Republic Bancorp, Inc. (NASDAQ: RBCAA), headquartered

in Louisville, Kentucky, is the holding company of Republic Bank

& Trust Company (the “Bank”).

Republic Bancorp, Inc. (“Republic” or the “Company”) is pleased

to report pre-tax earnings of $16.6 million for the fourth quarter

of 2017, an 11% increase from the same period in 2016. The

Company’s fourth quarter 2017 net income and Diluted Earnings per

Class A Common Share both decreased 52% to $4.8 million and $0.23,

with comparability to the prior period of both key metrics

significantly impacted by a $6.3 million charge to income tax

expense upon remeasurement of the Company’s net deferred tax assets

(“DTAs”)(1) precipitated by tax reform and common among financial

institutions. Without this charge, net income and Diluted Earnings

per Class A Common Share for the fourth quarter of 2017 would have

been $11.2 million and $0.53, with these non-GAAP(2) metrics

representing increases of 12% and 10% over the fourth quarter of

2016.

As it relates to the Company’s charge to income tax expense upon

remeasurement of its net DTAs during the quarter, on December 22,

2017, President Donald Trump signed into law the “Tax Cuts and Jobs

Act” (the “TCJA”). The TCJA, among other things, reduces the

federal corporate tax rate from 35% to 21%, effective January 1,

2018. As a result of the reduced tax rate, Republic and many other

financial institutions incurred charges to income tax expense

representing the decrease in the value of their net DTAs. In

general, net DTAs represent the future benefits of tax deductions

that the Company has recognized in a current or prior period for

its GAAP-based financial statements, as compared to what it expects

to record in the future for its income tax returns when those

deductions can be realized for tax purposes.

Fiscal year 2017 net income was $45.6 million, a less than 1%

decrease from fiscal 2016, resulting in Diluted Earnings per Class

A Common Share of $2.20. As with the comparability between the

fourth quarters of 2017 and 2016, comparability between the fiscal

years of 2017 and 2016 was also significantly impacted by the

TCJA-driven charge to income tax expense of $6.3 million as

mentioned above. Excluding the impact of this charge, net income

for 2017 would have been $52.0 million with Diluted Earnings per

Class A Common Share of $2.50, with both of these non-GAAP metrics

representing an increase of 13% over 2016.

Steve Trager, Chairman & Chief Executive Officer of

Republic, commented, “Before addressing tax reform, let me say that

I am very excited to see solid growth in our pre-tax earnings from

the same quarter a year ago. Largely driven by loan growth and

complemented by expansion in our net interest margin, our top-line

revenue for the fourth quarter of 2017 increased a strong $9.0

million, or 22%, over the same period in 2016. Furthermore, credit

quality metrics within our Core Banking(3) operations continue to

remain quite strong from period to period. On the other side of the

ledger, I am thrilled about our $272 million, or 9%, growth in

deposits during 2017, with $195 million of that growth representing

‘core deposits’(4). We set deposit growth as one of our main goals

for 2017, and I would like to acknowledge the entire Republic team

for their efforts in this growth.

“Regarding tax reform, while the new law had a negative impact

on the net income and the carrying value of the net DTAs of most

financial institutions during the fourth quarter, including

Republic, we embrace the benefits of the reduced federal tax rate

in the years to come. While there remains a level of uncertainty

regarding how this new law will impact consumer behavior and the

many products and services that we offer, we are optimistic that

over the long term it will provide us more flexibility in

attracting new clients and new associates, while at the same time

providing a greater return to our shareholders,” concluded Steve

Trager.

The following table presents Republic’s financial performance in

accordance with GAAP for the fourth quarters and years ended

December 31, 2017 and 2016, along with adjusted non-GAAP

performance and a reconciliation to GAAP for the impact of the

previously mentioned charge to income tax expense during the fourth

quarter of 2017. The non-GAAP presentation and the reconciliation

to GAAP are presented to allow appropriate comparability between

the reported periods and to illustrate the impact of the

TCJA-driven charge to income tax expense on the Company’s financial

performance.

(dollars in

thousands, except per share data)

Financial

Performance Highlights

Three Months Ended Dec. 31, $ %

Years Ended Dec. 31, $ % 2017

2016 Change Change 2017 2016

Change Change TOTAL COMPANY: Income before

income tax expense - GAAP* $ 16,612 $ 14,960 $ 1,652 11 % $

78,386 $ 68,963 $ 9,423 14 %

Net income: Net income -

GAAP* $ 4,838 $ 10,000 $ (5,162 ) (52 )% $ 45,632 $ 45,903 $ (271 )

(1 )% Impact of TCJA(1)* 6,326 —

6,326 NM 6,326 — 6,326

NM Adjusted net income - Non-GAAP $ 11,164 $ 10,000

$ 1,164 12 $ 51,958 $ 45,903 $ 6,055

13

Diluted earnings per share (“EPS”) of

Class A Common Stock:

Diluted EPS of Class A Common Stock - GAAP $ 0.23 $ 0.48 $ (0.25 )

(52 )% $ 2.20 $ 2.22 $ (0.02 ) (1 )% Impact of TCJA 0.30

— 0.30 NM 0.30

— 0.30 NM Adjusted diluted EPS of Class

A Common Stock - Non-GAAP $ 0.53 $ 0.48 $ 0.05

10 $ 2.50 $ 2.22 $ 0.28 13

Return on average assets

(“ROA”):

ROA - GAAP 0.39 % 0.87 % NA (55 )% 0.95 % 1.02 % NA (7 )% Impact of

TCJA 0.51 — NA NM 0.13

— NA NM Adjusted ROA - Non-GAAP 0.90

0.87 NA 3 1.08 1.02 NA 6

Return on average equity

(“ROE”):

ROE - GAAP 3.02 % 6.62 % NA (54 )% 7.26 % 7.68 % NA (5 )% Impact of

TCJA 3.95 — NA NM 1.01

— NA NM Adjusted ROE - Non-GAAP 6.97

6.62 NA 5 8.27 7.68 NA 8

CORE

BANK(3): Income before income tax expense $

17,105 $ 14,869 $ 2,236 15 % $ 56,545 $ 51,636 $ 4,909 10 %

Net income: Net income - GAAP $ 6,883 $ 9,939 $ (3,056 ) (31

)% $ 33,448 $ 34,859 $ (1,411 ) (4 )% Impact of TCJA 4,594

— 4,594 NM 4,594

— 4,594 NM Adjusted net income -

Non-GAAP $ 11,477 $ 9,939 $ 1,538 15 $ 38,042

$ 34,859 $ 3,183 9

REPUBLIC PROCESSING GROUP(5):

Income (loss) before income tax expense $ (493 ) $ 91 $ (584

) NM $ 21,841 $ 17,327 $ 4,514 26 %

Net income

(loss): Net income (loss) - GAAP $ (2,045 ) $ 61 $ (2,106 ) NM

$ 12,184 $ 11,044 $ 1,140 10 % Impact of TCJA 1,732

— 1,732 NM 1,732 —

1,732 NM Adjusted net income (loss) - Non-GAAP

$ (313 ) $ 61 $ (374 ) NM $ 13,916 $ 11,044 $

2,872 26

NA – Not applicable

NM – Not meaningful

*See Segment Data at the end of this

Earnings Release

Results of Operations for the Fourth

Quarter of 2017 Compared to the Fourth Quarter of

2016

Core Bank(3) – Net income from Core Banking was

$6.9 million for the fourth quarter of 2017, a decrease of $3.1

million from the fourth quarter of 2016. Approximately $4.6 million

of the Company’s TCJA-driven charge to income tax expense was tied

to the Core Bank. Excluding the previously mentioned charge to

income tax expense, Core Bank non-GAAP net income (as adjusted) for

the fourth quarter of 2017 would have increased $1.5 million, or

15%, from the fourth quarter of 2016.

