UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of

1934

LIVE CURRENT MEDIA INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

88-0346310

|

|

(State or other jurisdiction of incorporation or

organization)

|

|

(I.R.S. Employer Identification No.)

|

|

1130 Pender Street – Suite 820

|

|

|

|

Vancouver, BC

Canada

|

|

V6E 4A4

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(604) 648-0500

Registrant’s telephone number

Securities to be registered under Section 12(b) of the Exchange

Act:

|

Title of each class to be so registered

|

|

Name of exchange on which each class is to be

registered.

|

|

|

|

|

|

NONE.

|

|

N/A

|

Securities to be registered under Section 12(g) of the Exchange

Act:

Common Stock, $0.001 par value

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

|

(Do not check if a smaller reporting company)

|

|

|

LIVE CURRENT MEDIA INC.

FORM 10

TABLE OF CONTENTS

Page 2 of 22

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this registration statement

constitute "forward-looking statements.” These statements, identified by words

such as “plan,” "anticipate,” "believe,” "estimate,” "should,” "expect" and

similar expressions include the Company’s expectations and objectives regarding

its future financial position, operating results and business strategy.

Forward-looking statements involve known and unknown risks, uncertainties,

assumptions and other factors that may cause its actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Such

factors include, general economic conditions particularly related to demand for

the Company’s products and services, changes in business strategy, competitive

factors (including the introduction or enhancement of competitive services),

pricing pressures, changes in operating expenses, fluctuation in foreign

currency exchange rates, inability to attract or retain consulting, sales and/or

development talent, changes in customer requirements, and/or evolving industry

standards, as well as those factors discussed in the section titled “Part II,

Item 1A. Risk Factors” in this registration statement.

Forward looking statements are based on a number of material

factors and assumptions, including the availability and final receipt of

required government licenses, that sufficient working capital is available to

complete the proposed activities, that contracted parties provide goods and/or

services on the agreed time frames. While the Company considers these

assumptions may be reasonable based on information currently available to it,

they may prove to be incorrect. Actual results may vary from such

forward-looking information for a variety of reasons, including but not limited

to risks and uncertainties disclosed in the section titled “Risk Factors” in

this registration statement.

The Company intends to discuss in their Quarterly Reports

and Annual Reports any events or circumstances that occurred during the period

to which such documents relate that are reasonably likely to cause actual events

or circumstances to differ materially from those disclosed in this registration

statement. New factors emerge from time to time, and it is not possible for

management to predict all of such factors and to assess in advance the impact of

each such factor on its business or the extent to which any factor, or

combination of such factors, may cause actual results to differ materially from

those contained in any forwarding looking statement.

As used in this registration statement,

unless the context

otherwise requires, “we,” “us,” “our,” the “Company” and “Live Current” refers

to Live Current Media Inc. All dollar amounts in this registration statement are

in U.S. dollars unless otherwise stated.

Page 3 of 22

BUSINESS

General

Live Current Media Inc. (the “Company”) was incorporated under

the laws of the State of Nevada on October 10, 1995. The Company has an

authorized capital of 500,000,000 shares of common stock with 34,837,625 shares

currently issued and outstanding.

The Company operates its business through its wholly owned

subsidiary, Domain Holdings Inc., originally formed under the laws of British

Columbia, Canada on July 4, 1994 and re-domiciled to Alberta, Canada on April

14, 1999 (“DHI”). The Company is also the majority shareholder of Perfume Inc.

(95% ownership), formed under the laws of the State of Delaware on March 13,

2008. Perfume Inc. is currently dormant and does not carry on an active

business. References herein to the Company include DHI and Perfume Inc.

(collectively, the “Subsidiaries”) unless otherwise stated.

On June 4, 2014, pursuant to an arbitration award issued as

part of certain legal proceedings among the Company, former executives and

directors of the Company and certain shareholders of the Company (including

David M. Jeffs, the Company’s current Chief Executive Officer), the District

Court for Washoe County, Nevada ordered a receiver to be appointed and to take

charge of the Company’s assets. The Company operated throughout 2015 and 2016

under receivership. On January 11, 2017, the District Court in Washoe County

entered an order terminating the receiver’s possession of assets of the Company

resulting in operations of the Company being returned to the directors of the

Company. On May 4, 2017, the District Court in Washoe County discharged the

Company from receivership. A description of the legal proceedings resulting in

the appointment of the receiver is provided under “Legal Proceedings”.

Business of the Company and DHI

The Company’s sole business currently is that of managing the

business of DHI. DHI is in the business of utilizing its exclusive ownership of

domain names to develop internet-related business ventures.

Online Business Development.

The Company, through DHI,

holds title to a portfolio of approximately six hundred (600) intuitive, generic

domains, such as Rodeo.com, Electronic.com, Boxing.com and Number.com, which

inherently attract a stream of online visitors. The Company is not actively

seeking to acquire additional domain names at this time. However, the Company

will evaluate future opportunities to acquire additional domain names as they

present themselves. The Company seeks opportunities to use its domain name

rights to develop online businesses, by itself and through alliances with other

entities. The Company believes that its operating businesses can share common

platforms and infrastructure helping to create a scalable, adaptable and

efficient growth model, while also capitalizing on the generic domain names’

ability to intuitively attract customers. The Company also believes it may be

able to create economies of scale with each new business it develops. The

Company’s business model for these operating businesses includes multiple

revenue streams via revenue-sharing, leasing, web-advertising and trading of

domain names. The Company has not, to date, capitalized on this plan in any

significant manner.

Joint Ventures and Participations.

The Company believes

that its inventory of generic domain names may be attractive to established

non-Internet businesses that are leaders or near-leaders in their respective

industries. The Company’s business plan focuses on offering a long-term,

strategic partnership in exchange for commitments that could include cash,

marketing exposure, access to limited products, and business development

activities. Similarly, the Company seeks to identify end-consumers who purchase

the products and services that complement the businesses utilizing the Company’s

inventory of domain names. Since 2000, the Company has implemented its business

plan by entering into arrangements pursuant to which the Company has leased or

licensed rights to utilize generic domain names owned by the Company to existing

entities in return for cash payments and, in some cases, an equity participation

in the entity or a joint venture established to exploit the name. Currently, the

Company has two websites, Boxing.com and Number.com, that operate under a verbal

joint venture arrangement with a third party web developer (the “Web

Developer”). Under this arrangement, the Company owns the domain names and the

Web Developer develops and operates the websites at the Web Developers own cost

and expense. The terms of the arrangement call for the Company and the Web

Developer to split gross advertising revenues from the websites and the proceeds

of any sale of the websites. However, advertising revenues for Boxing.com and

Number.com have been minimal. As such, the Company has permitted the Web

Developer to retain advertising revenues to offset against the costs of operating those websites. A description of

the terms of the Company’s verbal arrangement with the Web Developer is attached

as Exhibit 10-1 to this registration statement. Boxing.com is a news and media

site offering users the opportunity to read daily news and statistics relating

to the boxing and fight industry and is focused on becoming the most used site

for boxing enthusiasts online. Number.com is a US directory of businesses.

