____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2018

Commission File Number 1-14732

__________________________________

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ___X____ No _______

COMPANHIA SIDERÚRGICA NACIONAL

Publicly-Held Company

Corporate Taxpayer’s ID (CNPJ/MF): 33.042.730/0001-04

NIRE Number: 35-3.0039609.0

CERTAIN UPDATES AND CHANGES TO 2016 FORM 20-F

This report on Form 6-K describes certain updates and changes to our 2016 Form 20-F as filed with the Securities and Exchange Commission on December 26, 2017.

|

|

|

|

Exhibit

|

|

Index

|

|

|

|

|

Exhibit A

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Nine-month Period Ended September 30, 2017

|

|

|

|

|

Exhibit B

|

|

Certain Updates and Changes to 2016 Form 20-F

|

|

|

|

|

Exhibit A

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of the financial condition and results of operations of Companhia Siderúrgica Nacional, or CSN, should be read in conjunction with CSN’s unaudited interim consolidated financial information as of September 30, 2017 and for the nine-month periods ended September 30, 2017 and 2016, furnished to the Securities and Exchange Commission, or the SEC, on January 26, 2018, the information presented under the sections entitled “Presentation of Financial and Other Information” and “Item 3. Key Information—Selected Financial Data,” “Item 5. Operating and Financial Review and Prospects,” “Item 11. Quantitative and Qualitative Disclosures About Market Risk” and CSN’s audited consolidated financial statements as of December 31, 2016 and 2015 and for the years ended December 31, 2016, 2015 and 2014 included in CSN’s annual report on Form 20-F, filed with the SEC on December 26, 2017, which we refer to as the CSN Annual Report.

The following discussion contains forward-looking statements that involve risks and uncertainties. CSN’s actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those set forth under “Forward-Looking Statements” and in “Item 3. Key Information—Risk Factors” in the CSN Annual Report.

Principal Factors Affecting Our Results of Operations

While we maintain international operations, both through subsidiaries outside Brazil and in the form of exports, our main operations continue to be in Brazil and, consequently, our results of operations and financial condition have been, and will continue to be, affected by Brazilian macroeconomic conditions, including the country’s GDP, inflation, interest rates and foreign exchange rates, among other economic indicators.

Our results of operations are also significantly affected by variations in the prices of our raw materials, principally iron ore, coal, coke and certain metals, and in the market prices of our principal products, steel and iron ore.

Brazilian Macroeconomic Environment

After eight consecutive quarters of economic contraction, the Brazilian economy grew 1.0% in the first quarter of 2017, technically marking an end to the country’s recession, followed by two consecutive quarters of growth. GDP growth in the nine-month period ended September 30, 2017 was 0.6%.

After reaching 10.5% and 10.7% in 2015 (as measured by the IGP-M and the IPCA, respectively), inflation rates decreased to (2.1)% and 1.8%, respectively, in the nine-month period ended September 30, 2017.

After reaching 14.3% in 2015, the Central Bank made eight consecutive reductions to the SELIC rate beginning in October 2016. As of September 30, 2017, the SELIC rate was 8.25%, which represented a 36.5% reduction in the nine-month period ended September 30, 2017. The SELIC rate was further reduced in October 2017 and December 2017, reaching a historic low of 7%.

After having depreciated 48% against the U.S. dollar in 2015, with a 2015-end U.S. dollar selling rate of R$3.905 to US$1.00, the

real

appreciated 22% against the U.S. dollar in 2016, with a 2016-end U.S. dollar selling rate of R$3.259 to US$1.00, and 2.8% in the nine-month period ended September 30, 2017. As of September 30, 2017, the U.S. dollar selling rate was R$3.168 to US$1.00.

