Dynex Capital, Inc. Announces 2017 Dividend Tax Information

January 31 2018 - 8:42AM

Business Wire

Dynex Capital, Inc. (NYSE: DX) today announced tax information

with respect to its 2017 Common Stock, Series A Preferred Stock and

Series B Preferred Stock dividends.

Dividend Tax Information

We are providing the information below to assist shareholders

with their tax reporting requirements relating to the dividend

distributions by Dynex Capital, Inc. (“Dynex” or the “Company”). As

detailed below, dividends paid by Dynex on its Common Stock were in

part ordinary taxable income and in part a return of capital. No

portion of the dividends paid in 2017 were capital gains. The

distributions of ordinary taxable income are not eligible for the

tax rate reductions enacted for qualified dividend income under the

Jobs and Growth Tax Relief Reconciliation Act of 2003 and are

accordingly being reported as non-qualifying dividends.

Shareholders should review the 2017 tax statements and/or Forms

1099 that they receive from their brokerage firms in order to

ensure that the dividend distribution information reported on such

statements conforms to the information set forth in this press

release.

The table below provides a summary of the tax information

relating to the quarterly dividend distributions of the Company for

the 2017 tax year:

Dynex Capital, Inc. Common Stock (CUSIP 26817Q506)

DividendRecordDate

PaymentDate

Dividendsper Share

Ordinary Income

CapitalGainDistribution

Return of Capital 12/29/2017 01/31/2018 $0.18 $0.0537977

$0.00 $0.1262023 10/03/2017 10/31/2017 $0.18 $0.0537977 $0.00

$0.1262023 07/06/2017 07/28/2017 $0.18 $0.0537977 $0.00 $0.1262023

04/05/2017 04/28/2017 $0.18 $0.0537977 $0.00

$0.1262023 $0.72 $0.2151908 $0.00 $0.5048092

Dynex Capital, Inc. Series A Preferred Stock (CUSIP

26817Q704)

DividendRecordDate

PaymentDate

Dividends perShare

OrdinaryIncome

Capital GainDistribution

Return ofCapital

10/01/2017 10/15/2017 $0.53125000 $0.5312500 $0.00 $0.00 07/01/2017

07/15/2017 $0.53125000 $0.5312500 $0.00 $0.00 04/01/2017 04/15/2017

$0.53125000 $0.5312500 $0.00 $0.00 01/01/2017 01/15/2017

$0.53125000 $0.5312500 $0.00 $0.00 $2.12500000

$2.1250000 $0.00 $0.00

Dynex Capital, Inc. Series B Preferred Stock (CUSIP

26817Q803)

DividendRecordDate

PaymentDate

Dividends perShare

OrdinaryIncome

Capital GainDistribution

Return ofCapital

10/01/2017 10/15/2017 $0.47656250 $0.47656250 $0.00 $0.00

07/01/2017 07/15/2017 $0.47656250 $0.47656250 $0.00 $0.00

04/01/2017 04/15/2017 $0.47656250 $0.47656250 $0.00 $0.00

01/01/2017 01/15/2017 $0.47656250 $0.47656250 $0.00

$0.00 $1.90625000 $1.90625000 $0.00

$0.00

Tax Disclaimer

The information above should not be construed as tax advice and

is not a substitute for careful tax planning and analysis.

Shareholders should consult their tax advisors regarding the

specific federal, state, local, foreign and other tax consequences

to them regarding their ownership of shares of the Company’s Common

and Preferred stock.

Dynex Capital, Inc. is an internally managed real estate

investment trust, or REIT, which invests in mortgage assets on a

leveraged basis. The Company invests in Agency and non-Agency

RMBS, CMBS, and CMBS IO. Additional information about Dynex

Capital, Inc. is available at www.dynexcapital.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180131005743/en/

Dynex Capital, Inc.Alison Griffin,

804-217-5897

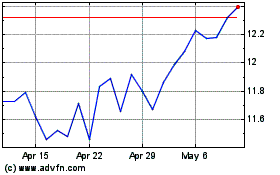

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Mar 2024 to Apr 2024

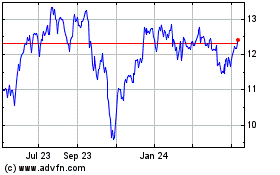

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Apr 2023 to Apr 2024