Core Bank net interest income increased $6.3 million, or 17%,

over the fourth quarter of 2016. The growth in net interest income

was propelled by a 30-basis-point rise in the Core Bank’s net

interest margin for the fourth quarter of 2017 to 3.72% and further

complemented by a $137 million, or 4%, increase in the Core Bank’s

quarterly average loans.

The overall change in the Core Bank’s net

interest income, as well as average and period-end loan balances by

origination channel, is presented below:

Net Interest

Income for the (dollars in thousands)

Three Months Ended Dec. 31, Origination Channel

2017 2016

$ Change

% Change Traditional Network $ 37,529 $

31,604 $ 5,925 19 % Warehouse Lending 4,460 5,160 (700 ) (14 )

Correspondent Lending 247 336 (89 ) (26 ) 2012-FDIC Acquired Loans

1,648 525 1,123 214 Total Core Bank $

43,884 $ 37,625 $ 6,259 17

Average Loan

Balances Period-End Loan Balances (dollars in thousands)

Three Months Ended Dec. 31, Dec. 31, Origination

Channel 2017 2016

$ Change

% Change 2017 2016

$ Change

% Change Traditional Network $ 3,247,472 $ 3,003,553

$ 243,919 8 % $ 3,286,582 $ 3,022,305 $ 264,277 9 % Warehouse

Lending 523,725 590,196 (66,471 ) (11 ) 525,573 585,439 (59,866 )

(10 ) Correspondent Lending 120,734 152,481 (31,747 ) (21 ) 116,792

149,028 (32,236 ) (22 ) 2012-FDIC Acquired Loans 6,836

15,672 (8,836 ) (56 ) 6,551 15,059

(8,508 ) (57 ) Total Core Bank $ 3,898,767 $ 3,761,902 $

136,865 4 $ 3,935,498 $ 3,771,831 $ 163,667 4

The following factors were the primary drivers of the changes in

the Core Bank’s net interest income and average loan balances by

origination channel for the fourth quarter of 2017, as compared to

the fourth quarter of 2016:

- The Core Bank’s Traditional Network

experienced solid average loan growth of $244 million from the

fourth quarter of 2016 to the fourth quarter of 2017. The overall

mix of this growth was well diversified, with average balance

increases of $149 million in commercial real estate; $79 million in

commercial and industrial; and $35 million in the construction and

development category.

- The Core Bank’s Traditional Network

received a favorable payoff of a purchased credit-impaired loan

acquired in the Company’s 2016 acquisition of Cornerstone Bancorp,

Inc. This favorable payoff contributed approximately $670,000 of

non-recurring interest income and approximately six basis points of

net interest margin to the Core Bank for the fourth quarter of

2017.

- The Core Bank’s 2012 FDIC-Acquired

loans contributed $1.1 million more in net interest income during

the fourth quarter of 2017 compared to the same period in 2016,

resulting from the payoff of one large loan and a credit to income

of $1.6 million of discount associated with this loan. Overall,

accretion income from the 2012 FDIC-Acquired loans contributed 13

basis points to the Core Bank’s net interest margin during the

fourth quarter of 2017 compared to a one-basis-point contribution

for the same period in 2016. Prospective accretion income related

to these loans is expected to be nominal, as the substantial

majority of discount accretion from these loans has now been

recognized.

- Within the Warehouse segment, net

interest income decreased $700,000, or 14%, from the fourth quarter

of 2016, as an increase in mortgage interest rates during the

quarter contributed to a decline in client usage of the Bank’s

Warehouse lines of credit. Overall, usage rates decreased from 58%

during the fourth quarter of 2016 to 50% for the fourth quarter of

2017. Primarily as a result of this factor, average outstanding

Warehouse line-of-credit balances for the fourth quarter of 2017

were $524 million, a $66 million, or 11%, decrease from a robust

fourth quarter in 2016.

The Core Bank’s provision expense for the fourth quarters of

2017 and 2016 primarily represented general loss reserves driven by

growth in the loan portfolio during the two periods. The Core

Bank’s credit quality metrics remained favorable, as indicated by

the table below:

As of and for the:

Quarters Ended: Years Ended: Dec.

31, Sep. 30, Jun. 30,

Mar. 31,

Dec. 31, Dec. 31, Dec.

31, Core Banking Credit Quality Ratios

2017

2017 2017 2017

2017 2016 2015

Nonperforming loans to total loans

0.36 % 0.40 % 0.40

% 0.46 %

0.36 % 0.42 % 0.66 % Nonperforming

assets to total loans (including OREO)

0.36 0.40 0.41 0.50

0.36 0.46 0.70 Delinquent loans to total loans(6)

0.21 0.20 0.18 0.16

0.21 0.18 0.35 Net

charge-offs to average loans

0.06 0.03 0.05 0.02

0.04

0.05 0.05 (Quarterly rates annualized)

OREO

= Other Real Estate Owned

Noninterest income for the Core Bank was $7.9 million during the

fourth quarter of 2017, a $24,000 increase from the fourth quarter

of 2016. Notable fluctuations in noninterest income for the quarter

included the following items:

- Interchange fees increased $247,000

primarily due to an 11% year-over-year growth in active debit

cards.

- Partially offsetting the increase

above, the Core Bank recorded $136,000 in losses on the sale of two

securities during the fourth quarter of 2017, with no similar sales

during the fourth quarter of 2016.

Core Bank noninterest expenses increased $4.5 million, or 16%,

from the fourth quarter of 2016 to the same period in 2017.

Comparability of noninterest expense between the two quarters was

impacted by adjustments to the Core Bank’s incentive compensation

accruals, which were made during both periods to bring accrual

balances in line with projected payouts. As a result of these

adjustments, net incentive compensation expense was a net charge of

$457,000 for the fourth quarter of 2017 compared to a net credit of

$393,000 for the fourth quarter of 2016. Excluding the impact of

the change in incentive compensation expense, noninterest expense

increased $3.9 million, or 13%, for the fourth quarter of 2017, as

compared to the fourth quarter of 2016 and was primarily driven by

the following:

- Salaries and employee benefits expense

increased $2.2 million, or 13%, as the Core Bank’s

full-time-equivalent employees increased by 46 employees during

2017 to support the Core Bank’s strategic initiatives.

- Occupancy expense increased $919,000,

primarily due to increases in rent, depreciation, and equipment

service expense resulting from new locations, existing banking

center renovations and the cost of technology to support the Core

Bank’s strategic initiatives.