The following table sets forth GDP growth, inflation rates, average interest rates and foreign exchange rate information (Brazilian

real

to U.S. dollar) for the periods indicated:

|

|

For the year ended December 31,

|

For the nine-month period ended

September 30,

|

|

|

|

|

|

|

|

GDP growth

|

0.1%

|

(3.8)%

|

(3.6)%

|

0.6%

|

|

Inflation (IGP-M)

(1)

|

3.7%

|

10.5%

|

7.2%

|

(2.1)%

|

|

Inflation (IPCA)

(2)

|

6.4%

|

10.7%

|

6.3%

|

1.8%

|

|

CDI rate

(3)

|

11.6%

|

14.1%

|

13.6%

|

8.0%

|

|

SELIC

(4)

|

11.8%

|

14.3%

|

14.1%

|

11.2%

|

|

Real

appreciation/(depreciation) in relation to the U.S. dollar

|

(13.4)%

|

(47.0)%

|

16.5%

|

2.8%

|

|

Period-end exchange rate (R$ per US$1.00)

(5)

|

2.656

|

3.905

|

3.259

|

3.168

|

|

Average exchange rate (R$ per US$1.00)

(6)

|

2.355

|

3.339

|

3.484

|

3.164

|

(1) The IGP-M is measured by Fundação Getúlio Vargas.

(2) The IPCA is measured by Instituto Brasileiro de Geografia e Estatística.

(3) The CDI is the accumulated rate of the interbank deposits in Brazil during each year.

(4) Annual average interest rate.

(5) Exchange rate (for sale) on the last day of the period.

(6) Average of U.S. dollar selling rate in the period.

Raw Materials and Product Prices

In the nine-month periods ended September 30, 2017 and 2016, our raw material costs in terms of steel production on an unconsolidated basis accounted for 57% and 47% of our total production costs, respectively. Our main raw materials include iron ore, coal, coke and pellets. As such, our results of operations are affected by changes in the prices of these raw materials. In the nine-month period ended September 30, 2017, the prices of iron ore, coal, coke and pellets increased by 47%, 73%, 95% and 58%, respectively. For more information on how the prices of our raw materials affect us, see “Item 3D. Risk Factors—Risks Relating to Us and the Industries in Which We Operate—The availability and the price of raw materials that we need to produce steel, particularly coal and coke, may adversely affect our results of operations” in our 2016 Annual Report, incorporated by reference in this offering memorandum.

Additionally, the prices at which we sell our principal products, steel and iron ore, and therefore our revenues, are also affected by the international prices for these products. For more information on how iron ore market prices affect us, see “Item 3D. Risk Factors—Risks Relating to Us and the Industries in Which We Operate—Prices charged for iron ore are subject to volatility. International iron ore prices may decrease significantly and have a negative impact on our revenues, cash flow, profitability, as well as result in a need to change the way we operate or in the suspension of certain of our projects and operations” in our 2016 Annual Report, incorporated by reference in this offering memorandum.

Consolidated Results of Operations

Nine-month Period Ended September 30, 2017 Compared with Nine-month Period Ended September 30, 2016

We maintain integrated operations in five business segments: steel, mining, logistics, cement and energy. We manage and control the performance of our various business segments, considering our proportional interest in our joint ventures MRS Logística S.A. and CBSI -

Companhia Brasileira de Serviços de Infraestrutura

, as reflected in the figures below, which may differ from those accounted according to IFRS.

Since December 1, 2015, we have been consolidating Namisa, which was recorded under the equity method until November 30, 2015. On December 31, 2015, Namisa was merged into CSN Mineração (formerly Congonhas Minérios S.A.). See our 2016 Annual Report, incorporated by reference in this offering memorandum, for more information.

