Becton, Dickinson and Co. Revenue Helped by Life-Sciences -- Earnings Review

February 06 2018 - 7:14AM

Dow Jones News

By Allison Prang

Becton, Dickinson and Co. released its first-quarter earnings

Tuesday before the market opened. Here's what you need to know.

LOSS: The company said it lost $174 million, or 76 cents a

share, down from the same period a year ago when it made a profit

of $562 million, or $2.58 a share. Restructuring and acquisition

costs were $354 million, 307% higher than the same period a year

ago. The company's income tax provision also rose by 84% to $231

million, and the company reported no other operating income.

ADJUSTED EARNINGS: On an adjusted basis, earnings were $2.48 a

share compared with $2.33 a share from the comparable period the

prior year. Analysts polled by FactSet were expecting adjusted

earnings of $2.41 a share.

REVENUE: Revenue rose 5.4% to $3.08 billion driven by a 9.1%

increase in the company's life-sciences segment, particularly

driven by revenue growth in its diagnostic systems division which

was up 14%. The only division where revenue fell was

medication-management solutions, which was down 2.3% from the same

time a year ago. Adjusting for foreign exchange, the company said

total revenue rose 3.7%.

GUIDANCE: Becton, Dickinson and Co. said adjusted earnings for

2018 are expected to be between $10.85 and $11 a share. Reported

revenue is expected to rise between 30% and 31%. It is expected to

increase between 4.5% and 5.5% on a currency-neutral basis, the

company said.

Shares fell 0.4% premarket on low volume, but have risen 26% in

the past year.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

February 06, 2018 06:59 ET (11:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

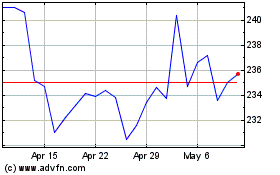

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

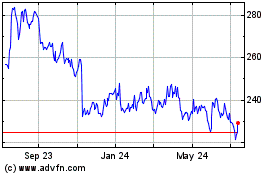

Becton Dickinson (NYSE:BDX)

Historical Stock Chart

From Apr 2023 to Apr 2024