Page 4 of 22

The Company expects to continue to seek additional

opportunities utilizing its domain names; however, there can be no assurance

that the Company will be able to locate such opportunities, or if located, it

will be able to enter into arrangements with such entities.

Sale and Lease of Domain Names.

The Company recognizes

opportunities which arise to monetize its ownership of domain names by selling

or leasing the domain names, which may be more valuable than the exploitation of

the ownership value of the names. The Company has previously sought

opportunities to sell all or a portion of the domain names it holds in one or a

series of transactions. Through these efforts, the Company has determined that

by selling the domain names individually rather than as a portfolio the Company

will maximize the revenue potential of these assets. The Company continues to

market its individual and portfolio of domain names using third party brokers.

The Company will continue to evaluate any offers received. During the fiscal

years ended December 31, 2016 and December 31, 2015, the Company’s only source

of income was from the sale of domain names.

The Company is also actively seeking opportunities to lease its

domain names to companies who want to benefit from the availability of

advertising and internet traffic that is generated by generic domain names.

Advertising Revenues.

Historically, the Company

generated revenue from advertising. However, advertising revenue has declined

significantly over the years due to changes in the advertising model. The

Company will continue to seek advertising revenue opportunities but does not

expect that advertising will ever again represent a significant revenue source

for the Company.

RISK FACTORS

An investment in the Company’s common shares involves a high

degree of risk. You should carefully consider the risks described below and the

other information in this registration statement before investing in its common

shares. If any of the following risks occur, the Company’s business, operating

results and financial condition could be seriously harmed. The trading price of

its common shares could decline due to any of these risks, and you may lose all

or part of your investment.

You should consider each of the following risk factors and the

other information in this registration statement, including the Company’s

financial statements and the related notes, in evaluating its business and

prospects. The risks and uncertainties described below are not the only ones

that impact on the Company’s business. Additional risks and uncertainties not

presently known to the Company or that the Company currently consider immaterial

may also impair its business operations. If any of the following risks do occur,

its business and financial results could be harmed. In that case, the trading

price of its common stock could decline.

Risks associated with the Company’s industry:

Effect of Existing Governmental Regulation.

The

Company’s services are subject to significant regulation at the federal, state

and local levels. Delays in receiving required regulatory approvals or the

enactment of new adverse regulation or regulatory requirements may have a

negative impact upon the Company and its business.

Licensing.

Currently, other than business and operations

licenses applicable to most commercial ventures, the Company is not required to

obtain any governmental approval for its business operations, although the

Company applies to ICANN and its contractors to obtain and maintain its domain

name assets. There can be no assurance, however, that governmental institutions

will not, in the future, impose licensing or other requirements on the Company.

Additionally, as noted below, there are a variety of laws and regulations that

may, directly or indirectly, have an impact on the Company’s business.

Privacy Legislation and Regulations.

While the Company

is not currently subject to licensing requirements, entities engaged in

operations over the Internet, particularly relating to the collection of user

information, are subject to limitations on their ability to utilize such

information under federal and state legislation and regulation. In 2000, the

Gramm-Leach-Bliley Act required that the collection of identifiable information

regarding users of financial services be subject to stringent disclosure and

“opt-out” provisions. While this law and the regulations enacted by the Federal

Trade Commission and others relates primarily to information relating to

financial transactions and financial institutions, the broad definitions of

those terms may make the businesses entered into by the Company and its

strategic partners subject to the provisions of the Act. This, in turn, may

increase the cost of doing business and make it unattractive to collect and

transfer information regarding users of services. This, in turn, may reduce the

revenues of the Company and its strategic partners, thus reducing potential

revenues and profitability. Similarly, the Children On-line Privacy and

Protection Act (“COPPA”) imposes strict limitations on the ability of Internet

ventures to collect information from minors. The impact of COPPA may be to

increase the cost of doing business on the Internet and reducing potential

revenue sources. The Company may also be impacted by the US Patriot Act, which

requires certain companies to collect and provide information to United States

governmental authorities. A number of state governments have also proposed or

enacted privacy legislation that reflects or, in some cases, extends the

limitations imposed by the Gramm-Leach-Bliley Act and COPPA. These laws may

further impact the cost of doing business on the Internet and the attractiveness

of Live Current’s inventory of domain names.

Page 5 of 22

Advertising Regulations.

In response to concerns

regarding “spam” (unsolicited electronic messages), “pop-up” web pages and other

Internet advertising, the federal government and a number of states have adopted

or proposed laws and regulations which would limit the use of unsolicited

Internet advertisements. While a number of factors may prevent the effectiveness

of such laws and regulations, the cumulative effect may be to limit the

attractiveness of effecting sales on the Internet, thus reducing the value of

the Company’s inventory of domain names.

There are currently few laws or regulations that specifically

regulate communications or commerce on the Internet. However, laws and

regulations may be adopted in the future that address issues such as user

privacy, pricing and the characteristics and quality of products and services.

For example, the Telecommunications Act of 1996 sought to prohibit transmitting

various types of information and content over the Internet. Several

telecommunications companies have petitioned the Federal Communications

Commission to regulate Internet service providers and on-line service providers

in a manner similar to long distance telephone carriers and to impose access

fees on those companies. This could increase the cost of transmitting data over

the Internet. Moreover, it may take years to determine the extent to which

existing laws relating to issues such as intellectual property ownership, libel

and personal privacy are applicable to the Internet. Any new laws or regulations

relating to the Internet or any new interpretations of existing laws could have

a negative impact on Live Current’s business and add additional costs to doing

business on the Internet.

Effect of new root domain names.

The Company’s business

is subject to a number of risks. In addition to competitive risks, the Company

is engaged in businesses that are not currently profitable, and there can be no

assurance that the Company’s business strategy will ever lead to profits.

Moreover, the Company relies upon an inventory of generic domain names for

lease, sale, and other ventures, which are made up mostly of “.com” suffixes.

The Internet Corporation for Assigned Names and Numbers (“ICANN”) has introduced

the introduction of additional new domain name suffixes, which may be as or more

attractive than the “.com” domain name suffix. New root domain names may have

the effect of allowing the entrance of new competitors at limited cost, which

may further reduce the value of the Company’s domain name assets. The Company

does not presently intend to acquire domain names using newly authorized root

domain names to match its existing domain names, although the Company has

certain .cn (China) root domain names to complement its growth strategy.

The Company’s stock price is volatile.