Our consolidated results for the nine-month periods ended September 30, 2017 and 2016 are presented by business segment below:

|

|

Nine-month period ended September 30, 2016

|

|

Consolidated Results

|

|

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

Net operating revenues

|

8,554

|

3,265

|

145

|

996

|

363

|

202

|

(895)

|

12,630

|

|

Domestic market

|

5,001

|

374

|

145

|

996

|

363

|

202

|

(1,510)

|

5,571

|

|

Export market

|

3,553

|

2,891

|

-

|

-

|

-

|

-

|

615

|

7,060

|

|

Cost of goods sold

|

(7,059)

|

(2,303)

|

(107)

|

(678)

|

(334)

|

(148)

|

1,158

|

(9,470)

|

|

Gross profit

|

1,495

|

962

|

38

|

318

|

28

|

54

|

264

|

3,160

|

|

General and administrative expenses

|

(653)

|

(52)

|

(19)

|

(74)

|

(54)

|

(19)

|

(759)

|

(1,630)

|

|

Depreciation

|

499

|

337

|

10

|

169

|

45

|

13

|

(152)

|

923

|

|

Proportionate EBITDA of joint ventures

|

-

|

-

|

-

|

-

|

-

|

-

|

373

|

373

|

|

Adjusted EBITDA

(1)

|

1,342

|

1,247

|

29

|

414

|

20

|

48

|

(274)

|

2,826

|

|

|

|

|

|

|

|

|

Nine-month period ended September 30, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of R$)

|

|

Net operating revenues

|

9,524

|

3,446

|

167

|

1,052

|

381

|

304

|

(1,343)

|

13,532

|

|

Domestic market

|

5,671

|

654

|

167

|

1,052

|

381

|

304

|

(1,895)

|

6,335

|

|

Export market

|

3,853

|

2,791

|

-

|

-

|

-

|

-

|

553

|

7,197

|

|

Cost of goods sold

|

(7,868)

|

(2,097)

|

(112)

|

(766)

|

(407)

|

(214)

|

1,447

|

(10,016)

|

|

Gross profit

|

1,656

|

1,349

|

55

|

286

|

(26)

|

90

|

105

|

3,516

|

|

General and administrative expenses

|

(760)

|

(122)

|

(20)

|

(68)

|

(59)

|

(20)

|

(521)

|

(1,571)

|

|

Depreciation

|

506

|

370

|

12

|

232

|

97

|

15

|

(141)

|

1,090

|

|

Proportionate EBITDA of joint ventures

|

-

|

-

|

-

|

-

|

-

|

-

|

406

|

406

|

|

Adjusted EBITDA

(1)

|

1,403

|

1,596

|

47

|

449

|

13

|

85

|

(151)

|

3,441

|

_________

(1) We calculate adjusted EBITDA as net income (loss) for the period

plus

net financial income (expenses), income tax and social contribution, depreciation and amortization and results of discontinued operations,

plus

other operating income (expenses), equity in results of affiliated companies and the proportionate EBITDA of joint ventures. EBITDA and adjusted EBITDA are not measures of financial performance recognized under Brazilian GAAP or IFRS and they should not be considered alternatives to net income (loss) as measures of operating performance, or as alternatives to operating cash flows, or as measures of liquidity. EBITDA and adjusted EBITDA are not calculated using a standard methodology and may not be comparable to the definition of EBITDA or adjusted EBITDA, or similarly titled measures, used by other companies. For further information and a reconciliation of Adjusted EBITDA, see “Summary Financial Data and Other Information.”

Net Operating Revenues

Net operating revenues increased R$902 million, or 7%, from R$12,630 million recorded in the nine-month period ended September 30, 2016 to R$13,532 million in the same period in 2017, due to higher steel and iron ore prices.

Net domestic revenues increased R$764 million, or 14%, from R$5,571 million recorded in the nine-month period ended September 30, 2016 to R$6,335 million in the same period in 2017, while net revenues of exports and sales abroad increased from R$7,060 million in the nine-month period ended September 30, 2016 to R$7,197 million in the same period in 2017, due to an increase in international steel and iron ore prices.

