- Net income reached US$806 million in

2017, from US$750 million in 2016, and was the highest net income

generation since 2007.

- Free cash flow after maintenance capex

for the full year was US$1.3 billion and conversion of EBITDA into

free cash flow after maintenance capex reached 50%.

- Total debt plus perpetual notes was

reduced by US$2.1 billion during 2017, on a pro-forma basis.

CEMEX, S.A.B. de C.V. ("CEMEX") (NYSE: CX), announced today

that, on a like-to-like basis for the ongoing operations and

adjusting for currency fluctuations, consolidated net sales

increased by 4% during the fourth quarter of 2017 to US$3.4

billion, and increased 3% for the full year 2017 to US$13.7 billion

versus the comparable periods in 2016. Operating EBITDA on a

like-to-like basis decreased by 7% during the fourth quarter of

2017 to US$625 million and decreased by 6% for the full year to

US$2.6 billion versus 2016.

CEMEX’s Consolidated Fourth-Quarter and

Full-Year 2017 Financial and Operational Highlights

- The increase in quarterly consolidated

net sales on a like-to-like basis was due to higher prices of our

products, in local currency terms in Mexico, the U.S. and our

Europe region, as well as higher volumes in our U.S., Europe and

Asia, Middle East & Africa regions.

- Operating earnings before other

expenses, net, in the fourth quarter decreased by 10%, to US$410

million and decreased by 9%, to US$1.7 billion, for the full-year

2017.

- Controlling interest net loss during

the quarter was US$105 million from an income of US$214 million in

the same period of 2016. Controlling interest net income for the

full year improved to US$806 million from US$750 million in

2016.

- Operating EBITDA on a like-to-like

basis decreased by 7% and 6% during the quarter and the full year,

respectively, to US$625 million and US$2.6 billion versus the

comparable periods of 2016.

- Operating EBITDA margin during the

quarter decreased to 18.3% from 20.7% in the same period of 2016.

For the full year, operating EBITDA margin decreased to 18.8% from

20.6% during 2016.

- Free cash flow after maintenance

capital expenditures for the quarter increased by 10% to US$680

million, compared to the same quarter of 2016. For the full year

2017, free cash flow after maintenance capital expenditures reached

US$1.3 billion and conversion of EBITDA into free cash flow after

maintenance capex reached 50%.

Fernando A. Gonzalez, Chief Executive Officer of CEMEX, said,

“Although 2017 was a challenging year, our two largest markets,

Mexico and the United States, performed well with like-to-like

increases in their EBITDA. We also generated free cash flow after

maintenance capex of close to US$1.3 billion, with a 50%

EBITDA-to-free-cash-flow conversion rate and which, together with

our asset-divestment initiatives, resulted in pro-forma debt

reduction of close to US$2.1 billion during the year.

“We had important headwinds during the year: underperformance in

Colombia, Egypt and the Philippines as well as increased energy

costs, mainly in Mexico. As we have done in the past, we focused on

the variables we control to dampen these headwinds and we continued

to deliver solid results.”

Consolidated Corporate Results

During the fourth quarter of 2017, controlling interest net loss

was US$105 million, versus an income of US$214 million in the same

period last year. Controlling interest net income for the full year

improved to US$806 million from US$750 million in 2016.

Total debt plus perpetual notes decreased by US$209 million

during the quarter. During 2017, total debt plus perpetual notes

was reduced by approximately US$1.7 billion, which represents a 13%

reduction from the debt level as of the end of 2016 and a 26%

reduction compared to the end of 2015. On a pro-forma basis,

including the payment of the 4.75% senior secured notes due 2022

outstanding aggregate principal amount, made on January 2018, total

debt plus perpetual notes was reduced by US$2.1 billion during

2017.

Geographical Markets Fourth-Quarter 2017

Highlights

Net sales in our operations in Mexico increased 6% on a

like-to-like basis in the fourth quarter of 2017 to US$781 million,

compared with US$701 million in the fourth quarter of 2016.

Operating EBITDA increased by 8% on a like-to-like basis to US$277

million versus the same period of last year.

CEMEX’s operations in the United States reported net

sales of US$838 million in the fourth quarter of 2017, an increase

of 4% on a like-to-like basis from the same period in 2016.

Operating EBITDA decreased by 5% on a like-to-like basis to US$158

million in the quarter, versus US$180 million in the same quarter

of 2016.

CEMEX’s operations in South, Central America and the

Caribbean reported net sales of US$452 million during the

fourth quarter of 2017, representing a decrease of 3% on a

like-to-like basis over the same period of 2016. Operating EBITDA

decreased by 10% on a like-to-like basis to US$105 million in the

fourth quarter of 2017, from US$108 million in the same quarter of

2016.

In Europe, net sales for the fourth quarter of 2017

increased by 5% on a like-to-like basis to US$911 million, compared

with US$780 million in the fourth quarter of 2016. Operating EBITDA

was US$99 million for the quarter, 9% higher on a like-to-like

basis than the same period last year.

Operations in Africa, Middle East and Asia reported a 14%

increase in net sales on a like-to-like basis for the fourth

quarter of 2017, to US$363 million, versus the same quarter of

2016. Operating EBITDA for the quarter was US$53 million, 31% lower

on a like-to-like basis from the same period last year.

CEMEX is a global building materials company that provides high

quality products and reliable service to customers and communities

in more than 50 countries. CEMEX has a rich history of improving

the well-being of those it serves through innovative building

solutions, efficiency advancements, and efforts to promote a

sustainable future.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of CEMEX to be materially different

from those expressed or implied in this release, including, among

others, changes in general economic, political, governmental and

business conditions globally and in the countries in which CEMEX

does business, changes in interest rates, changes in inflation

rates, changes in exchange rates, the level of construction

generally, changes in cement demand and prices, changes in raw

material and energy prices, changes in business strategy and

various other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. CEMEX assumes no obligation to update or correct the

information contained in this press release.

Operating EBITDA is defined as operating income plus

depreciation and operating amortization. Free Cash Flow is defined

as Operating EBITDA minus net interest expense, maintenance and

expansion capital expenditures, change in working capital, taxes

paid, and other cash items (net other expenses less proceeds from

the disposal of obsolete and/or substantially depleted operating

fixed assets that are no longer in operation). Net debt is defined

as total debt minus the fair value of cross-currency swaps

associated with debt minus cash and cash equivalents. The

Consolidated Funded Debt to Operating EBITDA ratio is calculated by

dividing Consolidated Funded Debt at the end of the quarter by

Operating EBITDA for the last twelve months. All of the above items

are presented under the guidance of International Financial

Reporting Standards as issued by the International Accounting

Standards Board. Operating EBITDA and Free Cash Flow (as defined

above) are presented herein because CEMEX believes that they are

widely accepted as financial indicators of CEMEX's ability to

internally fund capital expenditures and service or incur debt.

Operating EBITDA and Free Cash Flow should not be considered as

indicators of CEMEX's financial performance, as alternatives to

cash flow, as measures of liquidity or as being comparable to other

similarly titled measures of other companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180208005504/en/

CEMEX, S.A.B. de C.V.Media Relations:Jorge Pérez,

+52(81) 8888-4334mr@cemex.comorInvestor Relations:Eduardo

Rendón, +52(81) 8888-4256ir@cemex.comorAnalyst

Relations:Lucy Rodriguez,

+1-212-317-6007ir@cemex.com

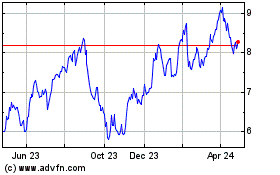

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024