The stock markets

in general, and the stock prices of internet companies in particular, have

experienced extreme volatility that often has been unrelated to the operating

performance of any specific public company. The market price of the Company’s

Common Stock is likely to fluctuate in the future, especially if the Company’s

Common Stock is thinly traded. Factors that may have a significant impact on the

market price of the Company’s Common Stock include:

|

|

(a)

|

actual or anticipated variations in the Company’s results

of operations;

|

|

|

(b)

|

the Company’s ability or inability to generate new

revenues;

|

|

|

(c)

|

increased competition;

|

|

|

(d)

|

government regulations, including internet

regulations;

|

|

|

(e)

|

conditions and trends in the internet

industry;

|

|

|

(f)

|

proprietary rights; or

|

|

|

(g)

|

rumors or allegations regarding the Company’s financial

disclosures or practices.

|

Page 6 of 22

The Company’s stock price may be impacted by factors that are

unrelated or disproportionate to its operating performance. These market

fluctuations, as well as general economic, political and market conditions, such

as recessions, interest rates or international currency fluctuations may

adversely affect the market price of the Company’s Common Stock.

Competition.

The Company competes with many companies

possessing greater financial resources and technical facilities than itself in

the B2B2C (business-to-business-to-consumer) market as well as for the

recruitment and retention of qualified personnel. In addition, while the Company

holds title to a wide variety of generic names that may prove valuable, many of

the Company’s competitors have a very diverse portfolio of names and have not

confined their market to one industry, product or service, but offer a wide

array of multilayered businesses consisting of many different customer and

industry partners. Some of these competitors have been in business for longer

than the Company and may have established more strategic partnerships and

relationships than the Company. In addition, as noted above, ICANN regularly

develops new domain name suffixes that will have the result of making a number

of domain names available in different formats, many of which may be more

attractive than the formats held by the Company.

Receivership.

On June 4, 2014, as a result of numerous

lawsuits involving the Company, the Washoe County court in Nevada ordered a

receiver to take charge of the Company’s assets to determine if the Company

should be dissolved. On January 11, 2017, the court in Washoe County Nevada

entered an order terminating the receiver’s possession of assets of the Company

resulting in operations of the Company being returned to the directors of the

Company. On May 4, 2017, the court in Washoe County Nevada discharged the

Company from receivership.

New Products and Services.

The Company seeks to develop

a portfolio of operating businesses either by itself or by entering into

arrangements with businesses that operate in the product or service categories

that are described by the domain name assets owned by DHI. The Company has not,

however, identified specific business opportunities other than Boxing.com and

Number.com at this point and there can be no assurance that it will do so.

Dependence on One or a Few Major Customers.

The Company

does not currently depend on any single customer for a significant proportion of

its business. However, as the Company enters into strategic transactions, the

Company may choose to grant exclusive rights to a small number of parties or

otherwise limit its activities that could, in turn, create such dependence. The

Company, however, has no current plans to do so.

Patents, Trademarks and Proprietary Rights.

On November

16, 2007, The Company filed a trademark application with the US Patent &

Trademark Office (“USPTO”) for the mark "LIVE CURRENT". A certificate of

registration was issued on October 14, 2008 and the mark was assigned

registration number 3,517,876.

The Company will consider seeking further trademark protection

for its online businesses and the associated domain names, however, the Company

may be unable to avail itself of trademark protection under United States laws

because, among other things, the names are generic and intuitive. Consequently,

the Company will seek trademark protection only where it has determined that the

cost of obtaining protection, and the scope of protection provided, results in a

meaningful benefit to the Company.

The Company does not expect to pay dividends in the

foreseeable future.

The Company has never paid cash dividends on its Common

Stock and has no plans to do so in the foreseeable future. The Company intends

to retain earnings, if any, to develop and expand its business.

“

Penny Stock” rules may make buying or selling the Company’s

Common Stock difficult, and severely limit its market and liquidity.

Trading

in The Company’s Common Stock is subject to certain regulations adopted by the

SEC commonly known as the “penny stock” rules. The Company’s Common Stock

qualifies as penny stocks and are covered by Section 15(g) of the Securities

Exchange Act of 1934, which imposes additional sales practice requirements on

broker/dealers who sell the Common Stock in the aftermarket. The “penny stock”

rules govern how broker-dealers can deal with their clients and “penny stocks”.

For sales of The Company’s Common Stock, the broker/dealer must make a special

suitability determination and receive from you a written agreement prior to making a sale to you. The

additional burdens imposed upon broker-dealers by the “penny stock” rules may

discourage broker-dealers from effecting transactions in The Company’s Common

Stock, which could severely limit their market price and liquidity of its Common

Stock. This could prevent you from reselling your shares and may cause the price

of the Common Stock to decline.

Page 7 of 22

Lack of operating revenues.

The Company has limited

operating revenues and is expected to continue to do so for the foreseeable

future. Management has assessed the Company’s ability to continue as a going

concern and the financial statements included with this registration statement

includes disclosure that there is a substantial doubt as to the Company’s

ability to continue as a going concern. The audit report of the Company’s

principal independent accountants for the years ended December 31, 2016 and

December 31, 2015 includes a statement regarding the uncertainty of the

Company’s ability to continue as a going concern. The Company’s failure to

achieve profitability and positive operating revenues could have a material

adverse effect on its financial condition and results of operations, and could

cause the Company’s business to fail.

No assurance that forward-looking assessments will be

realized.

The Company’s ability to accomplish their objectives and whether

or not they are financially successful is dependent upon numerous factors, each

of which could have a material effect on the results obtained. Some of these

factors are in the discretion and control of management and others are beyond

management’s control. The assumptions and hypotheses used in preparing any

forward-looking assessments contained herein are considered reasonable by

management. There can be no assurance, however, that any projections or

assessments contained herein or otherwise made by management will be realized or

achieved at any level.

FINANCIAL INFORMATION

Plan of Operation

The Company is in the business of developing and

commercializing its portfolio of domain names, some of which generate meaningful

amounts of Internet traffic, which the Company attributes to, among other

things, their generic descriptive nature of a product or services category.

Management believes that it can develop and sustain a business

based on the lease, sale and other exploitation of domain names because, in

part, of its ownership of a number of generic, intuitive domain names which

attract significant numbers of visitors to websites utilizing those names.

Moreover, because there are a limited number of potential domain names, the

Company believes that the value of these names may be significant and may allow

the Company to achieve both strategic relationships with leading participants in

key Internet businesses and businesses that desire to expand using the Internet,

as well as independent operations. Currently the Company owns two websites,

Boxing.com and Number.com, which are operated through a verbal arrangement with

an independent web developer.

The Company acquired a number of “.cn” domain names through a

lottery-allocation in 2003 which are available to be developed. In 2005, Live

Current also acquired a portfolio of second and third tier .com domain names,

all of which end in the word “Bound”, such as “shoppingbound.com,”

pharmacybound.com and vietnambound.com. Management does not believe that these

“bound” domain names will ever represent a significant part of the Company’s

business and will seek opportunities to divest itself of these assets.

The Company, for the immediate future, does not anticipate

independently developing technologies, processes, products or otherwise engaging

in research, development or similar activities. Instead, such activities will be

engaged in pursuant to arrangements with its strategic partners.

Management of the company believe that the Company currently

has enough cash on hand to manage its operations for the next 12 months.