Steel

Steel net operating revenues increased R$970 million, or 11%, from R$8,554 million recorded in the nine-month period ended September 30, 2016 to R$9,524 million in the same period in 2017, due to an increase in steel prices in domestic and foreign markets. Sales volume marginally decreased 0.05% from 3,670 thousand tons in the nine-month period ended September

30, 2016 to

3,668

thousand tons in the same period in 2017.

Steel net domestic revenues increased R$670 million, or 13%, from R$5,001 million in the nine-month period ended September 30, 2016 to R$5,671 million in the same period in 2017, due to a 14% increase in flat steel prices. Sales volume increased 1% from 2,049 thousand tons in the nine-month period ended September 30, 2016 to 2,071 thousand tons in the same period in 2017.

Steel net revenues from exports and sales abroad increased R$300 million, or 8%, from R$3,553 million in the nine-month period ended September 30, 2016 to R$3,853 million in the same period in 2017, due to a 10% increase in flat steel prices.

Mining

Total mining net operating revenues increased R$181 million, or 6%, from R$3,265 million in the nine-month period ended September 30, 2016 to R$3,446 million in the same period in 2017, mainly due to higher iron prices during this period. Iron ore prices increased 35% in the nine-month period ended September 30, 2017 compared to the same period in 2016, reaching an average price of US$73.25/dmt (Platts, 62% Fe).

Mining net export revenues decreased R$100 million, or 3%, from R$2,891 million in the nine-month period ended September 30, 2016 to R$2,791 million in the same period in 2017, mainly due to higher silica discounts, which increased from an average of US$2 in the nine-month period ended September 30, 2016 to US$4 during the same period in 2017.

Mining net domestic revenues increased R$280 million, from R$374 million in the nine-month period ended September 30, 2016 to R$654 million in the same period in 2017, due to an additional 1.1 million tons sold, as well as higher prices.

Logistics

Logistics net operating revenues

increased

R$78 million, or 7%, from R$1,141 million in

the nine-month period ended September 30, 2016

to R$1,219 million in the same period in 2017, due to a more favorable sales mix at MRS Logística S.A. and higher cargo traffic at TECON. In the nine-month period ended September 30, 2017, net revenue from railway logistics totaled R$1,052 million and net revenue from port logistics totaled R$167 million, while in the same period in 2016 net revenue from railway logistics totaled R$996 million and net revenue from port logistics totaled R$145 million.

Cement

Cement net revenue

increased

R$18 million, or 5%, from R$363 million in

the nine-month period ended September 30, 2016

to R$381 million in the same period in 2017, mainly due to an increase in sales volume.

Energy

Our net operating revenues from the energy segment

increased

R$102 million, or 50% of total net revenues from the energy segment, from R$202 million in

the nine-month period ended September 30, 2016

to R$304 million in the same period in 2017.

Cost of Products Sold

Consolidated cost of products sold

increased

R$546 million, or 6%, from R$9,470 million in

the nine-month period ended September 30, 2016

to R$10,016 million in 2017, mainly due to higher raw material and input costs, which effect was partially offset by lower labor and maintenance costs.

Steel

Consolidated steel costs of products sold were R$7,868 million in

the nine-month period ended September 30, 2017

, which represented a 11% increase compared to R$7,059 million in the same period in 2016, mainly due to an increase in raw material costs.

|

|

Nine-month period ended September 30,

|

Variation of Nine-month period ended September 30, 2016 versus 2017

|

|

|

|

|

|

|

Steel Production Cost

(Parent Company)

|

(R$ million)

|

(R$/ ton)

|

(R$ million)

|

(R$/ ton)

|

(R$ million)

|

(R$/ ton)

|

|

Raw materials

|

1,830

|

844

|

3,380

|

1,079

|

1,550

|

235

|

|

Iron ore

|

345

|

159

|

646

|

206

|

301

|

47

|

|

Coal

|

466

|

215

|

955

|

305

|

489

|

90

|

|

Coke

|

218

|

101

|

702

|

224

|

484

|

124

|

|

Metals

|

436

|

201

|

522

|

167

|

86

|

(34)

