Ford Scoops Up Software Firms as It Drives Toward the Driverless

January 25 2018 - 4:26PM

Dow Jones News

By Mike Colias

Ford Motor Co. is acquiring two small software firms to help

build out its mobility business, a move that highlights the need

for auto companies to seed their management teams with technology

talent to keep pace in a fast-changing transportation sector.

Ford said Thursday it is buying Autonomic Inc., a Palo Alto,

Calif., startup with 70 employees that is developing a software

backbone for Ford to provide urban transit services to consumers

and businesses. Ford said the firm's CEO, Sunny Madra, will lead a

new team inside Ford that will come up with ideas for new transit

options.

The nation's No. 2 auto maker by sales also said it would

acquire TransLoc, a North Carolina firm that makes software to help

transportation operators optimize drive routes. Ford didn't

disclose terms of either transaction.

Adding talent through acquisitions has become a common strategy

among conventional auto makers and suppliers as they scramble to

compete with tech giants to develop driverless vehicles and build

businesses around them.

Ford, for example, is spending $1 billion over five years for

artificial-intelligence startup Argo AI, whose founders had

previous ties to Alphabet Inc. and Uber Technologies Inc. GM in

early 2016 bought autonomous-vehicle developer Cruise Automation in

a deal potentially valued at $1 billion, based on performance

milestones.

Cruise, based in San Francisco, has become GM's Silicon Valley

beachhead for attracting tech talent. GM has grown Cruise's

workforce 10-fold in two years, to about 500 employees.

In acquiring Autonomic and TransLoc, Ford considered areas

"where we thought we needed a really fast infusion of help," Ford

Mobility President Marcy Klevorn said.

Traditional auto makers are leaning on acquisitions across a

broad range of tech realms -- everything from software and hardware

for self-driving cars to consumer apps -- as they prepare for a

future in which cars are increasingly automated and connected to

other parts of the transportation system.

BMW said this week it acquired Parkmobile, an app that allows

users to pre-book and pay for parking spots. GM and Ford's Argo

each recently acquired companies developing lidar, or laser-based

systems that give autonomous cars a 3-D view of their

surroundings.

Ford's approach to building a driverless-vehicle business

differs from that of GM, which is focused on deploying its

autonomous Chevrolet Bolt in a robot-taxi service in 2019. Ford is

focused on offering services to commercial customers who need to

move goods or people around cities.

Ford said it is starting a service that works with health-care

providers to shuttle non-emergency patients who don't or can't

drive themselves. Its Chariot van service contracts with employers

in five cities to shuttle workers to and from their jobs. By 2021,

Ford plans to introduce driverless vehicles to handle some

rides.

On Wednesday, Ford finance chief Bob Shanks said such services

would generate a profit within five years. Ford said the mobility

business lost about $300 million in 2017, and that losses would

widen this year.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

January 25, 2018 16:11 ET (21:11 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

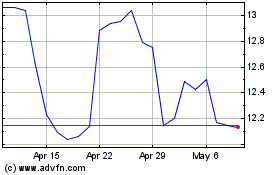

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

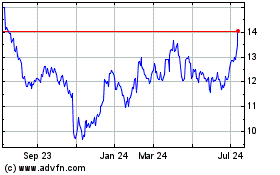

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024