- Data processing expense increased

$823,000, with a large portion of this increase due to estimated

conversion-related expenses for an upcoming change to the Company’s

digital-banking vendor for its commercial clients.

Republic Processing Group(5)

Republic Processing Group (“RPG”) reported a net loss of $2.0

million for the fourth quarter of 2017 compared to net income of

$61,000 for the same period in 2016. Approximately $1.7 million of

the Company’s TCJA-driven charge to income tax expense was tied to

RPG. Excluding the previously mentioned charge to income tax

expense, RPG would have reflected a $313,000 non-GAAP loss (as

adjusted) for the fourth quarter of 2017.

Within the Republic Credit Solutions (“RCS”) segment of RPG, net

income decreased $1.6 million primarily due to RCS’s $1.7 million

portion of the TCJA-driven charge to income tax expense. Pre-tax

earnings for RCS increased to $2.6 million for the fourth quarter

of 2017 compared to $2.4 million for the same period in 2016. The

nominal increase in pre-tax earnings at RCS was primarily driven by

growth in net interest income and largely offset by greater

provisions for loan losses, with the change in both income

statement categories resulting from a higher volume of RCS’s

line-of-credit product during the fourth quarter of 2017 as

compared to the fourth quarter of 2016.

The Tax Refund Solutions (“TRS”) segment of RPG reported an

expected net loss of $2.0 million for the fourth quarter of 2017

compared to a net loss of $1.5 million during the fourth quarter of

2016. The higher net loss for the fourth quarter of 2017 was

primarily driven by a $673,000 increase in salaries and employee

benefits expense resulting from additional contract labor retained

to prepare for the 2018 tax season. The TRS segment derives

substantially all of its revenues during the first and second

quarters of the year and historically operates at a net loss during

the second half of the year, as the Company prepares for the next

tax season.

Republic Bancorp, Inc. (the “Company”) is the parent company of

Republic Bank & Trust Company (the “Bank”). The Bank currently

has 44 full-service banking centers and one loan production office

throughout five states: 32 banking centers in 11 Kentucky

communities - Covington, Elizabethtown, Florence, Frankfort,

Georgetown, Independence, Lexington, Louisville, Owensboro,

Shelbyville and Shepherdsville; three banking centers in southern

Indiana – Floyds Knobs, Jeffersonville and New Albany; six banking

centers in five Florida communities (Tampa MSA) – Largo, Port

Richey, St. Petersburg, Seminole, and Temple Terrace; two banking

centers in two Tennessee communities (Nashville MSA) – Cool Springs

(Franklin) and Green Hills (Nashville) and one loan production

office in Brentwood (Nashville); and one banking center in Norwood

(Cincinnati), Ohio. The Bank offers internet banking at

www.republicbank.com. The Bank also offers separately-branded,

nation-wide digital banking at www.mymemorybank.com. The Company

has $5.1 billion in assets and is headquartered in Louisville,

Kentucky. The Company’s Class A Common Stock is listed under the

symbol “RBCAA” on the NASDAQ Global Select Market.

Republic Bank. It’s just easier here. ®

Forward-Looking StatementsThis press release contains

certain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements in the preceding paragraphs are based on

our current expectations and assumptions regarding our business,

the future impact to our balance sheet and income statement

resulting from changes in interest rates, the ability to develop

products and strategies in order to meet the Company’s long-term

strategic goals, the economy, information concerning the impact of

the TCJA, and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Our actual results may differ materially from

those contemplated by forward-looking statements. We caution you

therefore against relying on any of these forward-looking

statements. They are neither statements of historical fact nor

guarantees or assurances of future performance. Actual results

could differ materially based upon factors disclosed from time to

time in the Company’s filings with the U.S. Securities and Exchange

Commission, including those factors set forth as “Risk Factors” in

the Company’s Annual Report on Form 10-K for the period ended

December 31, 2016. The Company undertakes no obligation to update

any forward-looking statements. These forward-looking statements

are made only as of the date of this release, and the Company

undertakes no obligation to release revisions to these

forward-looking statements to reflect events or conditions after

the date of this release.

Republic Bancorp, Inc. Financial

Information

Fourth Quarter 2017 Earnings

Release

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Balance Sheet Data

Dec. 31, 2017 Dec. 31, 2016 Assets: Cash and

cash equivalents $ 299,351 $ 289,309 Investment securities 591,458

534,139 Loans held for sale 16,989 15,170 Loans 4,014,034 3,810,778

Allowance for loan and lease losses (42,769 ) (32,920

) Loans, net 3,971,265 3,777,858 Federal Home Loan Bank stock, at

cost 32,067 28,208 Premises and equipment, net 45,605 42,869

Goodwill 16,300 16,300

Other real estate owned (“OREO”)

115 1,391

Bank owned life insurance (“BOLI”)

63,356 61,794 Other assets and accrued interest receivable

48,856 49,271 Total assets $ 5,085,362

$ 4,816,309

Liabilities and Stockholders’

Equity:

Deposits: Noninterest-bearing $ 1,022,042 $ 971,952

Interest-bearing 2,411,116 2,188,740

Total deposits 3,433,158 3,160,692 Securities sold under

agreements to repurchase and other short-term borrowings 204,021

173,473 Federal Home Loan Bank advances 737,500 802,500

Subordinated note 41,240 41,240 Other liabilities and accrued

interest payable 37,019 33,998 Total

liabilities 4,452,938 4,211,903

Stockholders’ equity

632,424 604,406

Total liabilities and Stockholders’

equity

$ 5,085,362 $ 4,816,309

Average Balance Sheet

Data Three Months Ended Dec. 31, Years Ended Dec.

31, 2017 2016 2017 2016

Assets: Investment securities, including FHLB stock $

559,381 $ 571,158 $ 574,027 $ 572,599 Federal funds sold and other

interest-earning deposits 229,638 57,950 188,427 130,889 Loans and

fees, including loans held for sale 3,967,211 3,792,902 3,831,406

3,568,383 Total interest-earning assets 4,756,230 4,422,010

4,593,860 4,271,871 Total assets 4,953,134 4,622,760 4,826,208

4,485,829

Liabilities and Stockholders’

Equity:

Noninterest-bearing deposits $ 1,045,939 $ 950,020 $ 1,073,181 $

894,049 Interest-bearing deposits 2,383,196 2,197,411 2,267,663

2,058,592

Securities sold under agreements to

repurchase and other short-term borrowings

271,434 231,817 219,515 280,296 Federal Home Loan Bank advances

537,326 570,135 563,552 583,591 Subordinated note 41,240 41,240

41,240 42,502 Total interest-bearing liabilities 3,233,196

3,040,603 3,091,970 2,964,981

Stockholders’ equity

640,686 604,095 628,329 597,463

Republic Bancorp, Inc. Financial

Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Income Statement Data Three Months Ended Dec.