|

|

Outsourced slabs

|

151

|

69

|

78

|

25

|

(73)

|

(45)

|

|

Pellets

|

105

|

48

|

291

|

93

|

187

|

45

|

|

Scrap

|

12

|

6

|

52

|

17

|

40

|

11

|

|

Other

(1)

|

97

|

45

|

133

|

43

|

36

|

(2)

|

|

Labor

|

555

|

256

|

642

|

205

|

87

|

(51)

|

|

Other production costs

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Energy/fuel

|

644

|

297

|

765

|

244

|

121

|

(53)

|

|

Services and maintenance

|

364

|

168

|

507

|

162

|

143

|

(6)

|

|

Tools and supplies

|

177

|

81

|

231

|

74

|

55

|

(8)

|

|

Depreciation

|

284

|

131

|

330

|

105

|

46

|

(26)

|

|

Other

|

21

|

10

|

9

|

3

|

(12)

|

(7)

|

|

Total

|

|

|

|

|

|

|

Mining

Our mining costs of products sold decreased R$206 million, or 9%, from R$2,303 million in

the nine-month period ended September 30, 2016

to R$2,097 million in the same period in 2017, mainly due to a decrease in volume sold from 28 million tons in the nine-month period ended September 30, 2016 to 23 million tons during the same period in 2017.

Logistics

Cost of services attributable to our logistics segment increased R$93 million, or 12%, from R$785 million in

the nine-month period ended

September 30, 2016 to R$878 million in the same period in 2017, due to higher costs from increased transportation through rail services. For port logistics services, costs remained stable.

Cement

Cost of products sold attributable to our cement segment increased R$73 million, or 22%, from R$334 million reported in the nine-month period ended September 30, 2016 to R$407 million in the same period in 2017, mainly due to costs attributable to an increase in our customer base and our market share.

Energy

Cost of products sold attributable to our energy segment increased R$66 million, or 45%, from R$148 million in the nine-month period ended September 30, 2016 to R$214 million in the same period in 2017, due to an increase in energy available for sale and price readjustments.

Gross Profit

Gross profit increased R$356 million, or 11%, from R$3,160 million in the nine-month period ended September 30, 2016 to R$3,516 million in the same period in 2017, due to higher steel and iron ore prices.

Steel

Gross profit in the steel segment increased R$161 million, or 11%, from R$1,495 million in the nine-month period ended September 30, 2016 to R$1,656 million in the same period in 2017, due to an increase in market prices, which effect was partially offset by an increase in raw material costs.

Mining

Our gross profit in the mining segment increased R$387 million, or 40%, from R$962 million in the nine-month period ended September 30, 2016 to R$1,349 million in the same period in 2017, due to an increase in iron ore prices.

Logistics

Gross profit in the logistics segment decreased R$15 million, or 4%, from R$356 million in the nine-month period ended September 30, 2016 to R$341 million in the same period in 2017, due to higher costs in the railway segment.

Cement

Gross profit in the cement segment decreased R$54 million, or 193%, from R$28 million in the nine-month period ended September 30, 2016 to a loss of R$26 million in the same period in 2017, due to higher costs attributable to an increase in our sales resulting from our expanded geographical reach.

Energy

Gross profit in the energy segment increased R$36 million, or 67%, from R$54 million in the nine-month period ended September 30, 2016 to R$90 million in the same period in 2017, due to our sales of contracted power in the spot market.

Selling, General and Administrative Expenses

Selling, general and administrative expenses decreased R$59 million, or 4%, from R$1,630 million in the nine-month period ended September 30, 2016 to R$1,571 million in the same period in 2017. Selling expenses remained relatively stable, increasing R$16 million, or 1%, from R$1,248 million in the nine-month period ended September 30, 2016 to R$1,264 million in the same period in 2017, while general and administrative expenses decreased R$75 million, or 20%, from R$382 million in the nine-month period ended September 30, 2016 to R$307 million in the same period in 2017.

