Golden Entertainment Announces Closing of Public Offering of Common Stock & Full Exercise of Underwriters’ Option to Purcha...

January 23 2018 - 4:15PM

Business Wire

Golden Entertainment, Inc. (Nasdaq: GDEN) (“Golden”) announced

today the closing of its underwritten public offering of 7,475,000

shares of common stock at the previously announced public offering

price of $28.00 per share, which consisted of 6,500,000 shares sold

by certain of its shareholders and 975,000 shares sold directly by

Golden pursuant to the exercise in full of the underwriters’ option

to purchase additional shares.

Golden did not receive any proceeds from the sale of the shares

by the selling shareholders. The aggregate gross proceeds to Golden

from the offering of shares pursuant to the underwriters’ option,

before deducting the underwriting discounts and commissions and

offering expenses, were approximately $27.3 million. Golden expects

to use the net proceeds from the sale of 975,000 primary shares for

general corporate purposes, which may include, among other things,

capital expenditures, opportunistic acquisitions or working

capital.

J.P. Morgan and Morgan Stanley acted as joint book-running

managers and representatives of the underwriters for the offering.

Macquarie Capital also acted as a joint book-running manager. Union

Gaming acted as co-manager for the offering.

The offering is being made pursuant to an effective shelf

registration statement filed with the Securities and Exchange

Commission. The offering of these shares may be made only by means

of a prospectus supplement and the accompanying prospectus, copies

of which may be obtained by contacting: J.P. Morgan Securities LLC,

c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, telephone: (866) 803-9204 and Morgan Stanley

& Co. LLC, Attn: Prospectus Department, 180 Varick Street, 2nd

Floor, New York, New York 10014. Electronic copies of the final

prospectus supplement and accompanying prospectus are also

available on the website of the SEC at http://www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the offered shares, nor

shall there be any sale of such shares in any state or other

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of such state or other jurisdiction.

About Golden Entertainment, Inc.

Golden Entertainment, Inc. owns and operates gaming properties

across two divisions – resort casino operations and distributed

gaming. Golden operates approximately 16,000 slots, 114 table

games, and 5,164 hotel rooms, and provides jobs for approximately

7,000 team members. Golden owns eight casino resorts – seven in

Southern Nevada and one in Maryland. Through its distributed gaming

business in Nevada and Montana, Golden Entertainment operates video

gaming devices at nearly 1,000 locations and owns nearly 60

traditional taverns in Nevada. Golden Entertainment is licensed in

Illinois to operate video gaming terminals.

Forward Looking Statements

This press release contains forward-looking statements regarding

future events, including statements regarding the proposed public

offering, that are subject to the safe harbors created under the

Securities Act of 1933 and the Securities Exchange Act of 1934.

Forward-looking statements can generally be identified by the use

of words such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“project,” “potential,” “seek,” “should,” “think,” “will,” “would”

and similar expressions, or they may use future dates.

Forward-looking statements in this press release include, without

limitation, statements regarding Golden’s expectations as to the

anticipated use of proceeds from the public offering. These

forward-looking statements are subject to assumptions, risks and

uncertainties that may change at any time, and readers are

therefore cautioned that actual results could differ materially

from those expressed in any forward-looking statements. Factors

that could cause actual results to differ include, among other

things: risks and uncertainties associated with market conditions

and other risks and uncertainties discussed in Golden’s filings

with the SEC, including the “Risk Factors” section of Golden’s

Quarterly Report on Form 10-Q for the quarter ended September 30,

2017. Golden undertakes no obligation to update any forward-looking

statements as a result of new information, future developments or

otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180123006463/en/

Investor RelationsJCIRJoseph Jaffoni, Richard Land, James Leahy,

212-835-8500gden@jcir.comorMedia RelationsGolden Entertainment,

Inc.Howard Stutz, 702-495-4490Director Corporate

Communicationshstutz@goldenent.com

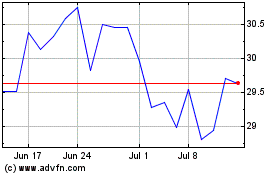

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

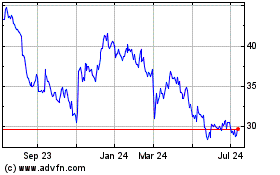

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Apr 2023 to Apr 2024