Current Report Filing (8-k)

January 31 2018 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

__________________

Date of Report (Date of earliest event reported):

January 25, 2018

__________________

GYRODYNE, LLC

___________________

(Exact name of Registrant as Specified in its Charter)

|

New York

|

|

001-37547

|

|

46-3838291

|

|

(State or other

jurisdiction

|

|

(Commission File

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification No.)

|

ONE FLOWERFIELD

SUITE 24

ST. JAMES, NEW YORK 11780

___________________

(Address of principal executive

offices) (Zip Code)

(631) 584-5400

____________________

Registrant

’s telephone number,

including area code

N/A

__________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy th

e filing obligation of the registrant under any of the following provisions:

[

] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01. Entry into a Material Definitive Agreement

Amendment to Employment Agreement

On January 25, 2018,

Gyrodyne, LLC, a New York limited liability company (the “Company”), and Peter Pitsiokos, its Executive Vice President, Chief Operating Officer, Secretary and Chief Compliance Officer, entered into Amendment No. 1 (the “Employment Agreement Amendment”) to that certain employment agreement effective as of May 15, 2014 between the Company and Mr. Pitsiokos. The Employment Agreement Amendment defines with greater specificity Mr. Pitsiokos’ duties and responsibilities with respect to the Company’s properties.

The description of the Employment Agreement Amendment in this Report

is only a summary of its material terms, does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment Agreement Amendment which is attached to this Report as Exhibit 10.1 and incorporated into this Item 1.01 by reference.

Amendment to Retention Bonus Plan

On

January 26, 2018, the Board of Directors of the Company approved Amendment No. 2 to its Retention Bonus Plan (the “Plan Amendment”). The Plan Amendment provides for (i) vesting of benefits upon the sale of each individual post-subdivision lot at Flowerfield and Cortlandt Manor, (ii) entitlement to a future benefit in the event of death, voluntary termination following substantial reduction in compensation or board fees, mutually agreed separation to right-size the board or involuntary termination without cause, and (iii) clarification of how development costs are calculated. As to any of the events referred to in clause (ii) above, a participant will only be eligible to receive a benefit to the extent that a property is sold within three years following the event and the sale produces an internal rate of return equal to at least four percent of the property’s value as of December 31 immediately preceding such event. The Plan Amendment does not have the effect of increasing the size of the participant pool, but rather only how benefits are divided among plan participants.

The description of the Plan Amendment in this Report is only a summary of its material terms, does not purport to be complete and is qualified in its entirety by reference to the full text of the Plan Amendment which is attached to this Report as Exhibit 10.

2 and incorporated into this Item 1.01 by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

Forward-Looking Statement Safe Harbor

The statements made in this

report that are not historical facts constitute "forward-looking information" within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as "may," "will," "anticipates," "expects," "projects," "estimates," "believes," "seeks," "could," "should," or "continue," the negative thereof, other variations or comparable terminology as well as statements regarding the evaluation of strategic alternatives. Important factors, including certain risks and uncertainties, with respect to such forward-looking statements that could cause actual results to differ materially from those reflected in such forward-looking statements include, but are not limited to, risks and uncertainties relating to the plan of liquidation, the risk that the proceeds from the sale of Gyrodyne, LLC's assets may be substantially below Gyrodyne, LLC's estimates, the risk that the proceeds from the sale of our assets may not be sufficient to satisfy Gyrodyne, LLC's obligations to its current and future creditors, and other unforeseeable expenses related to the proposed liquidation, the tax treatment of condemnation proceeds, the effect of economic and business conditions, including risks inherent in the real estate markets of Suffolk and Westchester Counties in New York, risks and uncertainties relating to developing Gyrodyne, LLC's undeveloped property in St. James, New York and other risks detailed from time to time in Gyrodyne, LLC's SEC reports.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

GYRODYNE, LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/

Gary Fitlin

|

|

|

|

|

Gary Fitlin

|

|

|

|

|

President and Chief Executive Officer

|

|

Date: January 30, 2018

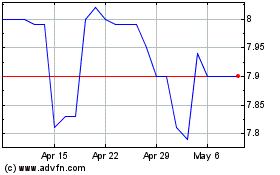

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024