Management’s Discussion and Analysis

The following selected financial data was derived from the

Company’s audited and unaudited financial statements. The information set forth

below should be read in conjunction with the Company’s financial statements and

related notes included elsewhere in this registration statement. From June 2014

to May 2017 the Company operated under receivership. During this time, the

Company did not engage in any efforts to develop its business as the receiver’s

primary responsibilities during this time were to make recommendations to the

court as to whether the Company should be dissolved or otherwise, and to settle

and resolve the Company’s ongoing litigation matters. As the Company is no

longer operating under receivership, results for fiscal 2016 and 2015 may not be

reflective of the Company’s financial results and capital requirements moving

forward.

Page 8 of 22

Summary of Results

|

|

|

For the Year

|

|

|

For the year

|

|

|

|

|

ended

|

|

|

ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

|

|

(audited)

|

|

|

(audited)

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

$

|

(195,257

|

)

|

$

|

(358,556

|

)

|

|

Litigation settlement

|

|

(225,000

|

)

|

|

-

|

|

|

Impairment of intangible

assets

|

|

-

|

|

|

-

|

|

|

Gain on debt retirement

|

|

-

|

|

|

-

|

|

|

Interest income

|

|

1,396

|

|

|

1,779

|

|

|

Interest expense

|

|

(207

|

)

|

|

(207

|

)

|

|

Other income

|

|

112

|

|

|

10,438

|

|

|

Foreign exchange

|

|

(818

|

)

|

|

5,402

|

|

|

Net and comprehensive income

(Loss)

|

$

|

(419,774

|

)

|

$

|

(341,144

|

)

|

|

|

|

For the three

|

|

|

For the three

|

|

|

For the nine

|

|

|

For the nine

|

|

|

|

|

month period

|

|

|

month period

|

|

|

month period

|

|

|

month period

|

|

|

|

|

ended

|

|

|

ended

|

|

|

ended

|

|

|

ended

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2017

|

|

|

2016

|

|

|

2017

|

|

|

2016

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

$

|

(102,284

|

)

|

$

|

(24,433

|

)

|

$

|

(258,171

|

)

|

$

|

(50,680

|

)

|

|

Litigation settlement

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(225,000

|

)

|

|

Gain on debt retirement

|

|

-

|

|

|

-

|

|

|

182,236

|

|

|

-

|

|

|

Interest income

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

Interest expense

|

|

(104

|

)

|

|

-

|

|

|

(155

|

)

|

|

-

|

|

|

Other income

|

|

120

|

|

|

-

|

|

|

120

|

|

|

7,252

|

|

|

Foreign exchange

|

|

533

|

|

|

-

|

|

|

527

|

|

|

-

|

|

|

Net and comprehensive income (Loss)

|

$

|

(101,735

|

)

|

$

|

(24,433

|

)

|

$

|

(75,443

|

)

|

$

|

(268,428

|

)

|

Revenue

The Company recognized a gain of $206,764 from the sale of

domain names during the year ended December 31, 2016 (2015 $5,000). The Company

did not recognize recurring revenues during its 2016 or 2015 fiscal years or the

interim periods ended September 30, 2017 and 2016. The Company does not

anticipate recognizing recurring revenues in the short term. The Company

continues to market its domain names in its portfolio and considers offers

received for domain names in its portfolio. The Company believes its portfolio

of domain names will continue to maintain its value over time. Although the

Company’s arrangement with the web developer for Boxing.com and Number.com calls

for revenues to be split between the Company and the web developer, advertising

revenues for those sites has been minimal. As such, the Company has permitted

the web developer to retain the advertising revenue to offset against the

developer’s costs of operating those sites. The Company does not anticipate

earning significant advertising revenue from Boxing.com or Number.com in the

near future.

The Company has an accumulated deficit of $17,361,036. The

Company is presently in the development stage of their business and cannot

provide any assurances that they will be able to generate regular or recurring

revenues in the near future.

Page 9 of 22

Results of Operation

Three Month Period Ended September 30, 2017

The Company recorded a net loss of $101,735 for the three month

period ended September 30, 2017 as compared to a net loss of $24,433 for the

three month period ended September 30, 2016. Professional fees decreased during

the three months ended September 30, 2017 to $16,971 (2016 - $96,287) as a

result of the termination of the receivership under which the Company had

operated during 2016 and 2015. In addition, during the three months ended

September 30, 2017 we recognized an impairment of intangible assets of $37,500

(2016 - $NIL) relating to the write off of the previously mentioned “Bound”

domains.

During the three months ended September 30, 2016, the Company

recognized a gain of $86,962 on the sale of domain names.

Nine Month Period Ended September 30, 2017

The Company recorded a net loss of $75,443 for the nine month

period ended September 30, 2017 as compared to a net loss of $268,428 for the

nine month period ended September 30, 2016. An increase in general and

administrative expenses to $157,589 (2016 - $29,539) during the nine months

ended September 30, 2017 was offset against a decrease in professional fees of

$63,082 (2016 - $227,905). Management fees during fiscal 2016 and 2015 were

minimal as the Company operated under receivership during that time. The

receivership was terminated in 2017, resulting in a decrease in professional

fees.

During the nine months ended September 30, 2016, the Company

recognized a gain of $206,764 on the sale of domain names. In addition, during

the nine months ended September 30, 2016, the Company paid the sum of $225,000

to C. Geoffrey Hampson in settlement of its litigation proceedings involving Mr.

Hampson. See “Legal Proceedings”. During the nine months ended September 30,

2017, the Company recognized a gain of $182,236 on the discharge of creditor

obligations as part of the receivership proceedings. The Company also recorded

an impairment of intangible assets of $37,500 relating to the write off of the

previously mentioned “Bound” domains.

Year Ended December 31, 2016 and 2015

The Company recorded a net loss of $419,774 for the year ended

December 31, 2016 and a net loss of $341,144 for the year ended December 31,

2015. During the year ended December 31, 2016, general and administrative

expenses increased by $36,956 to $76,956 as compared to $43,024 for the year

ended December 31, 2015. This was the result of additional costs related to a

special annual meeting held in 2016. Management fees and professional fees did

not materially change between the years ended December 31, 2016 and 2015.

Also during the year ended December 31, 2016 the Company

recognized a charge of $225,000 as a result of the settlement of litigation with

C. Geoffrey Hampson. See “Legal Proceedings”.

Liquidity and Capital Resources

At September 30, 2017, the Company had working capital surplus

of $663,980, a decrease of $37,943 or 5.4% from December 31, 2016 ($701,923) and

a decrease of $427,519 or 39.1% from December 31, 2015 ($1,091,499). During the

year ended 2016 the Company’s only significant source of cashflow came from the

sale of domain names. The Company did not have any significant source of

cashflow during the nine months ended September 30, 2017 or the year ended

December 31, 2015. Due to the fact that the Company has incurred recurring

losses and anticipates incurring further losses in the future, the Company’s

auditors have expressed a substantial doubt as to the Company’s ability to

continue as a going concern.

The Company believes it has the necessary cash requirements for

the next 12 months without having to raise additional funds.