31, Years Ended Dec. 31, 2017 2016

2017 2016 Total interest income(7) $ 56,349 $

45,903 $ 218,778 $ 173,992 Total interest expense 5,711

4,258 20,258 17,938 Net interest

income 50,638 41,645 198,520 156,054 Provision for loan and

lease losses 6,071 5,004 27,704 14,493 Noninterest income:

Service charges on deposit accounts 3,325 3,338 13,357 13,176 Net

refund transfer fees 171 121 18,500 19,240 Mortgage banking income

935 980 4,642 6,882 Interchange fee income 2,533 2,254 9,881 9,009

Program fees 1,851 1,102 5,824 3,044 Increase in cash surrender

value of BOLI 384 402 1,562 1,516 Losses on securities available

for sale (136 ) — (136 ) — Net gains on OREO 254 53 676 244 Other

873 2,235 4,108 4,398

Total noninterest income 10,190 10,485

58,414 57,509 Noninterest expenses: Salaries

and employee benefits 20,502 16,917 82,233 69,882 Occupancy and

equipment, net 6,518 5,618 25,194 21,777 Communication and

transportation 1,261 1,282 4,711 4,256 Marketing and development

1,098 1,005 5,188 3,778 FDIC insurance expense 328 297 1,378 1,780

Bank franchise tax expense 652 813 4,626 4,757 Data processing

2,606 1,586 7,748 6,121 Interchange related expense 931 1,071 3,988

4,140 Supplies 565 437 1,594 1,406 OREO expense 104 148 388 503

Legal and professional fees 616 591 2,410 2,556 FHLB advance

prepayment penalty — — — 846 Other 2,964 2,401

11,386 8,305 Total noninterest expenses

38,145 32,166 150,844 130,107

Income before income tax expense 16,612 14,960 78,386 68,963

Income tax expense: Income tax expense - TCJA(1) 6,326 —

6,326 — Income tax expense - Other 5,448 4,960

26,428 23,060 Total income tax expense

11,774 4,960 32,754 23,060

Net income $ 4,838 $ 10,000 $ 45,632 $ 45,903

Republic Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Selected Data and Ratios

Three Months Ended Dec.

31, Years Ended Dec. 31, 2017 2016

2017 2016 Per Share Data: Basic

weighted average shares outstanding 21,149 20,926 20,921 20,942

Diluted weighted average shares outstanding 21,258 20,941 21,007

20,954 Period-end shares outstanding: Class A Common Stock

18,607 18,615 18,607 18,615 Class B Common Stock 2,243 2,245 2,243

2,245 Book value per share(8) $ 30.33 $ 28.97 $ 30.33 $

28.97 Tangible book value per share(8) 29.27 27.89 29.27 27.89

Earnings per share (“EPS”):

Basic EPS - Class A Common Stock $ 0.23 $ 0.48 $ 2.21 $ 2.22 Basic

EPS - Class B Common Stock 0.21 0.44 2.01 2.02 Diluted EPS - Class

A Common Stock 0.23 0.48 2.20 2.22 Diluted EPS - Class B Common

Stock 0.21 0.44 2.00 2.01 Cash dividends declared per Common

share: Class A Common Stock $ 0.220 $ 0.209 $ 0.869 $ 0.825 Class B

Common Stock 0.200 0.190 0.790 0.750

Performance

Ratios: Return on average assets 0.39 % 0.87 % 0.95 %

1.02 % Return on average equity 3.02 6.62 7.26 7.68 Efficiency

ratio(9) 63 62 59 61 Yield on average interest-earning assets(7)

4.74 4.15 4.76 4.07 Cost of average interest-bearing liabilities

0.71 0.56 0.66 0.60 Cost of average deposits(10) 0.35 0.22 0.29

0.21 Net interest spread(7) 4.03 3.59 4.10 3.47 Net interest margin

- Total Company(7) 4.26 3.77 4.32 3.65 Net interest margin - Core

Bank(3) 3.72 3.42 3.55 3.30

Other Information:

End of period FTEs(11) - Total Company 997 938 997 938 End of

period FTEs - Core Bank 915 869 915 869 Number of full-service

banking centers 44 44 44 44

Republic Bancorp, Inc.

Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Credit Quality Data and Ratios As of

and for the As of and for the Three

Months Ended Dec. 31, Years Ended Dec. 31, 2017

2016 2017 2016

Credit Quality Asset Balances: Nonperforming

Assets - Total Company: Loans on nonaccrual status $ 14,118 $

15,892 $ 14,118 $ 15,892 Loans past due 90-days-or-more and still

on accrual 956 167 956

167 Total nonperforming loans 15,074 16,059 15,074

16,059 OREO 115 1,391 115

1,391 Total nonperforming assets - Total Company $

15,189 $ 17,450 $ 15,189 $ 17,450

Nonperforming Assets - Core Bank(3): Loans on

nonaccrual status $ 14,118 $ 15,892 $ 14,118 $ 15,892 Loans past

due 90-days-or-more and still on accrual 19 85

19 85 Total nonperforming loans

14,137 15,977 14,137 15,977 OREO 115 1,391

115 1,391 Total nonperforming

assets - Core Bank $ 14,252 $ 17,368 $ 14,252

$ 17,368

Delinquent loans: Delinquent loans -

Core Bank $ 8,460 $ 6,821 $ 8,460 $ 6,821 Delinquent loans - RPG(5)

5,641 2,137 5,641

2,137 Total delinquent loans - Total Company $ 14,101

$ 8,958 $ 14,101 $ 8,958

Credit Quality Ratios - Total Company: Nonperforming

loans to total loans 0.38 % 0.42 % 0.38 % 0.42 % Nonperforming

assets to total loans (including OREO) 0.38 0.46 0.38 0.46

Nonperforming assets to total assets 0.30 0.36 0.30 0.36 Allowance

for loan and lease losses to total loans 1.07 0.86 1.07 0.86

Allowance for loan and lease losses to nonperforming loans 284 205

284 205 Delinquent loans to total loans(6) 0.35 0.24 0.35 0.24 Net

charge-offs to average loans (annualized) 0.35 0.27 0.47 0.25

Credit Quality Ratios - Core Bank:

Nonperforming loans to total loans 0.36 % 0.42 % 0.36 % 0.42 %

Nonperforming assets to total loans (including OREO) 0.36 0.46 0.36

0.46 Nonperforming assets to total assets 0.28 0.36 0.28 0.36

Allowance for loan and lease losses to total loans 0.77 0.74 0.77

0.74 Allowance for loan and lease losses to nonperforming loans 213

175 213 175 Delinquent loans to total loans 0.21 0.18 0.21 0.18 Net

charge-offs to average loans (annualized) 0.06 0.09 0.04 0.05

Republic Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per

share amounts, number of employees and number of banking centers

are expressed in thousands unless otherwise noted)

Balance Sheet Data

Quarterly Comparison

Dec. 31, 2017 Sep. 30, 2017 Jun. 30, 2017

Mar. 31, 2017 Dec. 31, 2016 Assets: Cash and

cash equivalents $ 299,351 $ 329,862 $ 332,695 $ 206,187 $ 289,309

Investment securities 591,458 523,896 525,684 578,130 534,139 Loans

held for sale 16,989 13,135 11,756 10,292 15,170 Loans 4,014,034

3,957,512 3,916,320 3,710,376 3,810,778 Allowance for loan and

lease losses (42,769 ) (40,191 ) (37,898 )