Other Operating Income (Expenses)

Other operating income (expenses) decreased R$29 million from a net operating expense of R$325 million in the nine-month period ended September 30, 2016 to a net operating expense of R$296 million in the nine-month period ended September 30, 2017.

Equity in Results of Affiliated Companies

Equity in results of affiliated companies increased R$11 million, or 13%, from R$88 million in the nine-month period ended September 30, 2016 to R$99 million in the same period in 2017, mainly due to improved financial results from MRS Logística S.A.

Operating Income

Operating income increased R$455 million, or 33%, from R$1,293 million in the nine-month period ended September 30, 2016 to R$1,748 million in the same period in 2017.

Financial Expenses (Income), Net

Our financial income and expenses generated net financial expenses of R$1,819 million in the nine-month period ended September 30, 2016 and R$1,604 million in the same period in 2017. This decrease was mainly due to lower financial expenses during the nine-month period ended September 30, 2017, as a result of the decrease in Brazilian interest rates, including a decrease of 575 basis points in the SELIC rate in the twelve-month period ended September 30, 2017.

Hedge Accounting

CSN regularly exports a large portion of its iron ore production, as well as steel products. The revenue in

reais

from these exports is impacted by exchange rate fluctuations. On the other hand, CSN raises funds in foreign currency through borrowings and financings, in addition to imports of metallurgical coal and coke which are used in its steelmaking process, among other production inputs. These foreign currency-denominated liabilities act as a natural hedge for oscillations in export revenues.

In order to better reflect the effect of exchange rate fluctuations in its financial statements, as of December 31, 2014, CSN

began designating part of its U.S. dollar-denominated liabilities as a hedge for future exports. As a result, exchange variations arising from these liabilities have temporarily been recorded directly in net equity as “other comprehensive income,” and amounted to R$437 million in the nine-month period ended September 30, 2016 and R$264 million in the nine-month period ended September 30, 2017. These amounts are transferred onto our income statement when the exports occur, which allows impacts from exchange rate fluctuations on liabilities and exports to be recorded simultaneously. The adoption of hedge accounting does not involve the contracting of any type of financial instrument. For more information on our hedge accounting, see note 12.b to our unaudited interim consolidated financial information as of and for the nine-month period ended September 30, 2017, incorporated by reference in this offering memorandum.

Income Taxes

Income tax expense in Brazil refers to federal income tax and social contribution. The statutory rates for these taxes applicable to the periods presented herein were 25% for federal income tax and 9% for social contribution. Adjustments are made to income in order to reach the effective tax expense or benefit for each fiscal year. As a result, our effective tax rate between fiscal years shows volatility.

At statutory rates, the balances resulted in an increase in tax expenses of R$145 million in the nine-month period ended September 30, 2017, as compared to total expenses of R$265 million in the same period in 2016 (285% of income before taxes and adjustments to the income). After adjustments to meet the effective rates, we recorded expenses for income tax and social contribution of R$410 million in the nine-month period ended September 30, 2017, as compared to an expense of R$265 million in the same period in 2016. Expressed as a percentage of pre-tax income, income tax moved from minus 50% in 2016 to 285% in 2017. For the year ended September 30, 2017, the adjustments to meet the effective rates totaled expenses of R$361 million, comprised mainly of:

·

a positive R$38 million adjustment related to equity result;

·

expenses of R$44 million related to results of subsidiaries taxed at different rates or not taxed;

·

a negative R$536 million adjustment related to tax loss and negative basis for which the tax credit was not recorded;

·

a positive impact of R$534 million related to tax credits not recorded in the year; and

·

a negative impact of R$327 million related to reversion of tax credits recorded in the year (impairment of DAT on NOL).