The Company does not anticipate purchasing any plant or

significant equipment in the immediate future

Page 10 of 22

Off-Balance Sheet Arrangements

The Company has no significant off-balance sheet arrangements

that have or are reasonably likely to have a current or future effect on its

financial condition, changes in financial condition, revenues or expenses,

results of operations, liquidity, capital expenditures or capital resources that

is material to shareholders.

Critical Accounting Policies

In August 2014, the FASB issued ASU 2014-15,

Presentation of

Financial Statements – Going Concern (Subtopic 205-40): Disclosure of

Uncertainties about an Entity’s Ability to Continue as a Going Concern

,

which is intended to define management’s responsibility to evaluate whether

there is substantial doubt about an organization’s ability to continue as a

going concern within one year after the date that the financial statements are

issued (or within one year after the date that the financial statements are

available to be issued when applicable) and to provide related footnote

disclosures. The ASU provides guidance to an organization’s management, with

principles and definitions that are intended to reduce diversity in the timing

and content of disclosures that are commonly provided by organizations today in

the financial statement footnotes. The ASU is effective for annual periods

ending after December 15, 2016, and interim periods within annual periods

beginning after December 15, 2016, which for the Company is January 1, 2017. The

adoption of this standard did not have a material impact on the Company’s

financial position or results of operations.

In August 2016, the FASB issued ASU No. 2016-15,

Statement

of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash

Payments.

This ASU is effective for annual periods beginning after December

15, 2018 and interim periods within fiscal years beginning after December 15,

2019. ASU No 2016-15 addresses eight specific cash flow issues with the

objective of reducing the existing diversity in practice. The adoption of this

standard will not have a material impact on the Company’s financial position or

results of operations.

Other recent accounting pronouncements issued by the FASB

(including its Emerging Issues Task Force), the American Institute of Certified

Public Accountants, and the SEC did not, or are not believed by management to,

have a material impact on the Company’s present or future financial position,

results of operations or cash flows.

PROPERTIES

The Company does not currently have any interests in any real

property.

The Company and its Subsidiaries operate from their principal

office at 820 – 1130 Pender Street, Vancouver, British Columbia, Canada. The

Company’s telephone number is (604) 648-0500.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The following table sets forth certain information concerning

the number of common shares owned beneficially as of January 31, 2018 by: (i)

each person (including any group) known to us to own more than five percent (5%)

of any class of the Company’s voting securities, (ii) each of its directors,

(iii) each of its named executive officers; and (iv) officers and directors as a

group. Unless otherwise indicated, the shareholders listed possess sole voting

and investment power with respect to the shares shown.

Title of Class

|

Name and Address of

Beneficial

Owner

|

Amount and Nature of

Beneficial Ownership

|

Percentage of

Common

Shares

(1)

|

Directors and Officers

|

|

Common Shares

|

Amir Vahabzadeh, 1825 West King

Edward

Avenue, Vancouver, BC V6J

2W3

|

3,371,053

Direct

|

9.7%

|

Page 11 of 22

Title of Class

|

Name and Address of

Beneficial

Owner

|

Amount and Nature of

Beneficial Ownership

|

Percentage of

Common

Shares

(1)

|

Common Shares

|

David Jeffs, Stollenweg 5, 79299

Wittnau, Germany

|

8,409,903

Direct

1,124,500

Indirect

(2)

|

27.4%

|

Common Shares

|

John da Costa, 820 – 1130 West Pender

Street, Vancouver, BC V6E 4A4

|

0

|

0%

|

|

|

All Officers and Directors as a Group

|

12,905,456

|

37.1%

|

5% Shareholders

|

Common Shares

|

Amir Vahabzadeh, 1825 West King

Edward Avenue, Vancouver, BC V6J

2W3

|

3,371,053

Direct

|

9.7%

|

Common Shares

|

David Jeffs, Stollenweg 5, 79299

Wittnau, Germany

|

8,409,903

Direct

1,124,500

Indirect

(2)

|

27.4%

|

Common Shares

|

Susan Jeffs, 11750 Fairtide Road,

Ladysmith,

BC V9G 1K5

|

3,797,500

(2)

Direct

|

10.5%

|

Common Shares

|

Richard Jeffs, 11750 Fairtide Road,

Ladysmith, BC V9G 1K5

|

2,524,671

Direct

|

7.3%

|

Notes:

|

(1)

|

Under Rule 13d-3, a beneficial owner of a security

includes any person who, directly or indirectly, through any contract,

arrangement, understanding, relationship, or otherwise has or shares: (i)

voting power, which includes the power to vote, or to direct the voting of

shares; and (ii) investment power, which includes the power to dispose or

direct the disposition of shares. Certain shares may be deemed to be

beneficially owned by more than one person (if, for example, persons share

the power to vote or the power to dispose of the shares). In addition,

shares are deemed to be beneficially owned by a person if the person has

the right to acquire the shares (for example, upon exercise of an option)

within 60 days of the date as of which the information is provided. In

computing the percentage ownership of any person, the amount of shares

outstanding is deemed to include the amount of shares beneficially owned

by such person (and only such person) by reason of these acquisition

rights. As a result, the percentage of outstanding shares of any person as

shown in this table does not necessarily reflect the person’s actual

ownership or voting power with respect to the number of its shares

actually outstanding on January 31, 2018. As of January 31, 2018, there were

34,837,625 shares of common stock issued and outstanding.

|

|

(2)

|

1,124,500 shares are registered in the names of immediate

family members of Mr.

Jeffs.

|

Changes in Control

The Company is not aware of any arrangement, which may result

in a change in control in the future.

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the name and positions of the

Company’s executive officers and directors as of the date hereof.

|

Name

|

Age

|

Positions

|

David M Jeffs

(Appointed October 15, 2010.)

|

48

|

Director, Chief Executive

Officer, President, Treasurer and Secretary

|

John da Costa

(Appointed December 15, 2016)

|

53

|

Director

|

Amir Vahabzadeh

(Appointed December 15, 2016)

|

49

|

Director

|

Page 12 of 22

Set forth below is a brief description of the background and

business experience of the Company’s executive officers and directors:

David Jeffs

Mr. Jeffs has been the Chief

Executive Officer, President, Treasurer and Secretary of the Company since

October 2010. He was also the Chief Executive Officer of the Company from July

2002 through May 2007 and the President and a director of the Company from July

2002 through September 2007. Previously he was a consultant to the Company’s

subsidiary, Domain Holdings Inc., from November 2000 and was responsible for

revenue-generating initiatives. Prior to consulting for Domain Holdings Inc.,

Mr. Jeffs was the president and director of a private corporation trading in

consumer goods products since 1997. Mr. Jeffs graduated from the University of

British Columbia with a Bachelor of Arts where he majored in economics.