(42,362 ) (32,920 ) Loans, net 3,971,265 3,917,321

3,878,422 3,668,014 3,777,858 Federal Home Loan Bank stock, at cost

32,067 32,067 32,067 28,208 28,208 Premises and equipment, net

45,605 44,845 44,255 43,962 42,869 Goodwill 16,300 16,300 16,300

16,300 16,300 Other real estate owned 115 167 300 1,362 1,391 Bank

owned life insurance 63,356 62,972 62,578 62,185 61,794 Other

assets and accrued interest receivable 48,856

52,609 51,604 50,152

49,271 Total assets $ 5,085,362 $ 4,993,174 $

4,955,661 $ 4,664,792 $ 4,816,309

Liabilities and Stockholders’

Equity:

Deposits: Noninterest-bearing $ 1,022,042 $ 1,040,414 $ 1,061,637 $

1,070,237 $ 971,952 Interest-bearing 2,411,116

2,309,315 2,072,301 2,278,547

2,188,740 Total deposits 3,433,158 3,349,729

3,133,938 3,348,784 3,160,692

Securities sold under agreements to

repurchase and other short-term borrowings

204,021 173,311 113,334 144,375 173,473 Federal Home Loan Bank

advances 737,500 757,500 1,002,500 467,500 802,500 Subordinated

note 41,240 41,240 41,240 41,240 41,240 Other liabilities and

accrued interest payable 37,019 38,107

37,758 42,229 33,998

Total liabilities 4,452,938 4,359,887 4,328,770 4,044,128 4,211,903

Stockholders’ equity

632,424 633,287 626,891

620,664 604,406

Total liabilities and Stockholders’

equity

$ 5,085,362 $ 4,993,174 $ 4,955,661 $

4,664,792 $ 4,816,309

Average Balance

Sheet Data Quarterly Comparison Dec. 31, 2017

Sep. 30, 2017 Jun. 30, 2017 Mar. 31, 2017

Dec. 31, 2016 Assets: Investment securities,

including FHLB stock $ 559,381 $ 552,821 $ 597,818 $ 586,621 $

571,158 Federal funds sold and other interest-earning deposits

229,638 208,688 130,650 184,007 57,950 Loans and fees, including

loans held for sale 3,967,211 3,875,420 3,730,379 3,749,738

3,792,902 Total interest-earning assets 4,756,230 4,636,929

4,458,847 4,520,366 4,422,010 Total assets 4,953,134 4,834,653

4,668,048 4,847,700 4,622,760

Liabilities and Stockholders’

Equity:

Noninterest-bearing deposits $ 1,045,939 $ 1,052,162 $ 1,063,215 $

1,132,591 $ 950,020 Interest-bearing deposits 2,383,196 2,249,436

2,224,127 2,212,219 2,197,411

Securities sold under agreements to

repurchase and other short-term borrowings

271,434 208,160 179,594 218,412 231,817 Federal Home Loan Bank

advances 537,326 618,750 500,027 598,167 570,135 Subordinated note

41,240 41,240 41,240 41,240 41,240 Total interest-bearing

liabilities 3,233,196 3,117,586 2,944,988 3,070,038 3,040,603

Stockholders’ equity

640,686 633,874 627,940 610,429 604,095

Republic

Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Income Statement Data

Three Months Ended

Dec. 31, 2017 Sep. 30, 2017 Jun. 30, 2017

Mar. 31, 2017 Dec. 31, 2016 Total interest

income(7) $ 56,349 $ 53,725 $ 47,821 $ 60,883 $ 45,903 Total

interest expense 5,711 5,418 4,684

4,445 4,258 Net interest income 50,638 48,307 43,137

56,438 41,645 Provision for loan and lease losses 6,071

4,221 5,061 12,351 5,004 Noninterest income: Service charges

on deposit accounts 3,325 3,395 3,390 3,247 3,338 Net refund

transfer fees 171 177 2,770 15,382 121 Mortgage banking income 935

1,102 1,445 1,160 980 Interchange fee income 2,533 2,475 2,547

2,326 2,254 Program fees 1,851 1,597 1,284 1,091 1,102 Increase in

cash surrender value of BOLI 384 394 393 391 402 Losses on

securities available for sale (136 ) — — — — Net gains on OREO 254

31 249 142 53 Other 873 1,203 849

1,184 2,235 Total noninterest income 10,190

10,374 12,927 24,923 10,485

Noninterest expenses: Salaries and employee benefits 20,502

20,505 20,015 21,211 16,917 Occupancy and equipment, net 6,518

6,806 5,903 5,967 5,618 Communication and transportation 1,261

1,239 939 1,272 1,282 Marketing and development 1,098 1,677 1,409

1,004 1,005 FDIC insurance expense 328 300 300 450 297 Bank

franchise tax expense 652 749 790 2,435 813 Data processing 2,606

1,795 1,695 1,652 1,586 Interchange related expense 931 928 1,071

1,058 1,071 Supplies 565 241 261 527 437 OREO expense 104 55 132 97

148 Legal and professional fees 616 446 596 752 591 FHLB advance

prepayment penalty — — — — — Other 2,964 3,285

2,623 2,514 2,401 Total noninterest expenses

38,145 38,026 35,734 38,939

32,166 Income before income tax expense 16,612 16,434

15,269 30,071 14,960 Income tax expense: Income tax expense

- TCJA(1) 6,326 — — — — Income tax expense - Other 5,448

5,728 5,198 10,054 4,960 Total

income tax expense 11,774 5,728 5,198

10,054 4,960 Net income $ 4,838 $

10,706 $ 10,071 $ 20,017 $ 10,000

Republic

Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Selected Data and Ratios

As of and for the

Three Months Ended Dec. 31, 2017 Sep. 30, 2017

Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016

Per Share Data: Basic weighted average shares

outstanding 21,149 21,153 21,151 20,915 20,926 Diluted weighted

average shares outstanding 21,258 21,236 21,230 20,996 20,941

Period-end shares outstanding: Class A Common Stock 18,607

18,618 18,618 18,615 18,615 Class B Common Stock 2,243 2,243 2,243

2,243 2,245 Book value per share(8) $ 30.33 $ 30.36 $ 30.05

$ 29.76 $ 28.97 Tangible book value per share(8) 29.27 29.29 28.98

28.68 27.89

Earnings per share (“EPS”):

Basic EPS - Class A Common Stock $ 0.23 $ 0.51 $ 0.48 $ 0.97 $ 0.48

Basic EPS - Class B Common Stock 0.21 0.47 0.44 0.88 0.44 Diluted

EPS - Class A Common Stock 0.23 0.51 0.48 0.96 0.48 Diluted EPS -

Class B Common Stock 0.21 0.47 0.44 0.88 0.44 Cash dividends

declared per Common share: Class A Common Stock $ 0.220 $ 0.220 $

0.220 $ 0.209 $ 0.209 Class B Common Stock 0.200 0.200 0.200 0.190

0.190

Performance Ratios: Return on average

assets 0.39 % 0.89 % 0.86 % 1.65 % 0.87 % Return on average equity

3.02 6.76 6.42 13.12 6.62 Efficiency ratio(9) 63 65 64 48 62 Yield

on average interest-earning assets(7) 4.74 4.63 4.29 5.39 4.15 Cost

of average interest-bearing liabilities 0.71 0.70 0.64 0.58 0.56

Cost of average deposits(10) 0.35 0.31 0.28 0.22 0.22 Net interest

spread(7) 4.03 3.93 3.65 4.81 3.59 Net interest margin - Total

Company(7) 4.26 4.17 3.87 4.99 3.77 Net interest margin - Core

Bank(3) 3.72 3.68 3.46 3.33 3.42

Other Information:

