EU to Probe Apple's Acquisition of Song-Recognition App Shazam

February 06 2018 - 1:38PM

Dow Jones News

By Natalia Drozdiak

BRUSSELS -- Apple Inc.'s acquisition of the popular

song-recognition app Shazam Entertainment Ltd. may adversely impact

competition in Europe, European Union antitrust authorities said

Tuesday, announcing they would take over the merger review from

national regulators in Austria.

The move fits with a broader strategy by the EU to more closely

scrutinize mergers involving data-rich companies, but whose revenue

falls below traditional thresholds that determine whether a deal

merits a review by EU authorities. Top EU officials often stress

the value of data in the marketplace as a "new form of

currency."

Apple said in December it would acquire the UK-based developer

at a time when the iPhone maker is looking to boost its

music-subscription service. The deal would give Apple ownership of

an app that helps users identify unfamiliar songs. It also would

give the company access to extensive data and insight on people's

musical interests. Financial terms of the deal weren't

disclosed.

Apple initially registered the deal with regulators in Austria,

but the EU said it had concluded that regulators in Brussels were

"the best placed authority to deal with the potential cross-border

effects of the transaction." Apple now has to register the deal in

Brussels.

Austria, France, Italy, Sweden and several other EU countries

asked Brussels to take over the review on concerns the deal could

harm competition in their member states as well as impact trade

within the European market.

Apple didn't immediately respond to a request for comment.

Apple and the European Commission, the bloc's competition

regulator, have been at loggerheads over the EU's decision in 2016

to order the smartphone maker to pay Ireland EUR13 billion ($16.2

billion) in allegedly unpaid taxes. Both Ireland and Apple are

appealing the decision.

The probe into the Shazam acquisition comes as the EU is

considering changing its merger review rules to include a wider

swath of technology deals that normally wouldn't fall within its

purview, such as a merger involving an acquired company that

generates relatively little revenue but holds commercially valuable

data.

The commission, which has the power to block deals or seek

concessions like the sale of certain assets, only has jurisdiction

over a merger if the companies have combined annual world-wide

revenue of EUR5 billion and each has EUR250 million in revenue

within the EU as a whole.

Apple's acquisition of Shazam doesn't meet those traditional

revenue thresholds but national regulators or companies are allowed

to ask the commission to make an exception. Shazam in 2016 posted

revenues of about GBP40 million ($56.2 million), up from about

GBP35 million in 2015.

The commission has been considering the new rules after Facebook

Inc. paid roughly $22 billion for WhatsApp -- a deal that was

eventually cleared unconditionally by the EU in 2014.

The commission wasn't expected to review the deal because the

messaging app doesn't have sufficient revenue in the region. But

Facebook asked the commission for a single review that would cover

the 28-nation bloc, rather than face the possibility of separate

reviews in three or more EU countries.

--Sam Schechner contributed to this article.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

February 06, 2018 13:23 ET (18:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

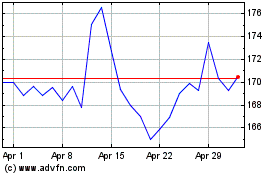

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

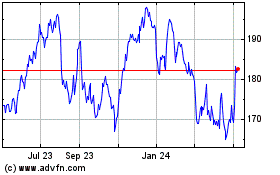

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024