Joao (John) da Costa

Mr. da Costa has more than

twenty five years of experience providing bookkeeping and accounting services to

both private and public companies and is the founder and President of Da Costa

Management Corp., a company that has provided management and accounting services

to public and private companies since August 2003. Since 2002, Mr. da Costa has

been the CFO, and a member of the Board of Directors of Triton Emission

Solutions Inc., a company reporting under the United States Securities Exchange

Act of 1934 (the “Exchange Act”). In addition to Triton Emission Solutions Inc.,

Mr. da Costa currently serves as the CFO, Treasurer and a director of Red Metal

Resources Ltd., a company reporting under the Exchange Act and engaged in the

business of acquiring and exploring mineral claims. Mr. da Costa also currently

serves as the CFO, Secretary and a director of Kesselrun Resources Ltd., a

Canadian reporting company listed on the TSX Venture Exchange.

Amir Vahabzadeh

Mr. Vahabzadeh has been involved

in the internet industry as a private online business owner and consultant for

over 20 years. Mr. Vahabzadeh holds a Bachelor of Arts degree and is a graduate

of the University of British Columbia and has been a shareholder of the Company

since 2000.

Term Of Office

The Company’s directors are elected to hold office until the

next annual meeting of the shareholders and until their respective successors

have been elected and qualified. The Company’s executive officers are appointed

by its board of directors and hold office until removed by its board of

directors or until their successors are appointed.

Other Significant Employees

Other than the Company’s sole executive officer, the Company

does not have any significant employees.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation paid or

accrued to the Company’s named executive officers, as that term is defined in

Item 402(m)(2) of Regulation S-K, during its last two completed fiscal years.

|

SUMMARY COMPENSATION TABLE

|

Name & Principal

Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-

Equity

Incentive

Plan

Compen-

sation ($)

|

Nonqualified

Deferred

Compen-

sation

Earnings

($)

|

All Other

Compen

-sation

($)

|

Total

($)

|

David Jeffs

President, CEO,

Treasurer & Director

|

2016

2015

|

$0

$0

|

$0

$0

|

$0

$0

|

$0

$0

|

$0

$0

|

$0

$0

|

$0

$0

|

$0

$0

|

Page 13 of 22

Notes:

|

(1)

|

The Company does not have a written compensation

arrangement in place with David Jeffs, however, it has agreed to

compensate Mr. Jeffs at a rate of $120,000 per year, commencing in January

of 2017, for his commitment as Chief Executive

Officer.

|

Outstanding Equity Awards at Fiscal Year End

As of the Company’s fiscal year ended December 31, 2016 the

Company had no outstanding equity awards.

Director Compensation

During our fiscal years ended December 31, 2016 and 2015, we

did not compensate our directors for acting in that capacity. We do not

currently have any compensation arrangements with our directors.

Compensation Committee Interlocks and Insider Participation

The Company does not have a compensation committee. The Board

of Directors conducts reviews with regard to the compensation of the directors

and the Chief Executive Officer once a year. To make its recommendations on such

compensation, the Board of Directors takes into account the types of

compensation and the amounts paid to officers of comparable publicly traded

companies.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

Related Transactions

None of the following parties has, during the Company’s last

two fiscal years, had any material interest, direct or indirect, in any

transaction with us or in any presently proposed transaction that has or will

materially affect us, in which the Company is a participant and the amount

involved exceeds the lesser of $120,000 or 1% of the average of the Company’s

total assets for the last two completed fiscal years:

|

|

(i)

|

Any of its directors or officers;

|

|

|

(ii)

|

Any person proposed as a nominee for election as a

director;

|

|

|

(iii)

|

Any person who beneficially owns, directly or indirectly,

shares carrying more than 10% of the voting rights attached to its

outstanding common shares;

|

|

|

(iv)

|

Any of its promoters; and

|

|

|

(v)

|

Any relative or spouse of any of the foregoing persons

who has the same house as such person.

|

Page 14 of 22

Director Independence

Quotations for the Company’s common stock are currently entered

on the OTC Pink marketplace, which does not have director independence

requirements. In determining whether any of its directors are independent, the

Company has applied the definition for “Independent Directors” set out in NASDAQ

Rule 5605(a)(2). In applying this definition, the Company has determined that

John da Costa and Amir Vahabzadeh are independent directors.

LEGAL PROCEEDINGS

Wrongful Dismissal Proceedings with Former CEO of DHI

On March 9, 2000, a former Chief Executive Officer of DHI

commenced a legal action against DHI for wrongful dismissal and breach of

contract. He is seeking, at a minimum, 18.39% of the outstanding shares of DHI,

specific performance of his contract, special damages of approximately $30,000,

aggravated and punitive damages, interest and costs. On June 1, 2000, DHI filed

a defense and counterclaim claiming damages and special damages for breach of

fiduciary duty and breach of his employment contract. The plaintiff has taken no

further action.

Legal Proceedings With Former CEO

Between May 2010 and February 2016 the Company was involved in

a number of law suits involving its former CEO, C. Geoffrey Hampson.

On May 14, 2010, David Jeffs, the Company’s current CEO, and

Richard Jeffs (plaintiffs) filed a complaint in the Circuit Court of Cook

County, Illinois, Chancery Division in which they, derivatively on behalf of the

Company, sued Mr. Hampson, James Taylor, Mark Benham and Boris Wertz

(defendants) and the Company (nominal defendant). Messrs. Taylor, Benham and

Wertz were directors of the Company at the time the lawsuit was filed. On

October 22, 2010, the Company took over as plaintiff in the complaint. The

Company alleged, among other matters, that (i) the defendant members of the

board of directors breached their fiduciary duties of loyalty, trust, good faith

and due care by failing to properly supervise Mr. Hampson, and (ii) that Mr.

Hampson breached his fiduciary duties and his employment agreement and defrauded

the Company by failing to devote the time necessary to manage the Company’s

business and failing to disclose to the board of directors his activities

relating to other businesses. The Company sought compensatory damages of no less

than $50,000,000, punitive damages, and attorney’s fees and other costs of

bringing the action. The complaint against Messrs. Hampson, Taylor, Benham and

Wertz was stayed in Illinois pending the outcome of arbitration, commenced by

Mr. Hampson against the Company on January 28, 2011 in British Columbia (see

below). The proceedings in Cook County, Illinois were stayed pending conclusion

of the arbitration proceedings.

On January 26, 2011, Mr. Hampson filed a third-party complaint

in the Circuit Court of Cook County, Illinois, against the Company. The claim

sought indemnification to cover the costs of Mr. Hampson in defending a

defamation suit filed against him during his time as CEO of the Company.

On January 28, 2011, Mr. Hampson initiated arbitration

proceedings in British Columbia under his employment agreement seeking severance

pay and expenses of $300,697.73.

On October 4, 2012, Mr. Hampson filed a complaint against the

Company in the Second Judicial District Court of the State of Nevada seeking a

court-ordered election of directors. On October 29, 2012 the court granted a

Writ of Mandate and Order Shortening Time. On November 19, 2012, the Company

held a meeting of its stockholders in Reno, Nevada. Stockholders present either

in person or on the provided conference call service did not represent a quorum

and the meeting was adjourned.

