CorEnergy Announces Tax Characterization of 2017 Distributions

January 24 2018 - 5:00PM

Business Wire

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA)

("CorEnergy" or the "Company") today announced the tax

characterization of the 2017 distributions paid to

stockholders.

The following table summarizes, for income tax purposes, the

nature of cash distributions paid by the Company during the year

ended December 31, 2017.

Common Shareholders

RecordDate

PayableDate

TotalDistributionsPer

Share

TotalOrdinaryDividendsBox 1a

QualifiedDividendsBox

1b

TotalCapitalGainDistr.Box 2a

NondividendDistr.Box

3

2/13/2017 2/28/2017 $ 0.7500 $ 0.5925 $ 0.0785 $

0.0000 $ 0.1575 5/16/2017 5/31/2017 0.7500 0.5925 0.0785 0.0000

0.1575 8/17/2017 8/31/2017 0.7500 0.5925 0.0785 0.0000 0.1575

11/15/2017 11/30/2017 0.7500

0.5925 0.0785 0.0000

0.1575 Total 2017 Distributions: $ 3.0000 $ 2.3700

$ 0.3140 $ 0.0000 $ 0.6300

7.375% Series A Cumulative Redeemable Preferred Stock

RecordDate

PayableDate

TotalDistributionsPer

Share

TotalOrdinaryDividendsBox 1a

QualifiedDividendsBox

1b

TotalCapitalGainDistr.Box 2a

NondividendDistr.Box

3

2/13/2017 2/28/2017 $ 0.4609 $ 0.4609 $ 0.0611 $ 0.0000 $ 0.0000

5/16/2017 5/31/2017 0.4609 0.4609 0.0611 0.0000 0.0000 8/17/2017

8/31/2017 0.4609 0.4609 0.0611 0.0000 0.0000 11/15/2017

11/30/2017 0.4609 0.4609

0.0611 0.0000 0.0000 Total 2017

Distributions: $ 1.8436 $ 1.8436 $ 0.2444

$ 0.0000 $ 0.0000

Additional information regarding the tax characterization of the

2017 distributions is available at corenergy.reit.

Nothing contained herein or therein should be construed as tax

advice. Consult your tax advisor for more information. Furthermore,

you may not rely upon any information herein or therein for the

purpose of avoiding any penalties that may be imposed under the

Internal Revenue Code.

About CorEnergy Infrastructure Trust, Inc.

CorEnergy Infrastructure Trust, Inc. (NYSE: CORR, CORRPrA), is a

real estate investment trust (REIT) that owns essential energy

assets, such as pipelines, storage terminals, and transmission and

distribution assets. We seek long-term contracted revenue from

operators of our assets, primarily under triple net participating

leases. For more information, please visit corenergy.reit.

Forward-Looking Statements

This press release contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although CorEnergy believes that the expectations reflected in

these forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Actual results could differ materially from

those anticipated in these forward-looking statements as a result

of a variety of factors, including those discussed in CorEnergy's

reports that are filed with the Securities and Exchange Commission.

You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Other than as required by law, CorEnergy does not assume a duty to

update any forward-looking statement. In particular, any

distribution paid in the future to our stockholders will depend on

the actual performance of CorEnergy, its costs of leverage and

other operating expenses and will be subject to the approval of

CorEnergy's Board of Directors and compliance with leverage

covenants.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180124006259/en/

CorEnergy Infrastructure Trust, Inc.Investor

RelationsLesley Schorgl, 877-699-CORR (2677)info@corenergy.reit

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Mar 2024 to Apr 2024

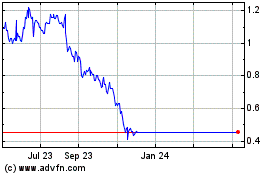

CorEnergy Infrastructure (NYSE:CORR)

Historical Stock Chart

From Apr 2023 to Apr 2024