Current Report Filing (8-k)

January 23 2018 - 7:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C.

20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 22, 2018

Date

of

Report

(Date

of

earliest

event

reported)

HELIUS MEDICAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

WYOMING

|

000-55364

|

36-4787690

|

|

(State or other jurisdiction of

|

(Commission

|

(I.R.S. Employer

|

|

incorporation or organization)

|

File Number)

|

Identification No.)

|

(Exact name

of

registrant as

specified

in

charter)

642 Newtown Yardley Road Suite 100

Newtown, Pennsylvania, 18940

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (215) 944-6100

Check

the

appropriate

box

below

if

the

Form

8-K

filing

is

intended

to

simultaneously

satisfy

the

filing

obligation

of

the

registrant

under

any

of

the

following

provisions:

|

|

☐

|

Written

communications

pursuant

to

Rule

425

under

the

Securities

Act

(17

CFR

230.425)

|

|

|

☐

|

Soliciting

material

pursuant

to

Rule

14a12

under

the

Exchange

Act

(17

CFR

240.14a12)

|

|

|

☐

|

Precommencement

communications

pursuant

to

Rule

14d2(b)

under

the

Exchange

Act

(17

CFR

240.14d2(b))

|

|

|

☐

|

Precommencement

communications

pursuant

to

Rule

13e4(c)

under

the

Exchange

Act

(17

CFR

240.13e4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

Emerging growth company

☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

☑

1

|

Item 5.03

|

Amendment to Articles of Incorporation or Bylaws

|

As previously disclosed on the Form 8-K filed June 9, 2017, at the 2017 annual meeting of shareholders of Helius Medical Technologies, Inc. (the “Company”) the shareholders approved an amendment to the Company’s Articles of Incorporation to effect, at the option of the board of directors of the Company (the “Board”), a reverse stock split of the Company’s Class A common stock, no par value (the “Common Stock”) at a ratio ranging from three-for-one (3:1) to seven-for-one (7:1) inclusive, with the effectiveness of the amendment or the abandonment of the amendment, to be determined by the Board prior to the date of the 2018 annual meeting of shareholders. As previously disclosed on the Form 8-K filed on January 4, 2018, on January 2, 2018 the Board approved the fixing of the ratio for the reverse stock split at five- for-one (the “Reverse Split”). To effect the Reverse Split, the Company has filed Articles of Amendment to its Articles of Incorporation (the “Reverse Split Amendment”) with the Secretary of State of Wyoming, which became effective after the close of business on January 22, 2018 (the “Effective Date”).

As a result of the Reverse Split, every five shares of Common Stock issued and outstanding as of the Effective Date were converted into one share of Common Stock. No fractional shares were issued in connection with the Reverse Split. Shareholders who otherwise would be entitled to receive a fractional share of Common Stock are instead entitled to receive a cash payment calculated by multiplying such fractional interest by $2.29, the average of the closing sales prices of the Common Stock on the Toronto Stock Exchange (denominated in Canadian dollars and converted into U.S. Dollars using the Bank of Canada nominal noon exchange rate on each such trading date) during regular trading hours for the five consecutive trading days immediately preceding the Effective Date (with such average closing sales prices being adjusted to give effect to the Reverse Split).

As a result of the Reverse Split, proportionate adjustments have been made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all stock options, restricted stock units and warrants issued by us and outstanding immediately prior to the Effective Date, which resulted in a proportionate decrease in the number of shares of Common Stock reserved for issuance upon exercise or vesting of such stock options, restricted stock units and warrants, and, in the case of stock options and warrants, a proportionate increase in the exercise price of all such stock options and warrants.

In addition, the number of shares authorized for future grant under our equity incentive/compensation plans immediately prior to the Effective Date was reduced proportionately.

The Reverse Split reduced the number of shares of Common Stock outstanding from 100,891,246 shares to 20,178,225 shares.

The Common Stock will begin trading on a post-split basis on the OTCQB and the Toronto Stock Exchange on January 23, 2018. The new CUSIP number for the Common Stock following the Reverse Split is 42328V504. The Company’s publicly traded common share purchase warrants, which trade on the Toronto Stock Exchange, will continue to trade under their existing CUSIP number 42328V116.

Our transfer agent, Computershare Trust Company of Canada, is acting as exchange agent for the Reverse Split and will send instructions to shareholders of record regarding the exchange of certificates for Common Stock. Shareholders owning shares via broker or other nominee will have their positions automatically adjusted to reflect the Reverse Split, subject to the broker’s particular processes, and will not be required to take any action in connection with the Reverse Split.

The foregoing summary of the Reverse Split Amendment is qualified entirely by reference to the Reverse Split Amendment, which is attached to this Current Report on Form 8-K as Exhibit 3.1 and is incorporated herein by reference.

2

|

Item 7.01

|

Regulation FD Disclosure

|

On January 23, 2018, the Company issued a press release to announce the completion of the Reverse Split. A copy of this press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 hereto, is furnished pursuant to Item 7.01 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. The Company’s submission of this Report shall not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01

Financial Statements and Exhibits

(d) Exhibits

3

SIGNATURE

Pursuant

to

the

requirements

of

the

Securities

Exchange

Act

of

1934,

the

registrant

has

duly

caused this report to be signed on its behalf by the undersigned hereunto duly authorized

.

|

|

HELIUS MEDICAL TECHNOLOGIES, INC.

|

|

|

|

|

|

Dated: January 23, 2018

|

By:

|

/s/ Joyce LaViscount

|

|

|

|

Joyce LaViscount, Chief Financial Officer

|

|

|

|

4

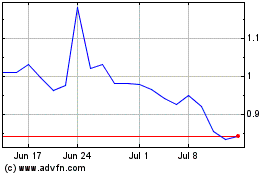

Helius Medical Technolog... (NASDAQ:HSDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

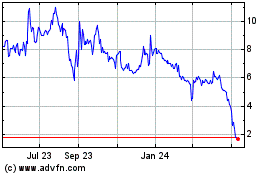

Helius Medical Technolog... (NASDAQ:HSDT)

Historical Stock Chart

From Apr 2023 to Apr 2024