On February 19, 2013, Mr. Hampson filed another lawsuit in the

Circuit Court of Cook Country, Illinois County, Chancery Division against David

Jeffs, Susan Jeffs, John L Hayes, Ogletree Deakins Nash Smoak & Stewart

P.C., and Krasnow Saunders Kaplan & Beninato LLP as defendants, and the

Company as a nominal defendant.

Page 15 of 22

On February 21, 2013, Mr. Hampson, Christopher Hampson, and

Hampson Equities filed in the Second Judicial District Court of the State of

Nevada a supplemental petition to compel election of directors, application to

appoint temporary and permanent receiver, and application to enter ancillary

equitable relief.

On March 29, 2013, Mr. Hampson, Christopher Hampson, and

Hampson Equities Ltd. filed a motion for preliminary injunction in the Second

Judicial District Court of the State of Nevada seeking an order enjoining the

Company and its officers and directors from dealing with the Company’s assets,

engaging in self-dealing transactions and violating the October 29, 2012 writ of

mandate.

On June 18, 2013, the Company, David Jeffs, Mr. Hampson,

Christopher Hampson and Hampson Equities agreed to a global binding arbitration

to take place in Las Vegas, Nevada to resolve all of the outstanding lawsuits

and arbitration involved in the dispute. The arbitration took place in October

of 2013.

On June 4, 2014, the arbitrator delivered his findings. As a

result of the arbitration, Mr. Hampson was ordered to repay the Company $297,747

and the arbitrator ordered a receiver to be put in charge of the assets of the

Company to determine whether or not the Company should be dissolved. The Company

operated under receivership from June 4, 2014 to May 4, 2017, whereupon the

District Court for Washoe County, Nevada discharged the Company from

receivership.

On February 16, 2016, the appointed receiver of the Company

negotiated a final settlement and mutual release with Mr. Hampson. As part of

this settlement, the Company paid $225,000 to Mr. Hampson in exchange for the

surrender by Mr. Hampson of 3,022,875 shares of the Company’s common stock for

cancellation. The release absolutely and unconditionally released the Company,

from any and all claims for relief, actions, suits, damages, debts, liabilities,

judgments, executions and other claims of every kind and nature whatsoever.

Wrongful Dismissal Suit with Former Employee

On March 17, 2011, a former employee filed a civil claim in the

Supreme Court of British Columbia against the Company and the Subsidiaries

seeking special damages of $120,000 and other damages as a result of the

Company’s termination of her employment. The Company filed a counter claim. On

February 16, 2016 the former employee and the Company agreed to dismiss all

claims.

MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS

Holders of the Company’s Shares

As of the date of this registration statement, the Company had

72 registered shareholders.

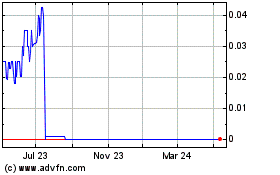

Market Information

The Company’s common shares trade over-the-counter in the

United States on the OTC Pink marketplace under the symbol “LIVC.” The following

is the high and low close information for the Company’s common stock during each

fiscal quarter of its last two fiscal years on the OTC Pink marketplace.

|

Period ended

|

|

High

|

|

|

Low

|

|

|

30 September 2017

|

$

|

0.063

|

|

$

|

0.02

|

|

|

30 June 2017

|

$

|

0.10

|

|

$

|

0.03

|

|

|

31 March 2017

|

$

|

0.08

|

|

$

|

0.01

|

|

|

31 December 2016

|

$

|

0.025

|

|

$

|

0.009

|

|

|

30 September 2016

|

$

|

0.0121

|

|

$

|

0.008

|

|

|

30 June 2016

|

$

|

0.0125

|

|

$

|

0.005

|

|

|

31 March 2016

|

$

|

0.01

|

|

$

|

0.0038

|

|

|

31 December 2015

|

$

|

0.0275

|

|

$

|

0.005

|

|

|

30 September 2015

|

$

|

0.0365

|

|

$

|

0.0245

|

|

|

30 June 2015

|

$

|

0.037

|

|

$

|

0.036

|

|

|

31 March 2015

|

$

|

0.0435

|

|

$

|

0.035

|

|

Page 16 of 22

High and low bid information for the last two fiscal years and

the interim periods ended March 31, 2017, June 30, 2017 and September 30, 2017

was not available. The above prices reflect the high and low close price for the

periods listed.

Bid quotations entered on the OTC Pink marketplace reflect

inter-dealer prices, without retail mark-up, markdown or commission and may not

represent actual transactions.

Dividend Rights

There are no provisions in the Company’s articles of

incorporation or bylaws restricting the Company’s ability to pay dividends on

our common stock. Chapter 78 of the Nevada Revised Statutes (the “NRS”) does

provide certain limitations on the Company’s ability to declare and pay

dividends. Section 78.288 of the NRS prohibits the Company from declaring

dividends where, after giving effect to the distribution of the dividend:

|

|

(a)

|

The Company would not be able to pay its debts as they

become due in the usual course of business; or

|

|

|

|

|

|

|

(b)

|

Except as allowed in the Company’s articles of

incorporation the Company’s total assets would be less than the sum of the

Company’s total liabilities plus the amount that would be needed to

satisfy any preferential rights.

|

The Company has never declared, nor paid, any dividend since

their incorporation and they do not foresee paying any dividend in the near

future since all available funds will be used to conduct the Company’s business

development activities. Any future payment of dividends will depend on its

financing requirements and financial condition and other factors which the board

of directors, in its sole discretion, may consider appropriate.

Equity Compensation Plan Information

The Company does not currently have any outstanding equity

compensation plans. The Company’s 2007 Stock Incentive Plan expired in August

2017 in accordance with its terms.

RECENT SALES OF UNREGISTERED SECURITIES

During the past three years, the Company did not issue any

securities.

Cancellation of issued shares

On August 10, 2016, in connection with the settlement reached

with C. Geoffrey Hampson, the Company’s former CEO, as described in “Legal

Proceedings” above, 3,022,875 common shares were returned to treasury and

subsequently cancelled.

DESCRIPTION OF REGISTRANT’S SECURITIES TO BE

REGISTERED

General

The Company’s authorized capital consists of 500,000,000 shares

of common stock, with a par value of $0.001 per share. As of the date of this

registration statement, the Company had 34,837,625 common shares issued and

outstanding.

Common Stock

The following is a summary of the material rights and

restrictions associated with its common shares. This description does not

purport to be a complete description of all of the rights of the Company’s

shareholders and is subject to, and qualified in its entirety by, the

provisions of its most current Bylaws and Bylaws, which are included as exhibits

to this registration statement.

Page 17 of 22

The holders of the Company’s common stock are entitled to

receive notice of and to attend and vote at all meetings of the shareholders and

each share of common stock shall confer the right to one vote in person or by

proxy at all meetings of the shareholders. Stockholders holding not less than

twenty five percent (25%) of the voting power of the Company whether present in

person or by proxy, constitute a quorum for all meetings of the stockholders.