For further information on our income taxes, see note 14 to our unaudited interim consolidated financial information as of and for the nine-month period ended September 30, 2017, incorporated by reference in this offering memorandum.

It is not possible to predict future adjustments to the federal income tax and social contribution statutory rates, as they depend on interest on stockholders’ equity, tax incentives, non-taxable factors, including income from offshore operations, and tax losses from offshore operations, especially when expressed as a percentage of income.

Net Income (Loss)

In the nine-month period ended September 30, 2017, we recorded a net loss of R$266 million, as compared to a net loss of R$797 million in the same period in 2016.

EBITDA Contribution of International Subsidiaries

Our U.S. subsidiary, CSN LLC, which owns a flat steel processing facility, contributed US$(11) million, US$35 million and US$32 million to our EBITDA in the years ended December 31, 2015 and 2016 and in the twelve-month period ended September 30, 2017, respectively.

Our Portuguese subsidiary, Lusosider, Aços Planos, S.A., which owns a flat steel processing facility, contributed €(11) million, €15 million and €18 million to our EBITDA in the years ended December 31, 2015 and 2016 and in the twelve-month period ended September 30, 2017, respectively.

Our German subsidiary, SWT, a long steel producer, contributed €45 million, €42 million and €23 million to our EBITDA in the years ended December 31, 2015 and 2016 and in the twelve-month period ended September 30, 2017, respectively.

Liquidity and Debt

Given the capital intensive and cyclical nature of our industry and the generally volatile economic environment in certain

emerging markets, we have retained a certain an amount of cash on hand to run our operations and to satisfy our short-term financial obligations. As of September 30, 2017, cash and cash equivalents totaled R$4,358 million.

The following table sets forth certain key liquidity data at the dates indicated:

|

|

At December 31,

|

At

September 30,

|

|

|

2016

|

2017

|

|

|

(in millions of

reais

)

|

|

Real

-denominated

|

|

|

|

Cash and cash equivalents, short-term investments and short and long-term restricted cash

|

2,195

|

1,282

|

|

Short-term receivables

|

1,077

|

1,233

|

|

Foreign currency-denominated

|

|

|

|

Cash and cash equivalents and short-term investments

|

3,437

|

2,857

|

|

Short-term receivables

|

920

|

1,008

|

|

Total

|

7,629

|

6,379

|

Indebtedness

The following table sets forth our loans and financings at December 31, 2016 and September 30, 2017:

|

|

|

|

|

|

|

|

|

|

(in millions of

reais

)

|

|

Principal amount

|

26,669

|

25,501

|

|

Interest accrued

|

606

|

401

|

|

Perpetual notes

|

3,259

|

3,168

|

|

(-) Transaction costs and issue premiums

|

|

|

|

Total loans and financing

|

|

|

As of September 30, 2017, our total debt was R$29,004 million. Our loans and financings were affected by the appreciation of the

real

against the U.S. dollar, which exchange rate ranged from R$3.259 on December 31, 2016 to R$3.1680 on September 30, 2017, and the decrease in the CDI rate, which ranged from 13.63% on December 31, 2016 to 8.14% on September 30, 2017.

|

|

Debt Amortization Schedule as of September 30, 2017

|

|

|

(in millions of

reais

)

|

|

Maturity Schedule

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts due

|

5,555

|

7,283

|

7,914

|

2,203

|

5,827

|

For further information on our indebtedness, see note 11 to our unaudited interim consolidated financial information as of September 30, 2017 and for the nine-month periods ended September 30, 2017 and 2016, incorporated by reference in this offering memorandum.

Exhibit B

The following are certain further updates and changes to the 2016 Form 20-F:

(a) To replace the text under the heading “Item 8A. Consolidated Statements and Other Financial Information—Legal Proceedings—Independent Investigation” with the following:

Following media reports about statements made as part of a plea bargain testimony in a criminal proceeding not involving us that illicit payments of R$16.5 million were allegedly arranged by our chairman and chief executive officer and made by us in connection with the construction of the Long Steel Plant in Volta Redonda in the 2010-2014 period, in May 2017 our Audit Committee decided to engage external forensic specialists and legal advisors to conduct an independent investigation regarding these allegations.

