non-controlling

interest |

|

253,024 |

|

|

245,920 |

| Shareholders’

equity |

|

1,550,977 |

|

|

1,251,748 |

| Total

liabilities and shareholders’ equity |

$ |

2,046,877 |

|

$ |

1,874,649 |

| |

WATSCO,

INC.Condensed Consolidated Statements of

Cash Flows (Unaudited, in

thousands)

| |

Year Ended December 31, |

| |

2017 |

|

2016 |

| Cash flow from

operating activities: |

|

|

|

| Net

income |

$ |

257,290 |

|

|

$ |

235,983 |

|

| Non-cash

items |

|

25,239 |

|

|

|

40,751 |

|

| Changes

in working capital |

|

19,317 |

|

|

|

1,022 |

|

| Net cash

provided by operating activities |

|

301,846 |

|

|

|

277,756 |

|

| |

|

|

|

| Cash flow from

investing activities: |

|

|

|

|

Investment in unconsolidated entity |

|

(63,600 |

) |

|

|

- |

|

| Capital

expenditures, net |

|

(17,708 |

) |

|

|

(42,833 |

) |

| Net cash

used in investing activities |

|

(81,308 |

) |

|

|

(42,833 |

) |

| |

|

|

|

| Cash flow from

financing activities: |

|

|

|

|

Net repayments under revolving credit agreement |

|

(213,494 |

) |

|

|

(10,006 |

) |

|

Dividends on Common and Class B Common stock |

|

(164,147 |

) |

|

|

(127,604 |

) |

|

Distributions to non-controlling interest |

|

(42,831 |

) |

|

|

(38,900 |

) |

|

Purchase of additional ownership from non-controlling interest |

|

(42,688 |

) |

|

|

(42,909 |

) |

|

Other |

|

5,225 |

|

|

|

5,503 |

|

|

Proceeds from non-controlling interest for investment in

unconsolidated entity |

|

12,720 |

|

|

|

- |

|

|

Net proceeds from sale of Common stock |

|

247,744 |

|

|

|

- |

|

| Net cash

used in financing activities |

|

(197,471 |

) |

|

|

(213,916 |

) |

| Effect of foreign

exchange rate changes on cash and cash equivalents |

|

1,419 |

|

|

|

(226 |

) |

| Net increase in cash

and cash equivalents |

|

24,486 |

|

|

|

20,781 |

|

| Cash and cash

equivalents at beginning of period |

|

56,010 |

|

|

|

35,229 |

|

| Cash and cash

equivalents at end of period |

$ |

80,496 |

|

|

$ |

56,010 |

|

| |

|

|

|

| Barry S. Logan |

|

|

Watsco,

Inc. |

| Senior Vice

President |

|

|

2665 S.

Bayshore Drive, Suite 901 |

| (305) 714-4102 |

|

|

Miami,

Florida 33133, USA |

| e-mail:

blogan@watsco.com |

|

|

(305)

714-4100 |

| |

|

|

Fax:

(305) 858-4492 |

| |

|

|

www.watsco.com |

| |

|

|

|

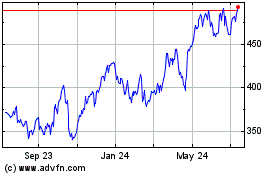

Watsco (NYSE:WSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

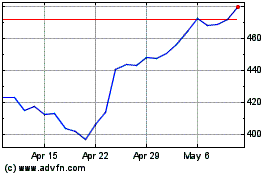

Watsco (NYSE:WSO)

Historical Stock Chart

From Apr 2023 to Apr 2024