End of period FTEs(11) - Total Company 997 970 976 973 938

End of period FTEs - Core Bank 915 896 904 901 869 Number of

full-service banking centers 44 45 45 45 44

Republic Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

(all amounts other than per share amounts,

number of employees and number of banking centers are expressed in

thousands unless otherwise noted)

Credit Quality Data and Ratios

As of and for

the Three Months Ended Dec. 31, 2017 Sep. 30,

2017 Jun. 30, 2017 Mar. 31, 2017 Dec. 31,

2016 Credit Quality Asset Balances:

Nonperforming Assets - Total Company: Loans on nonaccrual

status $ 14,118 $ 15,475 $ 15,467 $ 16,793 $ 15,892 Loans past due

90-days-or-more and still on accrual 956 906

335 203 167 Total

nonperforming loans 15,074 16,381 15,802 16,996 16,059 OREO

115 167 300 1,362

1,391 Total nonperforming assets - Total Company $

15,189 $ 16,548 $ 16,102 $ 18,358 $

17,450

Nonperforming Assets - Core Bank(3):

Loans on nonaccrual status $ 14,118 $ 15,475 $ 15,467 $ 16,793 $

15,892 Loans past due 90-days-or-more and still on accrual

19 55 33 81

85 Total nonperforming loans 14,137 15,530 15,500 16,874

15,977 OREO 115 167 300

1,362 1,391 Total nonperforming assets

- Core Bank $ 14,252 $ 15,697 $ 15,800 $

18,236 $ 17,368

Delinquent Loans:

Delinquent loans - Core Bank $ 8,460 $ 7,756 $ 6,844 $ 5,952 $

6,821 Delinquent loans - RPG(5) 5,641 4,270

2,169 10,211 2,137

Total delinquent loans - Total Company $ 14,101 $ 12,026

$ 9,013 $ 16,163 $ 8,958

Credit Quality Ratios - Total Company: Nonperforming

loans to total loans 0.38 % 0.41 % 0.40 % 0.46 % 0.42 %

Nonperforming assets to total loans (including OREO) 0.38 0.42 0.41

0.49 0.46 Nonperforming assets to total assets 0.30 0.33 0.32 0.39

0.36 Allowance for loan and lease losses to total loans 1.07 1.02

0.97 1.14 0.86 Allowance for loan and lease losses to nonperforming

loans 284 245 240 249 205 Delinquent loans to total loans(6)(12)

0.35 0.30 0.23 0.44 0.24 Net charge-offs to average loans

(annualized) 0.35 0.20 1.02 0.31 0.27

Credit Quality

Ratios - Core Bank: Nonperforming loans to total loans

0.36 % 0.40 % 0.40 % 0.46 % 0.42 % Nonperforming assets to total

loans (including OREO) 0.36 0.40 0.41 0.50 0.46 Nonperforming

assets to total assets 0.28 0.32 0.32 0.40 0.36 Allowance for loan

and lease losses to total loans 0.77 0.76 0.76 0.76 0.74 Allowance

for loan and lease losses to nonperforming loans 213 190 189 166

175 Delinquent loans to total loans 0.21 0.20 0.18 0.16 0.18 Net

charge-offs to average loans (annualized) 0.06 0.03 0.05 0.02 0.09

Republic Bancorp, Inc. Financial InformationFourth

Quarter 2017 Earnings Release (continued)

Segment Data:

Reportable segments are determined by the type of products and

services offered and the level of information provided to the chief

operating decision maker, who uses such information to review

performance of various components of the business (such as banking

centers and business units), which are then aggregated if operating

performance, products/services, and clients are similar.

As of December 31, 2017, the Company was divided into five

distinct reportable segments: Traditional Banking, Warehouse

Lending (“Warehouse”), Mortgage Banking, Tax Refund Solutions

(“TRS”) and Republic Credit Solutions (“RCS”). Management considers

the first three segments to collectively constitute the “Core Bank”

or “Core Banking” operations, while the last two segments

collectively constitute the Republic Processing Group (“RPG”)

operations. The Bank’s Correspondent Lending channel and the

Company’s national branchless banking platform, MemoryBank®, are

considered part of the Traditional Banking segment.

Prior to the third quarter of 2017, management reported RPG as a

segment consisting of its largest division, TRS, along with its

relatively smaller divisions, Republic Payment Solutions (“RPS”)

and RCS. During the third quarter of 2017, due to RCS’s growth in

revenues relative to the total Company’s revenues, management

identified TRS and RCS as separate reportable segments under the

newly classified RPG operations. Also, as part of the updated

segmentation, management will report the RPS division, which

remained below thresholds to be classified a separate reportable

segment, within the newly classified TRS segment. The reportable

segments within RPG operations and divisions within those segments

operate through the Bank. All prior periods have been reclassified

to conform to the current presentation.

The nature of segment operations and the primary drivers of net

revenues by reportable segment are provided below:

Reportable Segment: Nature of

Operations: Primary Drivers of Net Revenues:

Core Banking:

Traditional Banking Provides traditional banking products to

clients primarily in its market footprint via its network of

banking centers and to clients outside of its market footprint

primarily via its Digital and Correspondent Lending delivery

channels. Loans, investments, and deposits. Warehouse

Lending Provides short-term, revolving credit facilities to

mortgage bankers across the United States. Mortgage warehouse lines

of credit. Mortgage Banking

Primarily originates, sells and services

long-term, single family, first lien residential real estate loans

primarily to clients in the Bank’s market footprint.

Loan sales and servicing.

Republic

Processing Group: Tax Refund Solutions TRS offers

tax-related credit products and facilitates the receipt and payment

of federal and state tax refund products. The RPS division of TRS

offers general-purpose reloadable cards. TRS and RPS products are

primarily provided to clients outside of the Bank’s market

footprint. Loans, refund transfers, and prepaid cards.

Republic Credit Solutions Offers short-term credit products. RCS

products are primarily provided to clients outside of the Bank’s

market footprint, with a substantial portion of RCS clients

considered subprime or near prime borrowers. Unsecured

small-dollar, consumer loans.

The accounting policies used for Republic’s reportable segments

are the same as those described in the summary of significant

accounting policies in the Company’s 2016 Annual Report on Form

10-K. Segment performance is evaluated using operating income.

Goodwill is allocated to the Traditional Banking segment. Income

taxes are generally allocated based on income before income tax

expense unless specific segment allocations can be reasonably made.

Transactions among reportable segments are made at carrying

value.

