Current Report Filing (8-k)

February 05 2018 - 12:40PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 23, 2018

NanoFlex

Power Corporation

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

333-187308

|

|

46-1904002

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

17207

N. Perimeter Dr., Suite 210

Scottsdale,

AZ 85255

(Address

of Principal Executive Offices)

(former

name or former address, if changed since last report)

Registrant’s

telephone number, including area code:

480-585-4200

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT and

ITEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

On

January 23, 2018, NanoFlex Power Corporation, a Florida corporation (the “Company”) entered into a Securities Purchase

Agreement with Crown Bridge Partners, LLC (“CBP”) pursuant CBP agreed to fund the Company an amount up to $117,000.

On January 26, 2018, the Company issued CBP a $130,000 convertible promissory note (the “CBP Note”) which includes

an original issue discount of 10% which means that if the Company takes the full $117,000 in funding, it is obligated to repay

$130,000. The CBP Note entitles the holder to 2% interest per annum on all amounts received form CBP and each tranche of funding

received is repayable, with interest six months from the date of funding. Any amounts not repaid within six months shall bear

an interest rate of 12% per annum.

The

CBP Note may be converted into Company common stock at any time at a conversion price of $0.50 per share, provided, however, that

in the event of a default, the conversion price is to be adjusted to the lower of $0.50 or 60% of the lowest of (i) the lowest

trading price or (ii) closing bid price for the 20-trading day period prior to conversion. If there is an event of default, conversion

of the CBP Note could result in substantial dilution to the Company’s shareholders.

Along

with each tranche of funding, CBP is entitled to receive a commitment fee in the form of a warrant to purchase a number of shares

of Company common stock equal to 75% of the dollar amount of the tranche divided by $0.50. The warrants are to have a three-year

term and an exercise price of $1.00 per share and may be exercised utilizing a cashless exercise feature.

An

initial closing was held on January 26, 2018 and the Company received $56,000 and with the original issue discount, is obligated

to repay $65,000 on or before July 25, 2018 (this amount also reflects $2,500 in fees deducted for the first tranche). 97,500

warrants were issued to CBP.

CBP

may not convert the CBP Note, or exercise any warrants, to the extent that such conversion would result in CBP’s beneficial

ownership being in excess of 4.99% of the Company’s issued and outstanding common stock together with all shares owned by

CBP and its affiliates.

In

connection with the CBP Note, the Company’s transfer agent reserved 13,944,630 shares of the Company’s common stock

in the event that the CBP Note is converted and/or the warrants are exercised.

The

foregoing descriptions of the Securities Purchase Agreement with CBP and the CBP Note and warrant are qualified in their entirety

by reference to the full text of the form of Securities Purchase Agreement, the form of the CBP Note and form of CBP warrant,

copies of which are filed herewith as Exhibit 10.1, 10.2 and 10.3 respectively, and are incorporated by reference herein.

In

issuing the CPB Note and warrant, the Company relied on the exemption from the registration provisions of the Securities Act of

1933, contained in Section 4(a)(2) thereof.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

NanoFlex

Power Corporation

|

|

|

|

|

|

Date:

February 2, 2018

|

By:

|

/s/

Dean L. Ledger

|

|

|

|

Name:

Dean L. Ledger

|

|

|

|

Title: Chief

Executive Officer

|

2

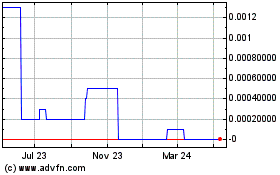

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

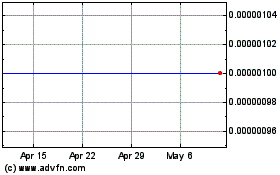

NanoFlex Power (CE) (USOTC:OPVS)

Historical Stock Chart

From Apr 2023 to Apr 2024