The internal investigation was conducted over a seven-month period, as directed by our independent Audit Committee, and the specialists and advisors involved were provided access to members of our senior management, including our chairman and chief executive officer, and information and documents related to the contracts, parties and periods implicated in the allegations. In November 2017, the investigation, based on the data reviewed, concluded with no findings of misconduct by us involving the contracts and periods alleged, or any evidence of any misconduct involving the parties mentioned in the allegations. As a result, we have not recorded any contingencies in this regard.

In October 2017, we were informed that the Brazilian Federal Police, at the request of the criminal court conducting the proceedings, opened an investigation into our chairman and chief executive officer regarding the same allegations. We have not been the subject of any investigation by any governmental or enforcement agencies with respect to these allegations. Additionally, no evidence or testimony has been requested to date. Because the inquiry is at a very early stage, we cannot assure that there will not be further facts or developments related to the inquiry, or further formal or informal allegations or related investigations against us, our affiliates or any of our officers, directors or shareholders, which could materially and adversely affect our reputation or the trading price of our securities, including the notes.

(b) To include the following as the seventeenth paragraph under the heading “Item 8A. Consolidated Statements and Other Financial Information—Legal Proceedings—Other Legal Proceedings”:

We are defendants in two criminal lawsuits related to alleged water and soil pollution. Additionally, we are subject to ongoing police inquiries related to alleged inappropriate air emissions, irregular effluents discharge, water and soil pollution and inadequate transportation, storage and disposal of waste.

(c) To include the following after the table under the heading “Item 5B. Liquidity and Capital Resources—Maturity Profile”:

On February 1, 2018, we released a material fact notice to the market, filed with the SEC on Form 6-K, informing the market of the status of our renegotiation for extended maturity dates of debt held by our principal creditors, Banco do Brasil and Caixa Econômica Federal. The aggregate principal amount of our and our subsidiaries’ debt with Banco do Brasil and Caixa Econômica Federal represents approximately 49% of our aggregate consolidated indebtedness as of September 30, 2017.

We have reached an agreement as to the principal commercial terms and conditions for the reprofiled debt, including an extended amortization schedule and the granting of certain collateral to the lenders, including in the form of pledges over a portion of shares we hold in Usinas Siderúrgicas de Minas Gerais S.A., or Usiminas. We have agreed with the lenders to sell any shares pledged in the short- to medium-term, and to use the proceeds from those sales for amortization payments under the amended financings with the lenders. Additionally, we are negotiating certain financial terms, covenants and collateral arrangements.

Completion of our local debt reprofiling is subject to execution of the final instruments, as well as compliance with certain conditions precedent, including corporate approvals by us and additional approvals by Banco do Brasil and Caixa Econômica Federal.

São Paulo, February 1, 2018.

David Moise Salama

Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 1, 2018

|

|

|

|

|

|

|

COMPANHIA SIDERÚRGICA NACIONAL

|

|

|

|

|

By:

|

|

|

|

|

|

Benjamin Steinbruch

|

|

|

|

Chief Executive Officer

|

|

|

|

|

By:

|

|

|

|

|

|

David Moise Salama

|

|

|

|

Executive Officer

|

|

|

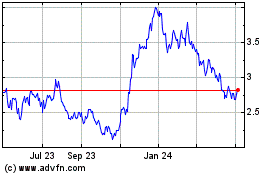

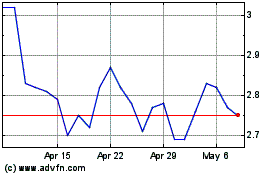

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Mar 2024 to Apr 2024

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Apr 2023 to Apr 2024