Republic Bancorp, Inc. Financial Information

Fourth Quarter 2017 Earnings Release

(continued)

Segment information for the three months

and years ended December 31, 2017 and 2016 follows:

Three Months Ended December 31, 2017

Core Banking

Republic Processing Group

(“RPG”)

Total Tax Republic Traditional

Warehouse Mortgage

Core Refund Credit

Total

Total (dollars in thousands) Banking

Lending Banking

Banking

Solutions Solutions

RPG Company Net interest income

$ 39,333 $ 4,460 $ 91

$ 43,884 $ 18 $ 6,736 $

6,754 $ 50,638 Provision for loan and

lease losses 1,312 (114 ) —

1,198 (228 ) 5,101

4,873

6,071 Net refund transfer fees — — —

— 171 —

171 171 Mortgage banking income — — 935

935 —

—

— 935 Program fees — — —

— 73 1,778

1,851 1,851 Losses on securities available for sale

(136 ) — —

(136 ) — —

— (136 )

Other noninterest income 6,970 10

87

7,067 12

290

302 7,369

Total noninterest income 6,834 10 1,022

7,866 256 2,068

2,324 10,190 Total noninterest expenses

31,085 944 1,418

33,447 3,600 1,098

4,698 38,145 Income

(loss) before income tax expense 13,770 3,640 (305 )

17,105

(3,098 ) 2,605

(493 ) 16,612 Income tax

expense (benefit) - TCJA(1) 5,115 181 (702 )

4,594 — 1,732

1,732 6,326 Income tax expense (benefit) - Other

4,403 1,331 (106 )

5,628 (1,125 ) 945

(180 ) 5,448 Total income tax

expense (benefit) 9,518 1,512

(808 )

10,222 (1,125 ) 2,677

1,552 11,774

Net income (loss) $ 4,252 $ 2,128 $ 503

$ 6,883 $ (1,973 ) $ (72 ) $

(2,045

) $ 4,838 Segment period-end

assets $ 4,470,932 $ 525,246 $ 11,115 $

5,007,293 $ 12,450 $

65,619 $

78,069 $

5,085,362 Net interest

margin 3.76 % 3.41 % NM

3.72 % NM NM

NM

4.26 % Three Months Ended December

31, 2016 Core Banking

Republic Processing Group

(“RPG”)

Total Tax Republic Traditional Warehouse Mortgage

Core Refund Credit

Total Total (dollars in

thousands) Banking Lending

Banking

Banking Solutions

Solutions

RPG

Company Net interest income $ 32,413 $ 5,160 $ 52 $

37,625 $ 18 $ 4,002 $

4,020 $

41,645

Provision for loan and lease losses 1,881 (189 ) —

1,692

(133 ) 3,445

3,312 5,004 Net refund transfer

fees — — —

— 121 —

121 121 Mortgage banking

income — — 980

980 — —

— 980 Program fees — —

—

— 36 1,066

1,102 1,102 Other noninterest

income 6,710 4 148

6,862 13 1,407

1,420 8,282 Total noninterest

income 6,710 4 1,128

7,842 170 2,473

2,643

10,485 Total noninterest expenses 26,809

985 1,112

28,906

2,672 588

3,260

32,166 Income (loss) before

income tax expense 10,433 4,368 68

14,869 (2,351 ) 2,442

91 14,960 Income tax expense (benefit) 3,282

1,624 24

4,930

(855 ) 885

30

4,960 Net income (loss) $ 7,151 $ 2,744

$ 44

$ 9,939 $ (1,496 ) $ 1,557

$

61 $ 10,000

Segment period-end assets $ 4,169,557 $ 584,916 $ 17,453

$

4,771,926 $ 13,575 $ 30,808 $

44,383 $

4,816,309 Net interest margin 3.41 % 3.50 % NM

3.42 % NM NM

NM 3.77 %

Republic Bancorp, Inc. Financial

Information

Fourth Quarter 2017 Earnings Release

(continued)

Year Ended December 31, 2017 Core Banking

Republic Processing Group

(“RPG”)

Total Tax Republic Traditional Warehouse Mortgage

Core Refund Credit

Total Total (dollars in

thousands) Banking Lending

Banking

Banking Solutions

Solutions

RPG

Company Net interest income $ 142,823 $ 17,533 $ 346

$ 160,702 $ 15,197 $ 22,621 $

37,818 $

198,520 Provision for loan and lease losses 3,923

(150 ) —

3,773 6,535 17,396

23,931 27,704

Net refund transfer fees — — —

— 18,500 —

18,500 18,500 Mortgage banking income — — 4,642

4,642 — —

— 4,642 Program fees — — —

—

176 5,648

5,824 5,824 Losses on securities available

for sale (136 ) — —

(136 ) — —

— (136

) Other noninterest income 27,588 37

279

27,904 164

1,516

1,680 29,584 Total

noninterest income 27,452 37 4,921

32,410 18,840 7,164

26,004 58,414 Total noninterest expenses

124,637 3,392 4,765

132,794 14,491 3,559

18,050 150,844 Income before

income tax expense 41,715 14,328 502

56,545 13,011 8,830

21,841 78,386 Income tax expense (benefit) -

TCJA(1) 5,115 181 (702 )

4,594 — 1,732

1,732

6,326 Income tax expense - Other 13,087

5,240 176

18,503

4,721 3,204

7,925 26,428

Total income tax expense (benefit) 18,202

5,421 (526 )

23,097 4,721

4,936

9,657 32,754

Net income $ 23,513 $ 8,907 $ 1,028

$

33,448 $ 8,290 $ 3,894 $

12,184 $

45,632 Segment period-end assets $ 4,470,932 $

525,246 $ 11,115

$ 5,007,293 $ 12,450 $ 65,619 $

78,069 $ 5,085,362 Net interest margin

3.55 % 3.53 % NM

3.55 % NM NM

NM 4.32

% Year Ended December 31, 2016 Core

Banking

Republic Processing Group

(“RPG”)

Total Tax Republic Traditional Warehouse Mortgage

Core Refund Credit

Total Total (dollars in

thousands) Banking Lending

Banking

Banking Solutions

Solutions

RPG

Company Net interest income $ 121,692 $ 16,529 $ 200

$ 138,421 $ 6,607 $ 11,026 $

17,633 $

156,054 Provision for loan and lease losses 3,448 497

—

3,945 2,772 7,776

10,548 14,493 Net

refund transfer fees — — —

— 19,240 —

19,240

19,240 Mortgage banking income — — 6,882

6,882 — —

— 6,882 Program fees — — —

— 210 2,834

3,044 3,044 Other noninterest income 26,090

18 360

26,468

189 1,686

1,875

28,343 Total noninterest income 26,090 18 7,242

33,350 19,639 4,520

24,159 57,509 Total

noninterest expenses 108,360 3,142

4,688

116,190 11,701

2,216

13,917 130,107

Income before income tax expense 35,974 12,908 2,754

51,636 11,773 5,554

17,327 68,963 Income tax

expense 11,015 4,798 964

16,777 4,270 2,013

6,283 23,060 Net income $ 24,959

$ 8,110 $ 1,790

$ 34,859 $ 7,503

$ 3,541 $

11,044 $ 45,903

Segment period-end assets $ 4,169,557 $ 584,916 $ 17,453

$

4,771,926 $ 13,575 $ 30,808 $

44,383 $

4,816,309 Net interest margin 3.26 % 3.59 % NM

3.30 % NM NM

NM 3.65 %

Republic Bancorp, Inc. Financial

Information

Fourth Quarter 2017 Earnings Release

(continued)

(1)

Upon enactment of the Tax Cuts and Jobs

Act (“TCJA”) on December 22, 2017, the Company recorded a charge to

income tax expense of $6.3 million due to the remeasurement of its

deferred tax assets and liabilities at a 21% corporate tax rate.