Except as otherwise provided by the NRS, the Company’s Articles of Incorporation

or its Bylaws, all action taken by the holders of a majority of the voting power

present at the meeting, excluding abstentions, at any meeting at which a quorum

is present shall be valid and binding. In the case of certain fundamental

changes such as liquidation, merger, or change of entity type or change of

jurisdiction of incorporation, or approval of stockholders owning a majority of

the Company’s outstanding voting power is required.

Holders of the Company’s common stock are entitled to receive

such dividends in any financial year as the board of directors may determine by

resolution, provided that dividends may not be declared or paid after giving

effect to the dividend, (i) the Company would be unable to pay or liabilities as

they become due in the usual course of business, or (ii) if the sum of its total

assets would be less than the total liabilities of the Company. In the event of

its liquidation, dissolution or winding-up, whether voluntary or involuntary,

the holders of the Company’s common stock are entitled to receive, subject to

the prior rights, if any, of the holders of any other class of shares, the

remaining property and assets of the Company. The Company’s common stock does

not carry any pre-emptive, subscription, redemption or conversion rights, nor do

they contain any sinking fund provisions.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Indemnification

Chapter 78 of the NRS, pertaining to private corporations,

provides that the Company is required to indemnify its officers and directors to

the extent that they are successful in defending any actions or claims brought

against them as a result of serving in that position, including criminal, civil,

administrative or investigative actions and actions brought by or on behalf of

the Company.

Chapter 78 of the NRS further provides that the Company is

permitted (but not required) to indemnify its officers and directors for

criminal, civil, administrative or investigative actions brought against them by

third parties and for actions brought by or on behalf of the Company, even if

they are unsuccessful in defending that action, if the officer or director:

|

(a)

|

is not found liable for a breach of his or her fiduciary

duties as an officer or director or to have engaged in intentional

misconduct, fraud or a knowing violation of the law; or

|

|

|

|

|

(b)

|

acted in good faith and in a manner which he reasonably

believed to be in or not opposed to the best interests of the Company,

and, with respect to any criminal action or proceeding, had no reasonable

cause to believe that his conduct was unlawful.

|

However, with respect to actions brought by or on behalf of the

Company against its officers or directors, the Company is not permitted to

indemnify its officers or directors where they are adjudged by a court, after

the exhaustion of all appeals, to be liable to the Company or for amounts paid

in settlement to the Company, unless, and only to the extent that, a court

determines that the officers or directors are entitled to be indemnified.

The Company’s Bylaws provide that the Company will indemnify

its officers and directors to the full extent permitted by law, provided that

the Company is not required to indemnify any director or officer in connection

with any proceeding initiated by that person, unless (i) indemnification is

required by law, (ii) the Company’s Board authorized the proceeding or (iii) the

Company voluntarily indemnifies the person, as permitted under the NRS.

Page 18 of 22

Advance of Expenses

Our Bylaws provide that we will advance to any person who was

or is a party or is threatened to be made a party to any threatened, pending or

completed action, suit or proceeding, whether civil, criminal, administrative or

investigative, by reason of the fact that he is or was our director or officer,

or is or was serving at our request as a director or executive officer of

another corporation, partnership, joint venture, trust or other enterprise,

prior to the final disposition of the proceeding, promptly following request

therefor, all expenses incurred by any director or officer in connection with

such proceeding upon receipt of an undertaking by or on behalf of such person to

repay said amounts if it should be determined ultimately that such person is not

entitled to be indemnified under our Bylaws or otherwise.

Our Bylaws provide that no advance shall be made by us to our

officers (except by reason of the fact that such officer is or was our director

in which event this paragraph shall not apply) in any action, suit or

proceeding, whether civil, criminal, administrative or investigative, if a

determination is reasonably and promptly made (i) by the Board of Directors by a

majority vote of a quorum consisting of directors who were not parties to the

proceeding, or (ii) if such quorum is not obtainable, or, even if obtainable, a

quorum of disinterested directors so directs, by independent legal counsel in a

written opinion, that the facts known to the decision-making party at the time

such determination is made demonstrate clearly and convincingly that such person

acted in bad faith or in a manner that such person did not believe to be in or

not opposed to our best interests.

Insurance

To the fullest extent permitted by the NRS, the Board of

Directors, may cause the Company to purchase and maintain insurance on behalf of

any person who is or was a Director, officer, employee or agent of the Company,

or is or was serving at the request of the Company as a director, officer,

employee or agent of another corporation, or as its representative in a

partnership, joint venture, trust or other enterprise against any liability

asserted against such person and incurred in any such capacity or arising out of

such status, whether or not the Company would have the power to indemnify such

person.

Page 19 of 22

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

1.

|

Audited financial statements for the fiscal years ended

December 31, 2016, including:

|

|

(a)

|

Report of Independent Registered Accounting

Firm;

|

|

|

|

|

(b)

|

Consolidated Balance Sheet for the years ended December

31, 2015 and 2016;

|

|

|

|

|

(c)

|

Consolidated Statements of Operations for the years ended

December 31, 2015 and 2016;

|

|

|

|

|

(d)

|

Consolidated Statements of Cash Flows for the years ended

December 31, 2015 and 2016;

|

|

|

|

|

(e)

|

Consolidated Statements of Stockholders’ Equity;

and

|

|

|

|

|

(f)

|

Notes to the Financial

Statements.

|

|

2.

|

Unaudited financial statements for the Nine Month Period

Ended September 30, 2017, including:

|

|

(a)

|

Consolidated Balance Sheet for the Nine Month Period

Ended September 30, 2017;

|

|

|

|

|

(b)

|

Consolidated Statements of Operations for the Nine Month

Period Ended September 30, 2017 and 2016;

|

|

|

|

|

(c)

|

Consolidated Statements of Cash Flows for the Nine Month

Period Ended September 30, 2017 and 2016;

|

|

|

|

|

(d)

|

Consolidated Statements of Stockholders’ Equity;

and

|

|

|

|

|

(e)

|

Notes to the financial Statements

|

Page 20 of 22

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING

AND FINANCIAL DISCLOSURE

On January 13, 2017, the Company engaged Dale Matheson

Carr-Hilton Labonte LLP (“DMCL”) to act as the Company’s principal accountant

for the purpose of auditing the Company’s financial statements. The engagement

of DMCL as the Company’s principal accountant effectively dismissed the

Company’s prior independent registered public accounting firm, Davidson &

Company LLP (“Davidson”). The decision to engage DMCL and dismiss Davidson was

approved by the Company’s board of directors. The Company did not consult with

DMCL during the last two fiscal years or any subsequent interim period prior to

their engagement regarding any matter set out in Item 304(a)(2) of Regulation

S-K.

Davidson did not audit the Company’s financial statements for

the past two fiscal years. During the two most recent fiscal years and in the

subsequent interim periods preceding the engagement of DMCL, there were no

disagreements with Davidson on any matter of accounting principles or practices,