The amount recorded is based on a reasonable estimate using

currently available information. The Company has up to one year to

adjust this amount for new information received.

(2)

GAAP – U.S. Generally Accepted Accounting

Principles.

(3)

“Core Bank” or “Core Banking” operations

consist of the Traditional Banking, Warehouse Lending and Mortgage

Banking segments.

(4)

Core deposits, a non-GAAP measure, are

total deposits excluding time deposits greater than or equal to

$250,000, all brokered deposits and all RPG deposits. Core deposits

are intended to include those deposits that are more stable and

lower cost and that reprice more slowly than other deposits when

interest rates rise. The following table reconciles

noninterest-bearing and interest-bearing deposits in accordance

with GAAP to core deposits:

(dollars in thousands)

Dec. 31, 2017 Dec. 31, 2016

$ Change

% Change Noninterest-bearing deposits - GAAP $

1,022,042 $ 971,952 $ 50,090 5 % Less: Noninterest-bearing deposits

- RPG 33,505 28,493 5,012 18 Core

noninterest-bearing deposits - Non-GAAP (a) $ 988,537 $ 943,459 $

45,078 5 Interest-bearing deposits - GAAP $ 2,411,116 $

2,188,740 $ 222,376 10 % Less: Time deposits, $250,000 and over

77,891 37,200 40,691 109 Less: Brokered money market accounts

373,242 360,597 12,645 4 Less: Brokered certificates of deposit

46,089 28,666 17,423 61 Less: Interest-bearing deposits - RPG

1,641 — 1,641 NM Core interest-bearing

deposits - Non-GAAP (b) $ 1,912,253 $ 1,762,277 $ 149,976 9 %

Total core deposits - Non-GAAP (a+b) $ 2,900,790 $ 2,705,736

$ 195,054 7

(5)

Republic Processing Group operations

consist of the Tax Refund Solutions and Republic Credit Solutions

segments.

(6)

The delinquent loans to total loans ratio

equals loans 30-days-or-more past due divided by total loans.

Depending on loan class, loan delinquency is determined by the

number of days or the number of payments past due.

(7)

The amount of loan fee income can

meaningfully impact total interest income, loan yields, net

interest margin and net interest spread. The amount of loan fee

income included in total interest income was $9.4 million and $5.9

million for the quarters ended December 31, 2017 and 2016. The

amount of loan fee income included in total interest income was

$46.2 million and $24.2 million for the years ended December 31,

2017 and 2016.

The amount of loan fee income included in

total interest income per quarter was as follows: $9.4 million

(quarter ended December 31, 2017); $9.1 million (quarter ended

September 30, 2017); $6.4 million (quarter ended June 30, 2017);

$21.3 million (quarter ended March 31, 2017); and $5.9 million

(quarter ended December 31, 2016).

Interest income for Easy Advances (“EAs”)

is composed entirely of loan fees. The loan fees disclosed above

included EA fees of $14.2 million and $5.2 million for the years

ended December 31, 2017 and 2016. EAs are only offered during the

first two months of each year.

(8)

The following table provides a

reconciliation of total stockholders’ equity in accordance with

GAAP to tangible stockholders’ equity in accordance with applicable

regulatory requirements, a non-GAAP measure. The Company provides

the tangible book value per share, another non-GAAP measure, in

addition to those defined by banking regulators, because of its

widespread use by investors as a means to evaluate capital

adequacy.

Quarterly Comparison (dollars in thousands, except

per share data)

Dec. 31, 2017 Sep. 30, 2017 Jun.

30, 2017 Mar. 31, 2017 Dec. 31, 2016

Total stockholders’ equity - GAAP (a)

$ 632,424 $ 633,287 $ 626,891 $ 620,664 $ 604,406 Less: Goodwill

16,300 16,300 16,300 16,300 16,300 Less: Mortgage servicing rights

5,044 5,128 5,159 5,158 5,180 Less: Core deposit intangible

858 911 964 1,017

1,070

Tangible stockholders’ equity - Non-GAAP

(c)

$ 610,222 $ 610,948 $ 604,468 $ 598,189

$ 581,856 Total assets - GAAP (b) $ 5,085,362 $

4,993,174 $ 4,955,661 $ 4,664,792 $ 4,816,309 Less: Goodwill 16,300

16,300 16,300 16,300 16,300 Less: Mortgage servicing rights 5,044

5,128 5,159 5,158 5,180 Less: Core deposit intangible 858

911 964 1,017

1,070 Tangible assets - Non-GAAP (d) $ 5,063,160

$ 4,970,835 $ 4,933,238 $ 4,642,317 $

4,793,759

Total stockholders’ equity to total assets

- GAAP (a/b)

12.44 % 12.68 % 12.65 % 13.31 % 12.55 %

Tangible stockholders’ equity to tangible

assets - Non-GAAP (c/d)

12.05 % 12.29 % 12.25 % 12.89 % 12.14 % Number of shares

outstanding (e) 20,850 20,861

20,861 20,858 20,860 Book

value per share - GAAP (a/e) $ 30.33 $ 30.36 $ 30.05 $ 29.76 $

28.97 Tangible book value per share - Non-GAAP (c/e) 29.27 29.29

28.98 28.68 27.89

(9)

The efficiency ratio, a non-GAAP measure,

equals total noninterest expense divided by the sum of net interest

income and noninterest income. The ratio excludes net gains

(losses) on sales, calls and impairment of investment securities,

if applicable.

(10)

The cost of average deposits ratio equals

annualized total interest expense on deposits divided by total

average interest-bearing deposits plus total average

noninterest-bearing deposits.

(11)

FTEs – Full-time-equivalent employees.

(12)

Delinquent loans for the RPG segment

included $8.4 million of EAs at March 31, 2017. EAs were only

offered during the first two months of 2017 and 2016. EAs do not

have a contractual due date but are eligible for delinquency

consideration three weeks after the taxpayer-customer’s tax return

is submitted to the applicable tax authority. All unpaid EAs are

charged-off by the end of the second quarter of each year.

NM – Not meaningful

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180126005018/en/

Republic Bancorp, Inc.Kevin Sipes, 502-560-8628Executive Vice

President & Chief Financial Officer

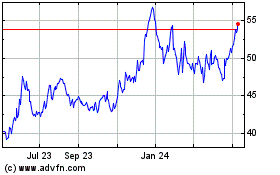

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Republic Bancorp (NASDAQ:RBCAA)

Historical Stock Chart

From Apr 2023 to Apr 2024